Analysis: Comparison of overseas to overall returns for leading Chinese manufacturers

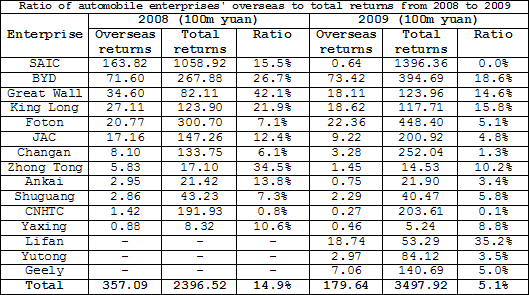

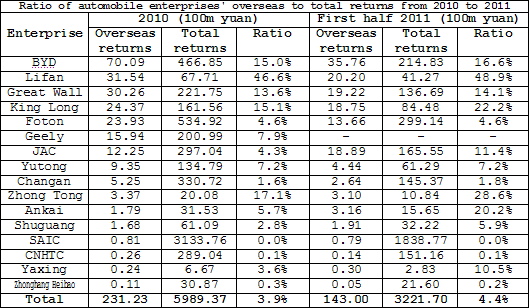

Gasgoo.com (Shanghai) - According to figures compiled by Gasgoo.com (Chinese), of the 25 Chinese manufacturers listed on the market, 16 have returns from business done overseas. In 2010, these 16 businesses managed to pull in a total of 23.12 billion yuan from foreign sales, accounting for 3.9 percent of their combined sales. That ratio is considerably lower than the 14.9 percent and 5.1 percent it was in 2008 and 2009, respectively; the drop has been attributed to the global banking crisis, as well as the rapid development of the automobile market in China. The ratio of overseas to total returns in the first half of this year has increased slightly to 4.4 percent, which has been linked to the declining domestic market, which in turn is due to the phasing out of preferential vehicle purchase policies, market competition and other factors.

BYD was the Chinese manufacturer with the largest overseas returns in 2010 with nearly 7.1 billion yuan coming in, or more than double the 3.15 billion yuan Lifan managed to pull in from foreign sales. Great Wall was third, followed by King Long, Foton, Geely, JAC, Yutong, Changan and Zhong Tong. From 2008 to 2010, BYD had constantly managed overseas returns of over 7 billion yuan, with its major markets being India, Hungary and Brazil.

Since 2010, Lifan and Great Wall have taken second and third on the rankings chart, though in China the latter is far larger than the former: Great Wall's total domestic returns have consistently totaled over 10 billion yuan compared to Lifan's 5 billion. King Long, Geely and JAC all managed foreign returns of over 1 billion yuan in 2010. Among them, JAC's sales grew especially rapidly, with the figures from the first half of this year reaching 1.89 billion yuan, more than each of the previous three years.

SAIC, whose foreign returns exceeded 16 billion yuan in 2008, dropped to under 100 million in 2009 following SsangYong entering receivership after the brand made a record loss. SAIC's yearly foreign sales have yet to once again surpass 100 million yuan.

Looking at the 2010 figures, five Chinese manufacturers, Lifan, Zhong Tong, King Long, BYD and Great Wall, all had foreign returns of over 10 percent. That year, foreign sales accounted for 46.6 percent of Lifan's business overall, an increase of 11 percentage points from the previous years. The ratio increased again in 2011 to 48.9 percent.

The ratio for foreign sales for Zhong Tong fell from 34.5 percent to 10.2 percent from 2008 to 2009, but rose again to 28.6 percent this year. Meanwhile, King Long, BYD and Great Wall, whose 2010 foreign to total returns ratios were 15.1 percent, 15.0 percent and 13.6 percent, respectively. All three manufacturers saw that ratio increase in 2011 to 22.2 percent, 16.6 percent and 14.1 percent, respectively.

Gasgoo not only offers timely news and profound insight about China auto industry, but also help with business connection and expansion for suppliers and purchasers via multiple channels and methods. Buyer service:buyer-support@gasgoo.comSeller Service:seller-support@gasgoo.com