Summary: Outline of income and profit changes for China's listed dealer networks from 2010 to 2011

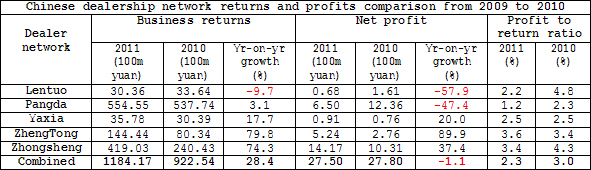

Gasgoo.com (Shanghai) - As once rapid sales increases in the Chinese automobile market came to a halt last year, the country's major dealer networks saw growth in their profits decrease as well. According to statistics compiled by Gasgoo.com (Chinese), the combined business returns of the country's five largest dealer networks–Pangda, Zhongsheng, ZhengTong, Lentuo and Yaxia– totaled 118.41 billion yuan ($18.71b) last year, growing 28.4 percent from 2010. However, their combined profits fell 1.1 percent to 2.75 billion yuan ($434.51m). Their average profit to returns ratio also decreased from 3.0 percent in 2010 to 2.3 percent last year.

Pangda remained the network with the largest business returns, followed by Zhongsheng, ZhengTong, Yaxia and Lentuo. However, worth noting is that while growth in the market as a whole decreased last year, sales of luxury vehicles continued to increase. Due to this trend, Zhongsheng and ZhengTong, which both specialize in luxury automobile sales, saw their returns grow 74.3 percent and 79.8 percent, respectively.

Yaxia also managed to maintain respectable year-on-year growth of 17.7 percent. From 2010 to 2011, the Anhui-based network saw its returns surpass those of rival Lentuo, whose returns fell a full 9.7 percent. Pangda's returns increased 3.1 percent over the year.

On the profit side of things, Zhongsheng was by far the most successful enterprise, followed by Pangda and ZhengTong. Zhongsheng's net profit in 2011 was 37.4 percent higher than the previous year. ZhengTong, meanwhile, witnessed full year-on-year growth of 89.9 percent. The two networks' profit to return ratios in 2011 were 3.4 percent and 3.6 percent, respectively.

Yaxia's net profit grew 20 percent, with its profit to return ratio remaining unchanged at 2.5 percent. Meanwhile, Lentuo and Pangda both saw their profits decrease last year. Lentuo's net profit fell a whole 57.9 percent, while Pangda's decreased 47.4 percent. The two networks' profit to return ratios decreased 2.6 percent and 1.1 percent, respectively. Pangda attributes its declining performance in 2011 to increasing infrastructure and labor costs, as well as the money lost in the network's failed bid to save Swedish manufacturer Saab from bankruptcy.

Gasgoo not only offers timely news and profound insight about China auto industry, but also help with business connection and expansion for suppliers and purchasers via multiple channels and methods. Buyer service:buyer-support@gasgoo.comSeller Service:seller-support@gasgoo.com