Summary: Chinese bus market in 2012

Gasgoo.com (Shanghai) - The bus market in China was one of the biggest beneficiaries of drives to limit private automobile use and encourage public transit usage last year. Several factors, such as the further spread of policies restricting the number of new vehicle registration to Guangzhou and other cities, played their part in stimulating steady growth in the market. However, the poor macroeconomic conditions affecting the overall Chinese commercial vehicle market prevented the country's bus sales last year from reaching full expectations.

According to statistics collected by Gasgoo.com (Chinese), a total of 425,600 buses were sold in China in 2012. The figure represents positive year-on-year sales growth of 5.5 percent, which is notable considering sales in the commercial vehicle market as a whole fell last year. However, the growth rate last year was still lower than the 13.3 percent rate achieved in 2011, and fell eight percent short of preliminary industry expectations. Overall poor macroeconomic conditions were cited as the major reason behind the sales decline.

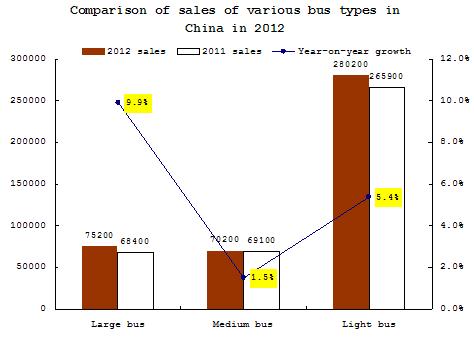

All three major bus segments experienced slight positive year-on-year sales growth over the course of the year, with large bus sales increasing 9.9 percent. Sales in the light bus segment grew 5.4 percent from 2011 to 2012, while the medium bus segment increased just 1.5 percent.

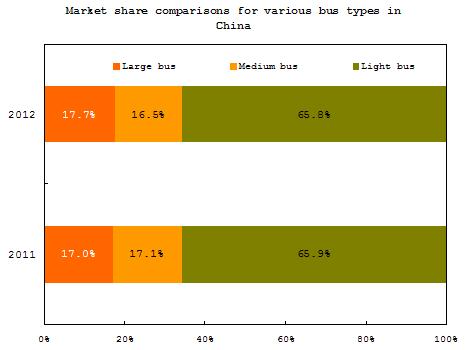

Looking at differences in market distribution between the three segments, the large bus market surpassed that of medium buses in 2012, while the percentage of the market held by light bus sales remained virtually the same.

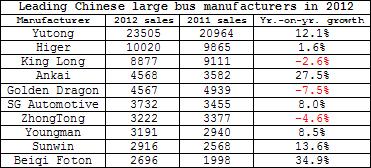

The Zhengzhou Yutong Group was once again 2012's largest large bus manufacturer, followed by Suzhou's Higer, King Long, Anhui's Ankai Automobile, Xiamen's Golden Dragon, SG Automotive Group, ZhongTong, Youngman Automobile Group, Shanghai's Sunwin and Beiqi Foton. The largest change with the rankings last year was Ankai's surpassing Golden Dragon to claim fourth place.

Three of the above manufacturers, King Long, Golden Dragon and ZhongTong, experienced sales decreases from 2011 to 2012. All the other manufacturers reported positive year-on-year sales growth, with Beiqi Foton's 34.9 percent increase being the largest. Leader Yutong's 12.1 percent increase was also notable, as it was far ahead of most other manufacturers in the segment.

Yutong also led the medium bus market last year, followed by Higer, King Long, Ankai, FAW Toyota, Golden Dragon, ZhongTong, Dongfeng Motor, Shaolin Auto and Yaxing Coach. Yutong was by far the segment's largest manufacturer, selling nearly 24,000 medium buses. No other manufacturer in the segment was able to pass the 10,000 sales mark last year.

Comparing year-on-year sales growth rates, Ankai's sales increased the most, growing 50 percent from 2011 to 2012. Dongfeng also reported a respectable growth rate of 41.3 percent. On the other end of the spectrum, FAW Toyota's sales fell over 40 percent last year, mirroring the JV's overall business performance. Higer and Golden Dragon also saw their sales decrease.

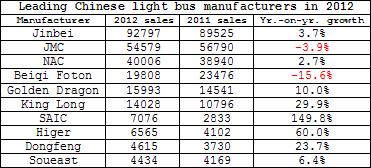

Shenyang's Jinbei was the most successful light bus manufacturer last year, followed by Jiangling Motors (JMC), Nanjing Automobile (NAC), Beiqi Foton, Golden Dragon, King Long, SAIC Commercial Vehicle, Higer, Dongfeng and South East Motor. Jinbei easily dominated the segment, with its yearly sales of over 92,000 units over 70 percent greater than that of second place Jiangling.

Of the top ten light bus manufacturers, Beiqi Foton and JMC were the only two to experience negative year-on-year sales growth, with the former reporting a drop of 15.6 percent in sales. The eight other manufacturers maintained positive growth, with SAIC sales jumping nearly 150 percent from 2011 to 2012.

Gasgoo not only offers timely news and profound insight about China auto industry, but also help with business connection and expansion for suppliers and purchasers via multiple channels and methods. Buyer service:buyer-support@gasgoo.comSeller Service:seller-support@gasgoo.com