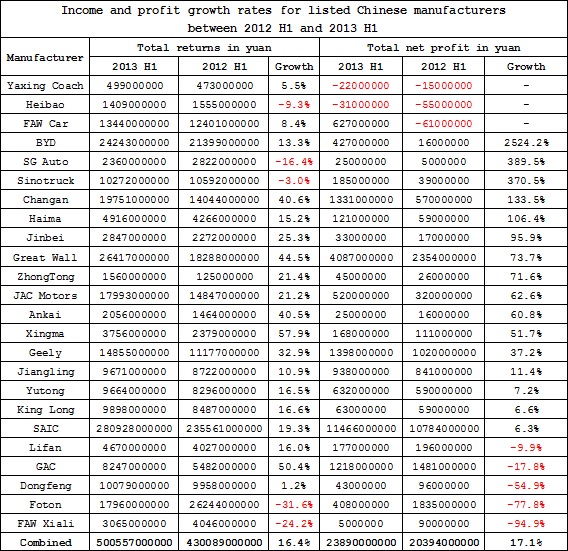

Summary: Total incomes and net profits for Chinese automobile manufacturers in first half of 2013

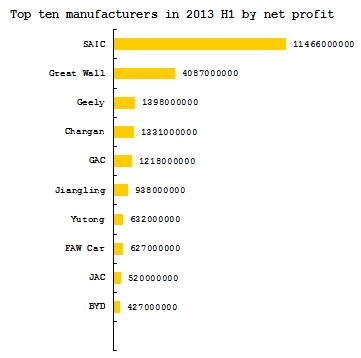

Gasgoo.com (Shanghai) - Thanks to a variety of factors, sales growth rates in the Chinese automotive market once again experienced double-digit growth during the first half of this year. As a result, many manufacturers posted impressive net profits for the six month time period, providing a strong contrast to the negative growth rates in profits reported last year. According to statistics compiled by Gasgoo.com (Chinese), China’s 24 listed automobile manufacturers earned a combined total of 23.89 billion yuan during the first half of 2013, representing positive year-on-year growth of 17.1 percent. The average net profit growth rate for the companies was 4.8 percent. Total business income increased 16.4 percent from last year.

Of the 24 listed manufacturers, only two reported suffering a net deficit for the first half of this year, compared to three manufacturers in the first half of 2012. Zhonghang Heibao and Yaxing Coach posted net deficits of 31.28 million yuan and 21.55 million yuan, respectively.

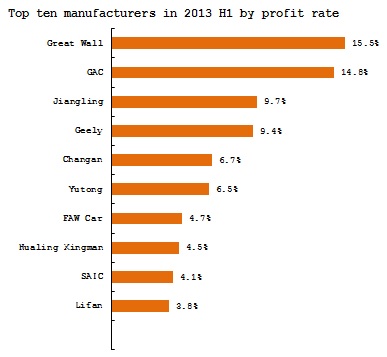

FAW Car, on the other hand, managed to recover to a net profit of 627 million yuan after suffering a net deficit of 61.42 million yuan a year ago. Growing sales volume and an increasingly favorable exchange rate with the yen, in turn leading to lowering production costs, have been cited as two major factors behind FAW Car’s recovery. The manufacturer is one of six which posted year-on-year net profit growth of over 100 percent, with the others being BYD, SG Automotive, Sinotruck, Changan and Haima. Jinbei, Great Wall, Jianghuai, Zhongtong and Hualing Xingma all saw their new profits grow between 50 percent and 100 percent.

Among the above manufacturers, BYD’s growth was the most impressive, with its net profits increasing over twenty fold from 16.27 million yuan last year to 427 million yuan this year. These results were actually entirely in line with industry expectations. The manufacturer’s strong performance was attributed to rapidly growing sales.

Other manufacturers also posted good results. Leading own brand Great Wall, for its part, reported its fourth consecutive year of growth with a net profit of 4.08 billion yuan, placing it only behind SAIC in the total net profit rankings. Great Wall posted a net profit rate of 15.5 percent, ahead of any other Chinese manufacturer.

There were only five manufacturers which suffered declines to their net profits. FAW Xiali led the pack due to its net profit falling almost 100 percent from the 58.14 million yuan reported last year to the 4.58 million yuan posted this year.

Foton, Dongfeng, GAC and Lifan were the other four manufacturers suffering a similar fate this year. Foton’s drop of 77.8 percent was particularly noticeable. The manufacturer pins this loss to investments made for its recently announced joint venture with Daimler AG.

Gasgoo not only offers timely news and profound insight about China auto industry, but also help with business connection and expansion for suppliers and purchasers via multiple channels and methods. Buyer service:buyer-support@gasgoo.comSeller Service:seller-support@gasgoo.com