Summary: Minivan sales in China from January to October

Gasgoo.com (Shanghai) - As a fairly unpopular segment in the Chinese market, minivan sales in the country have been unable to match sedans and SUVs. However, there has been a slight uptake as of late, as Chinese households have been gradually becoming more interested in purchasing minivans. According to statistics from Gasgoo.com (Chinese), minivan sales have managed to maintain steadily increasing year-on-year sales growth rates since 2010.

In 2020, minivan sales increased 4.0% year-on-year. That figures has grown over a percentage point since then every year, reaching 10.0% in 2014. Year-on-year sales growth for 2015 so far is 10.7%. This steadily increasing growth has been attributed to growing demand and better all-around functionality of new minivan models.

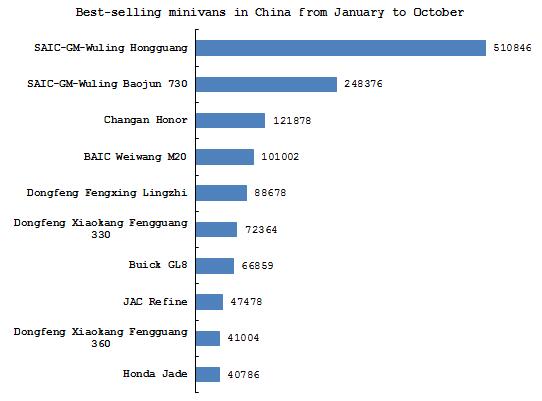

The immensely popular SAIC-GM-Wuling Hongguang has continued to lead China’s minivan market in October. The market share of the Hongguang over the first ten months of the year is 30.4%, slightly lower than the 40.4% of 2014 and the record high of 41.5% of 2013. By comparison, the Hongguang’s market share was only 1.4% in 2010. Having initially benefited from its introduction while the market was in its formation phases, the Hongguang is eventually beginning to show its age, as its market share has been taken up by the Baojun 730 and other new minivan models.

Looking at overall minivan sales from January to October, domestic own brand models have performed strongly. Own brand sales accounted for 88.3% of all minivans sold in the country over the ten month timeframe. In addition to the Hongguang, the Baojun 730, Changan Honor, BAIC Weiwang M20, Dongfeng Lingzhi and Dongfeng Joyear have also posted strong sales figures.

By comparison, the overall performance of foreign-branded minivans in the country has been a lot more lukewarm. The only two foreign-branded minivan models to make the top ten ranking for sales between January and October were the Buick GL8 and Honda Jade. The limited selection of minivan models offered by joint ventures, as well as the popular perception that they lack the features of their own brand counterparts, has severely limited their sales growth.

Sedans remain the largest segment in the Chinese passenger automobile market by far. The sedan segment will not lose its leading position in the market anytime soon. SUVs have been the fastest-growing segment, but it remains to be seen how long this wave of popularity will last. Likewise, where or not minivan sales will increase in the upcoming years is also unknown.

Gasgoo not only offers timely news and profound insight about China auto industry, but also help with business connection and expansion for suppliers and purchasers via multiple channels and methods. Buyer service:buyer-support@gasgoo.comSeller Service:seller-support@gasgoo.com