Dozen automakers raise new energy vehicle prices in China

Beijing (Gasgoo)- With the continuing raw material price hike and the gradual withdrawal of government subsidies since the begining of 2022, the price of NEVs in China has never been so high.

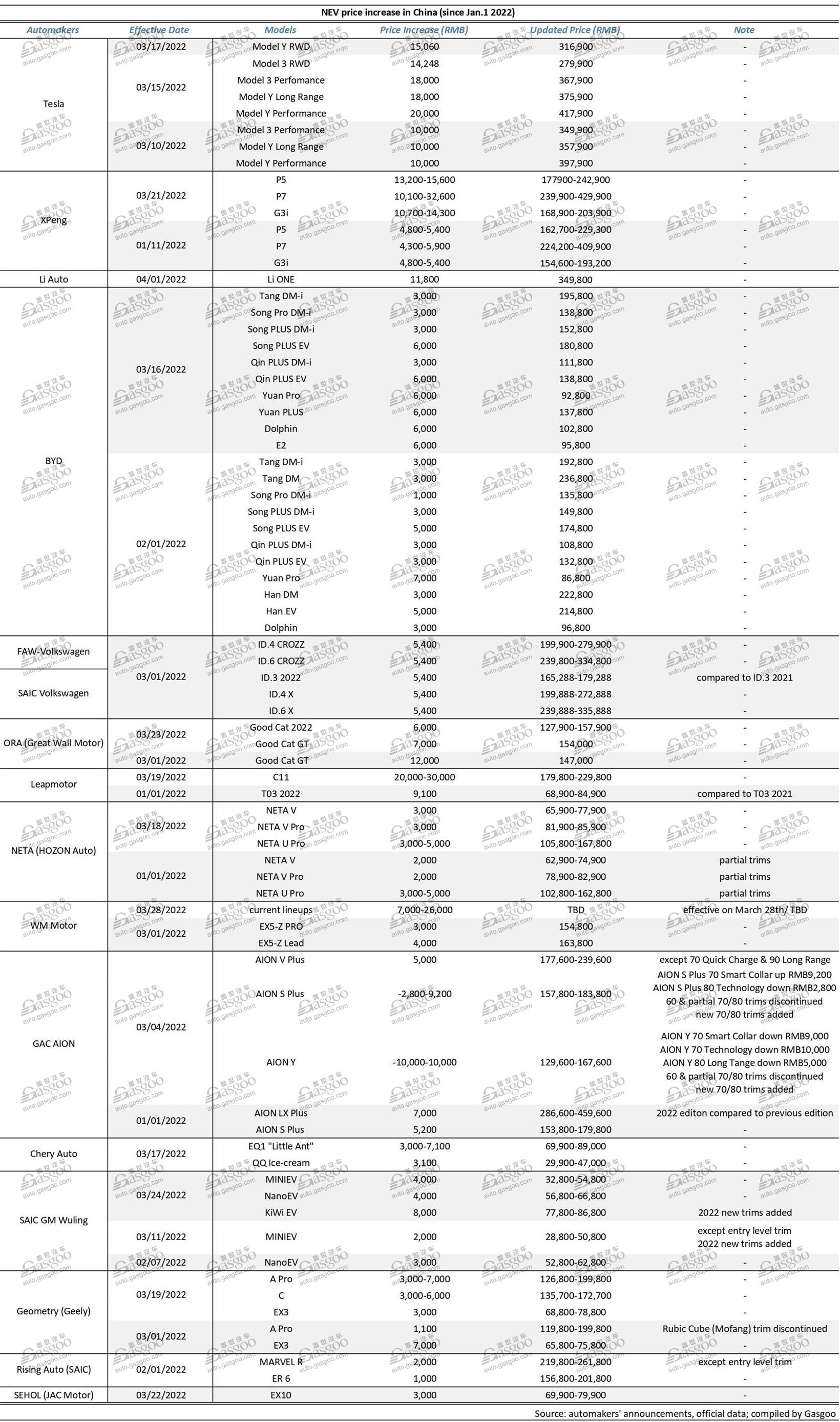

From auto startups like XPeng and Li Auto to traditional auto groups like Geely and Chery Auto, over a dozen of automakers have issued price increases on their NEV models, some even raised their prices thrice in a one-week span, such as the EV rockstar Tesla.

In the first two months of this year, only a handful of automakers lifted the prices of their products by a small percentage. For example, on January 11th, XPeng’s P5, P7, and G3i lineups saw a growth of RMB4,300-RMB5,900 ($675-$926). Most of the price changes on BYD’s models were RMB3,000-RMB5,000 ($471-$785) in February. The price of the Song Pro DM-i only grew RMB1,000 ($157).

However, in March, more and more automakers in China adjusted the prices on their NEVs. Those who already issued a price change before made an even steeper increase in March.

On March 18th, XPeng released a preannouncement of their upcoming price increase of “RMB10,100-RMB20,000”($1,586-$3,140), effective March 21st. The actual increase of XPeng’s second price lift was much more significant than advertised, as the prices went up as high as RMB32,600 ($5,119), on the P7 model.

On the other hand, Tesla issued three price increases from March 10th to March 17th, the lowest growth was still RMB10,000 ($1,570), while the highest adjustment reached RMB20,000 ($3,140), depending on the trims.

The reasons behind the concentrated price hikes are nothing other than the cliched chip supply crunch, raw material shortages, and the retreat of government subsidies on NEVs. Notably, judging from automakers’ corresponding announcements, the price increment in raw materials was the real culprit this time.

According to data collected by Wind, on March 17th, the quote for lithium carbonate skyrocketed to RMB480,000-RMB522,000 ($75,367-$81,962) per ton, whereas in the same period of 2021, the quote was merely RMB50,000 ($7,851) per ton. In the meantime, the cost of cobalt and nickel all surged up a great amount this year.

The spike in raw material costs pushed up the prices of power batteries. Major battery suppliers in China all lifted their product prices recently, including CATL, Gotion Hi-Tech, and Frasis Energy. From late 2021 to date, CATL has initiated price increases on its power batteries twice, each summed up to RMB10,000 ($1,570) by NEV battery cost standards.

Gasgoo Auto Research Institute (GARI) analyzed that aside from the unfinished price negotiations between automakers and battery suppliers, another reason behind the unaffected NEVs of some auto brands, is that the raw material price hike hits vehicle models under RMB300,000 ($47,105) harder than others. With the cost growing continuously, more auto brands will follow suit eventually.

Gasgoo not only offers timely news and profound insight about China auto industry, but also help with business connection and expansion for suppliers and purchasers via multiple channels and methods. Buyer service:buyer-support@gasgoo.comSeller Service:seller-support@gasgoo.com