SAIC Motor’s ‘asset-light’ Rising Auto to launch at least one model per year

SAIC Motor announced in October last year that it planned to set up “Rising Auto Technology Co., Ltd.” as an independent market-oriented unit derived from SAIC PV Motor's R brand. Managed by the subsidiary, “Rising Auto” would be run as a brand focusing on the smart mid-/high-end electric vehicle (EV) sector, which is parallel with “IM”, another SAIC-backed premium EV brand unveiled last year.

Involving a registered capital of 7 billion yuan ($1.108 billion), Rising Auto is 95% directly held by SAIC Motor, and the rest 5% is owned by an employee shareholding platform. Unlike IM, which is supported by Alibaba Group and Zhangjiang High-Tech, Rising Auto still represents an outreach of SAIC Motor's wholly-owned passenger vehicle business.

Bring spots for R7—first flagship model launched after Rising Auto's independence

At the Auto Guangzhou 2021, Rising Auto made its debut at an automotive exhibition with an independent booth. However, before that, the brand had already had two mass-produced models for sale—the MARVEL R and the ER6, which were previously under the R brand.

Currently, the third mass-produced model, named R7, has been available for presale and is expected for delivery in the second half of this year. The first PPV (production process validation) prototype of the R7 rolled off the production line on March 21, indicating the model moved one step closer to volume production.

R7; photo credit: Rising Auto

As the first flagship model after Rising Auto's independence, the R7 is set to vie with the likes of the NIO ES6 and the Model Y. Positioned as a full-sized SUV, the R7 measures 4,900mm long, 1,925mm wide, and 1,655mm tall with a wheelbase of 2,950mm. It is 40mm narrower and 103mm lower than that of the NIO ES6, but outperforms the latter by 50mm in both length and wheelbase.

Luminar LiDAR; photo credit: Rising Auto

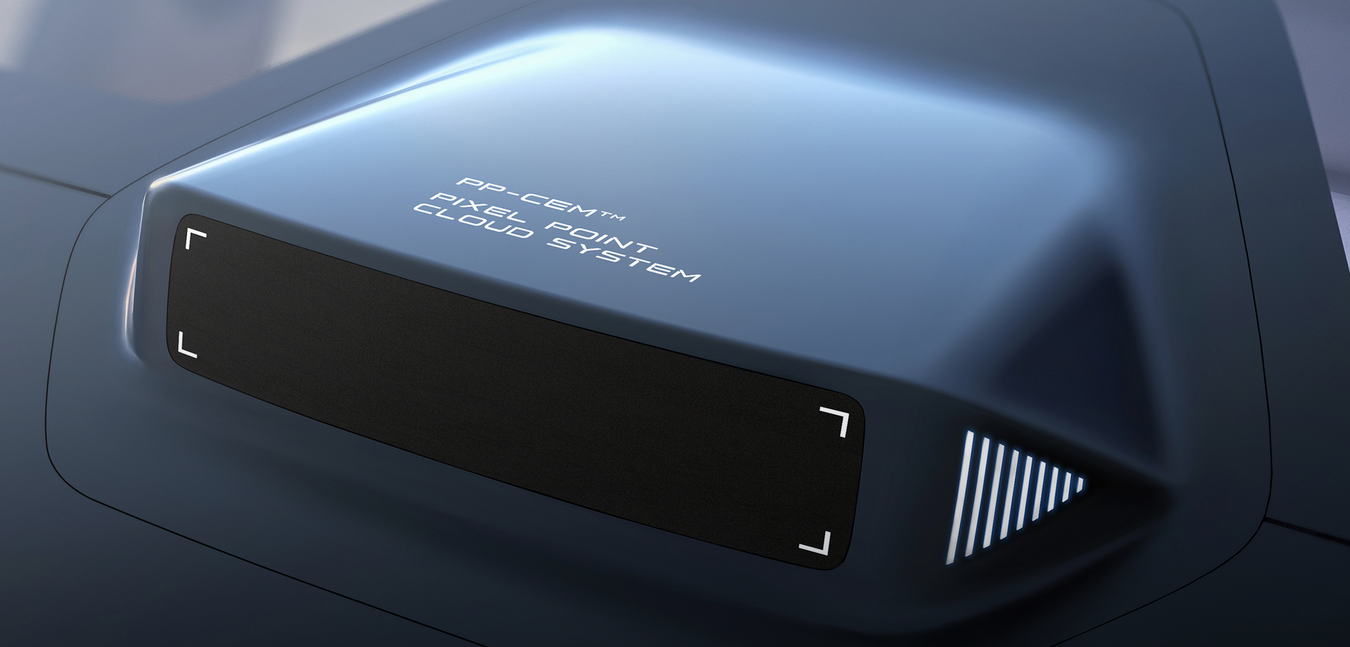

Notably, the R7 will be armed with the PP-CEM (pixel point cloud comprehensive environment model) intelligent driving system composed of 33 sensors in total, including 12 ultrasonic radars, 12 high-definition cameras, 2 4D imaging radars, 6 long-range point cloud radars, and a Luminar LiDAR unit. This full-stack smart driving solution is built on the “R-TECH” technology brand, where SAIC Motor invests 20 billion yuan ($3.167 billion).

In terms of the smart cockpit, the R7 carries a 43-inch true color triple connected screen, a 70-inch AR-HUD, Qualcomm Snapdragon 8155 chips, and the Bose 14-speaker audio system. It also adopts two NVIDIA DRIVE Orin smart driving chips, each of which uses a 7-nanometer production process to achieve a computing power of 254 TOPS.

The automaker revealed the R7 would come with both two-wheel-drive and all-wheel-drive (AWD) versions. The AWD one is able to churn out 400kW and 700 N·m, and can zip from 0 to 100km/h within around 4 seconds. Thanks to the oil cooling technology, the R7 will be well performed in heat dissipation when running at a high speed.

R7; photo credit: Rising Auto

The R7 will offer two battery pack options regarding the energy capacity. Besides, the automaker said the model’s battery pack can be exchanged for a fully charged one within only 2.5 minutes. It also noted it would mull over adopting the consumption solution of car-battery separation in the future.

Nevertheless, Rising Auto has not disclosed the concrete planning for the deployment of battery swapping network. If the automaker goes too slowly in deploying its own battery swapping system, the rapid battery swap feature will be nothing more than an “eye candy” for consumers.

Commercial logic and operational models

With regard to the commercial logic and operational model of the brand, Wu Bing, CEO of Rising Auto, underscored three key words—“asset-light”, “co-creation” and “independent operation”, at a media communication meeting held in late Feb.

Compared to other auto brands, Rising Auto faces much less pressure in technology investment and production facility construction as it was born to enjoy the technologies, resources and capabilities of SAIC Motor. To be specific, the group's newest EEA (electrical/electronic architecture) technology, design language as well as intelligent driving and smart cockpit technologies can be used in Rising Auto's products first, said Wu Bing, when he explained “asset-light”.

Rising Auto, SAIC Motor R&D Innovation Headquarters signing agreement to build co-creation center

The “co-creation” means other units of SAIC Motor can join the development of Rising Auto's vehicles. For instance, the group's design team can take part in the designing process of the brand’s car models, which are allowed to be mass-produced at SAIC Motor's manufacturing base in Shanghai's Lin-gang Special New Area.

Thanks to independent operation, Rising Auto's organizational architecture can work more efficiently. According to Mr. Wu, Rising Auto has 10 business units, which are all directly managed by himself.

Three development strategies

Thanks to the “asset-light” and “co-creation” models, Rising Auto can be taken up with implementing the three strategies, namely, “user-driven”, “digit-driven”, and “extreme-intelligence-driven”.

R7; photo credit: Rising Auto

As a user-driven company, how to improve users' experience should be prioritized. The automaker divides the entire process of user experience into many fractions, including consultation, test drive, order placement, contract signing, payment, car delivery, after-sales services, as well as re-purchase, which are all equipped with responsible staff members.

Under the digit-driven strategy, Rising Auto will collect data and classify them into different categories of vehicles, users, and experience, etc. The data categorized will be used for the development, positioning, and adjustment of new vehicle products. Mr. Wu said the data can help the automaker better learn what consumers really demand, so as to offer tailor-made and special services in the future.

He revealed Rising Auto plans to expand its staff member volume to around 600 at the end of this year, one third of which will belong to the digit business team.

Dedicated to the intelligent driving and intelligent cockpit, the extreme-intelligence-driven strategy will be mainly promoted by a co-built team that embraces talents from SAIC Motor Technology Center, SAIC Z-ONE, and Rising Auto.

Retailing and power systems

Assisted by SAIC Motor's resources, Rising Auto had to-day deployed 188 experience centers in 85 cities in China, including Shanghai, Sanya, and Harbin as of Feb. 25, 2022. What's more, it had also opened 18 delivery centers and 123 after-sales service outlets across the country by that moment.

Nonetheless, in terms of the power network building, there is still a great room for Rising Auto to improve.

As of Feb. 25, 2022, Rising Auto had deployed in China only 144 own-brand charging stations and 1,006 “Quanyi” (meaning “rights and interests”) charging stations, which particularly serve the users who have been given certain free charging quotas. Besides, the brand also had access to charging piles of some third-party operators, such as TELD and State Grid.

As a contrast, NIO, XPeng, ZEEKR (Geely Auto's premium EV brand), and CAAM (Volkswagen-backed charging solution provider) have all run much faster than Rising Auto in terms of charging facility deployment.

Sales target and new product launch plan

As to the sales target, Wu Bing disclosed that the annual deliveries of the R7 are expected to reach 10,000 units this year. For the year of 2022 to 2025, Rising Auto plans to launch at least one model per year, including sedans, SUVs, and MPVs. SAIC Motor wishes the brand to be a leading player in the mid-/high-end intelligent EV sector and become profitable in 2025.

Gasgoo not only offers timely news and profound insight about China auto industry, but also help with business connection and expansion for suppliers and purchasers via multiple channels and methods. Buyer service:buyer-support@gasgoo.comSeller Service:seller-support@gasgoo.com