At the beginning of the year of Loong, BYD once again served as a game-changer in China's automotive market.

On one side, its Honor Edition models floods the market, slashing the entry price of compact PHEVs (plug-in hybrid electric vehicles) below 80,000 RMB. With such a competitive pricing strategy, BYD sets the stage for the era where new energy vehicles are cheaper than oil-fueled ones.

On the other side, its premium car brand YANGWANG officially put the supercar model, the YANGWANG U9, onto the market, with a bold price tag of 1.68 million RMB, once again pushing the upper limit of BYD vehicles’ prices.

Honor Edition models launched by BYD; photo credit: BYD

From selling less than 180,000 new energy vehicles in 2020, to surpassing the 3 million-unit mark in 2023 and breaking into world's top 10 automakers, BYD keeps carving out its own milestones.

Hello everyone, welcome to Gasgoo. This is the first episode of the "Wheels of Change: Stories of Chinese Auto Giants series. Today, let's dive into the trailblazing journey of BYD on the road to electrification.

Back in 2003, BYD acquired Xi'an Qinchuan Automobile, stepping into the auto industry from batteries and electronics manufacturing. Despite doubts, BYD gambled on new energy vehicles, pouring a lot of resources into developing PHEV (plug-in hybrid electric vehicle) technologies. This bold move led to its stock price halved from 18 HK dollars.

Fast forward to the end of 2008, BYD made breakthroughs with its LFP (lithium iron phosphate) battery, the first-generation DM (Dual Mode) technology, and the world's first PHEV model, the F3DM. Two years later, BYD's first all-electric taxi fleet, composed of the e6 cars, hit the streets, marking the formation for BYD's "PHEV + BEV" two-pronged development approach.

In 2013 BYD's first model Qin from its "Dynasty" series, hit the market, not only carrying an impressive name, but also featuring the second-generation DM technology. This updated technology moved away from the first-generation DM tech's P1P3 electric motor structure to a parallel hybrid framework based on the P3 motor. Later, the BYD Tang DM adopted a P4 rear-axle motor on the basis of the P3.

Starting from 2015, BYD clinched the title of the world's top new energy vehicle seller for four years straight.

In 2021, BYD took a great leap forward with the launch of its in-house developed Blade Battery, the fourth-generation DM technology, and the e-Platform 3.0. By February 2024, BYD had cumulatively sold over 6.7 million new energy vehicles globally.

It's noteworthy that Toyota Motor formed a strategic partnership with BYD in November 2019. By April of the following year, they had established a joint venture that focuses on the R&D of battery electric vehicles. The partnership has already produced its first car model, the bZ3, using BYD's Blade Battery, electric motors, and electronic control system, with more models in the pipeline.

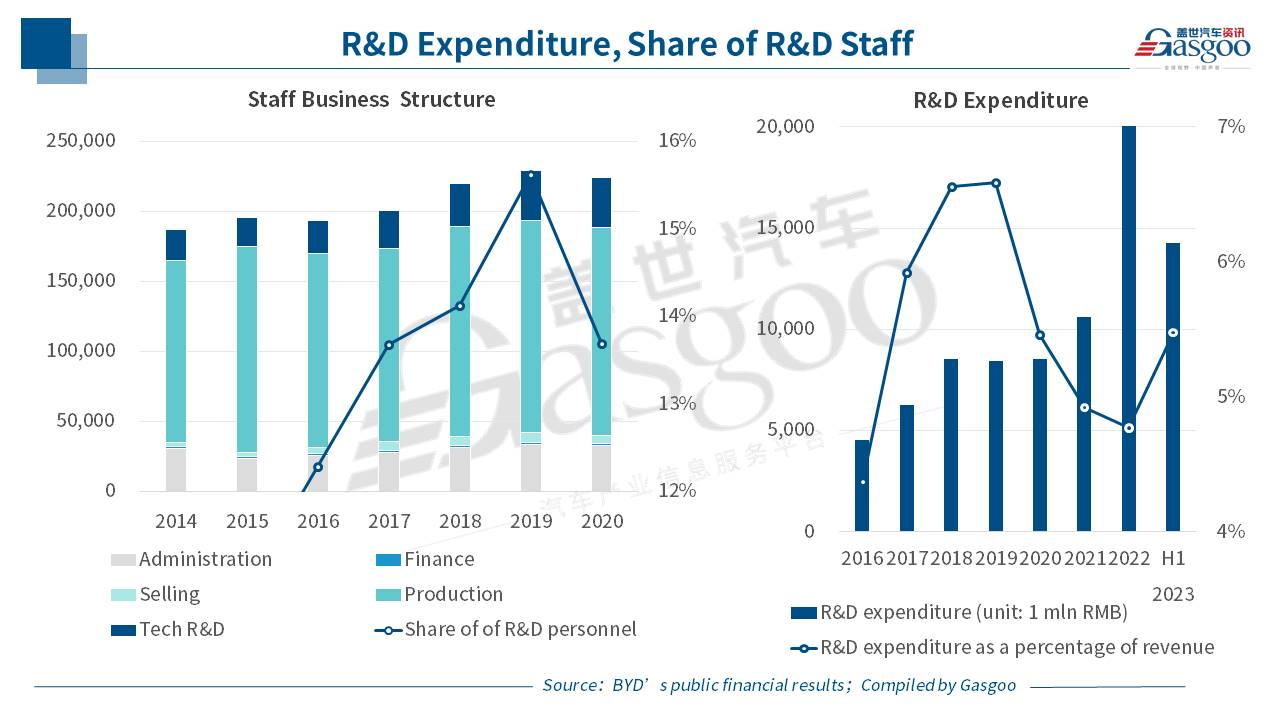

Over the past 21 years, BYD invested more than 100 billion RMB in R&D, established 11 research institutes, and built a team of over 90,000 R&D engineers, making it the automotive company with the largest R&D workforce in the world. On a global scale, BYD has filed for over 40,000 patents and has been granted more than 28,000.

BYD has created a "technology pool" that includes groundbreaking technologies and applications like the Blade Battery, the fourth-generation DM Super Hybrid technology, the e-Platform 3.0, the CTB (cell-to-body) technology, the e4 Platform, and the DiSus Intelligent Body Control System.

In the words of Wang Chuanfu, chairman and president of BYD, the company's "technology pool" is filled with multiple technologies ready to be deployed as the market demands. By swiftly responding to market changes with relevant technologies, BYD keeps on seizing market opportunities, turning its vehicle models into hot-selling products in their respective segments.

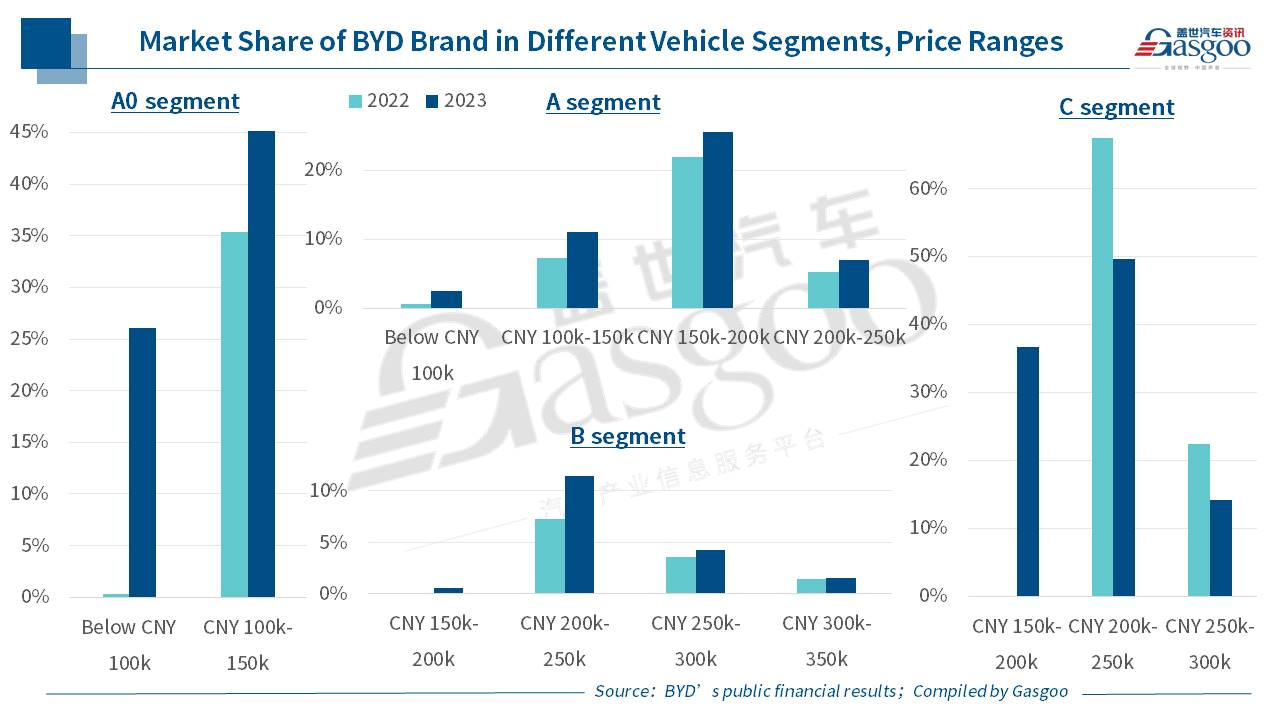

Shattering the monopoly of joint ventures

In 2023, BYD secured the top spot in the price segment of 100,000 RMB to 200,000 RMB in China with a 16.04% market share. However, in the compact car market priced between 100,000 RMB to 150,000 RMB, the penetration rate for new energy passenger vehicles stands at just 22.46%. Thus, BYD’s primary goal for 2024 lies in breaking through the dominance of joint ventures’ gasoline cars in this sector, and facilitating the comprehensive arrival of the new energy vehicle era while boosting its market share.

By March 1, 2024, BYD's Dynasty and Ocean series launched seven Honor Edition models within just two weeks, including the Qin PLUS, Destroyer 05, Dolphin, Han, Tang, Song PLUS, and Song Pro, covering the small-sized, compact, and mid-to-large-sized car segments, with prices ranging from 79,800 RMB to 249,800 RMB. The recent rounds of product launch saw a price reduction of up to 30,000 RMB from the Champion Editions’ starting price.

The question on everyone's mind is how much more BYD will reduce on prices, which depends on how much profit BYD aims to make.

According to BYD's 2023 financial announcement, its net profit attributable to shareholders is expected to be between 29 billion and 31 billion RMB, surging 74.5% to 86.5% year on year. Based on BYD's annual sales volume last year, its profit per vehicle would be nearly 10,000 RMB. Moreover, in the first half of 2023, the gross profit margin for BYD's automotive and related businesses grew by 3.28 percentage points to 20.67% from the 17.39% in 2021.

Obviously the higher-than-expected profit growth isn't just due to the rise in the price per car, and it also results from the dilution of depreciation and amortization under scale effects, as well as cost reductions achieved through vertical integration of BYD's supply chain.

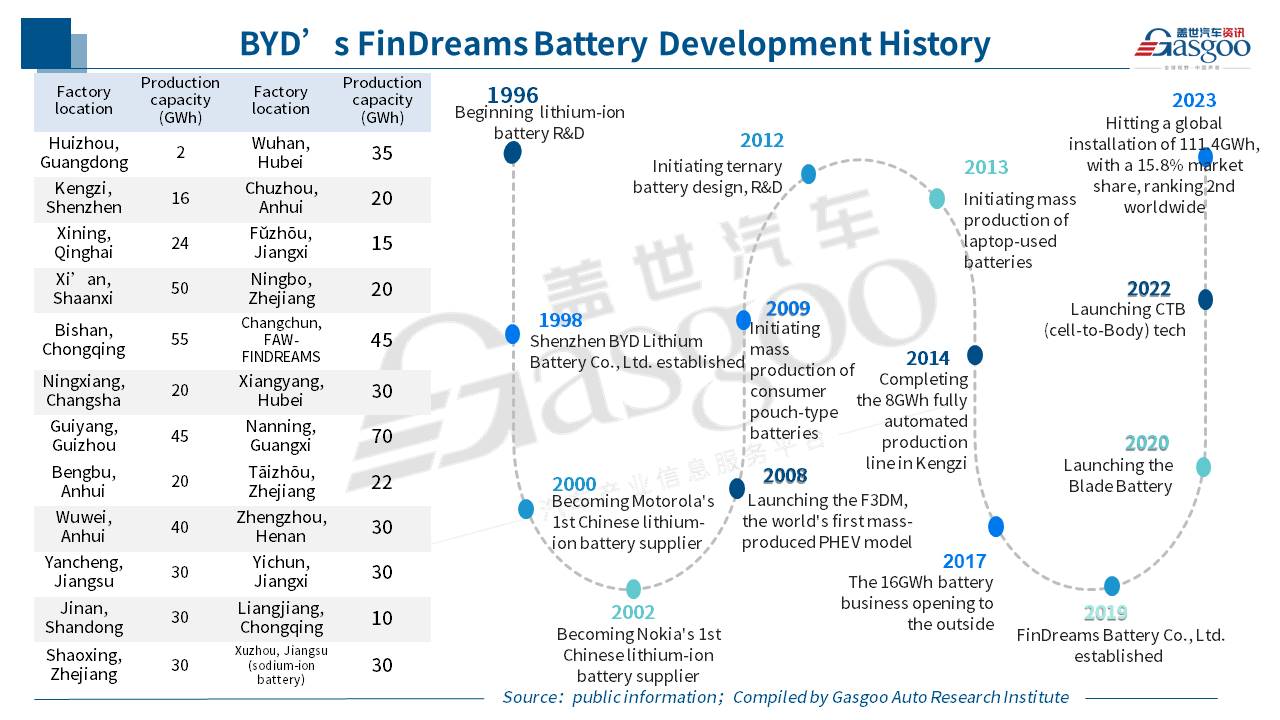

Take the battery for example. Leveraging its roots in the lithium-ion battery industry, BYD has realized in-house R&D of LFP and ternary lithium batteries, as well as the Blade Battery and CTB battery technologies. Additionally, BYD has been securing upstream mineral resources by multiple investments since 2010. In 2017, BYD set up Qinghai Salt Lake BYD Resource Development Co., Ltd. for producing battery-grade lithium carbonate; in 2020, it invested in Hunan Yuneng, the top Chinese producer of lithium iron phosphate; in 2021, it established Golmud BYD Lithium Battery Materials and Sichuan Shuneng Mineral; in 2022, it continued its aggressive expansion by investing in Chengxin Lithium, establishing Sichuan Ludi Mining, and securing land in Zhengzhou, Shenzhen, and Yichun cities for mining and production expansion.

Through these moves, BYD has nearly completed a comprehensive layout of lithium resources, cathode and anode materials, as well as lithium battery equipment.

At the end of 2023, BYD's battery unit hit a global installed capacity of 111.4 GWh, securing a 15.8% market share, second only to CATL. Looking ahead, BYD has planned a power battery production capacity of over 700 GWh across China. While meeting its internal needs, BYD is also broadening its reach into external markets, establishing strong collaborations with automakers like Toyota and FAW Group's Hongqi.

IGBT (insulated gate bipolar transistor) is also a major focus of BYD's industrial layout. BYD's venture into IGBT R&D dates back to the year of 2005, with the establishment of a dedicated IGBT department. In 2008, BYD acquired SinoMos Semiconductor (Ningbo) Inc. for 180 million RMB, ditching the contract manufacturing business to embark on independent R&D. A year later, BYD launched China's first self-developed "IGBT 1.0" chip, and marking the start of persistent upgrades and iterations for over a decade. In 2022, BYD introduced the "IGBT 6.0" high-end auto-grade chip, crafted with 90nm process technology.

BYD Semiconductor has now formed a comprehensive industry chain that spans chip design, wafer fabrication, module packaging and testing, to system-level application testing. This has enabled further large-scale application of SiC modules in high-end vehicle electric motor controllers and an upgrade of auto-grade MCU chips from 8-bit to 32-bit.

According to data from the Gasgoo Auto Research Institute, BYD's share in the China domestic new energy vehicle-used IGBT market exceeded 26% in 2023, growing by more than 6 percentage points from the previous year.

To date, BYD has established subsidiaries including FinDreams Battery, FinDreams Vision, FinDreams Technology, FinDreams Power, and FinDreams Precision, responsible for R&D and manufacturing of power batteries, automotive lighting, electronics, powertrains, and moulds, respectively.

As Wang Chuanfu puts it, except for glass, tires, and steel plates, which BYD cannot manufacture by itself, " all other components will be 'Made in BYD'."

Affected by year-end time-limited discounts and a 2-billion-RMB reward distributed to its car dealers, BYD's net profit for its automotive segment in the 4th quarter of 2023 is likely be between 6.65 billion RMB and 8.65 billion RMB, with per-vehicle profits to reach the range of 7,000 RMB to 9,200 RMB, which dropped from the previous quarter.

For BYD, how much to be cut on prices and how to do so depend on BYD's balance between overall scale and profit per vehicle.