Hi welcome to Gasgoo. In this episode of the Wheels of Change: Stories of Chinese Auto Giants series, we will continue to explore the growth journey of Guangzhou Automobile Group Co.Ltd. (GAC).

Tech-driven GAC Group

In recent years, GAC's development has been marked by a steady increase in the sales of its self-owned Trumpchi and AION brands. This growth stems not only from continuous improvements to the product system, but also from GAC's deep integration into the core industrial chain for new energy vehicles.

GAC Group has adopted a three-pronged strategy involving "independent R&D, joint-venture cooperation, and investment & acquisition," to comprehensively engage in the intelligent connected new energy vehicle sector. This approach has yielded multiple innovative solutions, such as Quark Electric Drive, 5C flash charging, Magazine Battery, Xingling electrical/electronic architecture, and the ADiGO intelligent driving ecosystem, spanning core areas from raw materials and key new energy vehicle components to chips, software, and intelligent driving technologies.

Initially, GAC's engagement in the key components for new energy vehicles was primarily through joint-venture partnerships, which bore fruits like GAC CATL, CATL GAC, and Guangzhou Nidec Auto Drive System.

Starting from 2020, GAC began building its own R&D system. That September, in collaboration with a third-party strategic partner shareholding platform, GAC established Greater Bay Technology, marking its venture into in-house R&D of power batteries.

Over the next two years, GAC founded Yinpai Battery Technology and Ruipai Power Technology, advancing its own capabilities in battery and electric drive systems. Notably, Yinpai's battery factory, with a planned annual capacity of 36GWh, began operations in December 2023. Initially set to produce 6GWh, it aims to eventually meet the battery needs for 600,000 new energy vehicles annually. The Magazine batteries made by the factory are already being installed onto to some car models under GAC AION and GAC Motor.

It's also noteworthy that, as GAC's capabilities in battery R&D advanced, one of its joint ventures with CATL, GAC CATL, was dissolved in June 2023.

Photo credit: GAC Group

Ruipai's intelligent electric drive factory opened for business in January 2024, signifying GAC AION's complete self-sufficiency in the key components for new energy vehicles. The facility's first product, the Quark M25 Super Electric Drive, will be used in Hyper-branded models first.

With the rapid development of new energy vehicles, the demand for energy replenishment and battery recycling is set to grow significantly. In response, GAC established UPower Energy in 2023 to develop a vertically integrated industrial chain that spans from lithium mining and battery materials production to battery manufacturing, energy storage, services of charging, battery swapping, battery rental, as well as battery recycling and reuse.

Currently, UPower Energy focuses on battery production and power services. Beyond operating Yinpai Battery’s factory, it has secured mining rights in Zunyi city, Guizhou province, with five more mines to be settled by the first half of 2024, so as to secure basic materials for lithium battery production.

Regarding power services, UPower Energy had established 979 EV charging stations by 2023, with a goal of reaching 2,000 by 2025. It also aims to expand from 62 battery swapping stations to 500 by 2025. In addition, alongside GAC AION’s car models that support separate operation of batteries and cars, UPower Energy launched a "Battery Bank" and introduced battery leasing services in September 2023. Moving forward, it will explore smart car-home energy solutions to further enhance its ecosystem.

In the realm of intelligent technologies, GAC has been actively engaged through a blend of in-house R&D moves and strategic partnerships for over a decade.

A key achievement is the ADiGO intelligent and interconnected driving system, which was launched in 2019. With its R&D spearheaded by GAC and supported by strategic partners such as Tencent and Huawei, this system includes the ADiGO PILOT for intelligent driving and the ADiGO SPACE for smart cockpits.

The ADiGO PILOT has evolved significantly over the past few years, supporting R&D of Level 2 to Level 4 autonomous driving technologies across various scenarios, including parking, expressways, highways, and urban roads. This technology is featured in models such as the Hyper GT, Hyper HT, Trumpchi EMKOO, Trumpchi E9, AION V, and AION LX. Building on this foundation, GAC is now advancing to the R&D of Level 3 and higher-level autonomous driving technologies.

GAC has also established the X Lab and has formed deep partnerships with companies like DiDi Autonomous Driving, WeRide, and Pony.ai to push forward the R&D of advanced self-driving technologies. It has already launched Robotaxi pilot service in Guangzhou and Shenzhen cities through its ONTIME mobility service platform.

On April 7, 2024, Guangzhou Andi Technology Co., Ltd., the joint venture between DiDi Autonomous Driving and GAC AION announced that it had officially received its business license. The company's first commercial Level 4 autonomous car model has completed its product definition and is undergoing joint design reviews, with plans for volume production by 2025.

In the intelligent cockpit sector, GAC's ADiGO SPACE has been successfully installed in multiple models across the Trumpchi, AION and Hyper brands. The Trumpchi M8 Grandmaster Pioneer edition features Huawei's in-car modules and the HarmonyOS operating system.

Beyond these applications, GAC has explored cutting-edge technologies in recent years, including hydrogen-fueled engines, ammonia-fueled engines, high-voltage cobalt-free batteries, solid-state batteries, robots, and flying cars.

Photo credit: GAC Group

In the flying car sector, GAC completed the global debut flight of its flying car GOVE in 2023, following over 300 testing flights. Looking ahead, GAC plans to initiate flying car demonstrations in 2025 and aims to launch a comprehensive multi-layered smart mobility service network that integrates ground transportation and air travel across two to three cities in the Guangdong-Hong Kong-Macao Greater Bay Area by 2027.

This relentless pursuit of innovation is underscored by GAC’s robust R&D system.

The group has established a global R&D network that centers on the Guangzhou-based GAC R&D Center, which is supported by the R&D centers in Los Angeles and Milan, GAC Advanced Design studio in Shanghai, and GAC Intelligent Connected Studio in Xiamen. This network harnesses the expertise of over 5,000 R&D professionals from more than ten countries, with a total investment of over 45 billion yuan in independent R&D.

Going forward, GAC plans to further enhance its tech talent pool, aiming to expand its global R&D team to over 6,400 by 2025.

Setting sail to build new growth driver with global reach

In the past few decades, China's automotive industry has laid a solid foundation through "technology-for-market" approach and various joint-venture collaborations with global companies.

Today, propelled by the surge in the intelligent electric vehicle sector, domestic companies are seizing the early-mover advantage to pioneer core technological innovations, and also seeking to build a full industrial chain in overseas markets through technology, service, and product exports. GAC Group is at the forefront of this movement.

In August 2023, GAC Group unveiled its ambitious "1551" internationalization strategy, setting a goal to sell 500,000 vehicles by 2030 and gaining a firm foothold in 5 major markets of Europe, Asia-Pacific, CIS (the Commonwealth of Independent States), the Middle East and Africa, and Central and South America. The strategy includes deep engagements in at least 12 strategic markets, each with a sales scale of around 100,000 vehicles.

For Europe, GAC plans to enter with full-electric vehicle models, focusing on Western Europe. In the Asia-Pacific, the group’s foray will start with both oil-fueled (including hybrid electric) vehicles and all-electric ones, with plans to set up production bases in Malaysia, Thailand, and Myanmar, covering ASEAN countries and building key markets in Thailand, Malaysia, the Philippines, and Indonesia. In the Middle East and Africa, GAC will leverage its Dubai branch and overseas parts warehouses to further develop such markets as Saudi Arabia and the UAE, while also operating SKD (semi-knocked down) factories in Nigeria and Tunisia, and pushing for CKD (completely knocked down) facility layouts in Egypt and South Africa. In Central and South America, the focus will be on Mexico and Chile. In the CIS region, the focus will be mainly on Russia, prioritizing CBU (completely built-up) in the short term.

Photo credit: GAC Group

Around the same time, GAC AION shipped the first 100 AION Y Plus vehicles to Laem Chabang, Thailand, and signed agreements with seven dealers in Thailand, Myanmar, Vietnam, and Singapore, marking the official kickoff of its Southeast Asia strategy.

In December 2023, GAC AION officially entered the Cambodian market and in January 2024, GAC MOTOR inaugurated its new office in Mexico. In February, GAC AION announced the groundbreaking for its factory in Rayong Industrial Park, Thailand.

As GAC AION's first overseas production base, the Thailand plant is designed with an annual capacity of 50,000 vehicles, to be built in two phases. The first phase is set to be completed by July this year, starting with the production of the right-hand drive AION Y Plus. By year-end, GAC AION expects to have 167 overseas sales outlets, aiming to export 3,500 new energy vehicles to the Southeast Asian market.

Although GAC AION’s overseas expansion started in 2023, in fact, GAC embarked on its global journey much earlier, initially focusing on the Trumpchi brand.

In September 2013, GAC Motor exported 115 Trumpchi-branded vehicles to Kuwait, marking its first volume export. Since then, GAC has established a presence in nearly 40 countries and regions across the Middle East, Americas, Africa, Southeast Asia, and Eastern Europe.

According to data compiled by Gasgoo Auto Research Institute, in 2023, GAC exported 55,366 passenger vehicles under its self-owned brands, with the Trumpchi brand accounting for 51,399 units and GAC AION for 3,967 units, still focusing on oil-fueled vehicles.

In 2023, GAC’s wholly-owned passenger vehicle brands scored a 67.75% year-on-year spike in annual export volume. Nevertheless, this performance didn’t stand out when compared to other domestic companies, such as Chery, SAIC MOTOR Passenger Vehicle, and Geely, whose full-year exported reached 923,931 unit, 685,018 units, and 274,101 units, respectively.

As for the reasons leading to the tepid performance, an analyst at Gasgoo Auto Research Institute suggested that GAC's Sino-Japanese joint ventures’ operations performed well for a long time, but in the early stages of the new energy vehicle era, GAC AION's strategy was heavily reliant on the B2B sector, making GAC prioritize the domestic market, while neglecting opportunities in global markets.

Today, GAC is catching up in exports, but considering the complexity and variability of overseas markets, along with the huge investment and return period required for initial setups, it might take some time for the group to establish a new growth driver through international business expansion.

Challenges and opportunities

From selling 350,000 units in 2020, which constituted 17% of the group's total sales, to 890,000 units in 2023, which accounted for nearly 36% of the overall sales, GAC Motor and GAC AION are becoming the backbone forces for the group's ambition to hit the one-trillion RMB revenue by 2030.

However, despite the striking performance of GAC’s wholly-owned brands, some challenges lie beneath the surface.

Profitability is the main concern. Historically, GAC has relied heavily on its joint ventures during the era of oil-fueled vehicles, with subsidiaries like GAC Honda and GAC Toyota being major contributors to its revenue and profits.

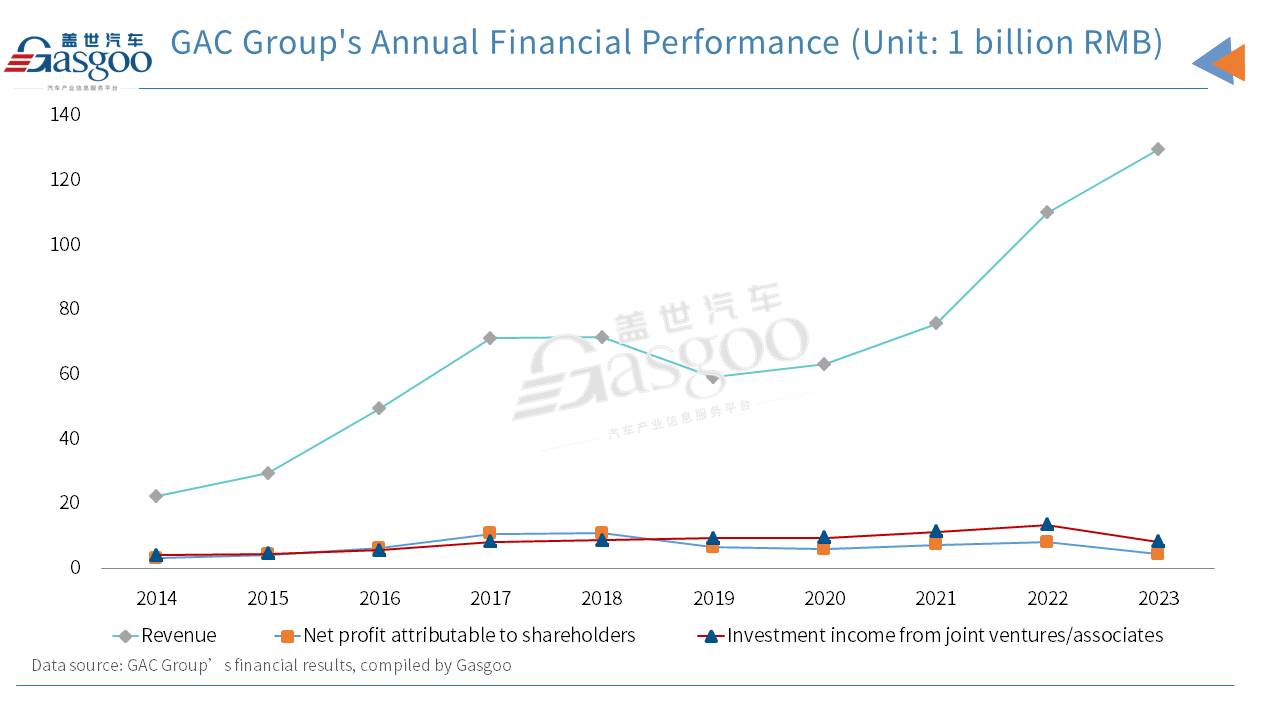

From 2014 to 2018, with joint efforts from both self-owned brands and joint ventures, GAC’s total sales surged from 1 million to 2 million vehicles. This growth boosted GAC's revenue from 22.4 billion yuan in 2014 to over 70 billion yuan in 2018, and net profits soared from 3 billion yuan to around 10 billion yuan.

During this period, earnings from investments in associated companies and joint ventures were substantial, rising from 4.1 billion yuan in 2014 to 8.753 billion yuan in 2018. Even in 2018, when GAC Motor’s sales reached a record high of 535,000 vehicles, income from these investments still accounted for 80% of the group’s net profits attributable to shareholders.

In 2019, GAC Motor saw its annual vehicle sales tumble around 150,000 units compared to 2018, leading to a plunge in both revenue and profits of the group, which reached 59.23 billion yuan and 6.62 billion yuan, respectively. That year, income from associated companies and joint ventures was as high as 9.399 billion yuan, significantly cushioning the losses from the own-brand business.

From 2020, GAC's performance embarked on another upward trajectory, achieving revenue of 110 billion RMB in 2022 with net profits of 8.068 billion RMB. During this period, the wholly-owned brand sector, particularly GAC AION, saw significant growth, reporting revenues of 7.61 billion RMB, 17.265 billion RMB, and 38.703 billion RMB in the three years.

However, this revenue growth did not translate significantly into profits. According to GAC Group’s financial results, from 2019 to 2021, GAC AION recorded net losses of 621 million RMB, 688 million RMB, and 1.389 billion RMB, respectively, totaling 2.697 billion RMB. The group’s main profit growth still heavily relied on associated companies and joint ventures, with investment incomes of 9.57 billion RMB, 11.404 billion RMB, and 13.48 billion RMB from 2020 to 2022.

In 2023, GAC Group reported robust revenues of 129.7billion RMB, marking a 17.62% year-on-year increase. This growth was bolstered by notable sales from GAC Motor and GAC AION, which sold 406,500 and 480,000 vehicles, respectively. Despite this strong performance, its annual net profit tumbled to just 4.429 billion RMB, nearly halved from the 8.068 billion RMB in 2022.

Photo credit: GAC AION

GAC attributes this decrease primarily to the sliding sales and profits of its joint ventures. Although its self-owned brands gained rapid sales growth, the profit margin was limited as their key models mainly target affordable vehicle markets. This is insufficient to support an upward development for the group's overall financial performance. Especially after the exit of joint ventures like GAC FCA and GAC Mitsubishi, coupled with sales declines of GAC Honda and GAC Toyota, the concern has been raised about whether the GAC's own-brand business can sustain the group's revenue growth.

Furthermore, GAC AION's future growth potential in the intelligent electric vehicle market is yet to be proven. As previously mentioned, the AION brand relied heavily on the ride-hailing market to boost sales. Despite significant strides in its consumer-focused strategy over the past two years, a substantial portion of its retail sales still comes from the B2B market. According to the registration data compiled by Gasgoo, GAC AION had about 443,000 vehicles registered last year, of which Hyper-branded models accounted for only 3,453 units and 48.4% of vehicles being non-commercial uses.

This strong association with the ride-hailing service impacts the brand's image and could pose challenges as the car-hailing market becomes increasingly saturated and competitive. Given the ongoing price wars in the automotive industry, where companies like BYD have initiated price cuts, the outlook for GAC AION to maintain its sales and profit levels is not optimistic.

Following this trend, GAC AION recently adjusted the prices of some of its models. On March 3, it launched the AION Y Plus Xingyao Edition, priced at 99,800 yuan, bringing the model's starting price below 100,000 yuan. Subsequently, GAC AION announced price reductions for products like the AION S MAX Xinghan Edition and AION V Plus.

Given that automakers such as Wuling, BYD, Chery, Geely, and Changan have all adjusted the prices of their hotter-selling models, GAC AION is poised to face heightened pressure. According to the forecast by Gasgoo Auto Research Institute, amidst these challenges, GAC AION’s total sales are expected to be between 400,000 and 450,000 units in 2024.

Photo credit: GAC AION

While GAC AION is striving to elevate its brand positioning and planning to go public, its overall development progress has been challenging. Since launching its first model, the Hyper GT, in July 2023, the Hyper brand only had 3,453 vehicles registered last year.

This indicates that GAC AION must try harder to realize its "high-end dream," especially in the highly competitive market of 200,000 to 300,000 RMB

On the IPO front, GAC AION's progress has also fallen short of expectations. Previously, Mr. Feng Xingya, GAC Group's General Manager, said GAC AION was expected for public listing in 2023. However, the plan has been delayed, with the IPO shifting focus from China's STAR Market to the Hong Kong Stock Exchange.

In early 2024, reports emerged that GAC AION was gearing up for an IPO in Hong Kong this year, aiming to raise 1 billion US dollars. Following a Series A funding round that valued GAC AION at over 100 billion RMB, a successful IPO would greatly boost the valuation of GAC Group. The pressing question now is whether GAC AION can sail through this challenging environment to carve a successful path forward.