Hi, welcome to Gasgoo. In this episode of “Wheels of Change: Stories of Chinese Auto Giants,” let’s talk about China first car manufacturer FAW.

FAW's 71-year Glorious History

CHINA FAW GROUP CO., LTD. (short for FAW), formerly named China First Automobile Works, can trace its roots back to 1953. Over the past 71 years, FAW has become one of China’s oldest and largest automotive manufacturers.

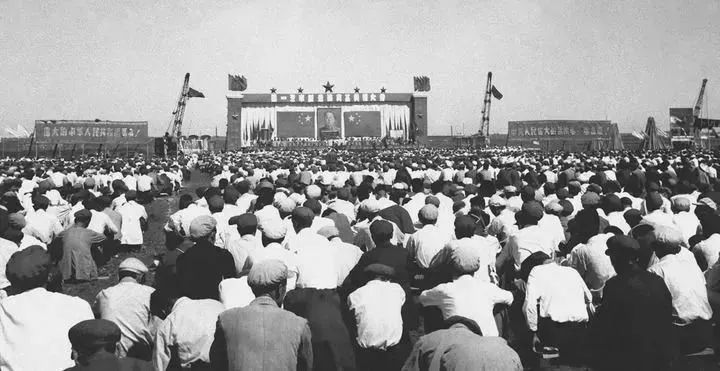

On July 15, 1953, the groundbreaking ceremony of the First Automobile Manufacturing Plant took place in Changchun, Jilin province, marking the first step towards the development of China's automotive industry. On July 13, 1956, the first Chinese-made Jiefang truck rolled off the assembly line, putting an end to the history of China's inability to manufacture automobiles.

Photo credit: FAW

In May 1957, FAW factory manager Mr. Rao Bin was given a challenging task: to produce a Chinese-made sedan as quickly as possible. At that time, when the People's Republic of China had been founded less than 10 years earlier, all sedans in China were imported, and there was no production capacity or experience to draw on.

With the experience of independent development of Jiefang trucks, FAW successfully trial-produced the first Chinese-made sedan, Dongfeng CA71 sedan, on May 12, 1958, based on the principle of "primary emulation with independent design". Three months later, the first Hongqi brand sedan, Hongqi CA72, was successfully trial-produced and made its debut at the military parade celebrating the 10th anniversary of the founding of the People's Republic of China in 1959. The model has since become the “national car” for national events and national leaders since then.

The birth of the Hongqi CA72 not only filled the gap of having no Chinese-made sedans, but also represented the development of China's automotive industry into a new stage.

During the initial growth period, FAW not only successfully established the two national automotive brands "Jiefang" and "Hongqi", but also sent a large number of technical and management talents throughout the country. FAW also accomplished the task of building the Second Automobile Works (SAW) of China and participated in several assistance projects outside the company.

In the 1980s, Jiefang’s single model struggled to meet market needs as market demands evolved, and sales began to decline. FAW faced a great challenge. However, riding on the 'winds' of China's reform and opening-up, FAW entered a period of reform and transformation.

With the spirit of perseverance, willpower and determination, FAW took 3 years to complete the design, trial production, testing and finalization of the second generation Jiefang CA141 truck. Finally, without halting or reducing production, the second generation Jiefang CA141 was officially put into production on January 1, 1987, successfully upgrading the product line and ending the 30-year single model history of Jiefang truck.

At that time, FAW had two dreams: one was to get rid of the outdated "Jiefang’s 30-year single-model system," which had already been achieved, and the other was to mass-produce Chinese-made sedans, a challenging goal.

Due to high fuel consumption, high manufacturing costs, lack of profitability and other reasons, FAW was forced to stop production of the "Hongqi" sedan in 1981. However, with China's reform and opening up and the influx of imported cars into the Chinese market in the mid to late 1980s, FAW shifted its focus to sedan production. In 1985 alone, as many as 100,000 sedans were imported into China.

In order to bring sedans into more households, FAW was listed as one of the three key units to prioritize sedan development during China’s Seventh Five-Year Plan period in 1987. In line with China’s development policies and its strategic planning, FAW put forward a development strategy: start with medium and high-end sedans as a base and gradually expand downward to cover a wider range of vehicle models and markets; utilize its existing plant resources and production capabilities; consolidate internal light vehicle resources in the south and north; propose a single plan to be implemented in phases. FAW pursued both external cooperation and independent development to implement the strategy.

In 1988, FAW and Audi signed the Technical Transfer License Agreement for the production of Audi cars at FAW. Under the license agreement, the Audi 100 was the first model to be produced from parts kits at FAW’s Changchun plant. The technology, talent and capital acquired through this partnership not only curbed the outflow of foreign exchange caused by imported cars, but also laid the foundation for FAW to develop its own sedans.

Photo credit: FAW

On November 20, 1990, FAW signed a joint venture agreement with Volkswagen for a 150,000-unit sedan project. The following February, FAW-Volkswagen was officially established. With a total investment of 11.13 billion yuan and an annual production capacity of 150,000 vehicles, the project was fully completed and put into production in nearly five years under the strong support of the Jilin Provincial Government.

FAW Toyota is another key player in FAW’s joint venture efforts. In the early 2000s, FAW lacked A0/A00 class cars, B class cars, SUVs and other passenger car products in its product matrix. At the same time, Chinese competitors and foreign automotive giants also conducted joint ventures, creating a new competitive landscape and development dynamic that posed a great threat to FAW's position in the industry.

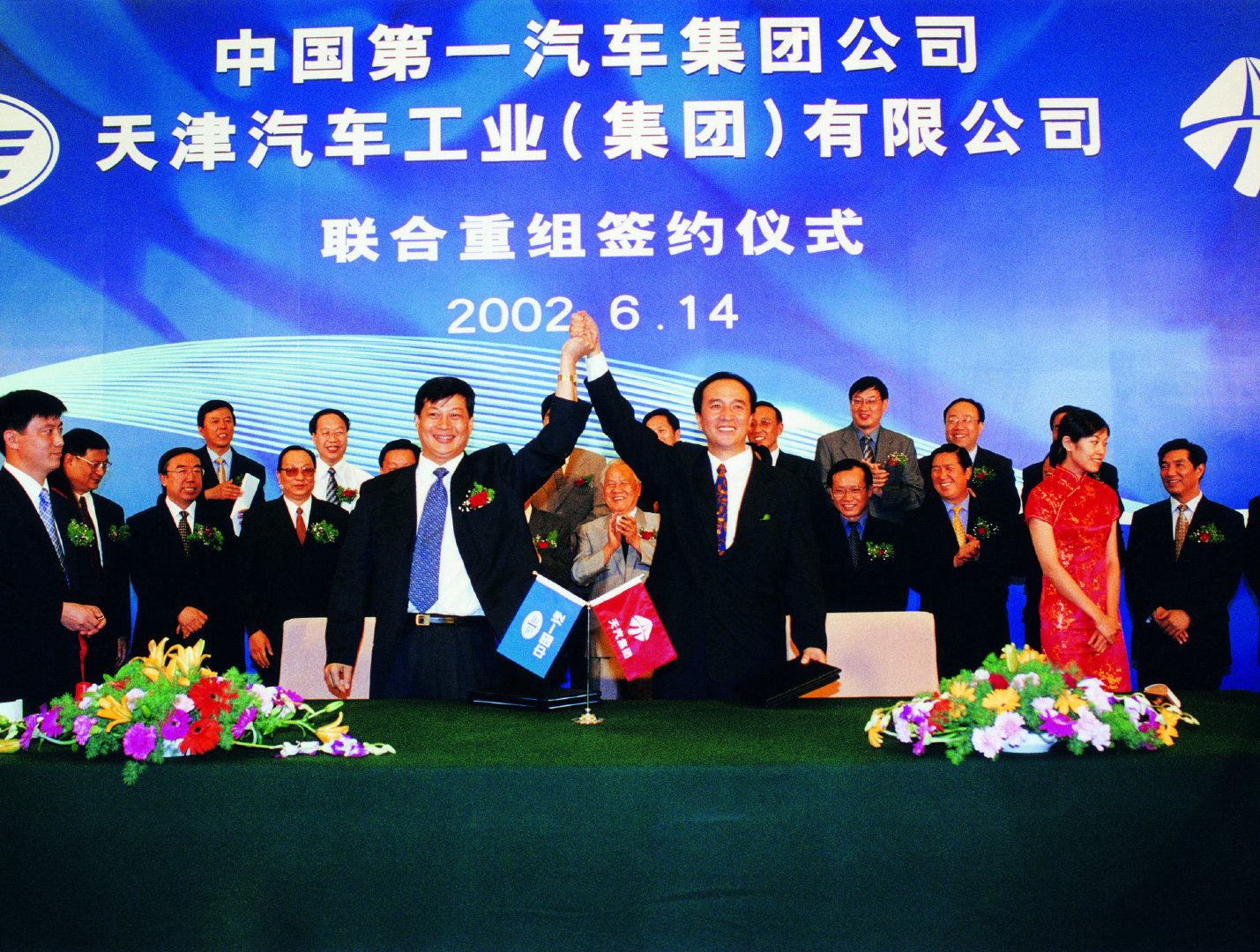

Photo credit: FAW

With a long-standing desire to learn from Toyota's production methods, FAW considered a partnership with Toyota as the best option. In June 2002, FAW formed a capital partnership with Tianjin Automobile Industry Group, paving the way for cooperation with Toyota. In August 2002, on the occasion of the 30th anniversary of the normalization of Sino-Japanese relations, FAW and Toyota held a signing ceremony at the Great Hall of the People in Beijing and agreed to establish a strategic and long-term cooperative relationship covering their automotive businesses in China, such as R&D, manufacturing, sales, after-sales service and advanced automotive technology.

In 2002, FAW also officially signed a cooperation agreement with Mazda in Shanghai, starting technical cooperation. In 2003, FAW subsidiary FAW Car Company (FCC) and Mazda carried out the technical cooperation of "authorized production", and FCC started the production of the first generation Mazda 6 sedan. In early 2005, FAW Mazda Motor Sales Company (FMSC) was established, with FCC, Mazda Motor and FAW holding 70%, 25% and 5% of the shares, respectively.

FAW successfully entered into joint ventures with Audi, Volkswagen, Toyota and Mazda. While absorbing the technologies of these partners, FAW also focused on developing its own passenger car brands, with the revival of the Hongqi and the launch of the Bestune being the most prominent examples.

In 1996, FAW modified the Audi 100, replaced its engine with the Chinese-made CA488 gasoline engine, and produced the Hongqi CA7220 sedan. By 1997, the model had sold nearly 28,000 units and generated a profit of 6.6 billion yuan, making it the most profitable model in the history of the Hongqi brand.

Under the technical cooperation agreement, FCC obtained the rights to use the Mazda 6's CD3 platform and LF series engines while producing the Chinese version of the Mazda 6. In 2006, FAW launched the Hongqi Bestune sedan based on the Mazda 6, which quickly became the most popular Chinese brand sedan with the best ride and the highest price. With the growing reputation of the Bestune sedan, FAW expanded it from a single model to an independent brand, and Bestune has since ushered in its own era.

After more than 70 years of development, FAW has become a Chinese state-owned automotive group with annual production and sales of more than 3 million vehicles. It has established five production bases in Northeast China, North China, East China, South China and Southwest China, and owns three major independent brands, Hongqi, Bestune and Jiefang, as well as joint venture brands such as Volkswagen (including Audi and Jetta) and Toyota.

In 2023, FAW Group sold 3.37 million new vehicles, an increase of 8.8% year on year, but did not reach the target of 4 million units; its revenue reached 624.94 billion yuan, an increase of 6% year on year.

In 2024, FAW set its annual sales target at 3.47 million units, aiming for a year-on-year growth of about 3%. In the first quarter of this year, FAW Group's vehicle sales reached 743,000 units, up 9.5% year on year, achieving 21.4% of the annual sales target.

FAW’s Joint Venture Cooperation Towards the 2.0 Era

Among the many joint ventures in China's automotive market, FAW-Volkswagen and FAW Toyota play an important role. These partnerships have not only brought technology, talent and supply chains to China's automotive industry, but have also brought scale and profitability to FAW.

Since its establishment in 1991, FAW-Volkswagen has grown from a single Jetta model to more than 20 models under the Audi, Volkswagen and Jetta brands, and has listed the top of China’s passenger car market for many times.

In 2020, FAW-Volkswagen's sales reached 2.11 million units (including Audi imported cars), up 1.9% year-on-year, making it the only automaker in China to produce and sell more than 2 million units.

In 2022, FAW Group sold 3.2 million vehicles, with revenue of 630 billion yuan and profit of more than 49 billion yuan. FAW-Volkswagen's cumulative new car retail sales totaled about 1.8 million units (including Audi imported cars), achieving its profit target of 41.5 billion yuan and contributing more than 80% to FAW Group's annual profit.

Since its establishment in 2002, FAW Toyota has launched nearly 20 models, covering various segments from sedans to SUVs and MPVs. In 2022, FAW Toyota rolled out its 10 millionth vehicle to celebrate its 20th anniversary. By the end of the year, both its total production and sales reached the "10-million-unit mark". To date, FAW Toyota has produced and sold more than 11 million vehicles, generating more than 1.6 trillion yuan in revenue.

However, with the rapid growth of Chinese independent brands in the new energy vehicle market and the automotive market entering a mature phase, joint venture brands such as FAW-Volkswagen and FAW Toyota have come under increasing pressure.

After peaking at 2.11 million units in 2020, FAW-Volkswagen's sales fell to around 1.77 million units in both 2021 and 2022, losing its position as the Chinese industry's production and sales leader, with its market share falling from double digits to 8.7%. FAW-Volkswagen's sales recovered to 1.91 million units in 2023, but still failed to break through the 2-million-unit threshold.

FAW-Volkswagen has planned to achieve annual sales of between 1.9 to 2 million units this year, but current trends indicate that it may face lots of challenges. According to the Gasgoo Auto Research Institute, FAW-Volkswagen's sales have declined for five consecutive months since February, and cumulative retail sales from January to June reached 798,500 units, far from the target of 1.9 million units.

FAW Toyota's situation is also challenging. In April, FAW Toyota's retail sales were 49,033 units, down 31.1% year-on-year, ranking it ninth among automakers in terms of retail sales. In May, the company fell out of the top ten due to declining sales of its flagship Corolla. In the first half of the year, FAW Toyota sold 329,000 units, down 11.82% year-on-year.

Faced with a sharp decline in sales, FAW Toyota had to reduce production capacity to alleviate the pressure. In October 2023, FAW Toyota informed dealers that it would reduce production by 66,000 units in December 2023, 60,000 units in January 2024, and 38,000 units in February 2024.

According to the Gasgoo Auto Research Institute, FAW Toyota currently has five production bases in China (three in Tianjin, one in Changchun and one in Chengdu), with a standard annual production capacity of 1 million units. In recent years, capacity utilization has been around 70% to 80%. If sales of gasoline vehicles do not improve significantly and new energy vehicles do not offset the decline in sales, capacity utilization is likely to decline further.

The poor sales performance of the joint ventures also affected FAW Group's overall sales. After peaking at 3.7 million units in 2020, FAW's new car sales fell to 3.5 million units in 2021 and 3.2 million units in 2022.

Clearly, FAW Group needs the stability of its joint ventures to achieve its 2024 sales target. Therefore, in the face of an increasingly challenging external environment and fierce market competition, FAW has begun to accelerate the top-level design for a new era of joint venture cooperation, called “Joint Ventures 2.0”.

The “Joint Ventures 2.0” strategy focuses on two main areas: first, to further consolidate the foundation of traditional fuel vehicle cooperation; and second, to actively expand new energy vehicle technologies, including electric vehicles, hybrid vehicles, and hydrogen fuel cell vehicles.

Photo credit: FAW-Volkswagen

For example, FAW-Volkswagen has launched the "Fuel Vehicle and Electric Vehicle Advancing Together" strategy, which focuses on continuing technological innovation in fuel vehicles while rapidly expanding capabilities in new energy vehicles. The new-generation Magotan, launched in July, is an example of FAW-Volkswagen's continued innovation in fuel vehicle technology. By partnering with industry leaders such as DJI, Qualcomm, iFLYTEK and Huawei, FAW-Volkswagen has launched its "intelligentization counteroffensive" in the fuel vehicle sector.

In addition, the joint ventures will also work to increase the proportion and capability of local R&D to enhance their voice and decision-making power in the product development process. In 2023, Volkswagen, Audi and Toyota each signed a strategic cooperation framework agreement with FAW to further deepen long-term cooperation. These agreements focus mainly on NEV and new platforms. For example, FAW's cooperation with Volkswagen mentions promoting the development of electric vehicles and strengthening the introduction of localized Chinese technology.