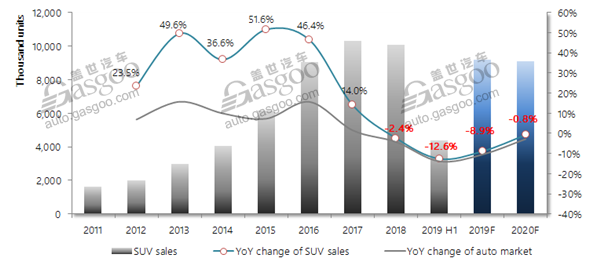

Data Talk: with high growth fading away, China’s SUV sales in 2019 forecasted to dip 8.9%

Shanghai (Gasgoo)- China's SUV market closed the first half of 2019 with a double-digit decrease of 13.4% over the previous year, according to the wholesale volume offered by the China Association of Automobile Manufacturers (CAAM). Based on the present performance, automakers’ planning for the second half and some policy factors, Gasgoo Auto Research Institute (GARI) predicts an 8.9% year-on-year drop in annual SUV sales this year.

SUV sales for the world’s biggest auto market represented a rare downturn in 2018, while joint-venture and premium auto brands have not slowed down the pace of new products’ roll-out, thus further squeeze market shares of China’s self-owned brands.

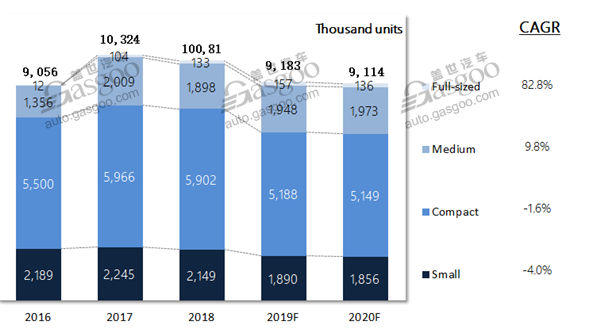

Market shares of medium SUVs has continued climbing since 2016 primarily thanks to sales growth of premium SUVs.

Sales of small-sized SUV declined in recent two years. Much of the blame should be laid on the slackened market demands and the loss of market shares captured by compact SUVs which feature increasingly lower prices.

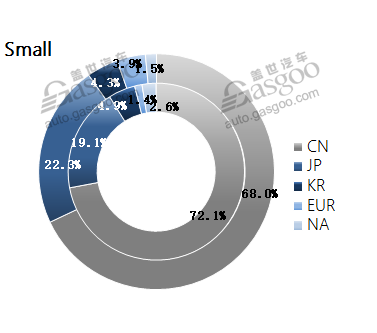

Market shares of small SUVs remained stable for recent years because relatively few all-new models were launched. In this segment, China-owned SUV brands saw their aggregated market shares shrink to 68% for the first half of 2019 from 72.1% for the year of 2018, mainly encumbered by sales decrease of such models as the Baojun 510 and the Soueast DX3 (the inner ring means annual market shares for 2018, the outer ring means the market shares for the first half of 2019).

As for the compact SUV segment, China-owned brands posted evident market share decline as joint ventures roll out more new compact models.

Regarding the medium segment, European SUVs saw their combined market shares significantly grow during the first six months with more all-new mid-sized premium SUV and change-over models hitting the market.

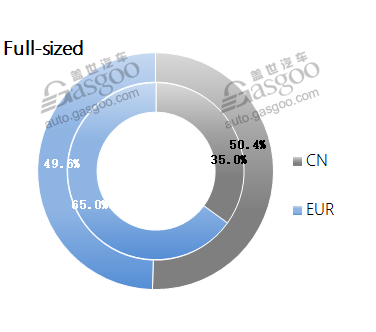

The full-sized segment is not the highlight for most automakers. In this segment, there is only one joint-venture-owned model—the Teramont/Teramont X from SAIC Volkswagen. China-owned brands boast impressive market share growth entirely thanks to fresh models.

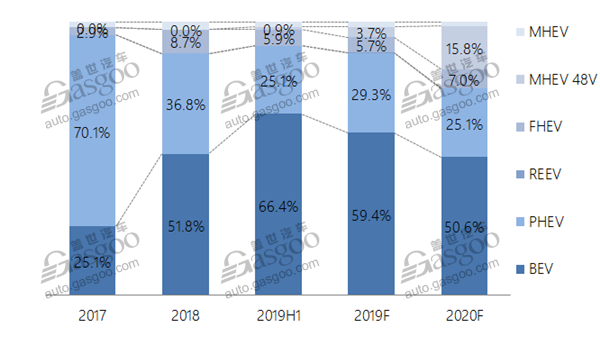

Due to the more diversified powertrain and stricter emission rules, the 48-volt mild hybrid system will be used to power more SUV models.

Gasgoo not only offers timely news and profound insight about China auto industry, but also help with business connection and expansion for suppliers and purchasers via multiple channels and methods. Buyer service:buyer-support@gasgoo.comSeller Service:seller-support@gasgoo.com