China's new‑energy vehicle market in 2025—propelled by policy, rapid tech iteration, brand rivalry and more discerning consumers—has kept up its strong growth and is showing sharper structural shifts. Battery‑electric vehicles (BEVs), the market's mainstay, are not only expanding but also diverging within their own ranks.

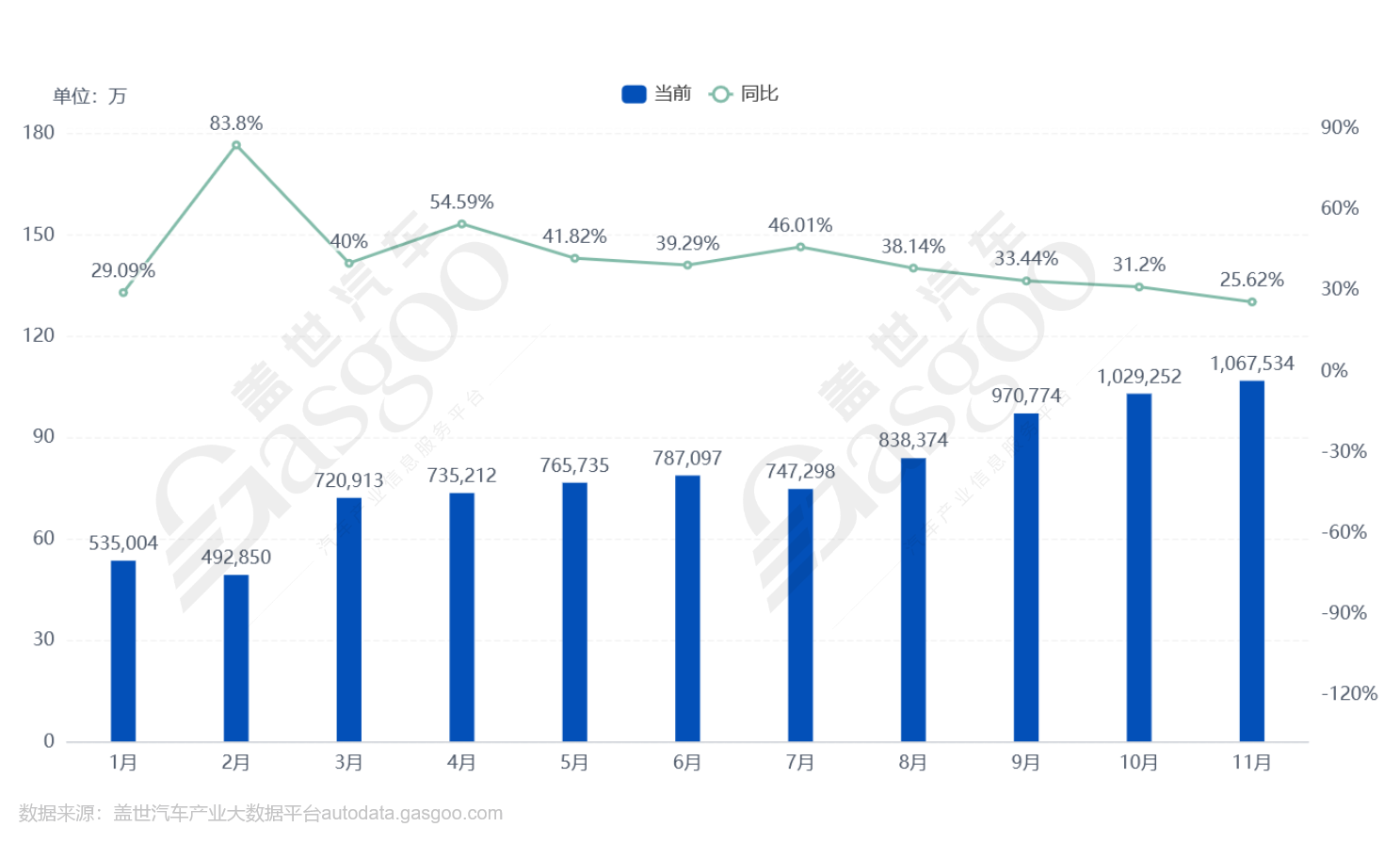

Monthly BEV sales trend, Jan–Nov 2025

According to the Gasgoo Auto Industry Big Data Platform, cumulative BEV sales reached 8.69 million from January to November 2025, sustaining growth. As scale expands, the internal structure is undergoing deep adjustment: budget runabouts and mid‑to‑high‑end smart cars are pulling in tandem; legacy brands and startups are battling head‑to‑head; product positioning and price bands are splitting further—patterns that are clear across the top‑10 models.

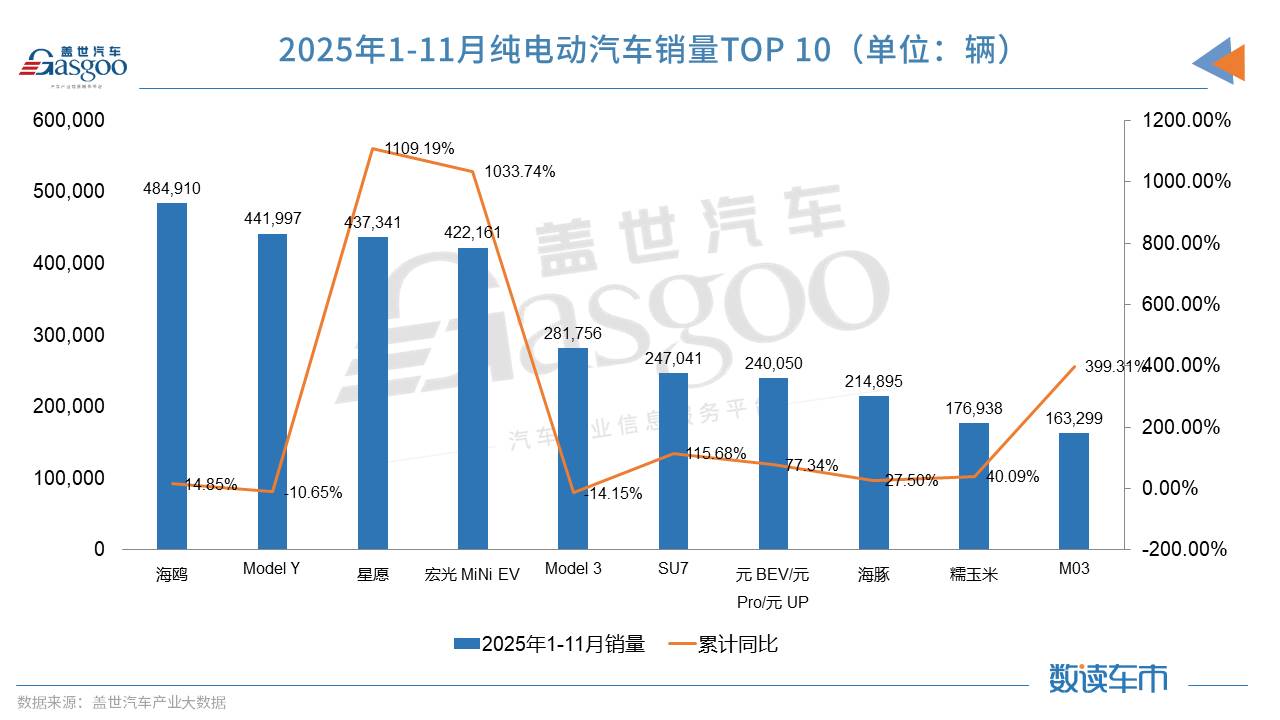

BYD Seagull, Tesla Model Y, Geely Galaxy Xingyuan, Wuling Hongguang MINI EV, Tesla Model 3, Xiaomi SU7, BYD Yuan series, BYD Dolphin, Changan Lumin and XPENG M03—ten models that, thanks to sharp positioning and product strength, ranked among the top BEV sellers in Jan–Nov 2025. The list doesn’t include December, yet it already captures the market’s mainstream trends and competitive dynamics.

Market map: a stable top, a bruising middle, and risers at the edges

Looking at cumulative sales through November, the 2025 BEV leaderboard presents a complex mix: stability at the top, a dogfight in the middle, and newcomers on the rise.

BYD’s Seagull leads with 484,910 units—up 14.85% year on year—and topped 50,000 in November alone, showing strong momentum. Priced at RMB 73,800–89,800, and backed by refined design and BYD’s tri‑electric tech, it hits the A00–A0 commuter segment squarely, outflanking same‑class gasoline cars and older EVs. Its steady run shows that in the budget market, value‑for‑money, reliability and brand pull make a potent combination.

Tesla’s Model Y ranks second at 441,997 units. Despite a 10.65% decline from a year earlier, its market position remains solid. Sales swings reflect production cadence, end‑of‑quarter pushes and intensifying competition; even so, in the RMB 250,000–350,000 mainstream SUV bracket, it’s still the benchmark. Brand heft, powertrain efficiency, an autonomy halo and its global profile form the moat.

Geely Galaxy Xingyuan and Wuling Hongguang MINI EV take third and fourth with year‑on‑year gains of 1,109.19% and 1,033.74%. Galaxy Xingyuan sold 437,341 units, pairing a RMB 68,800–97,800 ticket with fashionable lines and Geely’s backing—effectively replicating the Seagull playbook to stand as a co‑leader in the niche. The Hongguang MINI EV reached 422,161 units, leveraging model spinoffs, deeper channels and active user operations to keep drawing must‑have buyers at RMB 35,800–46,800. Their rapid climb highlights the capacity and vigor of the sub‑RMB 100,000 market, now a major source of incremental demand.

Places five through ten form the market’s middle band, with varied traits. Model 3 totaled 281,756 units, down 14.15% year on year, under pressure from new sedans such as Xiaomi SU7 and XPENG M03, as well as BYD’s Han and Seal. Even so, it remains a key player, anchored by its global pedigree and local refinements.

Xiaomi SU7 climbed into the top six with 115.68% year‑on‑year growth. Deliveries ramped fast post‑launch and stabilized around 20,000 per month, validating Xiaomi’s ecosystem leverage, sharp pricing and muscular marketing. More than a car, SU7 signals how consumer‑electronics thinking is reshaping automotive paradigms.

BYD’s Yuan series and Dolphin logged 240,050 and 214,895 units respectively—up 77.34% and 27.5%—serving as BYD’s steady pillars in the mid‑market. Balanced capability, word‑of‑mouth and service depth keep the numbers coming.

Changan Lumin reached 176,938 units, growing steadily in the microcar segment at RMB 49,900–69,900; XPENG M03 rose to 163,299 units, up 399.31%, priced at RMB 119,800–155,800. With a strong intelligent‑driving pitch and sedan form, it nearly quadrupled—evidence of smart tech’s pull around the RMB 150,000 mark.

The 2025 BEV top‑10 shakes out into three tiers: budget commuters (Seagull, Xingyuan, Hongguang MINI EV, Lumin) form the sales bedrock and growth engine; mid‑range all‑rounders (Model Y, Model 3, Yuan, Dolphin) are locked in the fiercest fight; and smart‑era sedans from startups (SU7, M03) are the biggest swing factor, rewriting the rules in the RMB 150,000–300,000 bracket. The market has become a diversified landscape spanning price points, segments and technology routes.

Behind the boom: positioning, price anchors and core tech

Behind the sales are precise reads of demand and the ruthless execution of core strengths. Through three lenses—positioning, pricing and technology—you can decode what powers these ten.

On positioning: Seagull, Xingyuan, Hongguang MINI EV and Lumin target high‑frequency short trips, delivering safe, compliant basics at low purchase and running costs—accelerating household electrification. Model Y, the Yuan series, Model 3 and Dolphin balance range, space, brand and cost to serve all‑purpose needs for first‑time family buyers and upgraders. Representing a new consumption trend, Xiaomi SU7 draws tech‑savvy users with a "people‑car‑home" ecosystem and high‑value specs, while XPENG M03 brings high‑end intelligent driving down to the RMB 150,000 range for those seeking smart, fresh experiences.

On pricing: the top ten span a wide RMB 35,800–361,900 range, each building a "value moat" at its price point. At RMB 30,000–60,000, the Hongguang MINI EV and Lumin set the minimum bar for compliant electric mobility—the core value is "have it" and "save more." At RMB 70,000–100,000, Seagull and Xingyuan offer near‑A‑segment quality with brand assurance, displacing same‑price gasoline cars. In the RMB 110,000–160,000 band, Dolphin wins with balance, M03 with smart tech, and Yuan with SUV versatility—this is the key battleground for domestic brands’ tech arms race and value push. And from RMB 200,000 to 350,000, Model 3/Y define value with global branding and efficient powertrains, while Xiaomi SU7 reframes expectations with top‑tier performance at mid‑market prices.

Source: BYD

On technology: different automakers build competitiveness from distinct strengths. BYD’s broad deployment of e‑Platform 3.0, blade batteries and in‑house electric drives delivers reliability and cost control across the core powertrain; Tesla uses FSD, the Supercharger network and a global E/E architecture to shape its tech brand and lower marginal R&D; XPENG, leveraging the reputation and roll‑out of XNGP, differentiates on intelligent‑driving experience as baseline performance converges; Xiaomi fuses ecosystems and user operations, connecting phones, IoT devices and cars seamlessly to build user stickiness; Wuling combines extreme cost discipline, platform development and deep distribution to deliver low‑price products and broad reach.

Competition has evolved beyond early fights over range and electrification into a three‑pronged contest of precise positioning, sincere pricing and a long suit in core technology. Winners establish pronounced advantages on one or more fronts and resonate deeply with target users' core needs.

Looking ahead: challenges and where BEVs go next

The Jan–Nov leaderboard is more than a mid‑term tally—it's a window into what's next.

First, further stratification and finer niches are likely to persist—hot at both ends, squeezed in the middle. The budget commuter segment still has room to run, though demands on cost, quality and iteration will be higher; competition in the mid‑to‑high end will pivot from range and acceleration to a full‑spectrum contest of intelligent features, luxury feel, ecosystem services and globalized experience; more blockbusters tied to personas and use cases are likely to emerge.

Source: XPENG

Intelligence is becoming the dividing line. Higher‑level driver assistance and immersive cabins are shifting from "nice‑to‑have" to "must‑have"; smart capability will be central to any brand's claim on the upper tiers.

The price war's normalization and a parallel value war are advancing together. Bare‑bones low pricing no longer ensures victory; the mix of price sincerity and value over‑delivery will be the focus. Brand divergence is accelerating: BYD leads with a multi‑brand matrix; Tesla holds the high end with global nameplates; startups cut through with sharp products; legacy automakers' NEV sub‑brands show fresh momentum; brands lacking tech signatures or scale advantages will face pressure.

Even as trends come into view, profitability and sustainability remain long‑term tests—especially below RMB 100,000, where margins are thin. Balancing scale and earnings is pivotal.

Supply‑chain security and technological autonomy still need strengthening. Advanced chips, high‑end materials and software algorithms carry "choke‑point" risks; building resilient, secure chains and independent IP is essential.

Infrastructure and the "last mile" of user experience are coming to the fore: charging convenience, after‑sales service and used‑car residuals shape the full ownership cycle, requiring coordinated effort by automakers, operators and government. Data security and privacy ethics, as cars get smarter, are becoming core compliance and societal issues.

For industry participants, clarity matters. Automakers need to pick a lane—tech leader, cost killer or experience innovator—avoid copy‑cat fights, and shift from manufacturing and sales to full‑lifecycle user operations; supply‑chain firms should track advances in solid‑state batteries, 800V platforms, SiC and integrated cockpit‑driving chips, boosting customization and co‑innovation; policymakers should pivot from purchase subsidies to building a fair, innovation‑friendly market, while accelerating new infrastructure across charging networks, grid upgrades and data regulation.

Conclusion: The Jan–Nov 2025 BEV top‑10 vividly captures China's NEV industry pressing ahead in a deep‑change phase. Market momentum has shifted from a single policy engine to a coordinated triple drive of policy guidance, technological push and real demand. The winners' profiles are sharpening: some master mass‑market needs, some set a higher tech brand bar with global vision, others redraw value with inventive thinking.

December may bring minor reshuffles, but the deeper logic—inevitable stratification, decisive tech long suits, and user experience as the ultimate destination—won't change. BEV competition has entered an endurance race of system‑level capability, strategic stamina and user‑centricity.