Gasgoo Munich- China's power battery installations totaled 42 GWh in January, reflecting a sharp 57.2% decline from the previous month amid typical year-end seasonality, while still posting an 8.4% increase compared with a year earlier, according to the data issued by the China Automotive Power Battery Industry Innovation Alliance ("CAPBIIA").

Lithium iron phosphate (LFP) batteries continued to dominate the mix, accounting for 32.7 GWh, or 77.7% of total installations. Ternary batteries contributed 9.4 GWh, representing 22.3% of the market. Both chemistries recorded significant month-on-month declines but maintained modest year-on-year growth, underscoring steady structural demand despite short-term fluctuations.

Battery installations in battery electric vehicles (BEVs) represented 77.4% of the total in January, up 4.8% from a year earlier. Plug-in hybrid electric vehicles (PHEVs) accounted for 22.6%, delivering a much stronger 22.9% year-on-year increase, with plug-in hybrid trucks emerging as a particularly fast-growing segment. Fuel cell vehicles remained negligible at 0.003% of installations, with volumes declining sharply from the previous year at 86.7%.

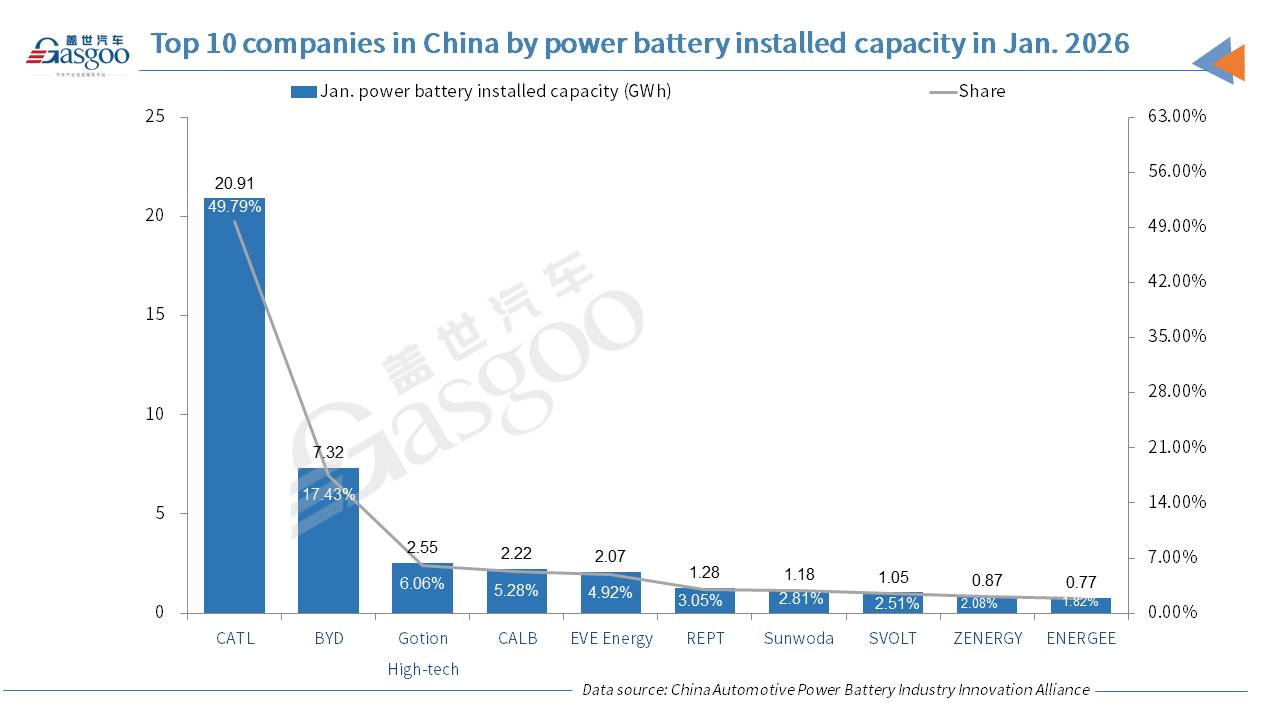

A total of 33 battery makers supplied China's new energy vehicle market in January, three fewer than in the same period last year, highlighting ongoing consolidation. The top two suppliers together delivered 28.2 GWh, commanding 67.2% of the market. The top five accounted for 83.4%, while the top ten captured 95.7% of total installations, a slight 1.1 percentage point drop from a year earlier. The figures indicate that although competition remains intense, market share is still heavily concentrated among leading players.

Combined output of power and energy storage batteries reached 168 GWh in January. Production declined 16.7% from the previous month but surged 55.9% year on year, reflecting continued capacity expansion and robust structural demand from both mobility and stationary storage applications.

Total battery sales, including power and energy storage units, amounted to 148.8 GWh in January, down 25.4% month on month but soaring 85.1% compared with a year earlier.

Image source: CATL

Power batteries made up the majority at 102.7 GWh, accounting for 69% of total sales, while energy storage batteries contributed 46.1 GWh, or 31.0%. Notably, energy storage battery sales more than doubled year on year, rising 164%, significantly outpacing the 63.2% growth recorded by power batteries. The divergence highlights the rapid scaling of China's grid and commercial storage sector alongside the automotive market.

Exports of power and energy storage batteries totaled 24.1 GWh in January, down 26% from December but up 38.3% year on year, representing 16.2% of monthly sales.

Power battery exports reached 17.7 GWh, accounting for 73.3% of total outbound shipments and posting robust annual growth of 59.3%. Energy storage battery exports stood at 6.4 GWh, comprising 26.7% of exports, with only marginal year-on-year growth.