At the start of 2025, a troupe of robots in floral jackets wowed the Spring Festival Gala with a yangge dance; elsewhere, they were already hauling parts on factory lines and inspecting high-voltage sites. As year-end approaches, several companies say they've hit the thousand-unit delivery mark, and leading players expect annual shipments to reach several thousand robots.

Looking back from the end of 2025, humanoid robots are no longer distant sci-fi or pricey lab pieces. They're moving into the rhythms of the real economy at a speed and depth not seen before.

In one year, the sector leapt from flashy tech demos to practical deployment. For humanoid robots, 2025 stands as a historic pivot — dramatic in both pace and consequence.

This year, technology, markets and capital together drove a profound shift. On one hand, embodied intelligence advanced from "early trials" to "initially usable." The deep fusion of AI foundation models with robot hardware brought the brain and the cerebellum into sync, sharpening scene understanding and enabling more autonomous action.

On the other, domestic supply chains triggered a cost reset. Real orders from industrial and commercial clients surged, turning the story from a capital pitch to proof of value — and vaulting top players into a new phase of thousand-unit deliveries.

Even so, beneath the social buzz and investor ardor, a gap remains to cross — from "usable" to "useful," from pilots to broad adoption.

Brain-and-cerebellum evolution: from strong limbs to a budding mind

2025 is a hinge year for humanoids: the industry's focus shifted from "can it move" to "can it work." Breakthroughs landed in three areas — the big brain’s autonomous decision-making, brain–body coordination control, and scaled progress in real-world scenarios.

So what exactly are a humanoid’s "big brain" and "little brain"?

Zhang Zhaoxiang, a researcher at the Institute of Automation, Chinese Academy of Sciences, says: "The 'big brain' handles higher-level cognition — perceiving the environment, understanding language, task planning and decision-making. It lets the robot know why and what to do. The 'little brain' manages low-level motion control and coordination — balance, trajectory planning, force control — ensuring the robot does things accurately."

For now, the big brain is advancing faster, thanks to AI foundation models and VLA (Vision-Language-Action) theory. Progress in the little brain leans more on hardware innovation married with precise algorithms, with the core challenge being human-like dexterity and adaptation.

On the big-brain side, foundation models are delivering. Roles for the brain, cerebellum and limbs are now clearer, with the perceive–decide–act–feedback loop tightly integrated. Multimodal models and reinforcement learning are pushing intelligence up a gear.

In March, Zhiyuan Robotics unveiled its Qiyuan foundation model, built on a Vision-Language-Latent-Action architecture that fuses multimodal foundation models with a mixture-of-experts system. The VLM perceives scenes from internet image-text data, an implicit planner within the MoE parses cross-platform video data, and an action expert executes fine operations using real-robot data. Trained on human video and real-machine data, the model generalizes rapidly with few samples. Across five tasks — from pouring water to cleaning a table — average success rates climbed from 46% to 78%.

Image credit: Zhiyuan Robotics website

In September, the Chengdu Humanoid Robot Innovation Center developed China's first robot task execution system based on a world model (R-WMES), marking a breakthrough in the "world model" domain of core AI and humanoid technology — enabling humanoids to "think like humans" and plan tasks autonomously.

According to the center, a world model approaches how the human brain thinks: by learning physical and causal laws of the real world, it builds a "reflex-like physical intuition," can simulate environmental changes internally, infer future states from the present, and assess the consequences of actions.

XPENG's robots, meanwhile, layered high compute on top of large models.

In November, XPENG introduced its new-generation humanoid IRON. Chairman He Xiaopeng said it runs second-generation VLA and three Turing AI chips, combining VLT+VLA+VLM into an advanced brain–cerebellum stack, enabling higher-level dialogue, walking and interaction.

Image credit: He Xiaopeng on Weibo

XPENG's second-generation VLA — the company's first production-grade physical-world foundation model — serves both as an action generator and a model for understanding and simulating the physical world. It upends the industry's conventional "vision–language–action" pipeline by removing language translation and, for the first time, outputting action commands end-to-end directly from visual signals — a new paradigm for physical modeling.

With end-to-end optimization across chips, operators and models, XPENG managed to run its second-generation VLA — with billions of parameters — on the 2,250 TOPS Ultra variant of its vehicles, while most in-car models in the industry remain in the tens of millions of parameters. Training data for the model nears 100 million clips — equivalent to the cumulative extreme scenarios a human driver would only encounter over 65,000 years.

In December, the Beijing Humanoid Robot Innovation Center open-sourced the XR-1 model for embodied cerebellum capabilities, alongside RoboMIND 2.0 and ArtVIP to support data training for XR-1 and related models.

XR-1 is China’s first — and only — embodied VLA model to pass the national standard test for embodied intelligence. These open-source releases aim to make robots genuinely useful across scenarios, pushing domestic embodied intelligence toward "fully autonomous and more user-friendly."

Beijing's self-developed XR-1 is designed for "unity of knowledge and action," built on cross-source learning, cross-modal alignment and cross-platform control. Its UVMC (unified visual–motor multimodal representation) maps vision to action, allowing robots to "reflex" like humans — instantly turning what they see into instinctive bodily responses.

A sharp big brain, though, isn't enough; robots also need a fast-reacting, precise little brain.

In March, the Beijing Humanoid Robot Innovation Center launched the world’s first general embodied intelligence platform with "one brain, many skills" and "one brain, many machines," called Huisi Kaiwu — composed of an embodied big brain and little brain.

The embodied big brain handles AI model–driven task planning, with natural interaction, spatial awareness, intent understanding, hierarchical planning and error reflection. The embodied little brain executes end-to-end skills via data, split into manipulation and motion-control sub-platforms. Manipulation covers meta-skill libraries, generalized grasping, skill decomposition and error handling; motion control drives whole-body control, dual-arm collaboration, stable walking and mobile navigation.

In practice, Huisi Kaiwu lets the big brain plan tasks, calls specific skills from the little brain to execute, and feeds results back to the big brain — closing the loop.

In July, Shanghai-based Matrix Superintelligence debuted its MATRIX-1 humanoid and its brain–cerebellum–limb collaborative OS.

The system tackles a long-standing challenge: coordinating high-level decisions (brain), fine motion control (cerebellum) and limb execution end-to-end — so robots can "see–think–act" like humans.

For now, despite visible progress, the little brain still needs breakthroughs in hardware, algorithms and integration to mesh seamlessly with the big brain and master complex tasks. Brain–cerebellum coordination will require fine-tuned design.

Capital shifts from funding rounds to IPOs, and the competitive map sharpens

R&D needs capital.

According to the Humanoid Robot Scenario Application Alliance, the third quarter of 2025 saw more than 56 funding deals globally in humanoids, with total financing topping 18.8 billion yuan — a single-quarter record.

Q3 not only outstripped the first two quarters combined, it lifted the full-year tally.

By the end of September 2025, cumulative global financing had exceeded 32.8 billion yuan across more than 140 deals. China accounted for 86% — about 120 transactions — making it the core battleground of this wave.

Meanwhile, per data compiled by Gasgoo, more than 30 companies in robot hardware and core components alone have completed or are pursuing IPOs this year. Include firms with adjacent scenarios or technologies, and the number swells.

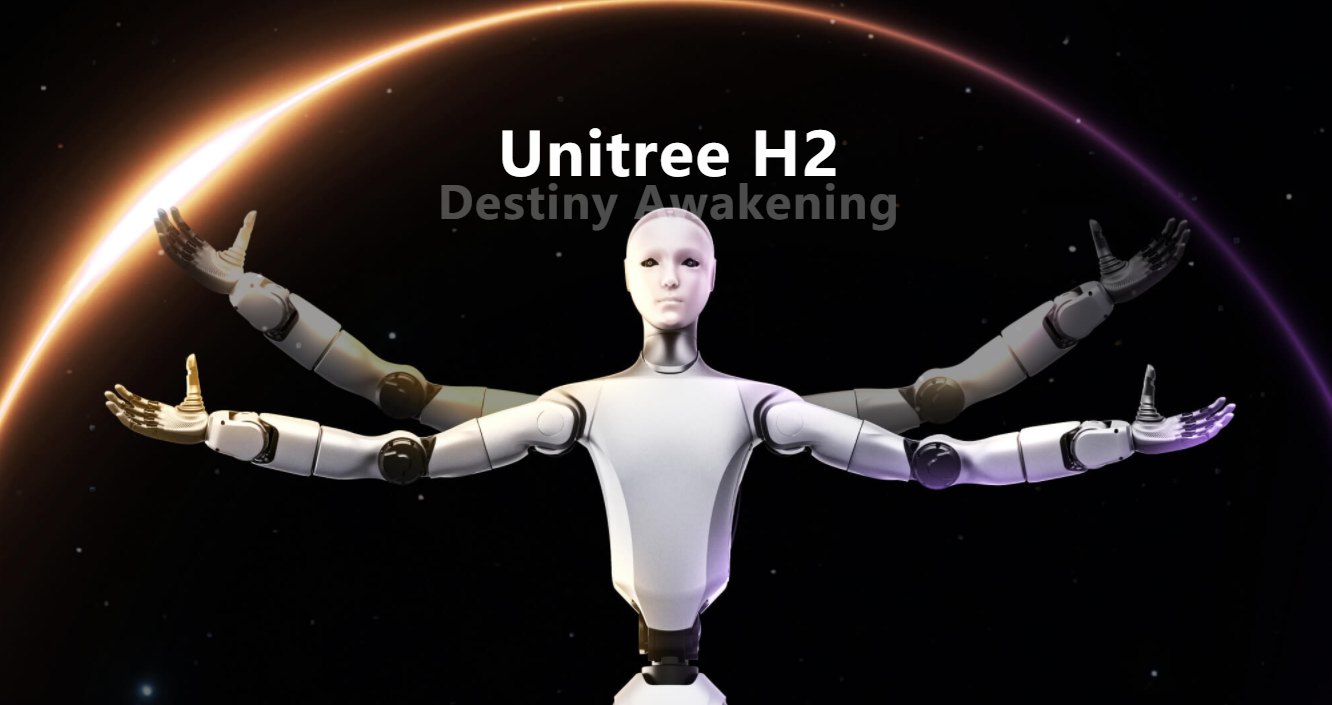

Broadly, Gasgoo counts no fewer than 20 robotics companies that have filed prospectuses with the Hong Kong Stock Exchange. Unitree Robotics, Leju Robotics and Mech-Mind, among others, are entering the IPO home stretch.

Two leaders — Unitree Robotics and Zhiyuan Robotics — are racing to be the "first humanoid robot stock." Zhiyuan, for its part, has publicly denied reports of a Hong Kong listing and has not disclosed definitive IPO progress.

Unitree appears closer. In September, the company said it plans to submit its listing application between October and December 2025. As of early December, its counseling status had shifted to "acceptance," just one step from filing a prospectus.

Image credit: Unitree Robotics website

Also in November, the China Securities Regulatory Commission's website showed Unitree had completed IPO counseling with CITIC Securities. The report said the company has established governance structures that meet listing requirements.

Since November, multiple robotics firms have accelerated listing timelines, with Unitree drawing attention as a potential "first humanoid robot stock." A successful IPO could funnel capital across the supply chain and help shift the industry from an R&D-heavy phase to scaled deployment.

China's humanoid sector has formed clear tiers: Zhiyuan, Unitree and Galaxy General sit in the first echelon with valuations in the tens of billions of yuan; companies such as Xinghaitu comprise a second tier around CNY 5 billion; other hot names cluster between CNY 2 and 3 billion.

Commercial validation: orders surge as mass production begins

The standout shift in 2025: investors no longer pay just for spectacle. Real orders and scaled deliveries now decide the pecking order.

With that, 2025 is shaping up as the first true year of commercialization. Attention has moved from slide decks and demo reels to order books, delivery capacity and closed-loop use cases.

By Gasgoo's tally, small-batch deliveries are underway at Zongqing Robotics, Tesla, Figure AI, UBTECH Robotics, Unitree Robotics, Zhiyuan Robotics, Xingdong Jiyuan and Qianxun Intelligent, among others.

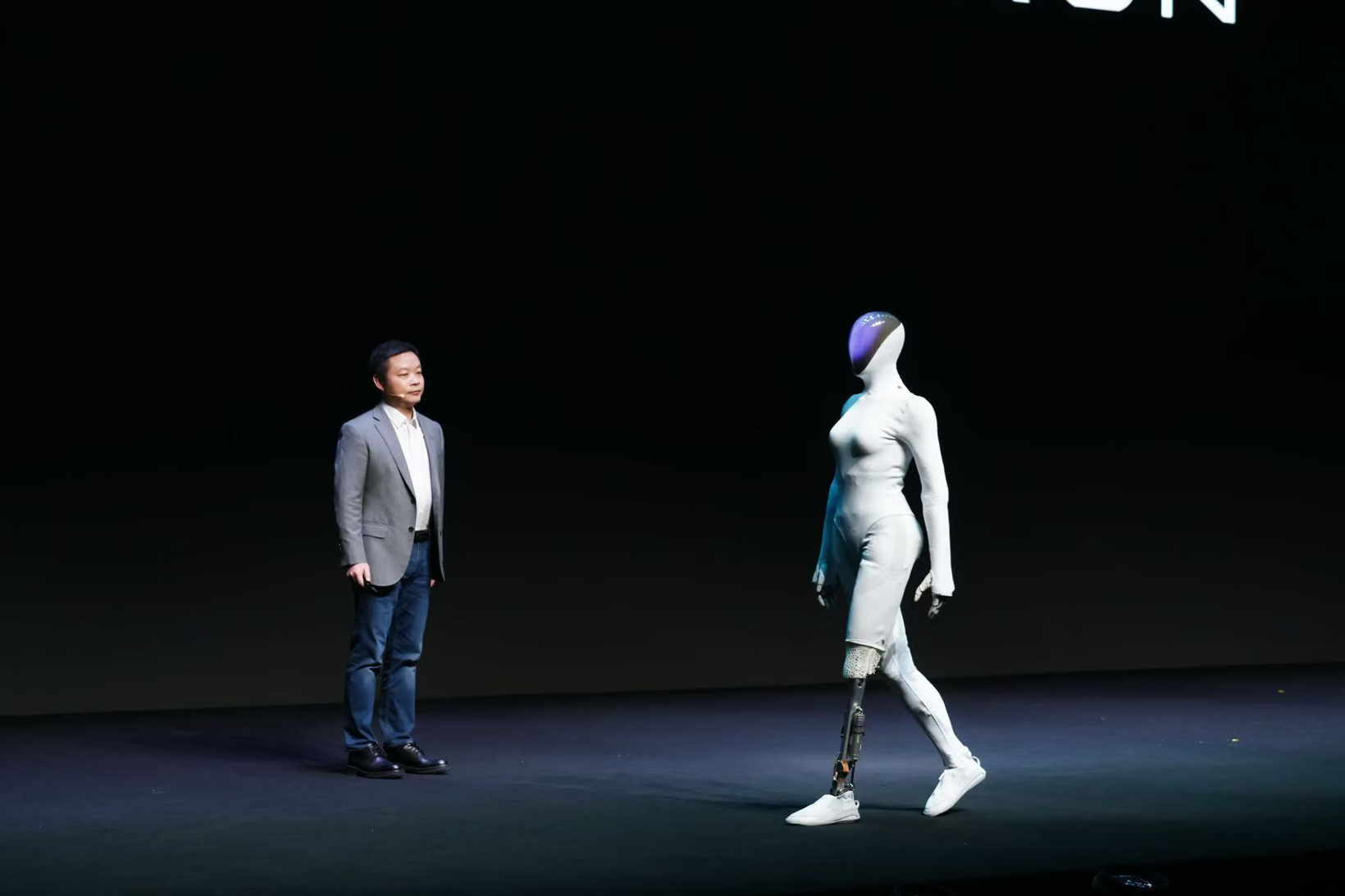

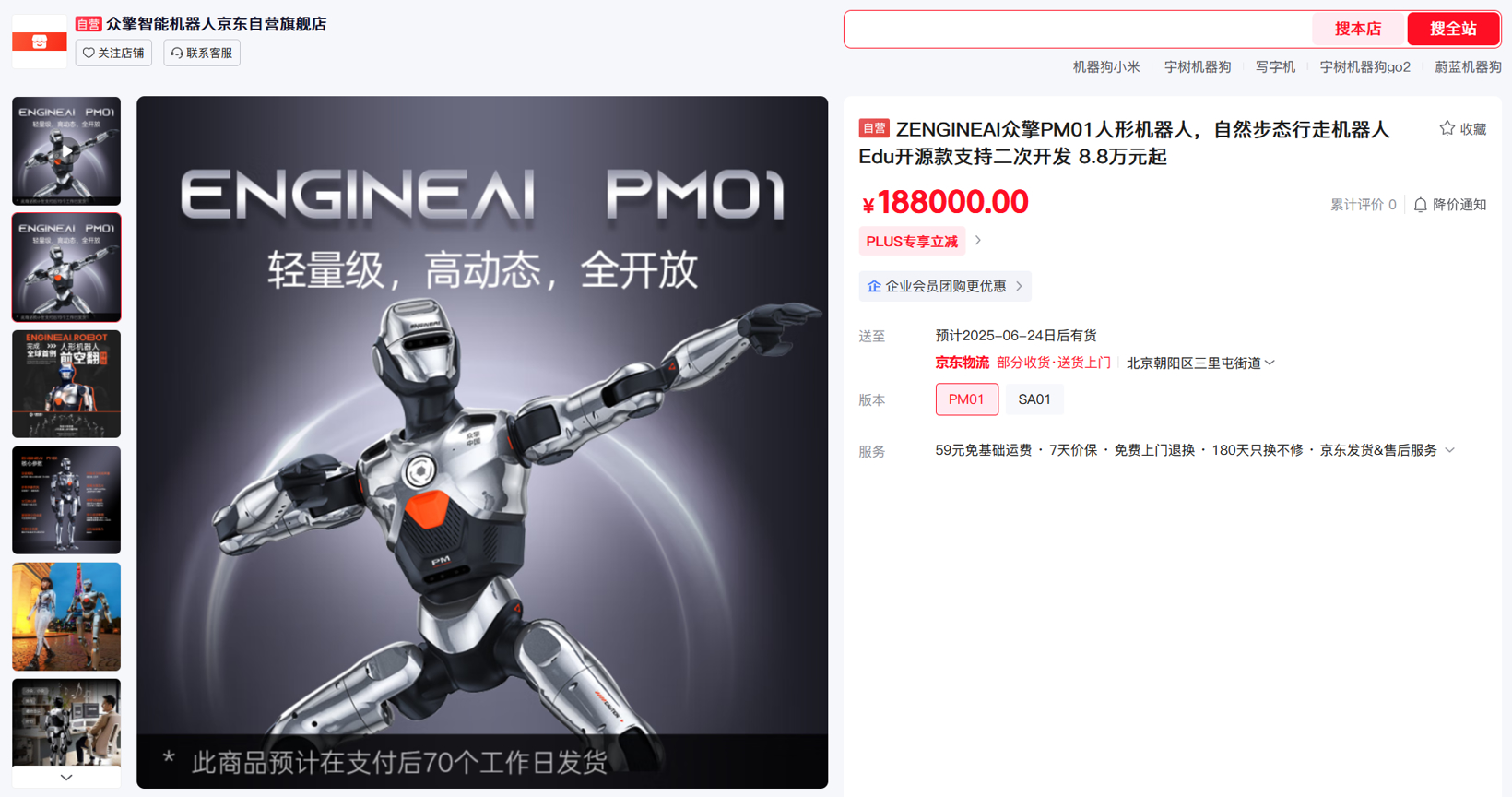

In April, Zongqing Robotics said two humanoid models were in mass production and on sale. The ENGINEAI PM01 lightweight humanoid — which went viral after co-dancing the "Axe Dance" with influencer "Jiakang Ge" — launched on JD.com's official flagship store at CNY 188,000.

Image credit: Zongqing Robotics JD.com flagship store

On August 1, Songyan Power said it delivered 105 humanoids in July — its first month above 100 units. That included 92 N2 units and 13 E1 units, with month-on-month growth of 176%, a company record for production and deliveries.

Image credit: Songyan Power WeChat account

On August 27, JEE Technology said 200 embodied intelligence robots — including both humanoids and wheeled units — were about to roll off the line at its Future Robotics factory. In September, Kepler Robotics announced mass production of its "blue-collar humanoid" K2 Bumblebee and the start of commercial deliveries.

On October 14, a Ningbo Huaxiang executive said shipments of the company's full-size biped robots would exceed 1,000 units in the second half, with rapid growth continuing next year. Also in October, DOBOT signed a procurement contract for embodied intelligence robots with Ruidefeng Precision Technology Co., Ltd. — a deal worth more than CNY 80.5 million, covering humanoids and embodied collaborative robots.

Major ticket orders have centered on UBTECH Robotics, Unitree Robotics and Zhiyuan Robotics.

Take Unitree as an example. This year, UBTECH booked a string of large deals in humanoid commercialization.

In September, the company signed a 250 million yuan contract — touted as the largest single procurement in the global humanoid space. October brought another 126 million yuan order. In November, it added three more — 159 million, 264 million and 143 million yuan — with the 264 million yuan deal resetting the global single-order record. On December 10, UBTECH said it had signed a humanoid sales contract exceeding 50 million yuan with a leading domestic AI foundation-model firm. The Walker S2 — the world’s first industrial humanoid with autonomous battery swapping — is the core product, with delivery slated for this year.

By mid-November, UBTECH’s Walker S2 had entered mass production and delivery. The first batch — several hundred units — has been deployed on the front lines in auto manufacturing, smart factories, smart logistics and embodied intelligence data centers. Current monthly capacity exceeds 300 units; full-year deliveries are expected to top 500.

UBTECH Chief Brand Officer Tan Min said the plan is to produce 1,000 humanoids in 2025; assuming smooth rollouts across scenarios, capacity could reach 5,000 units in 2026 and 10,000 in 2027.

Image credit: UBTECH

First steps into the consumer market: prices fall, online retail emerges

Advances in little-brain motion control and big-brain perception and decision-making have made robots safer and easier to interact with. At the same time, scale and competition in core parts — joints, chips and more — are pulling down system costs. Some companies have moved prices from the "hundreds of thousands of yuan" range into "tens of thousands," opening the door to consumer trials.

Behind the hot financing in 2025, investors want to see commercialization. While industrial-scale adoption takes time, the consumer market offers a proving ground that can quickly reach users, validate products and generate cash — helping refine hardware and build brands.

With global humanoids entering mass production this year, Gasgoo's research arm expects commercialization to accelerate in 2026. By 2029, the global humanoid market could exceed CNY 150 billion — and keep climbing toward a trillion-CNY track.

For now, consumer penetration is taking two paths: lower prices, and retail or rental formats.

In May last year, Unitree launched the G1 at CNY 99,000 — challenging perceptions that humanoids must cost six figures. On July 25, Unitree debuted the dual-legged humanoid R1 on its official video channel for just CNY 39,900, breaking the CNY 50,000 barrier and pushing the entry to "mass-market" levels. In August, Zhiyuan’s Lingxi X2 Youth Edition opened for presale on the Zhiyuan store and JD.com at CNY 98,000.

The biggest shock came in late October. Songyan Power unveiled "Bumi," billed as the world’s first sub-10,000-yuan high-performance humanoid, at CNY 9,998.

Image credit: Unitree Robotics website

From CNY 100,000 to CNY 50,000 — and now below CNY 10,000 — humanoid prices are edging into the realm of premium smartphones and game consoles. That's fueling speculation about robots entering the home.

At the same time, companies are testing new sales formats.

In August, the world's first embodied intelligence robot "4S" store debuted during the 2025 World Robot Conference at Beijing's Robotics Industrial Park (Yizhuang). The concept centers on embodied robots, combining Sales, Spareparts, Service and Survey into one — a full life-cycle service model meant to connect supply and demand more efficiently and convert value.

On November 11, China's first humanoid "7S" store opened at Optics Valley Innovation Plaza in Wuhan. Built by the Hubei Humanoid Robot Innovation Center, it brings together more than a dozen supply-chain firms, including Shouzhi Innovation, Qiling Robotics and Gelanruo — marking the shift from labs and factories to an open market and a key milestone for industrialization and commercialization.

Image credit: Hubei Humanoid Robot Innovation Center

The 7S store revolves around seven functions, building an end-to-end ecosystem from tech to scenarios: Sales, Spareparts, Service, Survey, Solution, Show and School.

On December 22, Gasgoo noted a CCTV Finance report: China's first open robot rental platform, Qingtian Rent, launched in Shanghai — signaling a shift from fragmented procurement to ecosystem sharing.

The platform already covers 50 core cities and more than 600 service providers nationwide, offering multi-brand, multi-model robot rentals with prices ranging from CNY 200 to above CNY 10,000.

By 2026, rental services are expected to reach more than 200 cities. Users will be able to order directly via mini-programs and e-commerce channels.

Qingtian Rent is a platform launched by Zhiyuan Robotics, built around a "power-bank-style" rental concept to standardize and ecosystemize robot leasing.

Its core idea is to turn today's high-threshold robot use into a convenient "shared power bank" model. Zhiyuan plans to integrate financiers, OEMs, content providers, logistics and insurers via Qingtian Rent, building a nationwide network of rental nodes.

On the supply side, beyond Zhiyuan itself, embodied-intelligence OEMs such as Accelerated Evolution will join the platform, offering a broader product lineup and skill packs to ease the current lack of variety.

Final notes

From the vantage point of year-end, humanoids have shed their gala costumes and stepped onto factory floors and commercial front lines.

From "a budding mind" in tech to thousand-unit deliveries in business — and consumer trials via lower prices — the industry has leapt from story to value. Capital’s tailwind, rapid tech iteration and real orders together sketch a steep growth curve.

Still, moving from "usable" to "useful," and from pilots to ubiquity, means crossing chasms in reliability, cost and ecosystem.

So 2025 isn't an endpoint, but the overture to a broader narrative — humanoids fusing more deeply with how we work and live.