Gasgoo Munich- Stepping into 2026, China's passenger car market has abandoned the rational momentum seen throughout 2025. A wave of price adjustments, stronger than expected, has quietly arrived—kicking off a fresh round of pricing battles right at the start of the year.

Explosive Start: January Price Cuts Are Deep

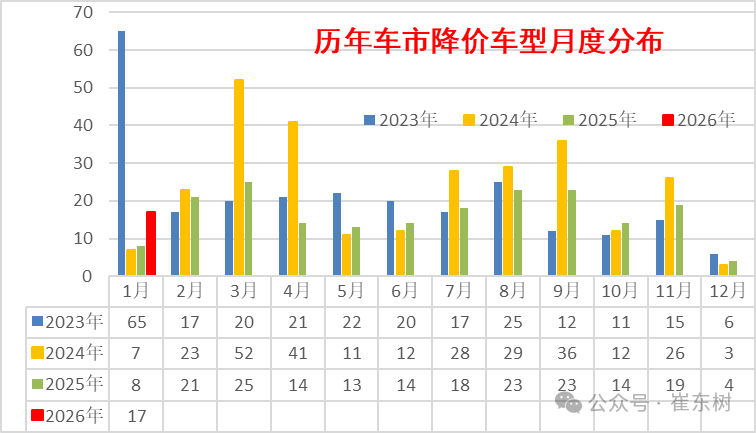

Looking back at the past three years, price cuts were frequent in 2023, while intensity peaked between March and April 2024. By 2025, industry promotions cooled significantly, with the number of discounted models plummeting from April through October. Yet, the price surge at the start of 2026 has shattered that stability.

Recent data from Cui Dongshu, secretary-general of the CPCA, shows 17 models saw price cuts in January 2026. That’s an increase of nine compared to the same period in 2025, and a sharp jump from just four in December 2025. Against the backdrop of 2025’s full-year total of 177 models—an average of 14.75 per month—the January 2026 volume alone hit 115% of last year's monthly average, signaling unprecedented early momentum.

Image Source: Cui Dongshu

Breaking it down by powertrain, internal combustion engine (ICE) vehicles have become the absolute main force of this round. Ten ICE models saw price cuts in January, an increase of five year-on-year. To put that in perspective, only 52 ICE models were discounted throughout all of 2025—averaging fewer than 4.4 per month.

On the new energy front, six battery-electric models saw price cuts in January—three more than the previous year. One extended-range electric vehicle (EREV) model was discounted, adding one compared to the prior period, while no conventional hybrids saw cuts. Notably, 73 battery-electric models were discounted in all of 2025, averaging roughly 6.1 per month.

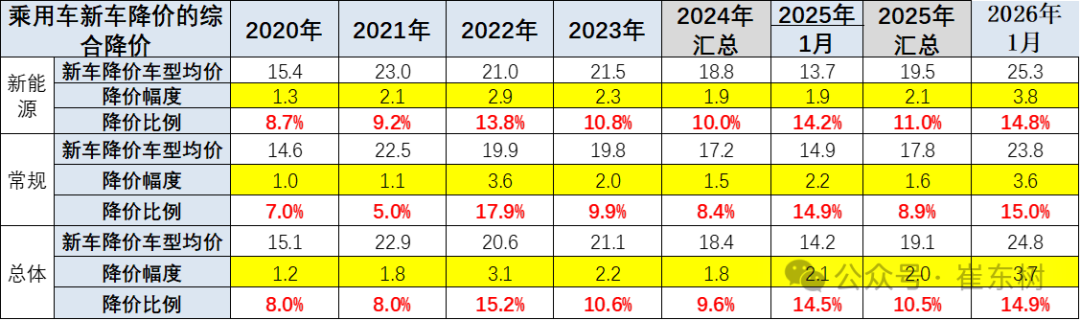

More than the sheer volume of cuts, consumers are focused on the actual depth of the discounts. Data shows that in January 2026, the average price of discounted models in the passenger car market was 248,000 yuan, with an average price reduction of 37,000 yuan—a discount rate of 14.9%. By contrast, for the full year of 2025, the average price of discounted models was 191,000 yuan, with an average reduction of 20,000 yuan, representing a 10.5% discount.

By category, the intensity of cuts for ICE and new energy vehicles is neck-and-neck, with ICE models holding a slight edge. Among new energy vehicles, the average discounted price was 253,000 yuan, with an average reduction of 38,000 yuan—or 14.8%. For conventional ICE vehicles, the average discounted price was 238,000 yuan, with an average reduction of 36,000 yuan, representing a 15% discount.

Image Source: Cui Dongshu

Another defining feature of this price wave is a distinct shift in the structure of discounted models. Luxury brands have replaced mid-to-low-end models as the primary drivers of cuts. Represented by BMW, luxury brands not only slashed prices on multiple ICE and new energy models in January, but some also adopted a "lower price, higher specs" strategy.

It is worth noting that these statistics include not only hidden cuts where new models break previous price floors, but also "price-hike-then-cut" scenarios. Some models launched with lower prices, only to see increases due to rising lithium costs, and are now seeing reductions again. Even if they don't break their original launch price, they are included in the data. This approach captures the loosening price dynamics more accurately, suggesting that price cuts in the actual market are even more widespread than the numbers alone indicate.

Multiple Factors at Play: Looking Beyond the Surface of the Price War

Since 2025, industry promotions and price cuts have returned to rationality, significantly improving market order. So, why has 2026 opened with such a fierce price war? In reality, this isn't a temporary promotional stunt by automakers; it is the result of overlapping factors: policy adjustments, market competition, inventory pressure, and the reshaping of price structures.

In an interview with Gasgoo, Cui Dongshu noted that while the price cuts in January 2026 appear large on the surface, the actual impact is smaller. The movement is largely driven by the phasing out of new energy subsidies and the implementation of new energy vehicle taxes.

Indeed, the adjustment to the new energy vehicle purchase tax policy is the most direct and core driver of this price wave. According to requirements from the Ministry of Finance, the State Taxation Administration, and the Ministry of Industry and Information Technology, the decade-long policy of full purchase tax exemption for new energy vehicles officially ended on January 1, 2026. It has been replaced by a new rule halving the tax. The maximum tax reduction per vehicle has dropped from 30,000 yuan to 15,000 yuan, significantly increasing the cost for consumers buying new energy vehicles.

Take a new energy vehicle with a guide price of 300,000 yuan as an example. In 2025, consumers enjoyed a full exemption and paid no purchase tax. In 2026, with the halved tax rate, the consumer must pay approximately 13,300 yuan in purchase tax (calculated as guide price ÷ 1.13 × 10% × 50%), directly increasing the purchase cost. However, if the automaker lowers the guide price by 30,000 yuan to 270,000 yuan, the consumer pays about 11,900 yuan in tax, resulting in a total cost of 281,900 yuan—actually lower than the 300,000 yuan paid in 2025. Through this method, automakers absorb the impact of policy changes while preserving their models' market competitiveness.

Cui Dongshu points out that facing the imposition of purchase taxes on new energy vehicles, the number of models with direct price cuts surged in January 2026. The return of inflated guide prices to reasonable levels helps rationalize the tax burden for consumers.

Beyond policy factors, a dramatic shift in the high-end market landscape has also fueled the price cuts. Another notable feature of this wave is that luxury brands are leading the charge—a reflection of the intense transformation in the premium segment. In recent years, domestic brands have accelerated their move upmarket, new energy luxury models have gained traction, and competition among imported cars has intensified. Consequently, traditional luxury brands have seen their market share severely squeezed, and the market environment has deteriorated rapidly.

Image Source: Mercedes-Benz

Data shows that the promotional intensity for luxury vehicles climbed to a high of 28.8% in January 2026, an increase of 2.5 percentage points year-on-year. In fact, promotional spending on luxury cars has been rising since September 2025. Even though consumption upgrades have kept high-end demand relatively resilient, it has been difficult to withstand the pressure of market competition.

The urgent need for ICE automakers to break through the stalemate is further driving the downward pricing trend. Although new energy vehicles are developing rapidly, ICE models still account for half of the domestic passenger car market. The fact that the number of discounted ICE models in January 2026 far exceeded that of new energy models underscores the desperate need for ICE manufacturers to find a path forward.

Since 2025, the ICE market has exhibited a trend of "steady promotions, shrinking price cuts," with only 52 models discounted throughout the year—a decrease of 26 compared to the previous period. However, squeezed by new energy vehicles and intensifying internal competition, sales of many ICE models have slipped while inventories have surged, creating an urgent need to break the development deadlock through price reductions.

According to data released by Cui Dongshu, promotions for traditional ICE vehicles fell to 23.7% in January 2026, a slight dip of 0.5 percentage points from the previous month but an increase of 1.8 percentage points year-on-year. ICE promotional intensity has hovered around 24% for five consecutive months. With promotional efforts stabilizing but price cuts intensifying significantly, the essence of the shift is ICE manufacturers moving from "hidden promotions" to "explicit price cuts." They are breaking the original pricing structure by directly lowering guide prices to reverse their passive competitive position.

Furthermore, the reshaping of the price system itself is a significant trigger for this price wave. The price wars of 2023-2024 were characterized by "disorderly involution," with automakers lowering transaction prices through hidden promotions and subsidies. This caused a severe disconnect between guide prices and actual transaction prices, creating market chaos. While 2025 saw a return to rational promotions and price cuts, significantly improving market order, the reshaping of the price system was not completed. The price cuts of January 2026 are a continuation of that process.

Cui Dongshu previously told Gasgoo that for some brands, these adjustments only modify the official guide price, not the retail price. In terms of actual market performance, terminal sales prices have not fluctuated significantly. The core of this adjustment is to bring previously inflated pricing back to a reasonable range, essentially helping consumers lower purchase tax costs without substantially altering the competitive landscape.

Price-Cut Intensity to Ease as "Involution" Becomes More Rational

This wave of price cuts has put the market on high alert: How long will it last? Will more models join the discount lineup?

In response, Cui Dongshu stated in an interview with Gasgoo that this price surge is primarily driven by the adjustment of taxable prices at the start of the year. As inventory clears, new models launch, and industry standards guide the market, the intensity of price cuts will ease significantly. The price trend for the full year is expected to be high in the beginning and low later on—a normal retracement.

Notably, the "anti-involution" process in the 2026 auto market will continue to advance. The industry is poised to achieve three key transitions, gradually moving toward a stage of higher-quality, rational development.

First, a shift from "price involution" to "value competition." In previous price wars, some automakers fell into the trap of "blind discounting" to seize market share, compressing profits and even launching "low-price, low-quality" models that triggered disorderly competition. The price cuts of 2026, however, represent an active adjustment by automakers to align prices with product value. The "lower price, higher specs" strategy adopted by luxury brands, in particular, highlights a "value-first" philosophy. Future competition will bid farewell to pure price comparisons, moving instead to a comprehensive contest of technology, quality, service, and experience. Automakers that blindly cut prices while ignoring product value will eventually be eliminated by the market.

Image Source: Chery Automobile

Second, a shift from "hidden promotions" to "transparent pricing." Between 2023 and 2024, automakers relied heavily on hidden promotions like steep discounts, subsidies, and gifts. This caused a severe disconnect between guide prices and transaction prices, forcing consumers into repeated bargaining and creating a poor experience that disrupted market order. In 2026, automakers are proactively lowering guide prices and reducing hidden promotions to align them with actual transaction costs. This shift will not only improve the buying experience but also promote the healthy development of dealerships, fostering a virtuous cycle and returning the auto market to a rational trajectory.

Third, a shift from "policy-driven" to "dual-driven by market and technology." The rapid development of the new energy vehicle market previously relied heavily on policy drivers like purchase tax exemptions and subsidies. With the phasing out of these policies in 2026, the impetus from government support is gradually weakening. Automakers now need to rely on market demand and core technological upgrades to drive industry growth. The fact that automakers are absorbing policy impacts through price cuts while simultaneously increasing R&D investment and enhancing product competitiveness is a concrete manifestation of this transition. Future development in the new energy market will depend more on market demand and technological breakthroughs, leading to healthier and more sustainable industry growth.

For market participants, this price wave represents both an opportunity and a hidden risk. Only by viewing it rationally can they grasp the pace of development.

For consumers, 2026 is undoubtedly a favorable time to buy, especially for those planning to purchase luxury or new energy vehicles. With automakers lowering prices, purchase costs have dropped significantly, highlighting the value-for-money of these models. However, consumers should not follow the herd blindly. They should choose models based on actual needs, prioritizing solid product quality and guaranteed after-sales service. Buyers should avoid purchasing "low-quality" products simply because they are "cheap," while also paying attention to resale values to avoid the risk of significant depreciation down the line.

For automakers, this price wave is an opportunity for industry transformation. Rather than getting trapped in price involution, it is better to devote more energy to technological R&D, product upgrades, and service optimization. By building core competitiveness to gain a market advantage—and aligning with the broader trend toward value competition and rational development—automakers can secure a foothold in the future market competition.