One of the most important mechanisms underlying the globalization process lies in the transfer of advanced manufacturing capabilities to low-wage economies. These "capabilities" comprise both levels of productivity and levels of quality. The latter is by far the more important element: poor productivity can be offset by low wage rates, but until firms attain some threshold level of quality, they cannot achieve any sales in global markets, however low the local wage level (for a full discussion, see Sutton, 2000).

The globalization process impinges in a very different way on different industries. Within Indian manufacturing, for example, the machine tool industry has suffered major adjustment problems, as discussed in a companion paper (Sutton, 2001). In what follows, we look at a contrasting case: the auto-component supply chain in China and India. Here, the degree to which capabilities are transferred is relatively effective: norms exist throughout the international industry which are universally accepted, and the transfer of good working practices is mediated not only by the activities of multinational car makers and (first-tier) component suppliers, but also by an ancillary grouping of consultancy firms that mediate such transfers. In China and India, this transfer process has been driven by the arrival of international car makers, often operating as joint ventures with local partners. As this new generation of car makers develop, the domestic supply chain in sourcing their own needs, they interact with local suppliers (some of whom are

3 themselves affiliates of multinational component makers). The resulting transfer of production know-how has driven major advances in productivity and quality.

The aim of this study is to examine the extent to which Chinese and Indian auto component producers have advanced towards international best practice levels of productivity and quality. The report is based on a survey of nine car manufacturers in

China and six in India; a range of general component suppliers in both countries, and on a detailed benchmarking study of six seat producers and six exhaust suppliers in each country.

The first issue examined in what follows relates to the degree of development of the local supply chain. A study of outsourcing patterns for a broad set of key components and subassemblies2 indicates a similar pattern in both countries, with about half of these items being outsourced in both cases.

A second issue relates to the quality of components supplied. By looking at the pattern of defect rates for incoming components at twinned pairs of firms in the two countries, we find that

• For new generation car makers (i.e. multinational joint ventures established in the

1990s), supplier quality is close to international best practice in both countries, but …

• As we move down the supply chain to second tier suppliers of 'typical' components, there is an extremely sharp deterioration in quality, in both countries.

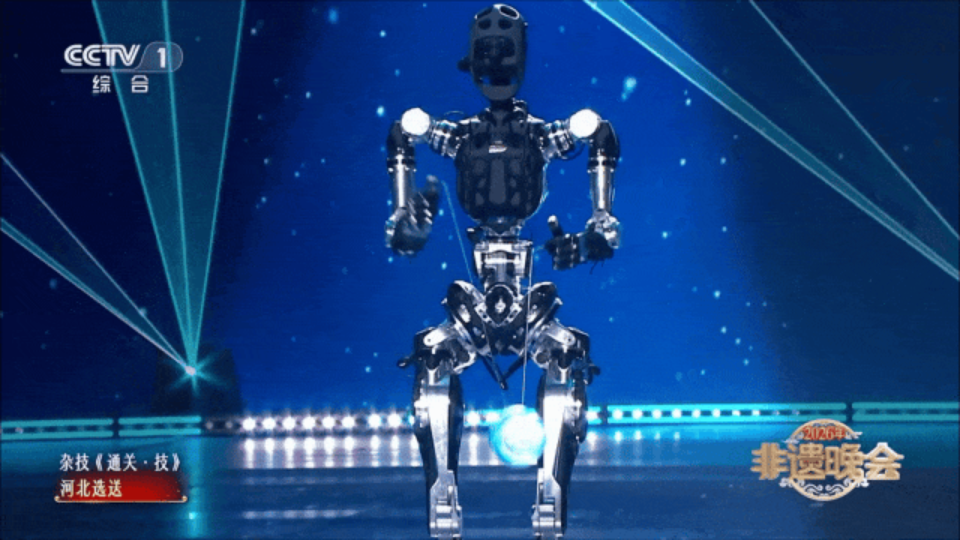

A third strand of the study relates to the benchmarking of seat and exhaust producers, in terms of both quality and productivity. The six seat producers together supply all leading car makers in each country. Their methods of production are, in most cases, similar to those used in the U.S., Japan and Europe. Productivity and quality levels (as measured by external defect rates) are fully in line with international best practice. For exhausts, on the other hand, three types (generations) of production techniques are possible, with differing levels of capital intensity (hand held welding torches; semi-automated jigs and fixtures; robot production). All three generations are in use among firms supplying leading car makers. Quality levels are similar in both countries, but the median level is somewhat lower than international best practice and there is a 'tail' of low performers.

Levels of labour productivity are low compared to international best practice, but the gap is small compared to the relevant wage ratio, so that unit labour costs per part produced are relatively low. Interestingly some Chinese firms, but not Indian firms, have moved to high levels of capital intensity, using robot welding for key welds, while choosing to use a higher level of manning on robots than is customary in high wage countries. By so doing, they can achieve major cost savings by attaining levels of scrap losses that are extremely low relative to international best practice.

A key question is whether, following WTO entry, multinational car makers will continue to source locally to the same degree as they now do. The answer appears to be a clear 'yes'; the supply chain, whose development was fostered by local content rules in the

5 pre-WTO period, has achieved levels of quality and productivity that will ensure a continuation of the present pattern of domestic sourcing.