Once symbols of status, taste, and top-tier craftsmanship, the "German Big Three" and other traditional luxury brands are facing unprecedented challenges in the Chinese market.

Since 2023, traditional luxury brands led by BBA have seen a significant slide in sales in China. Mercedes-Benz, BMW, and Audi have all posted declines to varying degrees, with dealers even falling into the predicament of losing money on every unit sold.

Meanwhile, brands like Tesla, Li Auto, NIO, and AITO have steadily gained market share in the price range above 300,000 yuan — forming a stark contrast.

Facing this crisis, traditional luxury brands have not sat idle. A series of self-rescue measures have rolled out rapidly: price adjustments, model refreshes, deep localization, and partnerships with Chinese tech giants like Huawei and Momenta.

Yet market feedback remains underwhelming. Is this a temporary setback, or an inevitability in the shifting tides of the era?

Desperate Measures from Legacy Luxury Brands

Confronted by plunging sales, traditional luxury brands have long since dropped their pretensions. They are attacking on four fronts — price, product, localization, and technology cooperation — revealing an urgent need to survive and crack the current sales slump.

Price cuts have emerged as the most direct and rapid response to the market downturn. In the past, strong brand premiums allowed them to maintain sales despite high prices. But as competition intensifies and that premium erodes, cutting prices has become a reluctant move to defend share — with the scope and depth of discounts hitting record highs in recent years.

In terms of scope, discounts now cover the entire product lineup, spanning both internal combustion and new energy models. In early 2026, BMW initiated massive official price cuts, lowering guide prices for 31 mainstream models. Drops generally exceeded 10%, with some models seeing cuts of up to 300,000 yuan, driving the entry threshold to a new low.

Mercedes-Benz and Audi followed suit, with terminal prices diving significantly. Second-tier luxury brands pushed even harder, with terminal discounts on some models reaching 100,000 to 150,000 yuan.

Image Source: Audi

Beyond direct guide price reductions, hidden discount methods like terminal offers, financial subsidies, and trade-in allowances have also emerged endlessly.

Notably, BMW attempted to exit the price war in 2024 to stabilize its system, but its return to massive official cuts in 2026 underscores the immense sales pressure it faces — even at the risk of shrinking profit margins, it had no choice but to re-enter the fray.

While cutting prices, traditional luxury brands are also accelerating product refreshes. They are optimizing existing internal combustion models on one hand and expanding new energy layouts on the other, hoping to escape the trap of trading volume for price by boosting product competitiveness.

Regarding new energy product deployment, traditional luxury brands are speeding up the launch of pure electric and plug-in hybrid models, striving to expand their NEV matrix.

BMW has launched multiple pure electric models and plans to use its domestically produced "New Class" models in 2026 as the first carriers of a new generation of advanced driver-assistance systems. Mercedes-Benz introduced pure electric models like the EQE and EQS, and plans to launch at least four new cars equipped with Momenta solutions by 2027. Audi, meanwhile, has rolled out models like the Q6L e-tron.

Localization strategy has been elevated to unprecedented heights. In R&D, luxury brands are establishing centers in China to focus on localized needs like intelligence and space, while strengthening cooperation with local component suppliers.

In production, they are expanding domestic capacity to achieve full localization of mainstream models. Some new energy models are also being produced locally to reduce costs and tariff impacts.

In marketing, they are abandoning the singular global mindset of the past. Leveraging traditional festivals, short-video platforms, and local KOLs, they are launching campaigns that are younger and more grounded. At the same time, they are extending dealer networks deeper into lower-tier markets to expand market coverage.

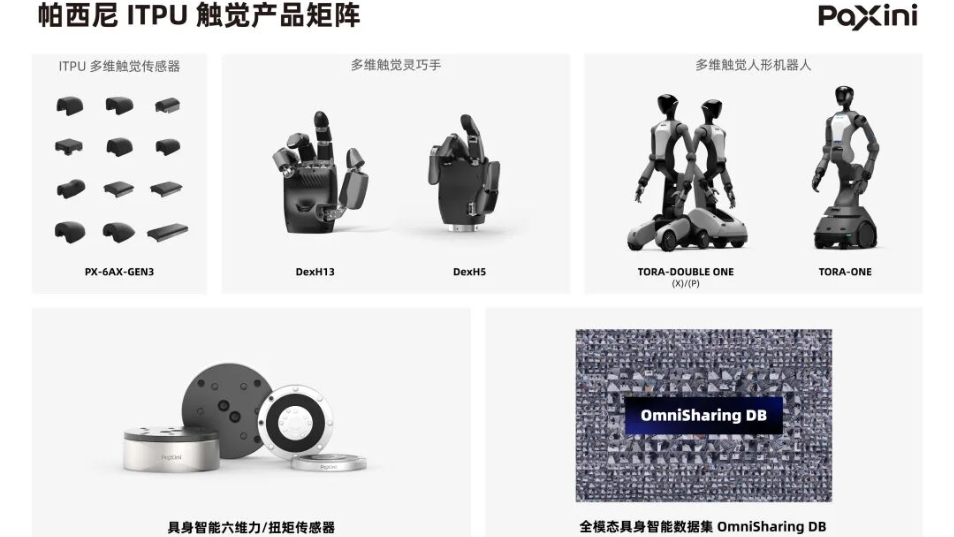

To quickly bridge the intelligence gap, traditional luxury brands have also set aside their pride to engage in deep cooperation with Chinese tech firms like Huawei and Momenta.

Cooperation with Momenta is particularly prominent: BMW, Mercedes-Benz, and Audi have all partnered with it to jointly develop advanced driver-assistance systems for the Chinese market. Mercedes-Benz strategically invested in Momenta as early as 2017 and announced deeper cooperation in 2024. Audi is also refining its autonomous driving layout through partnerships, with American brands like Cadillac following close behind.

Collaboration with Huawei is equally deep. Audi is not only tied to Huawei for intelligent driving solutions but is also co-developing in hardware and ecosystems. BMW, for its part, is developing related features based on the HarmonyOS ecosystem.

Furthermore, battery giants like CATL and BYD have also become partners to boost core competitiveness in core electric components.

Why Is the Market Still Unresponsive?

Despite the self-rescue measures, market response has fallen short of expectations.

In 2025, deliveries for BBA in China all declined year-on-year, with electric vehicle sales generally accounting for less than 20% of the total. The core issue is that many current rescue efforts remain superficial, failing to address root problems and thus unable to truly sway consumers.

While price cuts can attract attention in the short term, they are laden with hidden traps, offering limited actual benefit to consumers.

On one hand, some discounts are exaggerated. For some traditional luxury brands, the cuts are merely marketing gimmicks — seemingly massive but attached to numerous restrictions, or even hiding "financial traps" and "cost-cutting routes" via reduced configurations. Moreover, some discounted models are actually inventory cars; long-term parking can degrade battery health, making vehicle quality hard to guarantee.

This is evident from dealer feedback. A Mercedes dealer told Gasgoo: "Although the guide prices for some models were adjusted a few days ago, the actual transaction price hasn't changed much. Take the Mercedes C-Class: the guide price has been adjusted to 324,600 yuan, but the actual on-the-road price remains at over 270,000 yuan, basically the same as before."

Meanwhile, a BMW dealer revealed to Gasgoo: "Since the end of 2025, the BMW 3 Series has enjoyed a 10,000 yuan discount, and we expect an additional 5,000 yuan discount by mid-year. For the BMW 3 Series 325i, the financed price is just over 240,000 yuan."

This further illustrates that many official price cuts merely adjust the "sticker price." The terminal market had already offered discounts based on actual pressure, so the perceived savings for consumers are actually quite limited.

Image Source: BMW

On the other hand, product competitiveness remains insufficient even after price cuts, with a clear gap to competitors. Although traditional luxury brands' internal combustion models have undergone upgrades, core technologies haven't seen breakthrough progress. Advantages in powertrains and chassis tuning are fading against high-end domestic models, while configuration, comfort, and space often lag behind same-priced domestic rivals.

As for new energy models, they are priced high yet lag behind Chinese new-force rivals in core metrics like range and intelligence. With price and value misaligned, consumers are no longer willing to pay for inflated brand premiums.

Beyond product shortcomings, lagging intelligent transformation is a core reason traditional luxury brands struggle to break out.

In today's auto market, intelligence is a core consideration for buyers. The experience of features like smart driver assistance and intelligent cockpits directly determines market competitiveness.

However, even with partnerships with Huawei and Momenta, results haven't landed at scale. The intelligence level of existing products remains low, and the gap compared to Chinese new forces and high-end domestic models is still obvious.

More notably, some traditional luxury brands suffer from "outdated thinking" during their transformation. They still apply R&D logic from the ICE era, treating intelligence as an "add-on" rather than a core competency. This lack of deep R&D and sustained investment has slowed their transition, making it hard to keep up with market rhythm.

Insufficient product competitiveness further accelerates the erosion of brand premiums, causing the "luxury halo" of traditional brands to gradually fade.

On one hand, brand images are aging. Marketing narratives still revolve around "century-old heritage" and "German craftsmanship," failing to attract young consumers who prioritize intelligence and personalization.

Chinese new forces excel at building lifestyle brands that resonate with young demographics and create emotional connections. For instance, NIO uses its "NIO House" and "NIO Life" ecosystems to make users feel they are joining an elite community. Li Auto targets "family users" precisely, winning over dads with spacious interiors, range-extending technology, and smart cockpits.

By comparison, traditional luxury brands' narratives lack freshness and struggle to resonate with young consumers, leading to a significant exodus of this demographic.

On the other hand, quality issues, declining after-sales service, and price cuts that reduce configurations have further damaged brand reputation and consumer trust. Coupled with the continued rise of domestic high-end brands squeezing market space, the loss of consumer groups is becoming increasingly pronounced.

Insufficient localization — failing to truly align with core Chinese consumer needs — is another major trigger for the predicament. Although they propose "localization" strategies, most remain at the surface level without deeply understanding unique market demands.

In localization R&D, while traditional luxury brands have set up centers in China, core technology remains in overseas headquarters. Local centers often only handle minor tweaks to global products, lacking autonomous development rights and making it hard to launch products or tech truly tailored to China.

Zhang Yongwei, Secretary-General of the China EV 100, pinpointed the issue: "The biggest change for Chinese local companies is rapid iteration and accelerated innovation, constantly meeting changing consumer needs. Multinationals need to match this faster innovation and response capability. They must change slow decision-making and move away from the inherent models formed by the dividends of managing technology abroad — they must accelerate innovation." This difference in response speed and organizational structure is the structural reason traditional luxury brands are losing the localization battle.

How Much Time Is Left?

Despite the difficulties, China's luxury market holds immense potential. With accumulated brand equity, technical reserves, and channel resources, traditional luxury brands can still break through — provided they find the right positioning, solve core issues, and accelerate transformation.

While NEV penetration rises, luxury internal combustion vehicles still hold over half the market, and BBA's main ICE models sell strongly. The advantages of no range anxiety and high reliability make them the first choice for business travelers and long-distance drivers, and some consumers have deep emotional attachments to ICE cars — this is the base traditional brands can hold in the short term.

Therefore, traditional luxury brands should optimize their ICE product structure, improve value and comfort, control prices reasonably, and ensure good service to firmly lock in this user base.

While holding the ICE base, accelerating the new energy transition is the core direction for long-term breakthroughs.

Electrification is an irreversible trend. Luxury brands must speed up NEV launches, optimize product matrices, introduce more models tailored to Chinese consumers, and achieve precise alignment of price and value.

In intelligence, traditional brands should deepen cooperation with Chinese tech firms, accelerate R&D and testing of advanced driver-assistance systems, and build intelligent cockpits tailored to local needs to narrow the gap with new forces.

While cooperating with Chinese firms, they must also deepen localization R&D. Traditional brands should grant more autonomous development rights to their China R&D centers, aggressively recruit local talent, and focus on core needs like space, comfort, and intelligence to develop exclusive products and technologies.

Image Source: Mercedes-Benz

Reshaping brand value is crucial to attracting young consumers and winning back trust. Traditional brands must update their philosophy, shed labels of "aging" and "conservative," and build a new image of "tech-savvy, young, and high-end." Promotions should highlight core selling points like new energy and intelligence to break the limits of traditional narratives.

Zhang Hong, a member of the Expert Committee of the China Automobile Dealers Association, offered specific advice: "BBA should orderly shrink inefficient outlets, while learning from new energy brand models to strengthen user community operations and attempt to build 'lifestyle brands' to attract young consumers."

Additionally, brands should leverage young communication channels like short videos, social platforms, and local KOLs to launch diversified marketing campaigns and regain the attention of young consumers.

Conclusion

The China campaign for traditional luxury brands is, in essence, a self-revolution.

Facing the wave of intelligent electrification, price cuts and alliances are stopgaps. Only by squarely addressing shortcomings, firmly deepening transformation, rooting in the local market, and reshaping brand value can they preserve their advantages, break through current dilemmas, regain vitality in the fiercely competitive Chinese luxury market, and achieve sustainable development.