Why Tesla’s China car registrations tumble in April

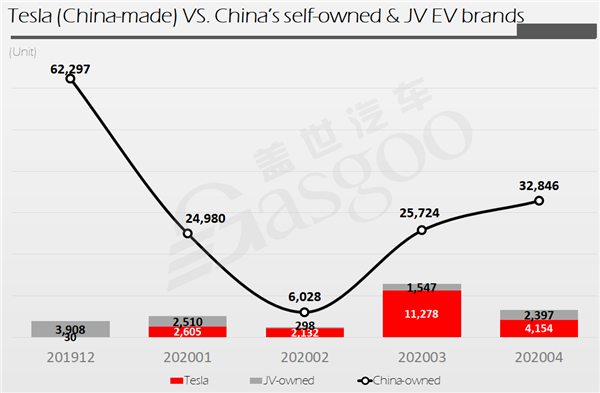

Shanghai (Gasgoo)- In April, a total of 4,154 consumers in China bought the Mandatory Liability Insurance for Traffic Accidents of Motor Vehicles (MLI) for the China-built Tesla Model 3 sedans, according to the China Insurance Regulatory Commission, which represented a plunge of 63% compared to March.

The insurance registrations of the imported Model 3, Model X and Model S reached 159, 13 and 308 units respectively last month, of which both the former two posted significant decrease.

The downturn in the locally-produced Model 3's April sales has been much discussed as the EV manufacturer largely outsold other NEV makers in China which were hard hit by the COVID-19 pandemic during the first quarter.

The numbers do not lie: the Jan.-Mar. insurance registrations of the China-made NEVs totaled 101,366 units, of which 16% share belonged to the Model 3.

What are the factors accountable for the sales decline? The production shortage was the least one that should be blamed. According to the MIIT's data, there were 11,211 units of the homegrown Model 3 output in April, far more than the sales volume for the same period. The manifest gap between the production and sales portends a heavier inventory the Tesla sellers must face and the plentiful extra operational cost for the company.

Tesla's vehicle-assembly plant in Fremont was idled from the end of March 23 because of the coronavirus, which made the Shanghai Gigafactory 3 ever more crucial for the automaker as the U.S. was behind in China in reopening its economy.

Part of the explanations was that consumers adopted wait-and-see attitude to see whether Tesla will further lower the car's prices.

China's government said in late April it would extend the subsidies for NEVs for two years which were supposed to be stopped this year. However, the cash handouts will only apply to PVs priced below 300,000 yuan ($42,000) after transition period.

(China-made Tesla Model 3 Standard Range Plus, photo source: Tesla)

To qualify for the NEV subsidies, Tesla announced on May 1 the post-subsidy starting price of the China-made Standard Range Plus Model 3 sedans was cut to 271,550 yuan ($38,082) from 303,550 yuan ($42,571).

However, it was not the first-time price change after the policy adjustment. On April 24, the company said the base prices of the aforesaid model would rise to 303,550 yuan ($42,570) from 299,050 yuan ($41,940) after subsidies. The increased part was deemed to offset the 10% subsidy cut effective from July 23.

It seems that the frequent price changes made consumers hesitate about buying cars. As the EV maker is striving to augment the usage of locally-supplied auto parts, the prices are expected to be further reduced in the future.

Another probable factor is the hardware downgrade discovered by consumers after comparing vehicle controller hardware codes. Supply chain disruption in China caused by the coronavirus spread compelled the automaker to equip some locally-produced Model 3 sedans with its older Hardware 2.5 chip rather than its new Hardware 3.0 shown on the specification list, Tesla offered the explanation in early March.

Understandably, the country's affected car owners were not happy to find out the discrepancy, and some of them lodged a complaint against Tesla through the “3.15” consumer right protection platform.

The incident even drew attention of China's authority. On March 10, China's MIIT summoned executives of Tesla (Shanghai) Co.,Ltd. for a face-to-face meeting and urged the company to keep the production of its China-built vehicles consistent with its promise.

The automaker quickly apologized for the decision and said it would provide influenced consumers with free upgrades once the supplies became available. However, the act-first-and-report-afterwards deed still bruised users' trust more or less.

Moreover, the emerging effect from the government's roll-out of incentives to spur car sales, and the overseas supply chain disruption caused by the coronavirus pandemic also contributed to the sales fluctuation, according to a senior analyst at Gasgoo Auto Research Institute (GARI).

After kicking off the volume delivery of the locally-made model in Jan., Tesla has been regarded by some industry insiders as the force that reshapes China's current NEV market landscape. Nonetheless, after comparing the sales of Tesla, the Big German Three and some high-profile Chinese indigenous brands, we found out that it is too early to make a defined judgement.

The data offered by the China Insurance Regulatory Commission and compiled by GARI show that the China-built Model 3 outnumbered all of BBA's models within the same segment in terms of both Feb. and Mar. sales, which made people feel upbeat about Tesla duplicating its U.S. success in China's premium automobile market. However, the April numbers seem to portend that there will be a win-win situation between Tesla and traditional luxury auto brands, and the latter might perform more stably in sales.

Frankly speaking, Tesla does upstage other brands, but it doesn't mean the U.S. EV maker has been streets ahead of China's leading self-owned brands. On the contrary, such most-searched local brands as BYD and NIO have been advancing steady growth. How to improve the competitiveness and anti-risk ability is crucial to their sustainable development.

China's locally-born EV brands has been orderly getting their sales on the track, but the foreign-invested brands (excluding Tesla) still presented weak sales. The advent of Tesla's locally-made products has catalyzed other foreign brands in speeding up launch of EV models. Thus, the competition landscape of China-owned and foreign-invested brands might change earlier than we expect.

On the other hand, after the roll-out of the heavyweight models based on Volkswagen's MEB platform and General Motors’ BEV2/3 platform, and the premium EVs developed by BMW, Mercedes-Benz and Audi, whether Tesla can maintain a high level in sales is hard to predict now (Data source: China Insurance Regulatory Commission, complied by Gasgoo Auto Research Institute).

Gasgoo not only offers timely news and profound insight about China auto industry, but also help with business connection and expansion for suppliers and purchasers via multiple channels and methods. Buyer service:buyer-support@gasgoo.comSeller Service:seller-support@gasgoo.com