Chinese EV startups outperform Tesla by April insurance registrations with joint efforts

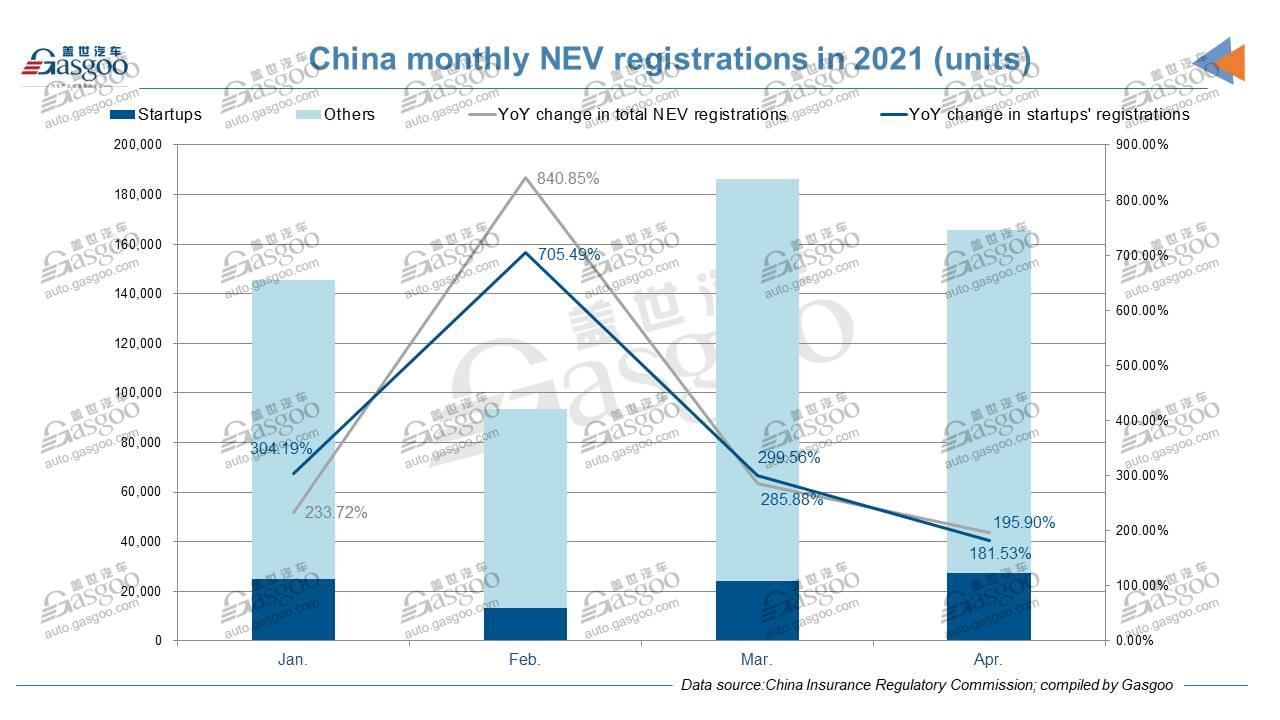

Shanghai (Gasgoo)- For the month of April 2021, consumers in China bought the MLI (Mandatory Liability Insurance for Traffic Accidents of Motor Vehicles) for 165,823 China-made new energy vehicles in total, representing a remarkable year-over-year leap of 195.9%, according to the China Insurance Regulatory Commission (CIRC).

In the meantime, the registrations of the vehicles from Chinese EV startups surpassed 27,000 units, zooming up 181.53% from the previous year, while also climbing 12.6% from the previous month.

In the Jan.-Apr. period, the country's NEV insurance registrations amounted to 591,220 units (+274.54% YoY), 15.2% of which were contributed by local EV startups.

It is worth noting that Tesla saw its April insurance registrations plunge 65.5% over a month ago to 11,949 units, fewer than the totals of all Chinese startups. Of those, there were 6,429 Model 3s (-73.8% MoM) and 5,520 Model Ys (-45.6% MoM). However, the Model Y was the best-selling locally-produced full-electric SUV model in April.

The top 3 cities by April registrations of Tesla's China-made vehicles were Shanghai, Shenzhen, and Beijing. Shanghai was the only one whose volume topped 1,000 units.

Among Chinese EV startups, the top 6 were still NIO, Li Auto, XPeng, Leapmotor, HOZON Auto, and WM Motor, accounting for 94.8% of the April registrations of all startups.

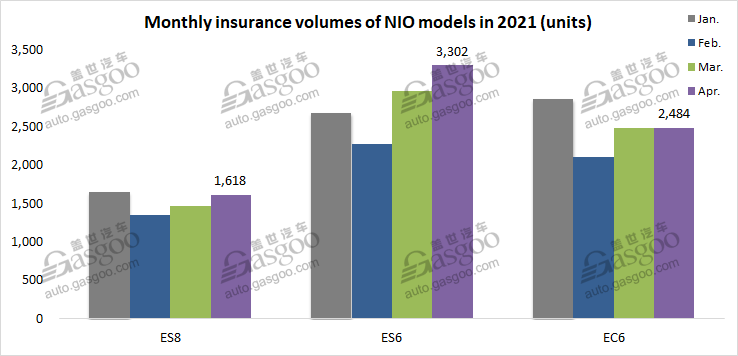

NIO still topped the other startups with an insurance volume of 7,404 units, logging a month-on-month increase of 7.1%. Of those, 5,982 vehicles were registered by private users.

Compared to March 2021, both the ES8 and the ES6 recorded double-digit growth. Meanwhile, the April registrations of the EC6 remained flat over a month earlier.

According to NIO, its vehicles accounted for 23% of China's total all-electric SUV registrations in April, the biggest among all brands. By April insurance volume, the ES6, the EC6, and the ES8 all entered the top 10 list of all-electric SUV models, ranking second, third and seventh respectively.

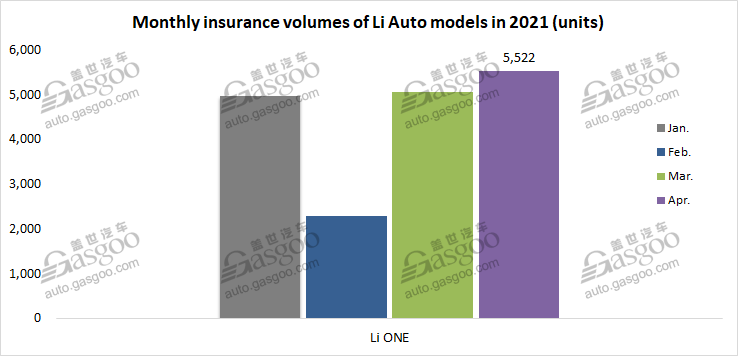

Li Auto was the runner-up with its monthly registrations climbing to 5,522 units in April from 5,058 units in March.

With only one mass-produced model for sale, the startup reported its cumulative deliveries amounted to 51,715 units by the end of April. It took the company only 17 months to reach the milestone of 50,000-unit deliveries since the first Li ONE was delivered in December 2019.

The growing sales must come with expanded sales and service networks. Li Auto said it had 73 retail stores covering 53 cities, and 143 service centers and Li Auto-authorized body and paint shops operating in 105 cities as of April 30.

XPeng saw its April registrations edge up 4.4% over a month earlier to 4,941 units, 85% of which were contributed by private users. Both the G3 and the P7 achieved increase compared to March.

On April 14, XPeng launched its third production model, the P5, which is purportedly the world's first production model equipped with LiDAR. The order volume of the P5s surpassed 10,000 units only 53 hours after the presale kicked off at the Auto Shanghai 2021. The startup plans to start delivering the P5s in the fourth quarter of this year, said He Xiaopeng, Co-founder, Chairman and CEO of XPeng.

XPeng P7; photo credit: XPeng

The Guangzhou-based startup has been touting the intelligence and connectivity functions as main selling points of its products. At the earnings call after XPeng announced its latest quarterly financial results, the company revealed the revenue from the XPILOT 3.0 software was around 80 million yuan ($97.193 million) in the first quarter of 2021.

“For the first time, the revenue from our XPILOT software was reflected in gross margin, marking a significant milestone in Chinese EV industry,” said Dennis Lu, XPeng's Vice President of Finance.

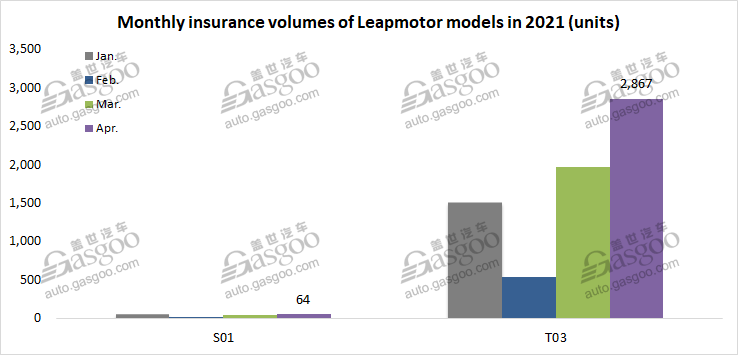

Within the so-called second-tier group, Leapmotor, HOZON Auto, and WM Motor all had registrations of over 2,000 units in April. However, the three companies all featured heavy reliance on one single model.

Leapmotor moved up to the fourth place among Chinese startups. Among 2,931 new vehicles registered in April, 2,867 units were contributed by the T03.

The startup began the presale of third production model, the C11, in early January 2021. The all-electric SUV went into corrosion testing last month, and is expected for volume production in this year's September.

HOZON Auto's registrations jumped 20.6% month on month to 2,919 units in April, 95.9% of which were from the Nezha V.

At the Auto Shanghai 2021, HOZON Auto announced the market launch of the Nezha U PRO, whose order volume had exceeded 5,000 units by the end of April.

Although WM Motor was the last one among the top 6 startups, its biggest sales contributor, the EX5, ranked fifth on the list of all-electric SUV models in April with an insurance volume of 1,958 units.

Gasgoo not only offers timely news and profound insight about China auto industry, but also help with business connection and expansion for suppliers and purchasers via multiple channels and methods. Buyer service:buyer-support@gasgoo.comSeller Service:seller-support@gasgoo.com