China’s passenger vehicle market scores YoY growth in both Aug. retail, wholesale volumes

Shanghai (Gasgoo)- In August 2023, China's passenger vehicle (PV) market reported robust retail sales, reaching 1.92 million units, marking a 2.5% year-on-year (YoY) increase and an 8.6% month-on-month (MoM) rise, according to the China Passenger Car Association (CPCA).

Cumulatively, this year has seen 13.22 million PVs sold, reflecting a 2% YoY growth.

For clarity, the PVs hereby refer to the cars, SUVs, and MPVs locally produced on the Chinese mainland.

August 2023 witnessed the highest-ever PV retail sales in history for the same period. This month showcased strong government policies aimed at promoting consumption, keeping sales promotions at their peak, said the CPCA. Additionally, the Chengdu Motor Show recently closed introduced a plethora of new and affordably priced models, further stimulating consumers' demands.

Despite disruptions from extreme weather conditions such as typhoons, rainstorm, and high temperatures, the enthusiasm for summer travel remained high, contributing to the overall growth of the automotive market. The national-level policies targeted towards the automotive industry continue to be rolled out, aimed at stabilizing and expanding car consumption. Besides, initiatives like the "Hundred Cities Connectivity" auto festival and the "Thousand Counties, Ten Thousand Towns" new energy vehicle (NEV) consumption season initiated by China's Ministry of Commerce have yielded positive results, with colorful promotional activities, auto shows, and the distribution of consumer vouchers effectively boosting consumer confidence.

Taking into account factors such as the early timing of the Chinese New Year, intense promotions to clear the inventories of the China VI-a vehicles, the delayed launch of China VI-b vehicles, and the gradual rise in the monthly base volume for the year-ago period, the cumulative PV retail sales for January to August reached 13.22 million units in China, demonstrating a notable YoY growth of 2.0%.

In August, China's domestic brands achieved remarkable performance with 1 million PVs retailed, a 17% YoY increase and a 6% MoM growth. They accounted for 52.1% of the country's overall PV retail volume in the month, up 6.1 percentage points year-on-year.

Year-to-date, domestic brands have captured 50% of the market, showing a growth of 4.7 percentage points compared to the same period last year.

Mainstream joint-venture brands retailed 650,000 locally-produced PVs in August, a decrease of 16% YoY, but a 10% growth MoM. The market shares of German and Japanese brands fell 1 and 4 percentage points to 20.1% and 16.7%, respectively, while the American brands’ share also dipped 0.4 percentage points to 8.5%。

Luxury auto brands sold 280,000 units in August by retail, indicating a 9% YoY increase and a 14% MoM growth. Improved product supply on a global scale bolstered the domestic retail market in China.

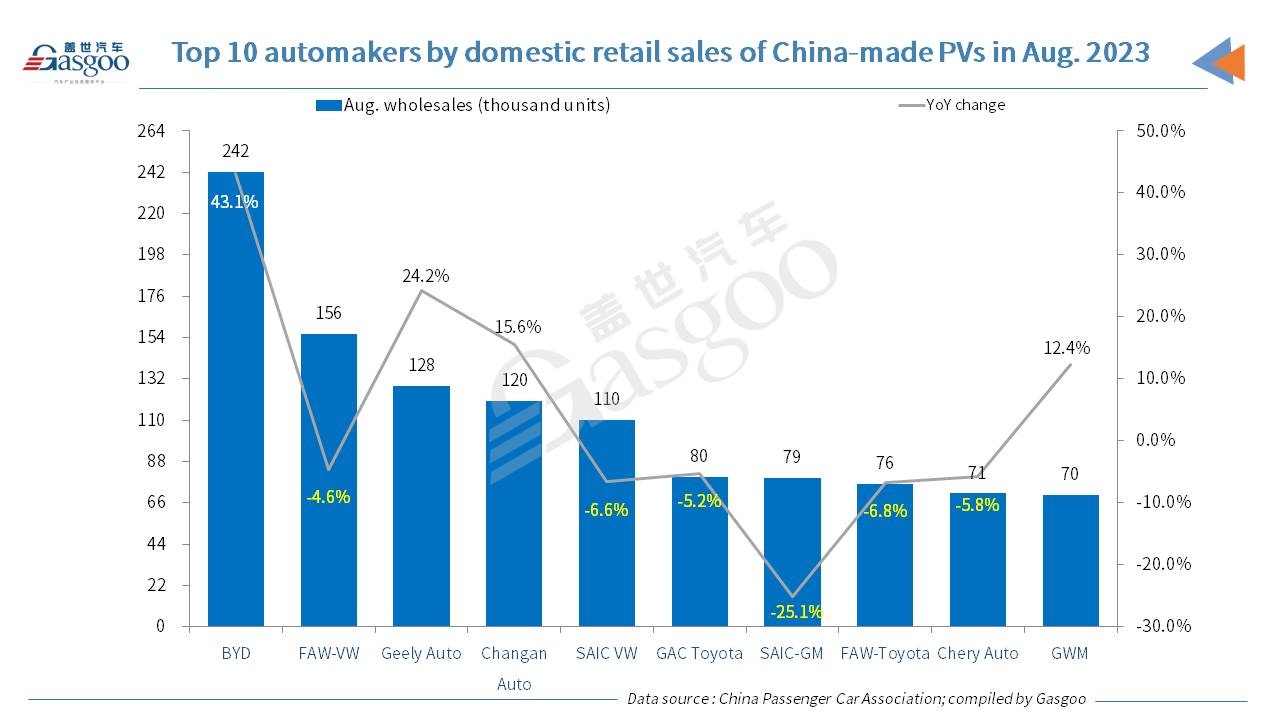

Among the top 10 automakers by August PV retail sales in China, BYD still secured the top position, and was also the fastest-growing one in terms of YoY change. Among the No.2 to No.10 carmakers, only Geely Auto, Changan, and GWM (all of them are China’s local brands) posted a rising movement over a year earlier.

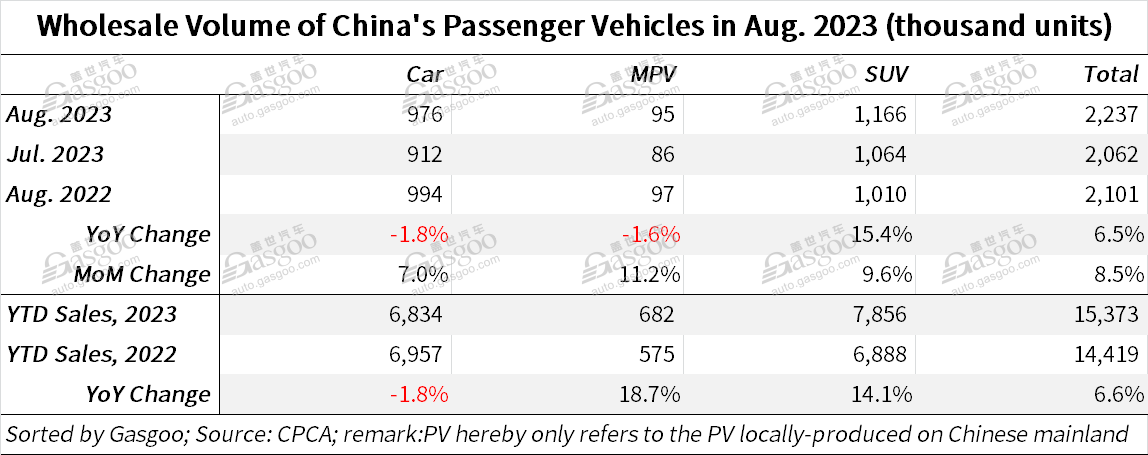

Nationwide, car manufacturers wholesaled 2.237 million PVs in August, a 6.5% YoY increase and an 8.5% MoM growth. Cumulatively for this year, 15.373 million PVs were wholesaled, up 6.6% YoY.

In August, domestic automakers wholesaled 1.28 million PVs, marking a 26% YoY increase and a 7% MoM growth. Mainstream joint ventures wholesaled 650,000 units, a 16% YoY decrease but a 12% MoM increase. Luxury carmakers' wholesales amounted to 300,000 units, a 1% YoY decrease but a 7% MoM growth.

Last month, the performance of major PV manufacturers remained strong, with 34 companies selling over 10,000 units (an increase of 3 compared to the previous month). Among them, 5 companies achieved a YoY growth rate of over 50%, and 10 companies recorded a YoY growth rate exceeding 10%, according to the CPCA's data.

BYD Tang DM-p; photo credit: BYD

As for the new energy passenger vehicles (NEPV) market, the month of August also witnessed a robust performance in both wholesale and retail volumes. To be specific, wholesale volume reached 798,000 units, reflecting a 25.6% YoY increase and an 8.2% MoM growth. Cumulatively for this year, 5.078 million NEPVs were wholesaled, marking a 38.5% YoY increase. Retail figures for August stood at 716,000 units, a 34.5% YoY increase and an 11.8% MoM growth. Year-to-date retail figures totaled 4.441 million units, a 36.0% YoY increase.

The country's production volume of locally-manufactured PVs in August amounted to 2.237 million units in the country, displaying a YoY increase of 5.3% and a MoM growth of 7.1%.

This year's total auto exports continued the strong growth trend from the end of last year. Under the statistical scope of the CPCA, PV exports (including complete vehicles and CKDs) reached 330,000 units in August, indicating a YoY jump of 31% and a MoM growth of 7%. NEVs accounted for 24% of total exports in the month. From January to August, China's PV exports totaled 2.32 million units, representing a YoY spike of 72%.

Gasgoo not only offers timely news and profound insight about China auto industry, but also help with business connection and expansion for suppliers and purchasers via multiple channels and methods. Buyer service:buyer-support@gasgoo.comSeller Service:seller-support@gasgoo.com