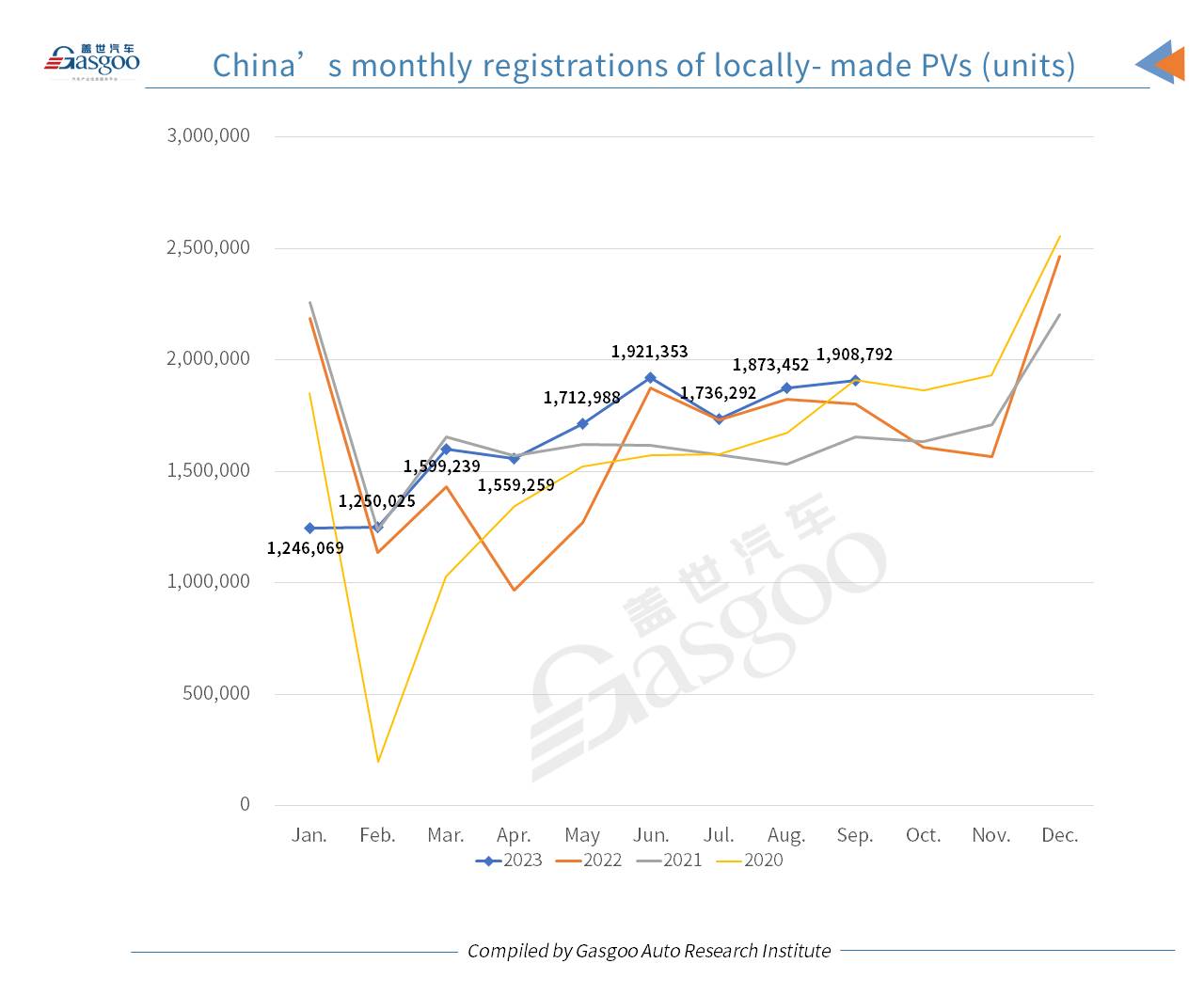

China's monthly registrations of locally-made passenger vehicles (PVs) reached 1,908,792 units in September 2023, climbing 5.78% from the previous year and also edging up 1.89% from the previous month, according to the data compiled by Gasgoo Auto Research Institute ("GARI").

For clarity, the PVs hereby refer to the vehicles locally produced and registered on the Chinese Mainland.

China's PV market displayed steady retail performance in September. The quarter-end sprint in the past month was characterized by robust promotional activities, and driven by automakers' and dealers' efforts who tried to fulfill their quarterly sales targets. Both oil-fueled and new energy vehicle (NEV) sectors saw greater sales promotions compared to August, further unleashing consumers' car-buying demands.

At the national level, a flurry of policy initiatives aimed at stabilizing and expanding automobile consumption emerged, offering guidance to the automotive industry. Multiple measures such as holding local auto shows and distributing consumer vouchers enriched the promotional landscape, contributing to a notable boost in consumer confidence.

In addition, the travel spree remained strong this year, with a significant number of people embarking on road trips during the Mid-Autumn and National Day holidays. As infrastructure improvements in roads, rest areas, and NEV charging facilities progressed, and with the growing diversity of a refined guesthouse system, media and social platforms played a role in continually updating and enhancing road trip solutions. Consequently, there was a growing demand for enhanced safety features and intelligent assistance features. Thanks to better product choices and more affordable pricing in recent months, consumers are exhibiting stronger car-shopping demands.

For the first nine months of this year, China's cumulative PV registrations summed up to 14,807,469 units, growing 4.1% from the previous year.

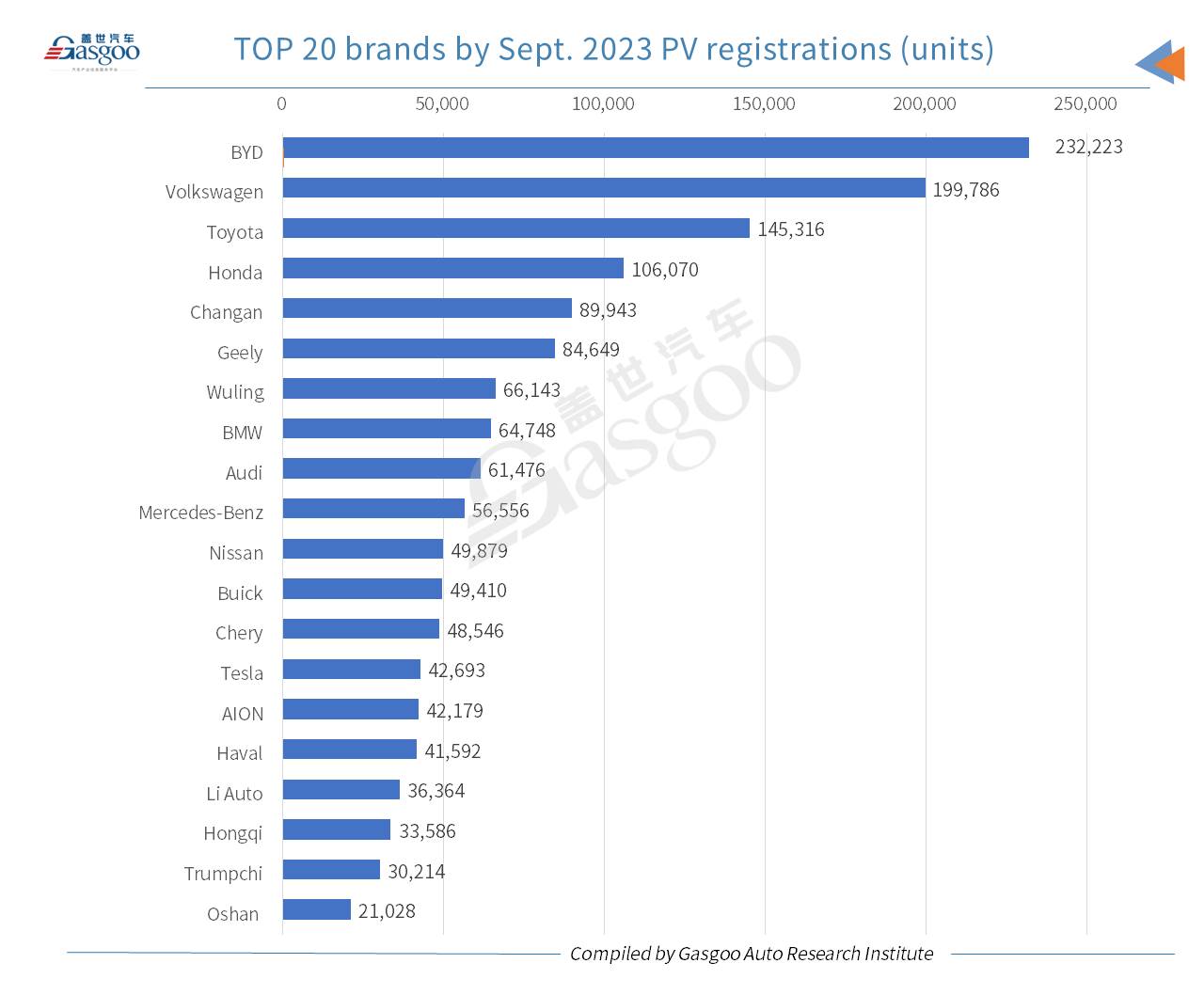

BYD was still crowned the highest-ranking brand in China with 232,223 PVs registered in September, for the first time exceeding the 230,000-unit mark on a monthly basis. Volkswagen sustained its runner-up title, successively followed by Toyota and Honda.

The three major China’s domestic brands—Changan, Geely, and Wuling—ranked 5th to 7th among all PV brands by September registrations, while the German trio—BMW, Audi, and Mercedes-Benz—held the three spots from 8th to 10th.

There were two BEV (battery electric vehicle)-dedicated brands shown in the second half of the top 20 PV brands list by September registrations, namely, Tesla and AION. Li Auto ranked 17th with only REEVs (range-extended electric vehicles) sold.

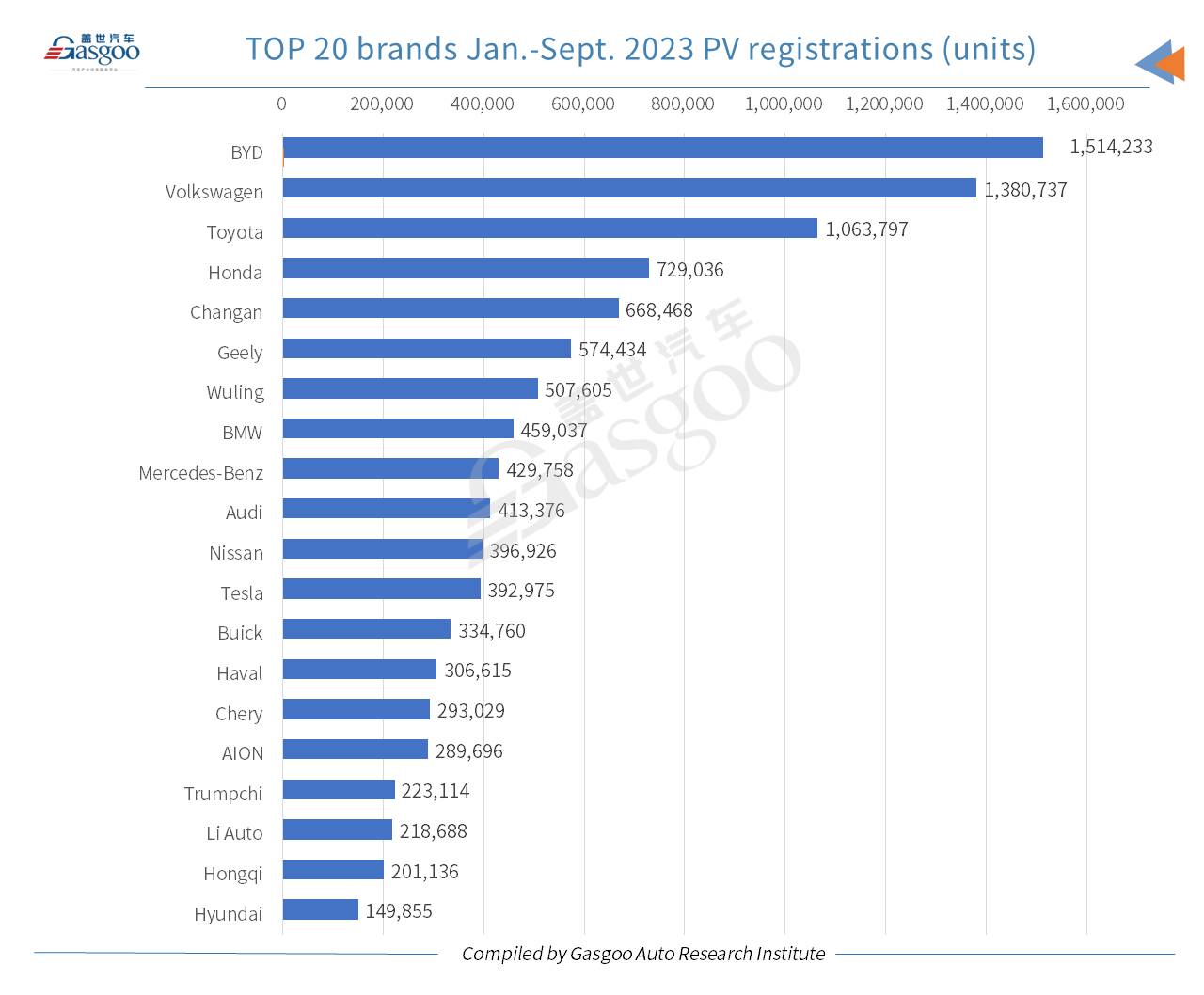

As for the Jan.-Sept. PV registrations, the top 20 brands contained 10 Chinese brands, 4 German brands, 4 Japanese & South Korean brands, and 2 American brands.

In September, the best-performing PV model by September registrations in China was the Model Y. The BYD Seagull stood at the No.2 spot with over 30,000 vehicles registered. The Lavida was honored the second runner-up and also the highest-ranking oil-fueled model.

Apart from the aforesaid three models, there were still 9 models with their respective registrations surpassing 20,000 units. Among them, the Yuan PLUS, the Dolphin, and the Song PLUS DM-i are all under the BYD brand.

In addition, such NEV models as the Wuling Binguo, the Han EV, the AION Y Plus, and the Song Pro DM appeared in the rankings of No.11 to No.20 models by September registrations. Among products from the German trio, the Audi A6L was the only one that entered the top 20 PV models list.

Regardinf the Q1-Q3 PV registrations, the Model Y became the first locally-made model to see its year-to-date registrations exceed 300,000 units. The Sylphy and the Lavida occupied the 2nd and 3rd spots, while the BYD-branded Dolphin, Qin PLUS DM-i, the Yuan PLUS, and the Song PLUS DM-i successively ranked 4th to 7th.

Among cities on the Chinese Mainland, Shanghai, Beijing, and Chengdu took the first three seats by September PV registrations, the same as that of August, and all of them had over 50,000 PVs registered in the month.

Moreover, there were ten cities whose registrations stood between 30,000 units and 50,000 units each last month, two of which (Guangzhou and Zhengzhou) surpassed the 40,000-unit mark.

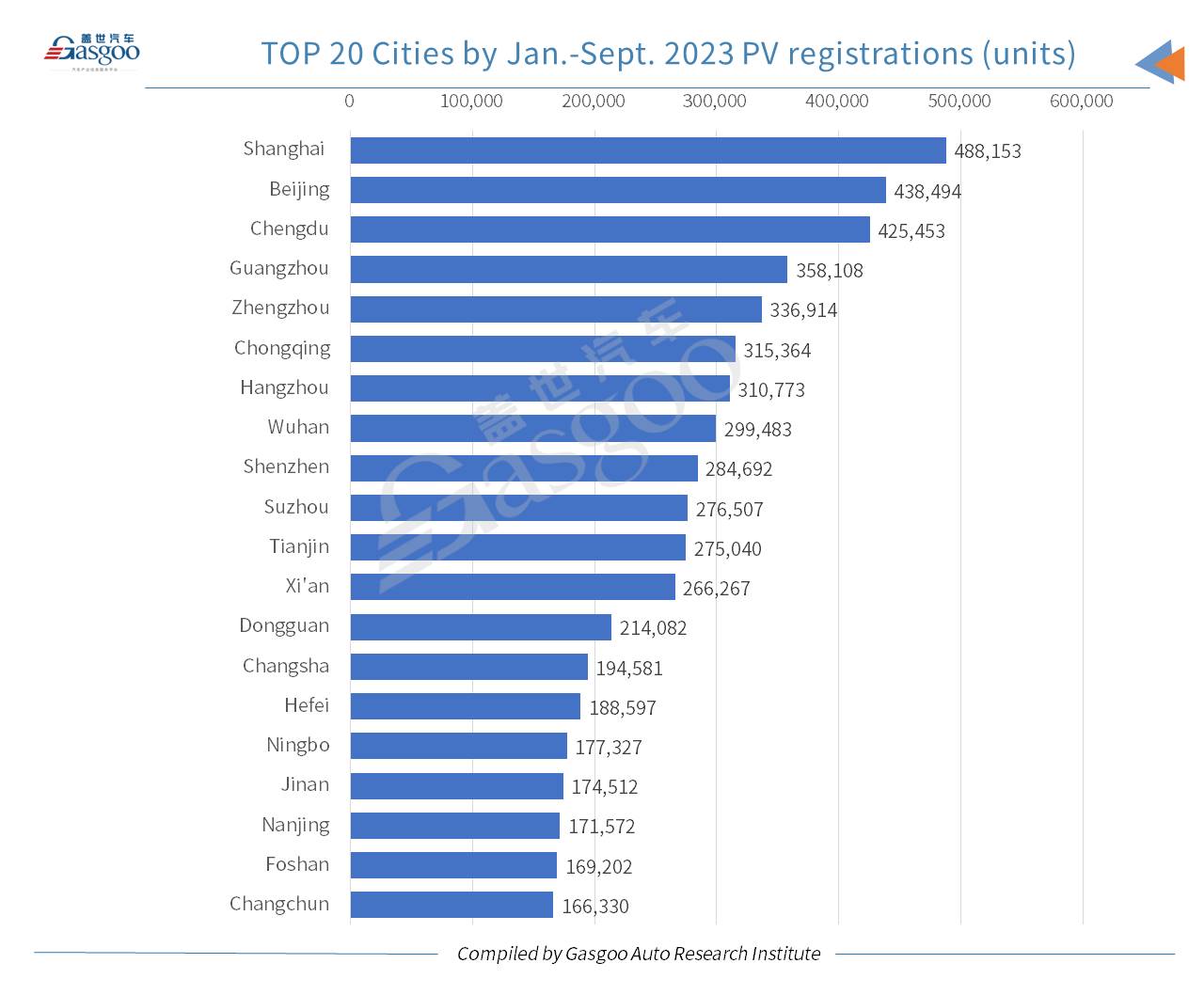

In terms of the cumulative performance for the first three quarters of 2023, Shanghai registered the most domestically-produced PVs among Chinese cities, while both Beijing and Chengdu also recorded a registration volume of more than 400,000 units.

The new energy passenger vehicle (NEPV) sector in China recorded a registration volume of 687,021 units last month, jumping 27.51% from the year-ago period and accounting for 36% of the total PV registrations in the countries.

For the first nine months of this year, the cumulative NEPV registrations across the Chinese Mainland leapt 37.55% year on year to 4,878,683 units, which represented 32.95% share in the overall PV market.

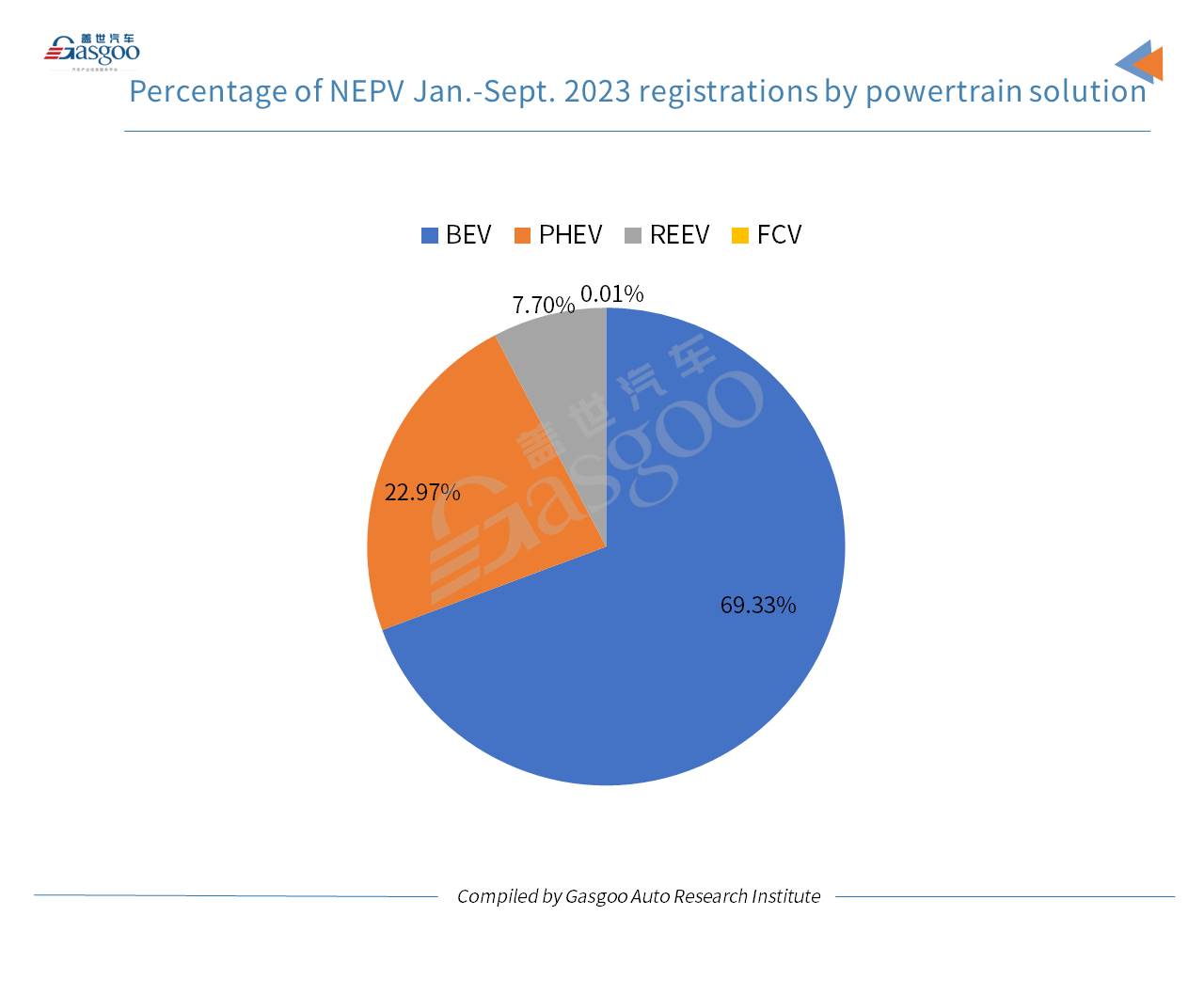

Speaking of the proportion of each powertrain solution, BEVs made up 70.88% of China's NEPV registrations in September. The plug-in hybrid electric vehicle (PHEV) registrations reached 200,078 units (including 61,149 REEVs) last month, accounting for 29.12% of the country's total NEPV registrations.

Of the NEPVs registered in Jan.-Sept. 2023, 69.33% were contributed by BEVs. Meanwhile, the FCEV (fuel cell electric vehicle) segment registered a year-to-date volume of only 332 units, 13 units of which were recorded last month.

With respect to the NEPV registrations in September, BYD still took a significant lead over other brands. It had 232,223 NEPVs registered in the month, which were even more than the sum of the No.2-No.9 spots’ occupants. Tesla was credited the runner-up, while GAC AION, Wuling, and Li Auto ranked 3rd to 5th.

Volkswagen ranked 7th with 21,488 NEPVs registered in September, including 19,245 BEVs, which were entirely contributed by the ID. series, and 2,243 PHEVs.

What's more, Geely, ZEEKR, and Galaxy, which were all from Geely Auto Group, ranked 12th, 14th, and 19th by September NEPV registrations, respectively. Notably, Galaxy, the NEV range launched in February this year, entered the top 20 brands list with 8,205 Galaxy L7 PHEVs registered last month.

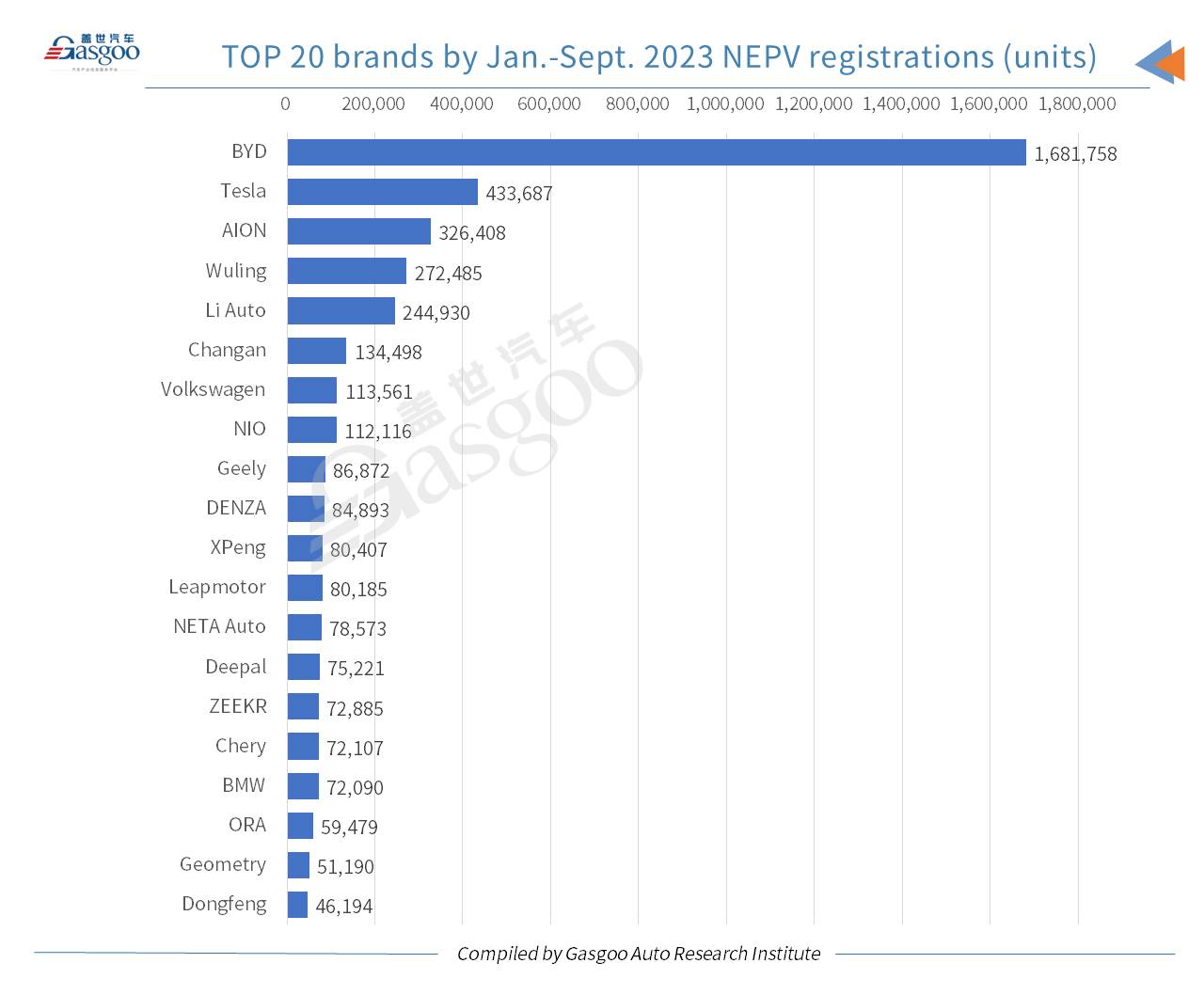

In terms of the Q1-Q3 NEPV registrations, the top five brands—BYD, Tesla, AION, Wuling, and Li Auto—all witnessed their cumulative volume surpass 200,000 units. DENZA, the brand majority-backed by BYD Auto, ranked 10th, while the four main Chinese NEV startups—NIO, XPeng, Leapmotor, and NETA Auto—took the 8th, and 11th to 13th spots.

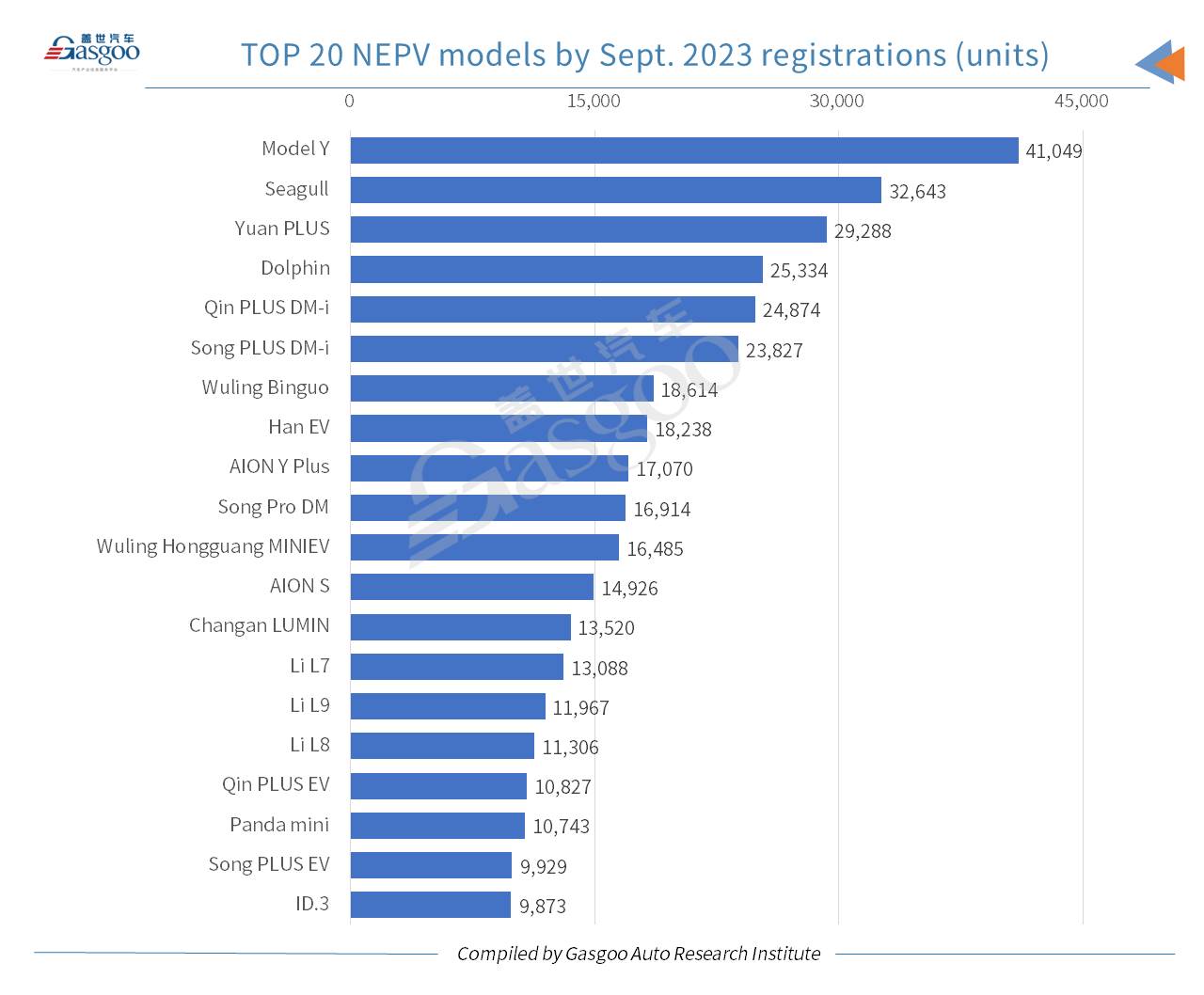

With regard to September registrations, the Model Y no doubt topped other homemade NEPV models. The five BYD-branded models—the Seagull, the Yuan PLUS, the Dolphin, the Qin PLUS DM-i, and the Song PLUS DM-i—took the 2nd to 6th places among all domestically-built NEPV models. Moreover, BYD's Han EV, Song Pro DM, Qin PLUS EV, and Song PLUS EV were also capsulated into the top 20 NEPV models list. Li Auto saw its three L series models all enter the top 20 rankings (14th-16th).

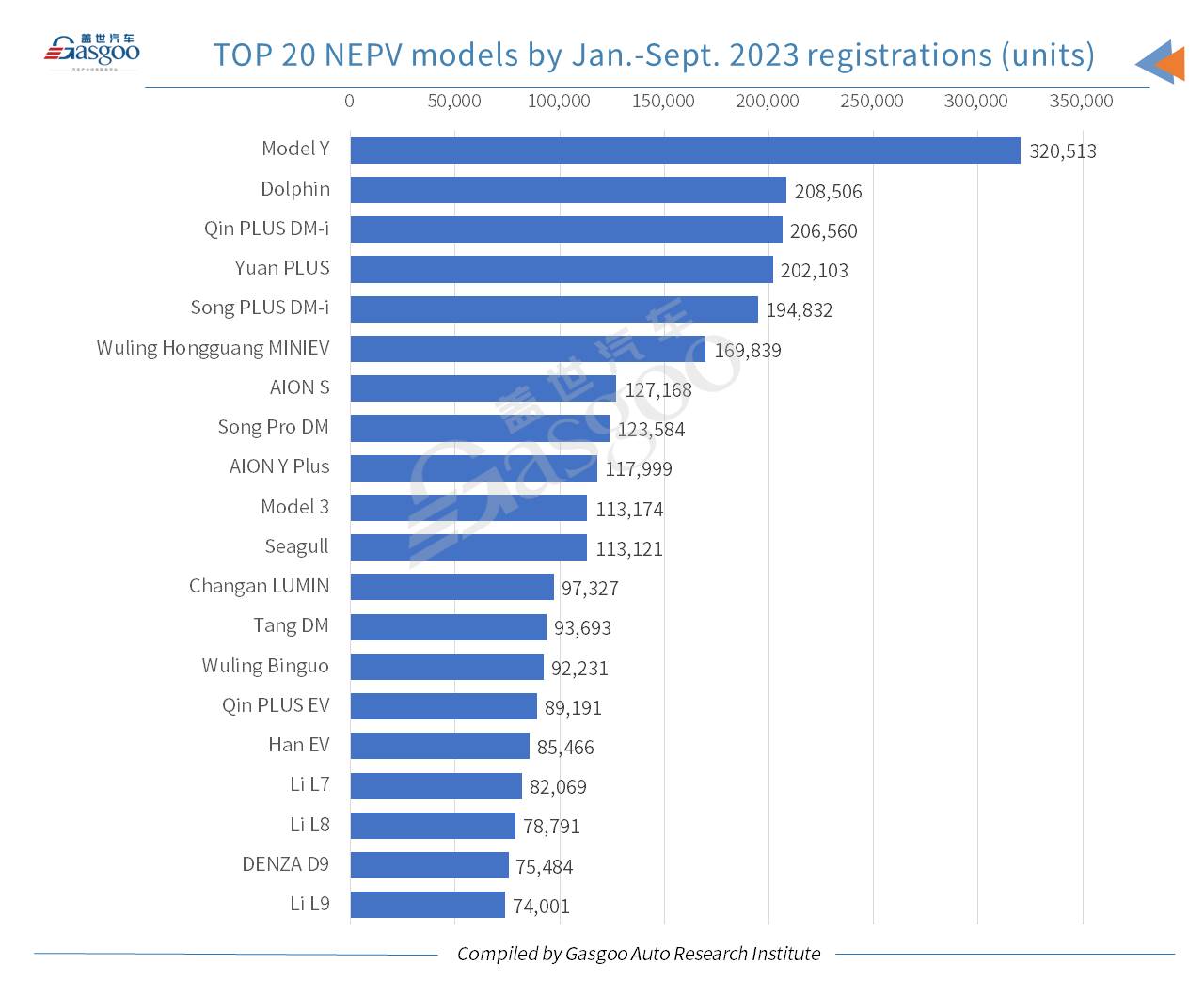

In terms of the Q1-Q3 registrations, there were 11 NEPV models with over 100,000 units registered each, 6 of which were under the BYD brand. The Model Y outperformed other as the only one to have over 300,000 vehicles registered. Besides, the DENZA D9 cracked the top 20 NEPV models list as the only MPV model.

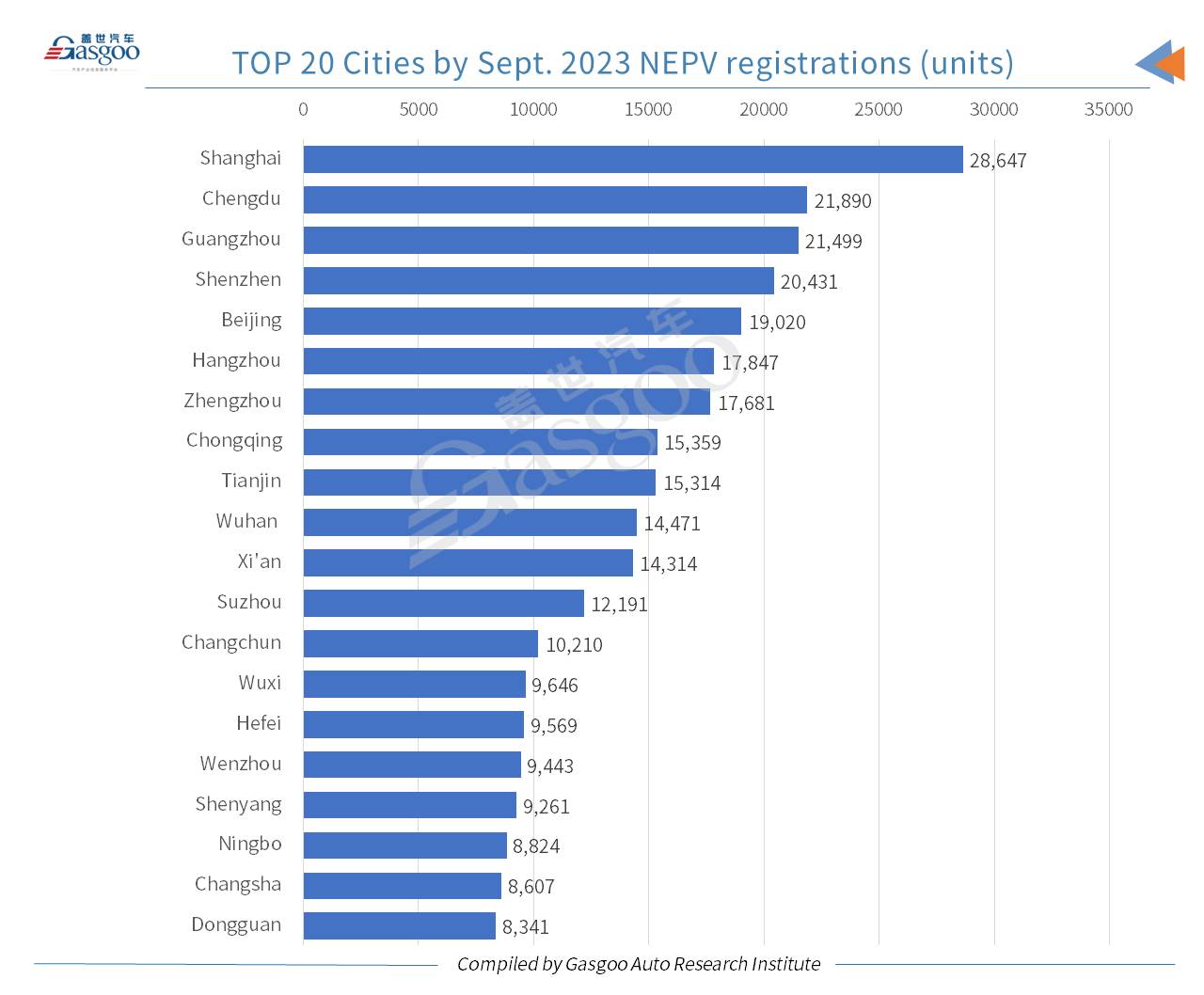

In September, Shanghai still outdid other cities with 28,647 locally-made NEPVs registered, which accounted for 49.23% of the city’s overall PV registrations. During this period, the top five best-selling NEPV models in Shanghai were the Tesla Model Y, the NIO ES6, the BYD Yuan PLUS, the BYD Song PLUS EV, and the BYD Dolphin.

Chengdu, Guangzhou, and Shenzhen saw their respective NEPV registrations also surpass 20,000 units last month, but Beijing failed to reach this mark.

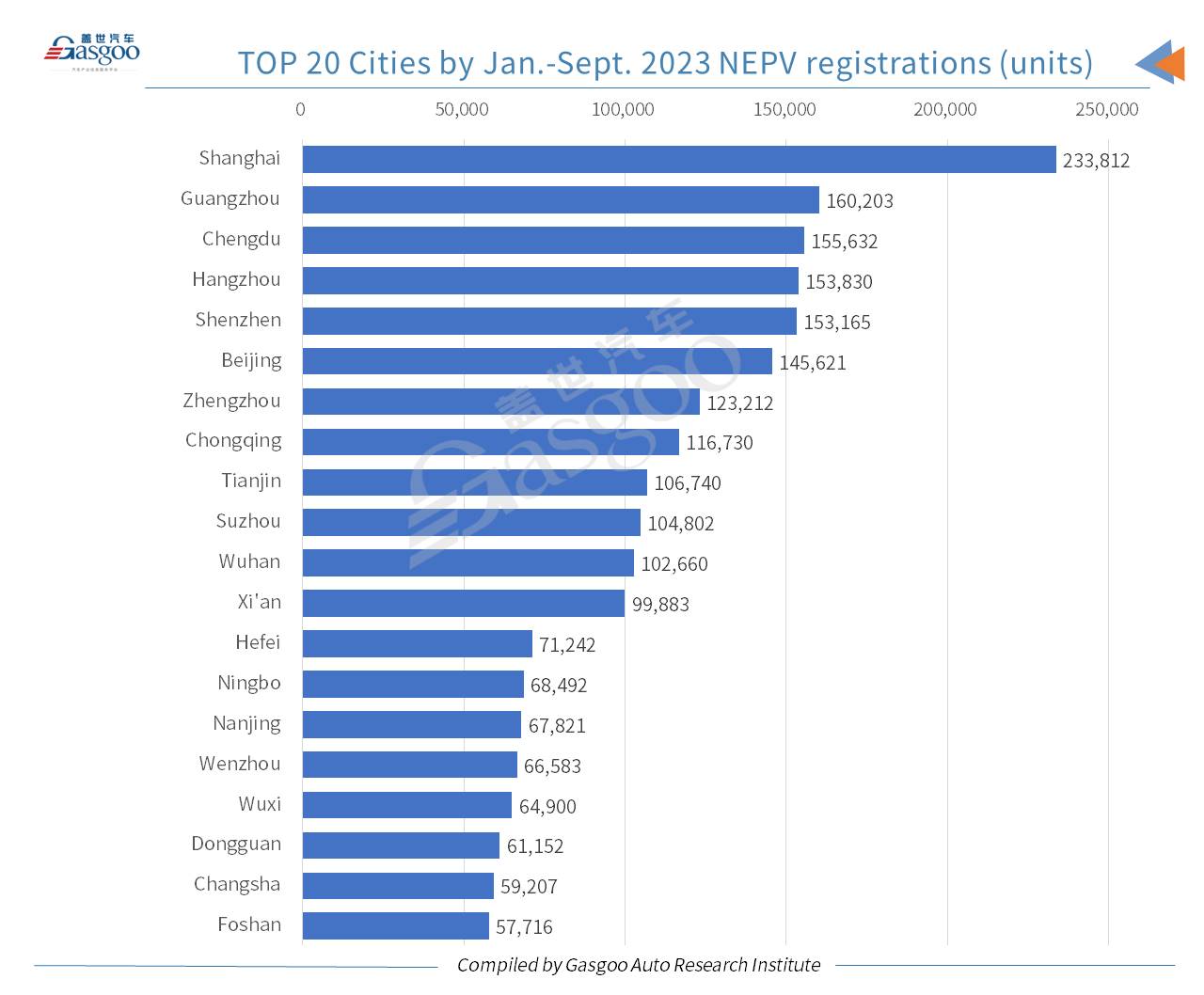

During this year's first nine months, there were 11 cities on the Chinese Mainland with over 100,000 domestically-built NEPVs registered each.