China’s domestic passenger vehicle market posts 10.2% YoY growth in Oct. 2023 sales

Shanghai (Gasgoo)- In October 2023, the domestic retail sales of passenger vehicles (PVs) in the Chinese market reached 2.033 million units, marking a 10.2% year-on-year (YoY) growth and a 0.7% month-on-month (MoM) increase, according to the China Passenger Car Association ("CPCA").

For the first ten months of this year, the cumulative PV retail sales in China amounted to 17.267 million units, rising 3.2% from the previous year.

For clarity, the PVs hereby refer to the cars, SUVs, and MPVs locally produced on the Chinese Mainland.

October witnessed a MoM growth in China's automobile sales, following the usual trend of a strong performance during the "Silver September" and "Golden October", the traditional peak season for car shopping in China. The growth was primarily driven by the increasing demand for new energy vehicles (NEVs), said the CPCA. The continuous expansion of promotional activities for both conventional oil-fueled and NEVs contributed to the unleashing of consumer demands.

At the national level, a series of policies aimed at stabilizing and expanding automobile consumption were introduced. Initiatives such as the “Hundred Cities Initiative” for automobile shopping festivals and the New Energy Vehicle Consumption Season in the massive rural area have yielded positive results. Moreover, diverse local events and promotional policies continue to be announced, with the release of local subsidies becoming more regular. These measures, coupled with corporate sales promotion efforts, are providing steady support to the automotive market in the year-end sprint.

However, persistent price reductions have led to heightened consumer caution, resulting in diminishing marginal benefits from terminal promotions, the association added. Towards the end of October, there was an observable increase in consumer’s "wait-and-see" sentiment, likely related to the anticipation of events like the "11.11" shopping festival.

In October, China's indigenous brands sold 1.13 million PVs by retail, marking a remarkable 20% YoY increase and a 5% MoM rise. They held a 55.6% share of the domestic retail market in October, reflecting a 4-percentage-point YoY increase. For the first ten months of this year, China’s self-owned brands accounted for 51% of the country’s overall PV retail sales, an increase of 4.9 percentage points over a year earlier.

In October, mainstream joint-venture brands retailed 680,000 PVs, a 2% YoY decrease but a 1% MoM increase. German brands accounted for 18.1% of the PV market’s overall retail volume, marking a 1.2-percentage-point YoY decrease, while Japanese brands represented 17.7%, also showing a 1.2-percentage-point YoY decline. American brands held a market share of 6.1%, reflecting a 0.8-percentage-point YoY drop.

Luxury car retail sales in October reached 220,000 units, indicating an 8% YoY increase but a 16% MoM decline. The issue of luxury car shortages due to chip supply constraints, which impacted the sales performance in the same period of last year, has gradually ebbed away, but the demand for traditional luxury cars remains relatively weak.

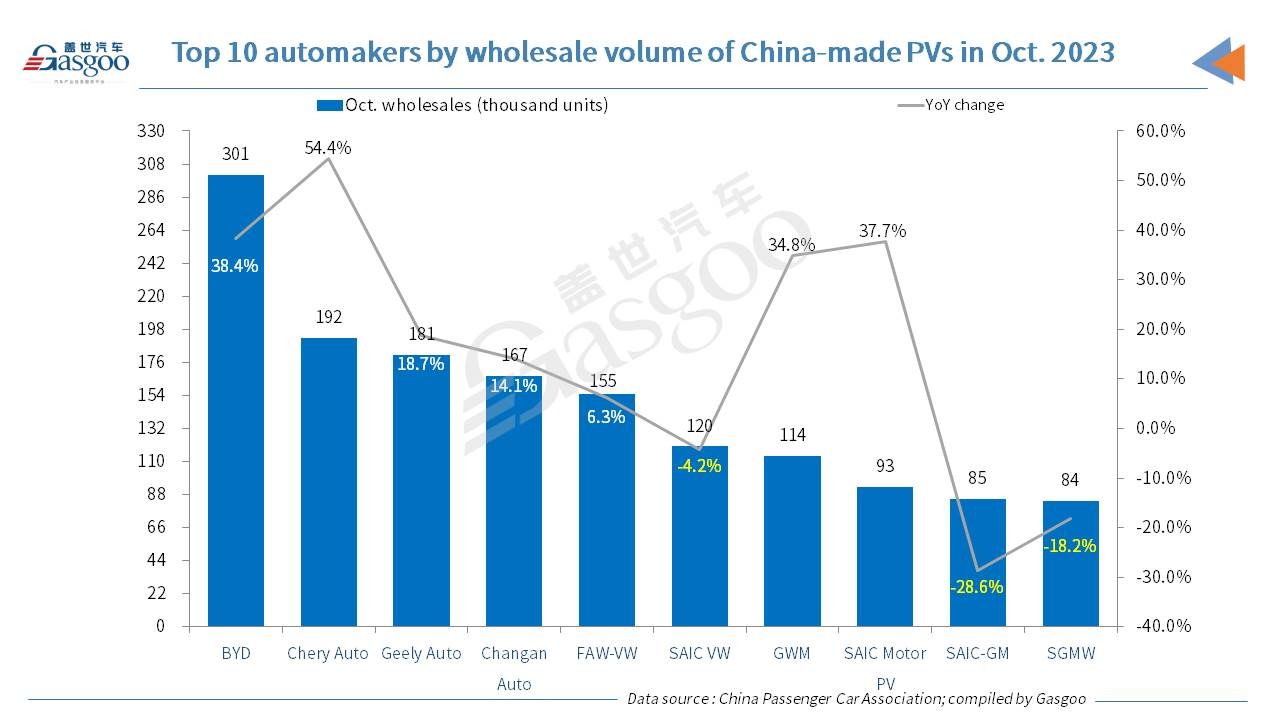

Among the top 10 automakers by October PV retail sales in China, BYD still secured the top position, while Chery Auto was the fastest-growing one in terms of YoY change. Apart from BYD and Chery Auto, FAW-VW, Geely Auto, Changan Auto, and Great Wall Motor ("GWM") also boasted a two-digit YoY jump in their respective October retail volume. SAIC-GM faced the sharpest decline compared to the year-ago period.

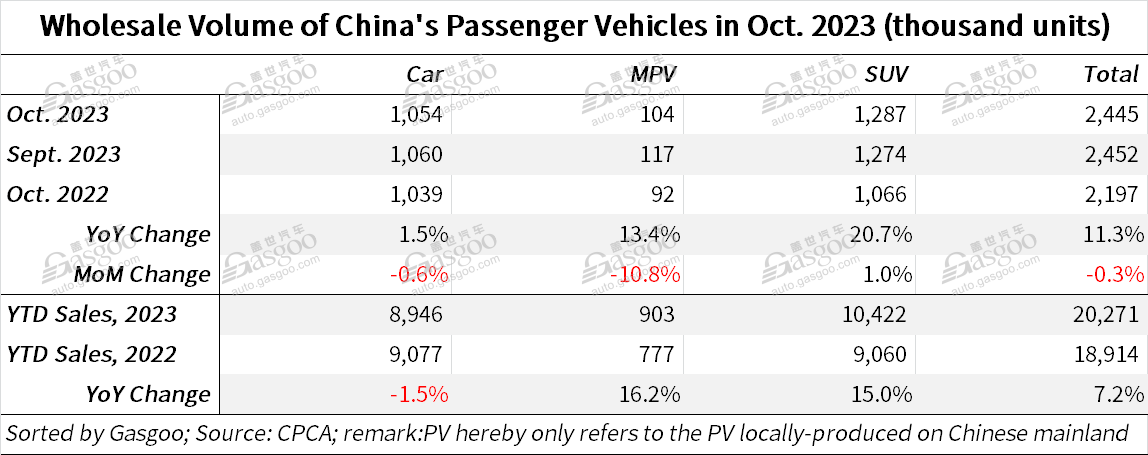

Nationwide, car manufacturers wholesaled 2.445 million PVs in October, displaying an 11.3% YoY increase, but a 0.3% MoM dip. Cumulatively for this year, 20.271 million PVs were wholesaled, up 7.2% YoY.

Breaking down the October wholesales by brand origins, China’s local brands sold 1.472 million units (+26% YoY, +6% YoY) and mainstream joint ventures’ brands contributed a wholesale volume of 714,000 units (-5% YoY, -7% MoM). In addition, the wholesales of luxury cars amounted to 260,000 units last month, shrinking 5% YoY and also sliding 14% MoM.

In October, the major passenger car manufacturers in China performed well overall, with 34 companies selling over a million units (remaining flat over the previous month). Among these, seven experienced a YoY growth of over 50%, while 18 achieved a growth rate exceeding 10%.

The country's PV production volume amounted to 2.451 million units last month, reflecting a YoY increase of 7.2% and a slight MoM growth of 0.6%. As market competition undergoes structural changes, companies have been prudent in their production strategies, said the CPCA.

The strong growth in automobile exports observed at the end of last year continues into 2023. In October, according to the statistics provided by the CPCA, China’s PV exports (including complete vehicles and CKD kits) amounted to 391,000 units, reflecting a 49% YoY increase and a 9% MoM growth. From January to October, the country’s PV exports reached 3.07 million units, showing a 66% YoY spike.

It is worth noting that in October, NEVs accounted for 28.6% of China’s total PV exports.

Gasgoo not only offers timely news and profound insight about China auto industry, but also help with business connection and expansion for suppliers and purchasers via multiple channels and methods. Buyer service:buyer-support@gasgoo.comSeller Service:seller-support@gasgoo.com