China’s passenger vehicle retail sales in July edge down YoY, but YTD sales still up

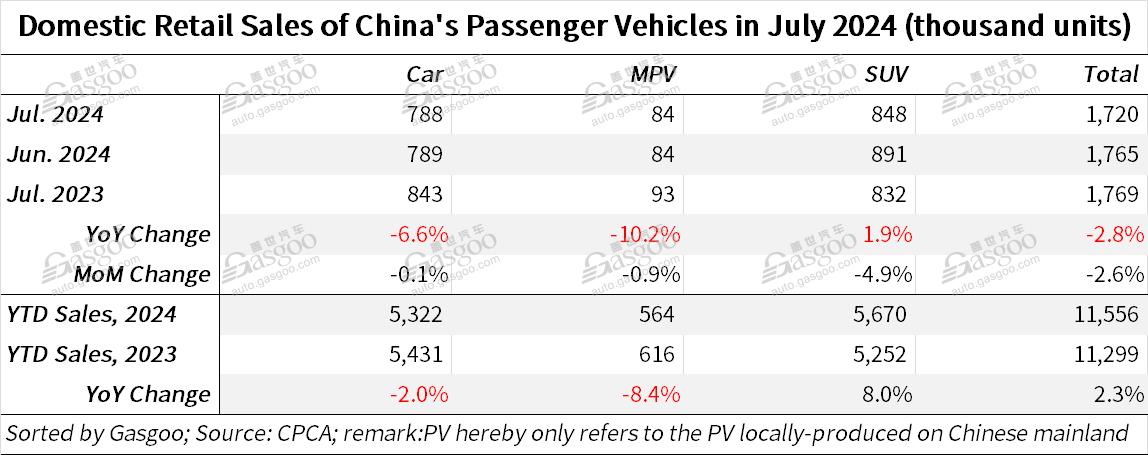

Shangai (Gasgoo)- In July 2024, China's domestic passenger vehicle (PV) market retailed 1.72 million vehicles, marking a year-over-year decrease of 2.8% and a month-over-month drop of 2.6%, according to data from the China Passenger Car Association ("CPCA").

For the first seven months of this year, the country's PV retail sales totaled 11.556 million units, climbing up 2.3% compared to the same period last year.

For clarity, the passenger vehicles hereby refer to cars, MPVs, and SUVs locally produced on the Chinese Mainland.

The CPCA said the economic landscape in July faced rising external uncertainties and relatively weak internal demand, with consumer expectations remaining low. However, the Chinese government's trade-in policies promoting vehicle scrappage and renewal showed effectiveness, with various regional policies introduced to stimulate demand. As a result, NEV sales exceeded the forecasts of passenger car manufacturers.

The market dynamics have shifted due to the shrinking size of first-time car buyers and the impact of new energy vehicles (NEVs), leading to a declining market share for traditional oil-fueled vehicles. The seasonal market pattern is weakening, with a noticeable shift towards a less pronounced off-season.

The association added, despite the high temperatures, frequent rains, and peak tourist season in July reducing foot traffic in non-supermarket stores, new automobile orders maintained positive momentum, contributing to overall market growth.

In July, China's self-owned brands retailed 1.06 million PVs, a 13% year-on-year increase and a 3% rise from June. These brands held a 61.8% share of the domestic retail market, up 8.5 percentage points over the year-ago period.

For the first seven months of 2024, China's indigenous brands made up 57% of the PV market in 2024, an increase of 7.2 percentage points from the previous year.

Mainstream joint-venture brands saw a significant decline in July, with retail sales at 440,000 units, down 25% year on year and 8% month on month. German brands held a 17.6% market share, down 2.9 percentage points over a year earlier, while Japanese brands had a 12.9% share, down 3 percentage points. American brands saw their market share drop to 5.8%, a 1.9 percentage point decline from the previous year.

Premium car retail sales in July reached 220,000 units in China, an 11% year-on-year decrease and a 14% drop from June. The premium car sector held a 12.5% market share, edging down 0.9 percentage points year on year, with traditional premium brands maintaining stable retail shares.

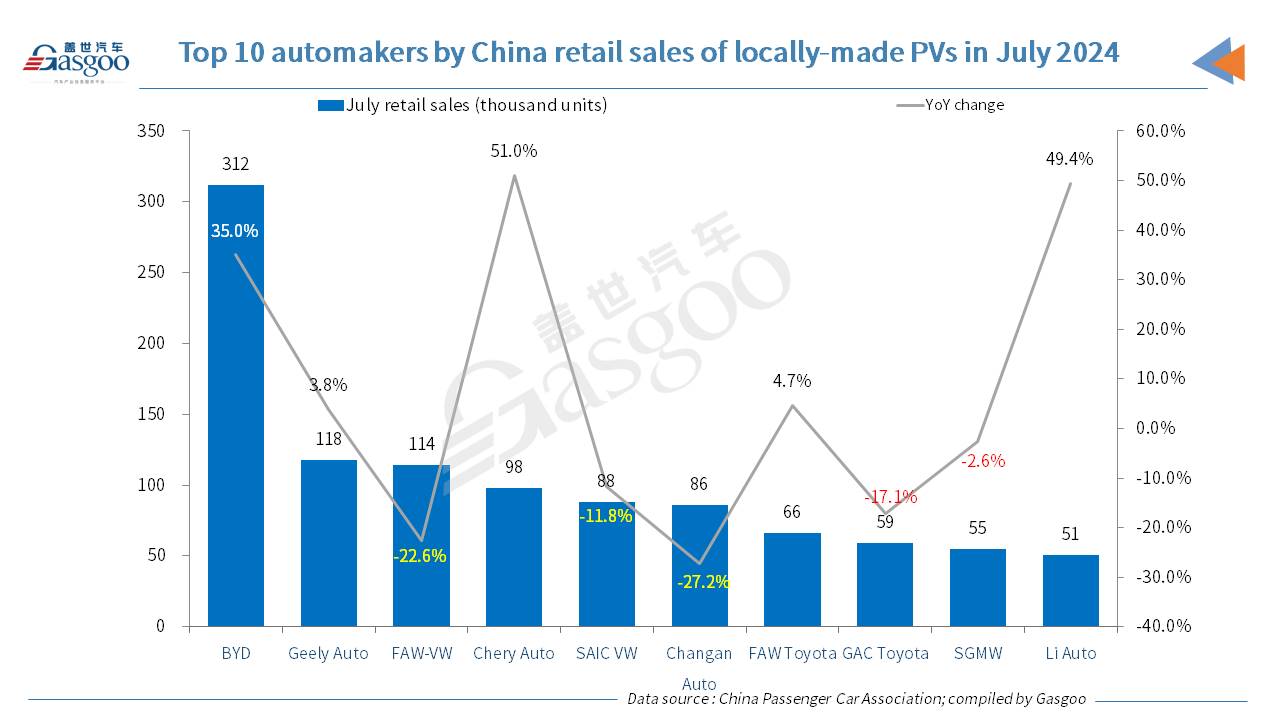

Among the top 10 automakers by July PV retail sales, five companies scored a rising momentum from the year-ago period. Of them, BYD was the highest-ranking one regarding the monthly retail sales, while both Chery Auto and Li Auto saw their respective PV retail volume zoom up nearly 50% year on year.

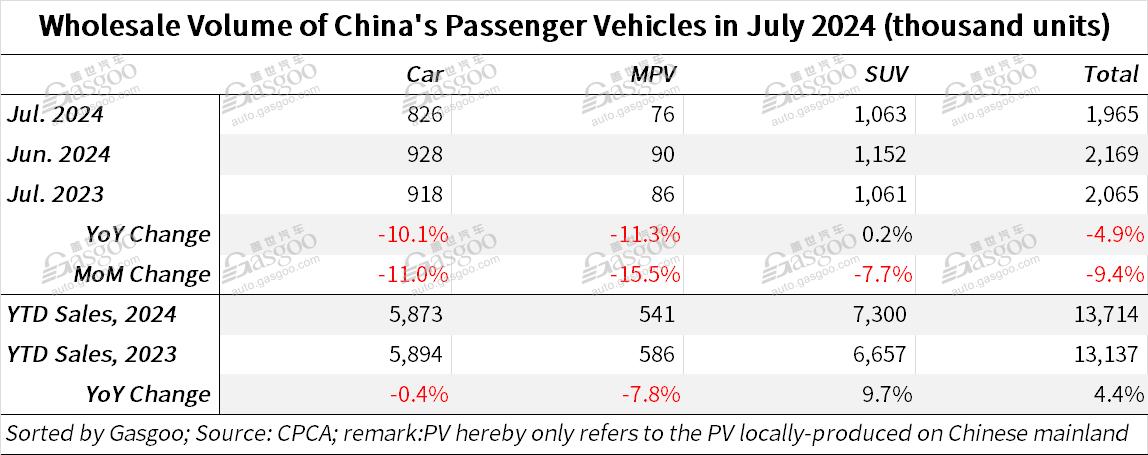

China's PV wholesale sales in July totaled 1.965 million units, a 4.9% year-on-year decline and a 9.4% decrease month-on-month. The overall wholesales did not reach new highs mainly due to stable passenger car exports over the previous month and a month-on-month fall in joint-venture retail sales.

In July, China's wholly-owned brands together recorded PV wholesales of 1.31 million units, a 9% year-on-year increase but a 7% month-on-month decline. Mainstream joint-venture brands logged 410,000 units, a 31% year-on-year plunge and a 17% drop from June. Premium car wholesale volume reached 242,000 units, down 13% year-on-year and 10% month-on-month.

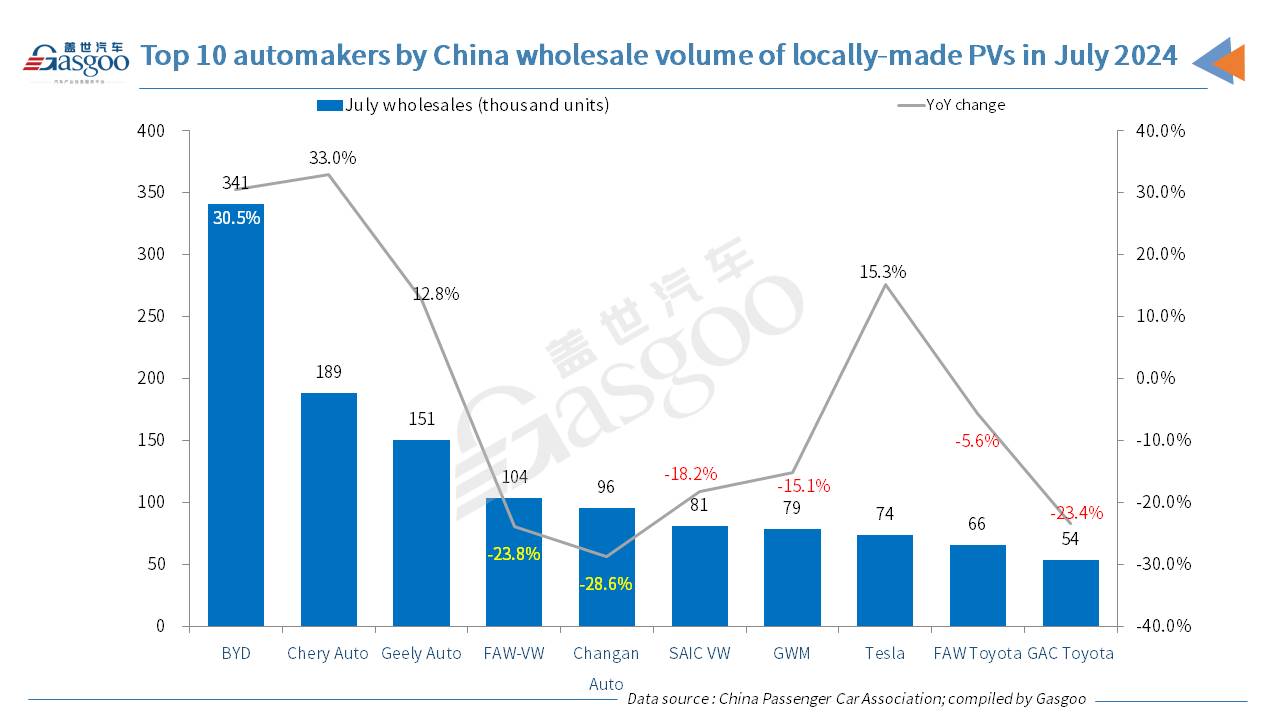

Major passenger car manufacturers displayed varied performances in July, with BYD, Chery Auto, Geely Auto, and Changan showing relatively robust strength. There were 32 manufacturers with a wholesale volume exceeding 10,000 units in July (compared to 35 in June and 31 in the same period last year), accounting for 95.3% of the market. Among these, two manufacturers achieved over 50% year-on-year surge, eight saw over 10% growth, and 19 experienced negative growth. Ten manufacturers saw a month-on-month positive growth, with four exceeding 10%, particularly among some indigenous and NEV emerging brands.

China's PV production in July was 1.982 million units, a 5.3% year-on-year decrease and a 7.1% month-on-month drop. Specifically, premium brands' output fell by 1% year on year but grew by 4% month on month; joint-venture brands' production shrank 29% year on year and 18% month on month; China's self-owned brands' production volume increased by 5% year on year but decreased by 6% month on month.

China's overall automobile exports continued their strong growth trend from last year. Customs statistics showed 553,000 vehicles exported in July, a 26% year-on-year jump and a 14% rise from June, with export value reaching $9.99 billion, up 14% year-on-year and month-on-month. Year-to-date, China's vehicle exports totaled 3.48 million units, a 25.5% year-on-year leap, with an export value of $65.1 billion, up 18%.

Passenger car manufacturers exported 376,000 vehicles last month (including CKDs), a 20% year-on-year increase, with Jan.-Jul. exports reaching 2.619 million units, up 31% over a year earlier.

With the recovery of markets in South America and other regions, China's wholly-owned brands' exports reached 306,000 units in July, a 21% year-on-year increase but a 5% month-on-month decline. Joint-venture and premium brands saw their combined exports reach 68,000 units, up 25% year-on-year and 7% month-on-month.

Gasgoo not only offers timely news and profound insight about China auto industry, but also help with business connection and expansion for suppliers and purchasers via multiple channels and methods. Buyer service:buyer-support@gasgoo.comSeller Service:seller-support@gasgoo.com