China’s YTD passenger vehicle retail sales edge up YoY by Aug. 2024

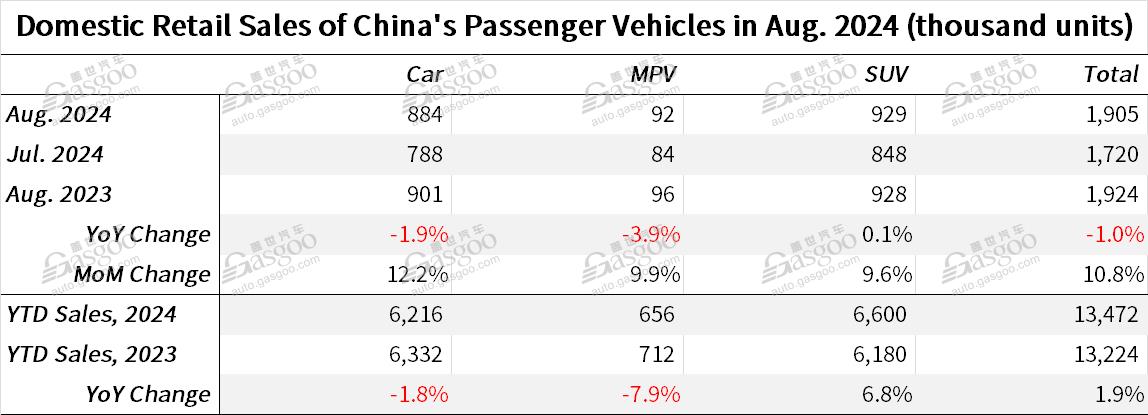

Shanghai (Gasgoo)- In Aug. 2024, China's domestic passenger vehicle (PV) market retailed 1.905 million units, marking a slight year-over-year decrease of 1% but a month-over-month increase of 10.8%, according to data from the China Passenger Car Association ("CPCA").

For the first eight months of this year, the country's PV retail sales totaled 13.472 million units, climbing up 1.9% compared to the same period last year.

For clarity, the passenger vehicles hereby refer to cars, MPVs, and SUVs locally produced on the Chinese Mainland.

The CPCA commented that the overall automobile market in China has shown signs of recovery, driven by policy support for scrapping and upgrading vehicles, as well as local trade-in incentives. Following government calls to curb unhealthy price competition, terminal prices have stabilized, easing consumer hesitation and boosting market activity. The growing momentum in the new energy vehicle (NEV) market, with penetration exceeding 50% for the second consecutive month, reflects a shift in energy structures. While traditional oil-fueled vehicle performance followed a seasonal pattern, NEV demand surged in August, continuing a strengthening trend in the second half of the year.

In Aug., the manufacturing industry's PMI (Purchasing Managers' Index) in China dropped to 49.1%, impacted by high temperatures, heavy rainfall, and a seasonal slowdown in some industries. However, policies from July 25, issued by China's National Development and Reform Commission and the Ministry of Finance, have increased subsidies for vehicle upgrades, raising incentives to 20,000 yuan for new NEV purchases and 15,000 yuan for 2.0L and below oil-fueled vehicles. The 5,000-yuan subsidy gap between NEVs and oil-fueled vehicles further stimulated NEV market demand, with strong growth in entry-level battery electric vehicles and plug-in hybrid electric vehicles.

According to the CPCA's summarization, key characteristics of China's PV market in Aug. include:

(1) A 17% month-over-month increase in NEV retail sales, reflecting positive market feedback from the scrapping and renewal policy.

(2) NEV retail penetration reached 54%, up 16.7 percentage points from August 2023, a record high.

(3) A divergence between wholesale and retail trends, as manufacturers stabilized production and reduced inventory for smoother market circulation.

(4) A slight slowdown in export growth, but NEV exports in August rose 23% year-over-year, outperforming the Jan.-Aug. cumulative export growth rate of 20%.

(5) Continued strength in China's self-owned brands, while startups showed mixed results, and global brands lagged in electrification.

China's wholly-owned brands retailed 1.2 million PVs in August, up 21% year over year and 14% month over month, accounting for 63.4% of the domestic PV market, a year-over-year increase of 11.4 percentage points. Year-to-date, China's indigenous brands held a 58% market share, up 7.8 percentage points from the previous year.

Mainstream joint-venture brands retailed 480,000 PVs in August, down 27% year over year but up 7% month over month. German brands accounted for 16.6% of overall PV retail sales, down 3.5 percentage points year over year, while Japanese brands took 12.6%, down 4.2 percentage points over a year ago. American brands held a 5.7% market share, down 2.9 percentage points year over year.

Premium passenger car sales reached 220,000 units last month, down 21% year over year but up 3% month over month. They held an 11.6% market share in Aug., a 3-percentage-point decline from the previous year.

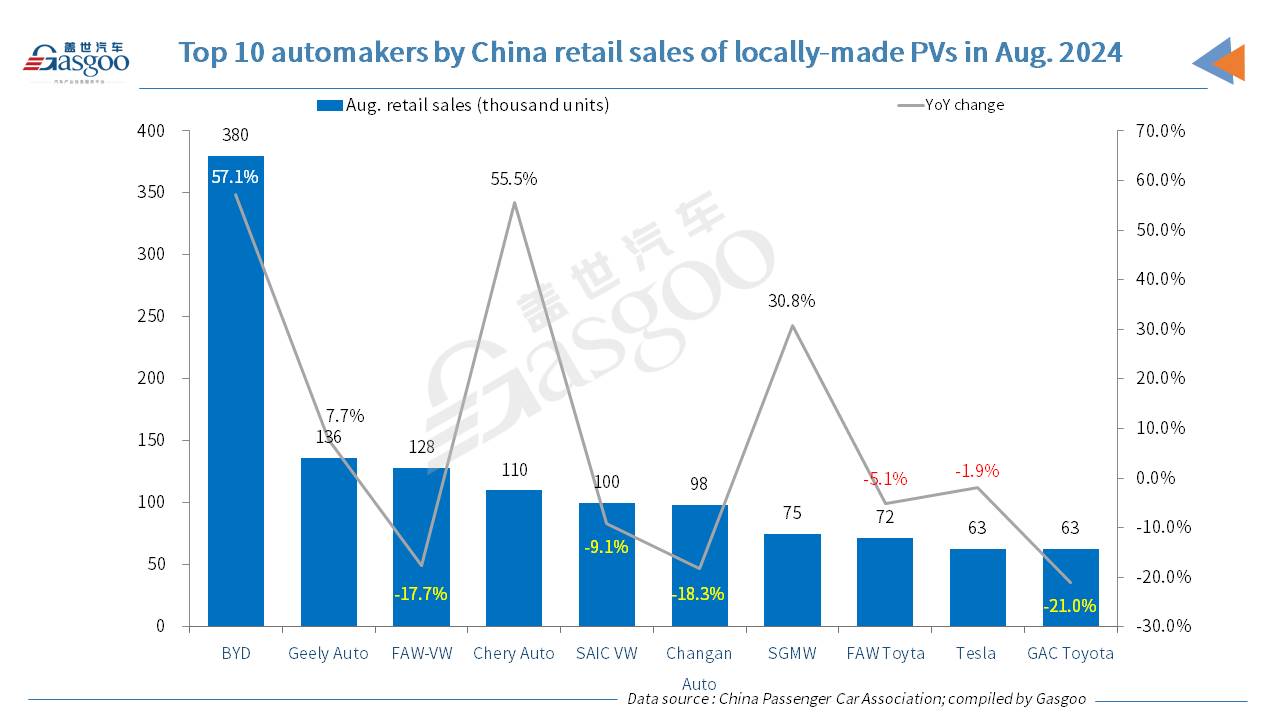

Among the top 10 automakers by Aug. PV retail sales, four companies scored a rising momentum from the year-ago period. Of them, BYD was the highest-ranking one regarding both the monthly sales volume and growth rate. Both Chery Auto and SAIC-GM-Wuling recorded a 2-digit year-on-year leap in their respective Aug. retail sales.

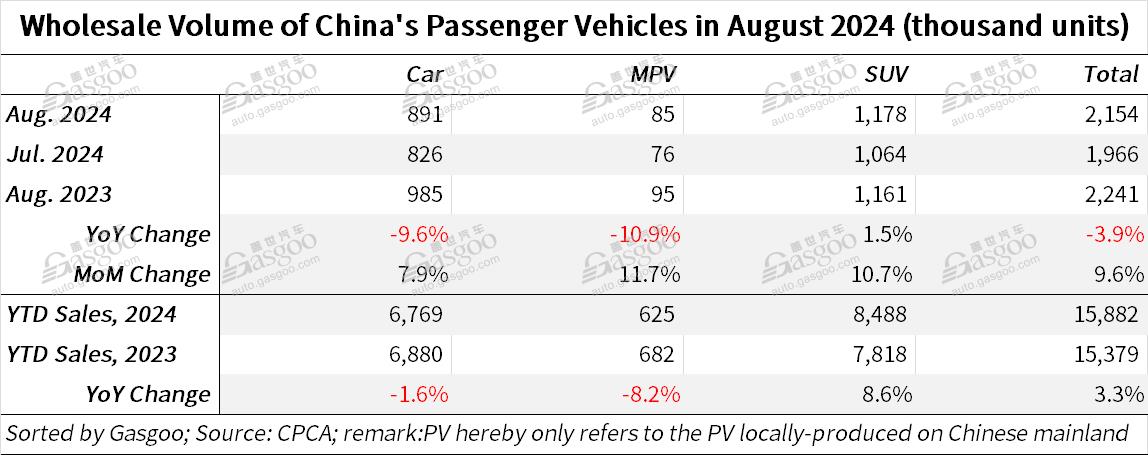

Passenger vehicle manufacturers in China wholesaled 2.154 million units in August, a 3.9% year over year decline but up 9.6% month over month. Cautious production during the summer months prevented wholesale volumes from reaching new highs.

China's self-owned brands sold 1.44 million PVs in August by wholesale, up 12% year over year and 9% month over month, while mainstream joint-venture brands wholesaled 460,000 PVs, down 30% year over year but up 12% month over month. Premium brands wholesaled 250,000 PVs, down 15% year over year but up 5% month over month.

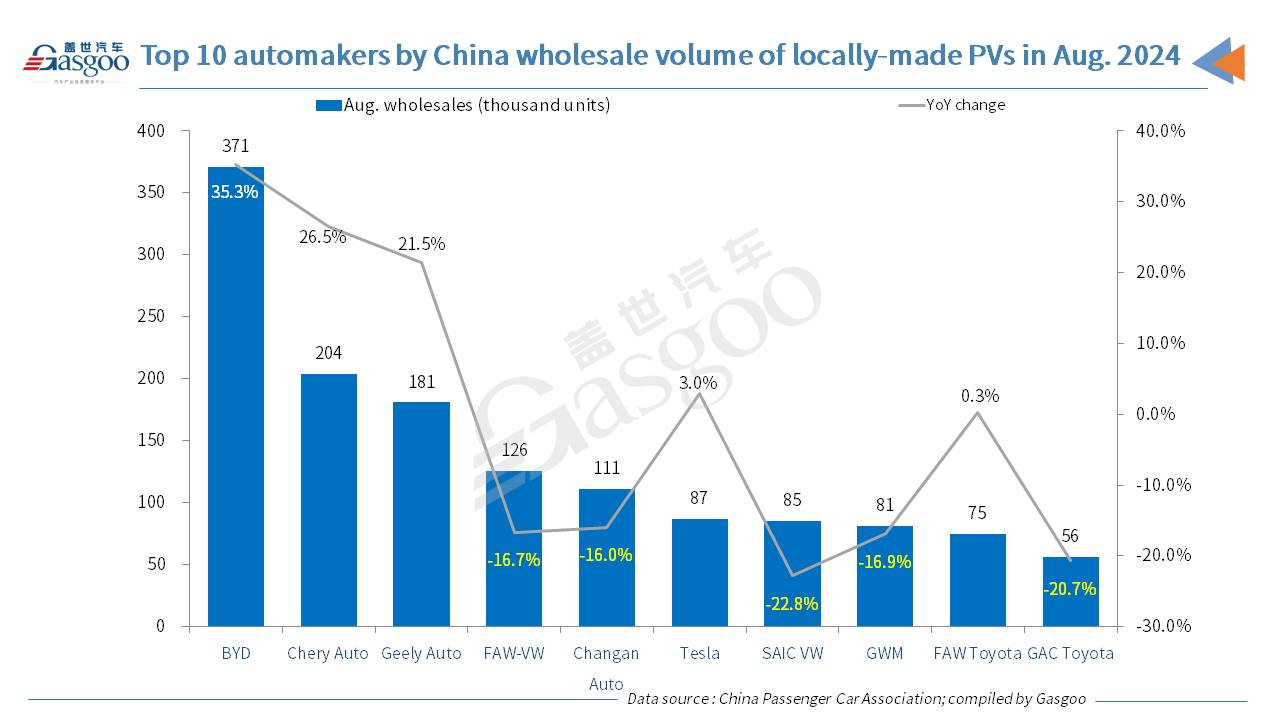

In August, leading automakers such as BYD, Chery, Geely, Volkswagen, and Changan saw strong wholesale performances. A total of 35 passenger vehicle manufacturers wholesaled more than 10,000 units in August each (up from 32 in July and 34 in August last year) each, accounting for 96.8% of the market. Of these, four companies achieved year-over-year growth rates above 50%, five grew by 10%-50%, while 16 experienced negative growth. Among manufacturers selling over 10,000 PVs, 27 saw positive month-over-month growth, with 17 achieving growth rates above 10%, driven by strong performances from China's wholly-owned brands and Sino-Japanese & Korean brands.

China's PV production reached 2.158 million units in August, down 3.7% year over year but up 8.9% month over month.

To be specific, premium car production fell 5% year over year and 1% month over month, joint-venture brands saw a 28% year-over-year drop but a 12% month-over-month increase, while China's indigenous brands posted an 8% year-over-year growth and a 10% month-over-month increase in their Aug. PV output.

Passenger car manufacturers exported 413,000 vehicles last month (including CKDs), a 24% year-on-year increase and a 9% month-on-month growth, with Jan.-Aug. exports reaching 3.04 million units, up 30% over a year earlier.

With the recovery of markets in South America and other regions, China's wholly-owned brands' exports reached 333,000 units in Aug., a 17% year-on-year increase and an 8% month-on-month rise. Meanwhile, joint-venture and premium brands saw their combined exports reach 80,000 units, up 20% over the previous month.

Gasgoo not only offers timely news and profound insight about China auto industry, but also help with business connection and expansion for suppliers and purchasers via multiple channels and methods. Buyer service:buyer-support@gasgoo.comSeller Service:seller-support@gasgoo.com