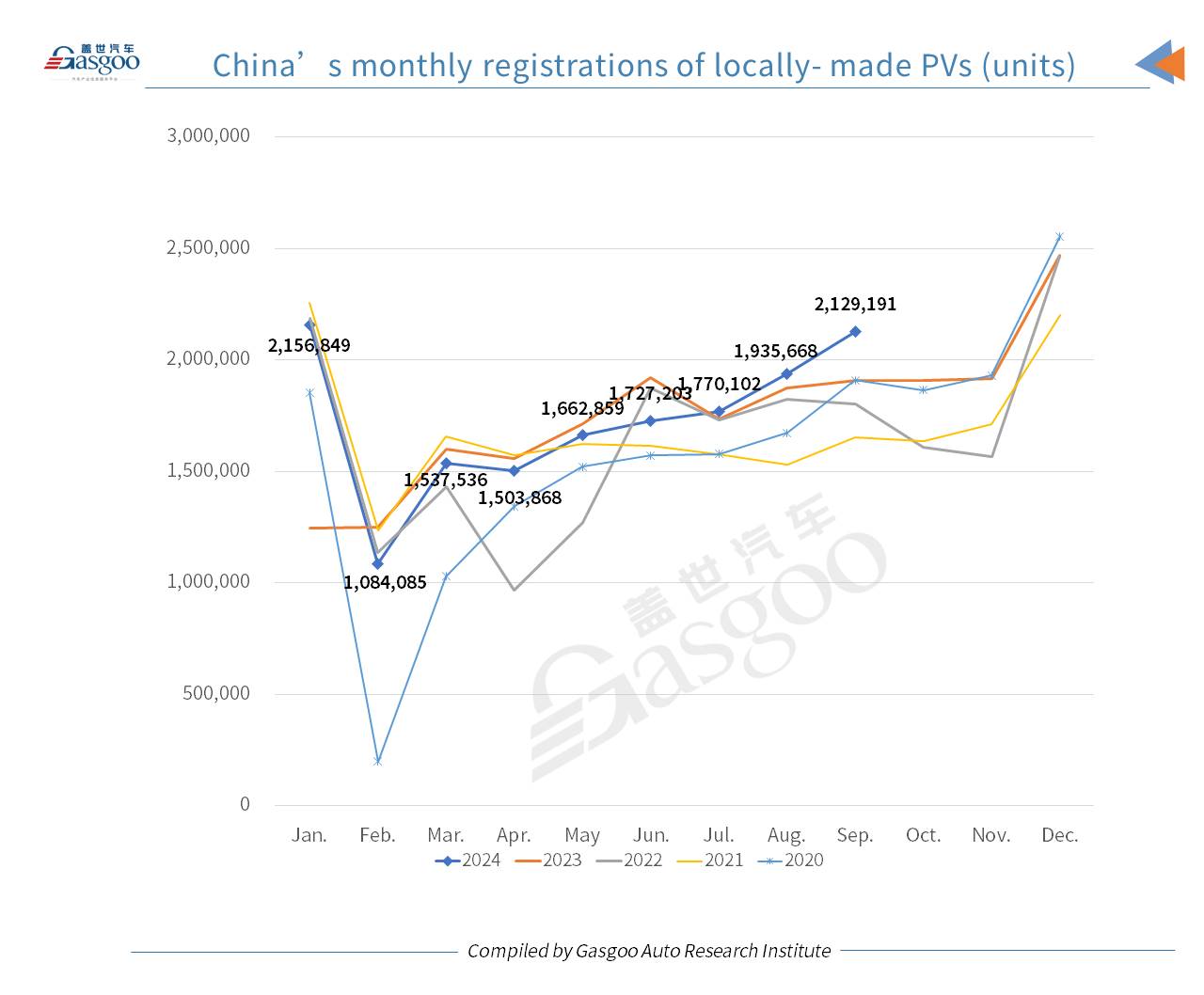

In September 2024, locally manufactured passenger vehicle (PV) registrations in the Chinese Mainland reached 2,129,191 units, marking year-over-year and month-over-month increases of 11.55% and 10%, respectively, according to the data compiled by the Gasgoo Auto Research Institute ("GARI"). This is the second time this year, after January, that monthly registrations have surpassed two million units.

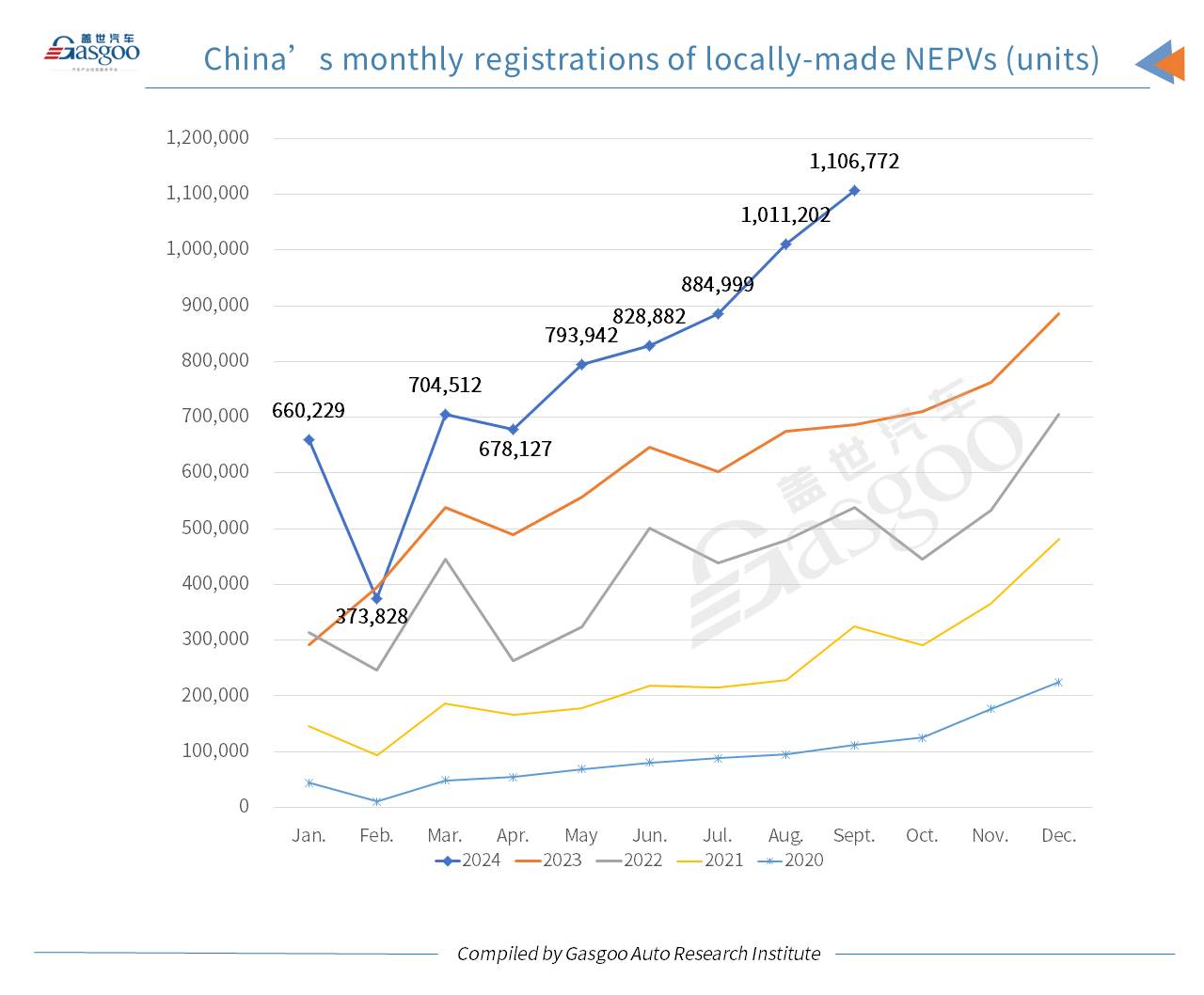

Of all passenger vehicles registered in September, 1,106,772 units were new energy vehicles (NEVs), accounting for a penetration rate of 51.98% and setting a new monthly record.

For clarity, the PVs hereby refer to the passenger vehicles locally produced and registered on the Chinese Mainland.

The rise in passenger vehicle sales last month was partly driven by national and local government incentives. Recently, China's central government allocated 150 billion yuan through special ultra-long-term bonds to stimulate consumption upgrades, particularly in auto trade-ins, which raised the subsidy standards for vehicle replacement. Local governments of provinces and cities across the country have launched and implemented various trade-in subsidy programs, often backed by government funding and supplemented by consumer incentives. In some regions, single-vehicle subsidies are substantial, and aggressive promotions from car companies have further boosted this wave of growth. Combined with the effects of the Mid-Autumn Festival and National Day holidays, China's passenger vehicle market saw strong growth in retail sales, highlighted by the "Golden September" peak-season effect. The recent rise in the stock market has also strengthened the wealth effect, potentially boosting sustained growth in vehicle sales.

The national subsidy for vehicle replacement has moved from simple incentives to differentiated encouragement, aiming to enhance consumer upgrades in the passenger car sector. Currently, the program offers a 20,000-yuan subsidy for new energy vehicle purchases and a 15,000-yuan subsidy for gasoline vehicles with engines of 2.0 liters or less. This 5,000-yuan advantage for NEV replacement has attracted price-sensitive consumers, with the majority of replacement buyers opting for NEVs. According to a survey by the China Passenger Car Association, in some regions, NEVs account for over 60% of trade-in replacement sales, particularly boosting entry-level battery electric vehicle (BEV) and the plug-in hybrid electric vehicle (PHEV) market. Additionally, local governments are gradually implementing policies that ease restrictions on vehicle purchase and registration locations, adding further momentum to the "Golden September, Silver October" sales peak.

With sustained efforts from car replacement policies and increased local incentives, the central government's call to reduce fierce competition has stabilized end-user pricing, reducing consumer hesitation and boosting overall market momentum.

For the first nine months of this year, total registrations for domestically manufactured passenger vehicles in China reached 15,507,361 units, a 4.73% increase from last year. NEV registrations totaled 7,042,493 units, surging 44.35% year over year and accounting for 45.41% of the passenger vehicle market.

Top 20 brands by Sept. and YTD 2024 passenger vehicle registrations

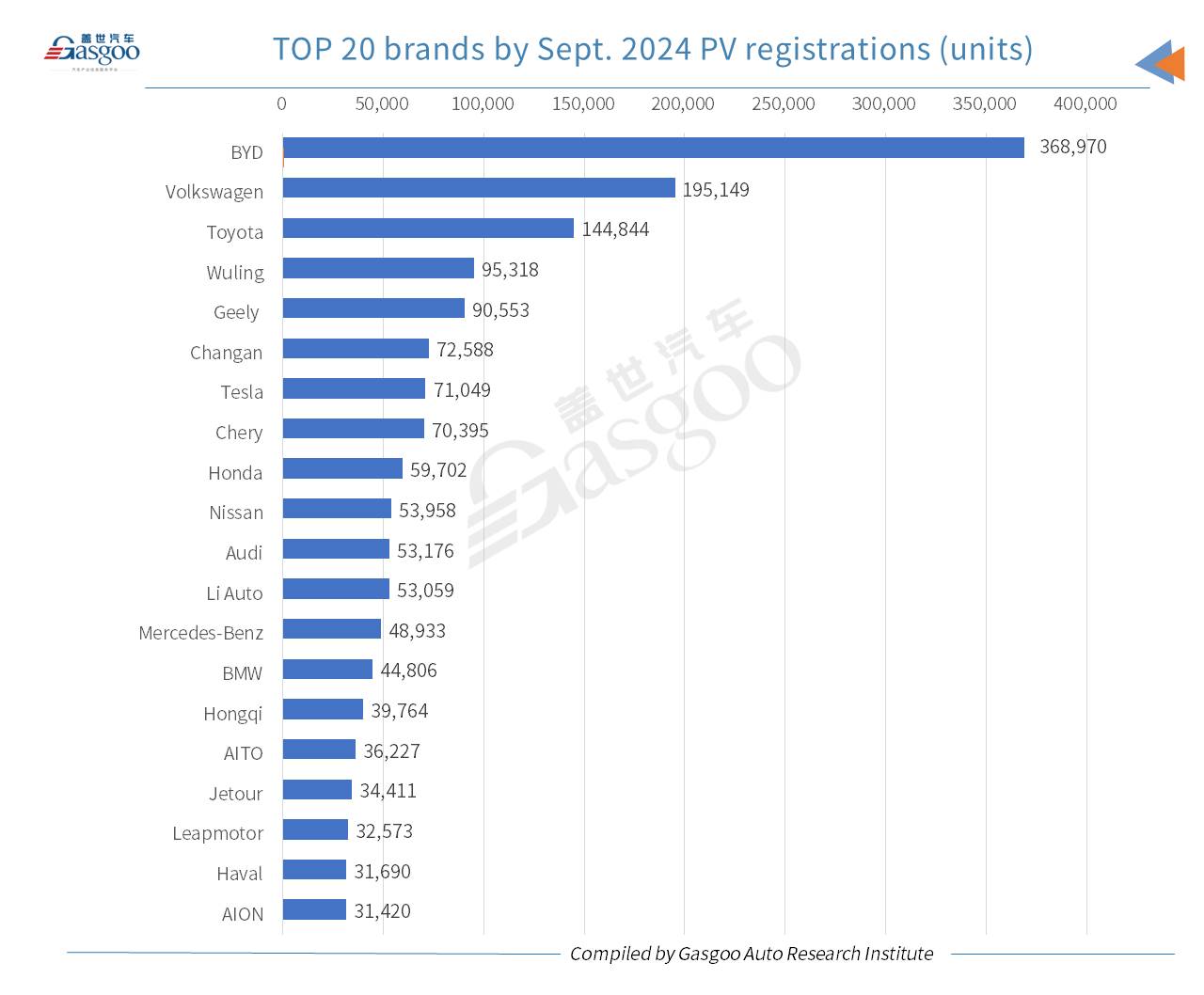

Based on September's registration data for domestically produced passenger vehicles, 12 of the top 20 brands were China's self-owned ones, including BYD, Wuling, Geely, Changan, Chery, Li Auto, Hongqi, AITO, JETOUR, Leapmotor, Haval, and AION. Five of these Chinese brands ranked within the top ten.

Among these top 20 brands, BYD retained a commanding lead with 368,970 units registered, outpacing the second-place Volkswagen by 173,821 units. BYD's sustained lead can be attributed to its extensive product lineup, with 26 models across its Dynasty and Ocean series registered in September alone. Notably, 13 models recorded over 10,000-unit registrations each in the month.

Wuling, Geely, Changan, and Chery ranked fourth, fifth, sixth, and eighth, respectively, with each exceeding 70,000-unit registrations in September but falling short of the 100,000-unit mark. Li Auto, AITO, Leapmotor, and AION—four brands focusing exclusively on NEVs—also made it into the top 20, ranking 12th, 16th, 18th, and 20th, respectively.

Among non-Chinese brands in the top 20, Volkswagen and Toyota ranked second and third. In Volkswagen's September registrations, NEVs accounted for 9.81% (19,135 units), including 1,206 PHEVs and 17,929 BEVs. By contrast, Toyota's NEV share was lower, with just 3.64% (5,272 units) of its total passenger vehicle registrations.

Tesla, the only wholly foreign-owned brand in the top 20, ranked seventh with 71,049 vehicles registered in September, underscoring the brand's substantial influence in China despite offering only two locally-made models.

Within the German trio, Audi took the lead, securing the 11th spot. Among the Four Rings' vehicles, there were two models, the Audi A6L and the Audi Q5L, each registering over 10,000 units in September. Mercedes-Benz and BMW followed in 13th and 14th place, respectively. Recently, their joint venture, Beijing IONCHI New Energy Technology Co., Ltd., launched the high-end supercharging brand IONCHI and inaugurated its first supercharging stations, signaling the brands' commitment to bolstering China's charging infrastructure and enhancing services for local NEV owners.

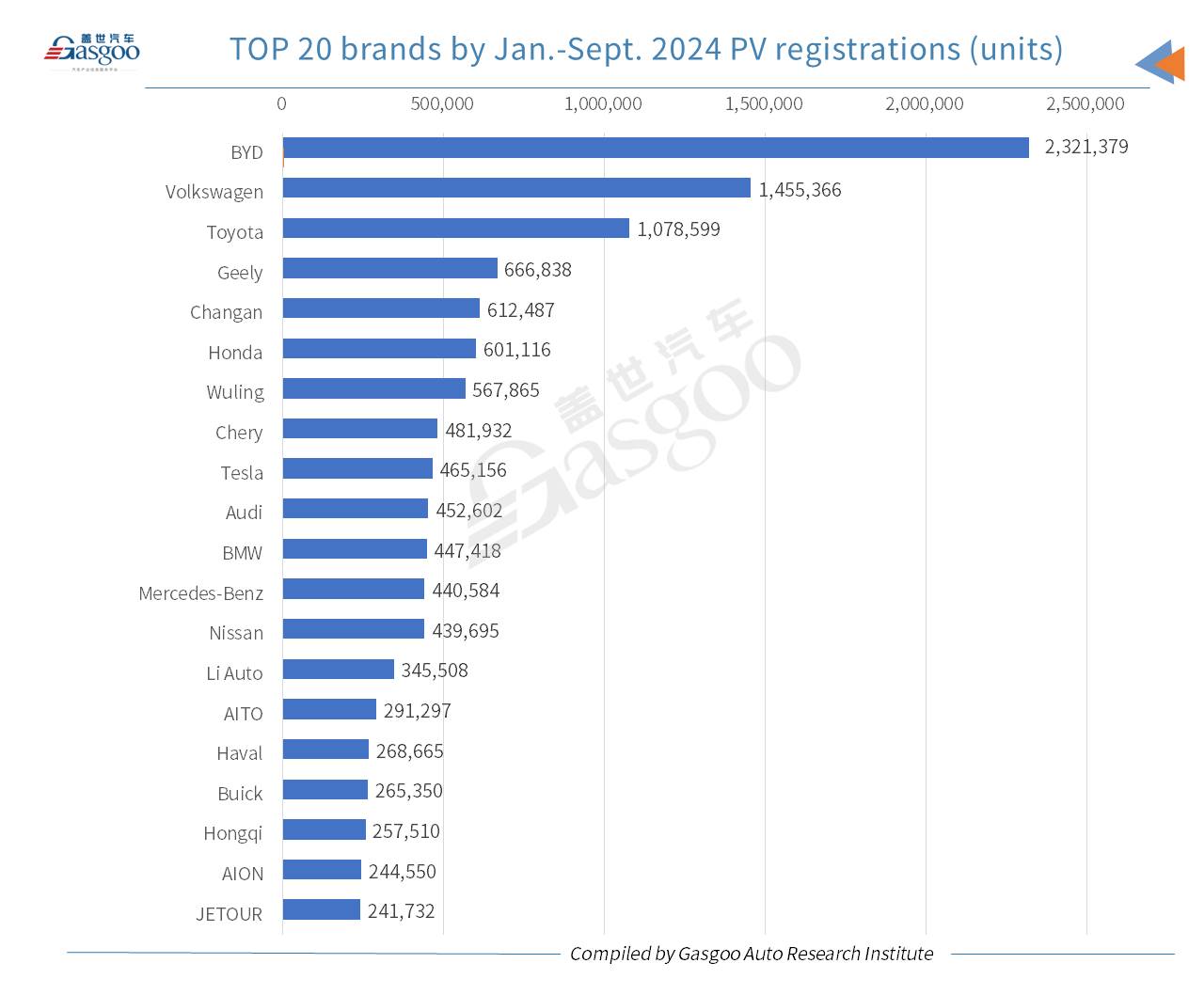

Regarding cumulative registrations from January to September, BYD, Volkswagen, and Toyota also ranked as the top three brands, with BYD being the only brand to exceed two million units. Volkswagen and Toyota both surpassed one million units. Aside from BYD, there are also 10 China's wholly-owned brands among the top 20, namely, Geely, Changan, Wuling, Chery, Li Auto, AITO, Haval, Hongqi, AION, and JETOUR.

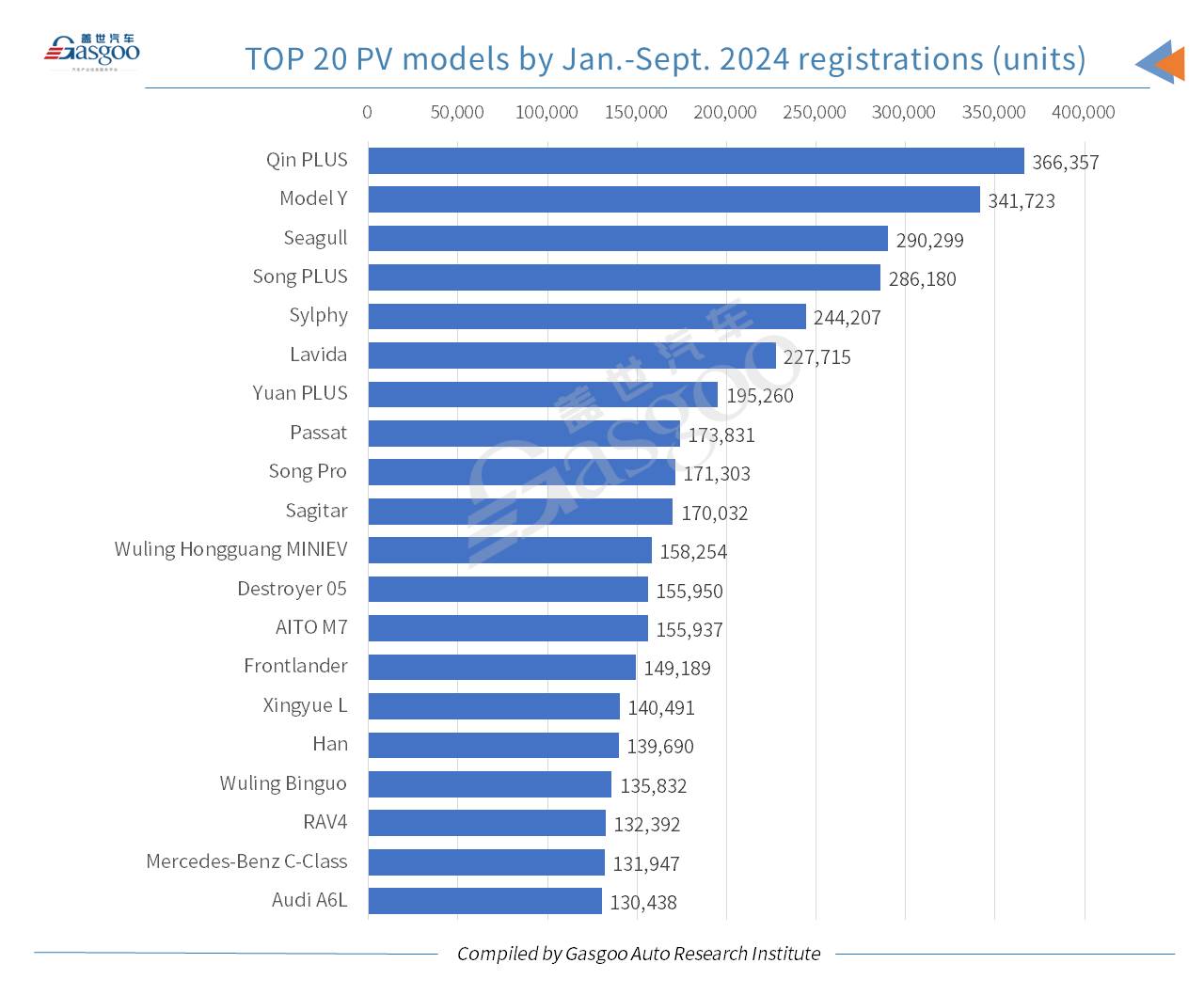

Top 20 PV models by Sept. and YTD 2024 registrations

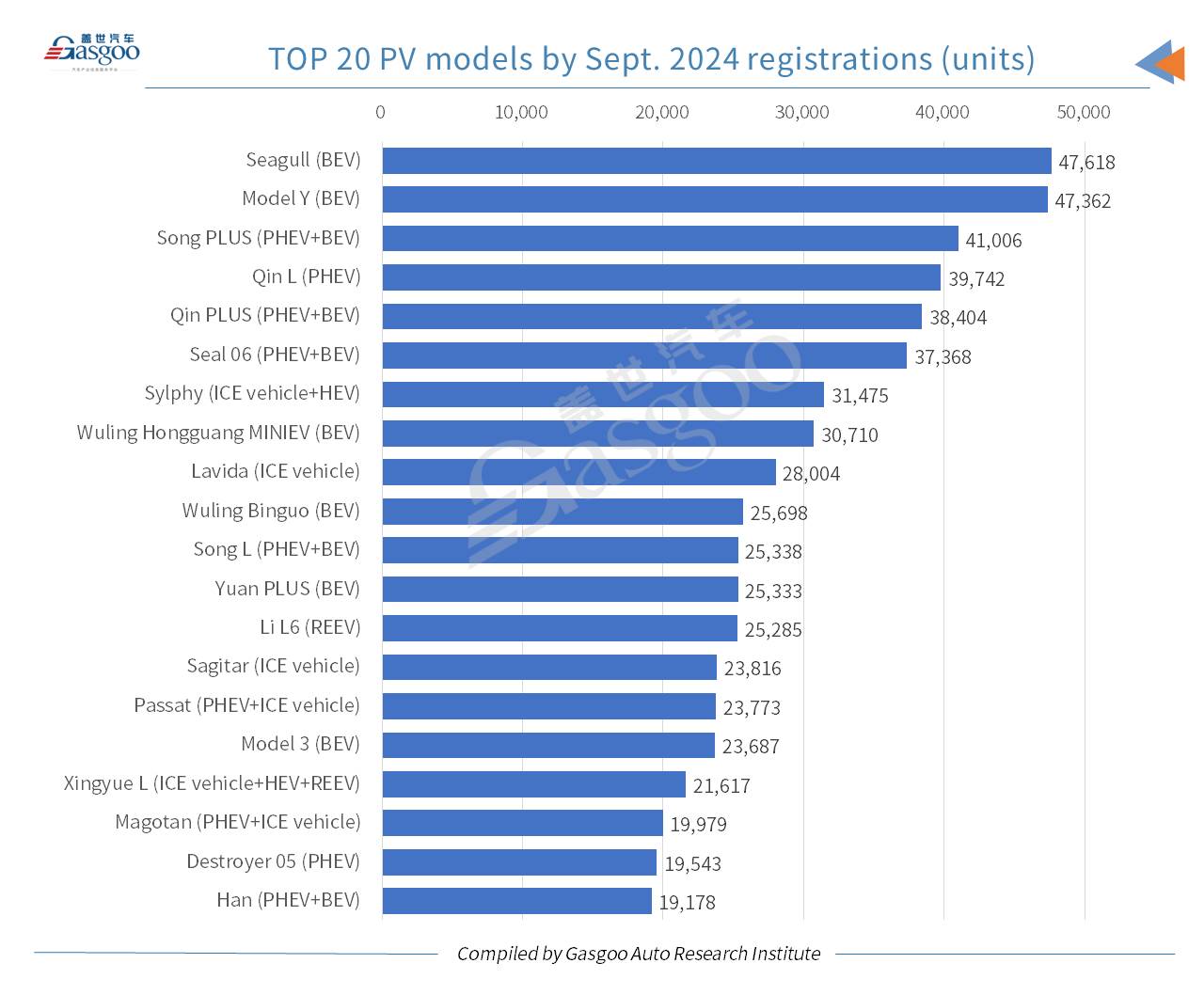

Among the top 20 passenger vehicle models by September registrations, only three—the Sylphy, the Lavida, and the Sagitar—lacked NEV variants. Within the top six models, no gasoline or hybrid electric vehicle (HEV) versions were present. Apart from the runner-up Model Y, BYD's models dominated the top six. The BYD Seagull, the top-selling model, is available only as a BEV model, while the Qin L offers solely a PHEV option. Other top-selling models, such as the Song PLUS (3rd), the Qin PLUS (5th), and the Seal 06 (6th), come in both BEV and PHEV versions. BYD further excelled in the rankings from seventh to twentieth, with four additional models.

Wuling brand's two affordable BEV models—Hongguang MINIEV and the Binguo— ranked eighth and tenth, respectively, while Tesla's Model 3 made it to the 16th. The Li L6, with 25,285 units registered, ranked 13th, just behind the Yuan PLUS with a narrow 48-unit difference.

As for the Jan.-Sept. registrations, six passenger vehicle models exceeded 200,000 units, with the Qin PLUS and Model Y surpassing 300,000 units. Notably, two models from the German trio—the Mercedes-Benz C-Class and the Audi A6L—also entered the top 20, ranking 19th and 20th, respectively.

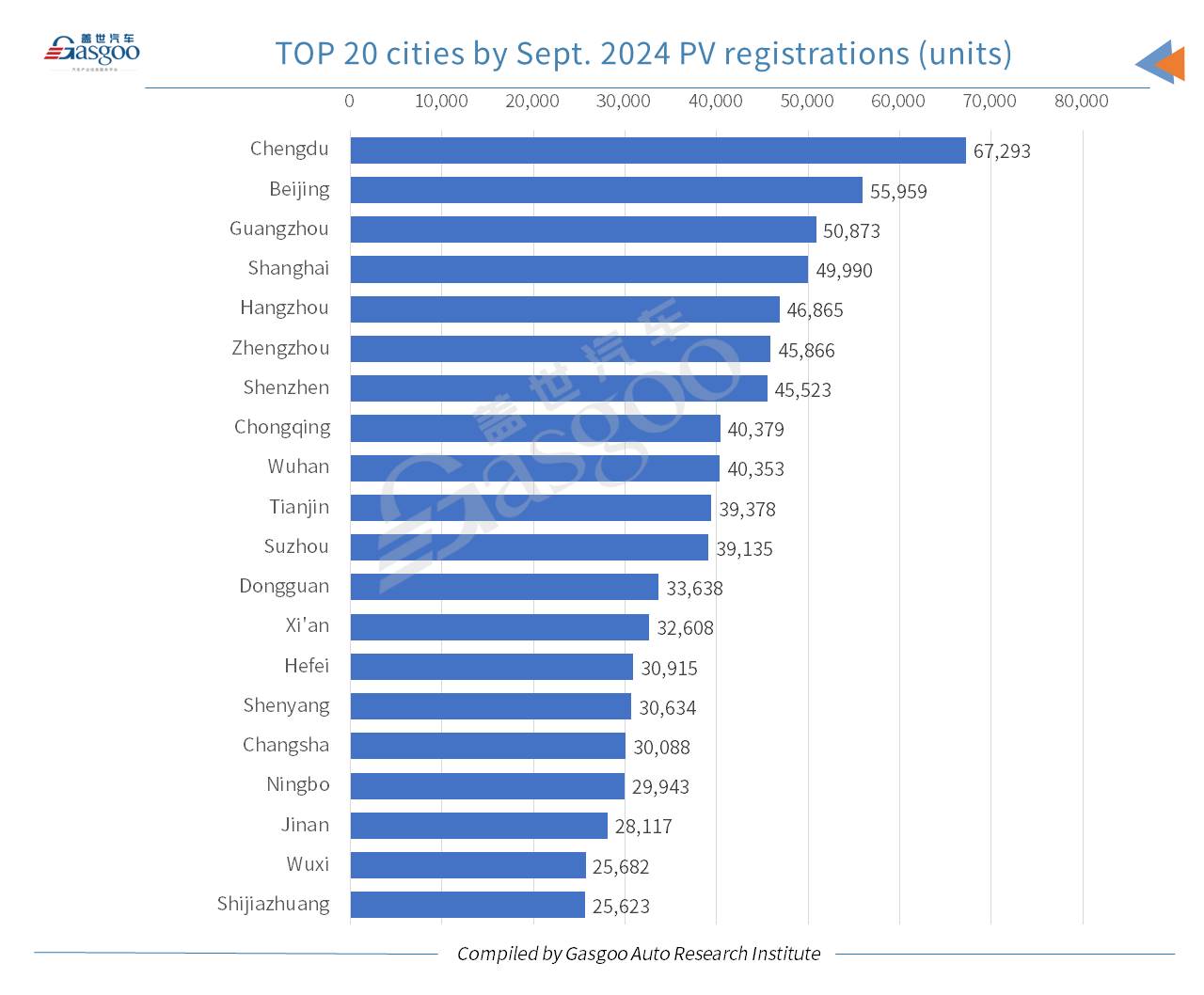

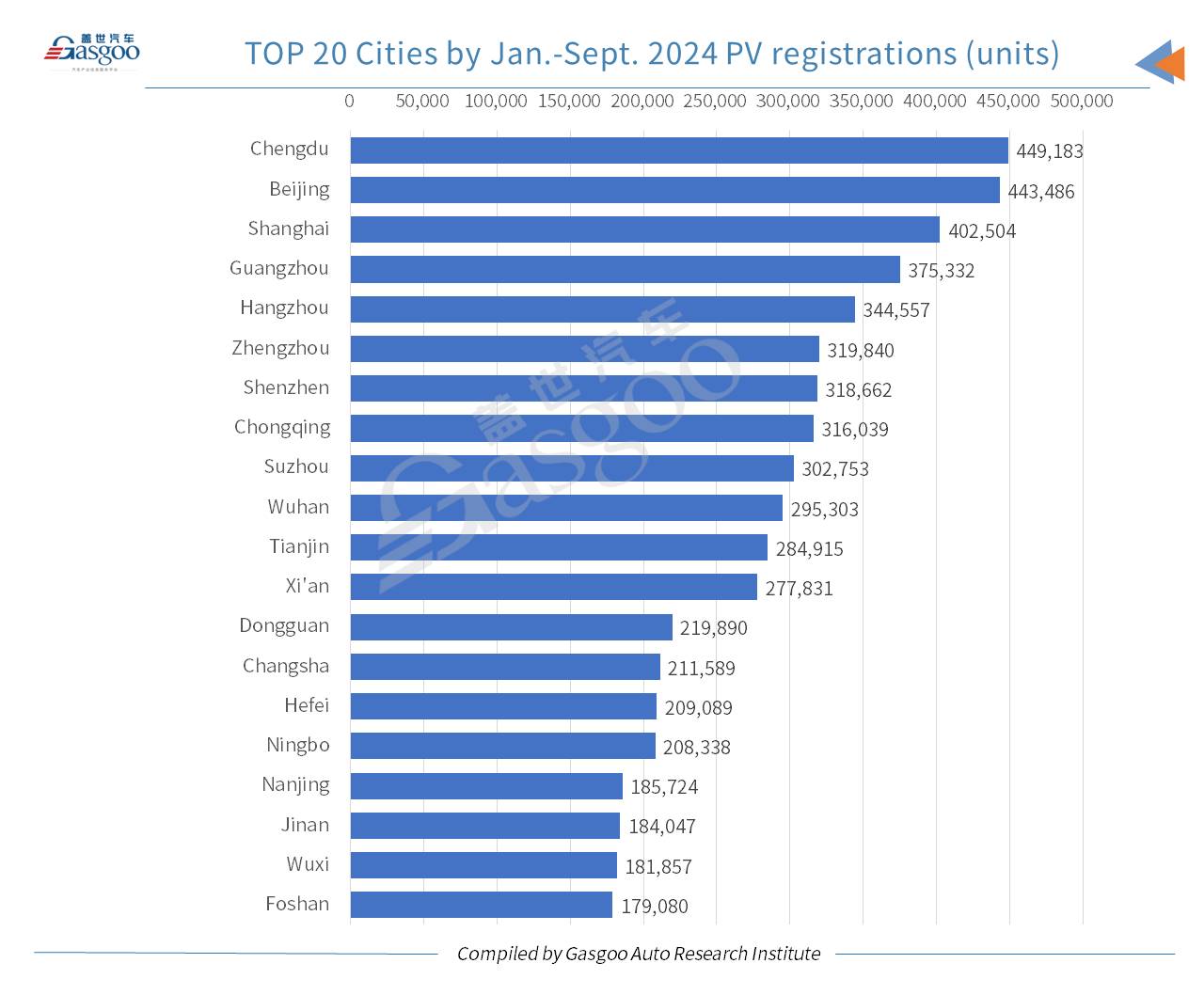

Top 20 cities by Sept. and YTD 2024 registrations

At a city level, 16 cities registered over 30,000 locally produced passenger vehicles in September, with nine exceeding 40,000 units and three over 50,000 units. Chengdu (67,293 units), Beijing (55,959 units), and Guangzhou (50,873 units) led the rankings.

For the first nine months of 2024, 16 cities surpassed 200,000 passenger vehicles in cumulative registrations, with nine cities exceeding 300,000 units. Only Chengdu, Beijing, and Shanghai exceeded 400,000 units year-to-date.

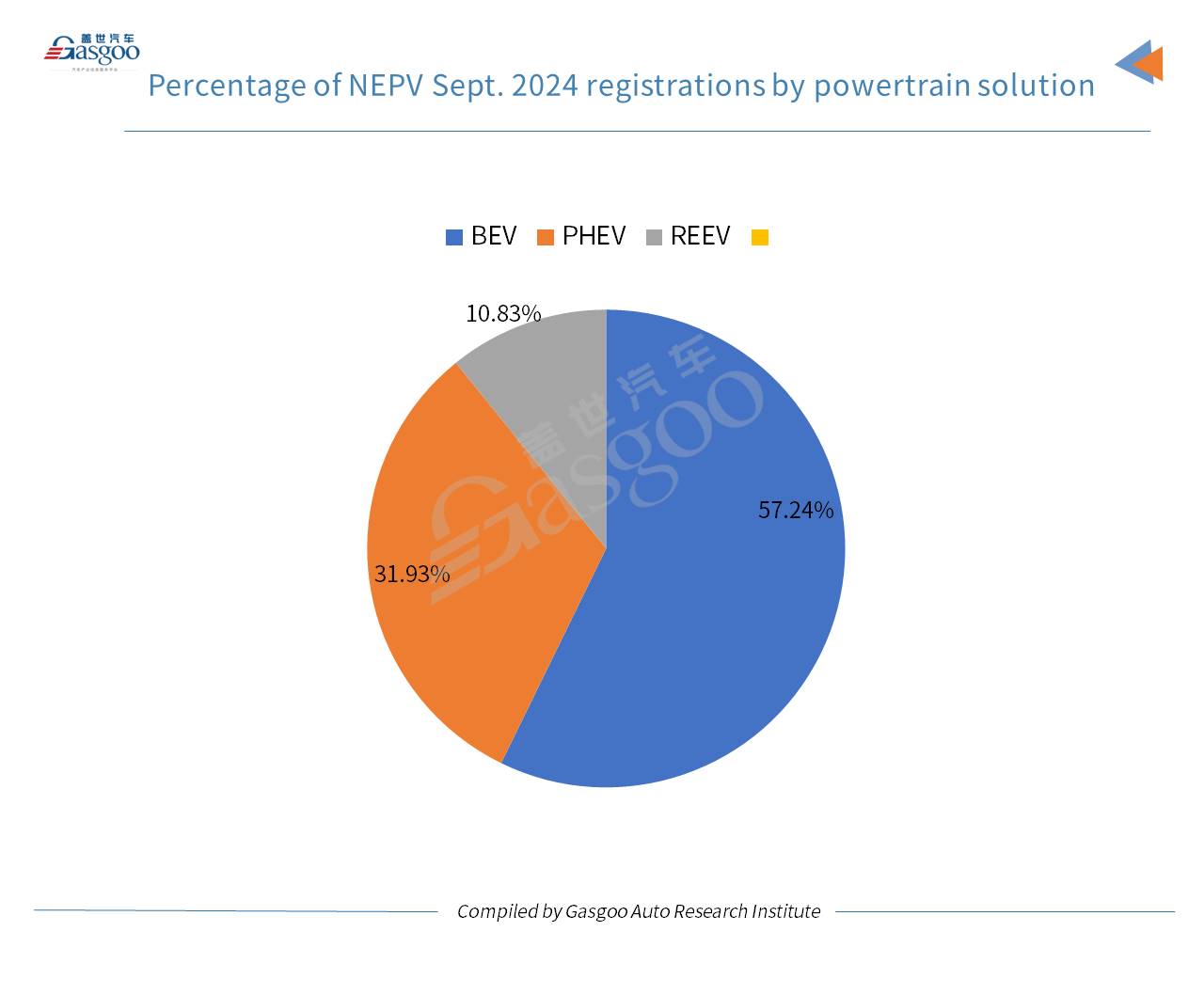

Monthly new energy passenger vehicle registrations and breakdown by powertrains

In September, 1,106,772 domestically produced new energy passenger vehicles (NEPVs) were registered in the Chinese Mainland, marking a 61.1% year-on-year spike and a 9.45% month-on-month growth.

In terms of powertrain solutions, BEV models held the largest share at 57.24%, followed by PHEVs at 31.93% and range-extended electric vehicles (REEV) at 10.83%.

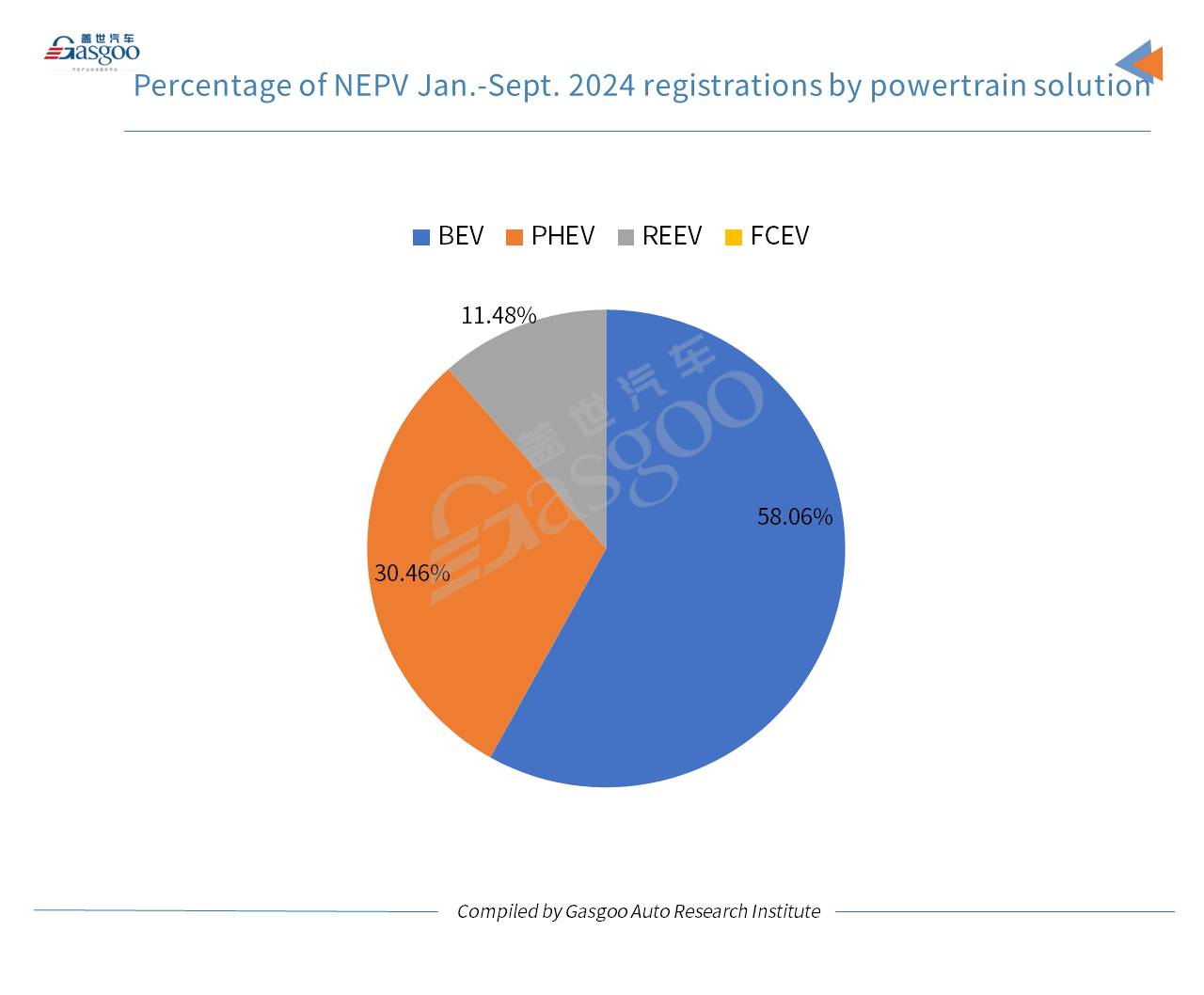

In the Jan.-Sept. period, cumulative NEPV registrations totaled 7,042,493 units, a 44.35% year-on-year hike. BEVs, PHEVs, and REEVs accounted for 58.06%, 30.46%, and 11.48%, respectively. Additionally, 23 fuel cell vehicles were registered, though their negligible proportion was omitted from the overall statistics.

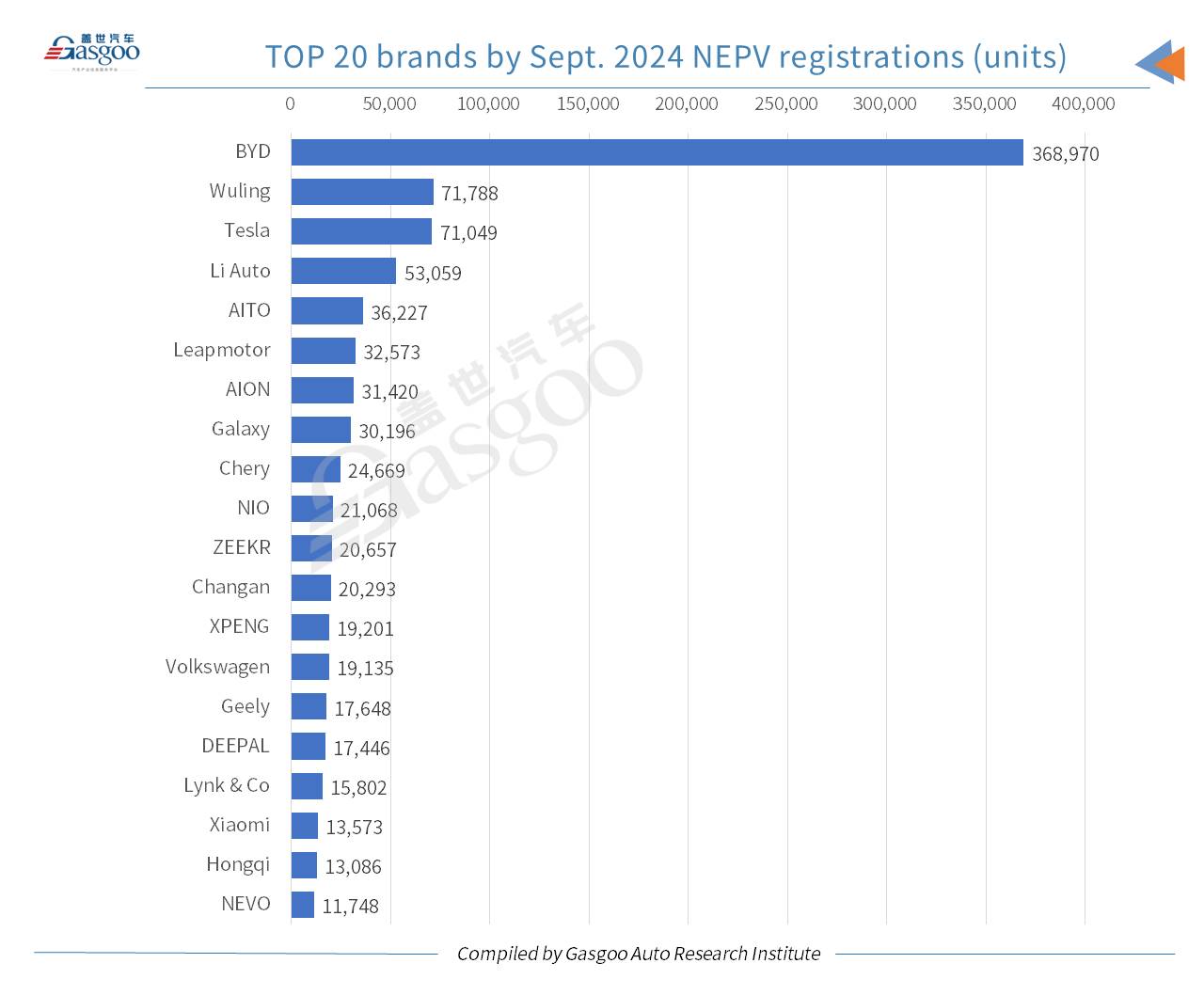

Top 20 brands by Sept. and YTD 2024 new energy passenger vehicle registrations

Based on September NEPV registrations, China's indigenous brands dominated the top 20, except for Tesla (3rd) and Volkswagen (14th). As the leader across all brands, BYD's registrations outpaced the combined total of the second through ninth spots. Li Auto ranked fourth, and the carmaker announced its milestone of one million vehicles of cumulative deliveries on October 18. Geely Holding's sub-brands Galaxy and ZEEKR ranked 8th and 11th, while Geely brand itself took the 15th spot. Xiaomi EV, with just one model on the market, achieved 13,573-unit registrations, ranking 18th.

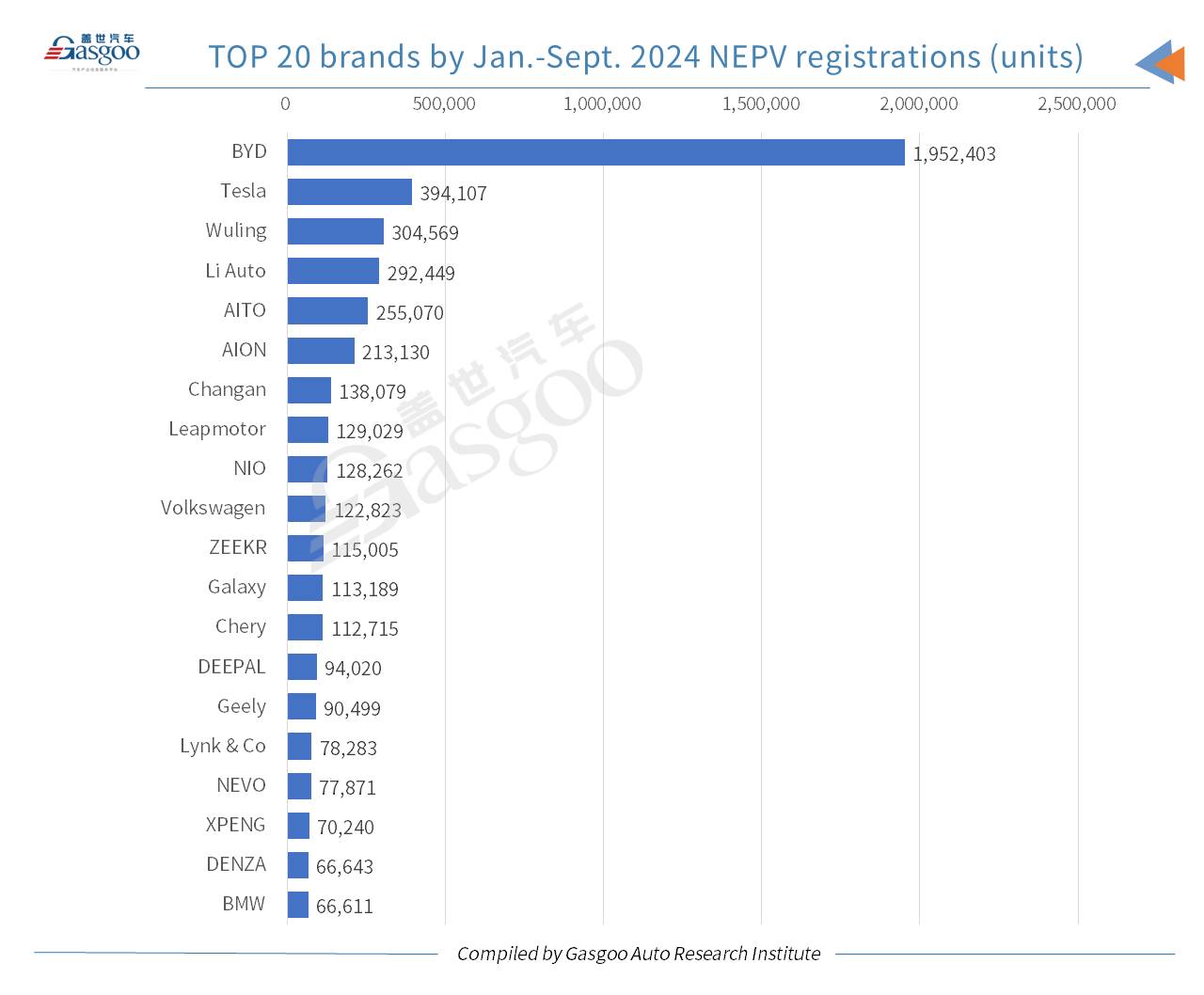

For the first three quarters of this year, a total of six brands each registered over 200,000 NEPVs. BYD led with over 1.9 million units. DENZA, the premium brand from BYD Auto, also joined the top 20 brands list by YTD NEPV registrations, ranking 19th. Tesla and Wuling each registered over 300,000 units, taking second and third places, respectively, with Li Auto, AITO, and AION following.

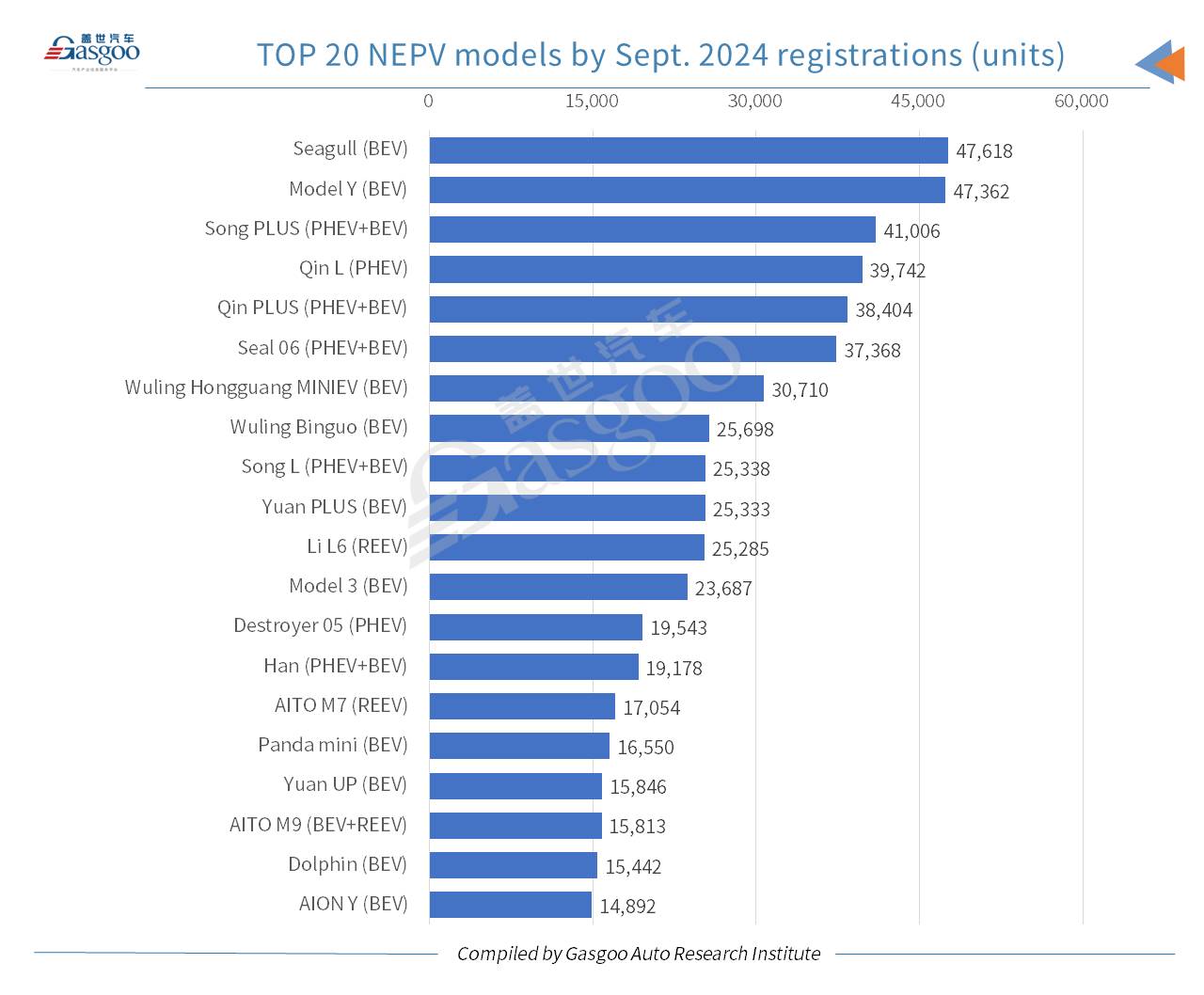

Top 20 new energy passenger vehicle models by Sept. and YTD 2024 registrations

In the NEPV model rankings by September registrations, BYD dominated with 11 models in the top 20, including seven in the top ten. Of these 11 models, six offered both BEV and PHEV versions.

Notably, the AITO M9, a large-sized SUV jointly developed by SERES and Huawei, entered the top 20 NEPV models list by September NEPV sales, securing the 19th spot. Hitting the market in late December 2023, the AITO M9 offers 10 different trim levels, priced between 469,800 yuan and 569,800 yuan, with options for five or six seats and available in both REEV and BEV versions. As of October 9 this year, the model has accumulated over 150,000-unit confirmed orders—a remarkable achievement for a vehicle in this price range.

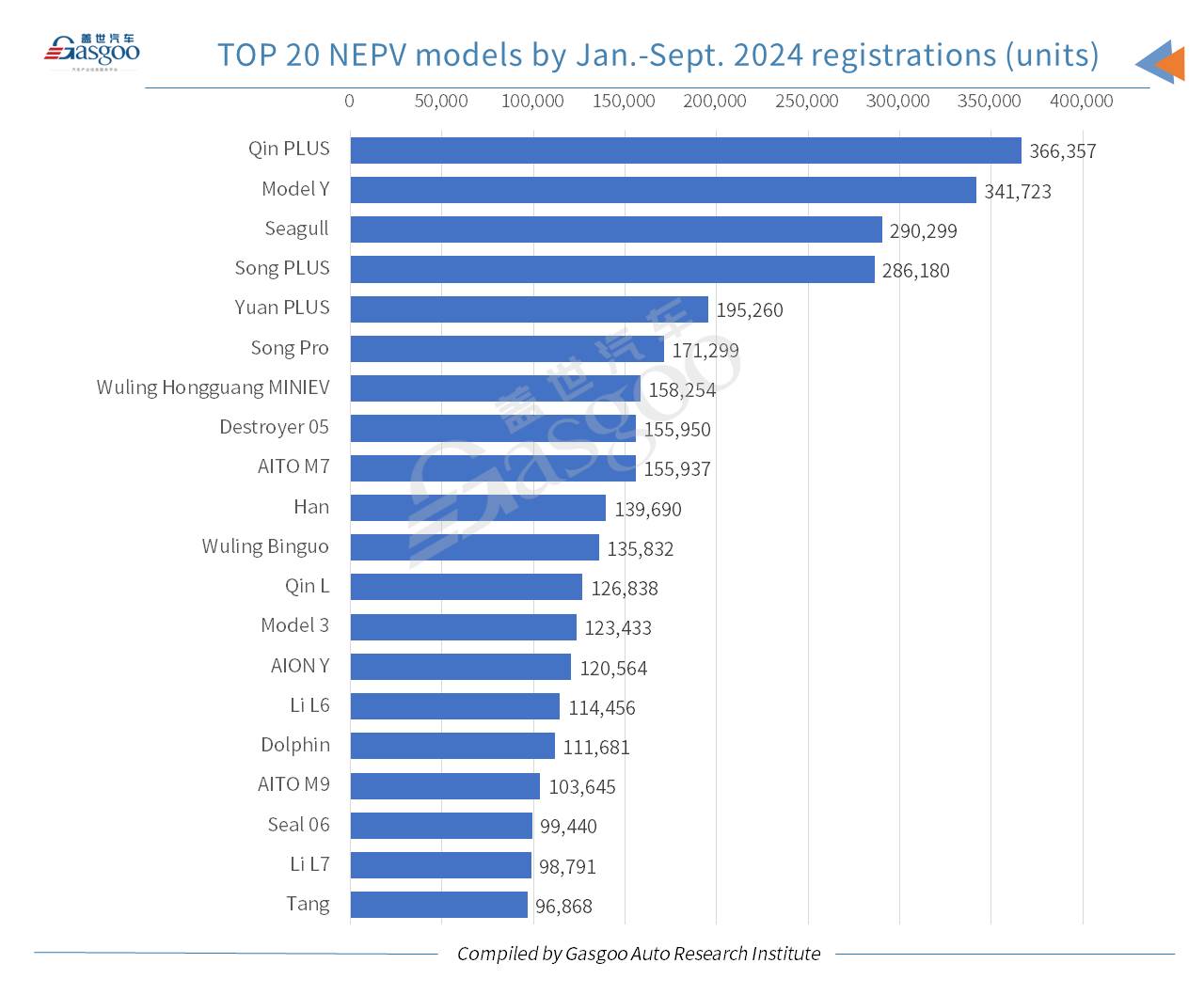

Looking at cumulative registrations from January to September this year, BYD continues to dominate the top 20 NEPV rankings, with 11 models making the list. Additionally, Wuling, AITO, Tesla, and Li Auto each have two models in the top 20 models list by YTD NEPV registrations.

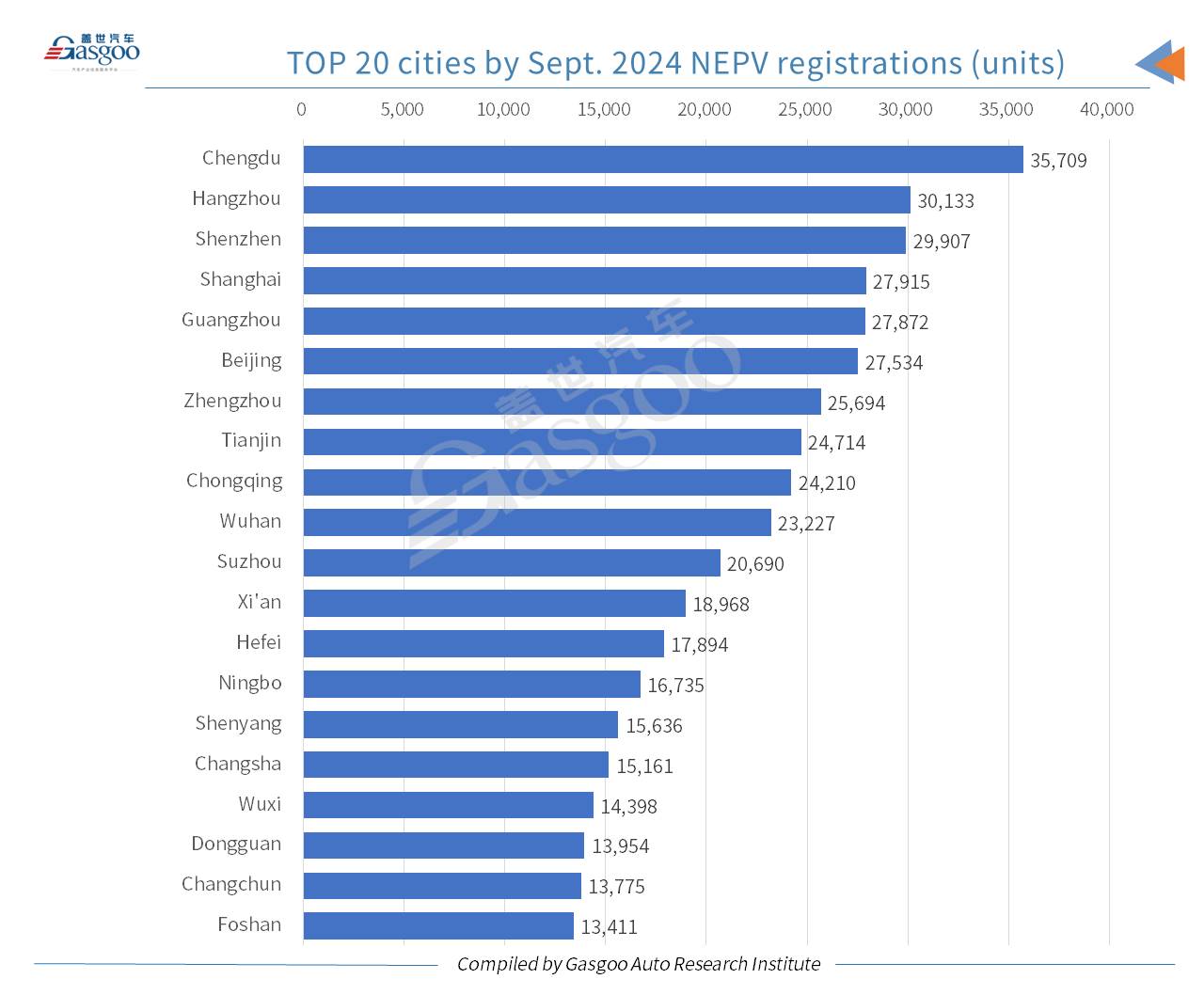

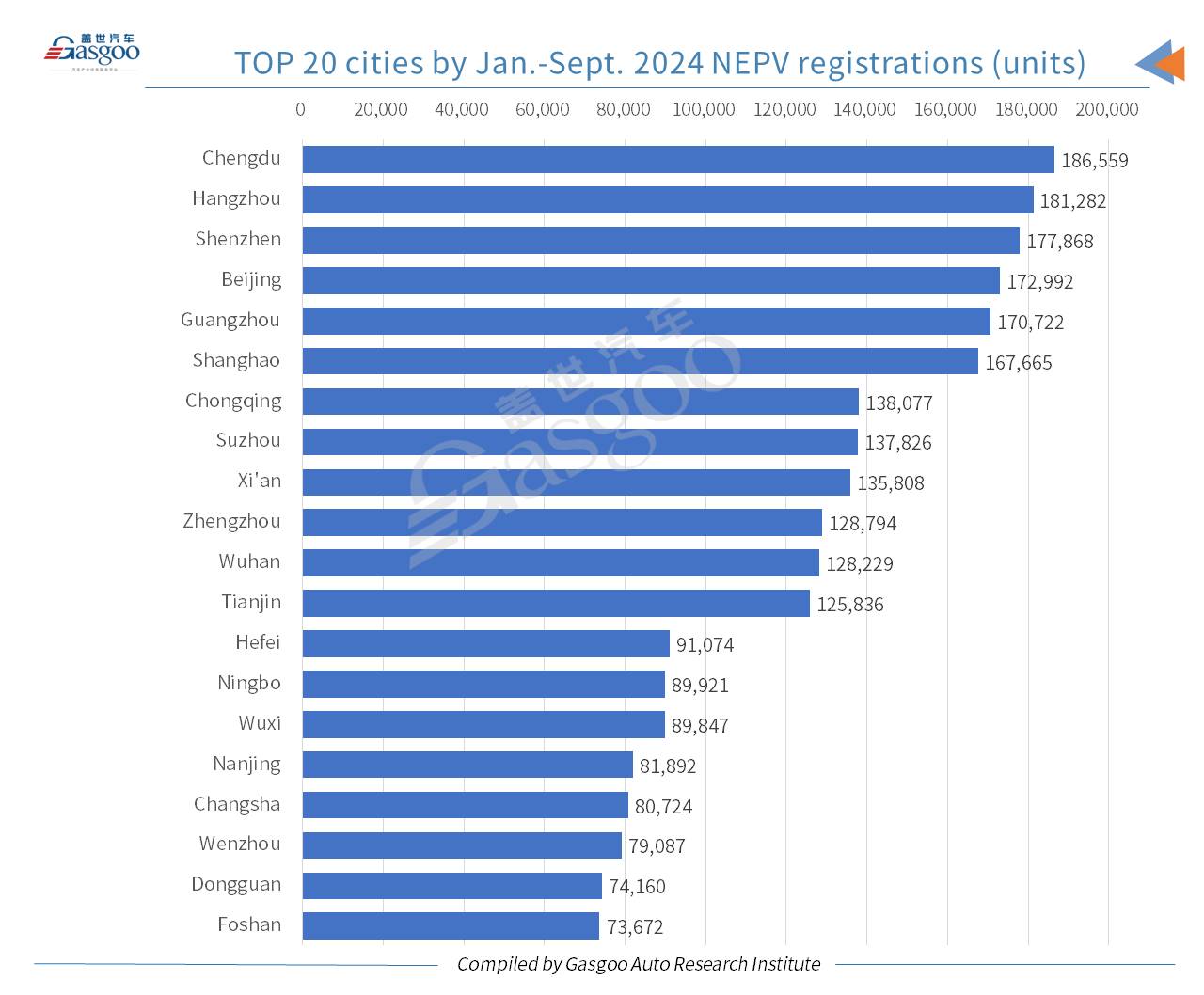

Top 20 cities by Sept. and YTD 2024 new energy passenger vehicle registrations

From the city perspective, Chengdu led in NEPV registrations in September, with 35,709 units, representing 53.06% of all homemade passenger vehicles registered in the city that month. Hangzhou came in second, with 30,133 NEPV registered, accounting for an impressive 64.3% of the city's total passenger vehicle registrations.

In the first nine months of 2024, 12 cities in the Chinese Mainland recorded NEPV registrations of over 100,000 units, with five of them surpassing the 170,000-unit mark. Chengdu and Hangzhou retained the top two positions, each exceeding 180,000-unit registrations year-to-date.