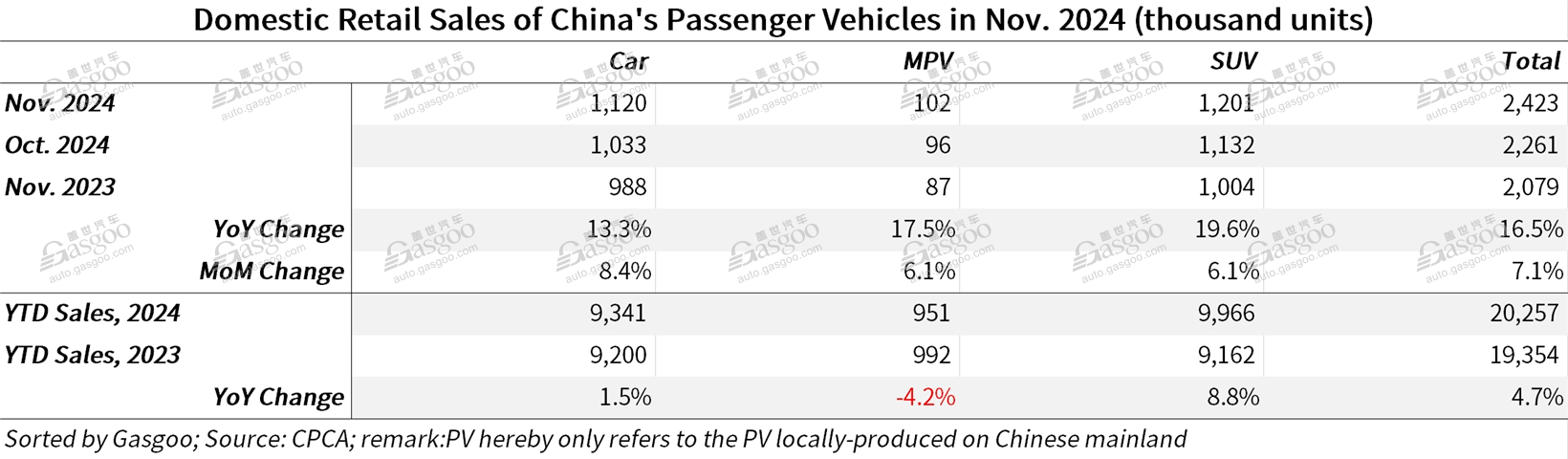

Beijing (Gasgoo)- In November 2024, the retail sales of passenger vehicles in China reached 2.423 million units, representing a 16.5% increase year-on-year and a 7.1% rise month-on-month, according to data from the China Passenger Car Association.

In the past month, China's retail sales of conventional oil-fueled passenger vehicles stood at 1.155 million units, showing a 7% decrease from a year earlier but an 8% uptick compared to October. Meanwhile, the penetration rate of new energy passenger vehicles (NEPVs) in the domestic market climbed to 52.3% in November.

The country's cumulative passenger vehicle retail sales totaled 20.257 million units in the Jan.-Nov. period of this year, reflecting a 4.7% growth over the previous year.

For clarity, the passenger vehicles hereby refer to cars, MPVs, and SUVs locally produced on the Chinese Mainland.

The high level of market activity that began in October continued in November in China, supported by the sustained effects of vehicle scrapping and replacement policies. These measures, combined with sales promotions during events like the "Double 11" and the Auto Guangzhou 2024, further stimulated consumer interest.

China's Ministry of Commerce reported that, as of November 18, over 4 million subsidy applications had been submitted, split evenly between vehicle scrapping and replacement incentives. Replacement subsidies have demonstrated a quicker effect on boosting sales compared to scrapping policies, underscoring the strong demand for vehicle upgrades among consumers.

NEPV purchases benefited significantly from policy advantages, including a 20,000-yuan subsidy for NEPVs compared to 15,000 yuan for oil-fueled vehicles, as well as additional regional incentives averaging 3,000 yuan for NEPVs. These policies have led most scrapping and some trade-in consumers to opt for NEPVs, fueling robust growth in entry-level all-electric vehicle (BEV) and plug-in hybrid electric vehicle (PHEV) markets.

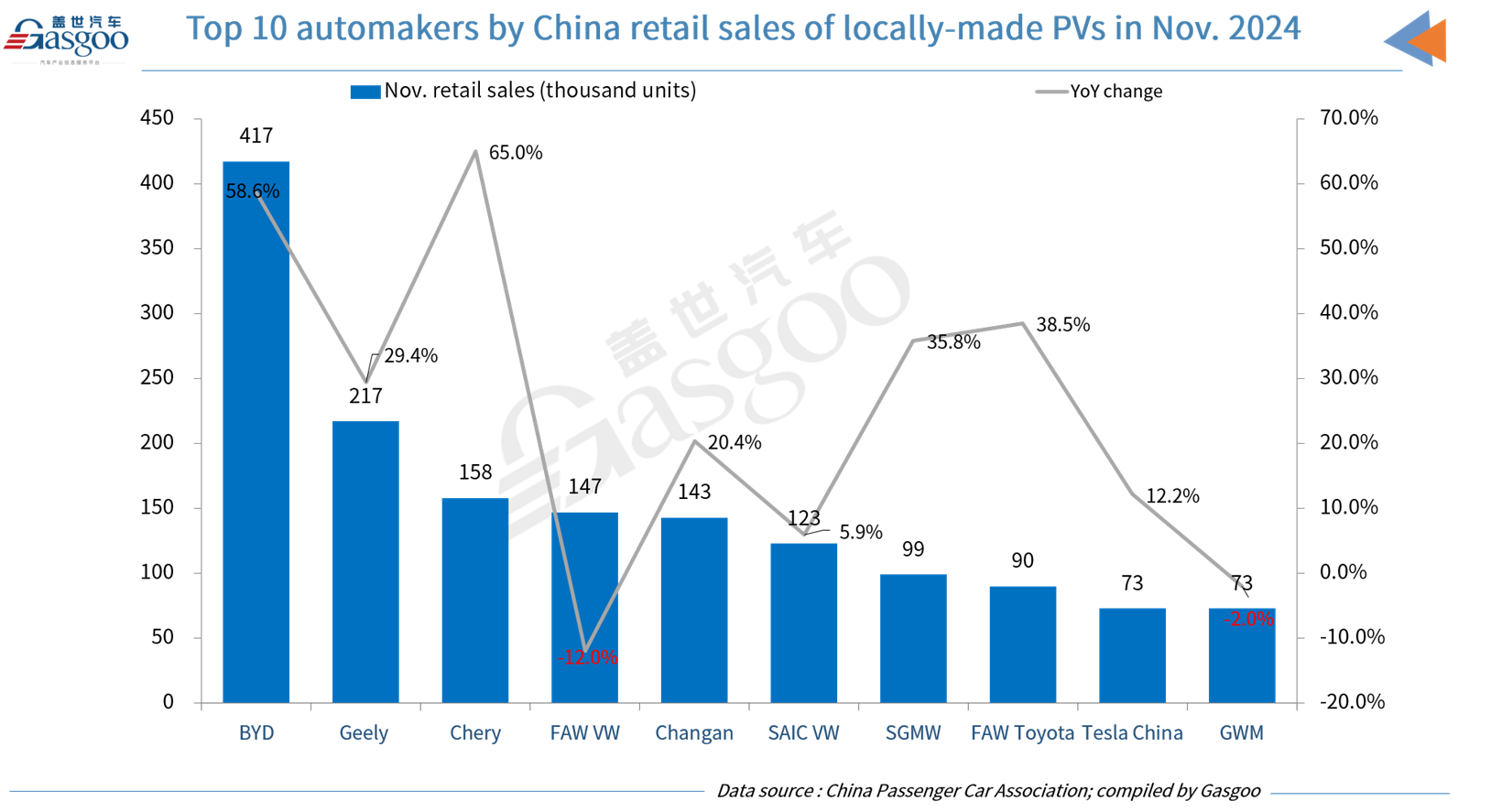

China's wholly-owned passenger vehicle brands achieved retail sales of 1.54 million units in November, representing a 34% surge compared to the previous year and a 4% rise from October. The domestic retail market share of these indigenous brands climbed to 64.1% last month, up 8.7 percentage points year-on-year.

For the first eleven months of 2024, Chinese indigenous brands secured a cumulative retail market share of 60%, indicating an 8.5 percentage points increase over the same period last year.

China's wholly-owned brands achieved significant growth in both the NEPV and export markets in November. Leading traditional automakers undergoing transformation and upgrades, including BYD, Geely, Chery, and SAIC-GM-Wuling, also saw substantial improvements in their retail performance last month.

On the other hand, mainstream joint ventures reported passenger vehicle retail sales of 600,000 units in the past month, which dropped 9% drop year on year but rose 6% compared to October. German and Japanese brands saw their shares shrink by 3 and 3.1 percentage points from the year-ago period to 15.6% and 12.4%, respectively. Meanwhile, U.S. brands' retail market share fell by 1.5 percentage points year over year to 6.4% in November.

Luxury brands faced similar challenges, with retail sales declining 4% from the previous year to 260,000 units in November, despite a 26% month-on-month increase. In the past month, luxury auto brands nabbed 10.9% of China’s passenger car market, down 2.2 percentage points year-on-year.

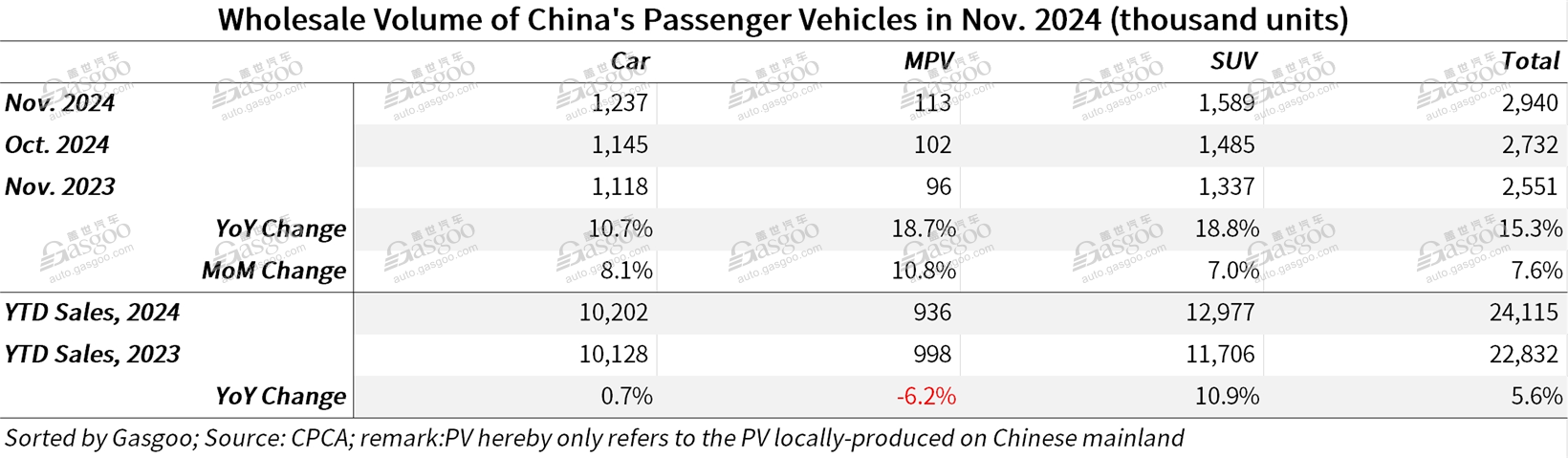

In November, China's passenger car wholesale volume hit record-high, with 2.94 million units sold, which reflected a 15.3% growth year-over-year and a 7.6% rise month-over-month. Cumulative wholesale sales for the first eleven months of 2024 reached 24.115 million units, up 5.6% from the same period last year.

Joint ventures in China recorded wholesale sales of 650,000 units in the past month, a 12% decline compared to the same period in 2023 but a 13% rise from October. Luxury vehicles contributed 280,000 units, down 3% year-over-year but up 14% month-over-month.

China's self-owned brands moved 2 million vehicles via wholesale in November, which jumped 31% from a year ago and climbed up 5% from the previous month.

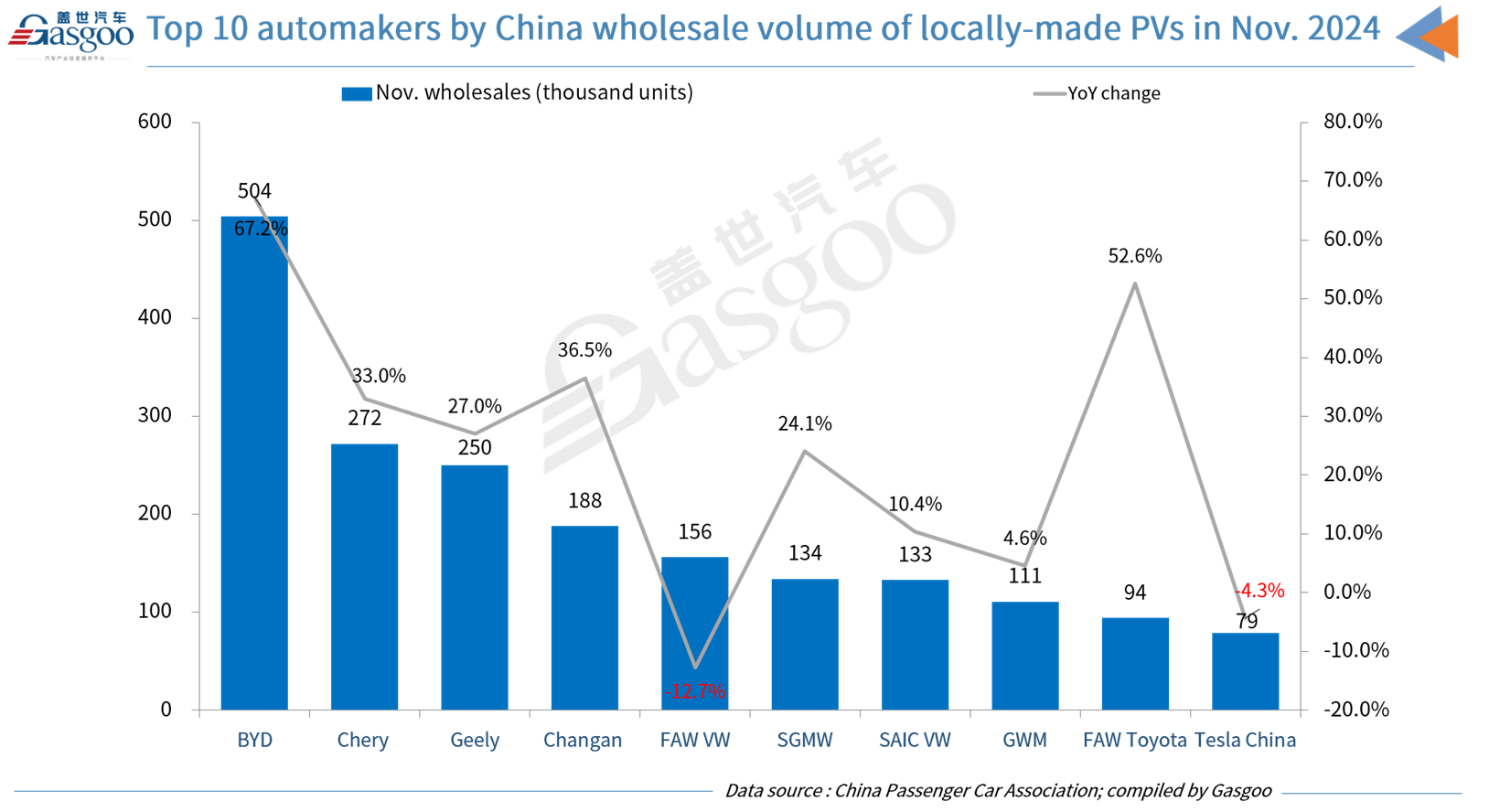

In November, the wholesale performance of major passenger car manufacturers was mixed. Companies such as BYD, Chery, Geely, and Changan showed strong overall performance. Eight manufacturers exceeded monthly sales of 100,000 units, maintaining their strong position and collectively accounting for 60% of the market.

Among the 37 manufacturers with wholesale volumes exceeding 10,000 units, 28 recorded month-over-month increases, with 16 achieving growth rates of over 10%. Joint ventures like SAIC-GM, Beijing Hyundai, FAW Toyota, Changan Ford, and SAIC Volkswagen demonstrated notable month-over-month growth.

China's passenger vehicle exports in November totaled 396,000 units (including complete vehicles and CKD), marking a 5% increase year-on-year but a 10% drop month-on-month. Year-to-date exports reached 4.387 million units, representing a robust 27% leap over the previous year. NEPVs constituted 20.2% of China's passenger car exports in November, slightly dipping 2.7 percentage points from a year earlier.