Germany’s July auto market: Short-term rebound masks long-term weakness, Chinese brands signal breakthroughs

In July 2025, new vehicle sales in Germany reached 264,802 units, up 3.4% month-on-month (MoM) and 11.1% year-on-year (YoY), reflecting a market characterized by "short-term rebound amid long-term pressure."

MoM growth was mainly supported by seasonal promotions and the gradual easing of supply chain bottlenecks, as automakers offered discounts to boost short-term demand. The YoY rise largely reflected a low comparison base, following the sharp drop in July 2024 caused by consumers bringing forward purchases ahead of the EU's Vehicle General Safety Regulation II (GSR II). Looking at the longer term, cumulative sales from January to July 2025 fell 2.5% YoY, highlighting the persistent structural softness in the market.

Brand landscape in flux: Chinese brands make break through, German giants hold ground

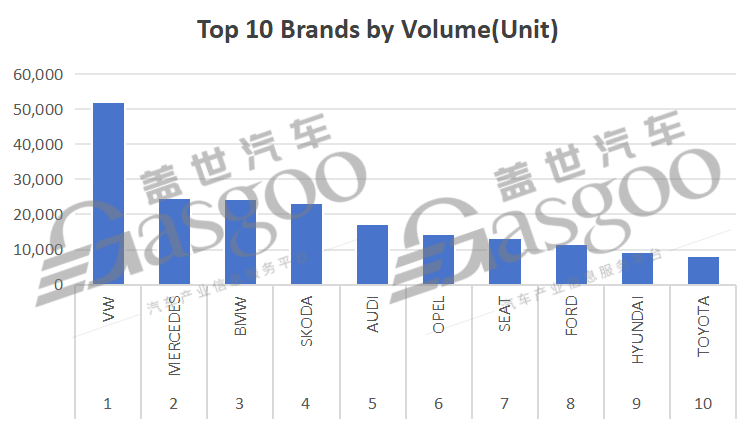

Among the top 10 best-selling brands in July, German automakers maintained a solid foothold with seven spots, even as the overall competitive landscape showed signs of significant shifts.

The German automakers held a firm market share, while competition in the premium vehicle segment intensified. VW once again topped the rankings with 51,938 units sold, capturing almost one-fifth of the market (19.6%). Its broad lineup, covering everything from entry-level to mid-range models, continued to anchor its dominant position.

In the premium vehicle segment, Mercedes-Benz and BMW sold 24,648 and 24,523 units respectively, a difference of only 125 vehicles, highlighting how closely contested the competition had become. The speed of electrification and the sophistication of smart features emerged as key battlegrounds in attracting premium buyers.

SKODA also posted a strong July performance, selling 23,379 units. Its approach of pairing high specifications with relatively affordable pricing appealed to consumers favoring practical choices amid economic pressures, bolstering the brand's market position.

Among non-European brands, Chinese automakers stood out as the most eye-catching players in July. MG Roewe achieved YoY growth of 8.5%, with sales reaching 1,986 units.

BYD posted an extraordinary YoY surge of nearly 400% (1,126 units) and, for the first time, narrowly surpassing Tesla by just 16 units.

POLESTAR also delivered a solid performance, with sales reaching 670 units (up 58.8% YoY).

Although XPENG's sales were relatively low at 266 units, its remarkable YoY growth of over 1,500% highlighted that Chinese brands in Germany were moving beyond isolated successes toward coordinated multi-brand expansion.

In July, Chinese brands sold a total of 4,981 vehicles in Germany (1.88% market share), yet demonstrating strong growth momentum. Brands like BYD and XPENG capitalized on their technological value—such as long-range battery packs and advanced driver-assistance systems—to quickly gain ground, expanding even in the face of EU tariff barriers.

In July, Tesla's sales in Germany softened significantly, falling 55% YoY to 1,110 units. Beyond mounting global competition in the EV sector, CEO Elon Musk's controversial stances were widely perceived as undermining the brand's image and consumer trust in Europe, acting as a key non-market factor behind the decline. This case illustrates how the actions and statements of corporate leaders can meaningfully influence brand performance in specific markets.

Model zpreferences: ICE momentum persists, EVs make select breakthroughs

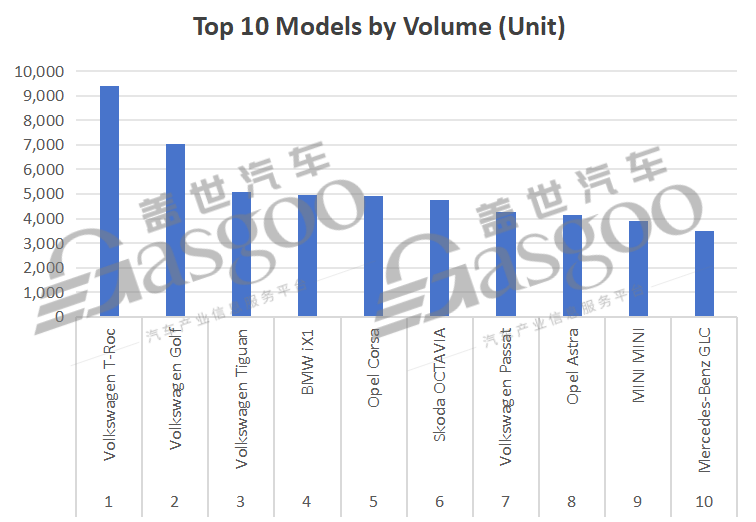

In July's top 10 best-selling models (including the Volkswagen T-Roc with 9,397 units, Golf with 7,026 units, and Tiguan with 5,072 units), internal combustion engine (ICE) vehicles took eight spots, showing the strong resilience of traditional consumer habits. SUVs filled four positions, reflecting families' persistent demand for space and versatility.

Of the top 10 models, five came from the Volkswagen Group. The only battery electric vehicle (BEVs) making the list was the BMW iX1 (4,945 units). Its performance highlighted both the niche potential of premium electric vehicles (EVs) and the broader challenge for electrification in Germany, where EVs still account for a small share—iX1 sales represented just 1.9% of the total.

Looking ahead: Three contradictions

Taken together, Germany's apparent "boom" in July was less a sign of genuine recovery than the product of a low comparison base, heavy promotional push, and easing supply bottlenecks. Behind the upbeat headline figures, the market is still weighed down by structural headwinds—most notably a sluggish economy and consumer sentiment that remains fragile.

The current challenges in the market are particularly evident:

First, with the 2025 carbon emission targets now assessed over a three-year cycle, the pace of electrification is losing steam. Limited public charging infrastructure and the hefty price premium of EVs—typically 30% to 50% higher than comparable ICE vehicle models—remain the biggest hurdles to mass adoption. From January to July, BEVs made up just 17.83% of total sales, still short of the 20% threshold.

Second, German automakers are in the midst of a difficult transition. They not only bear heavy costs for electrification R&D and production shifts but also face fierce competition from Chinese brands such as BYD and XPENG, whose affordable and increasingly advanced EVs are squeezing their traditional profit margins.

Third, Tesla's sales setback in Germany shows how a company's political stance can directly affect its brand and market performance. On top of that, the EU's high tariffs on Chinese EV imports and the Russia-Ukraine conflict pushing up energy costs for German manufacturing add further uncertainty to the market.

German auto giants must lean on their expertise in combustion engines and the premium market to defend their turf, even as they pour—cautiously but decisively—into costly electrification. At the same time, they face mounting pressure from fast-advancing Chinese brands and the urgent task of restoring consumer confidence. For now, the turbulence of this transformation shows no sign of easing.

Gasgoo not only offers timely news and profound insight about China auto industry, but also help with business connection and expansion for suppliers and purchasers via multiple channels and methods. Buyer service:buyer-support@gasgoo.comSeller Service:seller-support@gasgoo.com