Rankings of smart cockpit component suppliers in China (H1 2025): Rising share of China’s local players; intensifying market competition

In the first half of (H1) 2025, China's smart cockpit sector demonstrated a trend toward market concentration at the top and the rise of local players. From cockpit domain controller, head-up display (HUD) and augmented reality HUD (AR-HUD) to integrated center console display and integrated LCD instrument cluster, and further to smart speech solution, the data clearly outlined the competitive landscape and growth drivers of the industry.

According to data compiled by the Gasgoo Automotive Research Institute, leading companies in each segment secured significant market shares through technological advantages and market strategies, while Chinese suppliers stood out in certain niches. Continuous technological iteration and feature expansion were the key forces driving the development of each segment. Looking ahead, with further integration and breakthroughs in technology, the market was expected to witness more transformations and opportunities.

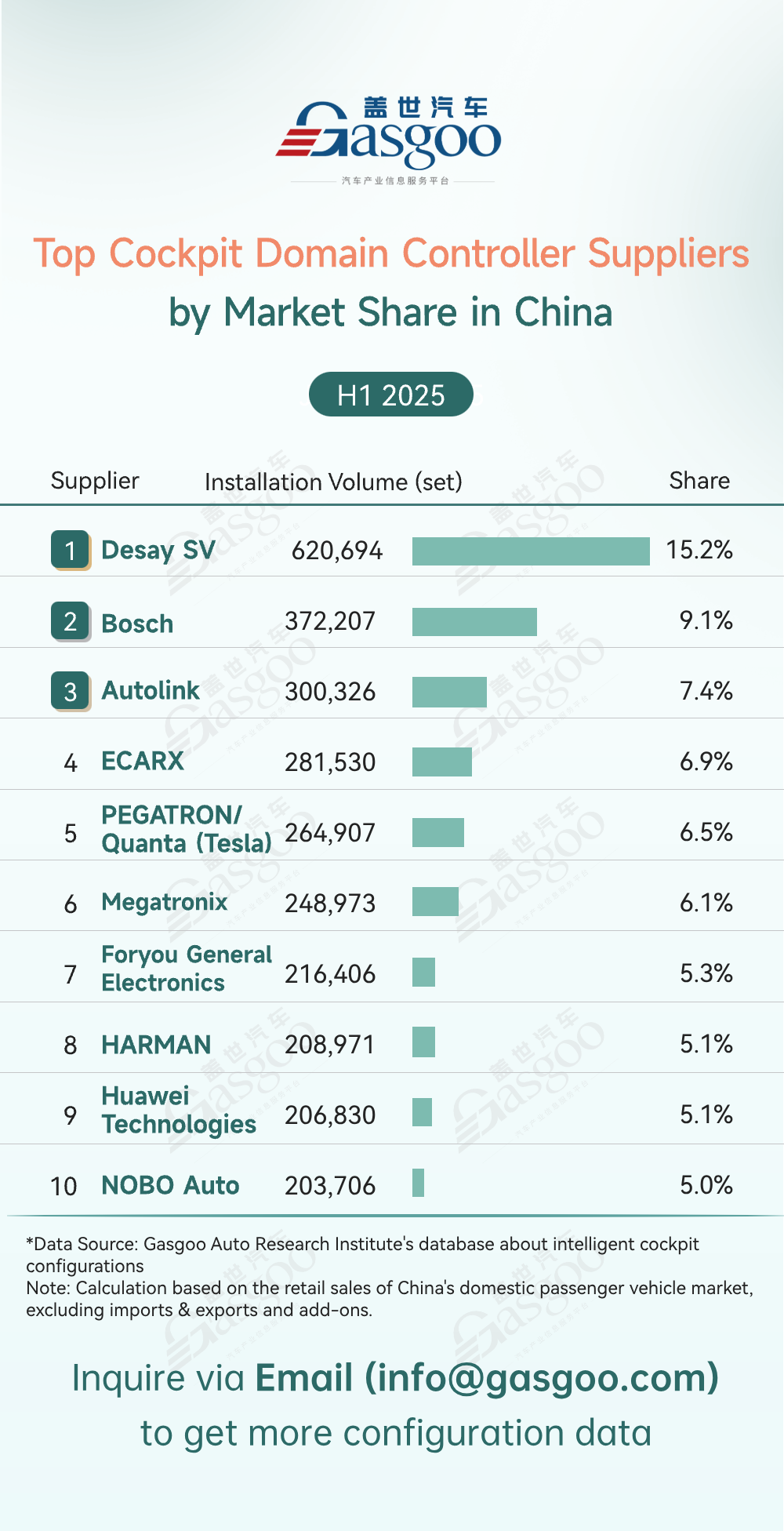

Top cockpit domain controller suppliers

Desay SV: 620,694 sets installed, 15.2% market share

Bosch: 372,207 sets installed, 9.1% market share

Autolink: 300,326 sets installed, 7.4% market share

ECARX: 281,530 sets installed, 6.9% market share

PEGATRON/Quanta (Tesla): 264,907 sets installed, 6.5% market share

Megatronix: 248,973 sets installed, 6.1% market share

Foryou General Electronics: 216,406 sets installed, 5.3% market share

HARMAN: 208,971 sets installed, 5.1% market share

Huawei Technologies: 206,830 sets installed, 5.1% market share

NOBO Auto: 203,706 sets installed, 5.0% market share

China's cockpit domain controller market saw robust growth in H1 2025, with local suppliers taking the lead. Desay SV ranked first with 620,694 sets installed (15.2% share) , followed by by local players such as Autolink (300,326 sets, 7.4%) and ECARX (281,530 sets, 6.9%). By leveraging deep insights into local demand, cost advantages, and agile supply chain capabilities, Chinese suppliers secured leading positions even against global players such as Bosch (372,207 sets, 9.1%). As automotive intelligence continued to advance, China's local companies were expected to further strengthen their presence and accelerate the industry's development.

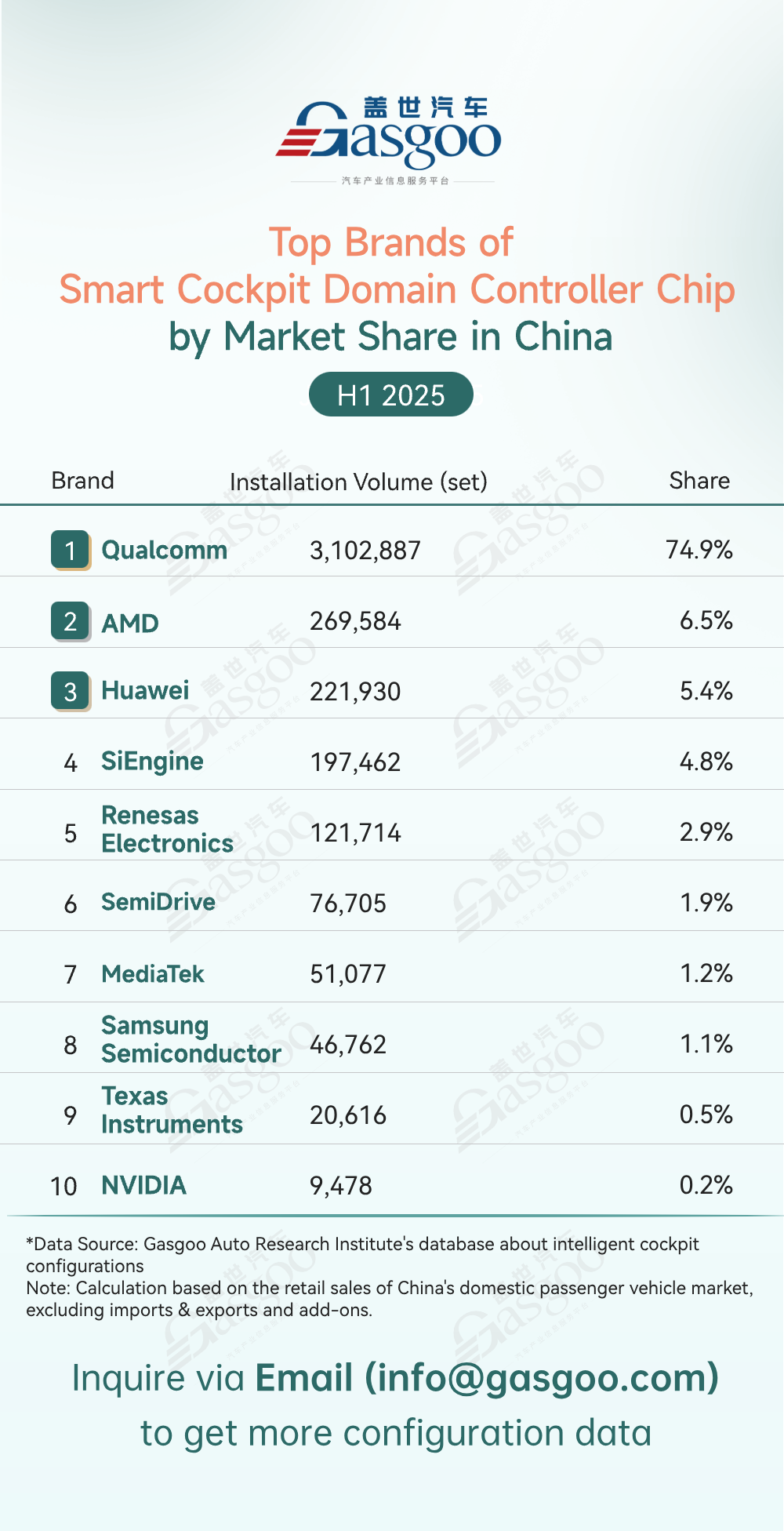

Top brands of smart cockpit domain controller chip

Qualcomm: 3,102,887 units installed, 74.9% market share

AMD: 269,584 units installed, 6.5% market share

Huawei: 221,930 units installed, 5.4% market share

SiEngine: 197,462 units installed, 4.8% market share

Renesas Electronics: 121,714 units installed, 2.9% market share

SemiDrive: 76,705 units installed, 1.9% market share

MediaTek: 51,077 units installed, 1.2% market share

Samsung Semiconductor: 46,762 units installed, 1.1% market share

Texas Instruments: 20,616 units installed, 0.5% market share

NVIDIA: 9,478 units installed, 0.2% market share

In the cockpit domain controller chip market, Qualcomm maintained a commanding lead with 3.1 million units installed (74.9% share), leveraging its technological expertise and ecosystem advantages. At the same time, China's local players such as Huawei (221,930 units, 5.4%) and SiEngine (197,462 units, 4.8%) collectively surpassed 10% of the market, demonstrating their strengths in computing optimization and localized adaptation. While Qualcomm's dominance is unlikely to be challenged in the short term, the accelerated development of domestic chips and growing OEM demand for supply chain autonomy is steadily expanding the footprint of local suppliers, driving both market competition and technological advancement.

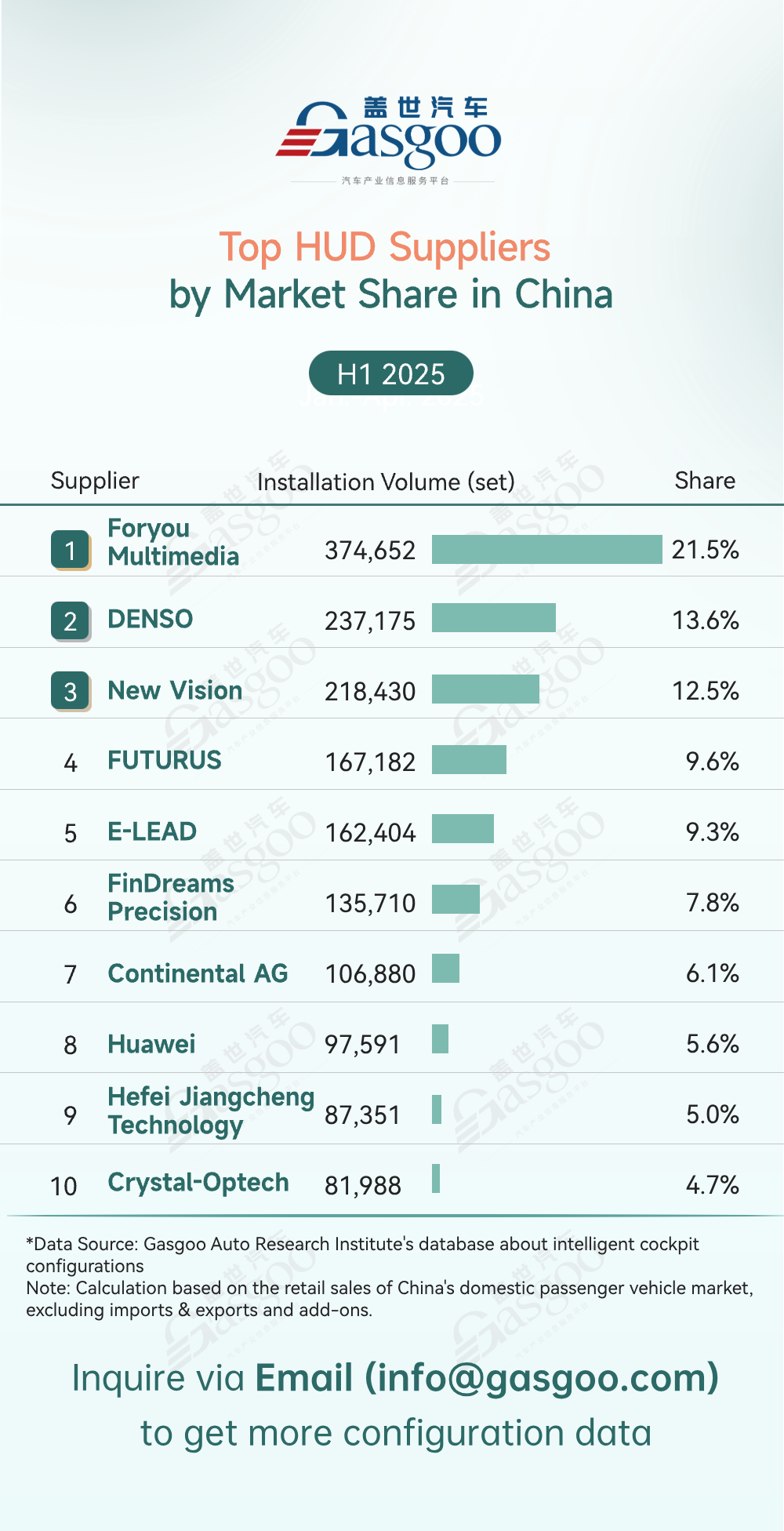

Top HUD suppliers

Foryou Multimedia: 374,652 sets installed, 21.5% market share

DENSO: 237,175 sets installed, 13.6% market share

New Vision: 218,430 sets installed, 12.5% market share

FUTURUS: 167,182 sets installed, 9.6% market share

E-LEAD: 162,404 sets installed, 9.3% market share

FinDreams Precision: 135,710 sets installed, 7.8% market share

Continental AG: 106,880 sets installed, 6.1% market share

Huawei: 97,591 sets installed, 5.6% market share

Hefei Jiangcheng Technology: 87,351 sets installed, 5.0% market share

Crystal-Optech: 81,988 sets installed, 4.7% market share

The HUD market emerged as a new growth driver for smart cockpits, with competition showing a clear tiered structure. The first tier was led by Foryou Multimedia, which dominated with 374,652 sets installed (21.5% share). The second tier included DENSO (237,175 sets, 13.6%) and New Vision (218,430 sets, 12.5%), both exceeding 10% share and maintaining a manageable gap with the leader. The third tier was formed by FUTURUS (167,182 sets, 9.6%) and E-LEAD (162,404 sets, 9.3%). This tiered structure highlighted the technological and scale advantages of leading players, while also reflecting the dynamic participation of diverse competitors, collectively accelerating the penetration of HUDs in smart cockpits.

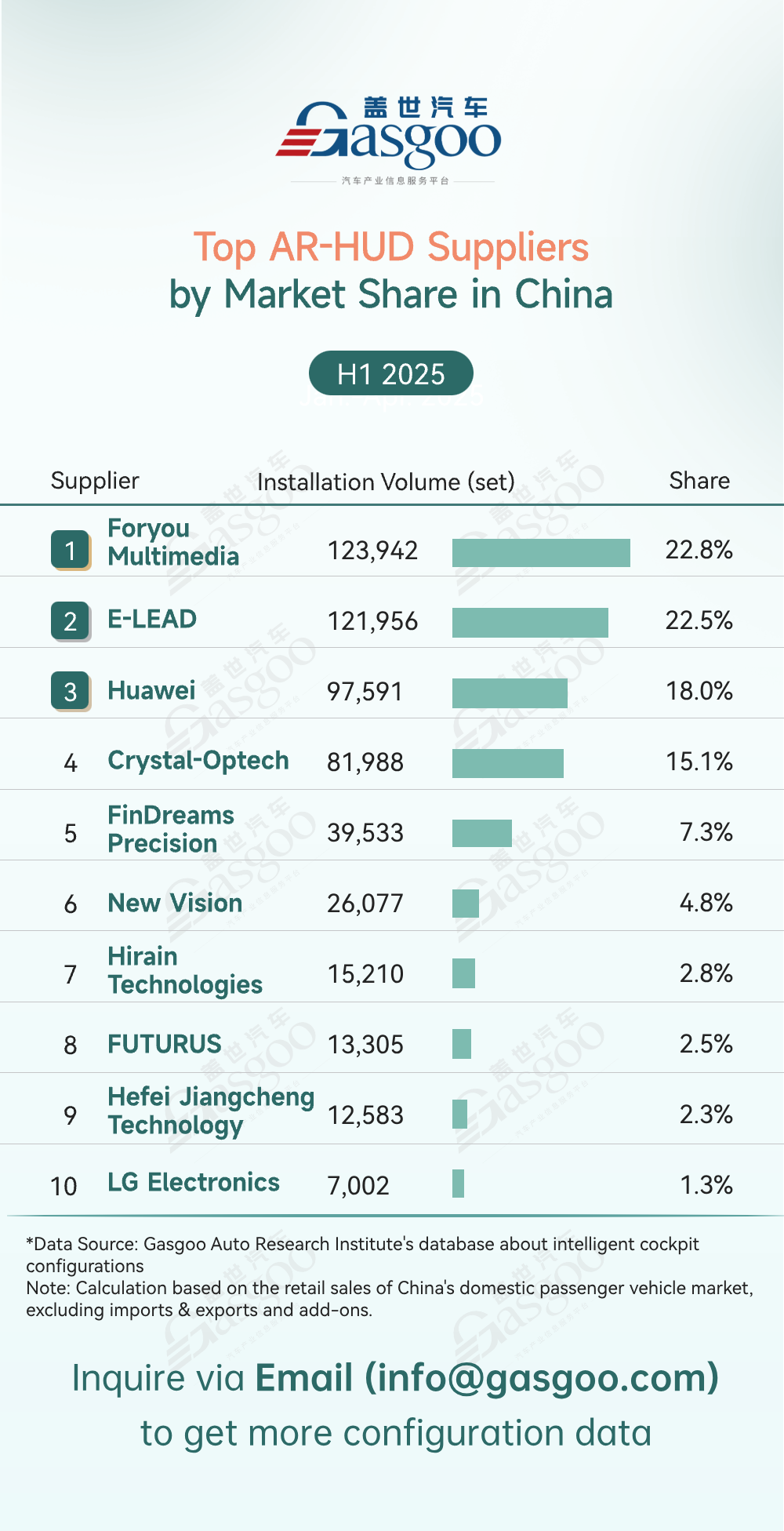

Top AR-HUD suppliers

Foryou Multimedia: 123,942 sets installed, 22.8% market share

E-LEAD: 121,956 sets installed, 22.5% market share

Huawei: 97,591 sets installed, 18.0% market share

Crystal-Optech: 81,988 sets installed, 15.1% market share

FinDreams Precision: 39,533 sets installed, 7.3% market share

New Vision: 26,077 sets installed, 4.8% market share

Hirain Technologies: 15,210 sets installed, 2.8% market share

FUTURUS: 13,305 sets installed, 2.5% market share

Hefei Jiangcheng Technology: 12,583 sets installed, 2.3% market share

LG Electronics: 7,002 sets installed, 1.3% market share

In the AR-HUD market, China's local suppliers are driving penetration. Foryou Multimedia (123,942 sets, 22.8% share), E-LEAD (121,956 sets, 22.5%), and Huawei (97,591 sets, 18.0%) led the field. The top 5 companies together accounted for over 85% of the market share. Through technology breakthroughs (such as overcoming challenges in optics and image fusion to enhance display quality and precision) and cost optimization (localized production to reduce costs and better meet automakers' demands), these companies accelerated AR-HUD adoption and upgrade in-car smart cockpit experiences, becoming the core driving force behind market penetration.

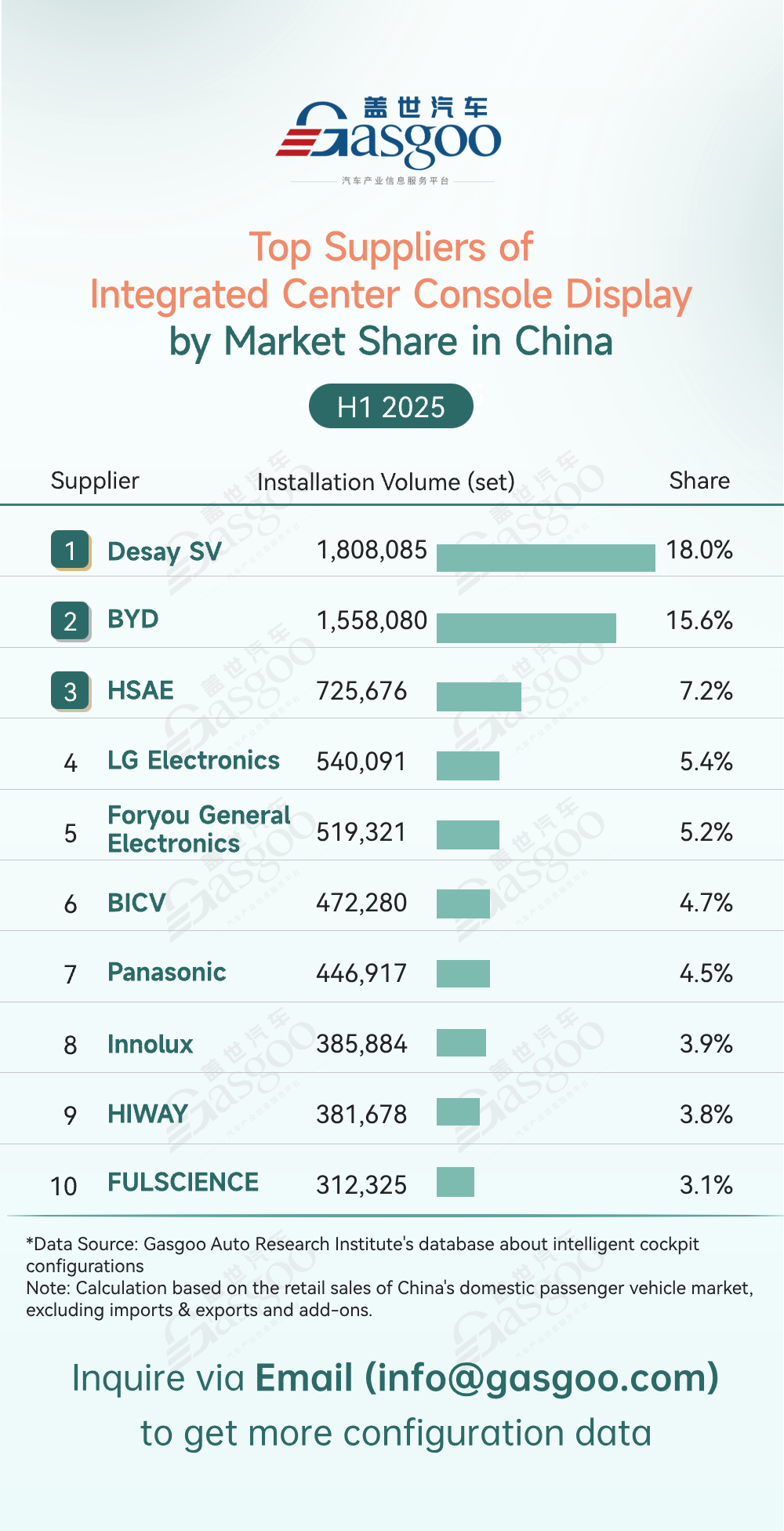

Top suppliers of integrated center console display

Desay SV: 1,808,085 sets installed, 18.0% market share

BYD: 1,558,080 sets installed, 15.6% market share

HSAE: 725,676 sets installed, 7.2% market share

LG Electronics: 540,091 sets installed, 5.4% market share

Foryou General Electronics: 519,321 sets installed, 5.2% market share

BICV: 472,280 sets installed, 4.7% market share

Panasonic: 446,917 sets installed, 4.5% market share

Innolux: 385,884 sets installed, 3.9% market share

HIWAY: 381,678 sets installed, 3.8% market share

FULSCIENCE: 312,325 sets installed, 3.1% market share

In the integrated center console display market, Chinese suppliers took the lead. Desay SV topped the list with 1,808,085 sets installed (18.0% share), closely followed by BYD at 1,558,080 sets (15.6%), forming a clear front tier ahead of HSAE (725,676 sets, 7.2%). Other China's local players, including Foryou General Electronics (519,321 sets, 5.2%) and BICV (472,280 sets, 4.7%), continued to expand their foothold. As NEVs become more widespread, the market is set to grow further, with competition shifting toward higher-resolution displays, larger panels, and multi-screen integration.

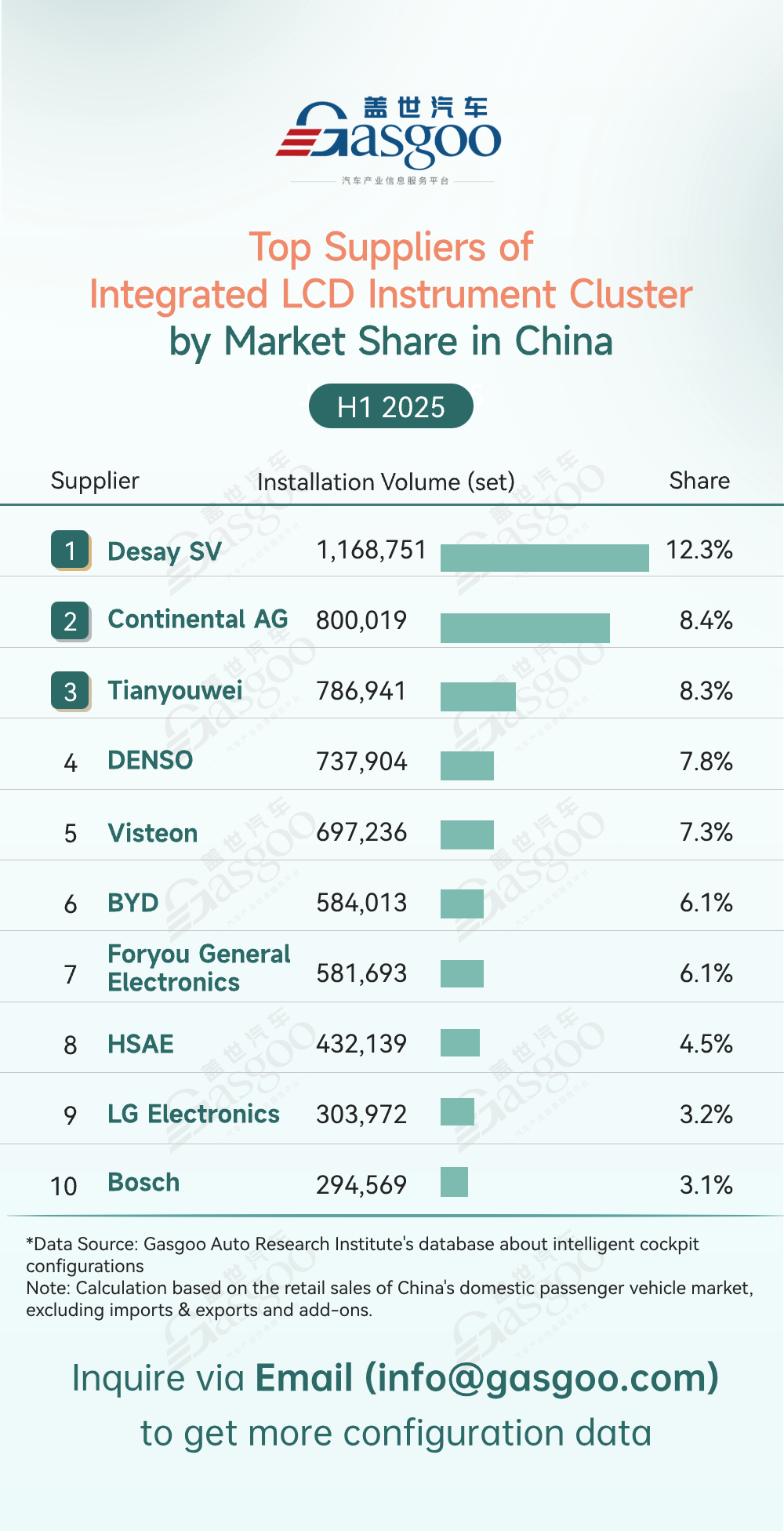

Top suppliers of integrated LCD instrument cluster

Desay SV: 1,168,751 sets installed, 12.3% market share

Continental AG: 800,019 sets installed, 8.4% market share

Tianyouwei: 786,941 sets installed, 8.3% market share

DENSO: 737,904 sets installed, 7.8% market share

Visteon: 697,236 sets installed, 7.3% market share

BYD: 584,013 sets installed, 6.1% market share

Foryou General Electronics: 581,693 sets installed, 6.1% market share

HSAE: 432,139 sets installed, 4.5% market share

LG Electronics: 303,972 sets installed, 3.2% market share

Bosch: 294,569 sets installed, 3.1% market share

The integrated LCD instrument cluster market has become highly competitive. Desay SV (1,168,751 sets, 12.3%) maintained the top position, but Continental AG (800,019 sets, 8.4%) and Tianyouwei (786,941 sets, 8.3%) closely followed, with only a narrow gap in market share. DENSO (737,904 sets, 7.8%) and Visteon (697,236 sets, 7.3%) also demonstrated strong competitiveness. Local companies like Desay SV and Tianyouwei competed directly with foreign firms such as Continental AG and DENSO, while BYD (584,013 sets, 6.1%) and Foryou General Electronics (581,693 sets, 6.1%) leveraged their partnerships with NEV manufacturers to gain market traction.

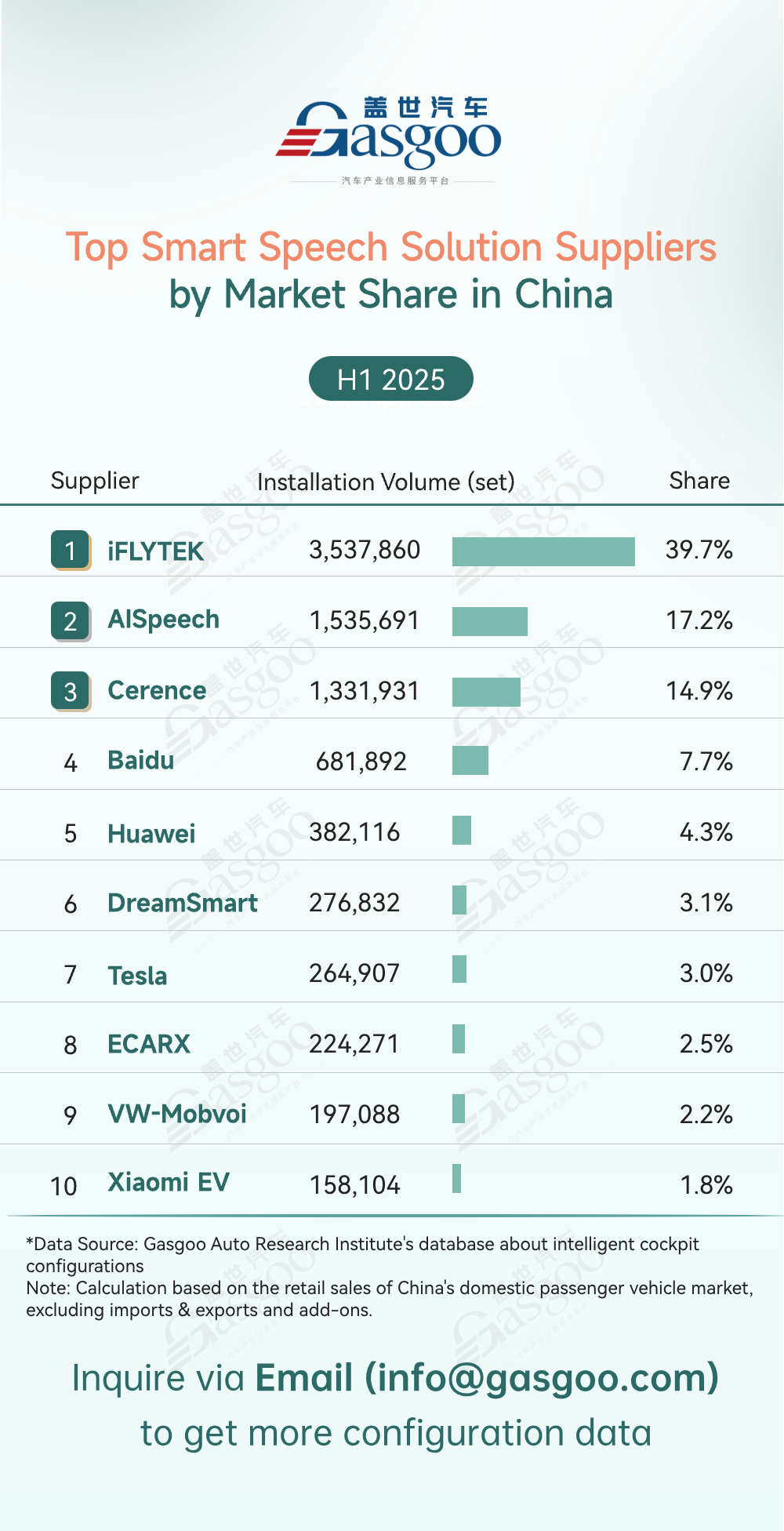

Top smart speech solution suppliers

iFLYTEK: 3,537,860 sets installed, 39.7% market share

AISpeech: 1,535,691 sets installed, 17.2% market share

Cerence: 1,331,931 sets installed, 14.9% market share

Baidu: 681,892 sets installed, 7.7% market share

Huawei: 382,116 sets installed, 4.3% market share

DreamSmart: 276,832 sets installed, 3.1% market share

Tesla: 264,907 sets installed, 3.0% market share

ECARX: 224,271 sets installed, 2.5% market share

VW-Mobvoi: 197,088 sets installed, 2.2% market share

Xiaomi EV: 158,104 sets installed, 1.8% market share

The smart speech solution market continued to advance in H1 2025. iFLYTEK led the market with a 39.7% share (3,537,860 sets), followed by AISpeech (1,535,691 sets, 17.2%) and Cerence (1,331,931 sets, 14.9%). Companies like Baidu and Huawei also captured notable shares through technological strengths. Leading suppliers drove the sector toward smarter and more personalized experiences by improving recognition accuracy, expanding interaction scenarios, and enhancing semantic understanding and multi-turn dialogue capabilities. Intensified competition is expected to accelerate both technological iteration and user experience innovation.

Gasgoo not only offers timely news and profound insight about China auto industry, but also help with business connection and expansion for suppliers and purchasers via multiple channels and methods. Buyer service:buyer-support@gasgoo.comSeller Service:seller-support@gasgoo.com