Rankings of electrification component suppliers in China (Jan.-Aug. 2025): Strengthening in-house supply model

According to data compiled by the Gasgoo Automotive Research Institute, China's electrification component market showed a clearer competitive landscape from January to August 2025. In power battery market, CATL led the pack with 130,439 MWh installed (39.9% share), followed by FinDreams Battery with 93,207 MWh (28.5%). In the power battery pack segment, FinDreams Battery took the lead with 2,359,847 units installed (31.8%). FinDreams-affiliated companies also ranked among the leaders in BMS, electric motor controllers, and onboard charger (OBC), underscoring their strong overall competitiveness in new energy vehicle (NEV) core components.

Overall, most core component markets are dominated by automakers' in-house supply, showing a high level of concentration. Meanwhile, mid-tier players are locked in intense competition, with ongoing technological upgrades and supply chain localization driving a more diverse and dynamic industry landscape.

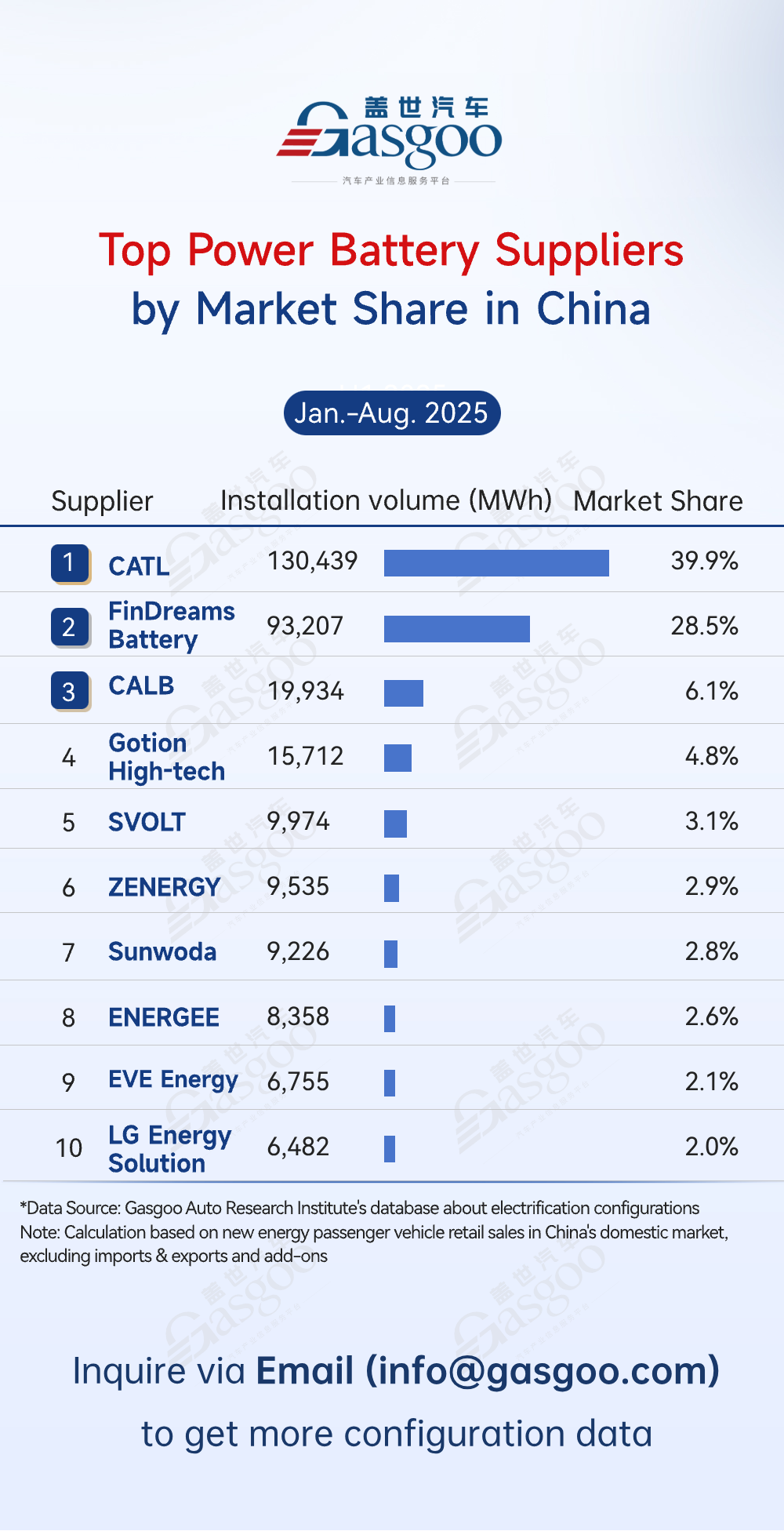

Top power battery suppliers

CATL: 130,439 MWh installed, 39.9% market share

FinDreams Battery: 93,207 MWh installed, 28.5% market share

CALB: 19,934 MWh installed, 6.1% market share

Gotion High-tech: 15,712 MWh installed, 4.8% market share

SVOLT: 9,974 MWh installed, 3.1% market share

ZENERGY: 9,535 MWh installed, 2.9% market share

Sunwoda: 9,226 MWh installed, 2.8% market share

ENERGEE: 8,358 MWh installed, 2.6% market share

EVE Energy: 6,755 MWh installed, 2.1% market share

LG Energy Solution: 6,482 MWh installed, 2.0% market share

The power battery market was marked by dual dominance and high concentration. CATL led with 130,439 MWh (39.9% share), followed by FinDreams Battery with 93,207 MWh (28.5%), forming a clear two-giant structure. CALB (6.1%), Gotion High-tech (4.8%), and SVOLT (3.1%) made up the second tier, while others such as ZENERGY, EVE Energy, and LG Energy Solution each held below 3%. Overall, the top 5 suppliers captured over 82% of the market. The industry was consolidating around major players, with technology innovation and large-scale delivery emerging as key differentiators.

Top power battery pack suppliers

FinDreams Battery: 2,359,847 sets installed, 31.8% market share

CATL: 1,421,978 sets installed, 19.2% market share

Tesla: 363,077 sets installed, 4.9% market share

Gotion High-tech: 348,988 sets installed, 4.7% market share

Shanju Battery: 338,973 sets installed, 4.6% market share

REPT: 335,939 sets installed, 4.5% market share

CALB: 317,786 sets installed, 4.3% market share

SVOLT: 286,687 sets installed, 3.9% market share

Leapmotor: 223,837 sets installed, 3.0% market share

Sunwoda: 144,940 sets installed, 2.0% market share

The power battery pack market showed a clear shift toward in-house production, exceeding 50% of total installations. FinDreams Battery led the pack with 31.8% and 2,359,847 units, followed by CATL with 19.2% and 1,421,978 units. Together they held 51.0% of the market. Tesla, Gotion High-tech, Shanju Battery, and REPT each claimed around 4.5%-4.9%, while Leapmotor and other automakers with self-developed pack systems accounted for about 3%. Overall, the market remained highly concentrated at the top, with intense competition among mid- and lower-tier players, reflecting an industry in active transition.

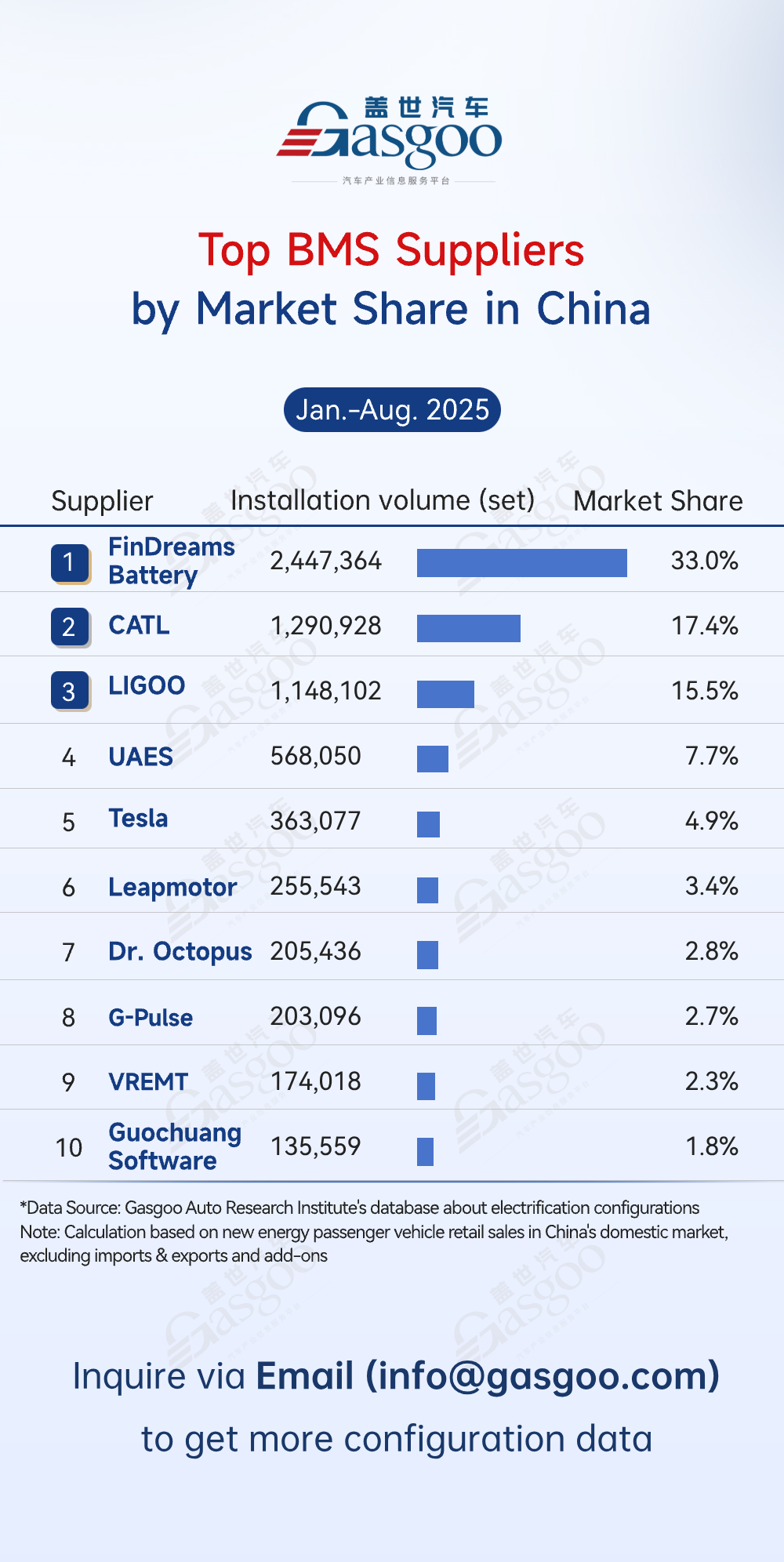

Top BMS suppliers

FinDreams Battery: 2,447,364 sets installed, 33.0% market share

CATL: 1,290,928 sets installed, 17.4% market share

LIGOO: 1,148,102 sets installed, 15.5% market share

UAES: 568,050 sets installed, 7.7% market share

Tesla: 363,077 sets installed, 4.9% market share

Leapmotor: 255,543 sets installed, 3.4% market share

Dr. Octopus: 205,436 sets installed, 2.8% market share

G-Pulse: 203,096 sets installed, 2.7% market share

VREMT: 174,018 sets installed, 2.3% market share

Guochuang Software: 135,559 sets installed, 1.8% market share

In the Battery Management System (BMS) market, automakers increasingly pursued independent control and in-house development. FinDreams Battery took the lead with 2,447,364 units installed (33.0% share), followed by CATL (17.4%) and LIGOO (15.5%), together capturing over 65% of the market. UAES (7.7%) and Tesla (4.9%) also held notable shares, while others—including Leapmotor, Dr. Octopus—each accounted for less than 5%. Tesla and Leapmotor achieved independent BMS supply, enhancing their control over core technologies and reshaping the competitive landscape.

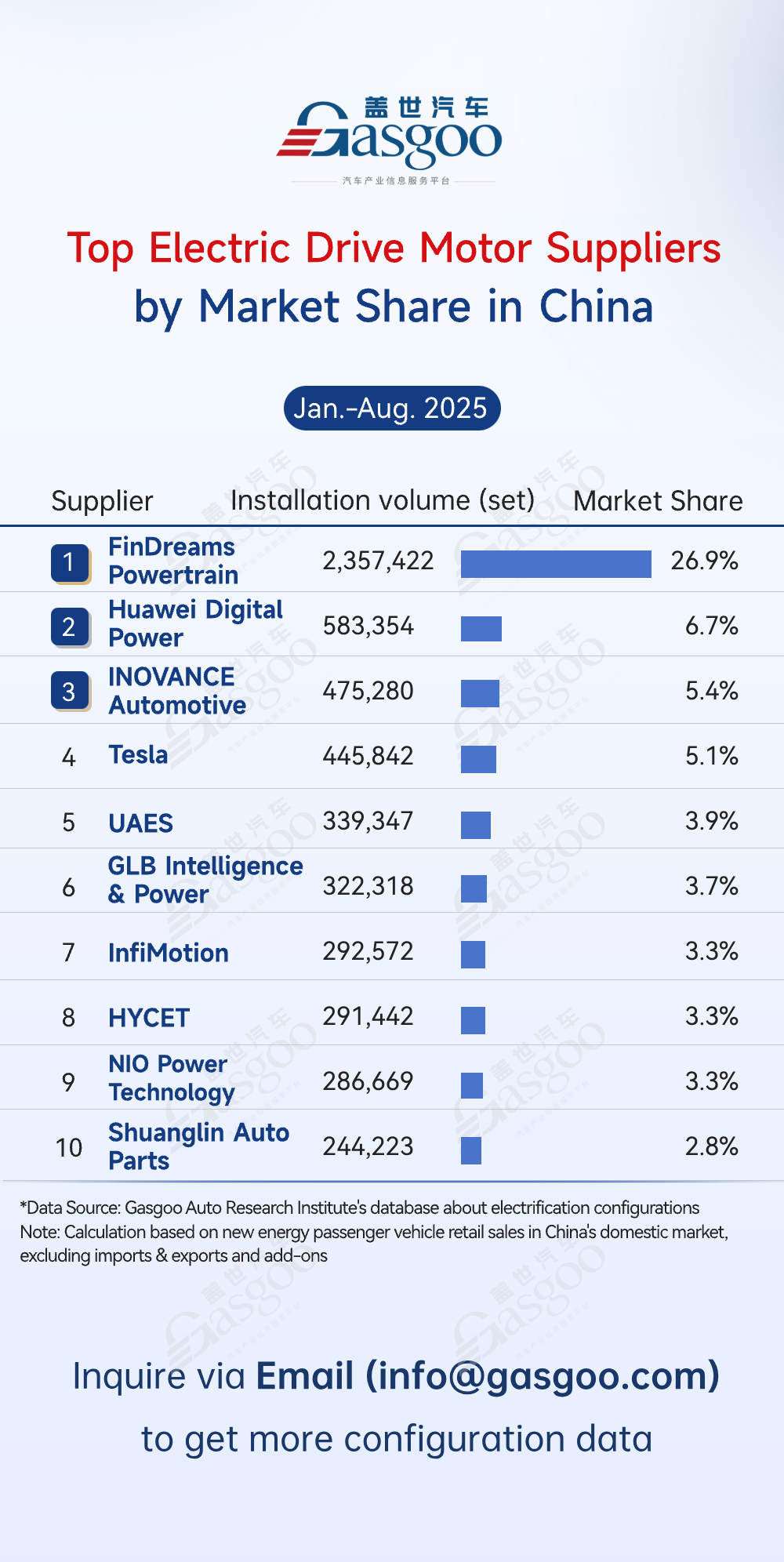

Top electric drive motor suppliers

FinDreams Powertrain: 2,357,422 sets installed, 26.9% market share

Huawei Digital Power: 583,354 sets installed, 6.7% market share

INOVANCE Automotive: 475,280 sets installed, 5.4% market share

Tesla: 445,842 sets installed, 5.1% market share

UAES: 339,347 sets installed, 3.9% market share

GLB Intelligence & Power: 322,318 sets installed, 3.7% market share

InfiMotion: 292,572 sets installed, 3.3% market share

HYCET: 291,442 sets installed, 3.3% market share

NIO Power Technology: 286,669 sets installed, 3.3% market share

Shuanglin Auto Parts: 244,223 sets installed, 2.8% market share

FinDreams Powertrain led the electric drive motor market with 2,357,422 units installed (26.9% share), maintaining a dominant position. Huawei Digital Power and INOVANCE Automotive ranked second and third with 6.7% and 5.4%, respectively. Tesla (5.1%) and UAES (3.9%) also held notable shares, while GLB Intelligence & Power, InfiMotion, and HYCET each accounted for around 2.8%–3.7%.

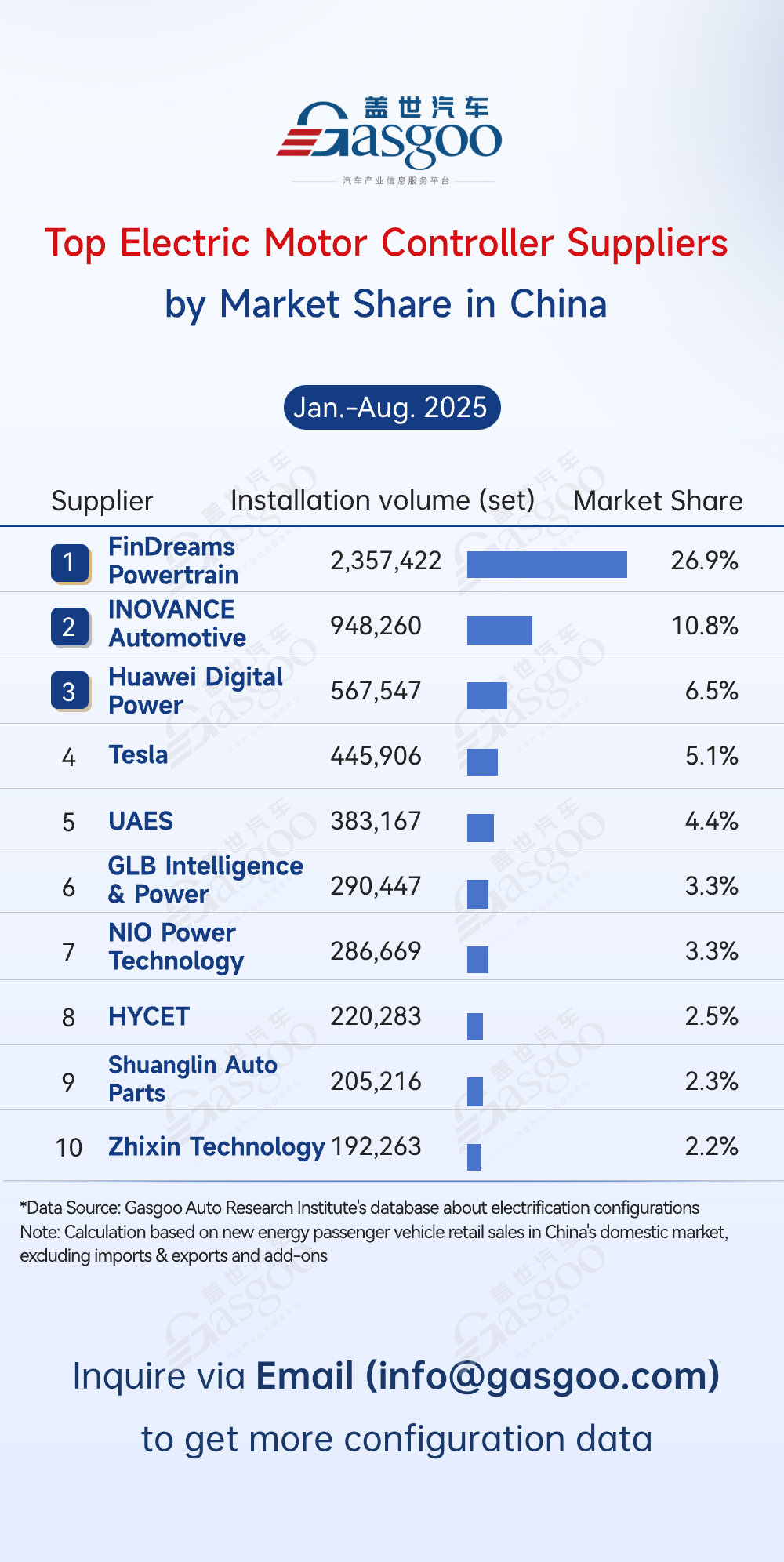

Top electric motor controller suppliers

FinDreams Powertrain: 2,357,422 sets installed, 26.9% market share

INOVANCE Automotive: 948,260 sets installed, 10.8% market share

Huawei Digital Power: 567,547 sets installed, 6.5% market share

Tesla: 445,906 sets installed, 5.1% market share

UAES: 383,167 sets installed, 4.4% market share

GLB Intelligence & Power: 290,447 sets installed, 3.3% market share

NIO Power Technology: 286,669 sets installed, 3.3% market share

HYCET: 220,283 sets installed, 2.5% market share

Shuanglin Auto Parts: 205,216 sets installed, 2.3% market share

Zhixin Technology: 192,263 sets installed, 2.2% market share

In the electric motor controller market, automakers' in-house production exceeded half of total installations. FinDreams Powertrain led the pack with 26.9% and 2,357,422 units, followed by INOVANCE Automotive (10.8%) and Huawei Digital Power (6.5%). Tesla (5.1%) and UAES (4.4%) also held steady shares. NIO Power Technology (3.3%) and Zhixin Technology (2.2%)—both automaker-linked—reflected growing self-sufficiency in motor controller development.

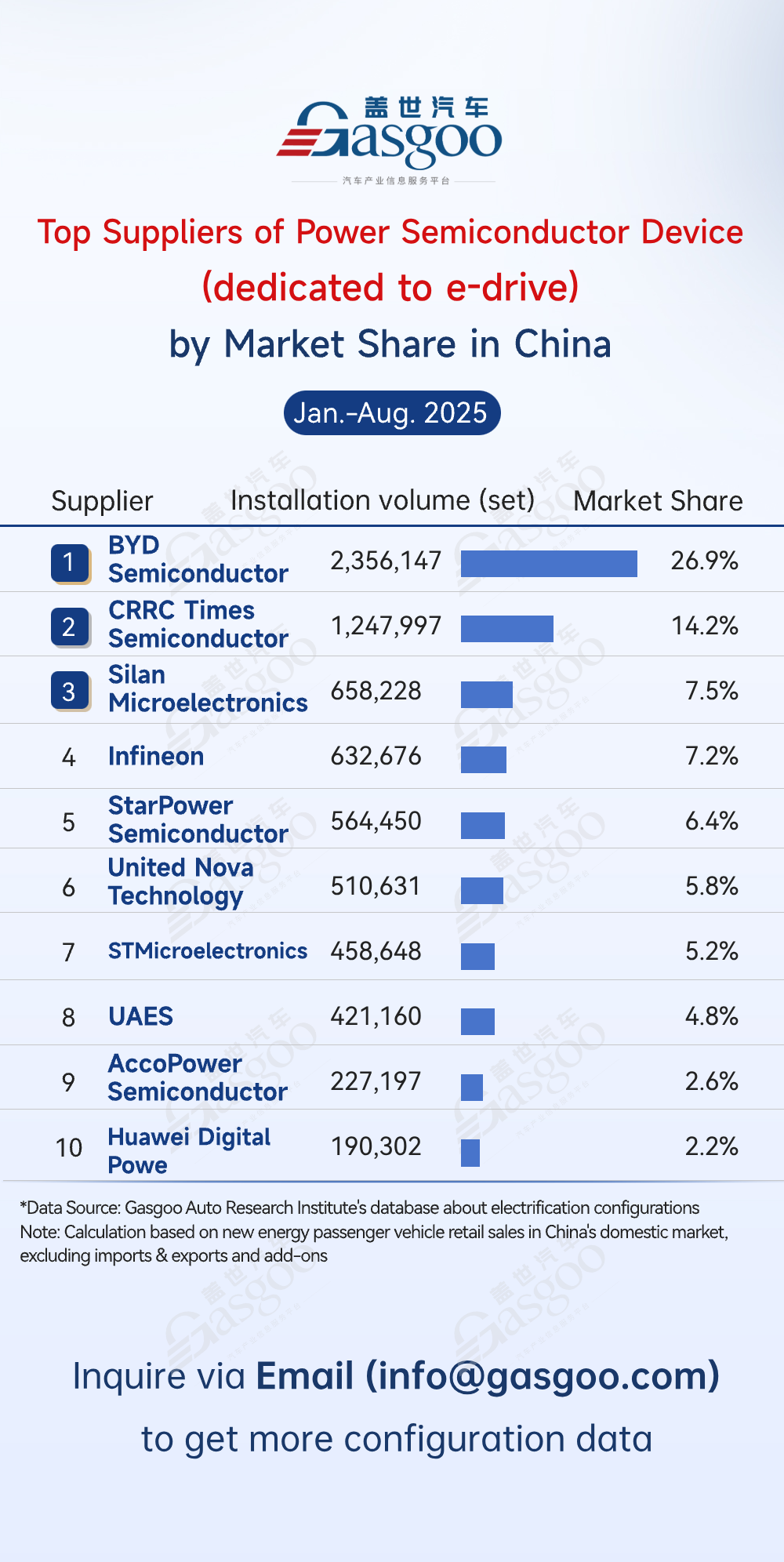

Top suppliers of power semiconductor device (dedicated to e-drive)

BYD Semiconductor: 2,356,147 sets installed, 26.9% market share

CRRC Times Semiconductor: 1,247,997 sets installed, 14.2% market share

Silan Microelectronics: 658,228 sets installed, 7.5% market share

Infineon: 632,676 sets installed, 7.2% market share

StarPower Semiconductor: 564,450 sets installed, 6.4% market share

United Nova Technology: 510,631 sets installed, 5.8% market share

STMicroelectronics: 458,648 sets installed, 5.2% market share

UAES: 421,160 sets installed, 4.8% market share

AccoPower Semiconductor: 227,197 sets installed, 2.6% market share

Huawei Digital Power: 190,302 sets installed, 2.2% market share

In the power semiconductor device (dedicated to e-drive) market, high concentration was a defining feature. BYD Semiconductor led the pack with a 26.9% share, followed by CRRC Times Semiconductor (14.2%) and Silan Microelectronics (7.5%), with the top 3 approaching 50% combined. The top 5 suppliers together captured over 62% of the market. The landscape reflected both the rapid rise of domestic players, driven by supply chain integration and scale advantages, and the active participation of international manufacturers, resulting in a fiercely competitive pattern of high concentration and China–foreign rivalry.

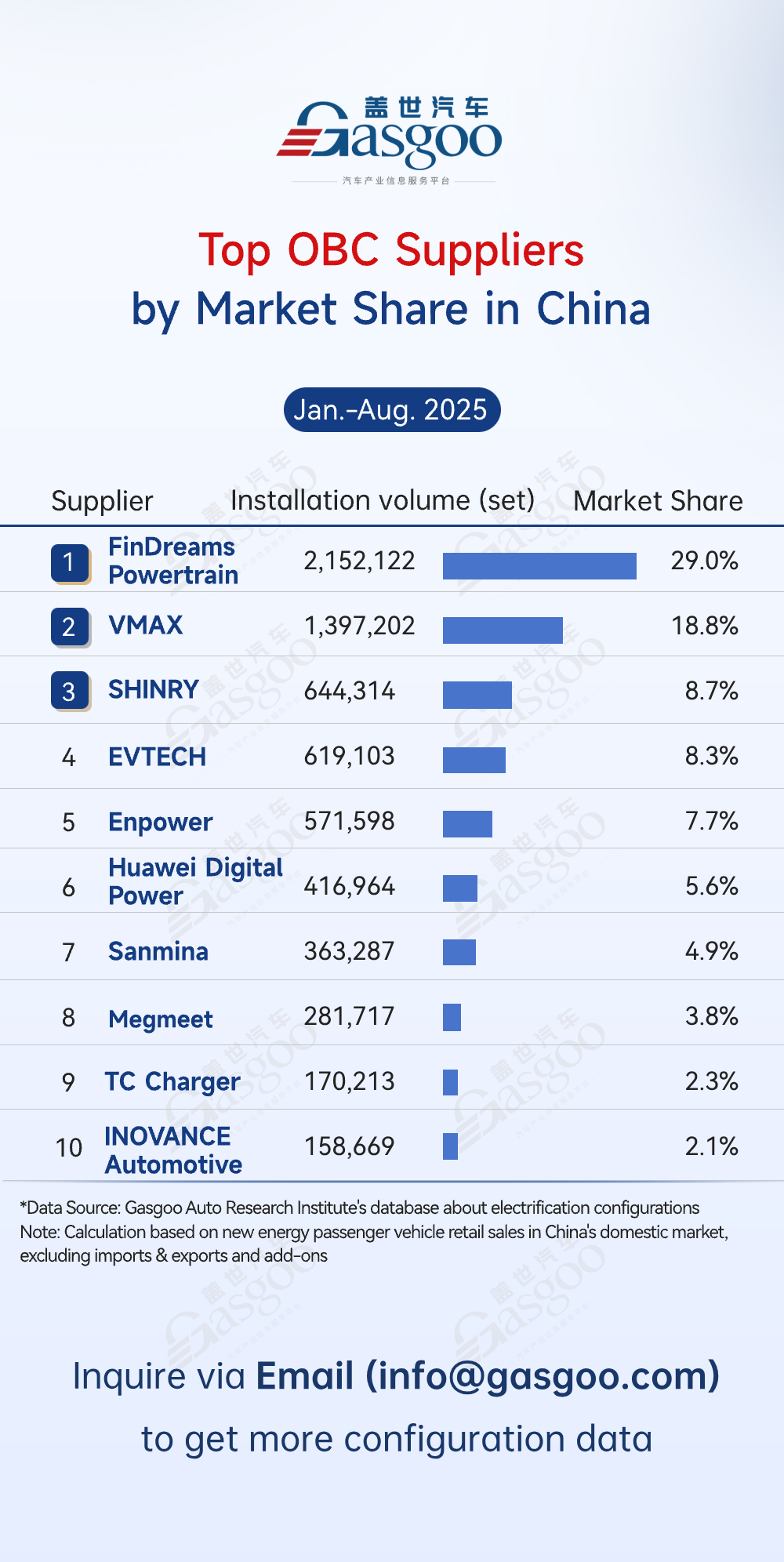

Top OBC suppliers

FinDreams Powertrain: 2,152,122 sets installed, 29.0% market share

VMAX: 1,397,202 sets installed, 18.8% market share

SHINRY: 644,314 sets installed, 8.7% market share

EVTECH: 619,103 sets installed, 8.3% market share

Enpower: 571,598 sets installed, 7.7% market share

Huawei Digital Power: 416,964 sets installed, 5.6% market share

Sanmina: 363,287 sets installed, 4.9% market share

Megmeet: 281,717 sets installed, 3.8% market share

TC Charger: 170,213 sets installed, 2.3% market share

INOVANCE Automotive: 158,669 sets installed, 2.1% market share

FinDreams Powertrain led the Onboard Charger (OBC) market with 2,152,122 units installed (29% share), followed by VMAX (18.8%), with the two together capturing nearly half of total installations. SHINRY (8.7%), EVTECH (8.3%), and Enpower (7.7%) ranked third to fifth, bringing the top five suppliers' combined share to 73%, underscoring the market’s strong concentration. Huawei Digital Power, Sanmina, and others held shares between 2.1% and 5.6%, reflecting a structure dominated by two leading players and diverse competition among mid-tier suppliers.

Top suppliers of multi-in-one main drive system (dedicated to BEVs)

FinDreams Powertrain: 1,012,310 sets installed, 25.3% market share

Tesla: 363,287 sets installed, 9.1% market share

GLB Intelligence & Power: 322,318 sets installed, 8.0% market share

INOVANCE Automotive: 205,716 sets installed, 5.1% market share

UAES: 200,472 sets installed, 5.0% market share

NIO Power Technology: 173,085 sets installed, 4.3% market share

Quzhou Jidian: 146,894 sets installed, 3.7% market share

CRRC Times Electric: 134,562 sets installed, 3.4% market share

Lingsheng Powertech: 131,967 sets installed, 3.3% market share

DEEPAL: 115,591 sets installed, 2.9% market share

In the multi-in-one main drive system (dedicated to BEVs) market, the trend toward in-house supply by automakers became increasingly evident. FinDreams Powertrain led the pack with a 25.3% market share, followed by Tesla (9.1%) and GLB Intelligence & Power (8.0%), forming the second competitive tier. INOVANCE Automotive (5.1%), UAES (5.0%), and NIO Power Technology (4.3%) also continued to expand their presence. Overall, leading players maintained dominant positions, while automakers' self-supply models prevailed. Competition increasingly focused on efficiency optimization and lightweight design within main drive systems.

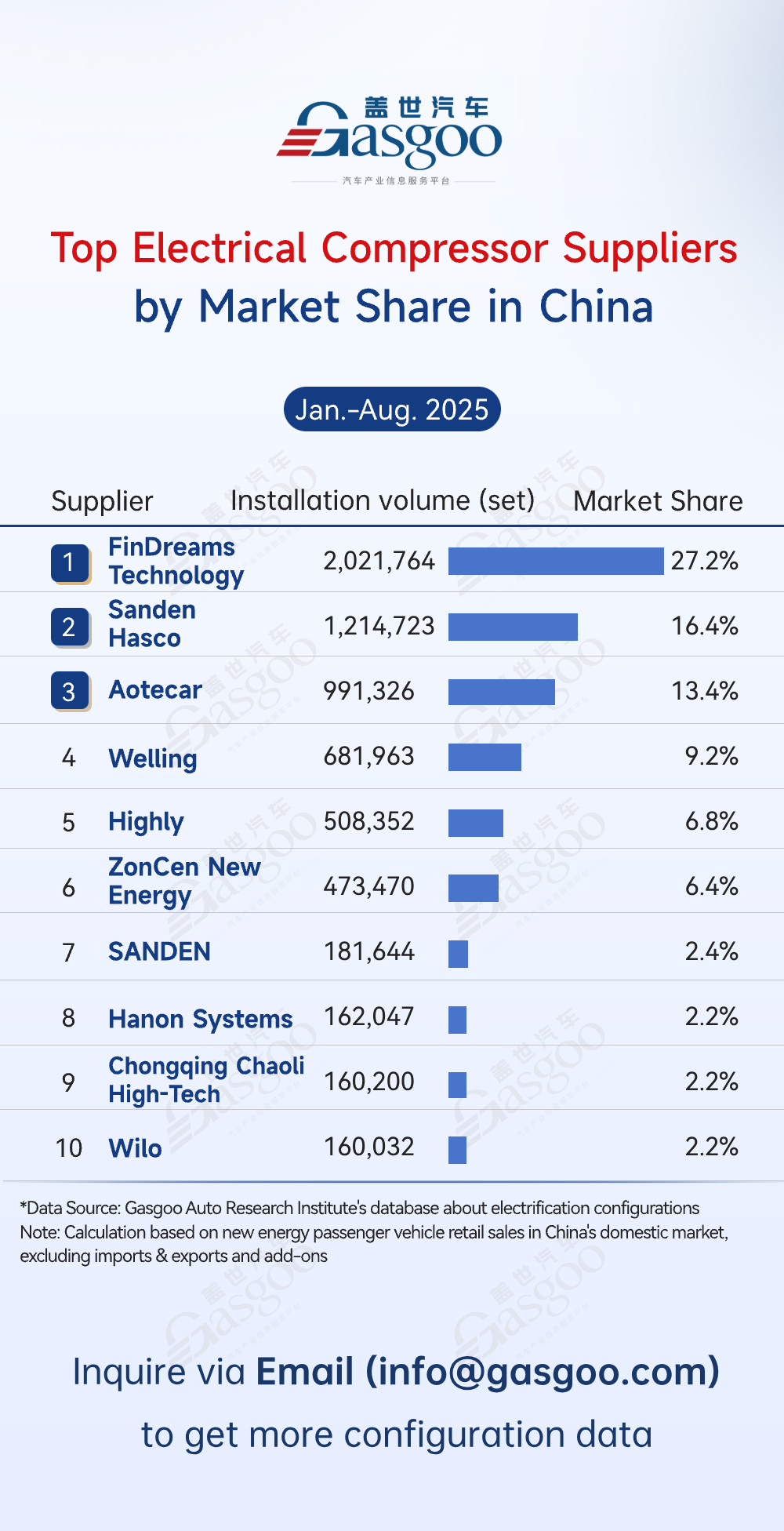

Top electrical compressor suppliers

FinDreams Technology: 2,021,764 sets installed, 27.2% market share

Sanden Hasco: 1,214,723 sets installed, 16.4% market share

Aotecar: 991,326 sets installed, 13.4% market share

Welling: 681,963 sets installed, 9.2% market share

Highly: 508,352 sets installed, 6.8% market share

ZonCen New Energy: 473,470 sets installed, 6.4% market share

SANDEN: 181,644 sets installed, 2.4% market share

Hanon Systems: 162,047 sets installed, 2.2% market share

Chongqing Chaoli High-Tech: 160,200 sets installed, 2.2% market share

Wilo: 160,032 sets installed, 2.2% market share

In the electric compressor market, high concentration among top players was evident, with the top 5 suppliers capturing 73% of total installations. FinDreams Technology took the lead with 2,021,764 units installed (27.2% share), followed by Sanden Hasco (16.4%) and Aotecar (13.4%). Welling, Highly, and ZonCen New Energy also held notable positions, while SANDEN, Hanon Systems, Chongqing Chaoli High-Tech, and Wilo each accounted for around 2%–3%.

Gasgoo not only offers timely news and profound insight about China auto industry, but also help with business connection and expansion for suppliers and purchasers via multiple channels and methods. Buyer service:buyer-support@gasgoo.comSeller Service:seller-support@gasgoo.com