Rankings of smart cockpit component suppliers in China (Jan.-Aug. 2025): Leading players diversify

From January to August 2025, China's smart cockpit component market continued its rapid growth, characterized by stronger localization, higher concentration, and faster iteration. In key areas such as smart speech solution, cockpit domain controllers, HUD, AR-HUD, China's local suppliers have established a dominant position due to their technological adaptability, agile supply chains, and ecosystem integration capabilities.

iFLYTEK led the smart speech solution segment with a 41.5% market share, while Desay SV maintained its leading position across cockpit domain controller, integrated center console display, and integrated LCD instrument cluster. Foryou Multimedia took the top spot in both HUD and AR-HUD segments, highlighting the continued dominance of Chinese suppliers.

AR-HUD, as a core component of the intelligent cockpit, is rapidly gaining traction, while large-screen integration technology evolves, shifting the supply chain from "scale competition" to "technological innovation." With ongoing local substitution, the market is moving towards clearer tech segmentation, deeper ecosystem integration, and differentiated innovation. The competition between established suppliers and new players is driving further momentum for the industry's intelligent upgrade.

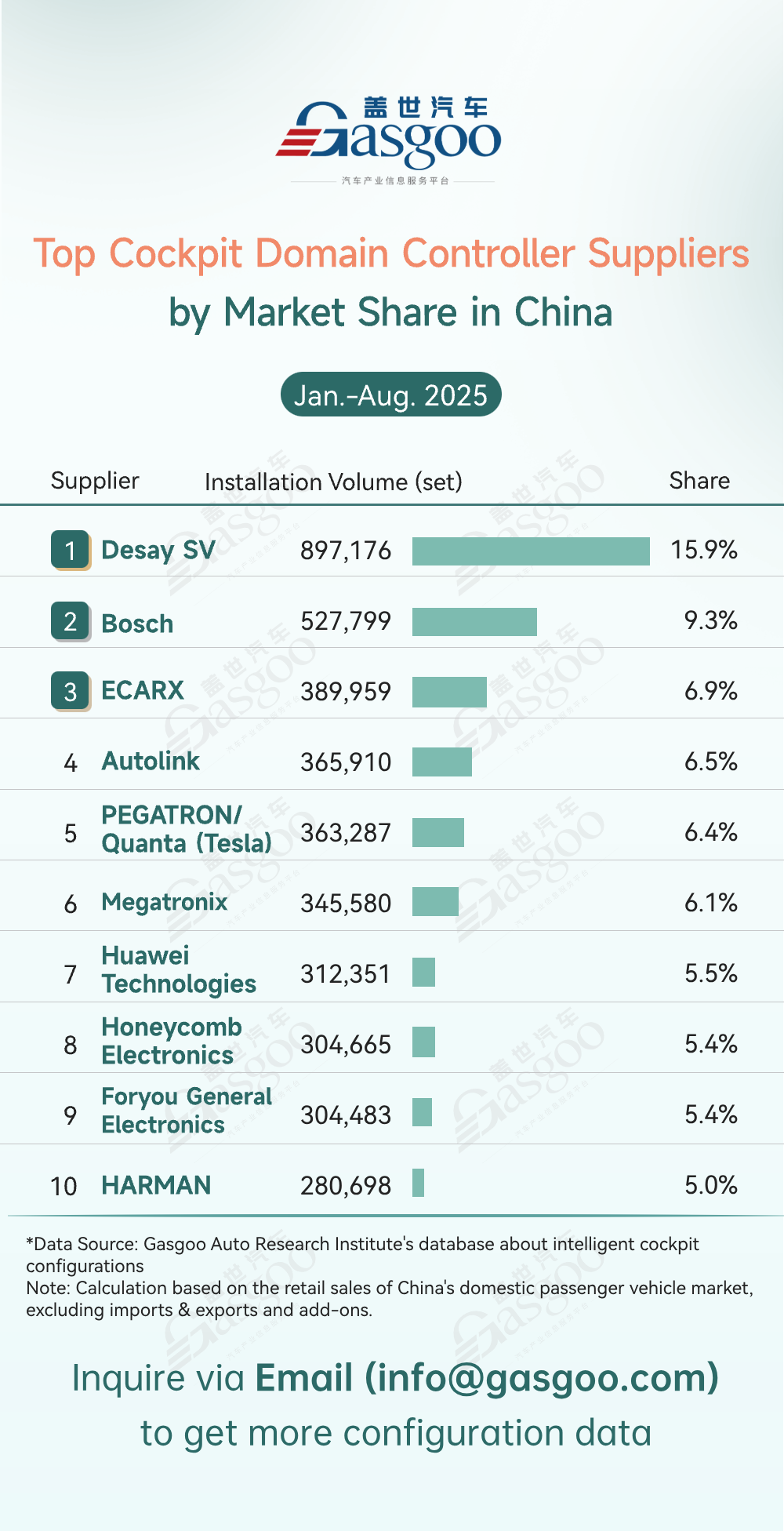

Top cockpit domain controller suppliers

Desay SV: 897,176 sets installed, 15.9% market share

Bosch: 527,799 sets installed, 9.3% market share

ECARX: 389,959 sets installed, 6.9% market share

Autolink: 365,910 sets installed, 6.5% market share

PEGATRON/Quanta (Tesla): 363,287 sets installed, 6.4% market share

Megatronix: 345,580 sets installed, 6.1% market share

Huawei Technologies: 312,351 sets installed, 5.5% market share

Honeycomb Electronics: 304,665 sets installed, 5.4% market share

Foryou General Electronics: 304,483 sets installed, 5.4% market share

HARMAN: 280,698 sets installed, 5.0% market share

From January to August 2025, the cockpit domain controller market continued strong growth, with China's local suppliers gaining a clear advantage. Desay SV led the pack with 897,176 units installed (15.9% share), followed by Bosch at 9.3%. ECARX, Autolink, PEGATRON/Quanta (Tesla) formed the second tier with 6%-7% market share. Huawei Technologies, Honeycomb Electronics, and Foryou General Electronics showed strong competition, reflecting the growing rivalry between tech firms and traditional Tier 1 suppliers.

As the cockpit domain controller market grows and demand for integration and intelligence rises, leading suppliers dominate with scale and technology. China's local suppliers are gaining influence, while competition among traditional Tier 1 players, tech companies, and emerging forces is driving the industry towards greater efficiency and intelligence, resulting in a high-concentration yet increasingly diverse competitive landscape.

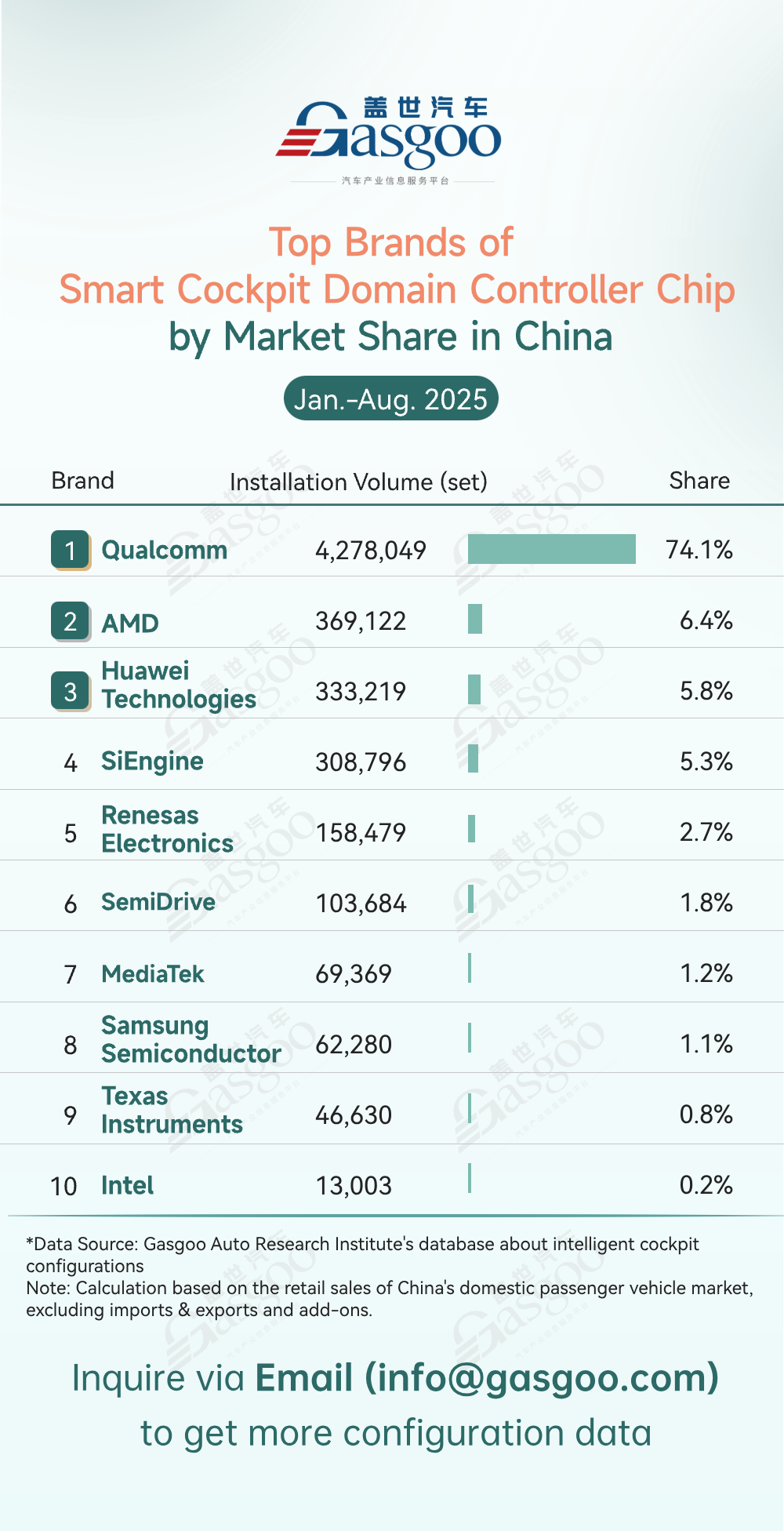

Top brands of smart cockpit domain controller chip

Qualcomm: 4,278,049 units installed, 74.1% market share

AMD: 369,122 units installed, 6.4% market share

Huawei Technologies: 333,219 units installed, 5.8% market share

SiEngine: 308,796 units installed, 5.3% market share

Renesas Electronics: 158,479 units installed, 2.7% market share

SemiDrive: 103,684 units installed, 1.8% market share

MediaTek: 69,369 units installed, 1.2% market share

Samsung Semiconductor: 62,280 units installed, 1.1% market share

Texas Instruments: 46,630 units installed, 0.8% market share

Intel: 13,003 units installed, 0.2% market share

From January to August 2025, the cockpit domain controller chip market saw Qualcomm dominate with over 4.27 million units installed (74.1% share). China's local suppliers like Huawei Technologies, SiEngine, and SemiDrive steadily increased their market share, showcasing the growth and potential of Chinese chipmakers in the automotive sector.

While Qualcomm's dominance remains strong in the short term, Chinese chips are quickly advancing in volume and technology, making China's local substitution increasingly feasible. As local suppliers grow stronger, market competition will diversify, and the industry will evolve toward greater innovation.

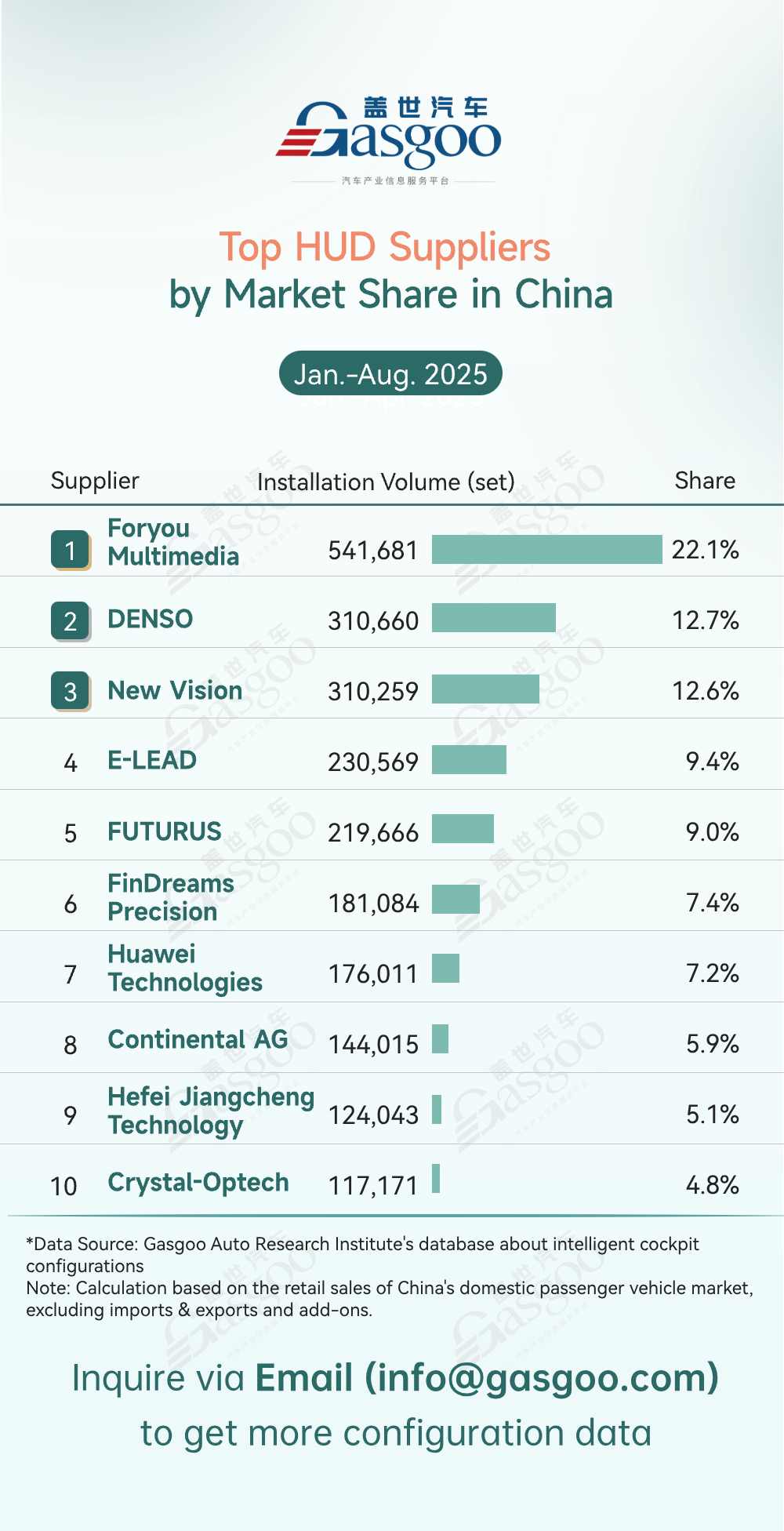

Top HUD suppliers

Foryou Multimedia: 541,681 sets installed, 22.1% market share

DENSO: 310,660 sets installed, 12.7% market share

New Vision: 310,259 sets installed, 12.6% market share

E-LEAD: 230,569 sets installed, 9.4% market share

FUTURUS: 219,666 sets installed, 9.0% market share

FinDreams Precision: 181,084 sets installed, 7.4% market share

Huawei Technologies: 176,011 sets installed, 7.2% market share

Continental AG: 144,015 sets installed, 5.9% market share

Hefei Jiangcheng Technology: 124,043 sets installed, 5.1% market share

Crystal-Optech: 117,171 sets installed, 4.8% market share

From January to August 2025, the HUD market saw a "leading players dominating with diverse competition" pattern. Foryou Multimedia led with a 22.1% market share, followed closely by DENSO and New Vision. E-Lead and FUTURUS were in tight competition around 9% market share, while Chinese players like FinDreams Precision and Huawei Technologies competed alongside traditional Tier 1 suppliers like Continental AG. With support from both local and international players, the HUD market will continue to grow more intelligent and competitive.

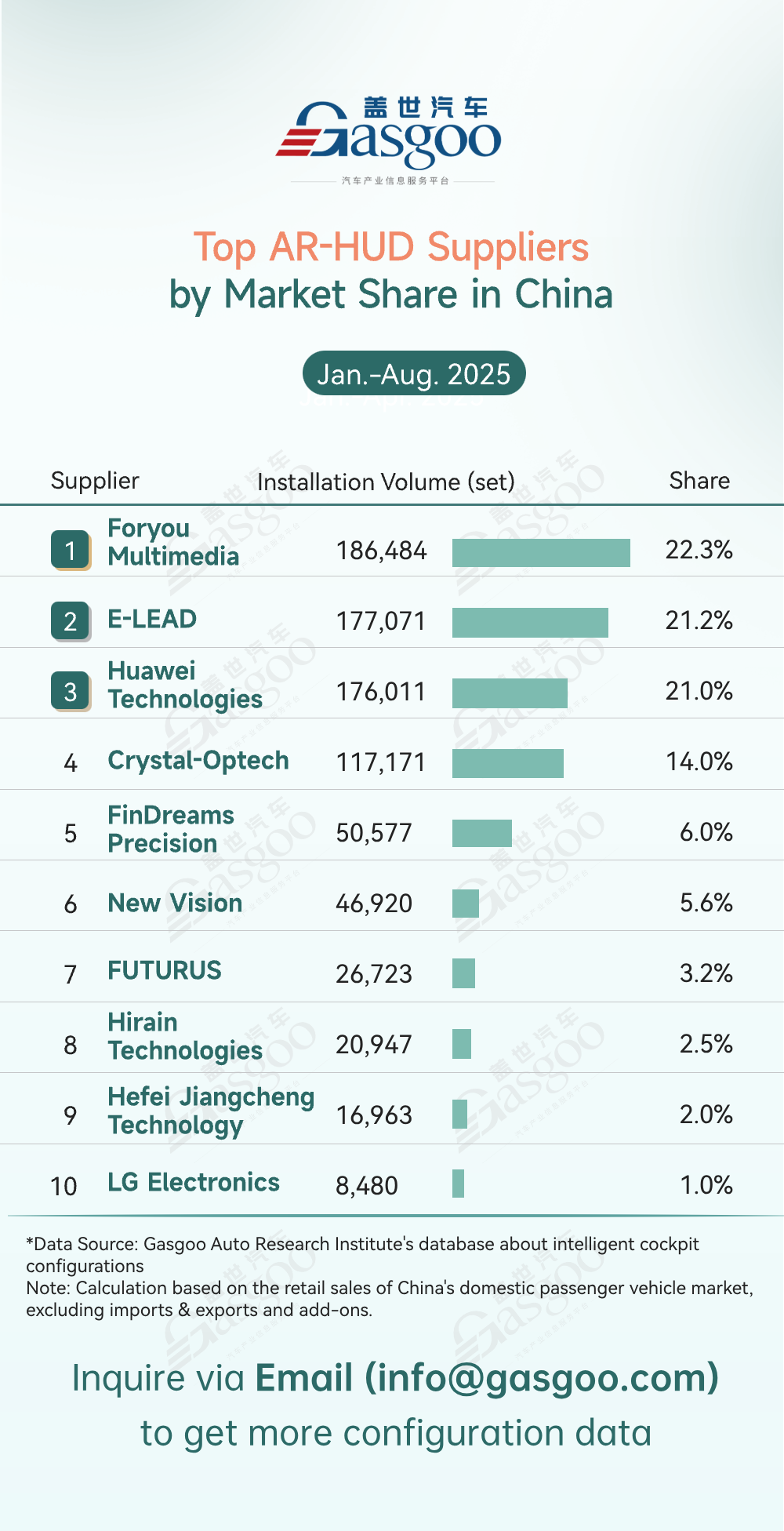

Top AR-HUD suppliers

Foryou Multimedia: 186,484 sets installed, 22.3% market share

E-LEAD: 177,071 sets installed, 21.2% market share

Huawei Technologies: 176,011 sets installed, 21.0% market share

Crystal-Optech: 117,171 sets installed, 14.0% market share

FinDreams Precision: 50,577 sets installed, 6.0% market share

New Vision: 46,920 sets installed, 5.6% market share

FUTURUS: 26,723 sets installed, 3.2% market share

Hirain Technologies: 20,947 sets installed, 2.5% market share

Hefei Jiangcheng Technology: 16,963 sets installed, 2.0% market share

LG Electronics: 8,480 sets installed, 1.0% market share

From January to August 2025, China's local suppliers dominated the AR-HUD market, with Foryou Multimedia, E-Lead, and Huawei Technologies holding over 64% of the market. Chinese companies are driving AR-HUD penetration in passenger vehicles through technological innovation and mass production. While competition remains, mid- and small-sized suppliers must focus on niche applications or differentiated technologies to grow. The China's local substitution trend is clear, with production capacity and cost control becoming key competitive factors as the industry accelerates its adoption of AR-HUD.

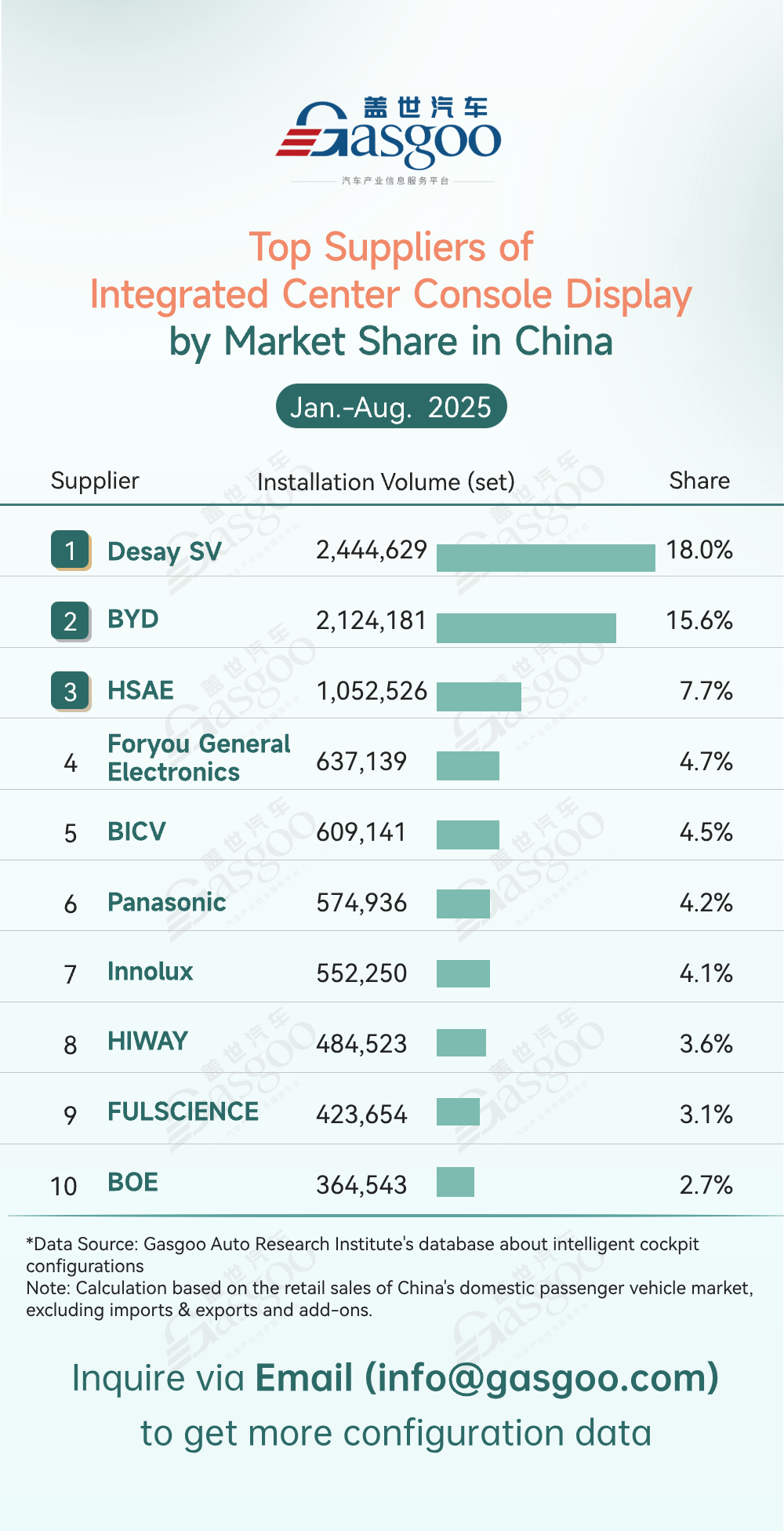

Top suppliers of integrated center console display

Desay SV: 2,444,629 sets installed, 18.0% market share

BYD: 2,124,181 sets installed, 15.6% market share

HSAE: 1,052,526 sets installed, 7.7% market share

Foryou General Electronics: 637,139 sets installed, 4.7% market share

BICV: 609,141 sets installed, 4.5% market share

Panasonic: 574,936 sets installed, 4.2% market share

Innolux: 552,250 sets installed, 4.1% market share

HIWAY: 484,523 sets installed, 3.6% market share

FULSCIENCE: 423,654 sets installed, 3.1% market share

BOE: 364,543 sets installed, 2.7% market share

From January to August 2025, China's local suppliers dominated the integrated center console display market. Desay SV and BYD held over 33% of the market, with other players like HSAE, Foryou General Electronics, and BICV gaining key positions. As the cockpit intelligence trend grows, Chinese suppliers are quickly expanding their market share by leveraging strong market insight and supply chain efficiency, driving the localization process and reinforcing their leadership in core cockpit components.

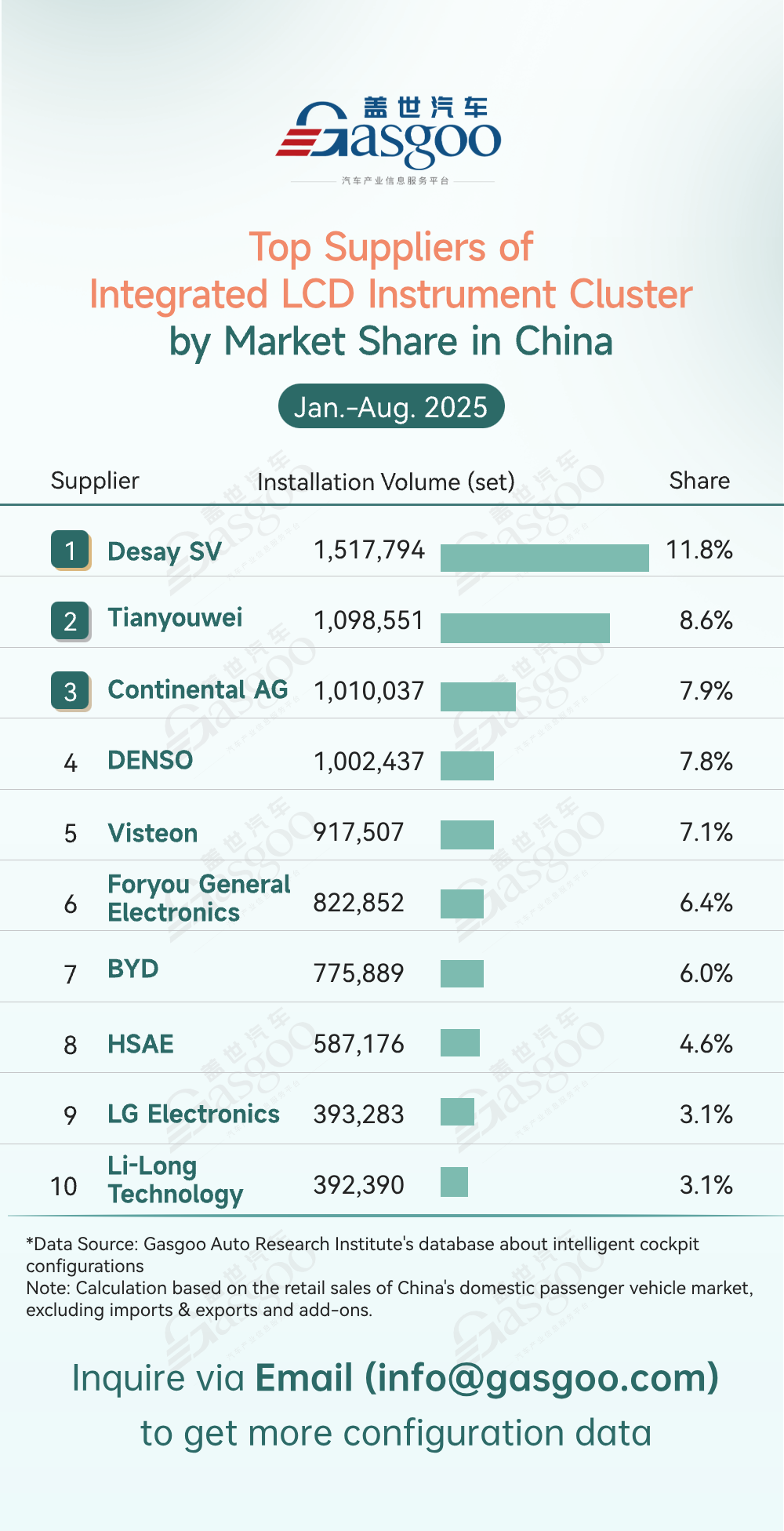

Top suppliers of integrated LCD instrument cluster

Desay SV: 1,517,794 sets installed, 11.8% market share

Tianyouwei: 1,098,551 sets installed, 8.6% market share

Continental AG: 1,010,037 sets installed, 7.9% market share

DENSO: 1,002,437 sets installed, 7.8% market share

Visteon: 917,507 sets installed, 7.1% market share

Foryou General Electronics: 822,852 sets installed, 6.4% market share

BYD: 775,889 sets installed, 6.0% market share

HSAE: 587,176 sets installed, 4.6% market share

LG Electronics: 393,283 sets installed, 3.1% market share

Li-Long Technology: 392,390 sets installed, 3.1% market share

From January to August 2025, the integrated LCD instrument cluster market was highly competitive, with Desay SV leading at 11.8% market share and over 1.51 million units installed. Companies like Continental AG, DENSO, and Visteon followed closely, with shares ranging from 7.1% to 8.6%. China's local suppliers like Desay SV and Tianyouwei are competing strongly with Tier 1 international brands, reflecting the demand for diverse supply and the growing capabilities ofChinese companies in both market share and installation volume.

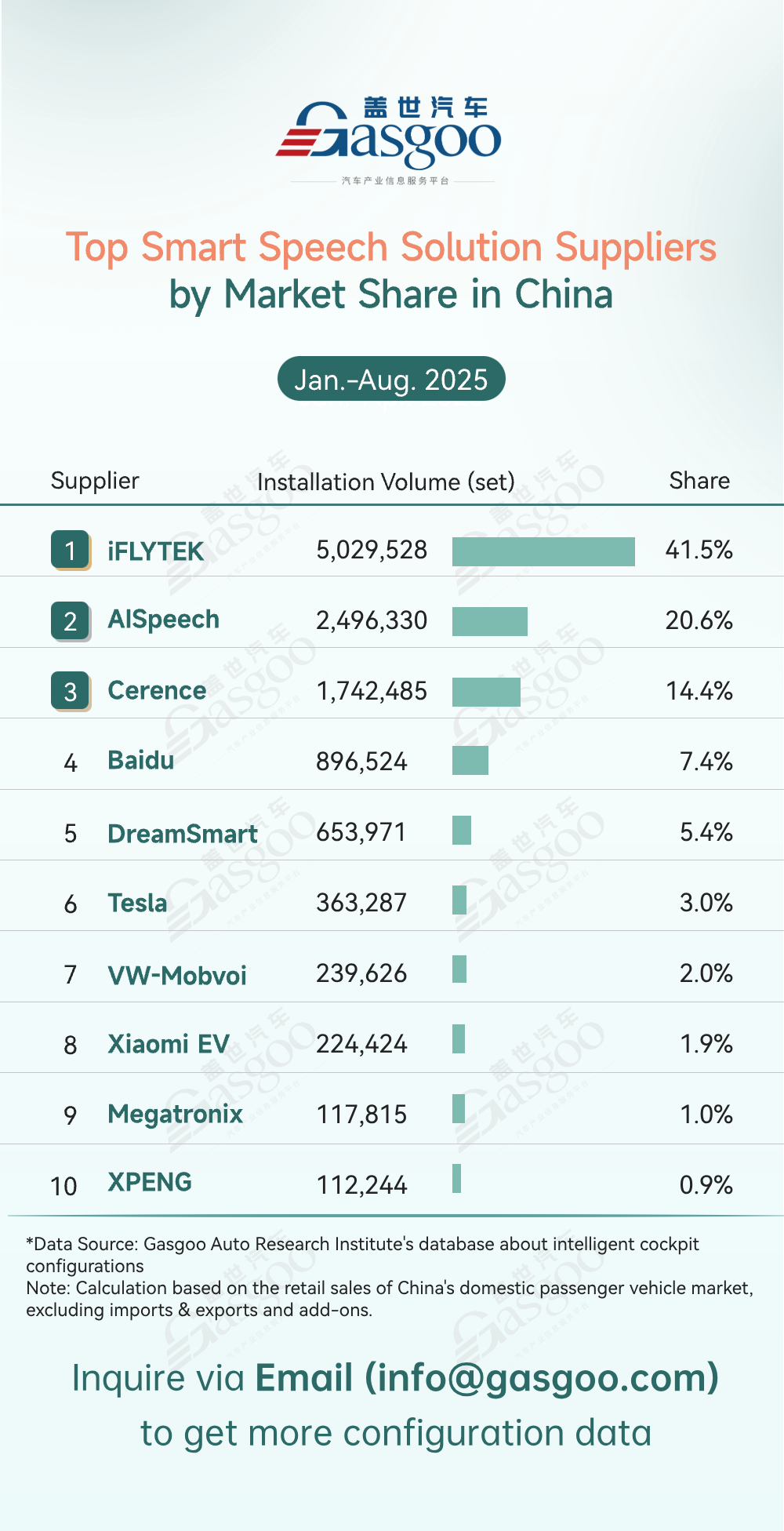

Top smart speech solution suppliers

iFLYTEK: 5,029,528 sets installed, 41.5% market share

AISpeech: 2,496,330 sets installed, 20.6% market share

Cerence: 1,742,485 sets installed, 14.4% market share

Baidu: 896,524 sets installed, 7.4% market share

DreamSmart: 653,971 sets installed, 5.4% market share

Tesla: 363,287 sets installed, 3.0% market share

VW-Mobvoi: 239,626 sets installed, 2.0% market share

Xiaomi EV: 224,424 sets installed, 1.9% market share

Megatronix: 117,815 sets installed, 1.0% market share

XPENG: 112,244 sets installed, 0.9% market share

From January to August 2025, China's local suppliers dominated the smart speech solution market, with iFlytek leading at 5,029,528 sets installed (41.5% share). AISpeech followed with over 20%, fueling the evolution of in-vehicle voice functions. Companies like Baidu and DreamSmart entered the market, while foreign brands like Tesla had limited presence. Chinese suppliers lead due to their technology adaptability, fast service, and deep understanding of local demand. Future competition will focus on tech innovation and integration with the intelligent cockpit, while foreign brands will need stronger localized innovation to gain influence.

Gasgoo not only offers timely news and profound insight about China auto industry, but also help with business connection and expansion for suppliers and purchasers via multiple channels and methods. Buyer service:buyer-support@gasgoo.comSeller Service:seller-support@gasgoo.com