Digital LiDAR Becomes the Go-To Choice for Tens of Thousands of Mass-Produced Robotaxis

Recently, leading Chinese Robotaxi companies such as Pony.ai and WeRide announced expansions into Singapore, Belgium, and other international markets, accelerating global deployment. Baidu's Apollo Go has also revealed partnerships with Uber and Lyft, with plans to launch services in Asia, the Middle East, and Europe. In North America, Robotaxi operations are advancing quickly. Waymo is expanding its network via Lyft, while Lucid, Uber, and Nuro announced plans to deploy up to 20,000 autonomous vehicles within six years, with the first engineering vehicle delivered on September 25.

The year 2025 is widely regarded as the first year of large-scale Robotaxi commercialization. With policy, technology, and market drivers converging, announcements of Robotaxi fleets are increasingly measured in thousands or even tens of thousands of vehicles.

Meanwhile, Robotaxi operations are facing higher expectations than ever, with operators and passengers expecting flawless safety, reliability, and sustainability.

"About 90% of Robotaxi companies worldwide are now using solid-state LiDAR—either already mass-produced or undergoing data collection tests. RoboSense's E1 holds nearly 100% market share in L4 blind-spot coverage," said Mark Xu, Global General Manager of Autonomous Driving at RoboSense, in an interview with Gasgoo. "Almost every Robotaxi model equipped with the E1 is planning to switch its main LiDAR to a high-line-count unit like the 500-beam EM4."

Besides performance, Mark emphasized that large-scale commercialization also demands higher standards for mass production and delivery: "What customers fear most is having a 'solution without a product' or a 'product without sufficient supply.'"

As Robotaxi moves from technical testing to large-scale commercial deployment, the industry landscape is being reshaped. Gasgoo conducted an in-depth interview with Mark Xu, Global GM of Autonomous Driving at RoboSense, to gain deeper insights into the product and technology strategies driving large-scale Robotaxi commercialization.

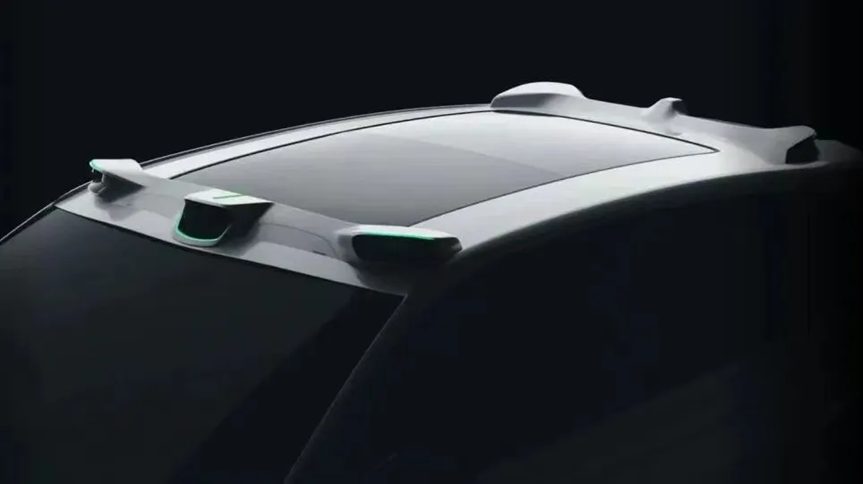

Credit: RoboSense

1. 2025 is defined as the year of large-scale commercialization for Robotaxi. In your opinion, what is the most critical factor driving the changes in the Robotaxi industry from the initial regional trials to full-scale deployment across the entire market?

Mark Xu: We believe that the most critical factors are the convergence of policy, technology, and market forces by 2025. At the policy level, cities such as Beijing, Shanghai, and Silicon Valley introduced regulations in 2025 to support the commercialization of autonomous driving. Technologically, advancements like our company’s EM4+E1 digital lidar system led to significant improvements in performance while greatly reducing costs, making large-scale deployment feasible. On the market side, with users becoming more accepting and mobility platforms like Didi and Uber starting to invest heavily—either through in-house development or partnerships—they plan to start rolling out fleets in the thousands by the end of this year or early next year, with tens of thousands more expected in the next few years. This shows that Robotaxi is finally moving from just testing technology to actually running a commercial business.

2. Is the Robotaxi sector a strategic business for RoboSense? It hasn't been mentioned much before, but now you seem to be working with most Robotaxi companies. Why is that?

Mark Xu : For RoboSense, Robotaxi is not only a key strategic business, but also a critical growth engine for the company.

We've always taken a pragmatic approach. Our M-series LiDAR has ranked No.1 in ADAS deliveries over the past few years. When Robotaxi companies first shifted to solid-state LiDAR (instead of mechanical units), they often started with our M1P. For example, the L4 project in Guangzhou jointly run by Pony.ai and ONTIME, WeRide's first solid-state LiDAR program, and Baidu's fifth-generation Apollo Go—all adopted our products, which perfectly matched their mass-production needs at that stage.

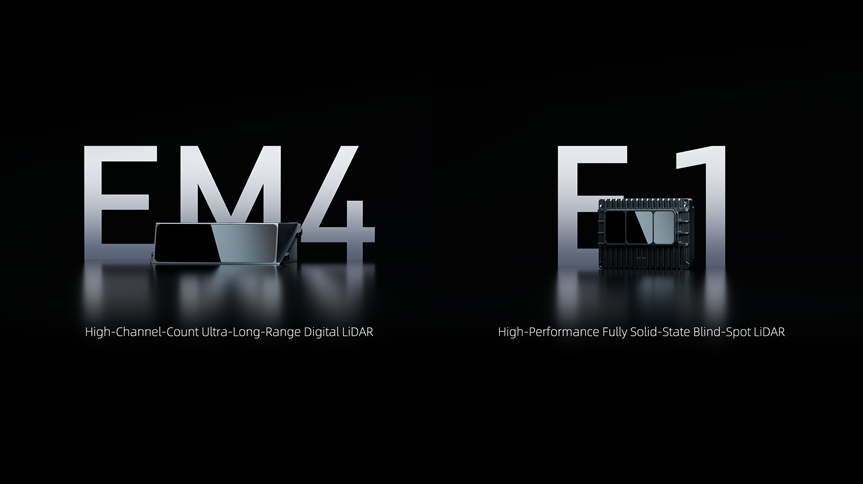

Now, with large-scale Robotaxi commercialization, our fully solid-state blind-spot LiDAR E1—the only automotive-grade mass-produced solution in the industry—meets the need for scaled deployment. Meanwhile, our 500-line high-line-count EM4 main LiDAR addresses long-range, high-precision perception required in continuous operation. Robotaxi companies across the board are moving over to the EM4+E1 combo.

About 90% of Robotaxi companies worldwide are now using solid-state LiDAR—either already mass-produced or undergoing data collection tests. RoboSense’s E1 holds nearly 100% market share in L4 blind-spot coverage, significantly ahead of competitors. Moreover, as previous-generation 128-beam main LiDAR can no longer meet the performance demands of the Robotaxi industry, almost every Robotaxi model equipped with the E1 plans to upgrade its main LiDAR to a high-line-count unit like the 500-beam EM4. In China, our partners include Didi, Baidu, Pony.ai, and WeRide, while overseas partners include Uber and Lucid. There are also some large-scale L4 clients abroad that we cannot disclose publicly.

3. EM4+E1 is selected by many leading Robotaxi companies as the preferred perception solution. Beyond performance specs, what key factors influence their decision? What gives RoboSense an edge over competitors?

Mark Xu: Beyond performance, customers value real mass-production capability. Our decisive advantages are product maturity and supply reliability.

EM4 is the only mass-produced 500+ beam LiDAR, and E1 is the only mass-produced fully solid-state blind-spot LiDAR. Both are already in large-scale production and delivery—unique in the industry.

Previous-generation LiDARs have lower line counts and insufficient performance, while competitors' next-generation products are mostly still at the concept or prototype stage. Robotaxi companies want fleets ready for deployment; they fear "solutions without products" or "products that can't be delivered." Our EM4+E1 combination is currently the only solution that meets both high performance and large-scale deployment needs.

Credit: RoboSense

4. We noticed that in this combination, EM4 serves as the main LiDAR while E1 acts as the blind-spot LiDAR. When working together, how do they achieve a "1+1>2" effect? For example, in point cloud stitching, functional redundancy, or handling extreme scenarios, what unique system-level advantages do they offer?

Mark Xu: The core logic of this combo is "long-range precise detection + near-field full coverage," enhanced further through technology fusion to elevate perception capabilities. In terms of division of labor, EM4, as the main LiDAR, is responsible for "seeing far and clearly." Typically, one unit is installed at the front, rear, and sides of the vehicle, covering the mid- to long-range surroundings and giving autonomous driving ample decision-making time. E1 focuses on addressing near-field blind spots. Arranged in a 360° layout, it forms a close-range protective net, delivering high-density point clouds. Through underlying hardware synchronization and algorithmic fusion, point cloud data is efficiently stitched and temporally synchronized, creating full-coverage perception. This setup also provides redundancy in extreme conditions, offering capabilities far beyond a single LiDAR configuration.

5. If competitors claim to achieve similar performance, how does RoboSense's EM4+E1 combination maintain its position as customers' top choice? What are the most difficult-to-replicate core barriers?

Mark Xu: The most difficult-to-replicate core barrier is our self-developed chip capability, which, combined with our large-scale production system, took years of investment to establish. It requires long-term technical accumulation and substantial capital—it's not something that can be achieved overnight.

In terms of chip development, we began focusing on LiDAR core chips back in 2017. Today, we have achieved full in-house development across the entire chain—from laser emission and scanning control to signal reception—and have obtained AEC-Q series certification. Even more critical is our iteration speed: the next-generation chip is already in development and is expected to launch next year, allowing us to maintain at least a one-year lead continuously.

Next is our ecosystem advantage. We are the only LiDAR company globally integrated into all three of NVIDIA's ecosystems. Both EM4 and E1 are embedded in the NVIDIA DRIVE AGX computing platform, which is currently used by companies such as Pony.ai, WeRide, Aurora, and Nuro. This "hardware + computing power" synergy provides a significant edge.

Finally, there is our scenario know-how. We work closely with clients to deeply understand real-world scenarios and define products accordingly. This kind of hands-on experience in solving actual problems cannot be gained from a few demos or purely conceptual designs.

6. Speaking of barriers, is self-developed chip technology the key to achieving high performance and large-scale production? What generational advantages does it bring to RoboSense in terms of cost, performance, and reliability?

Mark Xu: Absolutely. Self-developed chips are indeed key to achieving both high performance and large-scale production, providing us with generational advantages. In terms of performance, chip integration enables a fully digital signal chain, with processing latency controlled under 10ms—nearly twice as fast as the industry average. Moreover, by integrating large-array SPAD-SoC chips, the quality of point clouds is greatly improved. For instance, EM4’s native high-resolution point clouds are far more stable and accurate in detail recognition compared to “virtual high-line-count” LiDARs using algorithmic interpolation or 2D scanning LiDARs with mechanical rotation. Performance upgrades also benefit from clear pin-to-pin iteration advantages, allowing gradual improvements without affecting commercial operations of Robotaxi clients.

In terms of cost, replacing off-the-shelf chips with in-house developed chips significantly reduces material costs. High integration also simplifies the structure, lowering production costs. Regarding reliability, the highly integrated chip reduces the number of external components, making the system more stable and greatly extending its lifespan.

Compared to traditional solutions, our SPAD-SoC chips greatly simplify the system and reduce power consumption, while allowing LiDAR performance to follow Moore’s Law. This chip-level leadership directly translates into a generational leap in our products.

Credit: RoboSense

7. Robotaxi operators are most concerned with reliability in extreme scenarios. In real-world road tests, how has the EM4+E1 combo performed when encountering small objects over 10 cm high, low-lying obstacles, or challenging conditions like strong light and rain/fog? What performance or data validations have impressed your clients?

Mark Xu: Exactly. That's precisely the value of the EM4+E1 combo. Robotaxis are operating vehicles, so any perception failure that leads to an accident or service disruption carries extremely high costs. Safety must be foolproof, and passenger experience must also be considered. For example, a small rock just over 10 cm high can damage the chassis or wheels and create bumps that negatively affect passenger comfort. Likewise, sudden rain or strong sunlight that blinds cameras must be handled while still ensuring passengers reach their destinations safely. Even for these corner cases that Robotaxi clients care about, previous-generation 128-beam LiDARs cannot solve the problem. Some competitors have tried simulating higher line counts with interpolation, but these "virtual high-line-count" do not meaningfully improve resolution or reliability.

With over 520-beam, EM4's ultra-high line count can clearly detect small objects as small as 13x17 cm at up to 130 meters, and identify tires at 170 meters, mitigating risks from small obstacles. EM4 also uses digital filtering technology, maintaining over 60 meters of effective ground detection even in extreme rainy nights—compared to only 10 meters for previous-generation 128-beam LiDARs. It effectively removes rain noise and provides clear environmental information, ensuring safe vehicle operation.

Blind-spot LiDAR is also critical. A severe accident involving Cruise, for example, occurred because the LiDAR failed to detect a person lying on the road. Similarly, children, pets, small obstacles, or fallen pedestrians that suddenly appear near the vehicle often fall into the blind spots of main LiDARs. High-line-count, wide field-of-view blind-spot LiDARs like E1 cover these areas effectively. Clients are highly satisfied with E1's ultra-wide field of view, 144-line high-line-count coverage, and automotive-grade solid-state design. A compact E1 unit can be seamlessly integrated—4 to 6 around a RoboTaxi—providing near-field, full-coverage perception and effectively addressing these scenarios.

8. The Robotaxi market is expanding rapidly worldwide. How has the EM4+E1 combo been received in different regions such as North America, Europe, and the Middle East? How is RoboSense addressing these global challenges, and what proactive measures have been taken?

Mark Xu: We have already established a deep presence in key markets across North America, Europe, and the Middle East. Each region has its own requirements for scenarios, compliance, and environmental reliability. From the product design stage, we take global certification standards and regional requirements into account to ensure worldwide adaptability. We also conduct thorough testing based on customer needs to ensure smooth operation locally. For example, Uber's networks in Europe and the Middle East, as well as fleets from WeRide and Pony.ai equipped with our products, have been able to roll out quickly. This demonstrates the advantages of ecosystem collaboration.

Gasgoo not only offers timely news and profound insight about China auto industry, but also help with business connection and expansion for suppliers and purchasers via multiple channels and methods. Buyer service:buyer-support@gasgoo.comSeller Service:seller-support@gasgoo.com