Analysis: Financial situation of China's listed dealer networks

Gasgoo.com (Shanghai) - Gasgoo.com (China) has recently made a rough analysis of the performances of China's major dealer networks. There are currently seven publicly listed dealer networks active in the country now, Pangda, Zhongsheng, ZhengTong, Lentuo, Yaxia, Zhejiang Yuantong and China Automobile Trading. Among them, Yuantong and China Automobile Trading are backdoor listed companies whose sales business is relatively small. Therefore, the analysis will only focus on the five remaining enterprises.

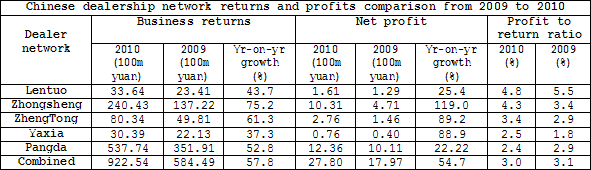

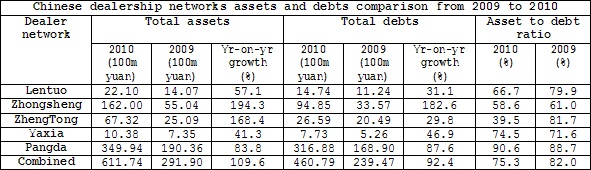

According to compiled statistics, the five companies in question had an average net profit to returns and current assets to liability ratios lower than the average for listed automobile manufacturers (3.0% and 1.07% compared to 4.9% and 1.14%). Additionally, the average asset to debt ratio was higher than automobile manufacturers (75.3% compared to 61.9%).

When looking at growth in industry returns, Zhongsheng made the largest gains from 2009 to 2010 (13.72b yuan to 24.04b yuan, an increase of 75.2%), while Lentuo's net profit increased the greatest amount (471m yuan to 1.03b yuan, a 119.0% increase). ZhengTong's growth of 61.3 percent in returns and 89.2 percent in net profit placed it second in both categories.

Pangda also managed growth rates in both categories of above 50 percent. Meanwhile, Yaxia and Lentuo saw return growth rates of under 50 percent. Yaxia, however managed a net profit growth rate of 88.9 percent.

Regarding asset and debt rates, the five dealers managed an average asset growth rate of 109.6 percent, while debts increased 92.4 percent on average from 2009. The asset to debt ratio was 75.3 percent, 6.7 percent lower than in 2009.

ZhengTong saw the greatest decrease in asset to debt ratio, falling a massive 81.7 percent to 39.5 percent. Lentuo's asset to debt ratio decreased the slowest amount. On the other hand, Yaxia and Pangda saw their asset to debt ratios rise from 71.6 percent to 74.5 percent and 88.7 percent to 90.6 percent, respectively.

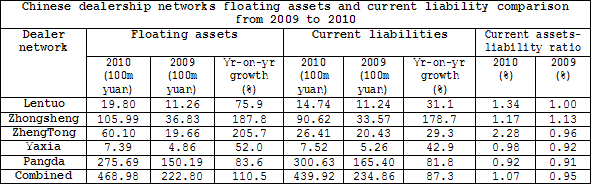

The total amount of floating assets and current liabilities for the five companies were 46.9 billion yuan and 43.9 billion yuan, respectively. The amount of floating assets over doubled in the two year time period. The growth rate for assets was much higher than for liabilities.

ZhengTong's floating assets grew the fastest at an astounding 205.7 percent. It was followed by Zhongsheng, whose liability rate was the highest among the five manufacturers. A balanced rate between assets and liabilities is a strong indication of an industry's financial ability in the short-term. A high ratio indicates that a company is able to guarantee that debts will be paid back. However, an excessively high ratio may be indicative of too much invested in static assets, which may ultimately hinder a company's profits.

Gasgoo not only offers timely news and profound insight about China auto industry, but also help with business connection and expansion for suppliers and purchasers via multiple channels and methods. Buyer service:buyer-support@gasgoo.comSeller Service:seller-support@gasgoo.com