Tesla outsold by top 6 Chinese NEV startups by Aug. insurance registrations

Shanghai (Gasgoo)- In August 2021, China's insurance registrations of locally-produced new energy passenger vehicles (NEPVs) stood at 228,855 units, soaring 143% year on year, while also climbing 6.8% month on month, according to the China Banking and Insurance Regulatory Commission (CBIRC).

The NEPV registrations for the month of August consisted of 178,779 battery electric vehicles (BEVs) and 39,620 plug-in hybrid electric vehicles (PHEVs), which include 10,456 range-extended electric vehicles (REEVs).

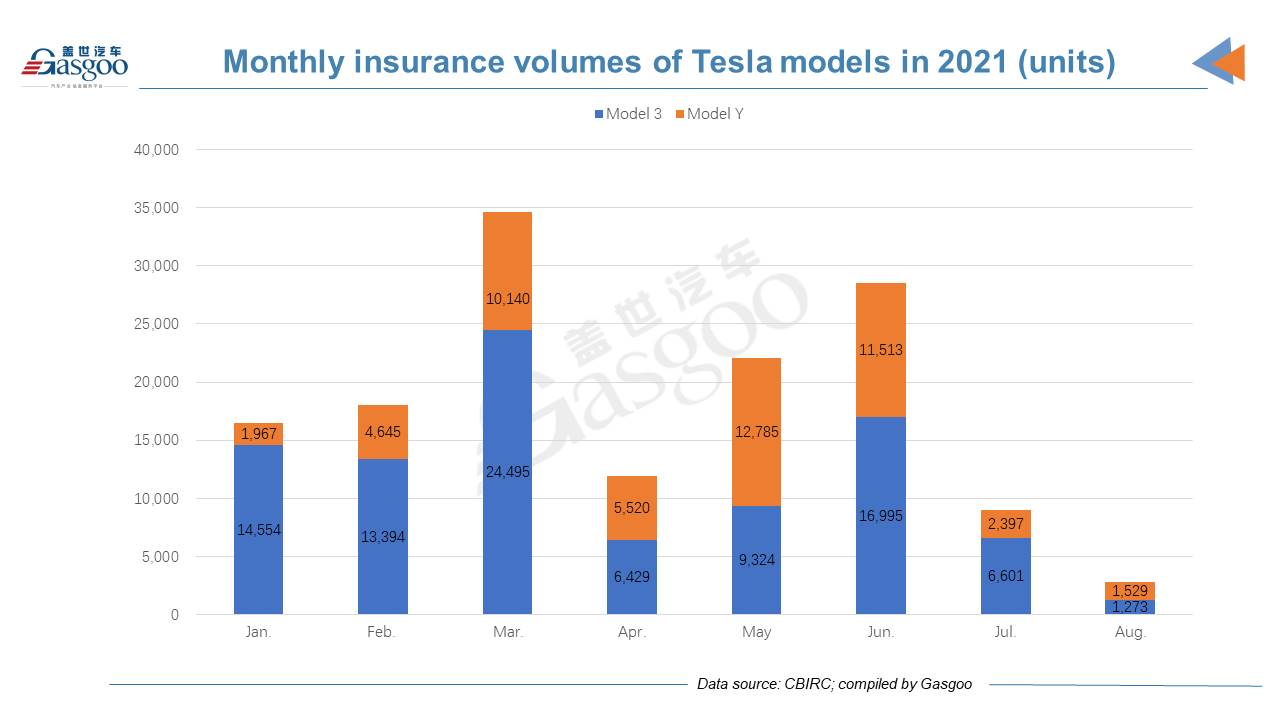

In August, Tesla saw its China-made vehicle registrations plunged 69% from the previous month to 2,802 units, hitting the lowest monthly level since February 2020, when the country was at the height of the coronavirus pandemic. It even failed to outsell WM Motor, the last one of the top 6 Chinese NEV startups by Aug. registrations, leading to a very rare result that has never appeared before.

The dismal registrations were much inconsistent with the data offered by the China Passenger Car Association (CPCA), which revealed the domestic wholesales of Tesla's China-made vehicles should reach 12,885 units in August.

The automaker received numerous inquiries about the big discrepancy from Internet users. “The report about ‘Tesla's China registrations were around 2,000 units are untrue”, Tesla replied via its Weibo account, while didn't explain the data gap.

The CBIRC's data show that the registrations of the China-made Model 3 were 1,273 units in August, which were quite close to the 1,309 units reported by the CPCA. Thus, the sales disparity should mostly flow from the Model Y's data.

Model Y Standard Range; photo credit: Model Y

Some industry insiders said the sales gap may partly result from the time difference between consumers paying the balance and buying insurance for cars. Usually, a buyer should pay the balance first and then purchase insurance about 2 days before picking up his car. As the delivery of the Model Y Standard Range began in late August, many consumers did not have their cars registered and licensed in the month-end period after fulfilling payments. If the CPCA's data were the numbers about the payment completion, it seems to make sense that the sales from the CPCA were much higher than the CBIRC's insurance volume.

However, this is just guesswork. We will be closely watching to see how Tesla's registrations will change in following months.

As for the landscape of the top 6 Chinese NEV startups in August, Li Auto still maintained its championship, while NIO was transcended by XPeng. It is also worth mentioning that HOZON Auto, which was previously seen as a so-called “second-tier” startup, saw its registrations exceed 6,000 units, only 435 units fewer than that of NIO, one of the so-called “first-tier” members.

Last month, Li Auto, still with only one model for sale, for the first time witnessed its monthly registrations top 9,000 units and shattered monthly record for the third month in a row. This volume made it the No.6 car brand by Aug. registrations of locally-built NEVs.

The Li ONE was the second runner-up among China-made NEV models by Aug. registrations.

Despite the popularity of the Li ONE, the automaker has never claimed itself as a staunch supporter of REEV technical route. In the opinion of Shen Yanan, co-founder and president of Li Auto, the choice of technical routes matter little as the targets for industry players are same—advancing the NEV industry and achieving carbon neutrality.

Mr. Shen said, at a recent industrial conference, most car owners drove the Li ONE as an all-electric car in fewer-than-100-km trips. In Beijing, the Li ONE has already been treated as a replacement of oil-fueled cars.

Last month, XPeng climbed to the runner-up place, while it still posted a 10% decrease from the previous month.

The decline was largely attributed to the 47% month-on-month slump in the G3's registrations. According to XPeng's statement, the company last month began the production transition for the G3 SUV to the G3i, the mid-cycle facelift version of the G3. As a result, deliveries of the G3 were affected in August.

With 73 units registered last month, the XPeng P5, the startup's third mass-produced model, was for the first time recorded by the CBIRC. Boasting two LiDAR devices, the all-electric family sedan is expected to be another sales contributor to XPeng after it scale delivery kicking off in October.

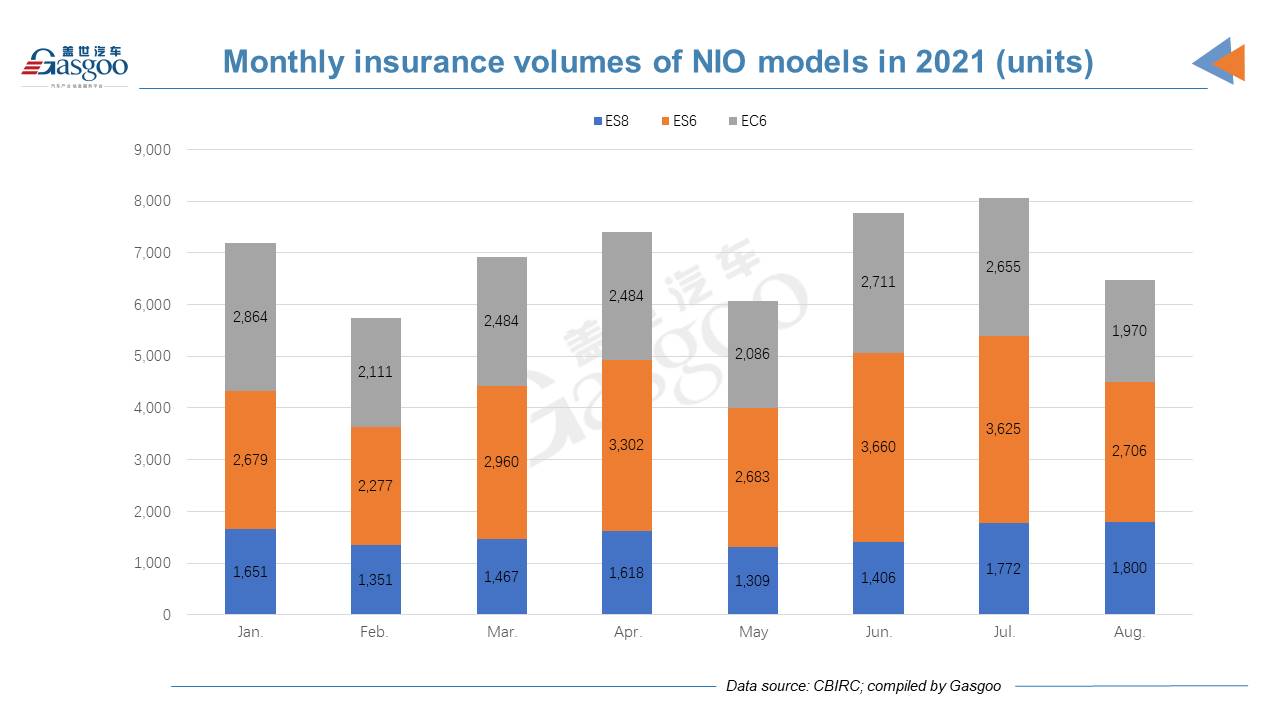

On the list of Chinese NEV startups, NIO dropped to the No.3 spot with its Aug. registrations shrinking 19.6% over a month earlier to 6,476 units. Among car brands by Aug. registrations of China-made NEVs, NIO ranked 11th, only two spots higher than HOZON Auto's NETA.

As for performance of its three models, only the ES8 posted a slight growth in Aug. registrations month on month, while both the ES6 and the EC6 suffered around 25% decrease. According to NIO, the vehicle production, especially the manufacturing of the ES6 and EC6, was materially disrupted by supply chain constraints resulting from the COVID-19 pandemic in certain areas in China and Malaysia.

In light of the continued uncertainty and volatility of semiconductor supply, NIO expects to deliver roughly 22,500 to 23,500 vehicles in the third quarter of 2021, revised from the previous outlook of 23,000 to 25,000 vehicles.

In August, HOZON Auto once again recorded an insurance volume above 6,000 units. Its cumulative registrations for the first eight months exceeded the full-year volume for 2020.

Regarding the contribution of the three models, the NETA V accounted for 74% of the startup's total registrations in August. The model ranked 16th among locally-built NEV models by Aug. insurance volume.

Last month, HOZON Auto saw its 60,000th new car roll off the production line, around 3 years after the birth of the first vehicle. The milestone signified that the startup has been well prepared for intelligent and scale production in terms of both car manufacturing and supply chains.

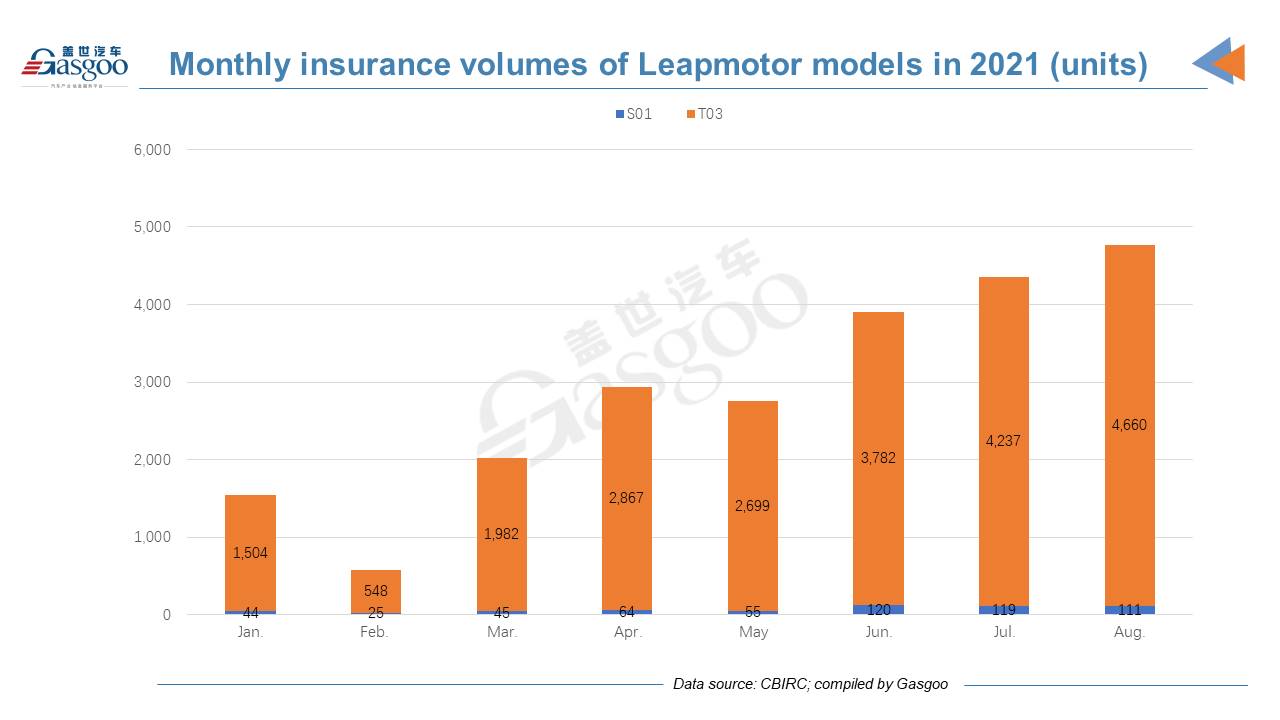

Leapmptor's monthly registrations rose 9.5% month over month to 4,771 units in August, 97.7% of which were the T03s.

The startup said its order volume in August amounted to 7,607 units, jumping 16% over the previous month and resulting in a year-to-date volume of 35,662 units.

WM Motor also had new product recorded by the CBIRC, namely, the E.5. The new model hit the market as the company's first vehicle designed for mobility services.

According to the CBIRC's data, among the 81 E.5 sedans registered last month, 20 units were put for car rental service and 54 units were registered by B2B users.

Gasgoo not only offers timely news and profound insight about China auto industry, but also help with business connection and expansion for suppliers and purchasers via multiple channels and methods. Buyer service:buyer-support@gasgoo.comSeller Service:seller-support@gasgoo.com