XPeng, Li Auto surpass NIO by 2021 registrations

For the year of 2021, registrations of locally-made new energy passenger vehicles (NEPVs) in China amounted to 2,894,229 units, leaping 165% from a year ago, according to the data compiled by Gasgoo Auto Research Institute.

In Dec. 2021, China saw its monthly registrations of locally-built NEPVs hit a new high of 481,642 units, representing a robust surge of 115% year-on-year.

The Dec. homegrown NEPV registrations were composed of 397,716 battery electric vehicles (BEVs), 83,919 plug-in hybrid electric vehicles (PHEVs), which included 17,837 range-extended electric vehicles (REEVs), as well as 7 fuel cell vehicles (FCVs).

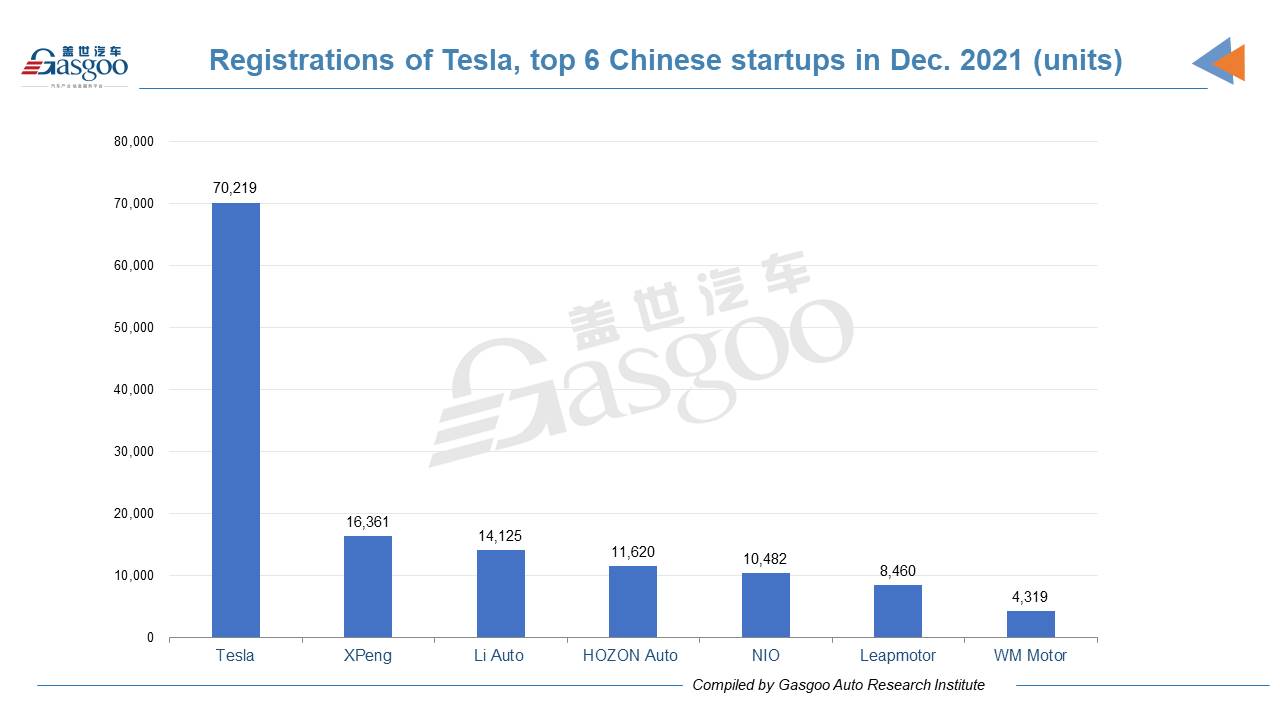

Among startups (including Tesla), the U.S. EV manufacturer achieved highest-ever monthly registrations of China-made vehicles at 70,219 units in Dec. 2021, which were even more than the totals of the top 6 Chinese NEV startups. Among all auto brands, it was honored the runner-up in terms of Dec. locally-built NEPV registrations, only following BYD.

The top 6 China's indigenous NEV startups all recorded highest-ever monthly registrations in Dec. Compared to the previous month, XPeng and Li Auto still held the first two spots, while NIO dropped to the fourth with the second runner-up place replaced by HOZON Auto.

After compiling twelve months of data, Gasgoo found out that Tesla’s annual registrations of China-made cars were more than the sum of the top 3 Chinese NEV startups’ volumes. NIO, who outsold other Chinese NEV startups for the first eleven months of 2021, failed to maintain the leadership at the end of the year. It was outperformed by XPeng and Li Auto, while the difference among the three firms was not significant.

Although Tesla said last year it had made Gigafactory Shanghai its primary vehicle export hub, the company's leading presence in China's domestic NEV market has not been whittled down. With only two production models, Tesla accounted for 14.6% and 10.8% of China's overall homemade NEPV registrations in Dec. and 2021 respectively.

Notably, the China-made Model Y completed its maiden year on Chinese market with yearly registraions topping 160,000 units. In Dec., it was the second hottest-selling NEPV model in China, only following SGMW's Wuling Hongguang MINIEV.

One major issue confronting Tesla China now is how to boost manufacturing capacity to meet the rapid rise in demands for both domestic markets and exports. Tesla's Shanghai factory was designed to output up to 500,000 cars a year, and currently has the capacity of producing Model 3s and Model Ys at a rate of 450,000 total units annually. In a document Tesla published in last Nov. on a Shanghai governmental platform, it plans to plow 1.2 billion yuan ($189.588 million) in a capacity expansion project at its Shanghai factory, which will allow Tesla to add 4,000 employees.

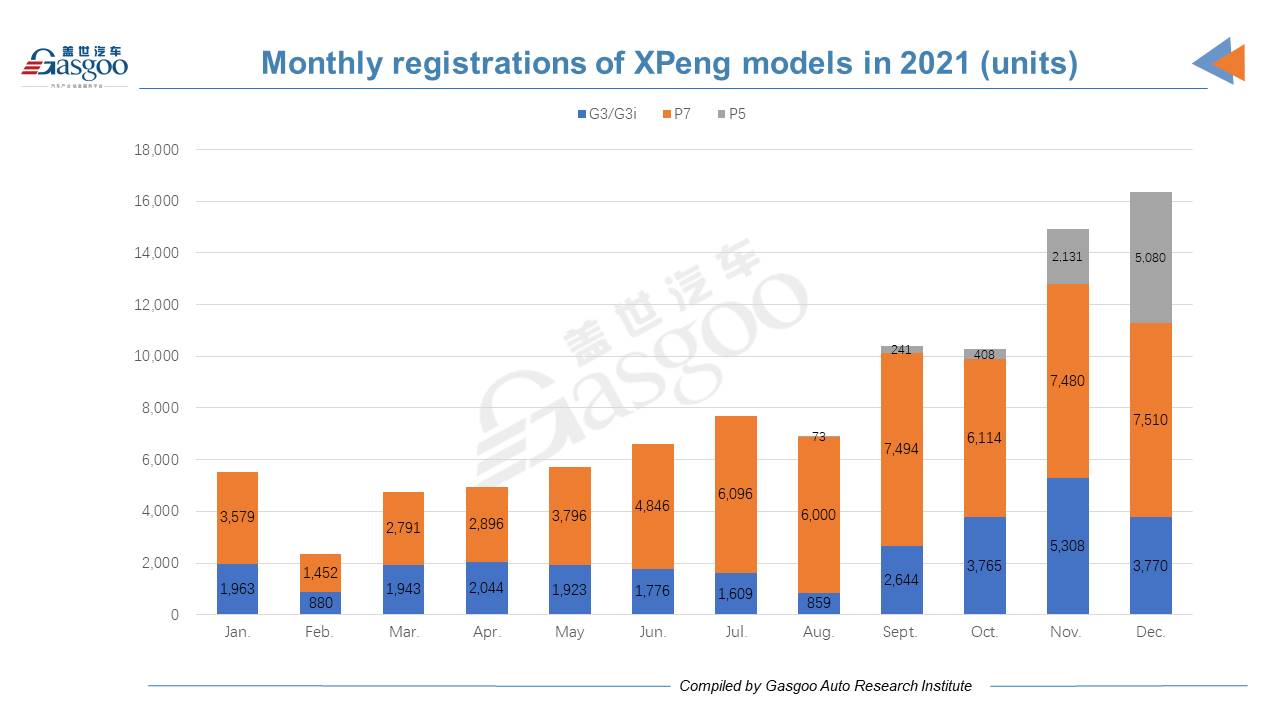

Despite multiple challenges like the COVID-19 resurgence and chip shortage, XPeng ranked highest among Chinese NEV startups by annual registrations and boasted a precipitous year-on-year hike of 490% in yearly registrations.

XPeng's remarkable sales owed much to its reasonable product matrix. Three mass-produced models cover both sedan and SUV segments with prices ranging from 150,000 yuan ($23,700) to 400,000 yuan ($63,200).

XPeng P5; photo credit: XPeng

With scale delivery beginning in last Oct., the P5 recorded registrations of 5,080 units in Dec. with a blooming leap of 138.4% month-over-month, serving as a key driver of XPeng's year-end sales sprint.

As XPeng's first production model, the G3 faced relatively weak demands during the first half of 2021. To reverse the slowdown, the startup put the G3i, the mid-phase facelift version of the G3, onto the market in last July. Powered by the fresh force, monthly registrations of the G3 series was standing above 3,700 units for the fourth quarter. The G3i accounted for 97% of total G3's registrations in Dec.

The G9, XPeng's fourth production model and first flagship model targeting global markets, was unveiled in last Nov. Delivery of the model may kick off in the third quarter of 2022 to further spur XPeng's sales.

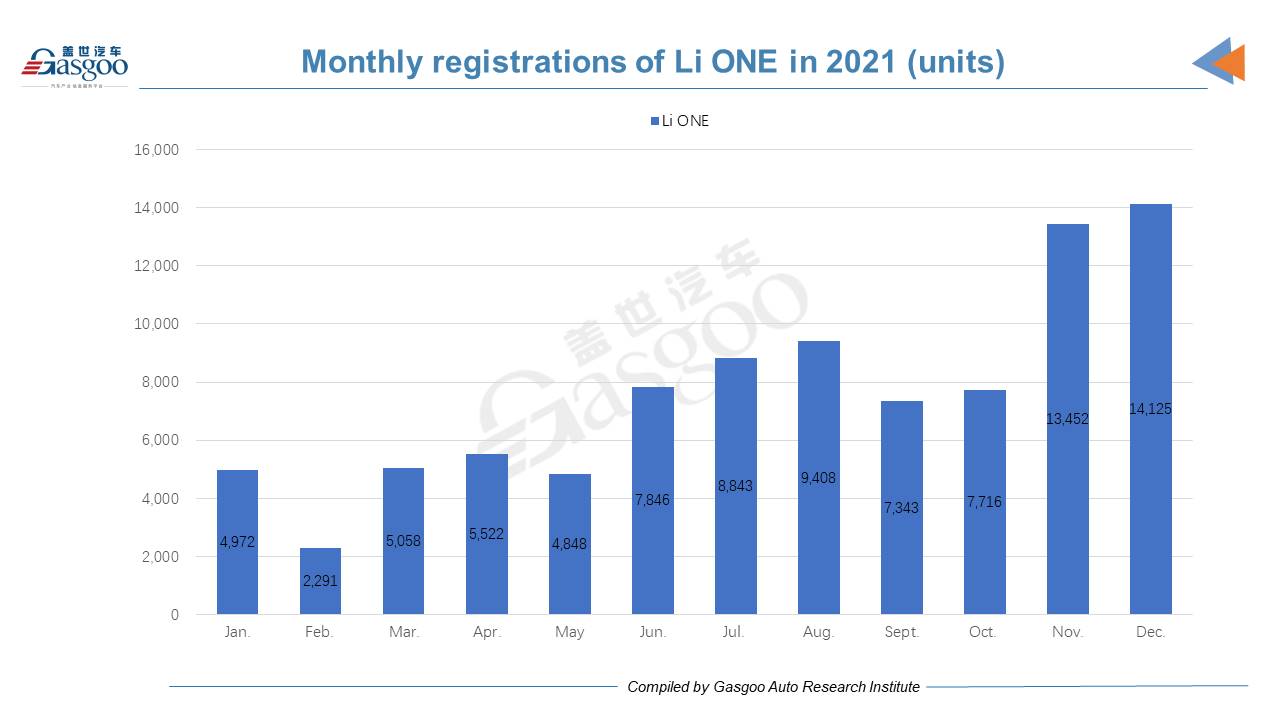

With only one production model for sale, Li Auto ranked ninth among auto brands in China regarding Dec. registrations of domestically-built NEPVs. From the perspective of products, the Li ONE was the No.6 made-in-China NEPV model and No.1 Chinese-startup-owned model by Dec. registrations.

Li ONE; photo credit: Li Auto

There is an interesting opinion which says the Li ONE's success mainly stems from the company's endeavors to reshape consumers' cognition over some points already common to today's auto industry.

For instance, in traditional cognition, users apt to choose the model with more seats or larger size, but Li Auto forwent the 7-seater version when launching the 2021 Li ONE with only one 6-seater version reserved. The company kept delivering to users this idea that, in the same cockpit, the 6-seater arrangement will offer greater seating experience than that of the 7-seater one. Thus, the separate seats in the second row and the wide aisle become two important selling points.

Additionally, to further improve users' in-car experience, Li Auto released the OTA 3.0 update last month. This update includes the company’s full-stack and self-developed Navigation on ADAS (NOA).

Although NIO obtained its best-ever monthly registrations in Dec., it failed to get the honor of the No.1 Chinese NEV startup by annual registrations.

The high-profile startup was for the first time surpassed by both XPeng and Li Auto in last August. By the end of Dec. 2021, NIO had lagged behind the two rivals for three straight months.

NIO's monthly registrations plunged to 2021’s lowest-level in October mainly due to the reduction in production volume as a result of the restructuring and upgrades of manufacturing lines at its Hefei car plant. The retooling work has already been completed to double the capacity of its Hefei plant to 240,000 vehicles a year.

In addition, NIO's second manufacturing plant, located at Hefei Xinqiao Smart Electric Vehicle Industrial Park, is expected to start production in third quarter this year. The two plants are designed to feature a total production capacity of up to 600,000 cars per year, William Bin Li, Chairman and CEO of NIO, revealed at the latest quarterly earnings call, indicating NIO is not struggled with manufacturing capacity issue.

One main crisis afflicting NIO is chip supply constraint, which is also an industry-wide problem, said Zhang Xiang, an auto industry analyst. He added chips used in NIO's cars are pretty high-end ones due to the premium position for vehicles. However, amid chip crunch, chip suppliers will prioritize the demands of global automakers rather than domestic automakers.

HOZON Auto outsold NIO in Dec., but its full-year registrations were over 25,600 units fewer than that of the latter. Although it has three production models for sale as well, the majority of registrations was contributed by only two of them. As the startup’s first mass-produced model, the NETA N01 recorded monthly registrations below 100 units for 11 months in 2021.

HOZON Auto sticks to a prudent route for the development of intelligence strength. The company’s founder and CEO Zhang Yong has said HOZON Auto will not launch “arm races” in spite of the industrial spree that highlights huge amounts of investment and rough combination of software, while only choose the right route befitting users’ demands.

In 2021, HOZON Auto strengthened intelligence ability for its products by teaming up with such tech giants as 360 Security, HUAWEI, and Horizon Robotics. Its in-house developed full-stack platform for automobile intelligence and safety, dubbed “Shanhai”, was launched at the Auto Guangzhou 2021 and will be applied in the NETA S first. The two-pronged mode may be a proper choice for HOZON Auto to improve intelligence capability and control costs.

Leapmotor saw its monthly registrations leap 63.6% month on month in Dec. thanks to the increase achieved by the T03 and the C11. Nonetheless, the share of the S01 was still insignificant.

As Leapmotor's biggest sales contributor, the T03 had an updated version hitting the market on Dec. 28, 2021. The 2022 T03 is priced higher than the old one, while offers fewer amenities for some trim levels. Given the NEV subsidy decreased from Jan.1, 2022, what happened to the new T03 was regarded by some industry insiders as a reasonable measure.

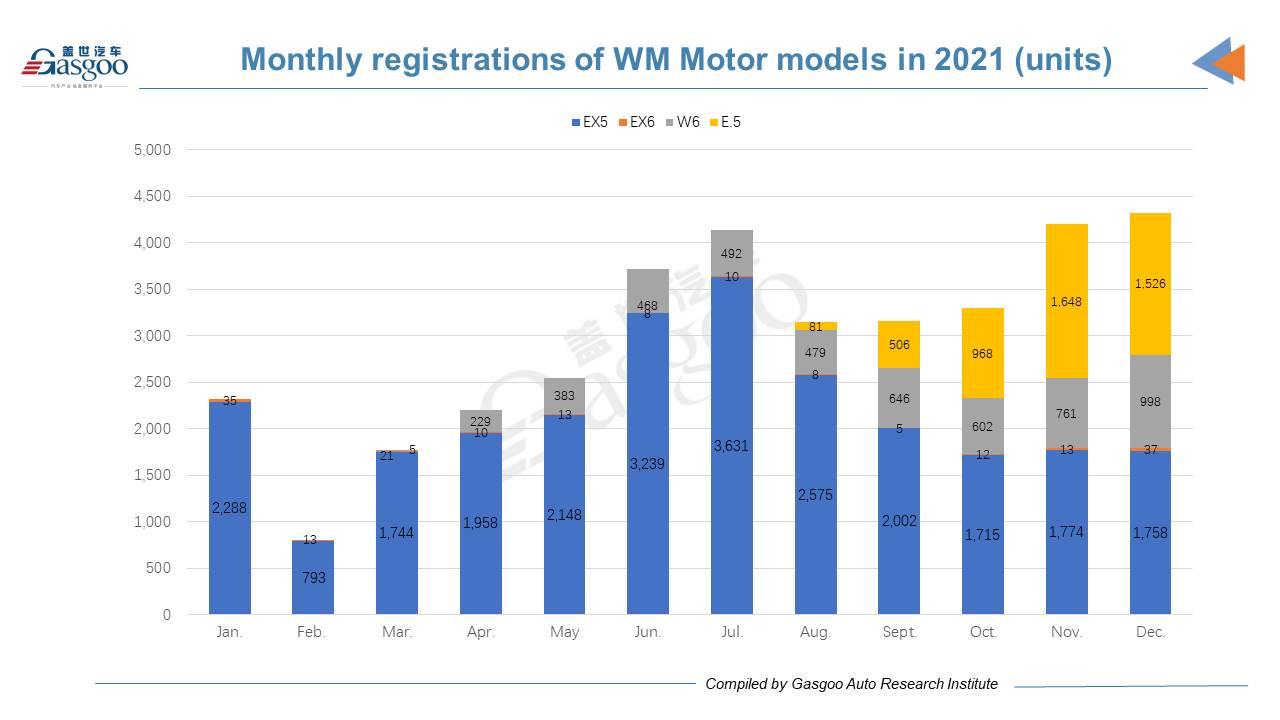

WM Motor ranked lowest among the top 6 Chinese NEV startups by both Dec. and annual registrations.

Of WM Motor's new vehicles registered in last Dec., 2115 units were for car rental service and only 1,980 units were registered by private users. Notably, the E.5, which accounted for 35.3% of the startup's Dec. registrations, is purposely built for mobility services.

Gasgoo not only offers timely news and profound insight about China auto industry, but also help with business connection and expansion for suppliers and purchasers via multiple channels and methods. Buyer service:buyer-support@gasgoo.comSeller Service:seller-support@gasgoo.com