China’s locally-made NEV registrations jump 58% year over year in April

Registrations of locally-built passenger vehicles underwent an obvious decrease in April in China, as production and market demand were affected by COVID-19 resurgence in several important vehicle-making districts, including Shanghai and Jilin province. However, the new energy passenger vehicle (NEV) segment maintained its growth momentum.

In April, the registrations of locally-made passenger vehicles fell to 969,092 units, according to data from Gasgoo Auto Research Institute. By the end of April, the market had registered a total of 5.72 million China-made passenger vehicles this year.

Half of the top 20 brands by monthly registrations were occupied by local brands. Three brands had monthly registrations of over 90,000 units, but only BYD managed to see growth from a year earlier. With a three-digit increase in monthly registrations, BYD's place moved one spot to the third compared with the ranking of March registrations.

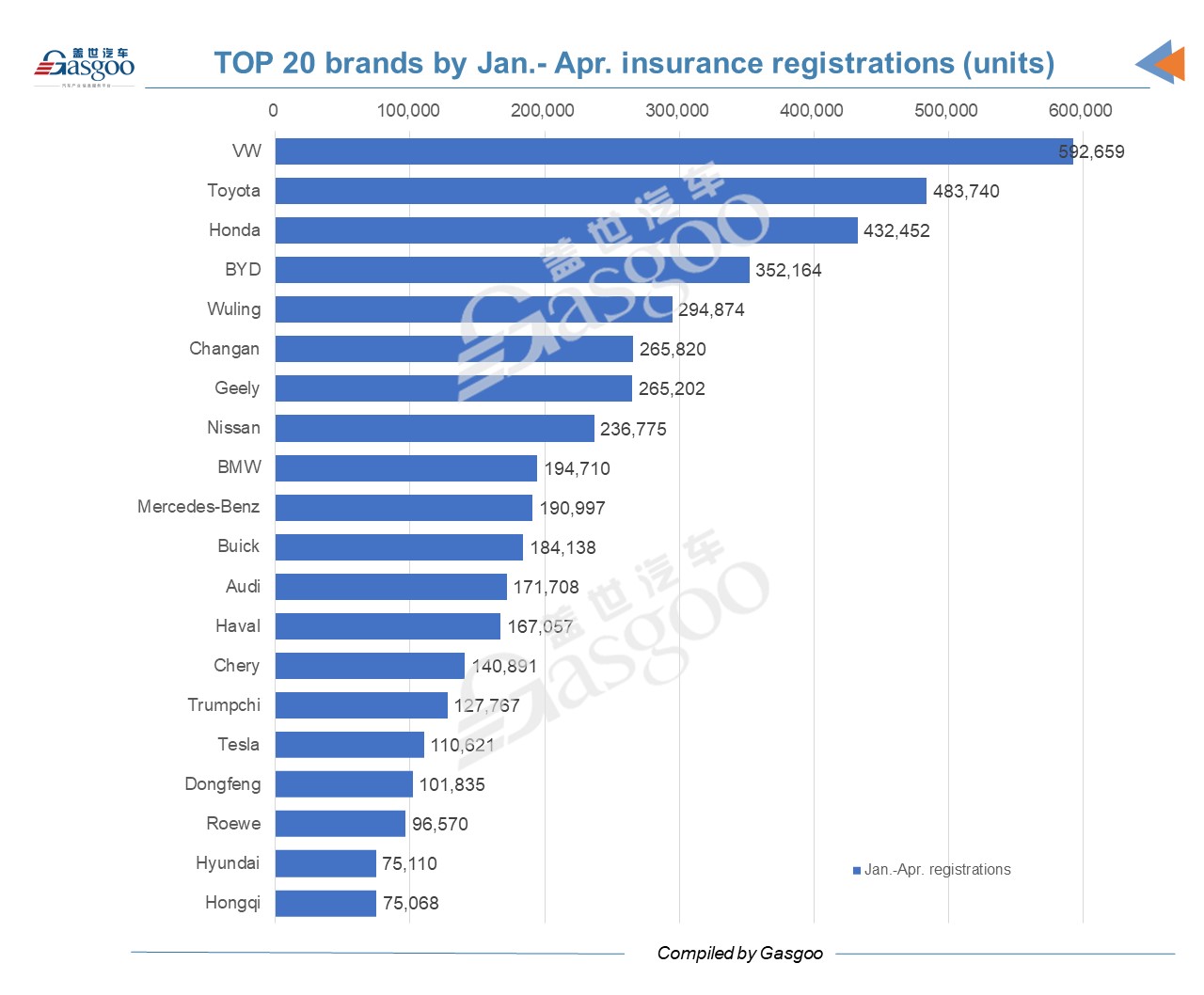

On the top 20 brands list by the total registrations of the first four months, Volkswagen, Toyota and Honda were the three most registered brands. BYD, Wuling, Chery, Trumpchi from GAC Group, Tesla and Hongqi bucked the downward trend with year-over-year registration growth in the period.

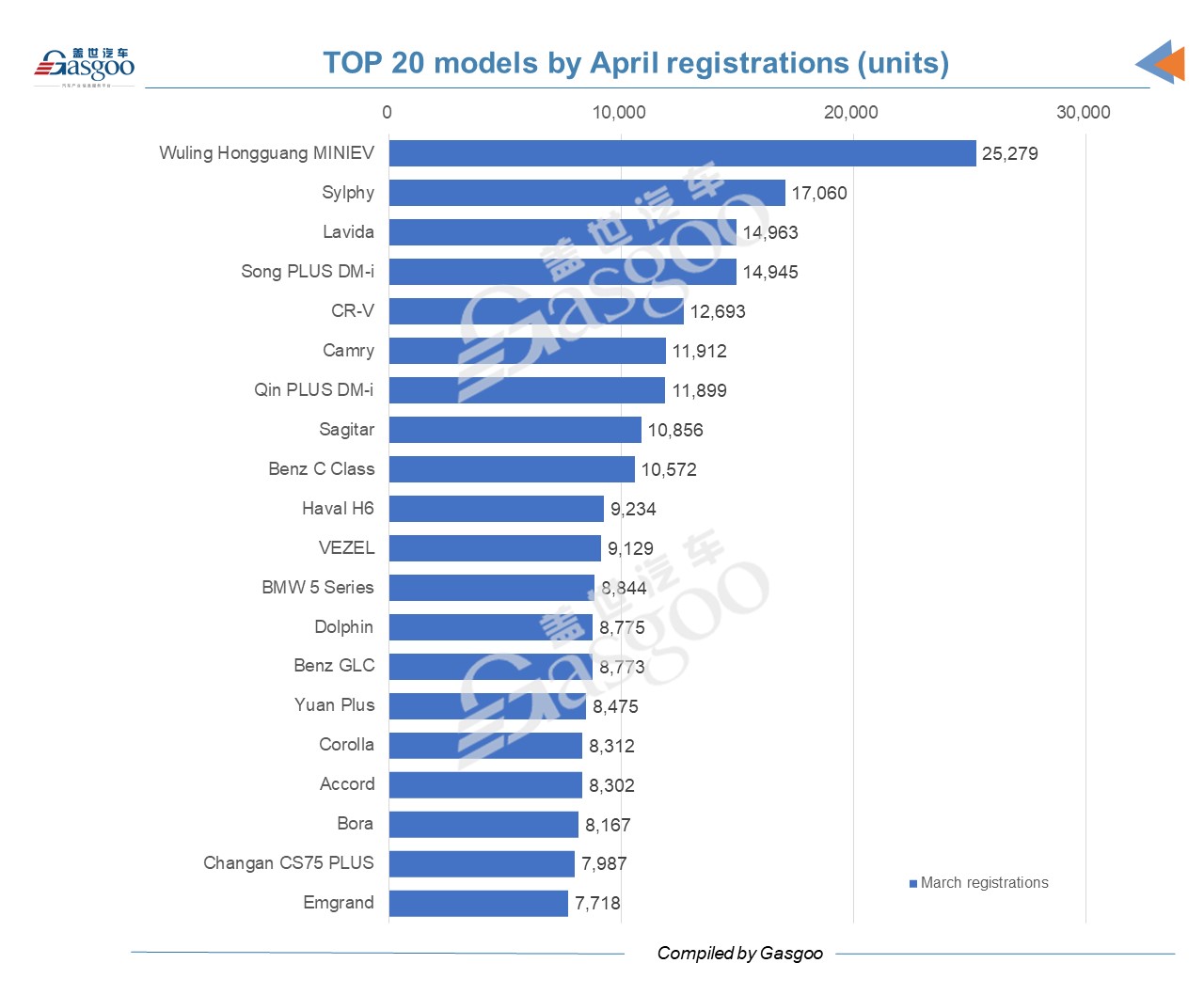

BYD-branded models occupied four spots on the top 20 models list by April registrations. Apart from BYD models, another four models from Chinese brands became members on the monthly model list.

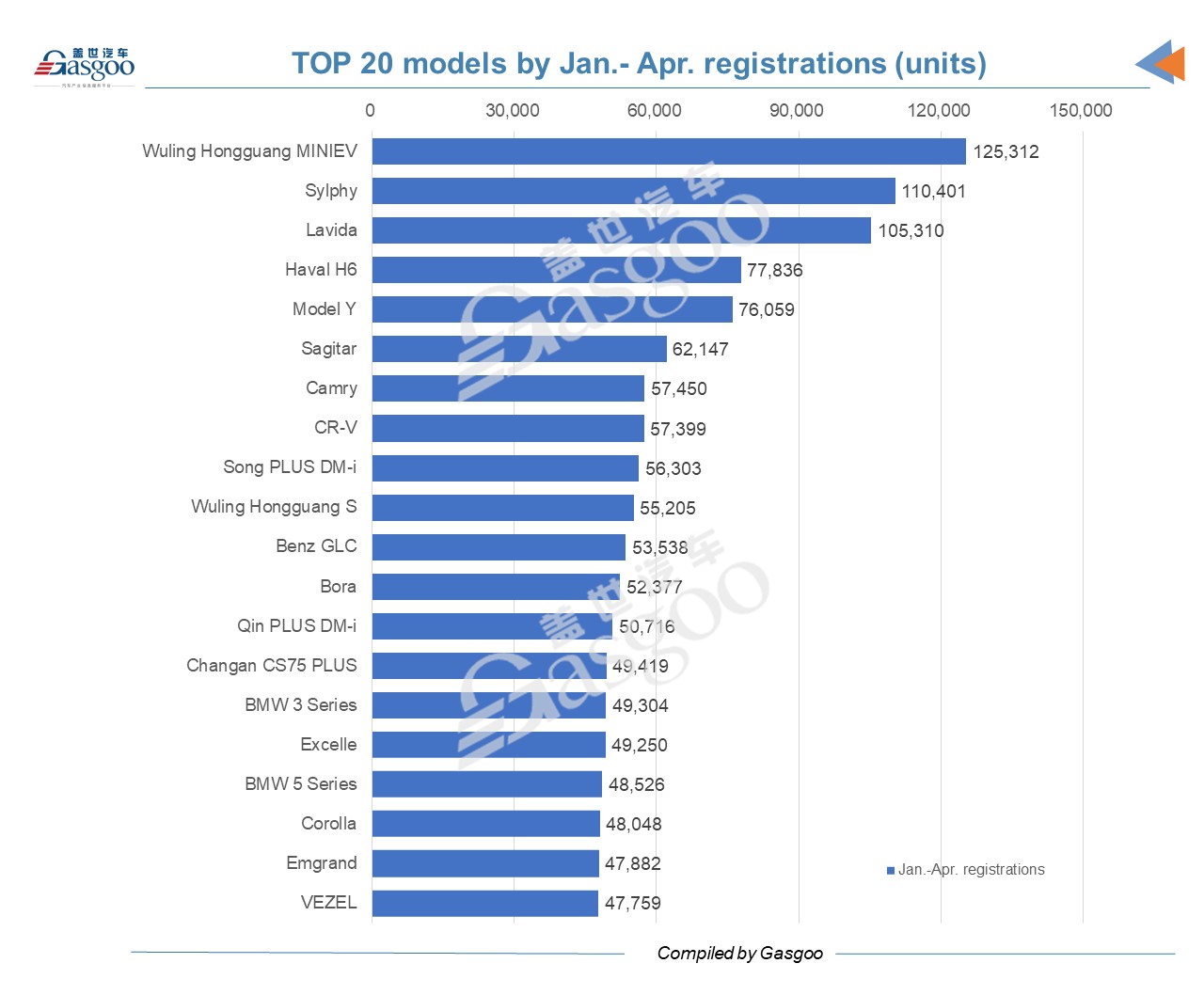

The Wuling Hongguang MINIEV topped both the monthly model list and the Jan.-Apr. model list. The country registered 24.84% more Wuling Hongguang MINIEVs in the first four months versus the same period in 2021. The Tesla Model Y, whose April registrations tumbled year over year, scored a registration surge of over 240% from a year ago to nearly 80,000 units in the Jan.-Apr. period.

Despite headwinds, China’s new energy vehicle registrations also gained growth in April. Last month, the registration volume of locally-made NEVs jumped 58.07% from a year ago to 262,115 units, 6.4% higher than the results of February. The market share of NEVs amounted to 27% out of the total passenger vehicle registrations.

Among those NEPVs registered in April, battery electric vehicles accounted for 75.8% with nearly 200,000 units registered while the rest were plug-in hybrid electric vehicles, including 8,335 range extended electric vehicles. Besides, 32,270 were for renting and only 75 were for operational purposes.

By the end of April, the largest NEV market in the world had registered over 1 million NEVs, 1,004,201, with an increase of 70% compared with the same month of 2021. Out of the total registrations, 989,827 were battery electric vehicles and 48,931 were range extended electric vehicles. NEVs registered for renting in the span made up 11.9% of the total registrations.

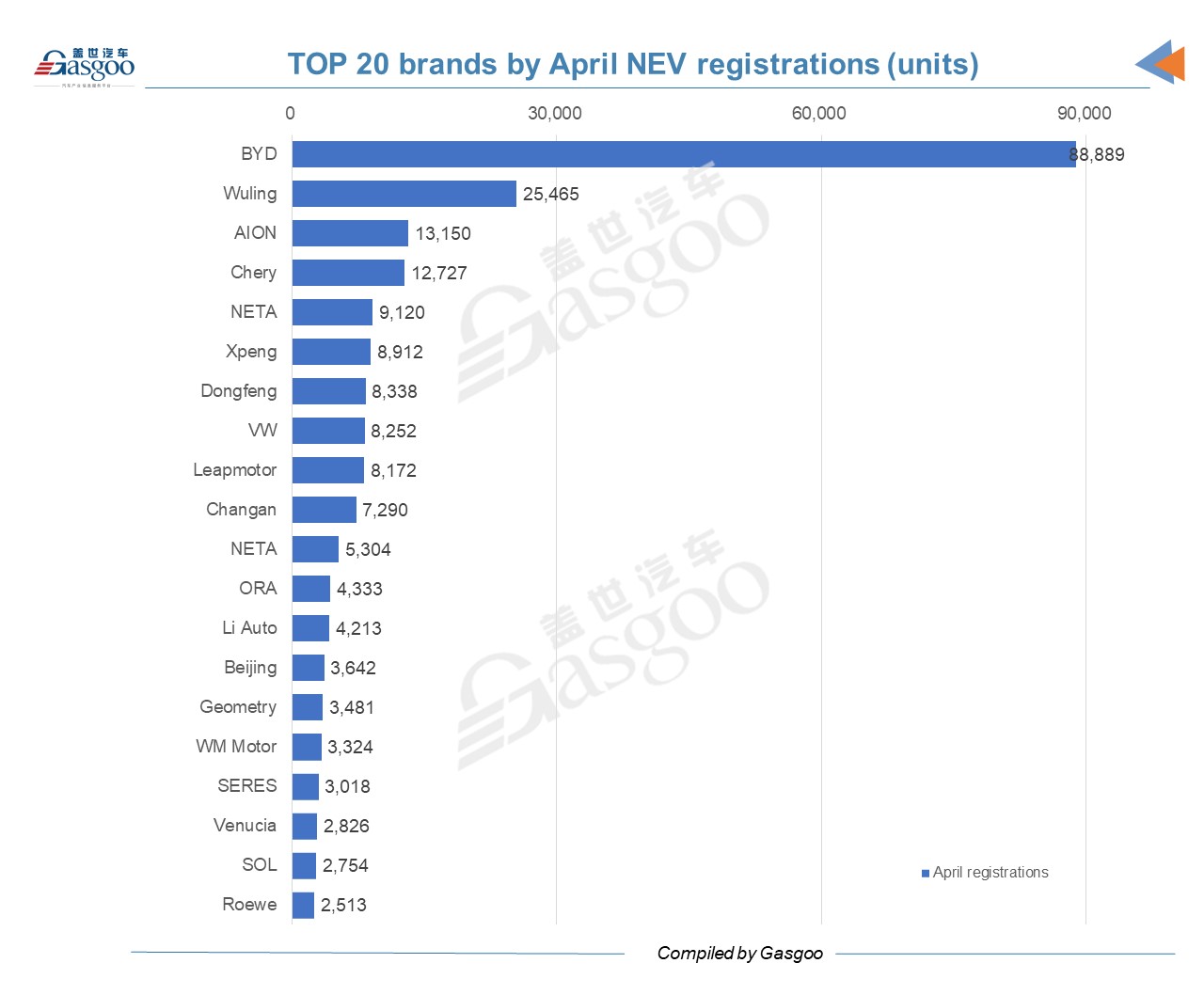

BYD was an obvious leader on both the monthly NEV registrations list and the year-to-date list. Wuling was a distant second on April list with fewer than one third of BYD’s registrations. NETA had the highest spot among all local electric vehicle startups on the monthly NEV registrations list. And there was only one foreign brand, namely Volkswagen, whose April results were the lowest level in the first four months. SERES and Venucia also made the list.

Tesla continued to be one of the top three brands by year-to-date registrations, in spite of poor April performances. Ranking second, Wuling also had year-to-date NEV registrations of over 100,000 units. Apart from the top 5 brands, the rest all had fewer than 50,000 NEVs registered in the four-month period.

All models of the top 20 NEV list by April registrations came from Chinese brands. The Wuling Hongguang MINIEV was also on the top of monthly NEV registration list, and 7 BYD-branded models occupied the following seven spots. On the monthly list, there were a total of nine models from BYD. Among all models from local startups, the Leapmotor T03, with 5,920 units registered, outnumbered other models, including the Li ONE, the NETA U and the XPeng P7.

On the Jan.-Apr. NEV registration list, the Tesla Model Y ranked second with 76,059 registered in the first four months of this year while the other locally-made Tesla model, the Model 3, dropped to the seventh from the fifth by Jan.-Mar. results. BYD models occupied the next two places while the Li ONE ranked fifth, the highest among all startups’ models.

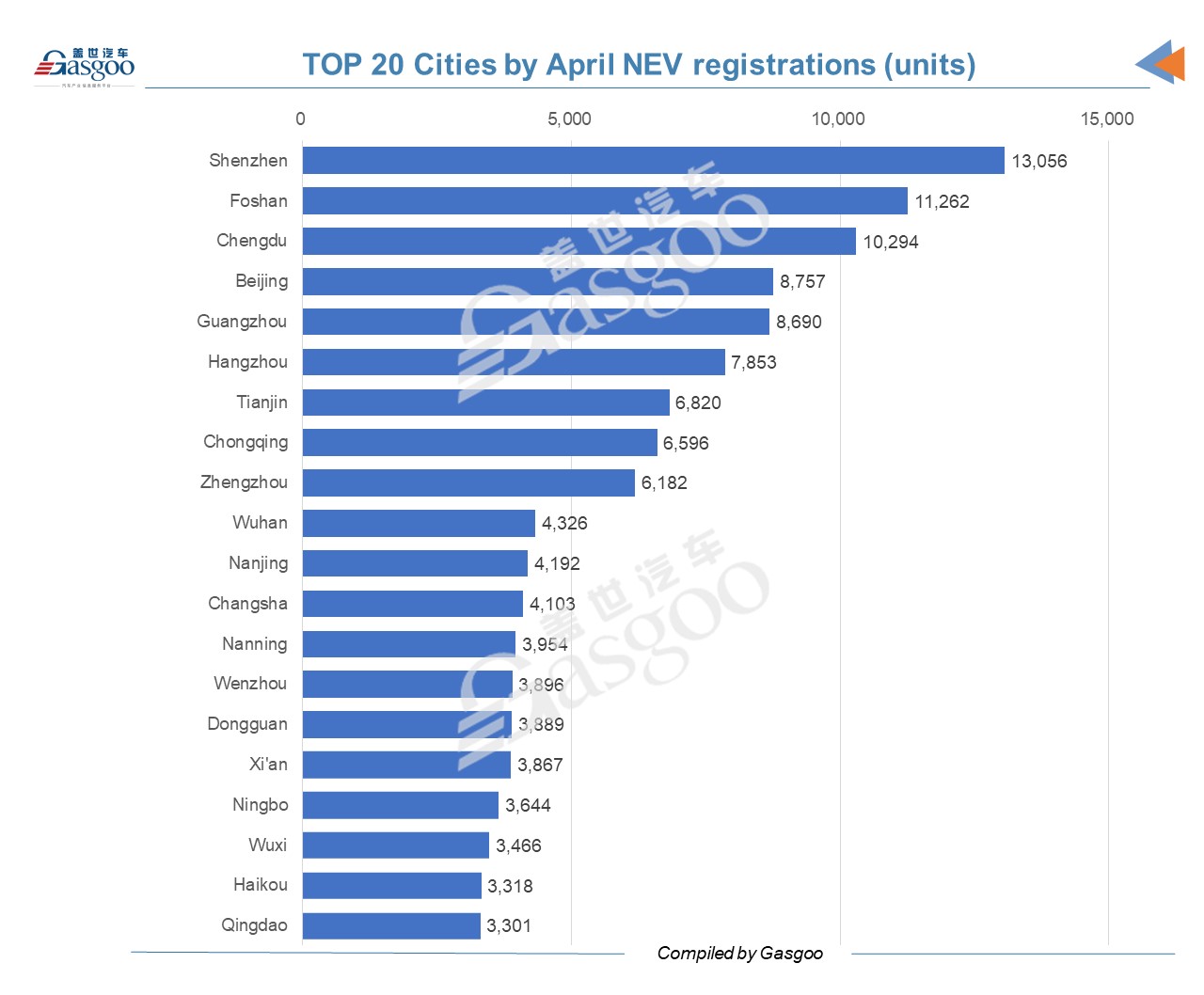

In April, four cities in China registered more than 10,000 NEVs, and Shenzhen registered the most, followed by Foshan and Chengdu. Four cities in Guangdong province were on the list, namely Shenzhen, Foshan, Guangzhou, Dongguan.

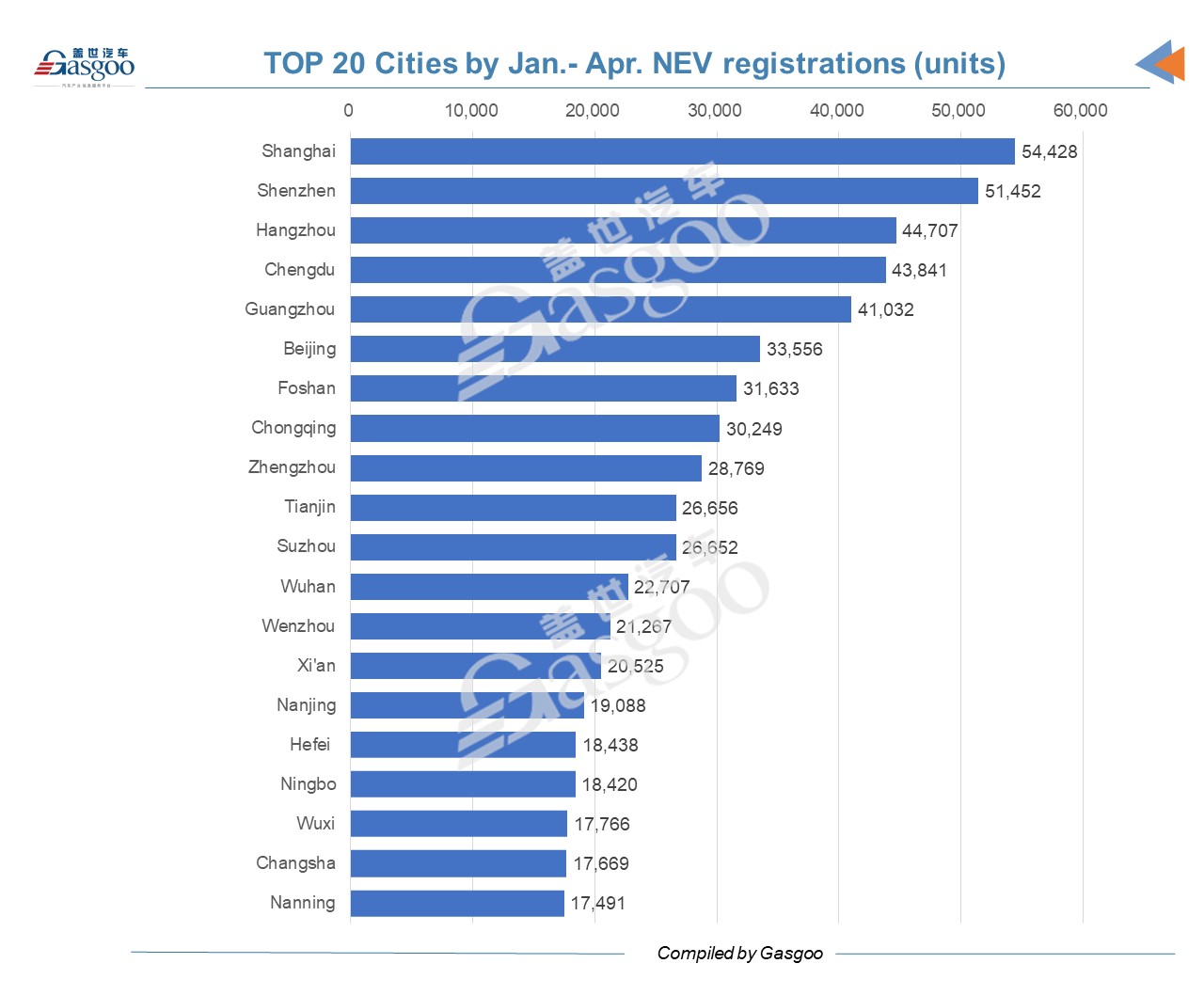

Shanghai continued to be the champion in terms of NEV registrations in the first four months, even though the city only registered hundreds of NEVs in the fourth month of this year. Shenzhen followed and was the other city with over 50,000 NEV registrations.

Gasgoo not only offers timely news and profound insight about China auto industry, but also help with business connection and expansion for suppliers and purchasers via multiple channels and methods. Buyer service:buyer-support@gasgoo.comSeller Service:seller-support@gasgoo.com