NIO Inc. (NYSE: NIO; HKEX: 9866; SGX: NIO) (“NIO” or the “Company”), a pioneer and a leading company in the premium smart electric vehicle market, today announced its unaudited financial results for the first quarter ended March 31, 2022.

Operating Highlights for the First Quarter of 2022

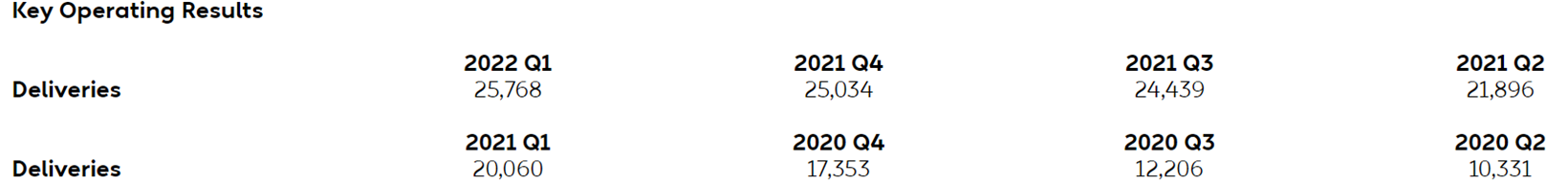

Deliveries of vehicles were 25,768 in the first quarter of 2022, including 4,341 ES8s, 13,620 ES6s, 7,644 EC6s and 163 ET7s, representing an increase of 28.5% from the first quarter of 2021 and an increase of 2.9% from the fourth quarter of 2021.

Financial Highlights for the First Quarter of 2022

Vehicle sales were RMB9,244.0 million (US$1,458.2 million) in the first quarter of 2022, representing an increase of 24.8% from the first quarter of 2021 and an increase of 0.3% from the fourth quarter of 2021.

Vehicle marginii was 18.1% in the first quarter of 2022, compared with 21.2% in the first quarter of 2021 and 20.9% in the fourth quarter of 2021.

Total revenues were RMB9,910.6 million (US$1,563.4 million) in the first quarter of 2022, representing an increase of 24.2% from the first quarter of 2021 and an increase of 0.1% from the fourth quarter of 2021.

Gross profit was RMB1,446.8 million (US$228.2 million) in the first quarter of 2022, representing a decrease of 6.9% from the first quarter of 2021 and a decrease of 14.9% from the fourth quarter of 2021.

Gross margin was 14.6% in the first quarter of 2022, compared with 19.5% in the first quarter of 2021 and 17.2% in the fourth quarter of 2021.

Loss from operations was RMB2,188.7 million (US$345.3 million) in the first quarter of 2022, representing an increase of 639.7% from the first quarter of 2021 and a decrease of 10.5% from the fourth quarter of 2021. Excluding share-based compensation expenses, adjusted loss from operations (non-GAAP) was RMB1,715.6 million (US$270.6 million) in the first quarter of 2022, representing an increase of 760.4% from the first quarter of 2021 and a decrease of 16.2% from the fourth quarter of 2021.

Net loss was RMB1,782.7 million (US$281.2 million) in the first quarter of 2022, representing an increase of 295.3% from the first quarter of 2021 and a decrease of 16.8% from the fourth quarter of 2021. Excluding share-based compensation expenses, adjusted net loss (non-GAAP) was RMB1,309.6 million (US$206.6 million) in the first quarter of 2022, representing an increase of 269.3% from the first quarter of 2021 and a decrease of 25.0% from the fourth quarter of 2021.

Net loss attributable to NIO’s ordinary shareholders was RMB1,825.0 million (US$287.9 million) in the first quarter of 2022, representing a decrease of 62.6% from the first quarter of 2021 and a decrease of 16.3% from the fourth quarter of 2021. Excluding share-based compensation expenses and accretion on redeemable non-controlling interests to redemption value, adjusted net loss attributable to NIO’s ordinary shareholders (non-GAAP) was RMB1,285.2 million (US$202.7 million) in the first quarter of 2022, representing an increase of 262.5% from the first quarter of 2021 and a decrease of 25.1% from the fourth quarter of 2021.

Basic and diluted net loss per Ordinary Share/American Depositary Share (ADS)iii were both RMB1.12 (US$0.18) in the first quarter of 2022, compared with RMB3.14 in the first quarter of 2021 and RMB1.36 in the fourth quarter of 2021. Excluding share-based compensation expenses and accretion on redeemable non-controlling interests to redemption value, adjusted basic and diluted net loss per ADS (non-GAAP) were both RMB0.79 (US$0.13), compared with RMB0.23 in the first quarter of 2021 and RMB1.07 in the fourth quarter of 2021.

Cash and cash equivalents, restricted cash and short-term investment were RMB53.3 billion (US$8.4 billion) as of March 31, 2022.

Recent Developments

Deliveries in April and May 2022

NIO delivered 5,074 vehicles in April 2022 and 7,024 vehicles in May 2022. As of May 31, 2022, cumulative deliveries reached 204,936 vehicles.

Singapore Exchange Listing

On May 20, 2022, NIO successfully listed, by way of introduction, its Class A ordinary shares (the “Shares”) on the Main Board of the Singapore Exchange Securities Trading Limited (the “SGX-ST”), under the stock code “NIO” in board lot sizes of 10 Shares. The Shares listed on the Main Board of the SGX-ST are fully fungible with the ADSs listed on the NYSE.

CEO and CFO Comments

"We set new record-high quarterly deliveries of 25,768 vehicles in the first quarter of 2022, and hit the milestone of exceeding 200,000 vehicle deliveries in May within four years since our first delivery," said William Bin Li, founder, chairman and chief executive officer of NIO. "Despite the volatilities of supply chain and the challenges in vehicle delivery resulting from the recent COVID-19 resurgence, we witnessed robust demand for our complementary products and achieved an all-time high order inflow in May 2022. On April 29, 2022, the first batch of tooling trial builds of the ET5 rolled off the production line at the new manufacturing plant at NeoPark in Hefei. We expect to start delivery of the ET5 in September 2022. In addition, we will further enhance our product offering by introducing the ES7, a new mid-to-large five-seater SUV based on NIO Technology 2.0 (NT2.0), in June and expect to start its delivery in late August," concluded Mr. Li.

"NIO successfully listed on the Main Board of the Singapore Exchange Securities Trading Limited on May 20, 2022, further strengthening our footing in the global capital markets," added Steven Wei Feng, chief financial officer of NIO. "To quickly recover from the COVID-19 impact and fulfill the growing market demand, we have been working closely with supply chain partners to ramp up the production capacity and accelerate the vehicle delivery since the beginning of June. While making decisive investments in new products, technologies and businesses, we strive to continuously optimize our cost structure, improve operating efficiency and create long-term value for our shareholders."

Financial Results for the First Quarter of 2022

Revenues

Total revenues in the first quarter of 2022 were RMB9,910.6 million (US$1,563.4 million), representing an increase of 24.2% from the first quarter of 2021 and an increase of 0.1% from the fourth quarter of 2021.

Vehicle sales in the first quarter of 2022 were RMB9,244.0 million (US$1,458.2 million), representing an increase of 24.8% from the first quarter of 2021 and an increase of 0.3% from the fourth quarter of 2021. The increase in vehicle sales over the first quarter of 2021 was mainly attributed to higher deliveries. Vehicle sales remained stable compared with the fourth quarter of 2021.

Other sales in the first quarter of 2022 were RMB666.6 million (US$105.1 million), representing an increase of 15.6% from the first quarter of 2021 and a decrease of 2.7% from the fourth quarter of 2021. The increase in other sales over the first quarter of 2021 was mainly attributed to the increased sales of service and energy packages and others in line with the incremental vehicle sales in the first quarter of 2022, which was partially offset by the decrease of revenues from battery upgrade services. Other sales remained stable compared with the fourth quarter of 2021.

Cost of Sales and Gross Margin

Cost of sales in the first quarter of 2022 was RMB8,463.7 million (US$1,335.1 million), representing an increase of 31.7% from the first quarter of 2021 and an increase of 3.2% from the fourth quarter of 2021. The increase in cost of sales over the first quarter of 2021 and the fourth quarter of 2021 was mainly driven by the increase of delivery volume in the first quarter of 2022.

Gross Profit in the first quarter of 2022 was RMB1,446.8 million (US$228.2 million), representing a decrease of 6.9% from the first quarter of 2021 and a decrease of 14.9% from the fourth quarter of 2021.

Gross margin in the first quarter of 2022 was 14.6%, compared with 19.5% in the first quarter of 2021 and 17.2% in the fourth quarter of 2021. The decrease of gross margin over the first quarter of 2021 was attributed to the decrease of vehicle margin and the reduction in other sales margin resulting from the expanded investment in power and service network. The decrease of gross margin over the fourth quarter of 2021 was mainly attributed to the decrease of vehicle margin.

Vehicle margin in the first quarter of 2022 was 18.1%, compared with 21.2% in the first quarter of 2021 and 20.9% in the fourth quarter of 2021. The decrease of vehicle margin over the first quarter of 2021 was mainly driven by the lower average selling price due to changes in our product mix. The decrease of vehicle margin over the fourth quarter of 2021 was mainly attributed to the increased battery cost per unit.

Operating Expenses

Research and development expenses in the first quarter of 2022 were RMB1,761.7 million (US$277.9 million), representing an increase of 156.6% from the first quarter of 2021 and a decrease of 3.7% from the fourth quarter of 2021. Excluding share-based compensation expenses (non-GAAP), research and development expenses were RMB1,514.1 million (US$238.8 million), representing an increase of 132.9% from the first quarter of 2021 and a decrease of 7.6% from the fourth quarter of 2021. The increase in research and development expenses over the first quarter of 2021 was mainly attributed to the increased personnel costs in research and development functions as well as the incremental design and development costs for new products and technologies. Research and development expenses remained relatively stable compared with the fourth quarter of 2021.

Selling, general and administrative expenses in the first quarter of 2022 were RMB2,014.8 million (US$317.8 million), representing an increase of 68.3% from the first quarter of 2021 and a decrease of 14.6% from the fourth quarter of 2021. Excluding share-based compensation expenses (non-GAAP), selling, general and administrative expenses were RMB1,801.5 million (US$284.2 million), representing an increase of 57.9% from the first quarter of 2021 and a decrease of 16.7% from the fourth quarter of 2021. The increase in selling, general and administrative expenses over the first quarter of 2021 was primarily due to the increase in personnel costs in sales and service functions and costs related to sales and service network expansion. The decrease in selling, general and administrative expenses over the fourth quarter of 2021 was mainly attributed to the decrease in marketing and promotional expenses, especially the marketing and promotional expenses incurred from the hosting of NIO Day in December 2021, as well as the decrease of professional services expenses.

Loss from Operations

Loss from operations in the first quarter of 2022 was RMB2,188.7 million (US$345.3 million), representing an increase of 639.7% from the first quarter of 2021 and a decrease of 10.5% from the fourth quarter of 2021. Excluding share-based compensation expenses, adjusted loss from operations (non-GAAP) was RMB1,715.6 million (US$270.6 million) in the first quarter of 2022, representing an increase of 760.4% from the first quarter of 2021 and a decrease of 16.2% from the fourth quarter of 2021.

Share-based Compensation Expenses

Share-based compensation expenses in the first quarter of 2022 were RMB473.0 million (US$74.6 million), representing an increase of 390.2% from the first quarter of 2021 and an increase of 19.2% from the fourth quarter of 2021. The increase in share-based compensation expenses over the first quarter of 2021 and the fourth quarter of 2021 was primarily attributed to the grant of options and restricted shares on a continued basis.

Net Loss and Earnings Per Share

Net loss in the first quarter of 2022 was RMB1,782.7 million (US$281.2 million), representing an increase of 295.3% from the first quarter of 2021 and a decrease of 16.8% from the fourth quarter of 2021. Excluding share-based compensation expenses, adjusted net loss (non-GAAP) was RMB1,309.6 million (US$206.6 million) in the first quarter of 2022, representing an increase of 269.3% from the first quarter of 2021 and a decrease of 25.0% from the fourth quarter of 2021.

Net loss attributable to NIO’s ordinary shareholders in the first quarter of 2022 was RMB 1,825.0 million (US$287.9 million), representing a decrease of 62.6% from the first quarter of 2021 and a decrease of 16.3% from the fourth quarter of 2021. Excluding share-based compensation expenses, adjusted net loss attributable to NIO’s ordinary shareholders (non-GAAP) was RMB1,285.2 million (US$202.7 million) in the first quarter of 2022.

Basic and diluted net loss per Ordinary Share/ADS in the first quarter of 2022 were both RMB1.12 (US$0.18), compared with RMB3.14 in the first quarter of 2021 and RMB1.36 in the fourth quarter of 2021. Excluding share-based compensation expenses and accretion on redeemable non-controlling interests to redemption value, adjusted basic and diluted net loss per Ordinary Share/ADS (non-GAAP) were both RMB0.79 (US$0.13), compared with RMB0.23 in the first quarter of 2021 and RMB1.07 in the fourth quarter of 2021.

Balance Sheets

Balance of cash and cash equivalents, restricted cash and short-term investment was RMB53.3 billion (US$8.4 billion) as of March 31, 2022.

Business Outlook

For the second quarter of 2022, the Company expects:

Deliveries of vehicles to be between 23,000 and 25,000 vehicles, representing an increase of approximately 5.0% to 14.2% from the same quarter of 2021.

Total revenues to be between RMB9,340 million (US$1,473 million) and RMB10,088 million (US$1,591 million), representing an increase of approximately 10.6% to 19.4% from the same quarter of 2021.

This business outlook reflects the Company’s current and preliminary view on the business situation and market condition, which is subject to change.