In March last year, the Chinese battery manufacturer CALB Co., Ltd. (“CALB”) filed for an IPO on the Hong Kong stock exchange with the aim of banking up to $1.5 billion. It could be the largest IPO in Hong Kong so far this year.

CALB noted in the prospectus that the net proceeds will be used to build up and expand a number of production base projects for EV battery and energy storage system (ESS).

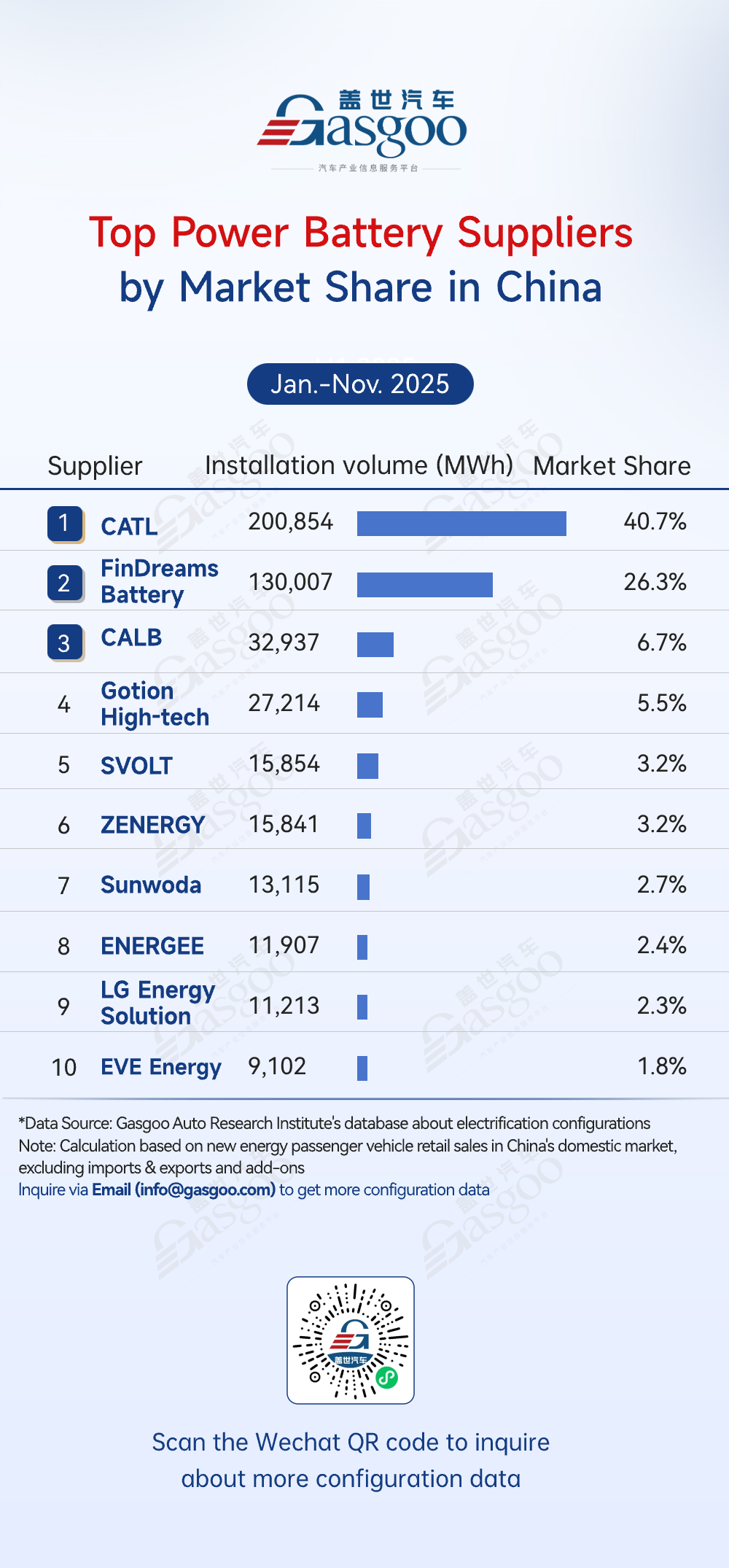

In 2022, CALB recorded an annual power battery installed capacity of 19.24GWh, accounting for 6.53% of China's total volume and ranking third among power battery manufacturers in China, according to the data from China Automotive Power Battery Industry Innovation Alliance (CAPBIIA).

Photo credit: CALB

Although CALB is still trailing far behind the top 2 players—CATL and BYD, the company has made a substantial progress during the past few years. In terms of annual power battery installed capacity, CALB moved up to the second runner-up last year from the No.6 place in 2019.

While getting its business back on track, CALB is also vigorously pushing ahead with the building of its battery production capacity. At a strategy launching ceremony held in November last year, the battery maker announced it had raised its annual production capacity target to 500GWh by 2025 and to 1TWh by 2030. Thus, the successful public listing is expected to help the company diversify its financing channels, so as to raise the requisite capital for achieving the expansion goal.

In this article, Gasgoo will help you better learn CALB by summarizing the company's development history and offering the key information about its financial performances, R&D investment, technical advantages, and production capacity, etc.

Development track

CALB's history can be dated back to 2007, when China Airborne Missile Academy (“Missile Academy”) established Sky Energy (Luoyang) Co., Ltd. (“Sky Energy”) in Luoyang city, Henan province, which was dedicated to manufacturing LFP batteries. Sky Energy was universally regarded as the predecessor of today's CALB.

Then in 2009, Aviation Industry Corporation of China, Ltd. (“AVIC”), a Chinese state-owned aerospace and defense conglomerate, and Missile Academy restructured Sky Energy, which was later renamed into China Lithium Battery Technology (Luoyang) Co., Ltd. (“Luoyang Company”) in September of that year. It is worth noting that Missile Academy is a public institution set up by AVIC.

In 2010, AVIC made capital increases to Luoyang Company through some of its subsidiaries, of which Sichuan Chengfei Integration Technology Co., Ltd. (“CITC”) took the majority shareholding upon completion of the capital increase.

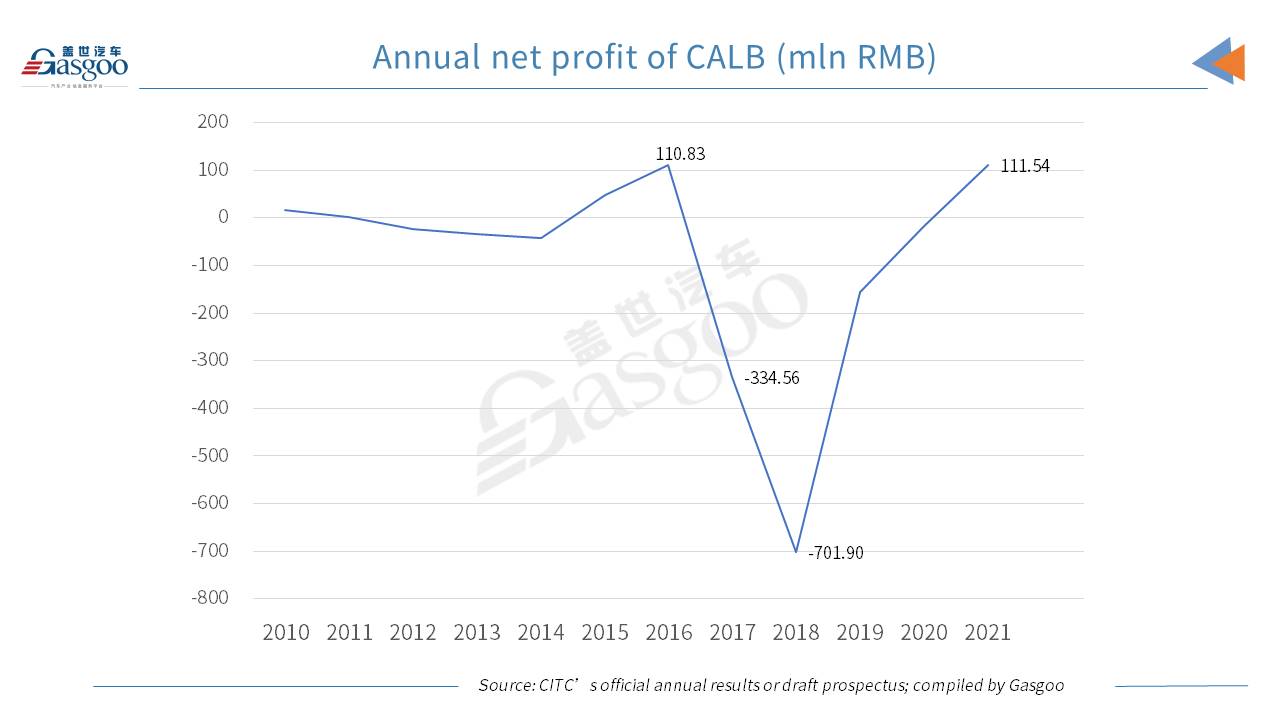

As China adopted policies to vigorously promote new energy vehicles (“NEVs”) in 2009, the automobile industry was facing increasing demands for power batteries. The policy tailwinds paved the way for Luoyang Company's blooming development after the aforesaid capital increase. According to the data offered by CITC's annual results and compiled by Gasgoo, Luoyang Company accounted for up to 63.31% of CITC’s annual revenue in 2016, jumping from the 28.37% in 2011. In the same year, Luoyang Company earned 110.83 million yuan ($16.572 million) of yearly net profit, logging a year-on-year increase for the second year in a row.

Luoyang Company took the commercial vehicle (“CV”) domain as

its gateway as the governmental policies prioritized the NEV promotion

in the CV field at the early stage. Under this development route, the

company rapidly obtained a slew of CV clients with the support of its

state-owned parent company.

After peaking in 2016, its net profit precipitously plunged into a loss of 334.56 million yuan ($50.025 million) in 2017 and then hit rock bottom in 2018.

One of a main factor leading to the plunge is that the government subsidy policies set for 2017 and 2018 were modified to promote the batteries with higher energy density and longer driving range, leading Chinese NEV makers to install ternary batteries in their newest models. Meanwhile, the government also whittled down the subsidies on new energy commercial vehicles. Amid those changes, the battery maker did not timely adjust its CV-focused strategy, failing to keep up in the market rat race.

The company's money-losing status largely weighed on the financial performance of CITC. In 2018, the parent recorded a net loss attributable to shareholders of around 204.655 million yuan ($30.6 million) and saw its gross margin drop 9.51 percentage points year on year to 1.46%. CITC said the sliding gross margin mainly resulted from the decline in the gross margin of its lithium battery business.

In March, 2019, the Shenzhen-listed CITC's trading was temporarily suspended for one day with its stock name prefixed with “ST”, which indicating that the firm was on the brink of being delisted.

Revival with help of Jintan district government

For the sake of recovery, CITC must properly handle the issue of CALB. At the critical moment, the government of Jintan District, Changzhou City lent a helping hand.

According to CALB's prospectus, it was established in Changzhou City, Jiangsu Province as a limited liability company on December 8, 2015, named CALB Technology Holding Co., Ltd. (“CALB Technology”) initially. Upon its establishment, CALB Technology was owned as to 50% by Jinsha Investment, 30% by Luoyang Company, and 20% by Huake Investment. Notably, both Jinsha Investment and Huake Investment are ultimately owned by the government of Jintan District. Luoyang Company was still the controlling shareholder of CALB Technology as it was entitled to exercise 51% of voting rights in the latter.

Subsequently, CALB Technology carried out restructuring in 2019. In April 2019, Luoyang Company transferred its 30% equity interests in CALB Technology to CITC, while making capital increases to CALB Technology through CITC, Jinsha Investment and Huake Investment. Upon completion of the restructuring in July 2019, CALB Technology became ultimately controlled

by the Jintan Group (a shorthand used to name a group of Jintan-based investors, including Jinsha Investment, Huake Engineering, Huake Investment, Jintan International, Jintan Hualuogeng and Jintan Holding).

Between August 2019 and November 2021, CALB Technology went through a series of capital increases and brought in new shareholders and investors, such as Lihang Jinzhi, Jinyuan Industry, employee shareholding platforms, Xiaomi Yangtze River Industry, and Chuanghe Xincai.

On November 18, 2021, the company's name was formally renamed to CALB Co., Ltd. from CALB Technology, meaning that it has ushered in a new development era.

To make the description easier, we will use “the Company” or “CALB” to refer to both “CALB Technology” and “CALB Co., Ltd.” in the following content.

Industrial position of today's CALB

Through several years of efforts, CALB has posted evident recovery in both revenue and profit, and made significant headways in technology development and production capacity expansion.

After dropping to

the historical low level in 2018, CALB's annual net loss drastically

shrunk year on year in both 2019 and 2021, and the Company once again

turned into a profitable firm in 2021.

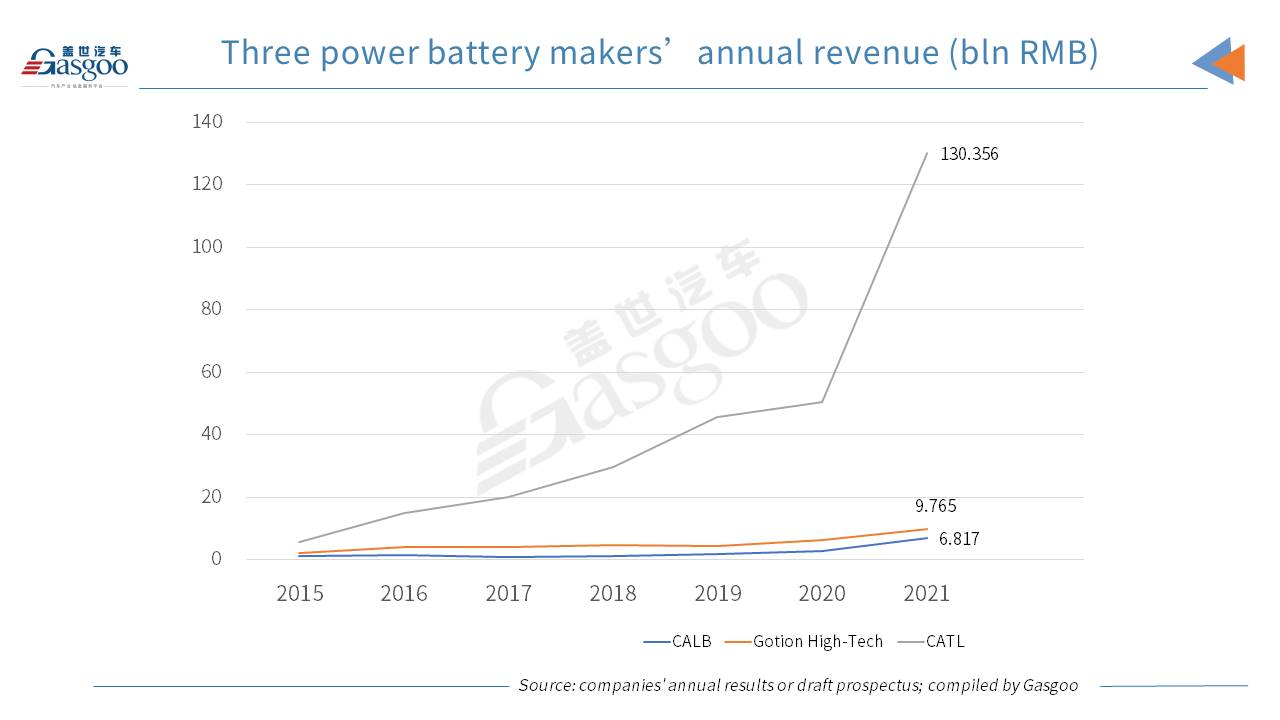

As for the annual revenue, CALB was clearly much outperformed by CATL and even trailed by its main rival Gotion High-Tech. Nevertheless, its yearly revenue shot up 141.3% from the previous year to 6.817 billion yuan in 2021.

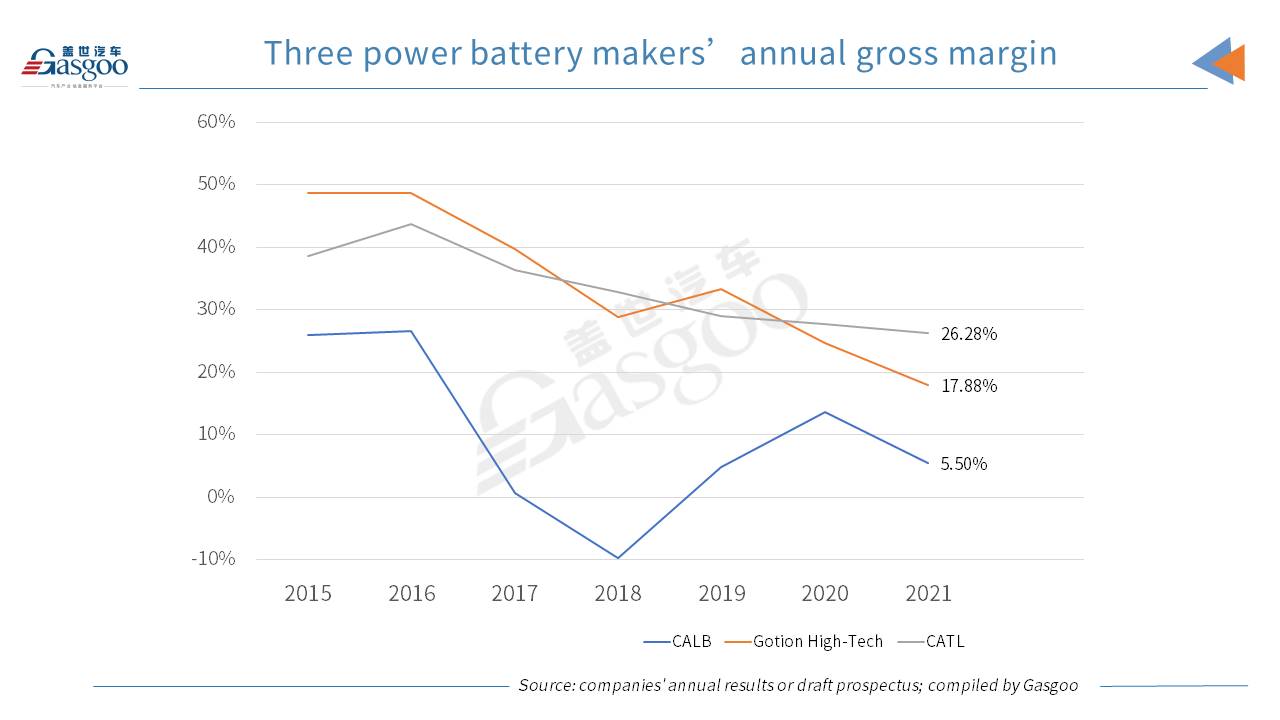

CALB's fast growth in revenue came at the expense of relatively low profit margin. Its annual gross margin have for years been lower than that of CATL and Gotion High-Tech's power lithium battery business. In 2021, the Company saw its yearly gross margin decline 8.1 percentage points year on year to only 5.5%.

Despite the low gross margin, CALB still

logged an annual operating profit of 113.122 million yuan in 2021, indicating the Company's outstanding performance in

cost control.

CALB's R&D investment amounted to 285.256 million yuan in 2021, accounting

for only 4.18% of the Company’s annual revenue. The proportion was lower

than that of both CATL and Gotion High-Tech.

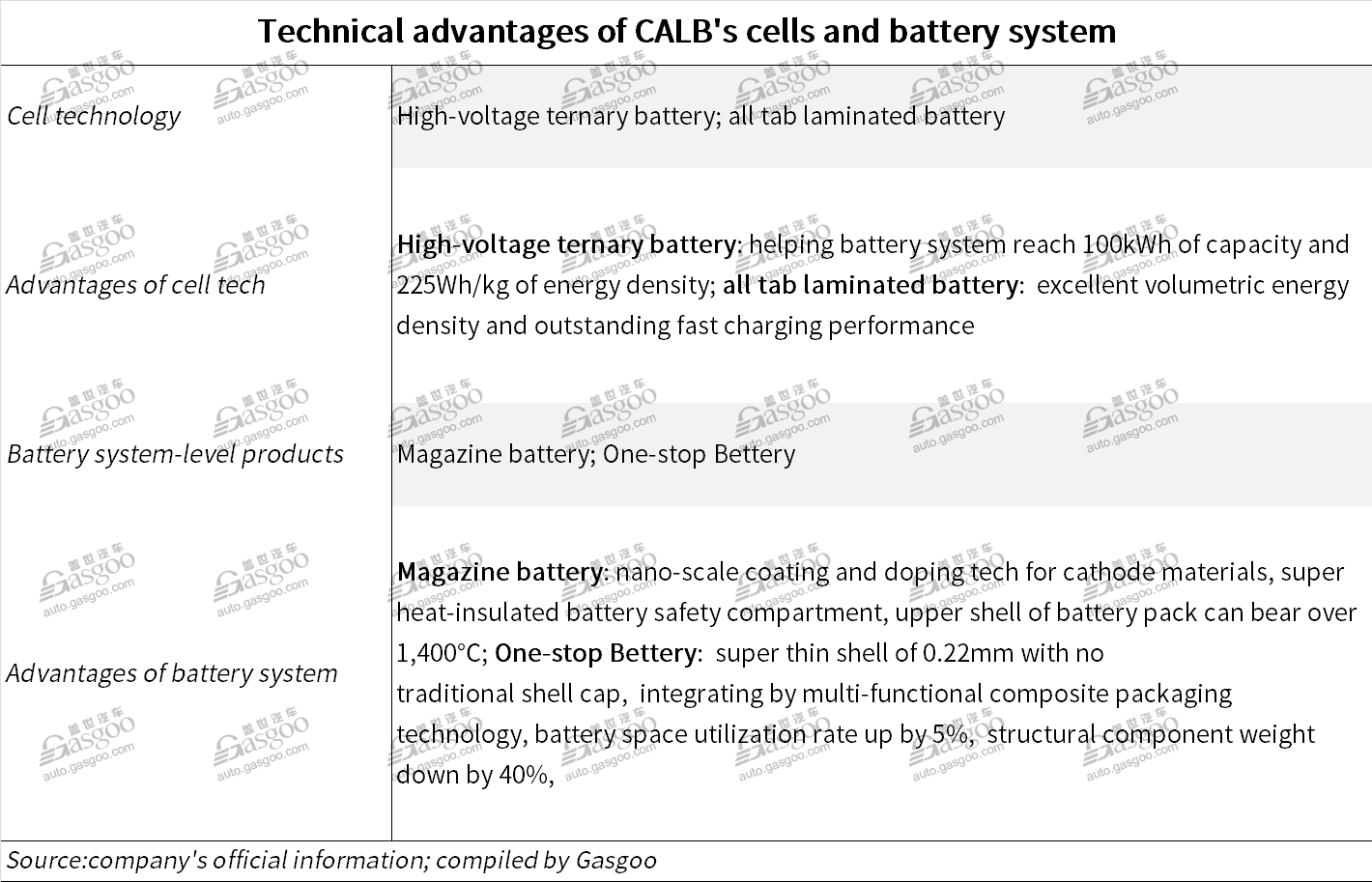

On the sides of technologies and products, CALB is primarily working on improving the battery safety and enhancing a cell's energy density by lifting the battery voltage.

On the level of battery system, CALB has released the One-stop Bettery solution and the Magazine battery, which should be the same one announced by GAC AION.

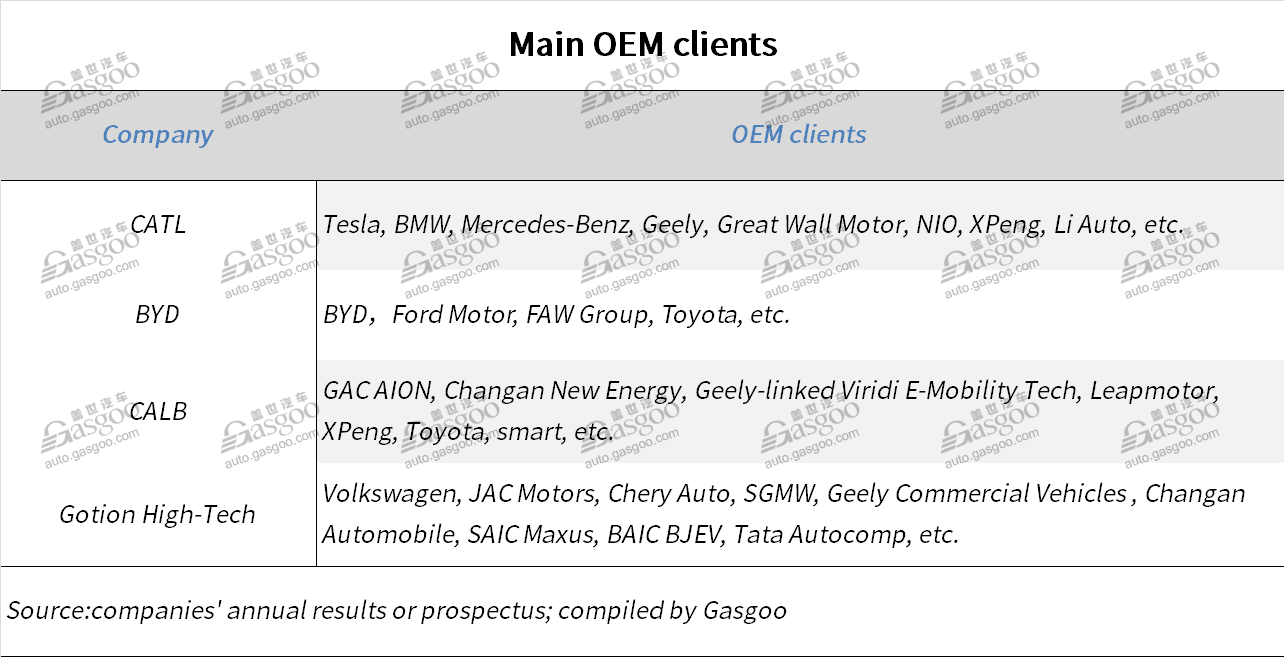

In

the aspect of clients, CALB has relatively fewer global OEM customers

than CATL, BYD, and Gotion High-Tech. Its orders are highly

concentrated. According to the prospectus, the contribution of the

Company's top 5 clients to its 2021 revenue totaled 82.9%.

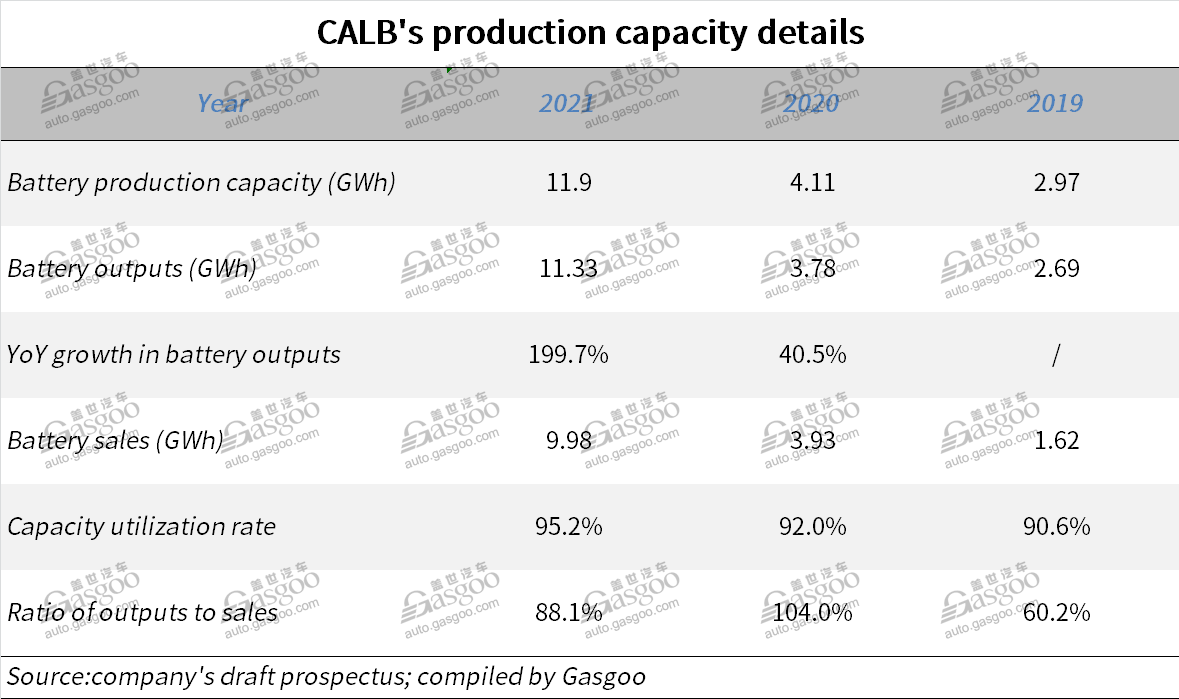

With

regard to the battery production capacity, CALB's annual production

capacity reached 11.9GWh as of 2021, surging 189.5% year on year.

In spite of the current gap, CALB still set an ambitious goal in production capacity expansion. It aims to reach a yearly capacity of 500GWh by 2025, only following CATL, BYD, and SVOLT among its Chinese peers. It was also the first one in China to announce the goal of hitting 1TWh per year by 2030.

Aerial view of CALB's Meishan power battery and energy storage system base; photo credit: CALB

CALB has so far expanded its existing production bases and constructed new production bases at various sites, including Changzhou, Xiamen, Chengdu, Wuhan, Hefei, Jiangmen and Meishan. Its industrial bases and R&D centers in Europe and North America have entered the planning phase.