Backlash from fame: the dual-edged sword of Li Auto's success

In addition to the tiered layout of the L series models gradually releasing competitiveness, Li Auto’s new strategies in supply chain and marketing have significantly strengthened its overall market position.

From the Li ONE to the four current models under the L series, Li Auto’s single-product strategy has evolved into a more diversified lineup, resembling a group battle strategy. On the surface, this approach, with more models, richer configurations, and a broader price range, has significantly enhanced Li Auto's competitiveness. In reality, this broader market coverage has also strengthened Li Auto’s supply chain management capabilities.

As Li Auto's first product, the Li ONE was heavily impacted by the pandemic throughout its lifecycle, with supply chain disruptions and chip shortages causing industry-wide difficulties. This situation pushed automakers to intensify communication with supply chain partners.

Li Auto’s product matrix expansion required stronger supply chain management. The smooth transition from the Li ONE to the L series models indirectly proves that Li Auto's supply chain management has significantly improved.

The L series models not only inherit the Li ONE’s strengths, such as low cost and high value with spacious interiors, but also introduce new features like onboard refrigerators and large screens, transforming the L series into a highly intelligent travel space. The new trio of refrigerator, large screen, and big sofa has become essential in smart electric vehicles.

On one hand, Li Auto has been expanding its own supply chain system, while on the other hand, the more flexible supply methods of China’s domestic suppliers have led to a perfect match, fostering the rapid growth of many new local suppliers.

As early as 2019, when Li Auto was seeking suppliers for air suspension systems for its L series models, it realized that international suppliers could not meet its customization and supply chain flexibility needs. Li Auto’s Vice President Liu Liguo revealed that when Li Auto proposed a demand of 10,000 units per month to overseas suppliers, they stated they could provide no more than 5,000 units per month.

As a result, Li Auto turned to local companies KH Automotive Technologies and Baolong Automotive. With the rapid growth of the L series models, both companies quickly became leaders in the air suspension market.

A similar story unfolded in the LiDAR sector. As Li Auto's sales rapidly increased, the shipment volumes of its supplier Hesai Technology’s LiDAR systems also soared, laying a crucial foundation for Hesai’s successful IPO, becoming China's first publicly traded LiDAR company. Additionally, Li Auto has adopted other made-in-China components, such as batteries from CATL and Sunwoda, braking systems from Bethel Automotive Safety Systems, and HUDs from FUTURUS, among others.

Beyond establishing a stable supply chain system of domestic suppliers, Li Auto has also been bold in its marketing strategies. According to Li Auto’s Vice President of Supply Chain Meng Qingpeng, at the beginning of 2023, when the company had fewer than 20,000 orders, Li Xiang proposed delivering these orders as quickly as possible while releasing weekly sales rankings. This approach was intended to make the industry aware of Li Auto’s strong sales while significantly shortening the consumer decision-making cycle, thereby boosting sales performance.

Li Xiang began widely sharing weekly sales rankings, and as Li Auto's sales rose, his activity on social media increased as well.

Photo credit: Li Auto

To build momentum for the Li MEGA model, Li Xiang set an ambitious goal to make the Li MEGA the top-selling vehicle above 500,000 RMB across the entire passenger car market. This bold claim, combined with Li MEGA’s outstanding design, quickly became a hot topic within and outside the industry.

Although the public buzz grew louder, Li Xiang neglected to adequately promote the Li MEGA's product strengths, focusing instead on sales performance and exterior design.

Before the official unveiling of the Li MEGA, leaked spy photos circulated online, showing a vehicle design drastically different from traditional MPVs, sparking widespread online discussion. Amid the swirling public discourse, Li Xiang took to social media to deny the authenticity of these photos.

However, when the Li MEGA was officially revealed, the vehicle closely resembled the previously leaked images and caused discussion online. Using the opportunity, Li Xiang humorously used AI technology to promote the company’s MindGPT large model, which was integrated into the Li MEGA.

The significance of the MindGPT in the Li MEGA was overshadowed by the intense public opinion. For the average consumer, the Li MEGA’s design was highly controversial, followed by a series of misunderstandings that sparked a serious brand crisis, resulting in numerous order cancellations and the worst sales slump in Li Auto's history.

Financial reports indicate that in Q1 2024, Li Auto's free cash flow was at negative 5.1 billion RMB. In comparison, the company had a positive cash flow of 6.7 billion RMB in Q1 2023, and 14.6 billion RMB in Q4 2023. This marked the first time since the 2022 transition from the Li ONE to the L series that Li Auto experienced negative cash flow.

However, unlike in 2022 when the sudden cessation of the Li ONE left Li Auto in a transitional phase, the current L series models still provide strong revenue generation. Yet, in preparation for making the Li MEGA the top-selling vehicle in its price range, Li Auto had expanded its team, anticipating major success. The harsh reality has forced painful layoffs instead.

According to former employees who were laid off, if Li Auto's situation does not improve by Q3 2024, a second round of layoffs might occur in September, with a list of affected personnel potentially already drawn up. Previously, Li Auto had initiated a round of workforce optimization, and multiple former employees reported that nearly 10,000 people were laid off. During this period, Li Auto's total number of employees decreased from over 30,000 at its peak to around 22,000.

When electrification struggles, intelligence takes the lead

In 2023, Li Auto officially launched its two-pronged strategy, which focuses on both electrification technologies and automotive intelligence technologies.

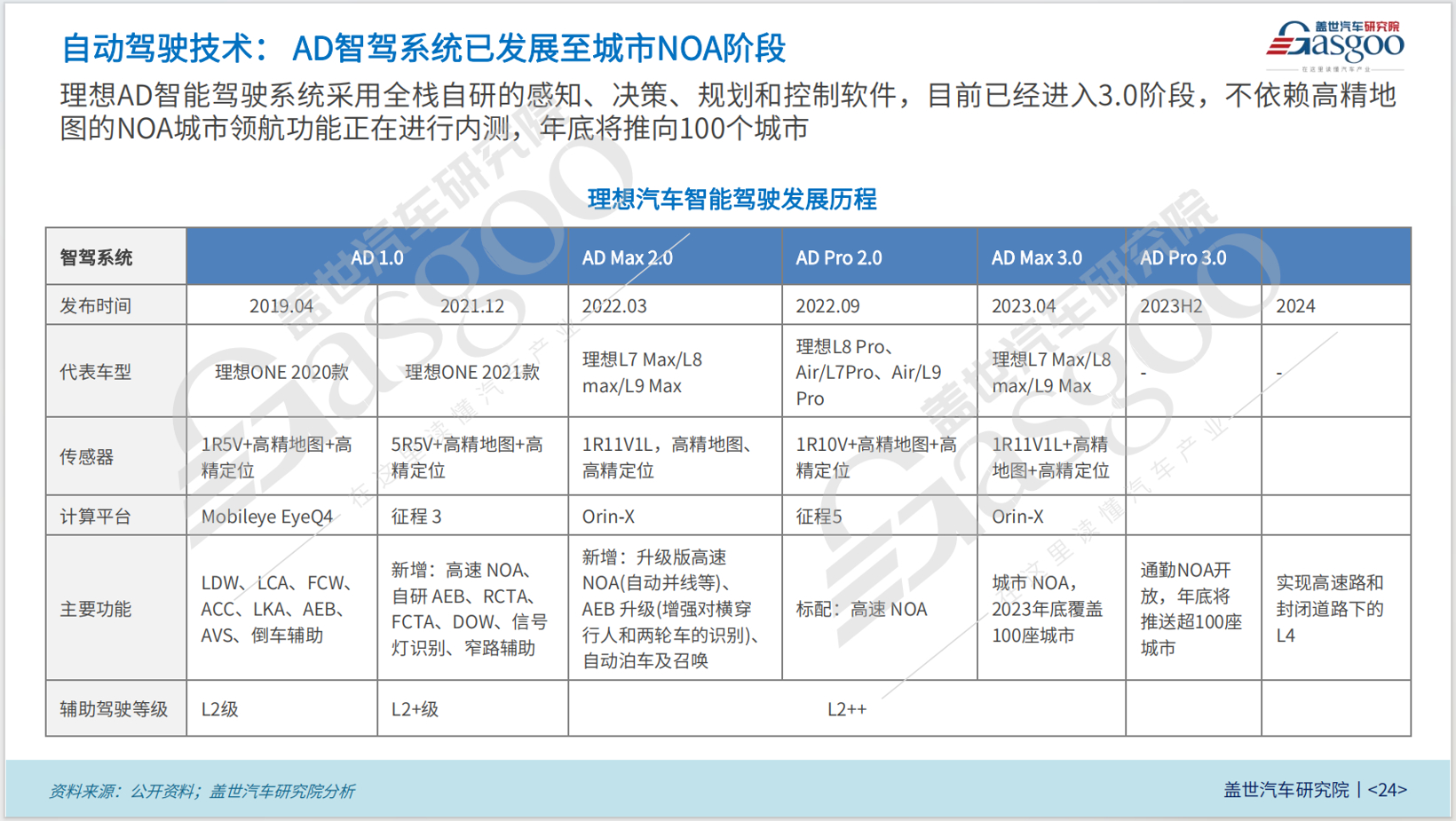

On the intelligence side, the company announced that the urban NOA (Navigation on Autopilot) feature of Li Auto AD Max 3.0 smart driving system would begin rolling out in the second quarter of 2024, with a goal of covering 100 cities by the end of the year. On the electrification front, Li Auto introduced an 800V ultra-fast charging solution, marking the company's entry into a new phase where REEVs and high-voltage battery-electric vehicles (BEVs) coexist.

However, the failure of the Li MEGA underscored the company's first setback in its electricfication strategy. To avoid a recurrence, Li Auto quickly adjusted its development pace. The all-electric SUV initially planned for release this year was postponed to next year.

This adjustment in the product release schedule directly impacted Li Auto's ability to meet its 2024 target of delivering 800,000 vehicles. In March, following the underperformance of the Li MEGA, the company revised its sales goal to a 50%-70% increase over 2023, setting a new target of selling 560,000-640,000 vehicles. With just over a year remaining until the deadline for the internal goal set in 2021, which aims for sales of 1.6 million vehicles by 2025, the delayed release of the all-electric SUV has become critical.

During the second-quarter financial report meeting, Li Xiang emphasized that successfully marketing a high-end all-electric SUV first requires a sufficient network of proprietary ultra-fast charging stations. In his view, the optimal time to launch such a vehicle is when Li Auto's own charging network approaches the scale of Tesla's in China. Additionally, Li Xiang is planning to upgrade and expand the number of showrooms and mall-based stores. He believes that showroom spaces are crucial for selling multiple models across different price ranges. Without adding 500-600 more fixed display spaces nationwide, there is a risk of increasing the number of models without corresponding growth in sales.

Accelerating the rollout of charging stations and increasing the number of display spaces became the primary tasks for Li Auto ahead of launching its all-electric SUV. As of July 31, 2024 Li Auto had built 701 ultra-fast charging stations with 3,260 charging piles across China. The company plans to have over 2,000 ultra-fast charging stations and more than 10,000 charging piles by the end of the year.

With the development of electrification technology temporarily slowed, Li Xiang shifted his focus to breakthroughs in the intelligence domain.

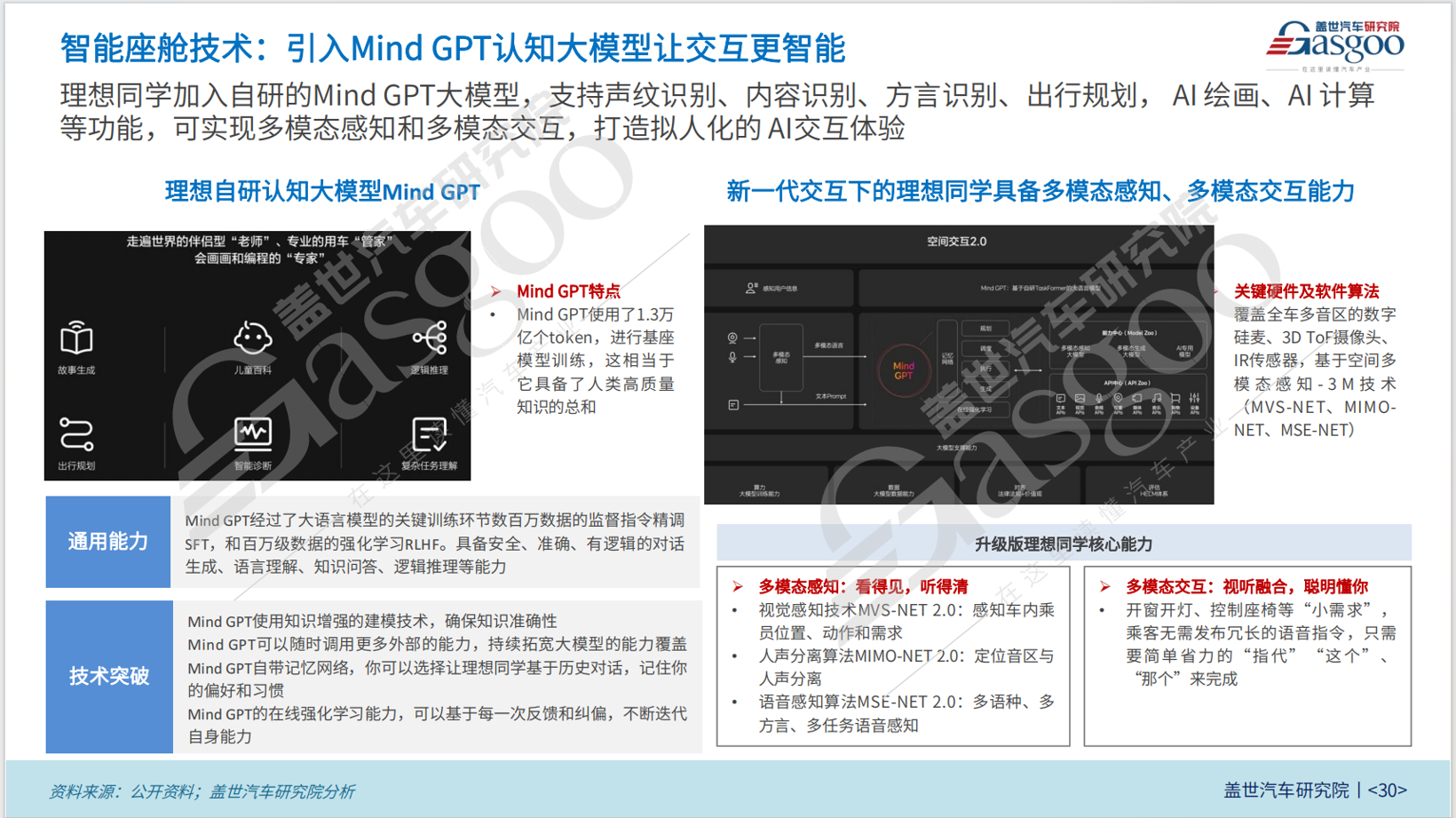

The Li MEGA is equipped with the Mind GPT large model, making it the first fully self-developed multi-modal cognitive model implemented in an intelligent cockpit in the Chinese automotive industry. Supported by the Mind GPT, the Li Xiang Tong Xue voice assistant demonstrated powerful semantic understanding capabilities, enriching users' in-car experiences.

In the field of intelligent driving, Li Auto held its 2024 Autonomous Driving Summer Launch Event on July 5, where it announced that the HD map-free NOA feature would be rolled out to Li Auto AD Max users in July. This update includes fully automated AES (Automatic Emergency Steering) and comprehensive low-speed AEB (Automatic Emergency Braking). At the same event, Li Auto introduced a new autonomous driving technology architecture based on an end-to-end model, VLM (Vision Language Models), and a world model, with an early adopter program for the new architecture set to begin.

On July 15, Li Auto started rolling out the OTA 6.0 vehicle system update, which officially activated the HD map-free NOA feature for AD Max users. This feature allows the vehicle to perform tasks such as autonomous lane changes, overtaking, obstacle avoidance, adaptive cruise control, traffic light recognition, and automatic intersection crossing in urban environments without relying on HD maps. This functionality is available on all navigable urban roads across China.

At the same time, Li Auto also upgraded the urban LCC (Lane Centering Control) feature for AD Pro users. The enhanced LCC can navigate complex intersections and perform tasks such as yielding to pedestrians and decisively avoiding obstacles in urban environments. Additionally, urban LCC will include a lane reconstruction capability, allowing for stable passage even when lane markings are unclear.

The intelligent driving capabilities of both AD Max and AD Pro models are steadily improving. At the 2024 China Auto Chongqing Summit, Li Xiang revealed plans to launch a supervised autonomous driving system trained on over 1,000 million clips by the end of 2024 or early 2025. Based on this technology, L3 autonomous driving with supervision can be delivered to users on a large scale.

As Li Auto previews its plans at industry forums and steadily advances the deployment of more sophisticated intelligent driving systems, it is evident that intelligence will be a key focus of the company's marketing approach leading up to the launch of its pure electric SUV.

It is undeniable that Li Auto is facing significant challenges from competitors such as AITO’s M7 and lower-priced models from Leapmotor and NETA Auto, which offer similar features to L series vehicles. Currently, the company's competitiveness is largely supported by its lower-priced Li L6 model. In this context, Li Auto urgently needs to find new breakthroughs. The upcoming launch of autonomous driving features and mid-to-high-end pure electric SUV products are expected to be the most anticipated developments for the company's future.

However, in the rapidly evolving smart electric vehicle industry, creating products that exceed industry standards and offer exceptional value requires substantial and sustained R&D investment. Financial reports from previous years show that Li Auto’s R&D spending has increased rapidly, from 790 million RMB in 2018 to 10.586 billion RMB in 2023. In the first quarter of 2024 alone, Li Auto's R&D expenses reached 3 billion RMB, a year-on-year spike of 64.6%, equivalent to the total R&D spending for the entire year of 2021. Li Auto has long recognized the importance of advanced technology, understanding that only by establishing technological barriers can it achieve rapid growth and maintain its leading position.

According to the company’s report, in the first seven months of 2024, Li Auto's total vehicle deliveries have reached 239,981 units. By the end of July, its cumulative deliveries stood at 873,345 units.