Five years ago, no one saw it coming: the real struggle would begin after the pandemic. While social order has been restored, normalcy hasn't returned for many lives.

In the auto sector, price wars, hyper-competition, and layoffs have become unavoidable keywords in recent years. It's getting harder to tell ourselves, "Just hang in there; things will get better."

As we enter 2026, what do we expect? Perhaps it mirrors the declaration of Yu Kai, founder of Horizon Robotics: the hope to be the one who "stays at the card table forever."

Image Source: Gasgoo Auto

In 2025, Professionals Just "Hanging On"

"At least I still have a job." "At least I'm still earning." "At least I wasn't laid off." These sentiments capture the reality for many auto insiders over the past year.

The global auto industry has been sucked into a fierce battle. Countless small and medium enterprises have collapsed in silence, while multinational giants have wielded the "ax of layoffs" to cut costs and boost efficiency. Incomplete industry statistics show that since Nissan launched its massive global cuts in 2024, more than 130,000 jobs have vanished from the automotive sector worldwide.

In the Chinese market, several once-prominent players have faded from view: SALEEN, WM Motor, HiPhi, Jidu, Neta. Employees at these firms found themselves jobless overnight. With every collapse, industry peers feel the pain, followed by relief that they weren't the ones left out in the cold.

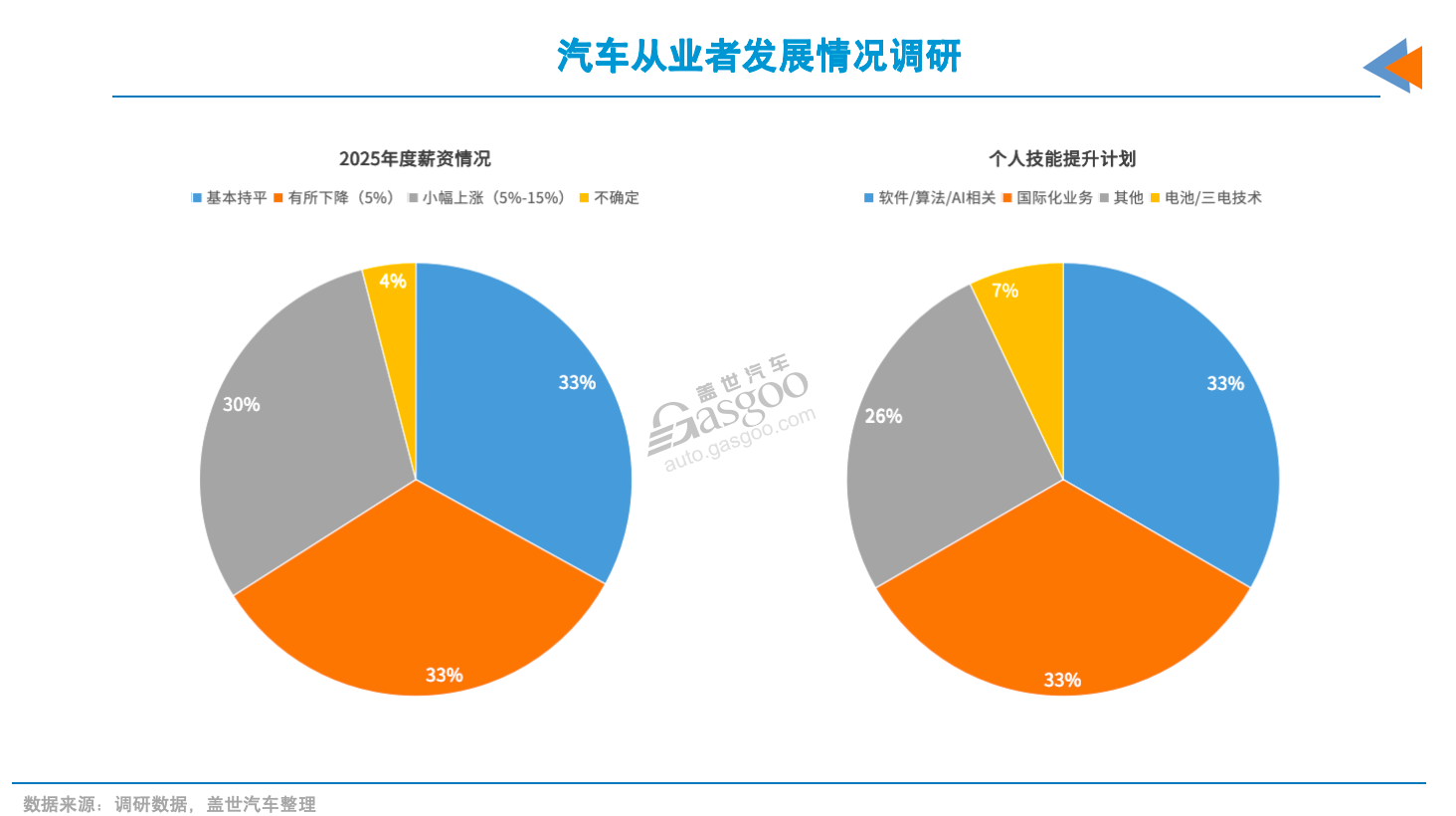

At this juncture, companies that can still afford to raise salaries for top performers are an envied minority. Since the pandemic, stagnant pay has been the norm, and pay cuts are hardly news anymore. A survey by Gasgoo found that in 2025, roughly 30% of respondents saw a pay increase, while another 30% suffered a cut. The remaining third saw little change. Few experienced a salary jump of 20% last year.

"A," a journalist at an automotive media outlet, took a pay cut but stayed put—his income remains relatively high within the industry. "If I switch jobs, the pay might not go up, but the workload definitely will," he said. "B," employed at a third-party testing agency, saw his total income halved as fierce competition drove down client billing rates. Then there is "K" from an automaker's product division, who admitted he has "never seen a year-end bonus." Any so-called "big package" is entirely contingent on how well new models perform in the market.

With the job market turning into a buyer's market, hiring requirements are demanding Swiss-army-knife versatility. Take content planning roles at automakers, for example: candidates must write, shoot, and edit, all while demonstrating boundless creativity. The pay remains for one person, but the workload is that of three—a practice euphemistically dubbed "boosting efficiency with AI tools."

As professionals compare notes on job requirements across companies, they find the situation is messy everywhere. "Better to just keep hanging on" often becomes the reluctant conclusion.

"It's a fortress, inside and out," sighed "C," who jumped from the auto sector to an artificial intelligence company. Her job title is still "content," but the nature of the work has shifted: she must translate complex technical parameters into user-friendly text, learn to produce AI-animated videos, and sit through endless meetings. "I've finally experienced the big-tech pace—I pass out the moment my head hits the pillow," she said. Her routine is 9 a.m. to 9 p.m. In a photo she shared, "half the office is still there at 9 p.m."

Then there is "D," an internet professional who spent a year unemployed after being laid off before landing a job at an AI firm. He hasn't received a raise in eight years. In March 2025, he took a 10% pay cut to join the new company. Although his contract specifies "16 months of pay," he remains realistic: "It's not fixed base pay; year-end bonuses are just empty promises." He recalls getting a brief 20% raise five years ago, only for the company to go bankrupt a month later. "My stock options vanished too."

This captures the reality for many automotive and internet practitioners in 2025: "hanging on" in an uncertain environment, clinging to a fragile sense of stability under the shadow of pay cuts, mounting workloads, and layoffs.

The Delayed Realization

Signs of the industry's upheaval actually appeared three years ago.

Top players were already rewriting the playbook as the price war erupted in full force. Back in 2023, BYD's annual sales surged past 3 million units, accelerating a market reshaping. Tesla, holding the cards on technology and pricing, sent shockwaves through the industry with every adjustment.

At the same time, the internal combustion engine's fortress was crumbling. Data from the China Passenger Car Association (CPCA) shows that the market share of domestic brands topped 50% in 2023, while strongholds held by German and Japanese joint ventures continued to shrink. In China, multinationals like Volkswagen, Toyota, and Honda joined the price war to defend their base, while brands like Hyundai, Kia, and Dongfeng Peugeot-Citroen saw their influence fade.

The divergence in fate among non-leading domestic brands is even starker. Seres and JAC grabbed a lifeline by partnering with Huawei, while JMC and Haima have largely lost their voice in the mainstream market.

Yet for the majority of rank-and-file employees lacking market sensitivity, this seemed like a problem for "the people upstairs." While executives burned the midnight oil over sales, market share, and strategy, the daily grind for the rank-and-file felt unchanged: pick up a task, hit the deadline, collect the paycheck.

The industry's turbulence felt like watching a scene through a window. Hearing about layoffs at a foreign firm, colleagues would discuss whether the severance was generous. Seeing a new entrant in trouble, they would offer a brief sigh of relief that they weren't on that sinking ship. Back then, finding a new job after being laid off wasn't too difficult. The explosion of new-energy vehicles created a talent gap in the millions, making opportunities seem abundant.

The early signs of change accelerated rapidly in 2024. The key variable was artificial intelligence (AI), quietly seeping from strategic presentations into daily work life. At industry forums, executives and experts began discussing how AI would change the world, the auto sector, organizational structures, and work patterns.

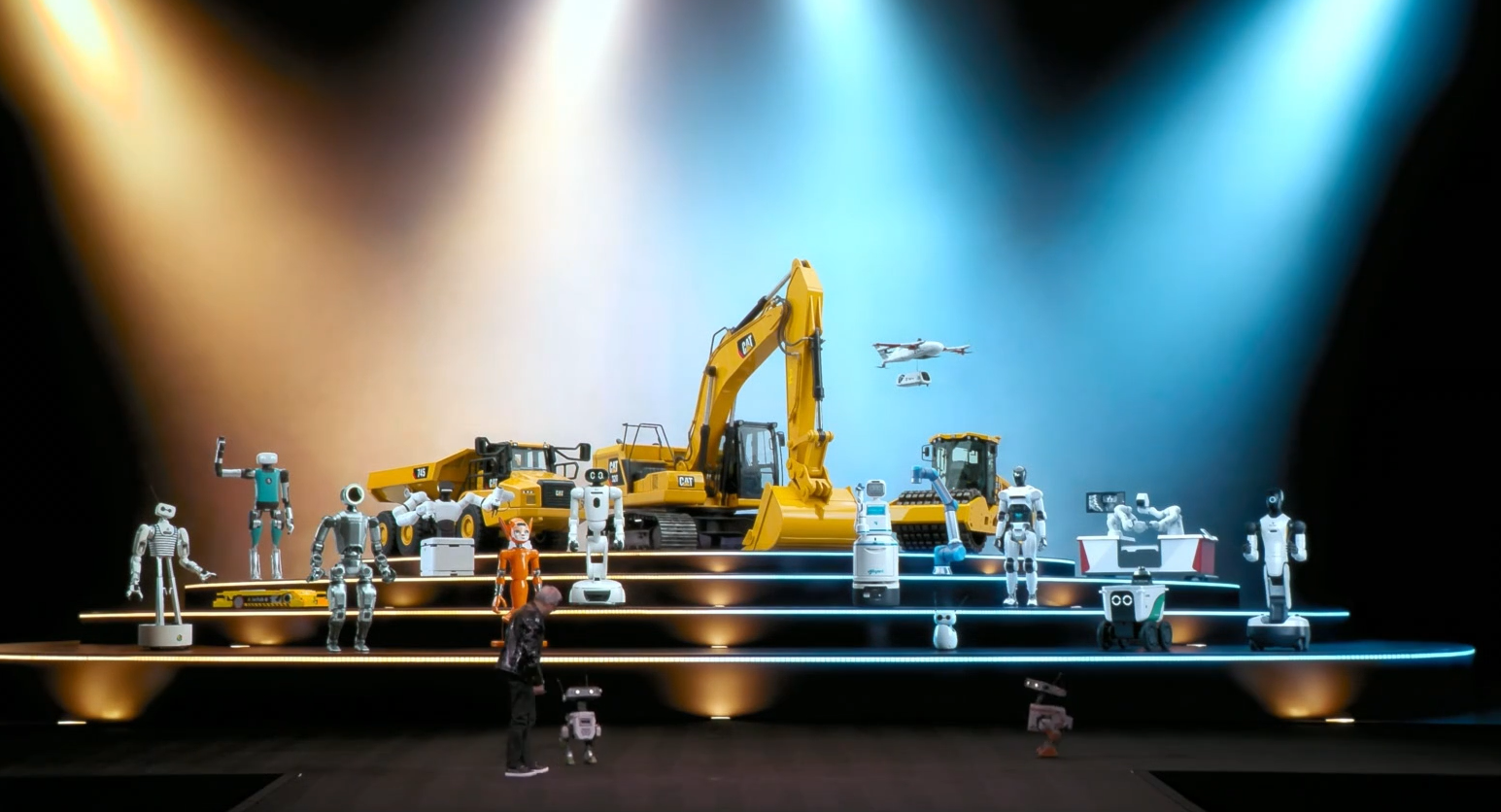

Image Source: NVIDIA Livestream Screenshot

Zhan Chungao, general manager of Yanfeng International, noted that at their core, phones, cars, and robots will all eventually be AI-driven. Wu Huixiao, CTO of Great Wall Motor, predicted that cars are evolving from mere mobility tools into embodied AI agents. XPENG and Li Auto have announced plans to transform into AI companies, while Tesla is betting its future on robotics.

Rank-and-file workers, meanwhile, are seeing their jobs "reshaped by AI." As AI rapidly generates copy and processes basic code, the technical barriers protecting many roles are being shaken. The introduction of AI tools often means heavier workloads: a report that once took a day might now be due by noon.

"E," who moved from a state-owned enterprise to a tech firm, felt this acutely. "My salary went up, but my responsibilities are scattered—I have to do the work of several people," he said. When he later joined a foreign firm, he found it had been fully "China-ized" and "digitalized," with AI becoming a daily tool for writing reports and conducting analysis.

Hyper-competition is eroding profits, directly impacting hiring strategies. Data shows the auto industry's profit margin stands at just 4.4%. Amid the sustained price war, growing revenue without growing profit has become the norm. With the exception of a few top players, most companies are operating below the "survival line." Controlling labor costs has become the most direct choice for businesses.

"M," who was looking to switch jobs, found that opportunities had clearly dried up. "I asked a few companies, and they all said they have no hiring plans for now," he said. The few roles that are still open often come with single days off, intense overtime, or extremely high turnover.

It is only now that professionals like "M" realize, with a jolt of delayed hindsight, that they have long been caught in the storm of this market competition.

Anxiety Persists into 2026

In a state of unease, we have walked into 2026. Yet the new year hasn't brought a fresh start. For the rank-and-file, if the theme of 2025 was "hanging on," the prevailing mood at the start of 2026 is "struggling to stay afloat."

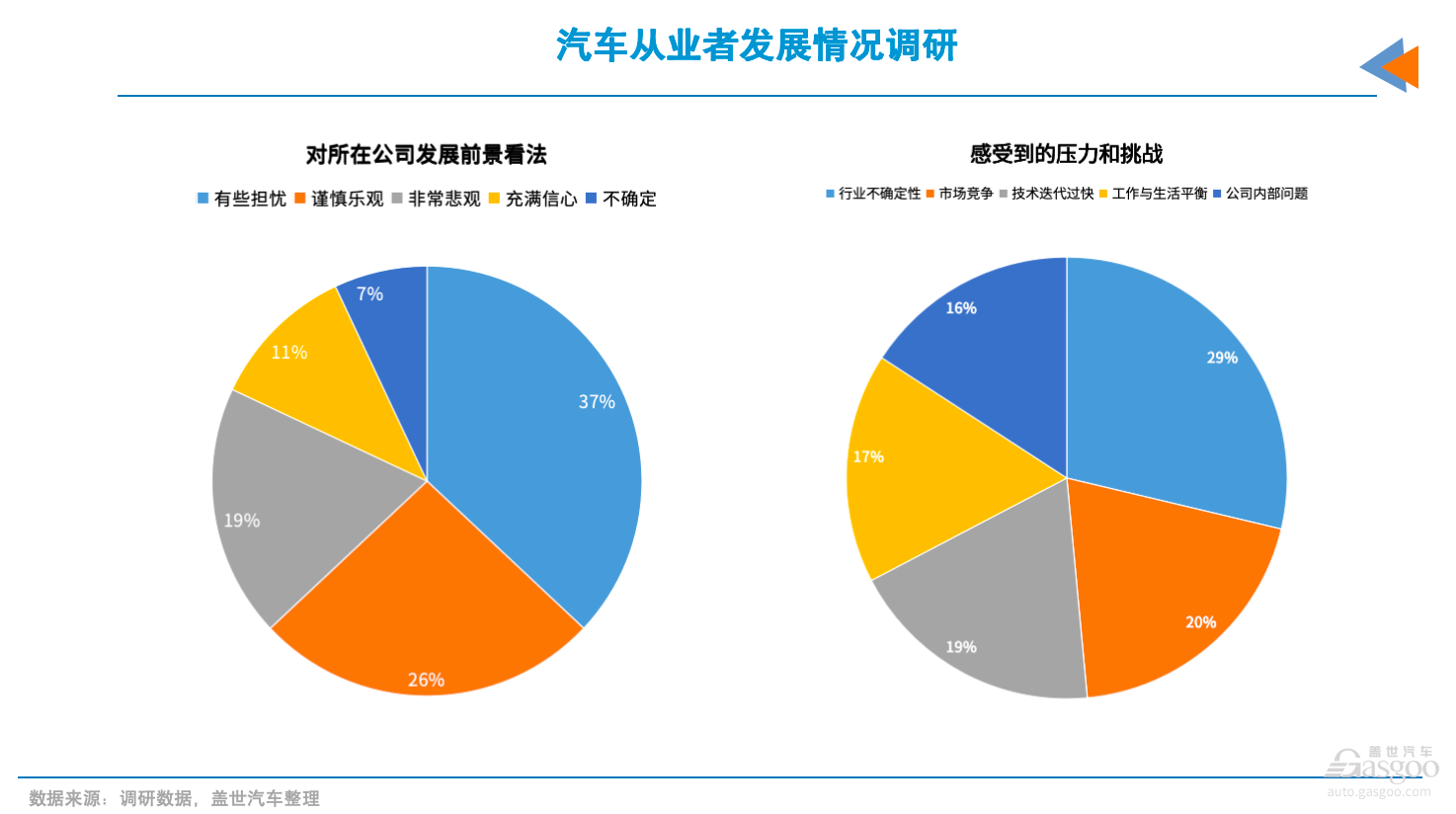

A Gasgoo survey found that only 10% of respondents remain optimistic about their company's development prospects, while more than 60% are worried. Against this backdrop, only 30% choose to stay put and dig deeper into their current roles. Another 50% are choosing to jump ship actively or watch for better opportunities.

Even the few who cast an "optimistic" vote, like "H," hold that confidence as a form of self-support. "We have to be optimistic about the industry's development," he said. "Whether we can achieve it is another story."

This suggests that the anxiety among respondents stems less from dissatisfaction with internal processes or efficiency, and more from the uncertainty surrounding the industry's future. We all know that the economic base determines the superstructure—and the temperature of the industry directly affects how each of us feels.

Reports indicate that multiple institutions are cautious about the 2026 auto market outlook. UBS predicts that domestic passenger car sales growth could slow sharply from 8% in 2025 to -2% this year. Morgan Stanley holds a similar view, believing market growth will decelerate significantly.

Cui Dongshu, secretary-general of the CPCA, stated that market competition is shifting from "price games" to "value competition." This implies the market pie is saturating, and the battle for market share is about to turn white-hot.

More tangible changes come from the market itself: From January 1 to 18, 2026, domestic passenger vehicle retail sales reached 679,000 units, a 28% year-on-year drop. Notably, retail sales of new energy vehicles plummeted 52% month-on-month, with some media describing it as an "unprecedented cold wave." During a recent visit by Gasgoo to several new-energy brand stores in shopping malls, foot traffic had dropped drastically. Even for the hotter brands, there were only one or two customers browsing at any given time.

When macro forecasts and market data both point to a "cooling," individual insecurity is invisibly magnified. "I'm starting to understand why so many people crave stability," said "S" to Gasgoo after a month of continuous overtime. Under the guise of "AI empowerment," her department's workload has only increased, yet she no longer has the courage to quit without a backup plan.

Behind those attractive salaries lies the cost of disrupted personal time and living space. "L," who works in the PR department of a brand, said working on weekends is the norm, making it impossible to look after family.

Further up the supply chain, the pressure takes a more tangible form. To match the accelerating delivery pace of automakers, three-shift rotations have become the norm on some parts production lines. "Q," who switched to a supply chain firm to manage automaker partnerships, has recently been "flying to a different city every day."

"G," who graduated from a vocational school last year, interned in the welding workshop of a large domestic automaker. The repetitive mechanical labor and the grueling two-shift cycle convinced him never to "return to the production line."

However, upon entering the workforce, he discovered that finding a suitable and satisfying job is far harder than he imagined.

In an environment saturated with overtime and hyper-competition from top to bottom, asking the meaning of that overtime—whether it's for promotion or a "better future"—has become pointless.

The so-called "poetry and distance" may have been buried deep in the heart. Most people only see the reality right in front of them: next month's mortgage and car payments. This is especially true for middle-aged workers supporting both parents and children; avoiding layoffs means saving more money and building slightly more resilience against risk. "Everyone fears falling behind the trend, fears moving too slowly, fears being eliminated," said "S."

We Must Still Believe in "Light"

For those of us in the auto industry, 2026 is still hard to view with optimism. The reality is stark: the market remains hyper-competitive, profits are thin, organizations are restructuring, and headcount is tightening.

Yet, we should still believe that there is light in life. Existence is inherently a mix of anxiety and hope. The road is winding, but the future is inevitably bright.

In a report titled "As Long as You're Alive, There's a Chance," published by a media outlet earlier this year, the demeanor of several new-energy founders revealed a calm that comes after weathering a low point. They are no longer talking about ethereal visions, but about concrete users, implementable technology, and how to make their companies run healthier. Survival has become the most practical ideal.

As NIO's William Li put it, "I think NIO is still alive, and as long as you're alive, there's a chance." This blunt statement captures the most critical goal for companies right now: do whatever it takes to survive. For them, simply remaining at the card table is, in itself, a source of confidence.

"Y," a dealer, noted that "the challenge is market uncertainty following changes to national subsidy policies, but the opportunity lies in the positive impact of automakers' new products." How long that impact lasts depends on whether the industry can seize the window of technological transformation.

For the average auto practitioner, where is the light ahead? "W," an industry veteran, offered a direction: "The auto market is incredibly vast and full of opportunities. We must always remain curious and learn new technologies."

So, where are the new opportunities in the auto sector? Those who understand the industry know they lie in assisted driving, in AI, in overseas markets...

By 2025, the penetration rate of L2 driver assistance systems in China had already surpassed 50%. Zhang Yongwei, vice chairman and secretary-general of the China EV 100, forecasts that the two to three years following 2030 will be the window for L3 and L4 technologies to move from pilot testing to large-scale application. He Xiaopeng, founder of XPENG, believes that over the next decade, AI, software, and hardware will become equally important to a car's value. And 2026, he says, "will be a critical moment for the mass application of AI and the large-scale commercialization of robotaxis."

New tracks inevitably create new roles. While AI replaces some repetitive jobs, it is also creating new positions, including algorithm engineers, cockpit engineers, intelligent driving product communication specialists, and AI experts.

Facing industry transformation, going with the flow is the most realistic and ideal choice. "Y" noticed that "AI has spread rapidly in domestic cars, but it will take time for joint venture brands to fully catch up." This difference in pace creates a window of opportunity for talent familiar with the local intelligent ecosystem.

Another area providing massive employment is overseas expansion. China's auto exports surpassed 8 million units in 2025. This means there is an urgent need in overseas markets for versatile talent who understand both product and technology, as well as market dynamics and cross-cultural operations.

There are also traditional roles where core capabilities cannot be replaced by AI. Take writing-related positions: AI can produce a standard report, but it struggles to create copy that truly moves people; it can analyze market data, but it cannot write a story with "human warmth." "No one wants to be interviewed by an AI," said "W."

He believes that "the auto industry has always been hyper-competitive, so the sooner you embrace AI, the better. Using AI effectively is key—it saves a vast amount of energy, allowing you to focus on the things AI cannot do."

"Y" also cautioned that practitioners should cultivate their skills deeply and immerse themselves in operations. "You can't view the current market through the lens of past experience," he argued. He believes that hyper-competition will breed new vitality, but only those who keep pace with the times and revolutionize their technological concepts and operational thinking will be able to reap the next wave of dividends.

In other words, we must learn to coexist with AI and let it serve as an assistant. Only then can we free up the energy to understand technologies like assisted driving and AI that are reshaping the industry.

The process of learning new skills isn't always enjoyable. "L" half-jokingly during a conversation, "If all else fails, I'll just go back to farming vegetables." Of course, not everyone has that option to fall back on.

But there is no denying that as long as we still have the strength to joke and banter, it proves that life still has its beautiful side.

(Note: All automotive practitioners mentioned in the text are identified by alphabetical pseudonyms.)