China's March vehicle registrations: three most popular vehicles are EVs

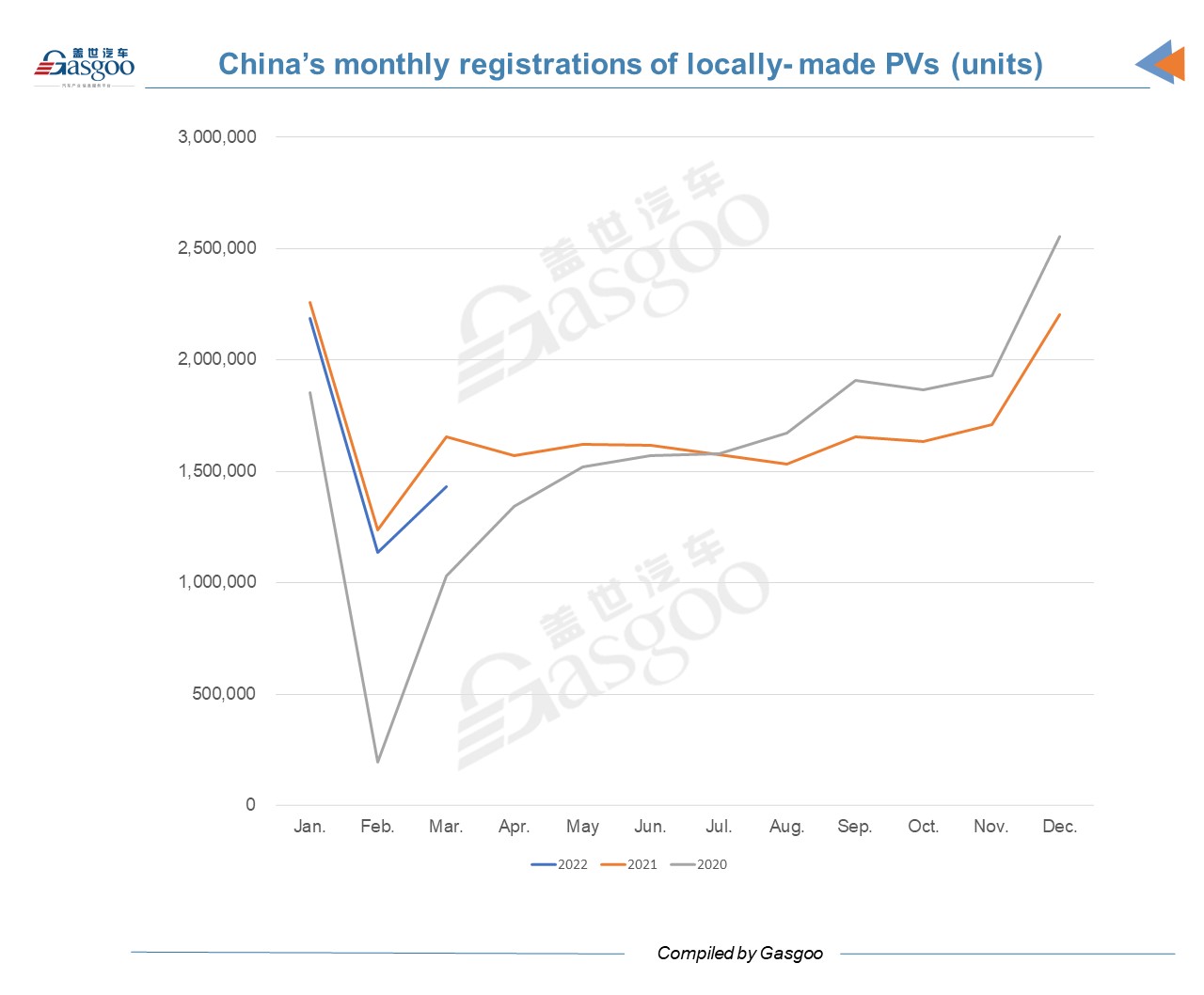

In the third month of 2022, the year-over-year decrease of locally-made passenger vehicle (PV) registrations in China widened when compared with the first two months, and the growth of new energy passenger vehicle (NEPV) registrations also narrowed from a year ago.

In March, the country registered 1,431,671 locally-built PVs, representing a decline of 13.58% versus the same month of last year, higher than the decline in January (3.2%) and in February (8.3%). But compared with February, the March results jumped 26.22%, according to data compiled by Gasgoo Auto Research Institute (GARI).

Due to three consecutive decreases in monthly registrations, the China-made PV registrations fell 7.76% from the same period of last year to 4,751,646 units in the first quarter of this year.

Top 20 brands and models

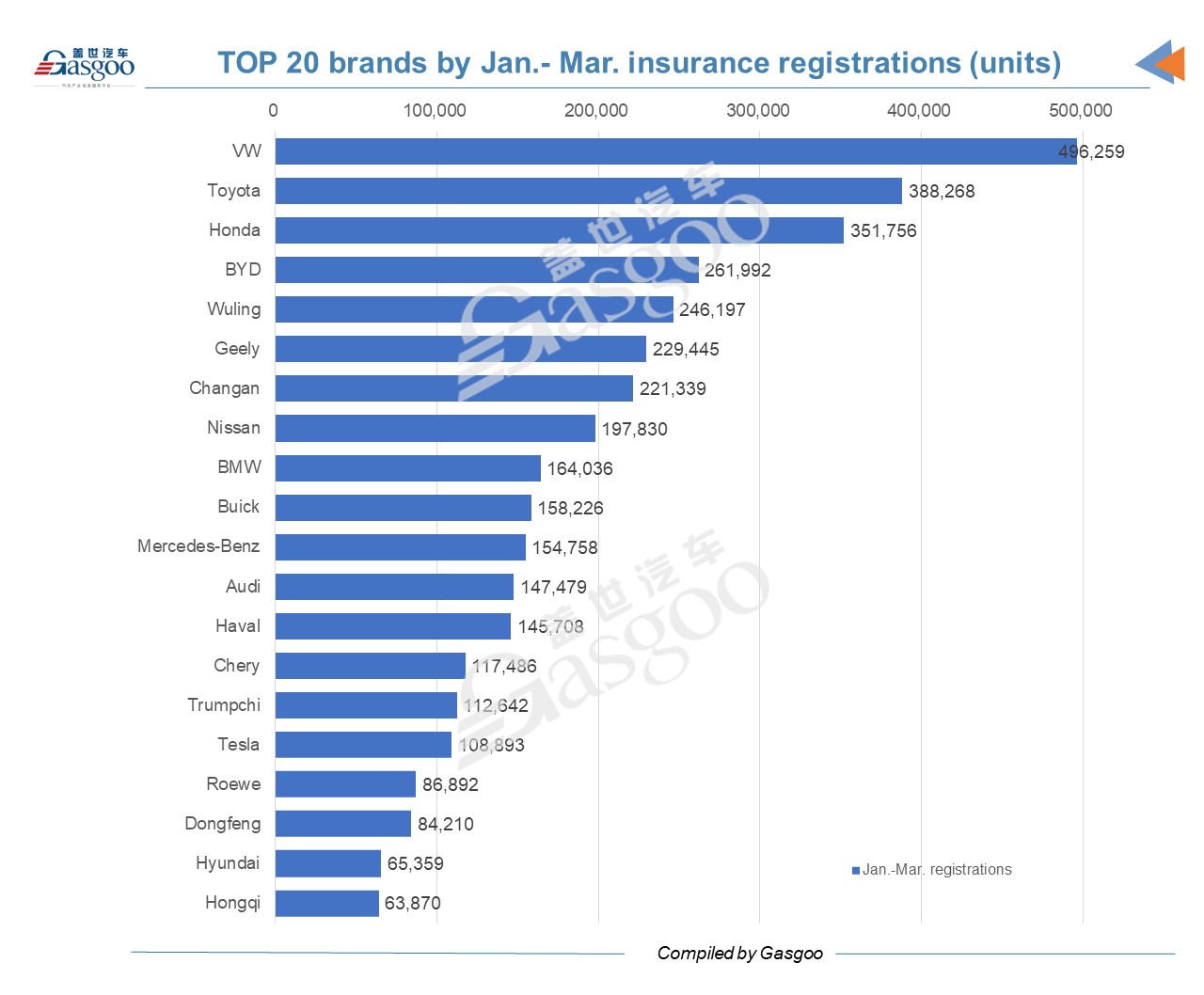

Four brands had monthly registrations of over 100,000 units and seven brands managed to realize year-over-year registration growth. Volkswagen registered the most China-made vehicles in the market, but its monthly registrations dropped 40% from a year ago. Honda, the second runner-up, also reported a decrease of 20.55% in monthly registrations from a year ago.

XPeng joined the top 20 brands list by March registrations with the highest year-over-year increase (227.23%) on the list. BYD came in second in terms of year-over-year increase (219.65%). Tesla, ranking sixth, was the only foreign brand which saw year-over-year registration growth last month. The American brand’s March registrations surged 88% from a year ago to 65,086 units.

By first-quarter registrations, BYD was the only brand with three-digit growth (142%) from a year ago. Apart from BYD, Toyota was another brand with increasing registrations among the top 5 brands, representing a year-over-year growth of 2.72%. Tesla registered 57.37% more vehicles than the first quarter of 2021.

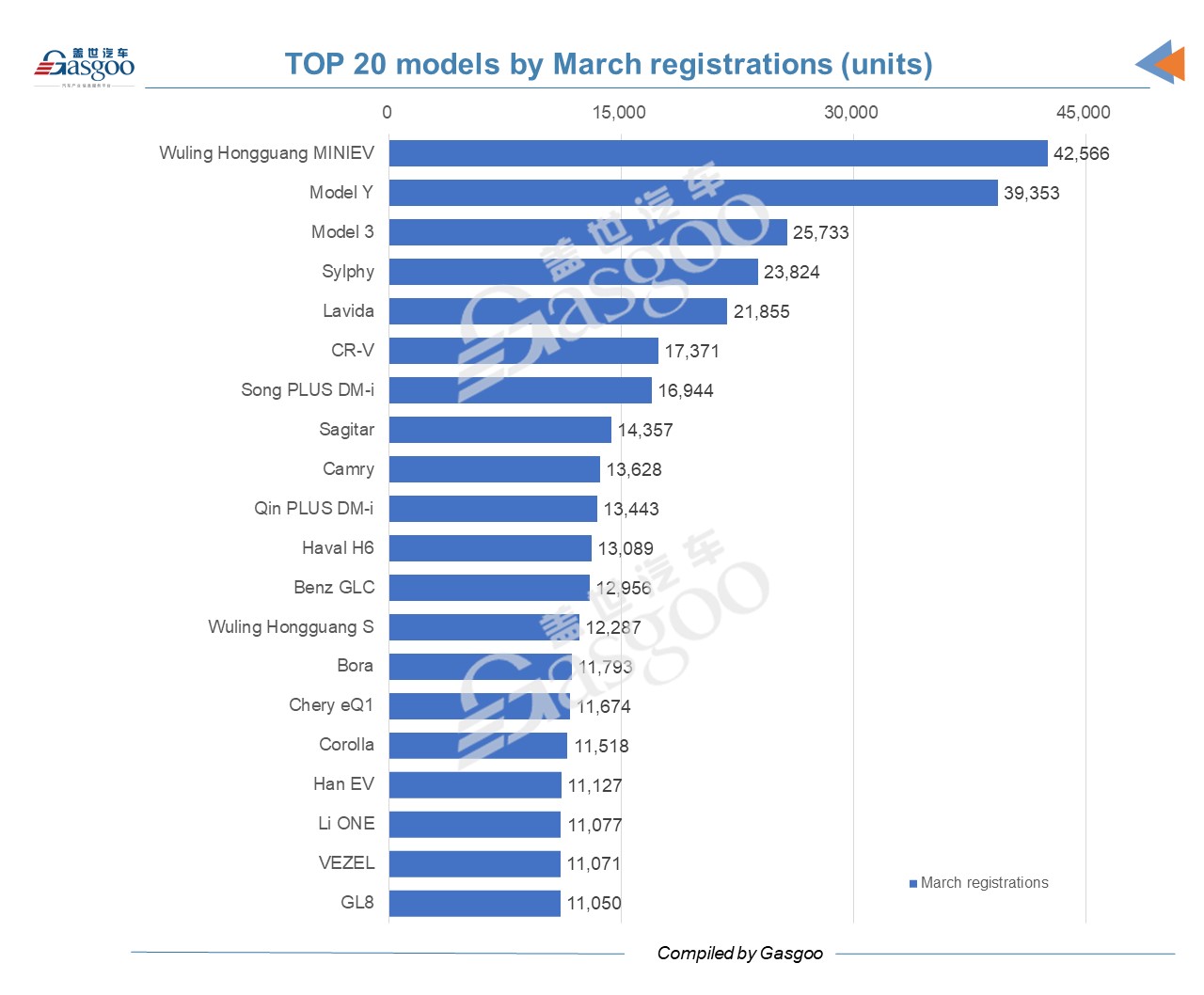

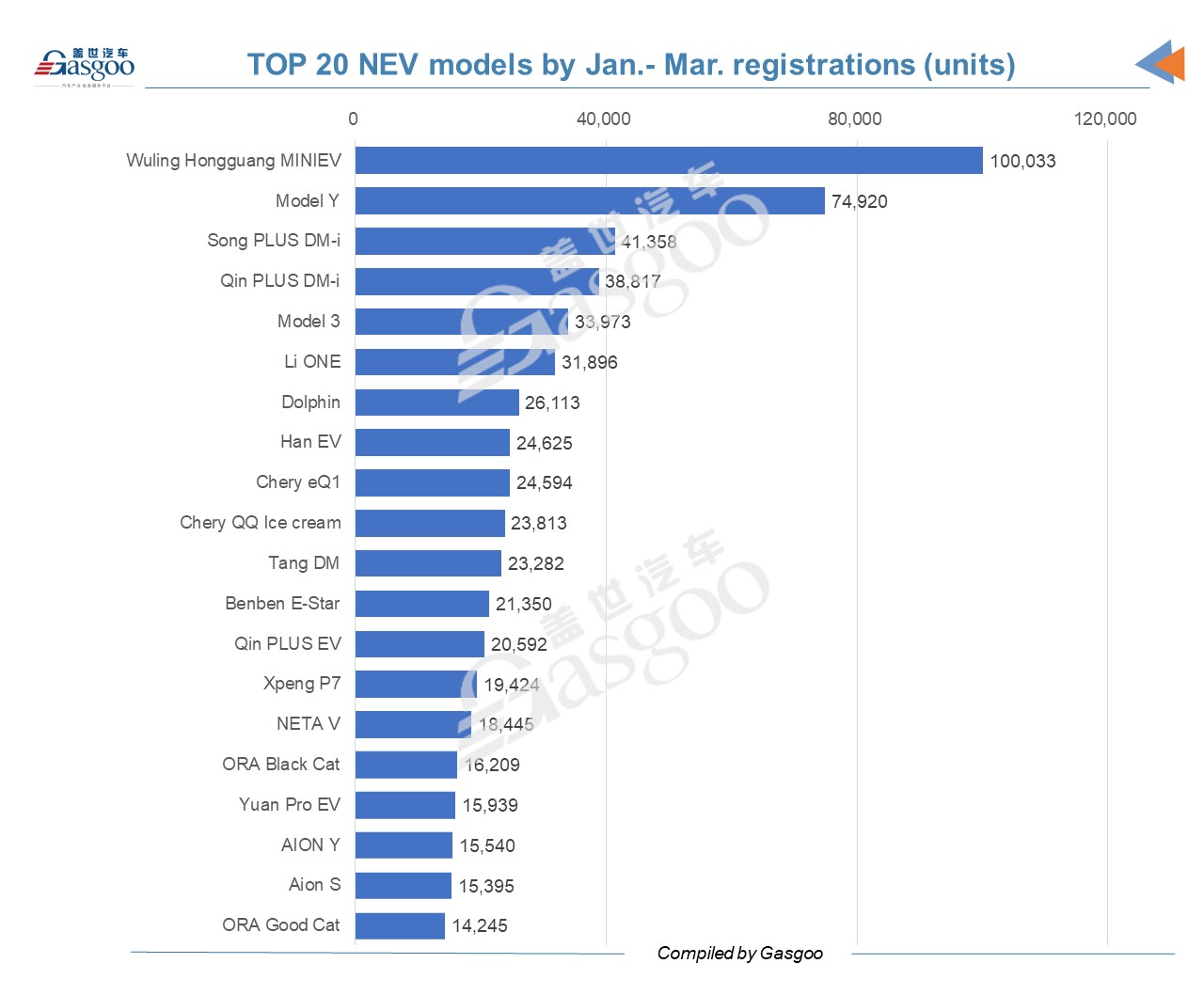

The Wuling Hongguang MINIEV had become the most registered vehicle model in China for two consecutive months after replacing the Sylphy in February. The following two spots were also taken by electric vehicles, namely the two China-made Tesla models, which outperformed the Sylphy. Another five NEPV models were on the list, including one from local startups.

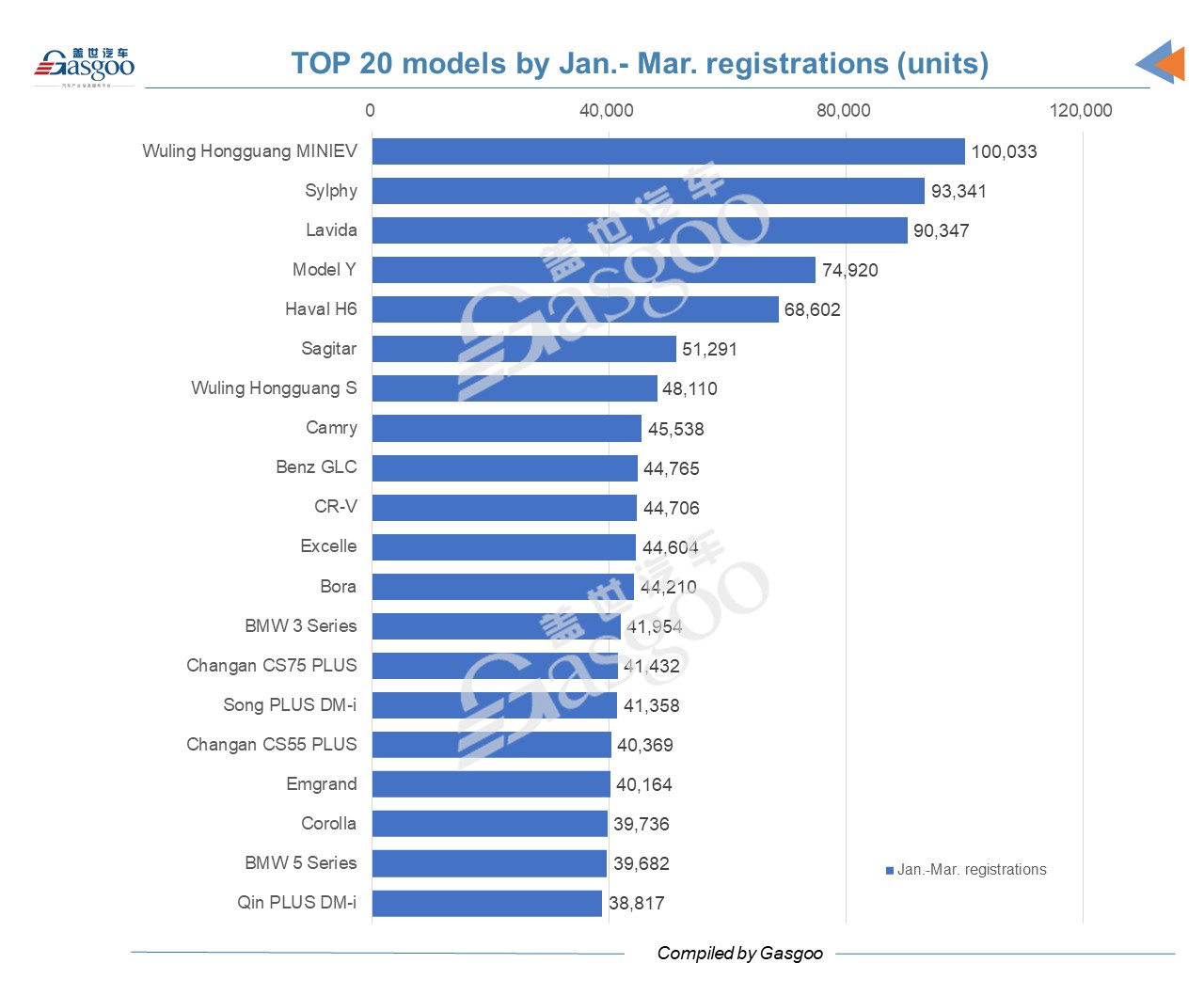

In the first quarter, the Wuling Hongguang MINIEV was the only model with registrations of over 100,000 units. The Model Y from Tesla ranked fourth while the Model 3 fell out of the top 20 models list. BYD had two models on the top 20 models list.

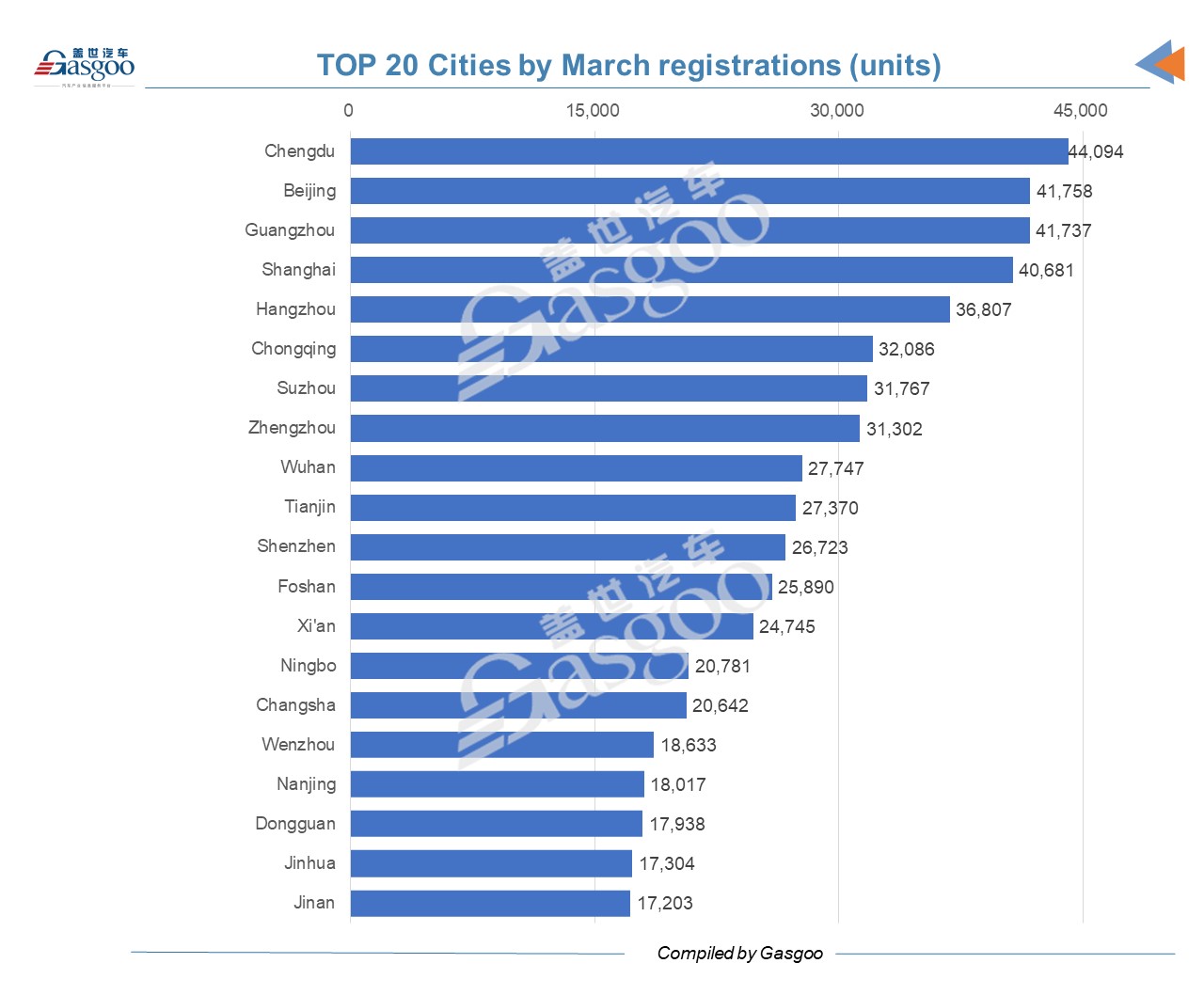

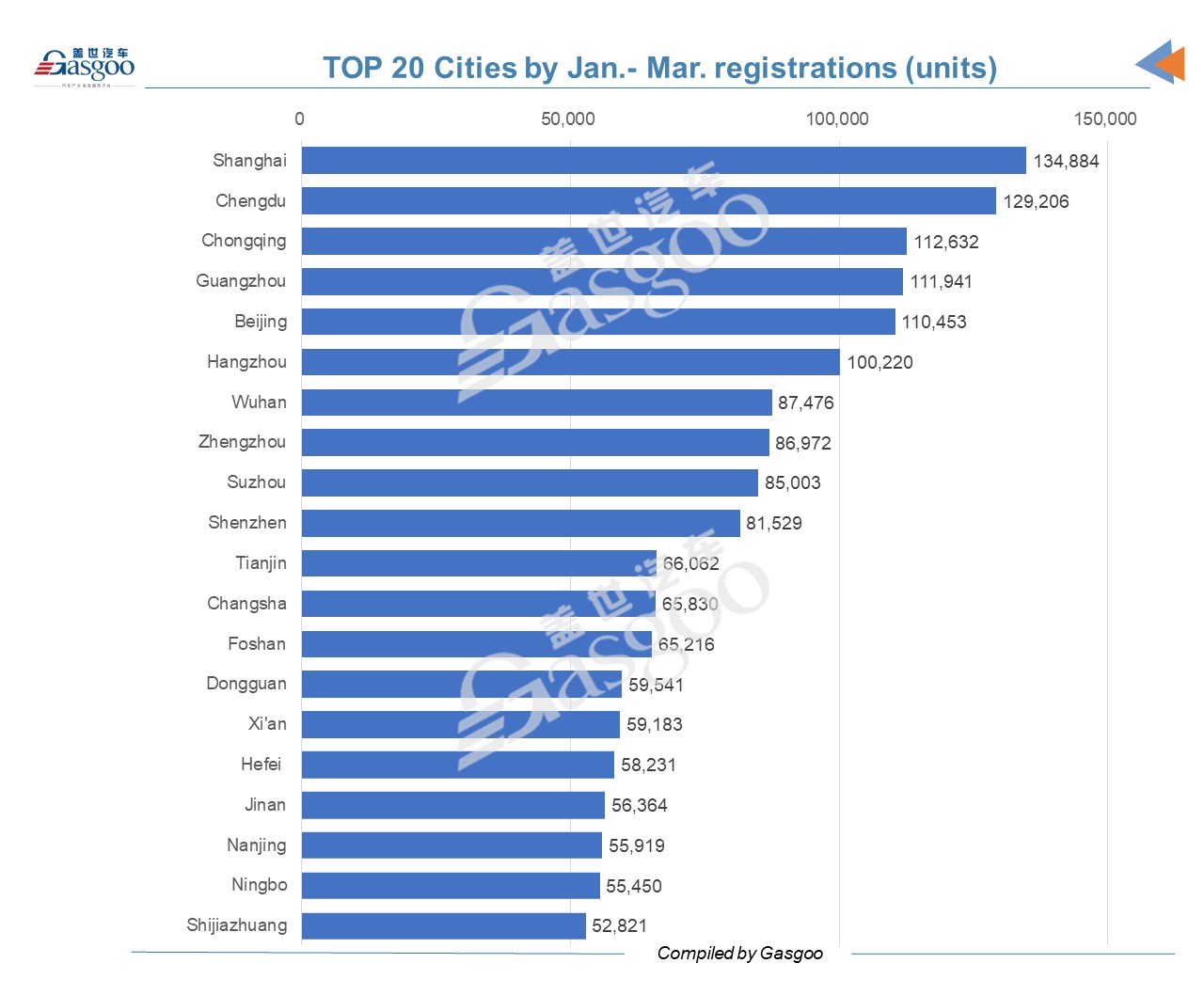

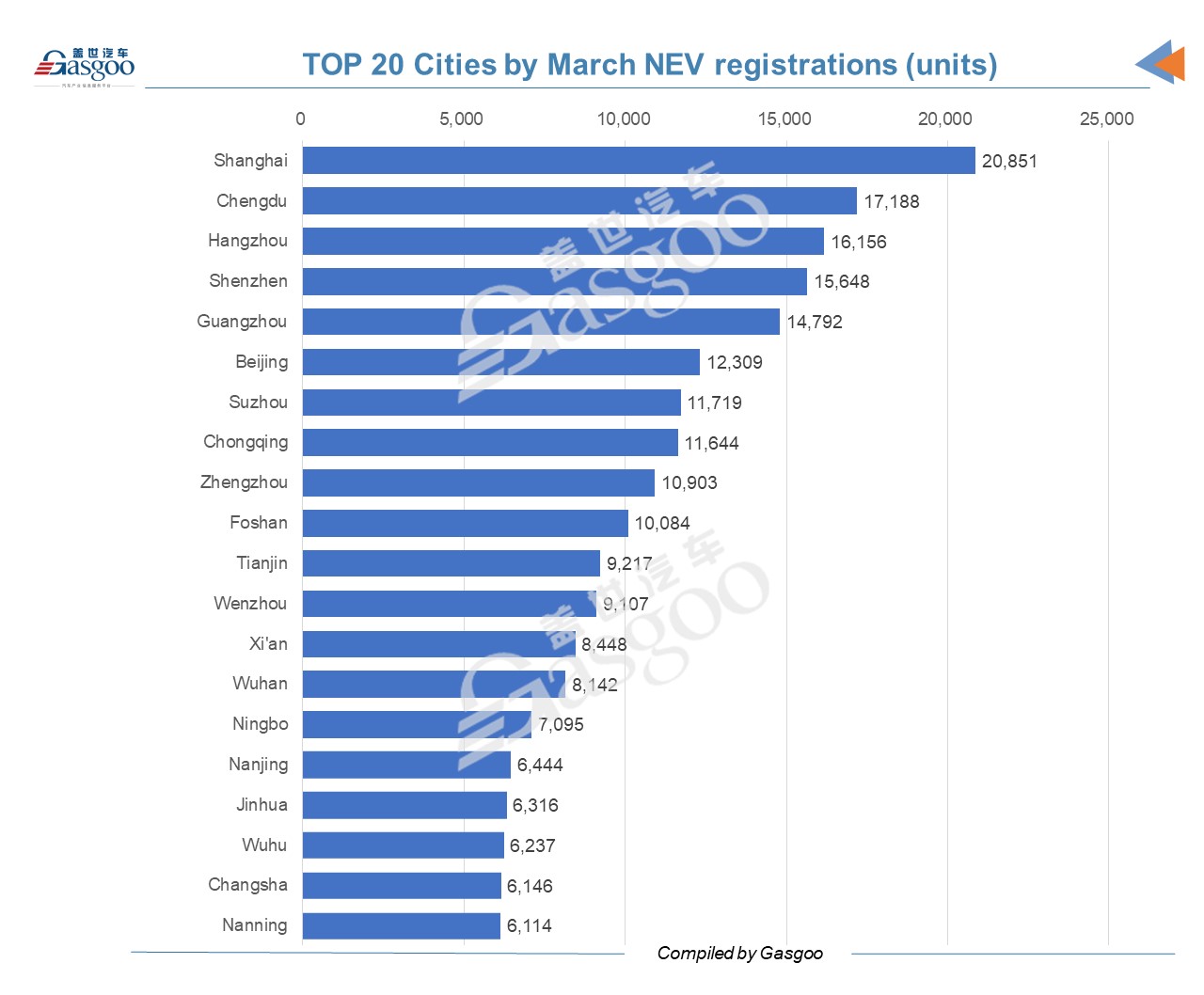

By cities, Chengdu, the provincial capital of Sichuan province, climbed to the top of the top 20 cities list by March registrations, surpassing Shanghai. All of the top 10 spots were occupied by provincial capitals or municipalities directly under the central government.

By quarterly registration results, Shanghai ranked first. And 6 cities registered over 100,000 new vehicles in the first three months of this year.

Top 20 brands by NEPV registrations and top 20 NEPV models

China registered 445,081 locally-made NEPVs in March, representing a year-over-year surge of 138.96% from a year earlier and accounting for 31.3% of the overall monthly vehicle registrations. Besides, the March NEPV results were also the second highest volume in the past 27 months.

Monthly registrations of battery electric vehicles (BEVs) amounted to 362,296 units, accounting for 81.4% of the total NEPV registrations while the volume of plug-in hybrid electric vehicles (PHEVs) totaled 82,784, including 16,215 range-extended electric vehicles. Among the NEPVs registered last month, 44,460 were for renting, 477 for operation while the rest were for non-operation purpose.

In the first three months of this year, the NEPV registrations all posted a year-over-year change of over 110%, indicating NEPVs are becoming increasingly popular. In total, the country registered 1,004,201 NEPVs in the first quarter, including 791,217 BEVs, 212,981 PHEVs and 3 fuel cell electric vehicles. 86,837 out of the vehicles were for renting and 826 units were for operation.

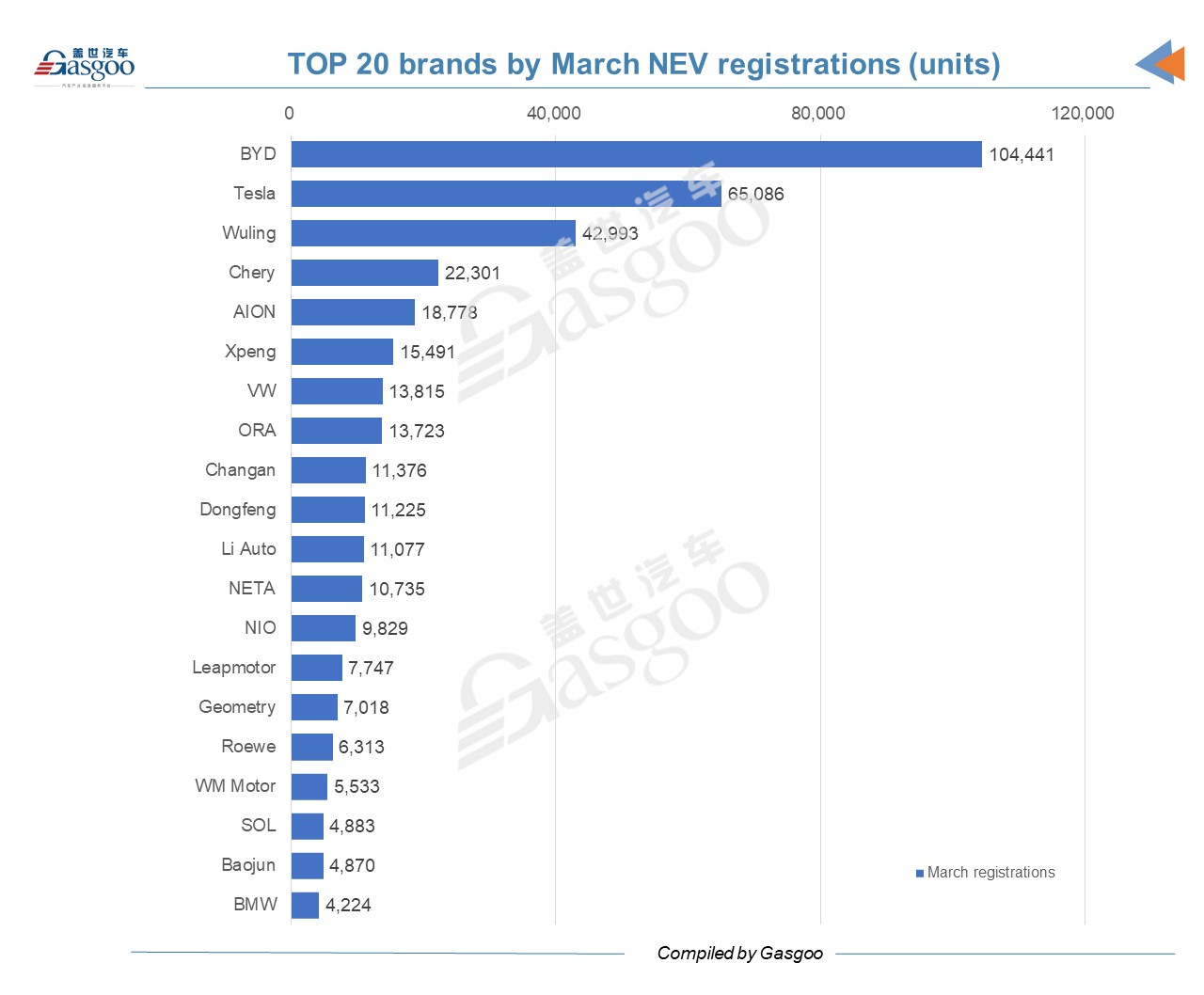

Chinese brands occupied 17 spots on the top 20 brands list by March NEPV registrations. Tesla was a distant second to BYD while BMW was the last one on the list.

Undoubtedly, BYD was the most registered brand by NEPV registrations in March, the month when the automaker stopped the production of oil-fueled vehicles and only sold NEPVs. With over 104,441 NEPVs registered, BYD’s NEPV registrations almost soared 488% versus the same month of last year. Dongfeng, Geometry from Geely Auto and Sehol brand all had monthly registration growth of over 500% from a year ago.

By quarterly results, BYD, Tesla and Wuling registered over 100,000 NEPVs. Chery followed, but the volume was only half of Wuling. Among all local startups, XPeng registered the most vehicles in the first quarter.

On the top 20 NEPV models by March Registrations, only two models came from foreign brands, the Tesla Model Y and Model 3, ranking 2nd and 3rd respectively. But on the quarterly NEPV models list, only the Model Y was on the top 20 list.

Shanghai registered the most NEPVs among all China’s cities both in March and in the first quarter. Beijing was out of the top 5 on the two lists.

Gasgoo not only offers timely news and profound insight about China auto industry, but also help with business connection and expansion for suppliers and purchasers via multiple channels and methods. Buyer service:buyer-support@gasgoo.comSeller Service:seller-support@gasgoo.com