China’s locally-made passenger vehicle registrations jump 19.16% YoY in August 2022

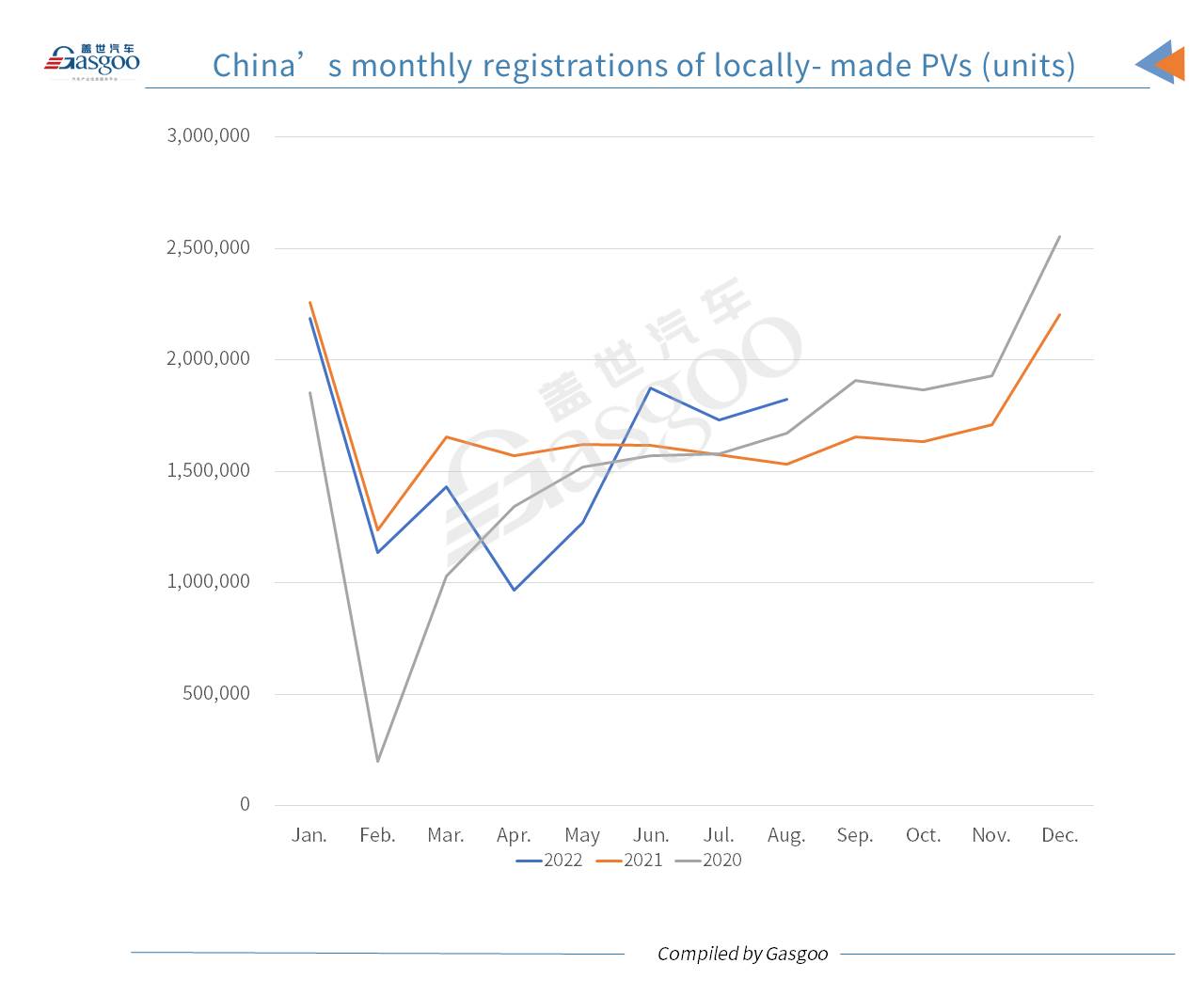

China's monthly registrations of locally-made passenger vehicles ("PVs") reached 1,823,747 units in August 2022, jumping 19.16% from the previous year, while also climbing 5.47% from the previous month, according to the data compiled by Gasgoo Auto Research Institute ("GARI").

For the first eight months of 2022, there were 12,419,470 domestically built PVs registered across the country, representing a 4.97% decrease from a year earlier, 3.2 percentage points fewer than the drop in Jan.-Jul. volume.

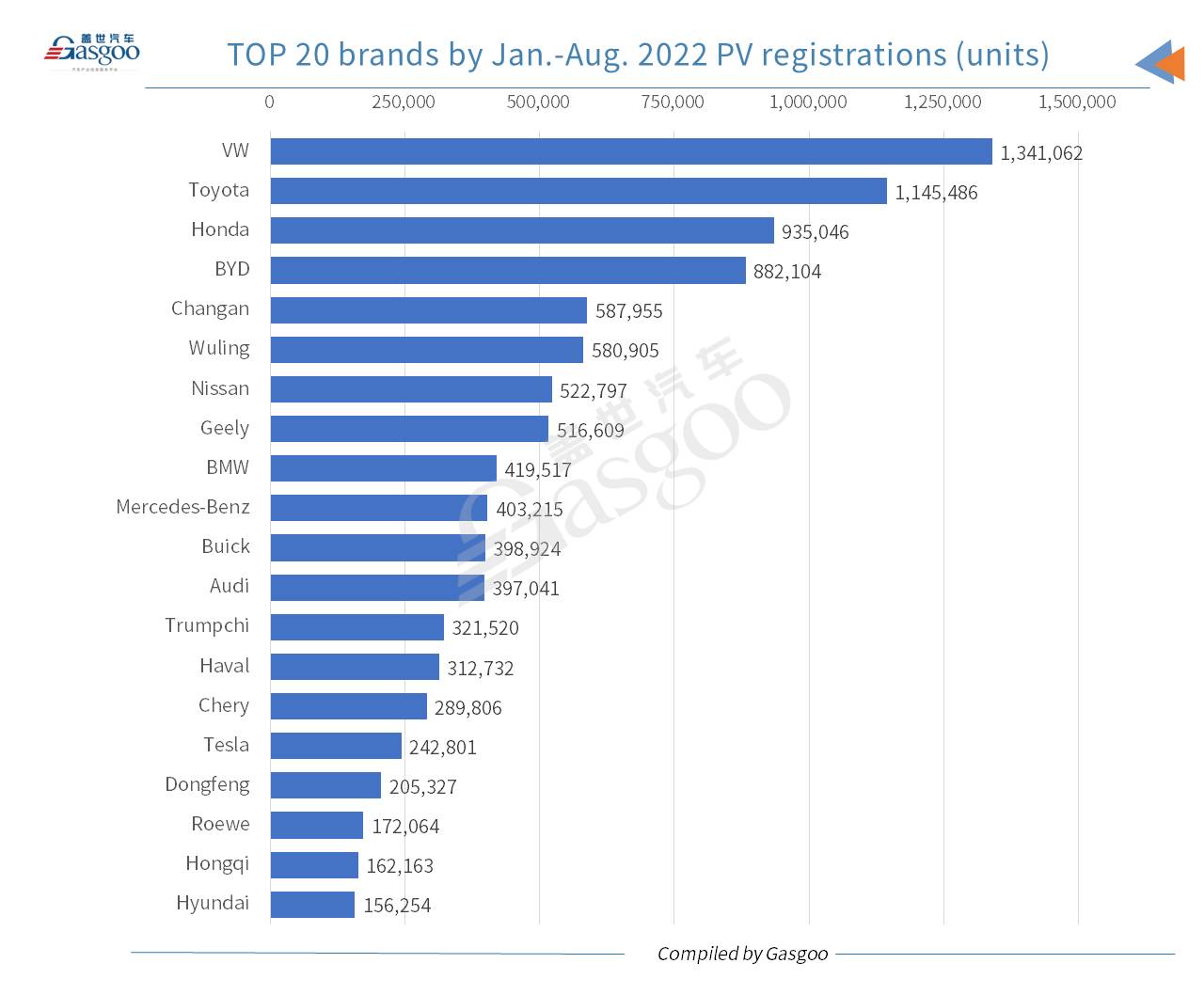

Regarding the Aug. registrations of China-made PVs, the top three brands—Volkswagen, Toyota and Honda—were the same as that of the previous-month ranking. BYD was also the highest-ranking local brand of China. Tesla moved up to the 16th place with only all-electric vehicles registered. The three German luxury brands—Audi, BMW, and Mercedes-Benz— ranked 9th, 11th, and 12th, respectively.

In terms of the PV registrations for the first eight months of 2022, the top three brands were Volkswagen, Toyota, and Honda. BYD was still the top-ranking Chinese indigenous brand. Mercedes-Benz immediately followed BMW, while it stood two spots higher than Audi.

The Nissans Sylphy was credited the best-selling PV model by Aug. registrations. SGMW's Wuling Hongguang MINIEV dropped one spot from the previous month to the runner-up place.

Apart from the Wuling Hongguang MINIEV, there were still five new energy vehicle ("NEV") models among the top 20 models by Aug. registrations, including three BEVs (the Model Y, the Dolphin, and the Yuan PLUS), and two BYD-branded PHEV models (the Song PLUS DM-i and the Qin PLUS DM-i).

Regarding the Jan.-Aug. registrations, the top seven PV models were the same as that of the rankings by Jan.-Jul. registrations. Tesla’s Model Y was honored the best-selling SUV model, outperforming the popular Haval H6. Sagitar surpassed CR-V to the eighth place.

As for luxury vehicles, the German big three all had models listed among the top 20 PV models by Jan.-Aug. registrations, of which the BMW 5 Series was the best-selling one.

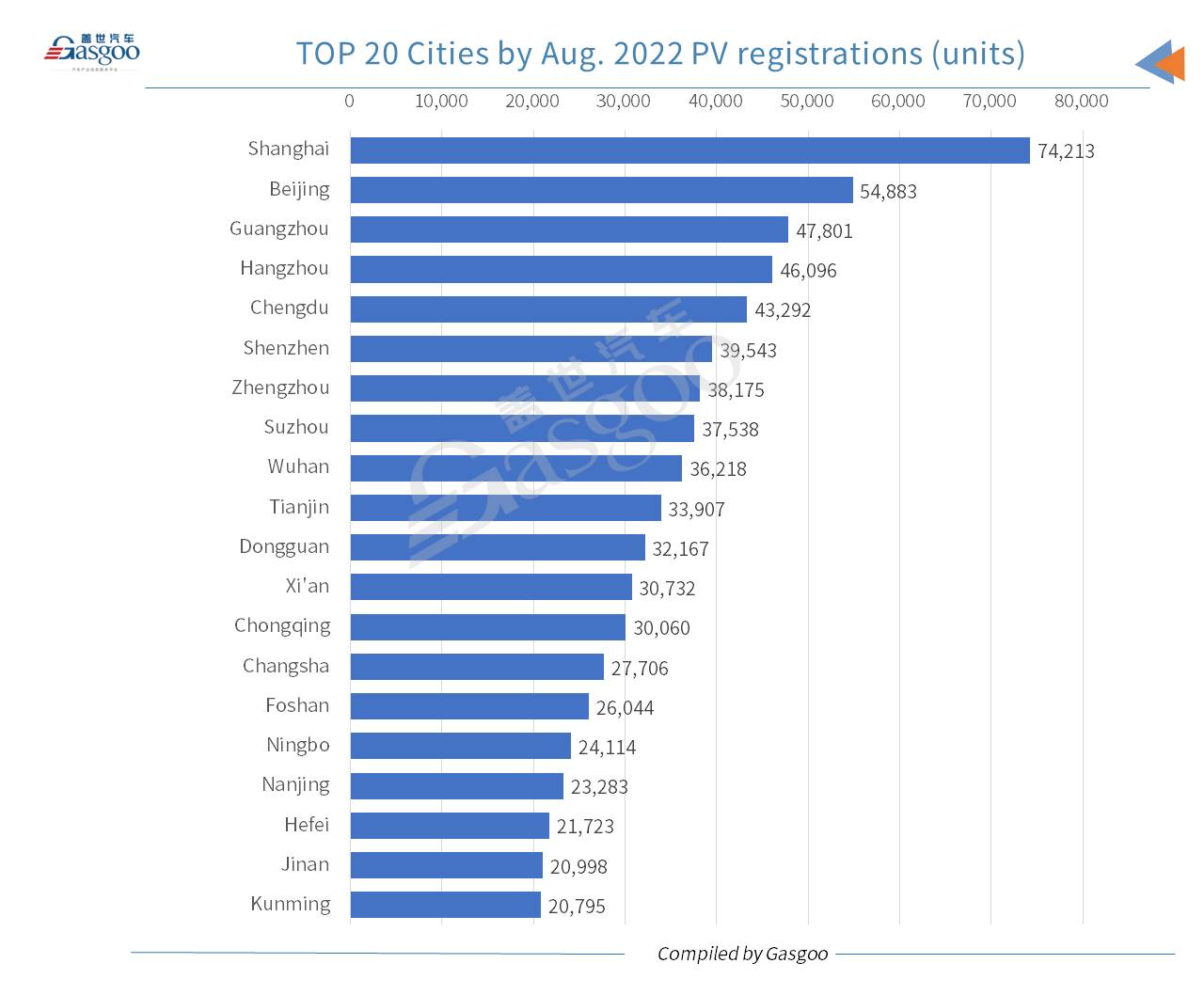

Regarding regional distribution, Shanghai registered the most homemade PVs in August, outselling the runner-up, Beijing, by 19,330 units. Compared to the previous month, Guangzhou's No.3 place remained unchanged. Chengdu dropped one spot from July to the fifth place, while Hangzhou stood at the fourth place by climbing one spot.

Among the top 20 cities by Aug. PV registrations, there were eleven provincial capitals. Such metropolises as Shenzhen, Chongqing, and Tianjin were all on the top 20 cities list.

The title-winning city by Jan.-Aug. 2022 PV registrations was Shanghai, who ranked fourth by the Jan.-Jul. volume. Chengdu, Beijing, and Guangzhou all had over 300,000 new PVs registered through the first eight months.

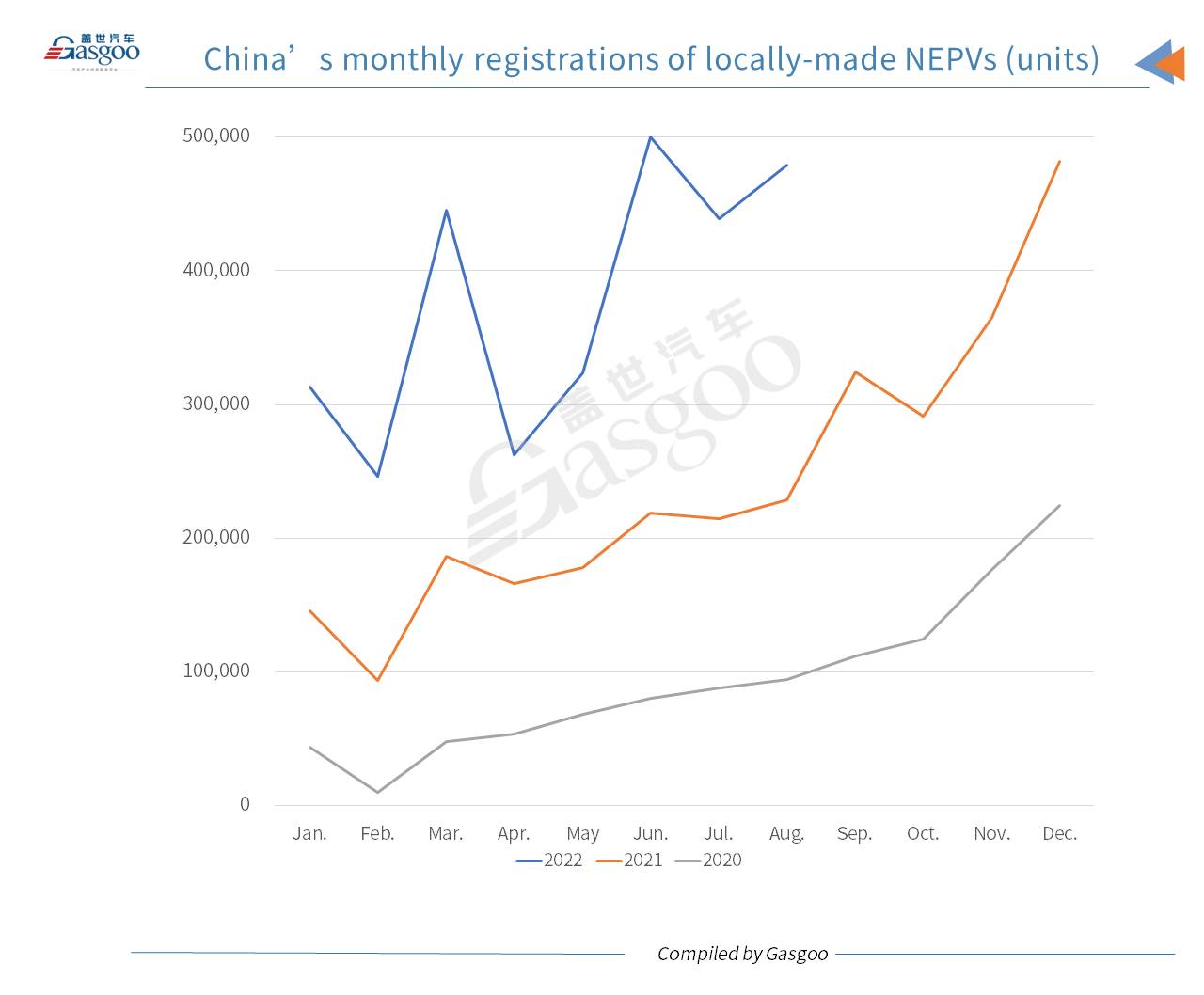

In August, China's monthly locally-made new energy passenger vehicle (“NEPV”) registrations rose 9.04% over a month ago to 478,796 units, while were still lower than the record-high level reached in June. Compared to the year-ago period, China's Aug. NEPV registrations soared 109.21%.

By specific powertrain solutions, BEVs posted a registration volume of 368,471 units in August, accounting for 76.96% of the country's total NEPV registrations. The PHEV registrations reached 110,245 units (including 11,591 REEVs).

Notably, there were 80 fuel cell vehicles registered across China last month.

Of the NEPVs registered in Jan.-Aug. 2022, 77.85% and 22.15% were contributed by BEVs and PHEVs (including REEVs), respectively.

Regarding the NEPV registrations in August, BYD was streets ahead of other brands. It had 156,148 NEPVs registered last month, which were even more than the sum of the No.2-No.7 occupants.

NETA ranked highest among Chinese NEV startups in terms of Aug. NEPV registrations, closely followed by NIO and Leapmotor. Nevertheless, the other two main Chinese NEV innovators, namely XPeng and Li Auto failed to gain a registration volume of over 10,000 units, of which Li Auto almost dropped out of the top 20 brands list.

BYD's leading presence in China's NEV market was also reflected by its Jan.-Aug. 2022 registrations. China's indigenous brands, such as Wuling, Trumpchi (including AION), and Chery, all entered the top 5 brand rankings by year-to-date NEPV registrations.

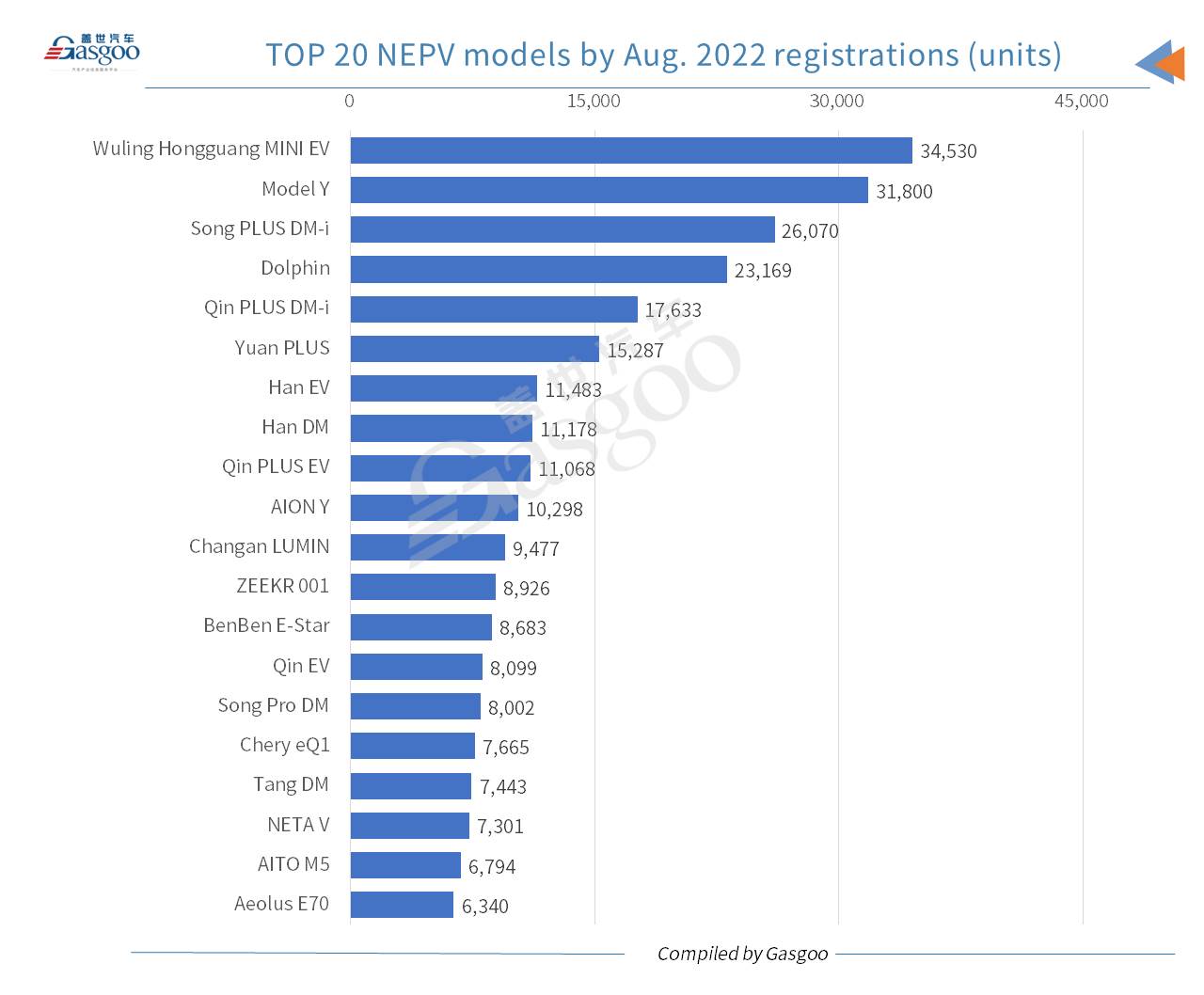

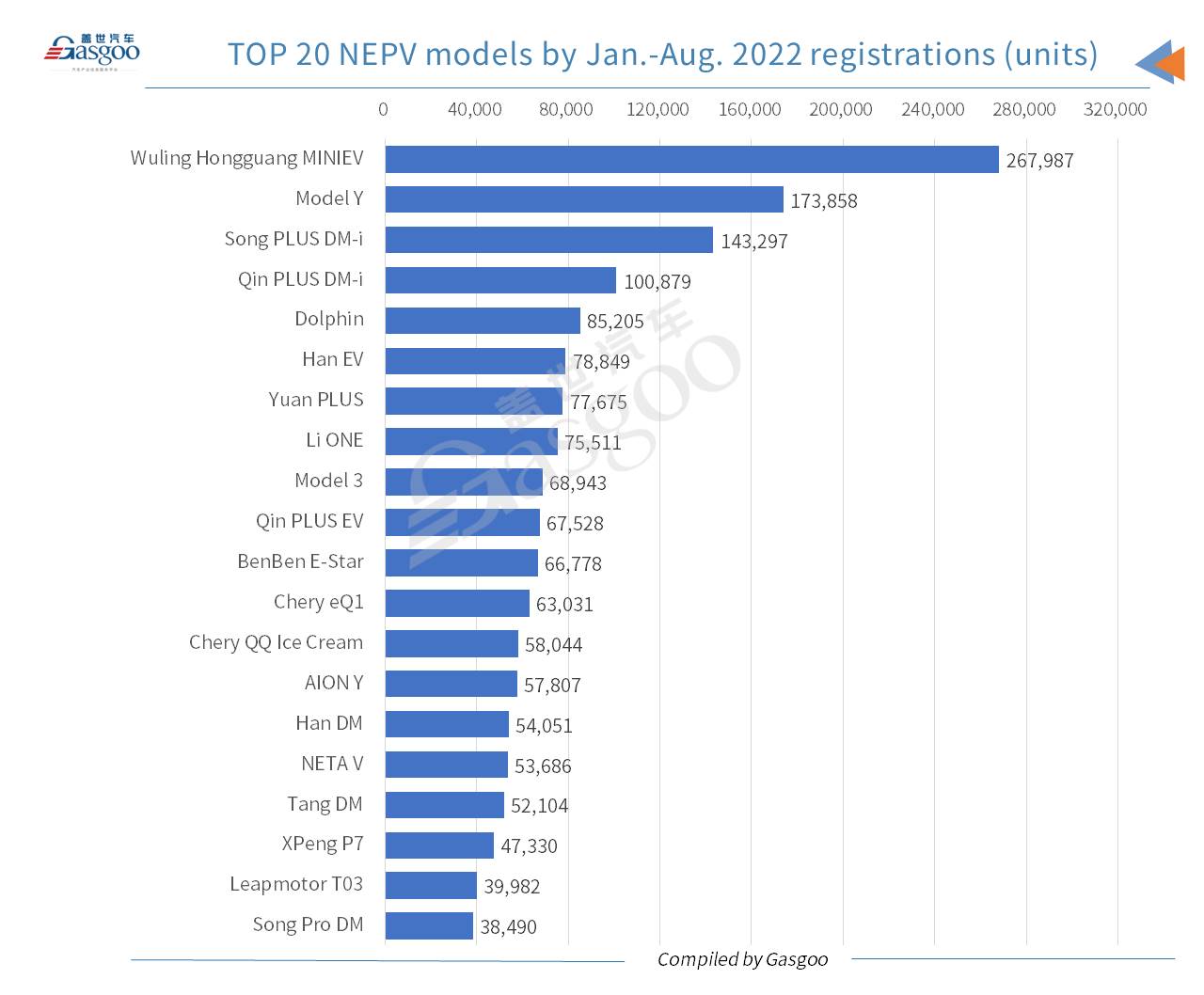

With respect to Aug. registrations, the Wuling Hongguang MINIEV and the Model Y outperformed other NEPV models. On the top 20 NEPV models list, there were ten from BYD brand, seven of which entered the top 10 rankings. The NETA V features the highest Aug. registrations among those under Chinese NEV start-up brands.

In terms of Jan.-Aug. 2022 registrations, four models from Chinese NEV startups—the Li ONE, the NETA V, the XPeng P7, and the Leapmotor T03—came into the top 20 NEPV models list. Both the Model Y and the Model 3 gained a seat on the top 10 list.

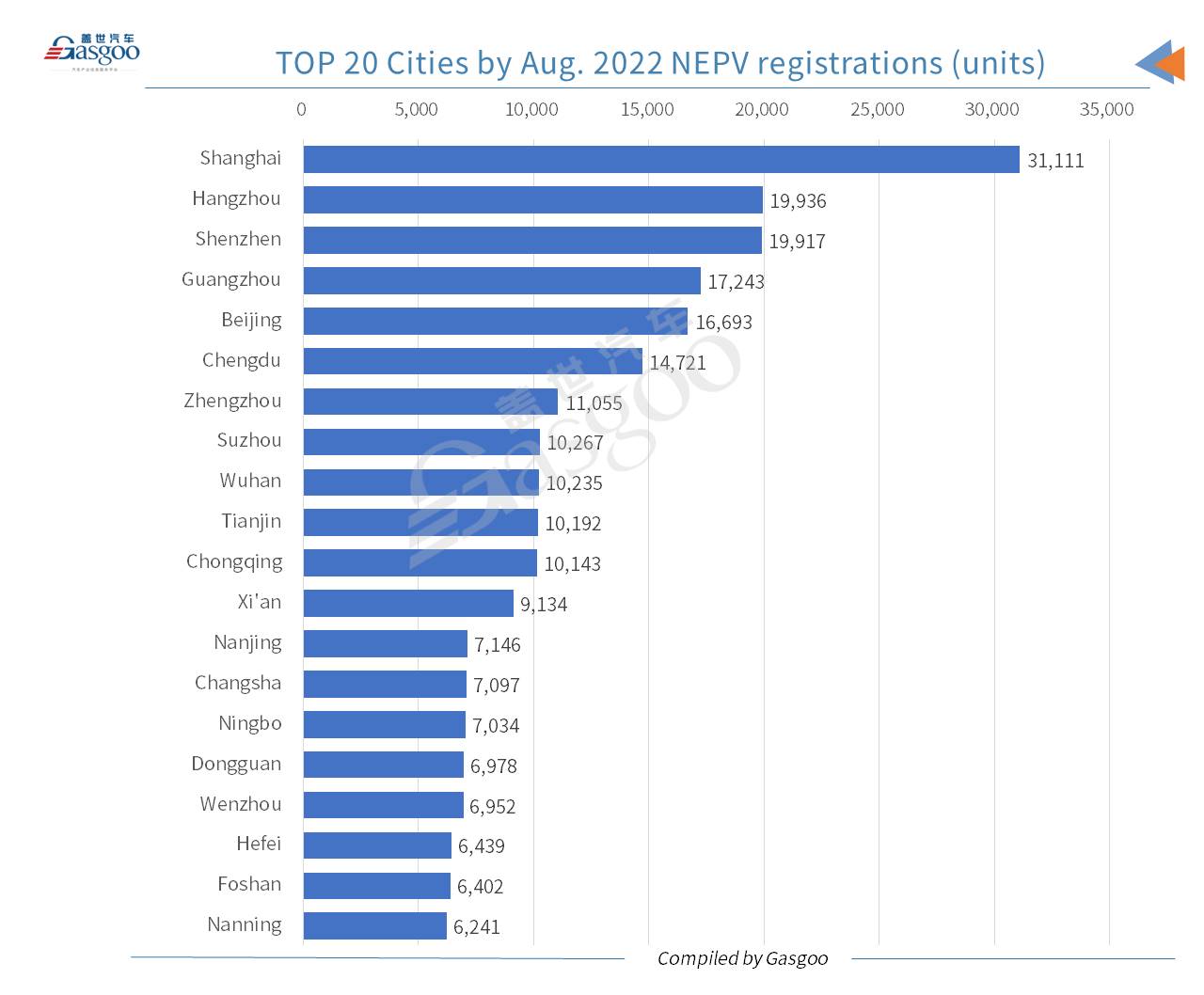

Shanghai were the only city whose NEPV registrations exceeded 20,000 units in August. Notably, NEPVs accounted for up to 41.92% of Shanghai's PV registrations in the month. Both Hangzhou and Shenzhen recorded an NEPV registration volume of over 19,000 units last month.

In Jan.-Aug. 2022, there were six cities with over 90,000 NEPVs registered each, of which the first three cities—Shanghai, Shenzhen, Hangzhou—had NEPV registrations exceeding 100,000 units.

Gasgoo not only offers timely news and profound insight about China auto industry, but also help with business connection and expansion for suppliers and purchasers via multiple channels and methods. Buyer service:buyer-support@gasgoo.comSeller Service:seller-support@gasgoo.com