In the last month of 2022, the three major Japanese automakers, namely Toyota Motor, Honda Motor, and Nissan Motor were all confronted with a less-than-expected annual sales performance in China, with Nissan taking the heaviest toll and Toyota the slightest.

The sales cutback in December 2022 marked the respective second, fourth, and fifth consecutive month for Toyota, Honda, and Nissan to sell less vehicles in China than a year ago. However, despite the overall downturn in China sales, all the three Japanese automakers in fact saw their monthly sales volume significantly recover from a month ago.

Toyota Motor sold 184,000 new vehicles in the world’s largest auto market in December, representing a 19.8% decline from a year earlier. The automaker’s full-year China sales volume amounted to 1,940,600 vehicles in 2022, notching down 0.2% year over year. According to Toyota Motor’s announcement on January 10, the year 2022 marked the first year in a decade for the company to see a year-on-year decline in annual China sales since 2012.

Through last year, GAC Toyota, the joint venture between GAC Group and Toyota Motor, celebrated its annual output and sales both exceed 1 million units for the first time ever. GAC Toyota produced 1,009,265 vehicles yearly, representing a 22.6% year-on-year jump. In the same year, the joint venture saw its full-year auto sales rise 21.4% from a year earlier to 1,005,000 units.

In November 2022, the automaker’s other joint venture in China, FAW-Toyota, held an event to celebrate its 10 millionth vehicle rolling off the production line.

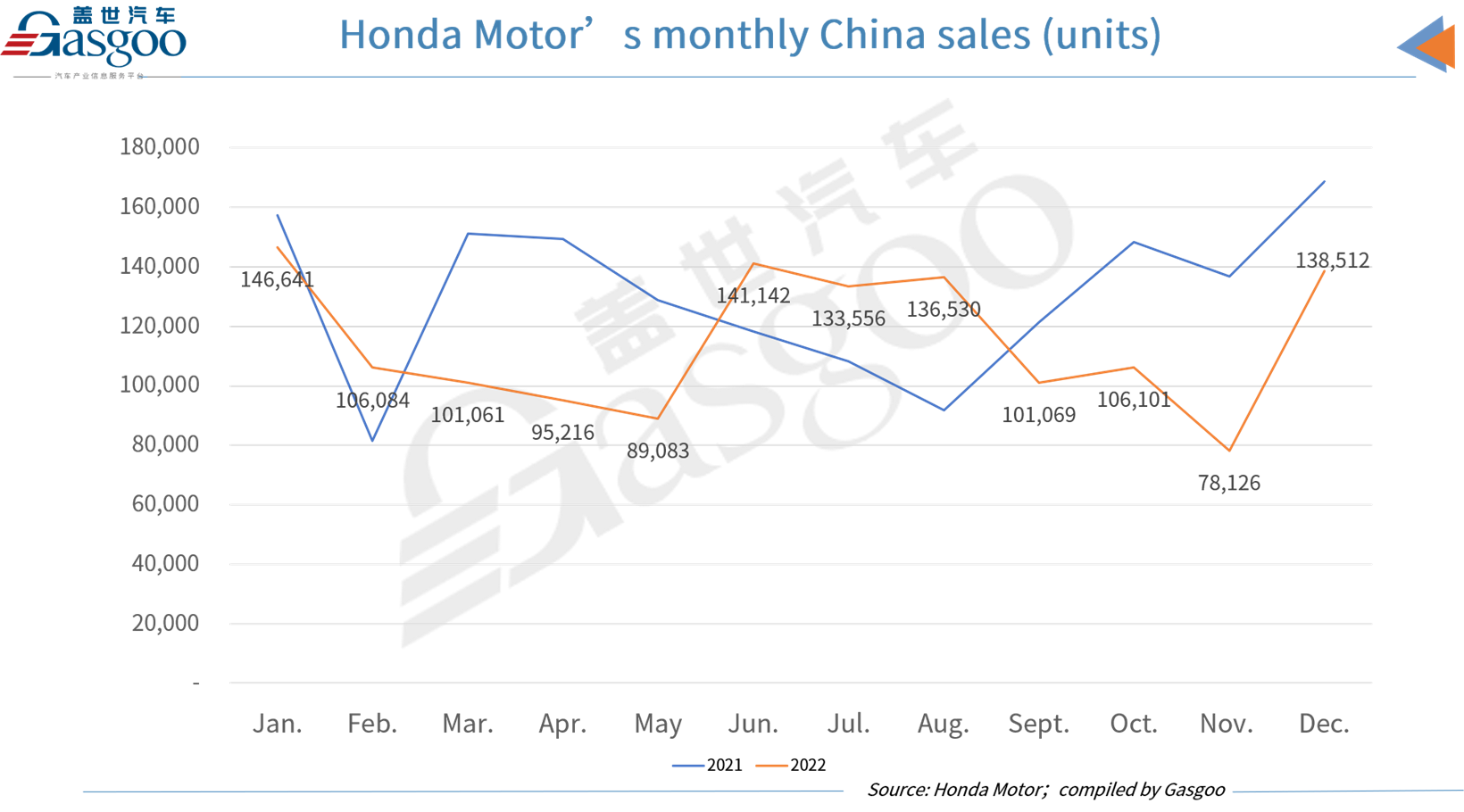

In December 2022, Honda Motor sold 138,512 vehicles in China, indicating a 77.29% leap from a month earlier but a 17.9% drop from the previous year.

In terms of the separate performance of the company’s two Sino joint ventures, GAC Honda saw a 13.12% decline over a year ago to 70,370 vehicles in December, while Dongfeng Honda recorded a 22.27% year-on-year decrease by selling 68,142 vehicles in the same period.

As to the full-year performance, Honda Motor sold 1,373,122 vehicles across China, indicating a 12.1% slip compared to that of 2021. Of the vehicles sold last year, 231,274 units were electrified vehicles (including HEVs, PHEVs, and BEVs).

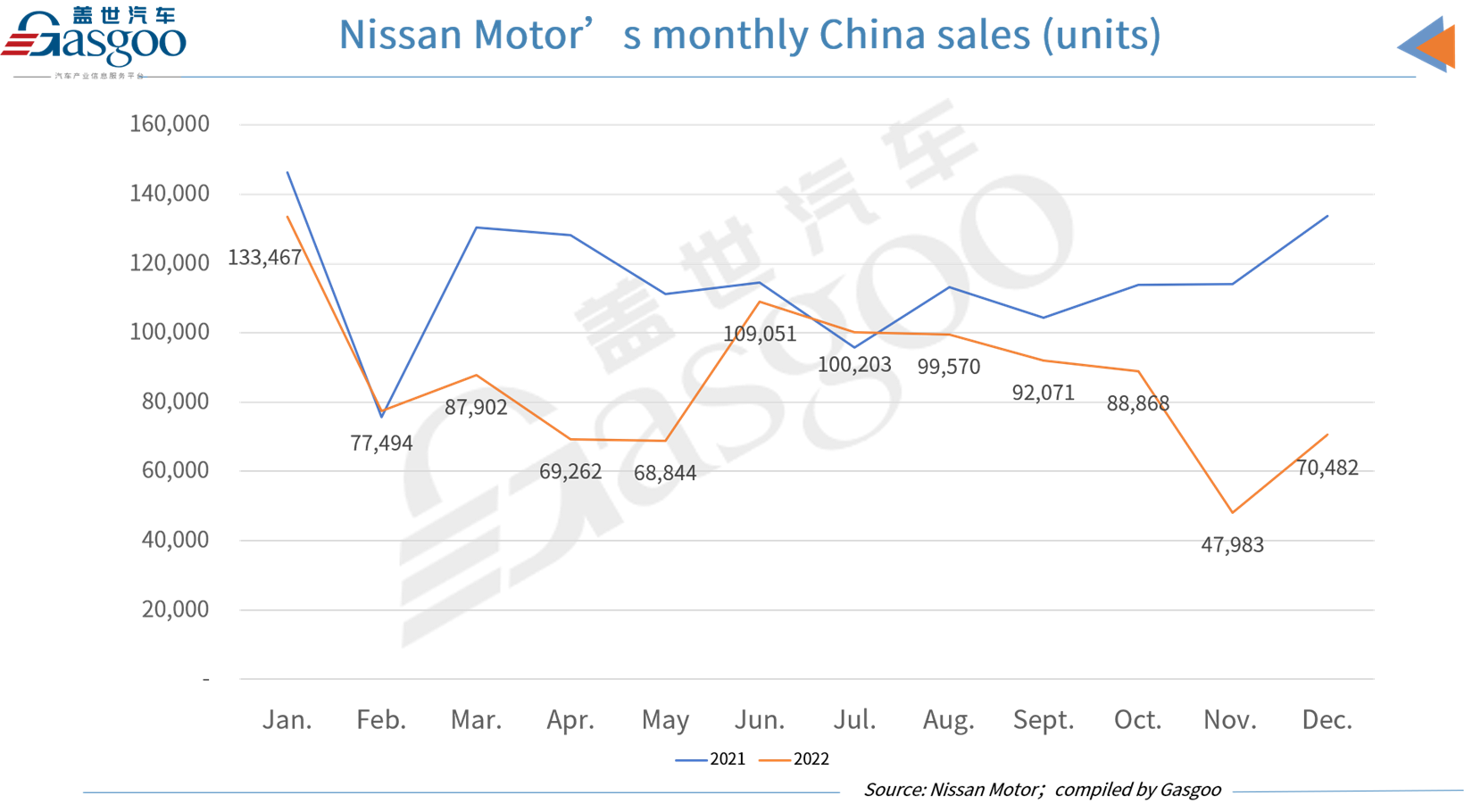

In December 2022, Nissan Motor sold 70,482 vehicles in China, representing a 46.9% hike month-on-month but a 41.7% plunge compared to the same period in 2021. In 2022, Nissan Motor witnessed its annual China sales exceed 1 million units, which marked the automaker’s eighth straight year with such sales record.

The Japanese automaker sold a total of 1,045,197 vehicles across the Chinese auto market last year to reflect a 22.1% drop from the previous year.

For clarity, the annual China sales Nissan Motor reported were composed of the full-year passenger vehicle sales of Nissan, Venucia, and Infiniti brands, as well as the light commercial vehicles sales of Dongfeng Automobile Co., Ltd. for the Jan.-Sept. period, and Zhengzhou Nissan for the entire year.

Under the successively weakening sales results, Nissan Motor set out to stage a comeback in the world’s largest auto market with a vigorous deployment plan in developing battery-electric vehicles.