In the second month of 2023, among the three major Japanese automakers in China, both Honda Motor and Nissan Motor still face a double-digit year-over-year downturn in monthly sales in the country, while Toyota Motor saw its monthly performance recover to its normal level.

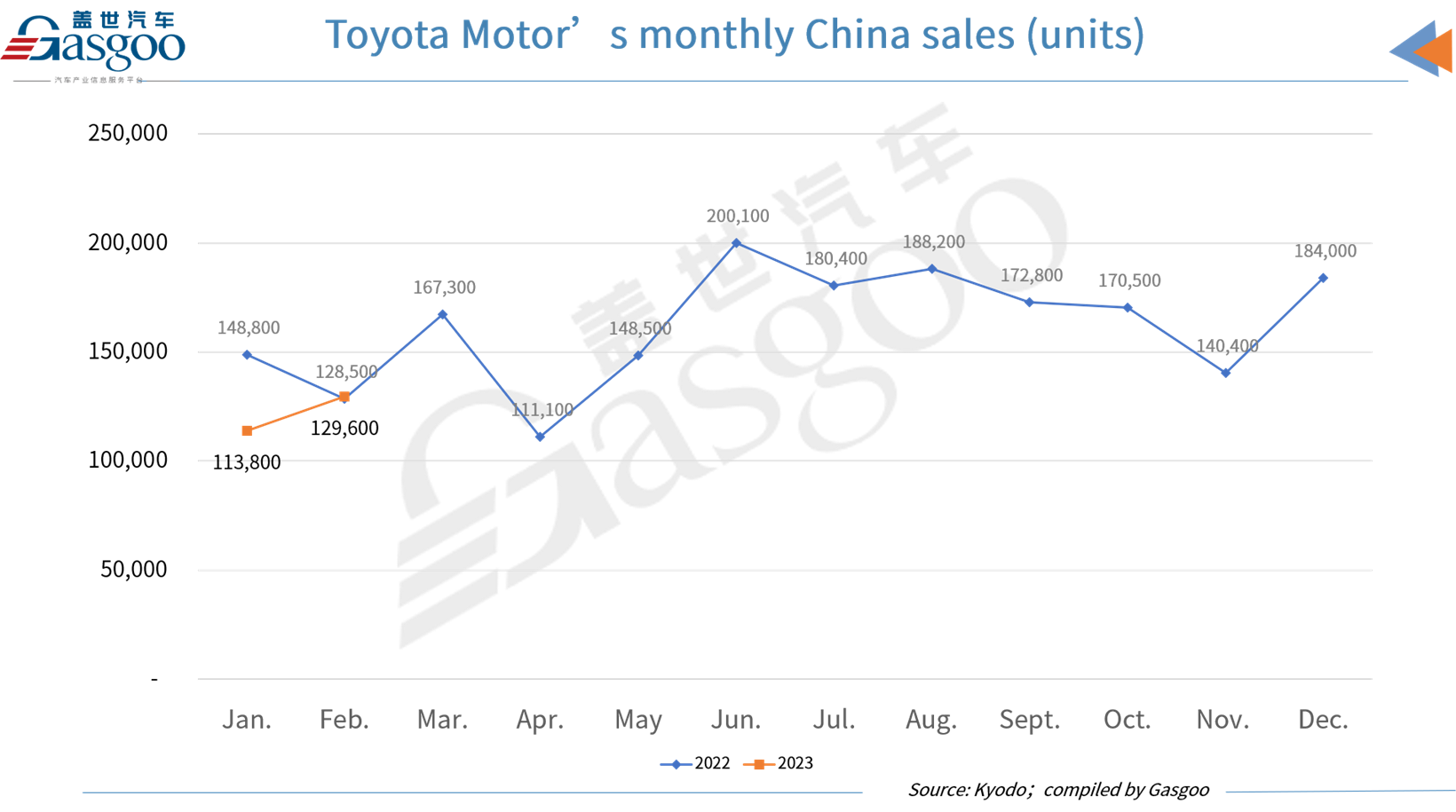

In February, Toyota Motor scored a turnaround in its monthly sales in China, with a 0.9% rise compared to a year ago, which also marked the automaker’s first positive growth in sales during the past four months in the world’s largest auto market.

Meanwhile, both Honda Motor and Nissan Motor failed to reverse their continuous sales downturn in February 2023, making last month the respective sixth and seventh consecutive month for the two companies to suffer a year-on-year plunge in sales in the Chinese market.

Toyota Motor sold about 129,600 new vehicles in China in February, representing a 0.9% notch up from a year earlier and a 13.88% increase from a month ago. It should be pointed out that February 2022 was the month where the Chinese Lunar New Year holiday fell in, automakers sales during February last year hovered at a relatively low level.

The positive results achieved in the past month were mainly attributed to the prominent performance of GAC Toyota, the Japanese automaker’s joint venture with GAC Group. GAC Toyota posted a 26.7% year-on-year jump in February sales, while the automaker’s other Sino joint venture, FAW-Toyota, was confronted with a 17.1% year-on-year drop in sales.

Photo credit: Lexus

Additionally, Lexus, the premium auto brand of Toyota, struggled with a 27.4% decline in February sales compared to a year ago in the Chinese market.

In February 2023, Honda Motor sold 74,142 vehicles in China, which slipped 30.1% % from a year earlier but climbed 15.5% from the previous month. However, the company’s monthly performance largely lagged behind the records in 2022.

As for the sales of the company’s two Sino joint ventures, GAC Honda faced a 30% drop over a year ago with 35,829 vehicles sold in February, while Dongfeng Honda’s monthly sales were also challenged with a 30.2% year-on-year tumble, which came in at 38,313 vehicles.

By the end of February, sales of Honda-branded electrified vehicles (including hybrid electric vehicles, plug-in hybrid electric vehicles, and battery electric vehicles) amounted to 27,351 units so far this year, accounting for roughly 20% of the company’s total sales volume in the period.

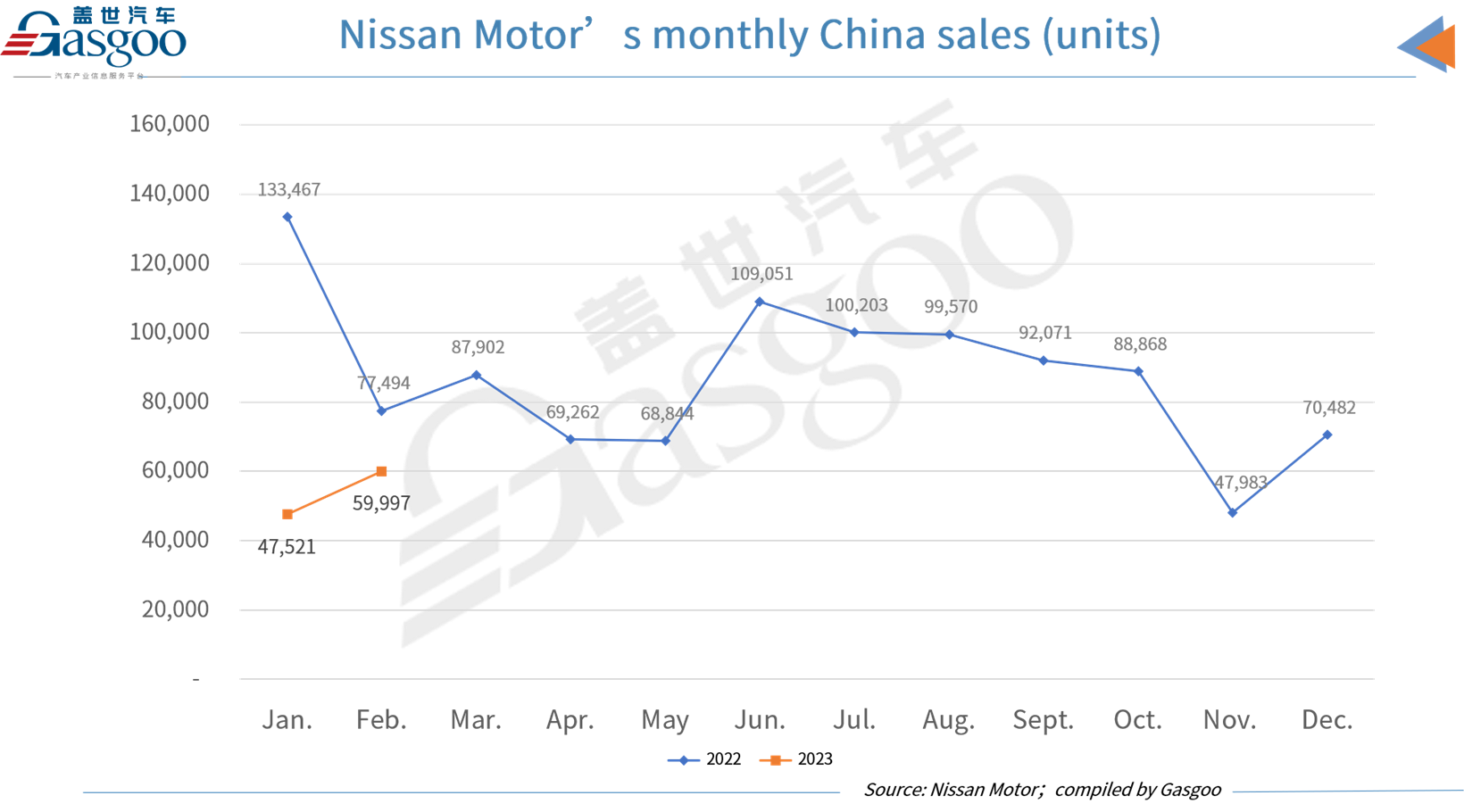

Given that the light commercial vehicles sales of Dongfeng Automobile Co., Ltd., were no longer included in Nissan’s China sales reports since October 2022, Nissan Motor’s current monthly sales volume is not comparable to that of the prior-year period.

In the second month of 2023, the company saw its monthly China sales recover from a month ago to 59,997 vehicles, which represented a 26.3% month-over-month jump.

In the passenger vehicle sector, both the Nissan and Venucia brands achieved a month-over-month leap in February sales. Specifically, the Nissan brand sold 50,093 vehicles (+23.5% MoM), while sales of the Venucia brand amounted to 6,003 units (+30.3% MoM).

Sales of Zhengzhou Nissan, the light commercial vehicle arm of Nissan Motor in China, came in at 3,271 units in the past month, which also surged 72.3% from that of January.