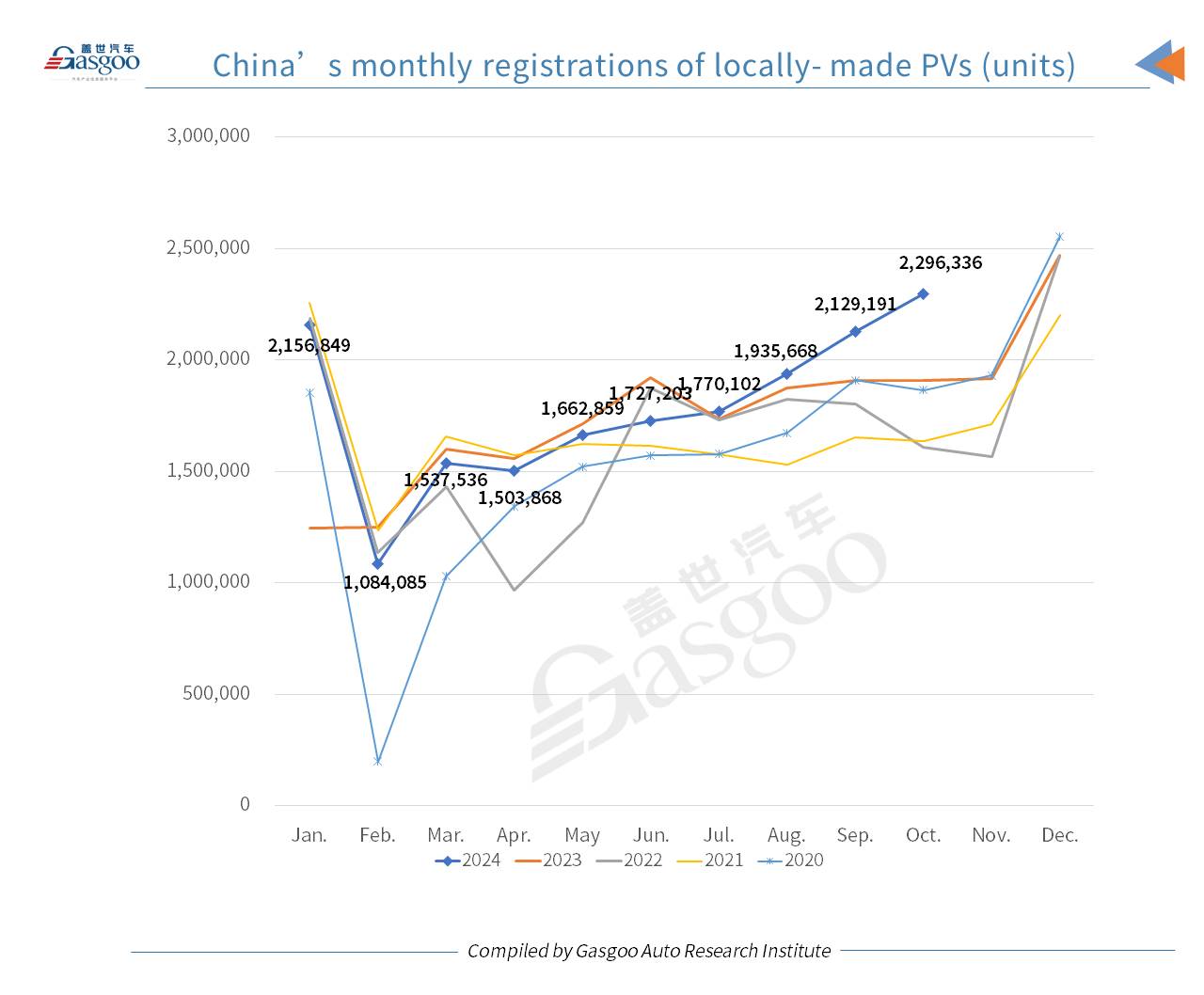

In October 2024, the registration volume of domestically produced passenger vehicles (PVs) in the Chinese Mainland reached 2,296,336 units, marking a year-on-year (YoY) jump of 20.32% and a month-on-month (MoM) growth of 7.85%, setting a new monthly high for the year, according to the data compiled by the Gasgoo Auto Research Institute ("GARI").

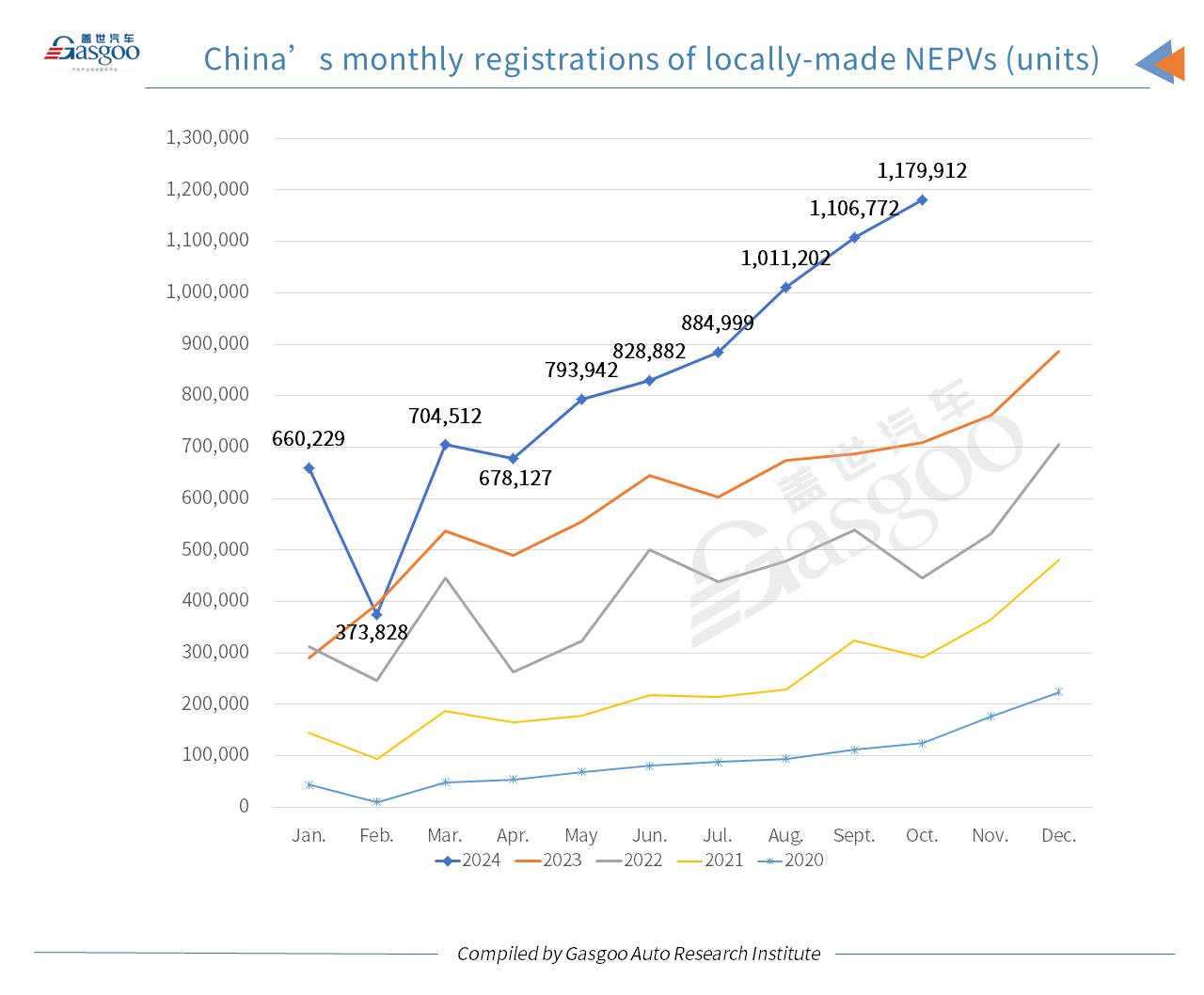

Of all PVs registered in October, 1,179,912 units were new energy vehicles (NEVs), achieving a penetration rate of 51.38% and hitting another record high for monthly registrations.

For clarity, the PVs hereby refer to the passenger vehicles locally produced and registered on the Chinese Mainland.

The surge in October registrations can be attributed to various factors, including the nationwide implementation of vehicle replacement subsidies and robust policies to encourage car consumption. Generous subsidies for vehicle purchase have provided a new impetus for market growth. The dual impact of the national vehicle scrappage and replacement policies, alongside regional initiatives promoting automobile trade-ins, significantly spurred market demands, particularly during the National Day holiday. Furthermore, the recent stock market recovery and stabilization of the housing market boosted consumer confidence, indirectly supporting car sales.

Under the scrappage and replacement subsidy program, NEV buyers receive 20,000 yuan per vehicle of subsidy, compared to 15,000 yuan for buyers of traditional fuel-powered cars with engines of 2.0 liters or less. The additional 5,000-yuan advantage for NEV buyers, combined with higher local subsidies and operational cost benefits, has shifted consumer preference toward NEVs. This dynamic has notably driven the growth of entry-level battery electric vehicle (BEV) and plug-in hybrid electric vehicle (PHEV) models.

During the National Day holiday, China's PV sales experienced a notable uptick, with robust momentum continuing throughout the month. NEV sales, in particular, demonstrated exceptional growth, with a peak-season surge in end-user consumption contributing significantly to the overall market expansion. As of November 6, more than 1.7 million subsidy applications for vehicle replacements had been submitted nationwide, reflecting the effectiveness of these policies in driving demand.

For the first ten months of 2024, the cumulative registration volume of domestically produced passenger cars on the Chinese Mainland stood at 17,803,697 units, a YoY increase of 6.51%. Of these, NEV registrations totaled 8,222,405 units, soaring by 47.14% YoY and accounting for 46.18% of the total PV market.

Top 20 brands by Oct. and YTD 2024 passenger vehicle registrations

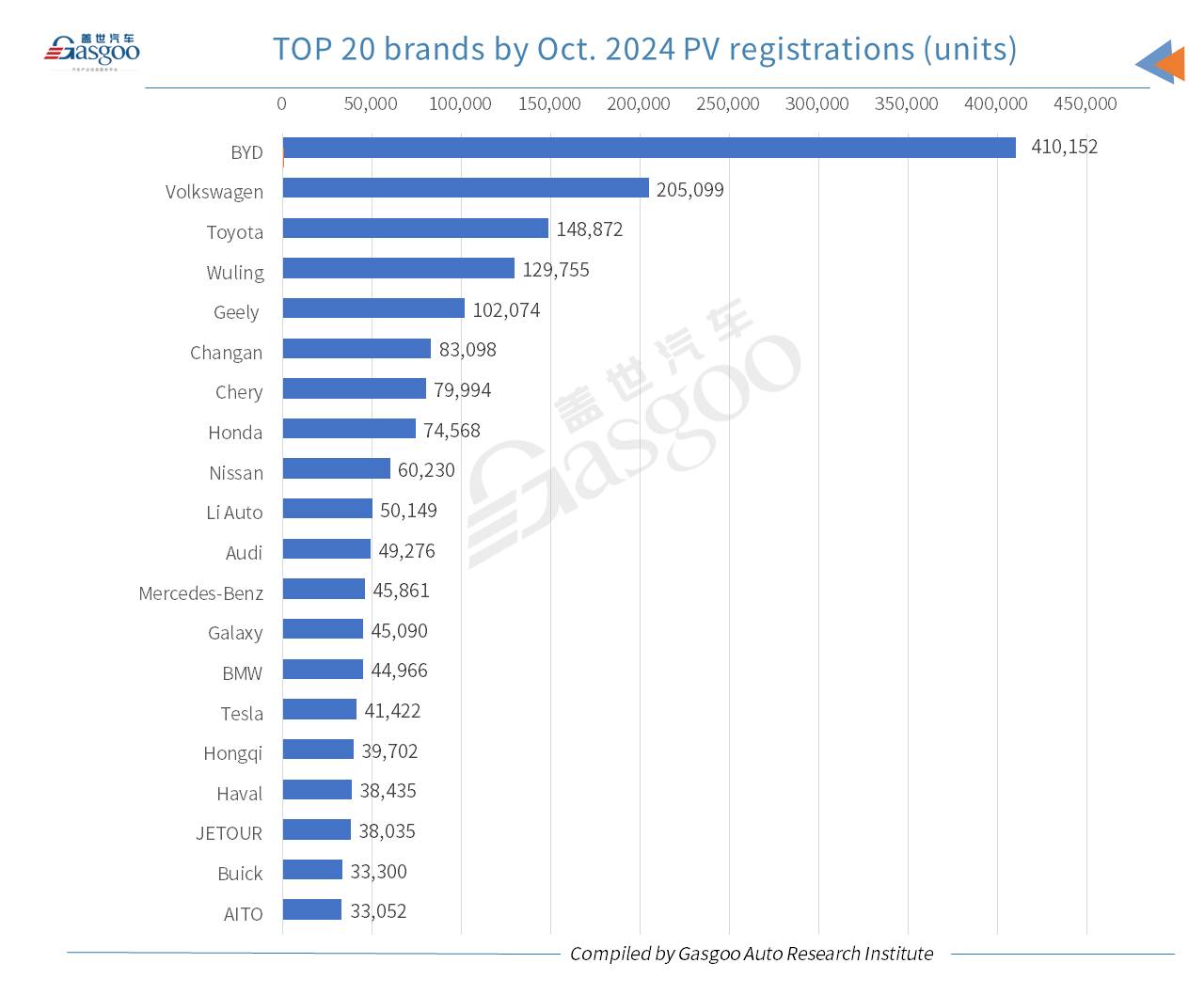

Among the top 20 PV brands ranked by October registration volume, 11 were Chinese domestic brands, namely, BYD, Wuling, Geely, Changan, Chery, Li Auto, Galaxy, Hongqi, Haval, Jetour, and AITO. Notably, six of these brands secured spots in the top 10 list.

BYD maintained its dominant position, recording over 400,000-unit registrations in October, which was nearly double that of second-placed Volkswagen. BYD's success is largely attributed to its diverse product lineup. In October, its Dynasty and Ocean series collectively accounted for registrations of 26 models, 13 of which exceeded 10,000 units in monthly registrations, showcasing robust market performance.

Wuling, Geely, Changan, and Chery ranked fourth, fifth, sixth, and seventh, respectively. While the rankings for the first three remained unchanged from September, Chery moved up one position. Each of these brands recorded over 70,000-unit registrations in October, with Geely surpassing 100,000 units. Additionally, three Chinese brands focusing on new energy vehicles (NEVs)—Li Auto, Galaxy, and AITO—secured positions in the top 20, ranking 10th, 13th, and 20th, respectively. However, Leapmotor and AION were absent from this month's top 20 list.

Volkswagen and Toyota continued to hold the second and third places among all brands by October PV registrations. Volkswagen’s NEVs accounted for 9.39% (19,265 units) of its October registrations, including 1,128 PHEVs and 18,137 BEVs. Toyota's NEV share was even lower, comprising just 2.21% (3,289 units) of its total registration volume.

Tesla, the only wholly foreign-owned brand in the top 20 list, ranked 15th with 71,049-unit registrations in October, dropping 8 places compared to September.

According to Tesla China's official Weibo account, a promotional campaign running from November 25 to December 31 offers buyers of the Model Y RWD and Long-Range AWD versions a discount of 10,000 yuan per car, coupled with a five-year zero-interest financing option. This adjustment brings the Model Y RWD's price down to 239,900 yuan. A Tesla representative cited the promotion as part of its strategy to achieve the company’s 2024 global sales targets. In the first three quarters of this year, Tesla's global deliveries fell 2.3% year-on-year, with declines in the first and second quarters. The brand has launched multiple purchase incentives globally to ensure modest annual sales growth.

Among the German trio, Audi performed best, ranking 11th, with two models—the Audi A6L and the Audi Q5L—each surpassing 10,000-unit registrations in October. Mercedes-Benz and BMW ranked 12th and 14th, respectively. Mercedes-Benz had three models with over 10,000-unit registrations in the month, while BMW's best-performing model, the BMW 3 Series, recorded 9,947 units.

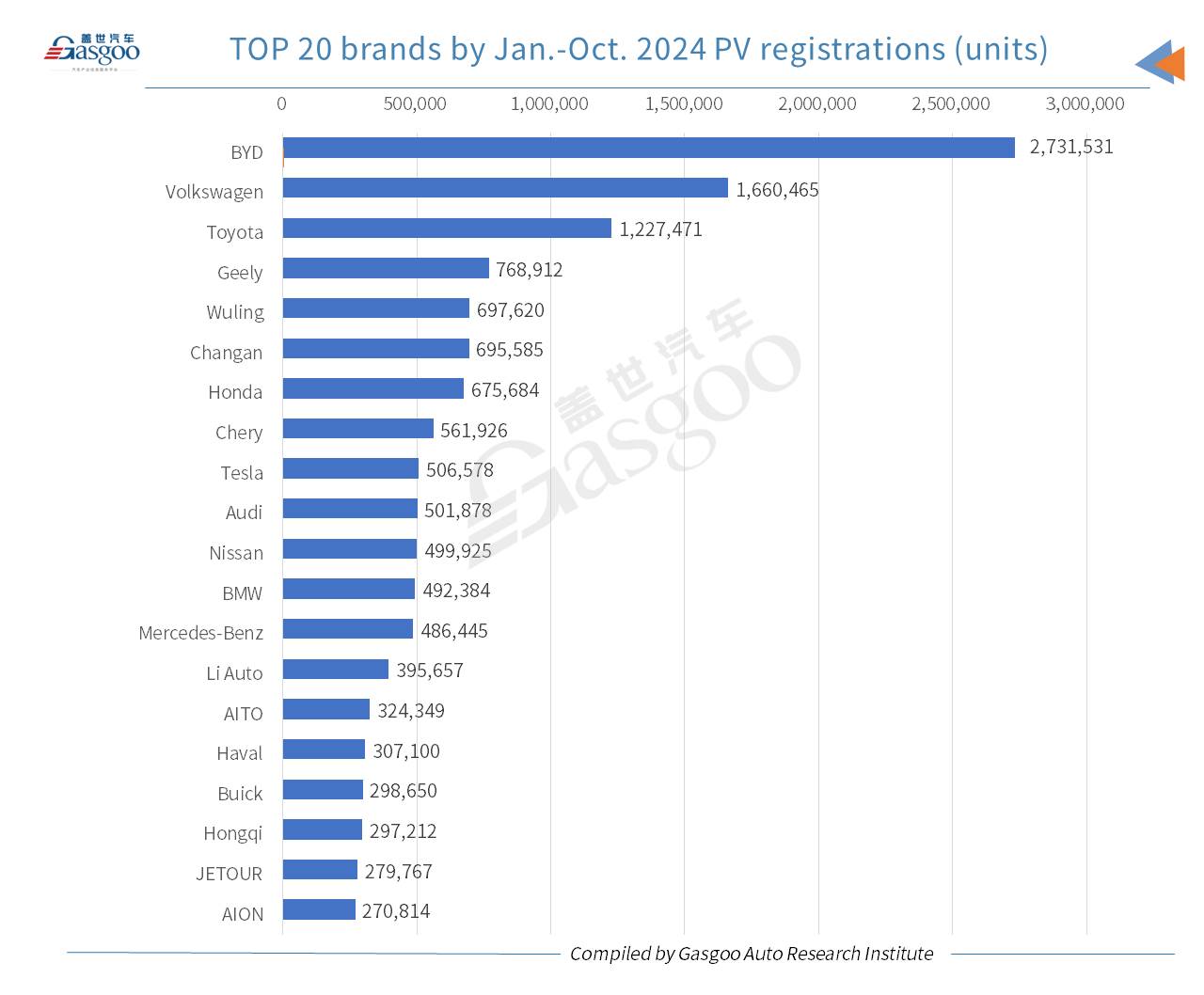

Year-to-date (YTD) registration data through October reaffirmed BYD, Volkswagen, and Toyota as the top three brands. BYD was the only brand with YTD registrations exceeding two million units, while Volkswagen and Toyota each surpassed one million units. Among the top 20 brands, 10 were China's self-owned brands, including Geely, Wuling, Changan, Chery, Li Auto, AITO, Haval, Hongqi, Jetour, and AION.

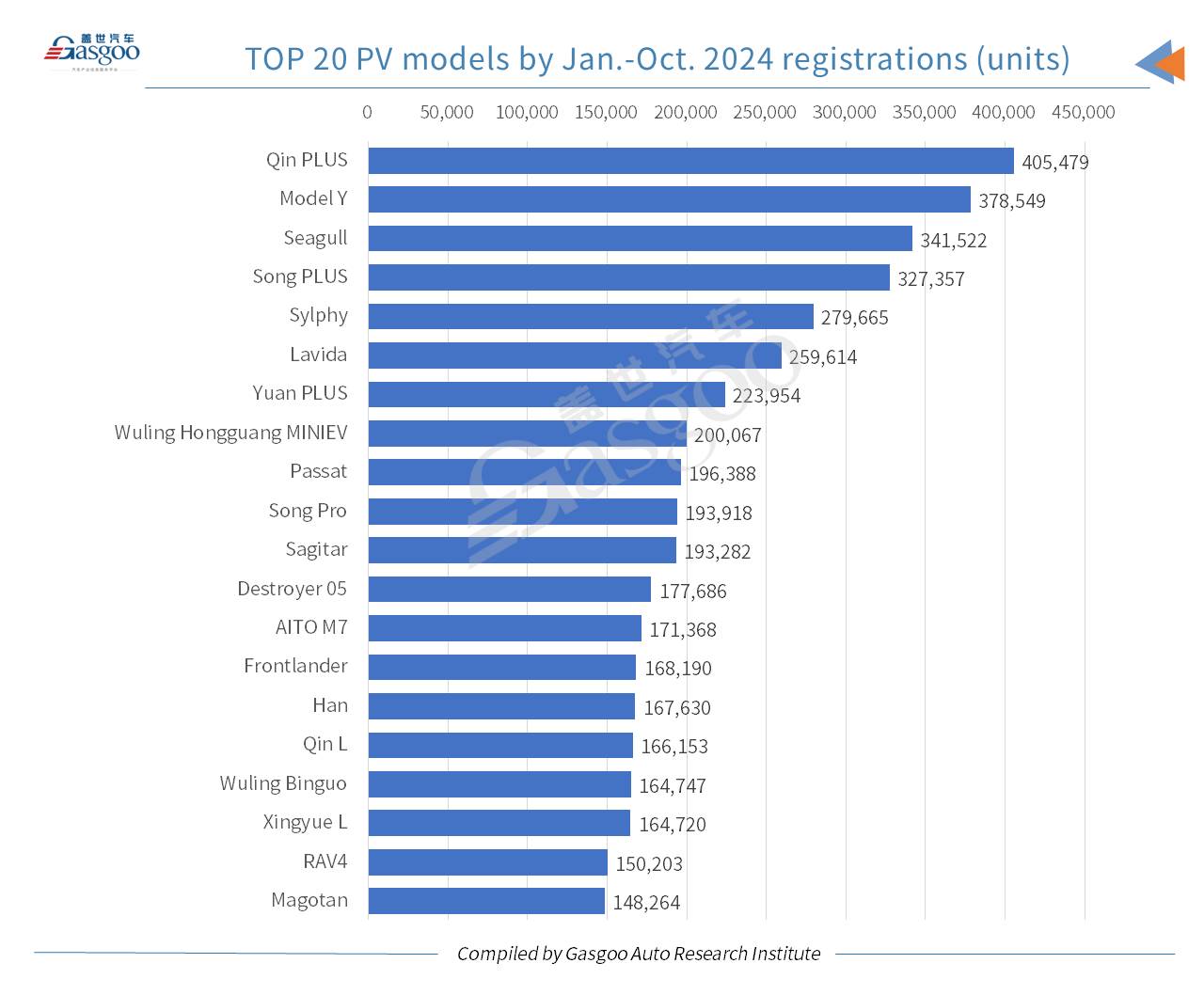

Top 20 PV models by Oct. and YTD 2024 registrations

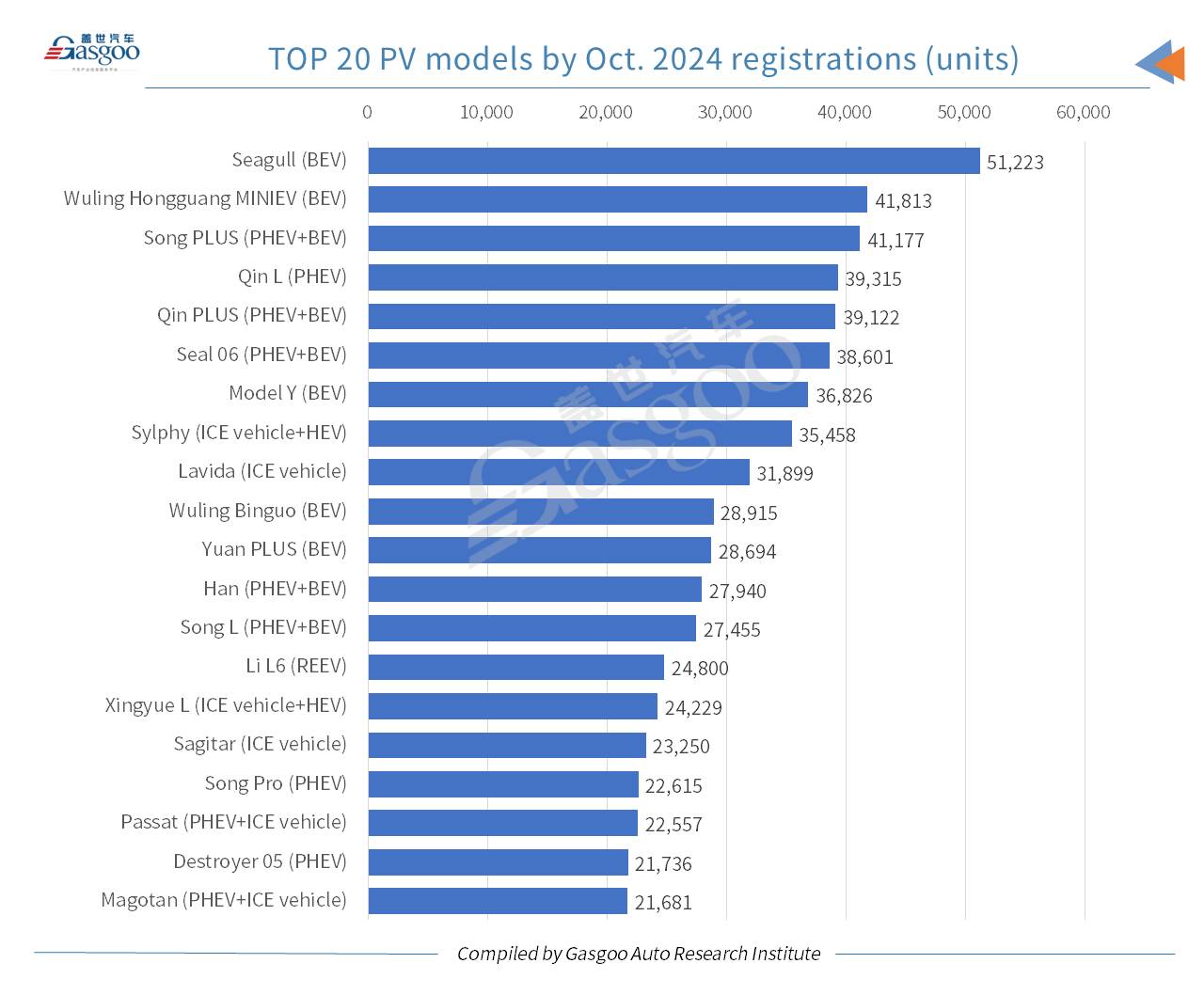

Among the top 20 PV models by October registration volume, only four—the Nissan Sylphy, the Volkswagen Lavida, the Geely Xingyue L, and the Volkswagen Sagitar—lacked contributions from new energy vehicle (NEV) variants. Notably, none of the top seven models included traditional internal combustion engine (ICE) vehicle or hybrid electric vehicle (HEV) versions.

BYD dominated the top six rankings, taking five spots aside from the second-place Wuling Hongguang MINIEV. The BYD Seagull, exclusively available as a BEV, maintained its position as the best-selling PV model in October. The Qin L, ranked fourth, is offered only as a PHEV. Meanwhile, the Song PLUS, Qin PLUS, and Seal 06 models, which ranked third, fifth, and sixth respectively, offer both BEV and PHEV options. BYD further demonstrated its strength in the 7th-to-20th rankings, with five additional models in this range.

Tesla faced challenges in October. The Model Y, which ranked second in September, dropped five spots to seventh. Meanwhile, the Model 3 fell out of the top 20 models rankings.

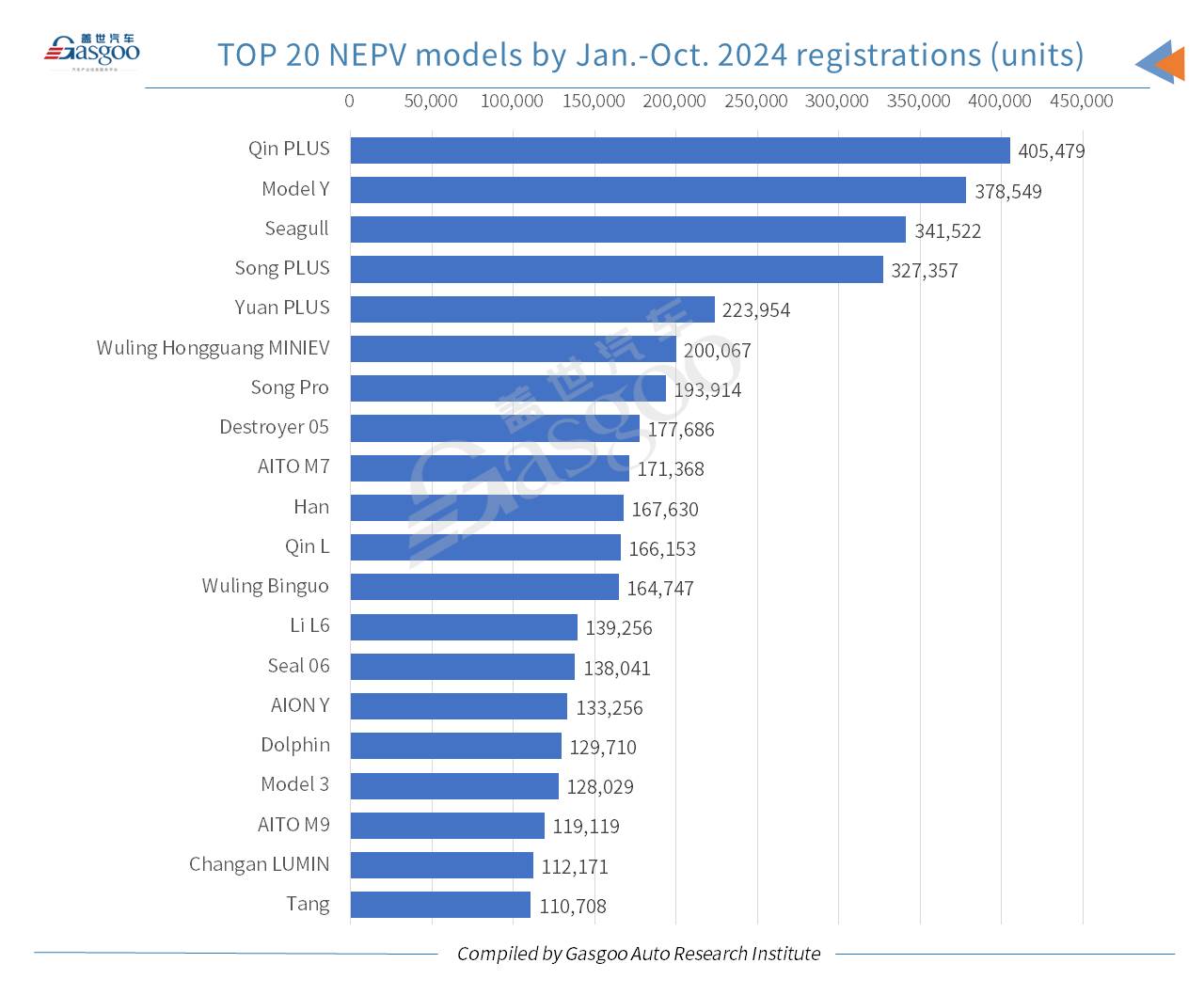

For the first ten months of 2024, eight PV models achieved cumulative registrations exceeding 200,000 units. Among them, the Qin PLUS, Model Y, Seagull, and Song PLUS surpassed 300,000-unit registrations. The Nissan Sylphy ranked fifth as the highest-placed joint-venture-owned model, followed by the Volkswagen Lavida. None of the German trio had a model in the top 20 by YTD registrations.

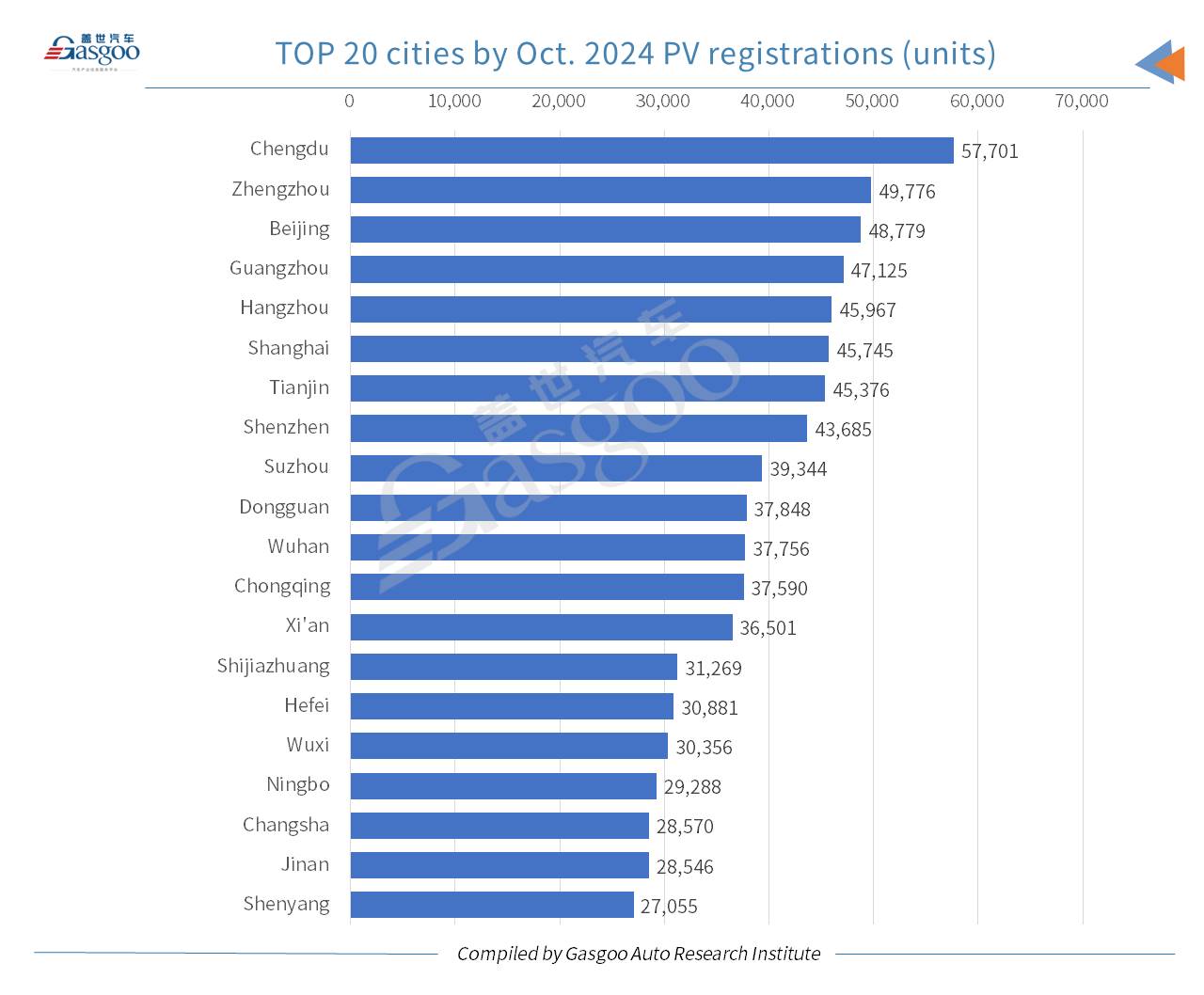

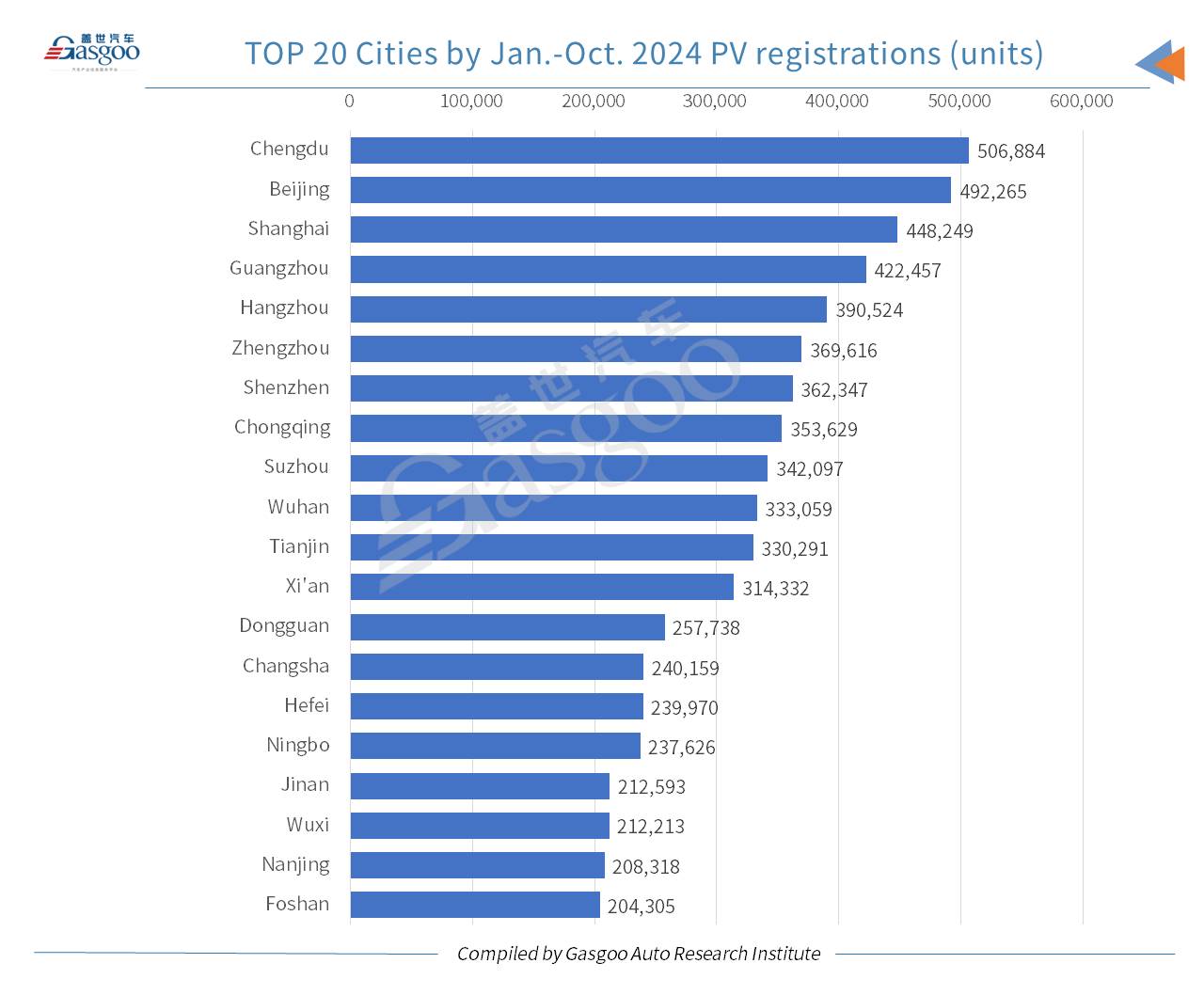

Top 20 cities by Oct. and YTD 2024 registrations

At the city level, 16 cities on the Chinese Mainland recorded over 30,000-unit registrations of locally produced PVs in October. Among these, eight cities surpassed 40,000 units, with one exceeding 50,000 units. Chengdu led with a 57,701-unit registration volume, followed by Zhengzhou (49,776 units) and Beijing (48,779 units).

YTD data revealed 12 cities with Jan.-Oct. registrations exceeding 300,000 units, of which four surpassed 400,000 units. Chengdu was the first city to exceed 500,000-unit registrations this year.

Monthly new energy passenger vehicle registrations and breakdown by powertrains

The Chinese domestic NEV market continued its robust expansion in October, with PV registrations reaching 1,179,912 units. This represents a 66.29% year-on-year spike and a 6.61% rise compared to September.

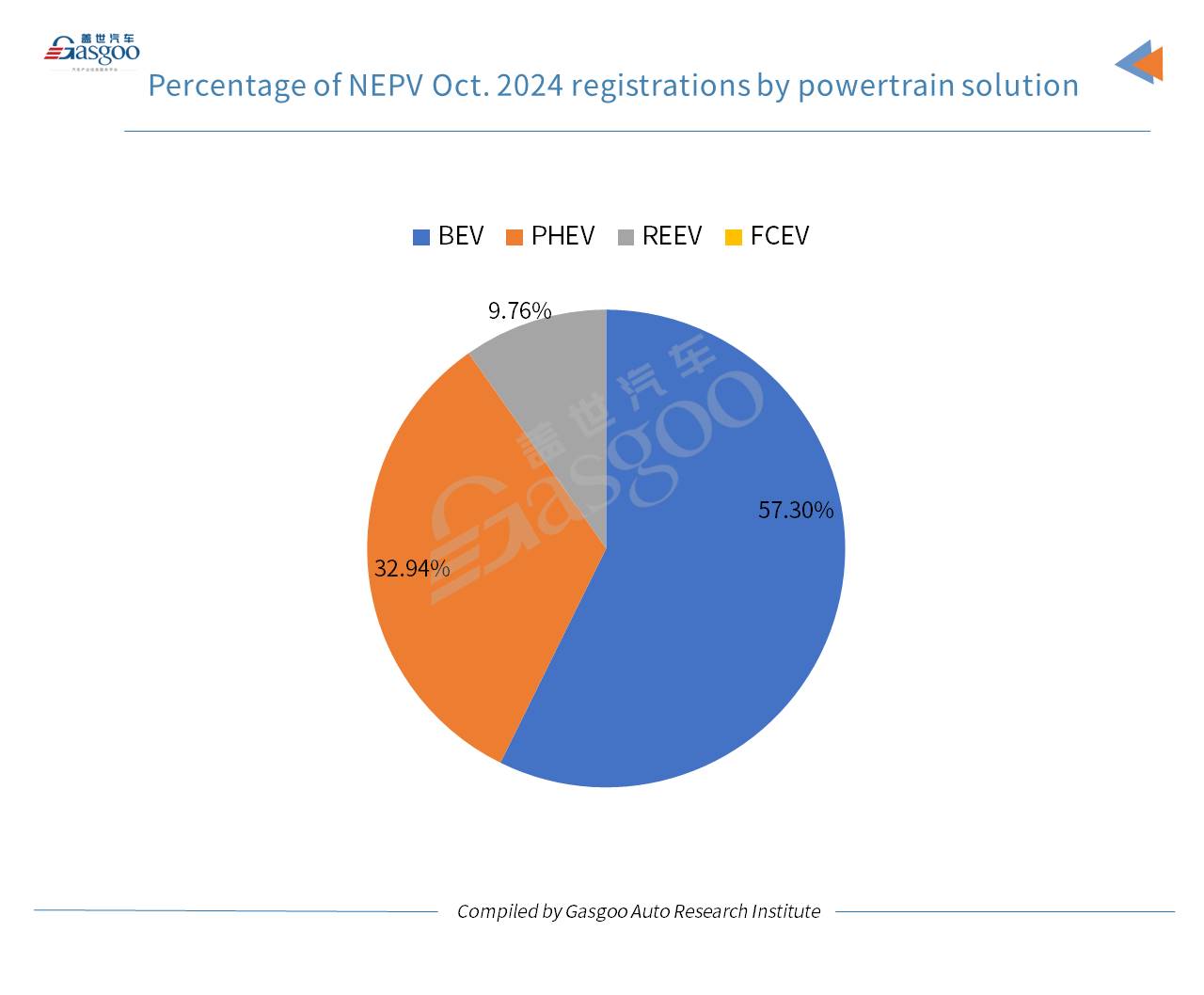

Among the registered new energy passenger vehicles (NEPVs) in October, BEVs dominated, accounting for 57.3% of the total PV registrations. PHEVs contributed 32.94%, while range-extended electric vehicles (REEVs) comprised 9.76%.

Top 20 brands by Oct. and YTD 2024 new energy passenger vehicle registrations

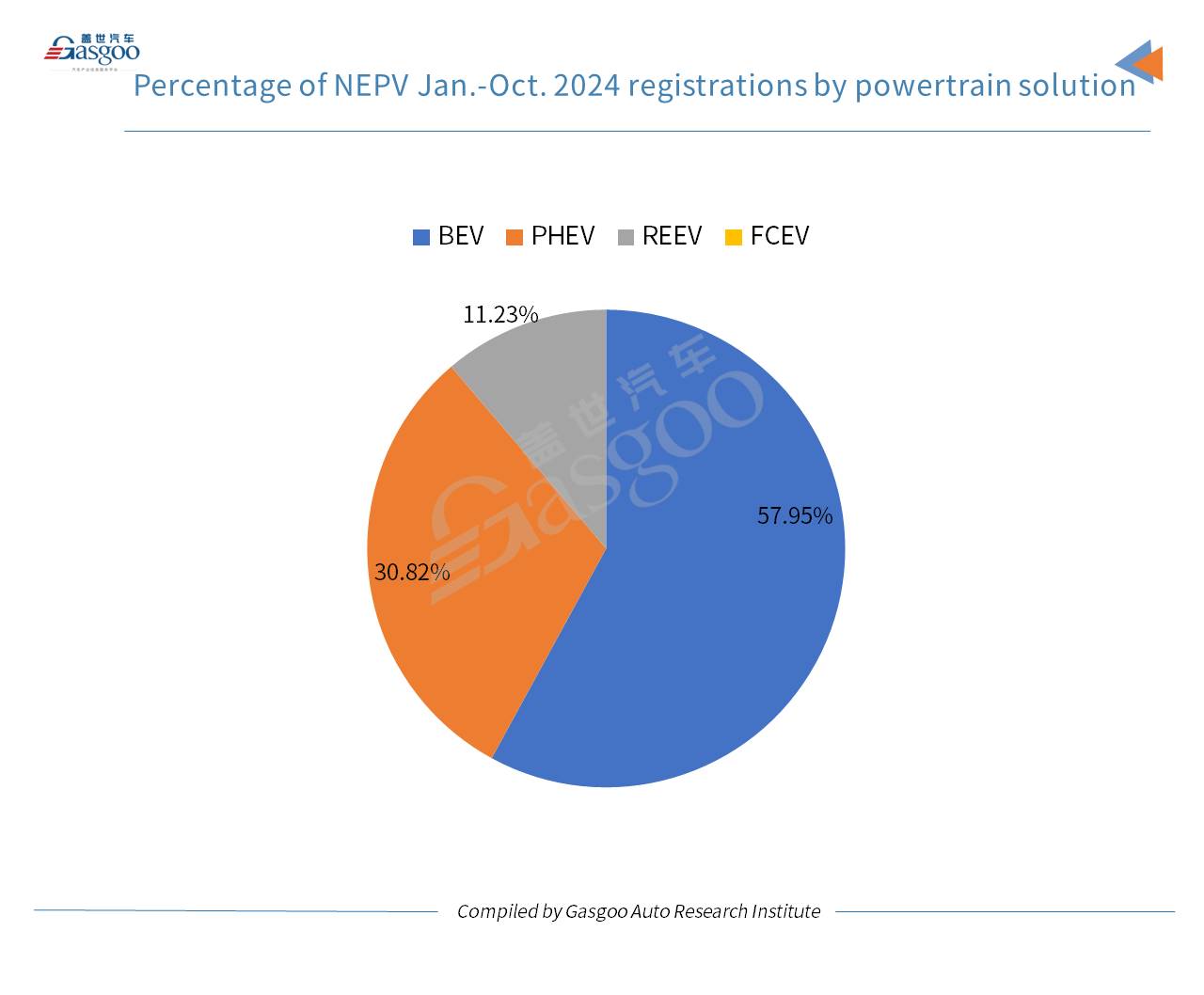

YTD data by October reveals a total of 8,222,405 NEPVs registered, marking a 47.14% hike compared to the same period in 2023. BEVs accounted for 57.95% of overall NEPV registrations, followed by PHEVs at 30.82% and REEVs at 11.23%. Additionally, 26 fuel cell vehicles were registered during this period, though their negligible numbers make their market share statistically insignificant.

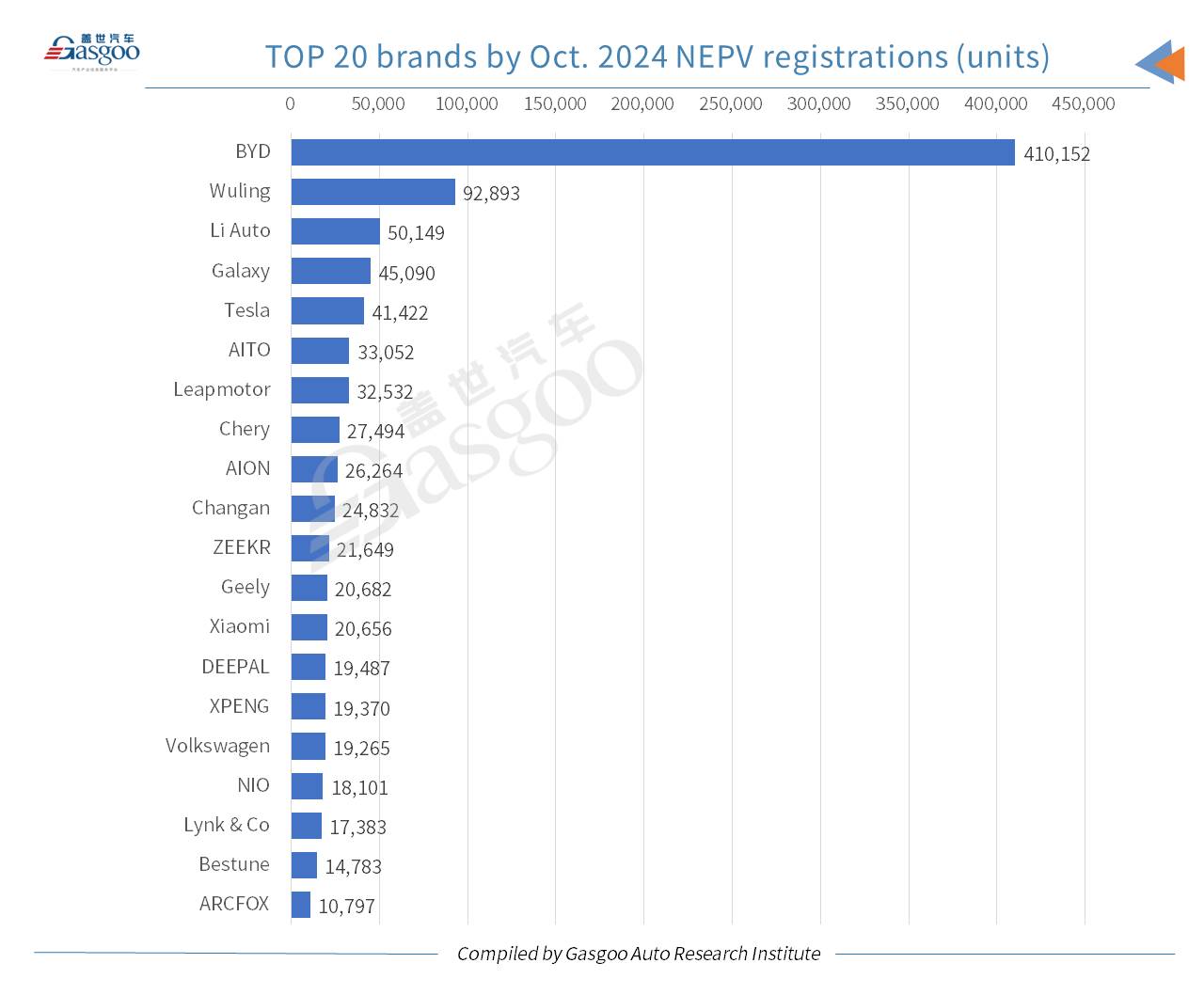

In October's NEPV brand rankings, 18 of the top 20 spots were occupied by Chinese local automakers, except Tesla (5th) and Volkswagen (16th). BYD topped the list, registering more vehicles than the combined total of brands ranked second through eleventh. Wuling secured the second place, driven by the strong performance of its Hongguang MINIEV and Binguo models, both exceeding 20,000-unit registrations for the month.

Li Auto climbed to the third place, improving one spot from September. On October 18, the company celebrated surpassing the milestone of 1 million units in cumulative vehicle deliveries. Geely Holding's Galaxy and ZEEKR brands ranked fourth and eleventh, respectively, while the Geely brand itself secured the twelfth spot. Notably, Xiaomi, with just one model on the market, entered the rankings at thirteenth place with 20,656 units registered in October.

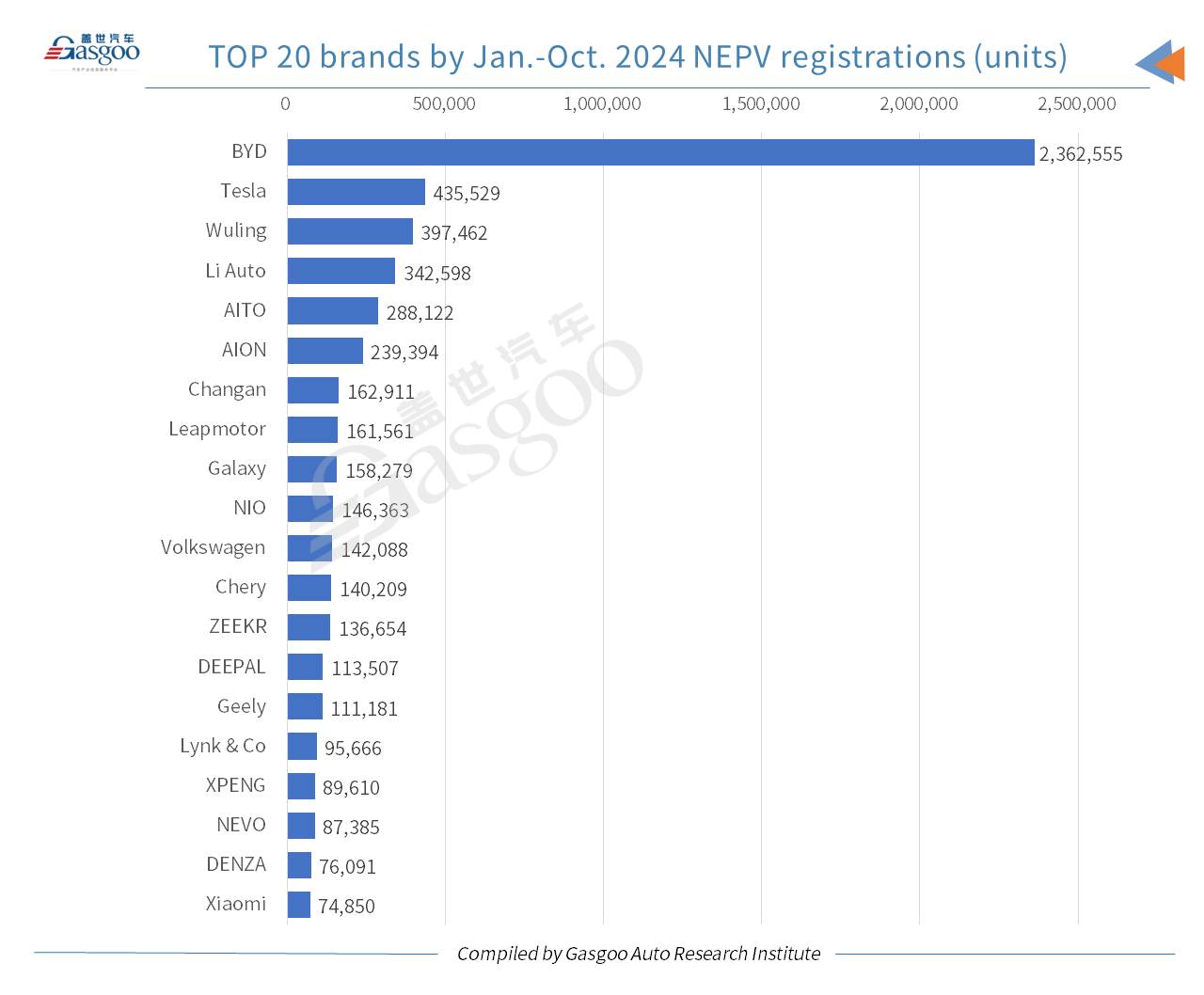

For the first ten months of the year, six brands achieved cumulative NEPV registrations exceeding 200,000 units. BYD led with over 2 million-unit registrations, far outpacing competitors. Tesla ranked second with over 400,000 units registered, followed by Wuling and Li Auto in third and fourth positions. AITO and AION rounded out the top six. BYD Auto's premium sub-brand DENZA also made it into the top 20, ranking 19th.

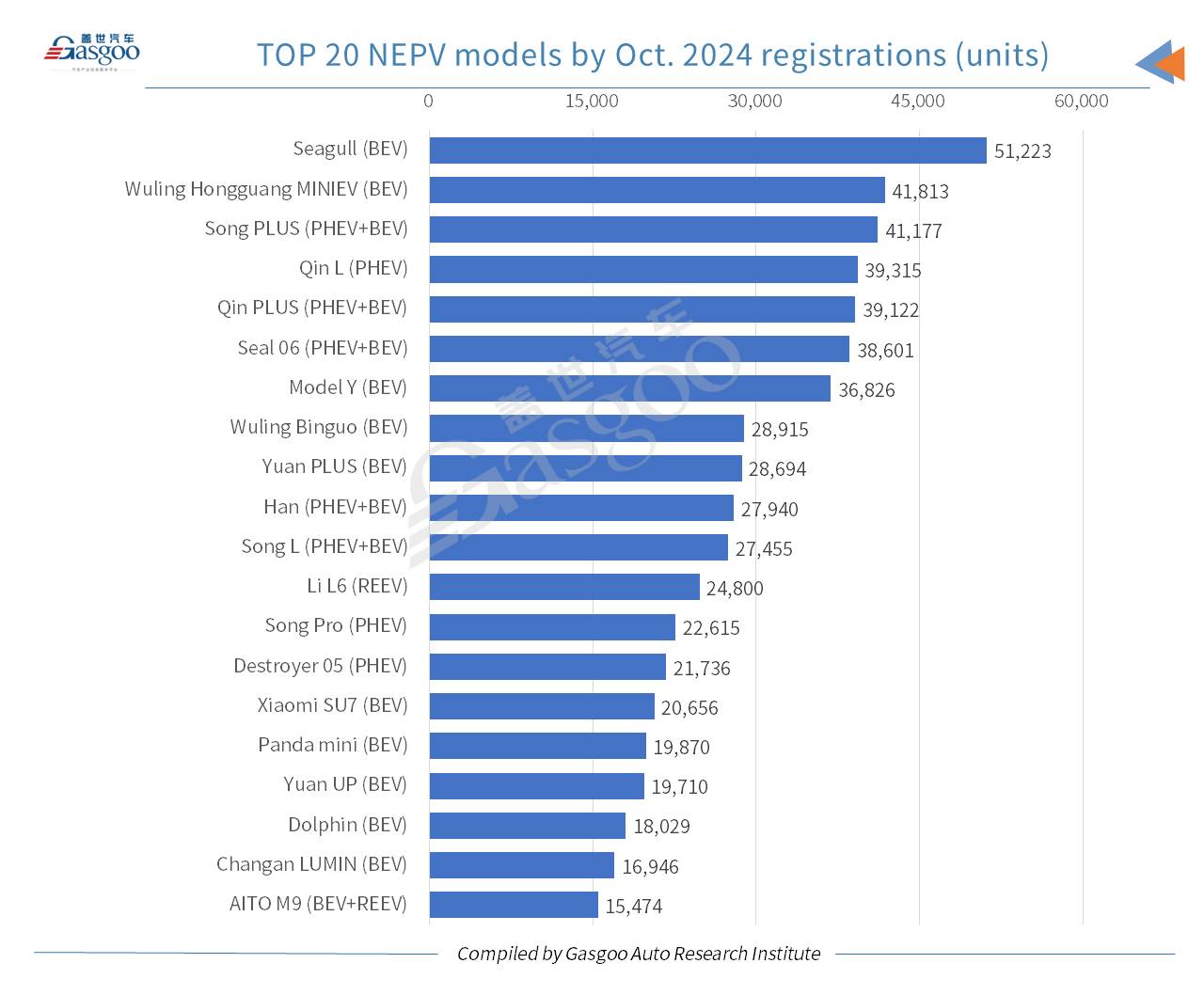

Top 20 new energy passenger vehicle models by Oct. and YTD 2024 registrations

In October, BYD solidified its dominance in the NEPV models rankings, claiming 12 of the top 20 spots, including 7 in the top 10. Of these, five models offer both BEV and PHEV variants. The Wuling Hongguang MINIEV climbed five positions from September to secure the second place, while Tesla's Model Y dropped five spots to seventh.

Among NEPV models by Jan.-Oct. registrations, BYD maintained a strong presence with 11 models in the top 20. Wuling, AITO, and Tesla each had two models on the top 20 list.

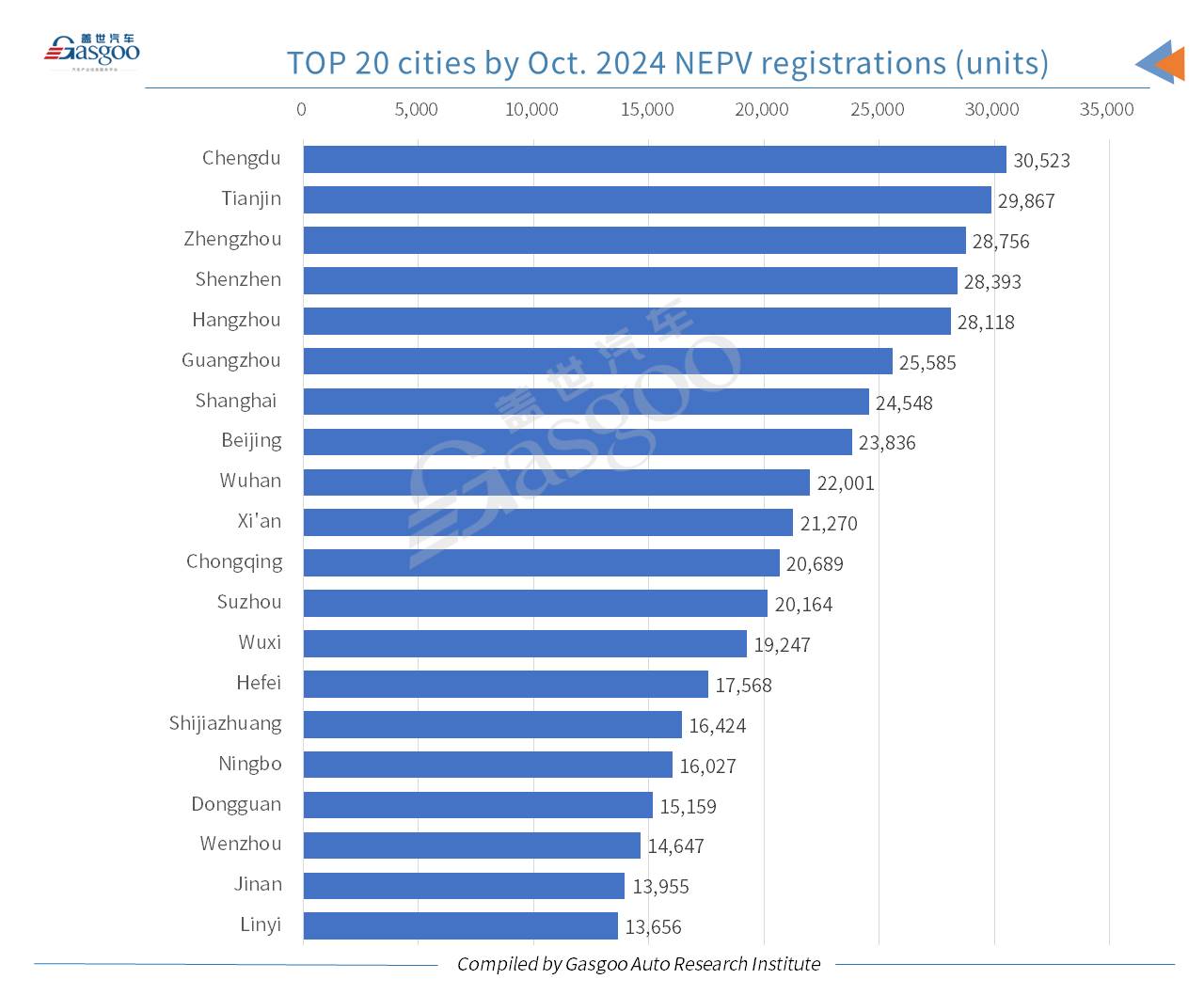

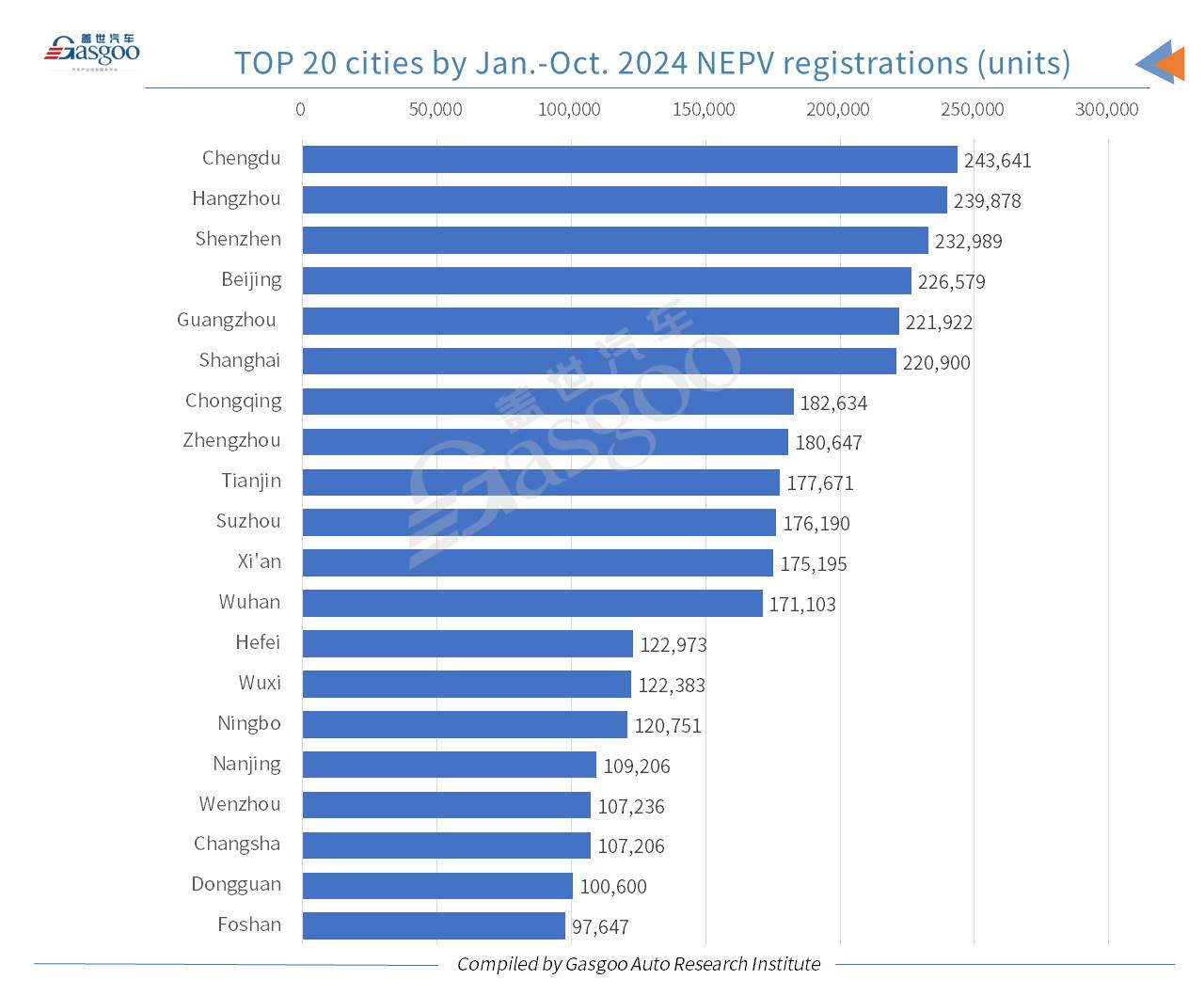

Top 20 cities by Oct. and YTD 2024 new energy passenger vehicle registrations

On a city level, Chengdu emerged as the leader in October NEPV registrations, with 30,523 units, accounting for 52.9% of the city’s total PV registrations. Tianjin followed with 29,867 NEPVs registered, representing 65.82% of its total PV market.

For the first ten months, 19 cities recorded YTD NEPV registrations exceeding 100,000 units, with six cities surpassing 200,000 units. Chengdu, Hangzhou, and Shenzhen led the pack, each with over 230,000 units registered.