From January to May 2025, China's new energy vehicle (NEV) electrification component sector sees increasing consolidation, as leading suppliers tighten their grip on the competitive landscape.

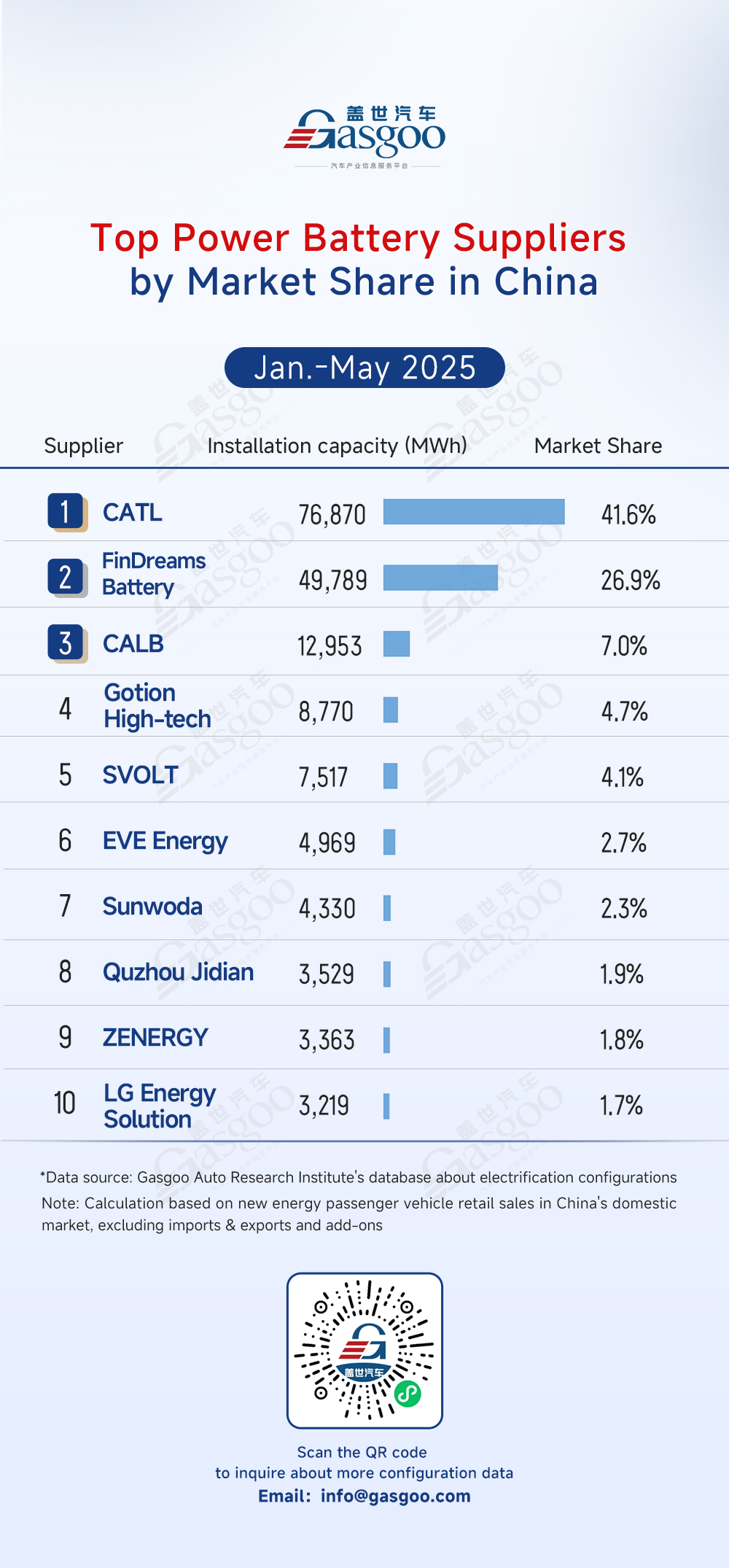

In the power battery segment, CATL holds a dominant 41.6% market share, followed by FinDreams Battery at 26.9%, with the top 5 suppliers together accounting for a striking 84% of the total market.

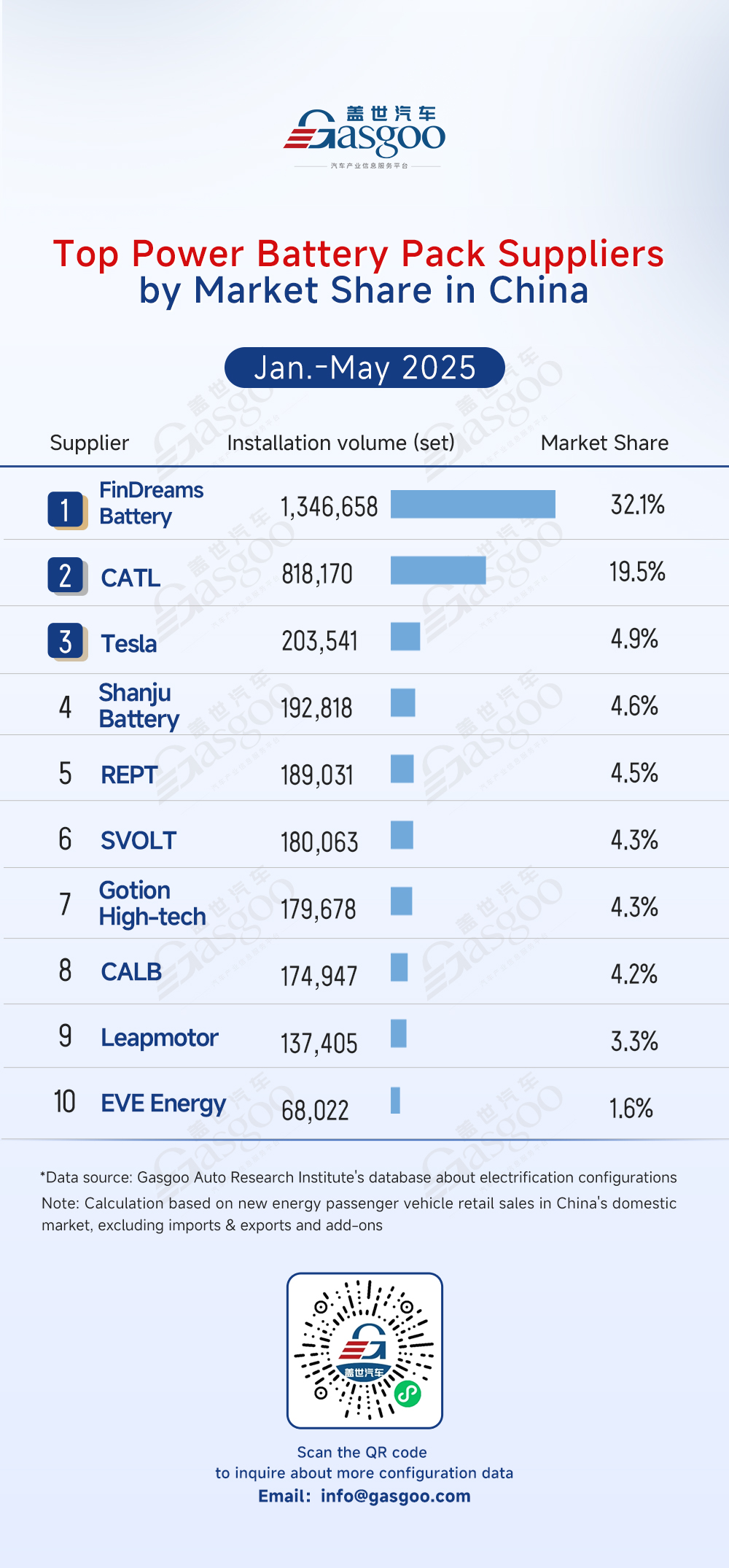

This consolidation trend is evident across several key segments. In the power battery pack sector, FinDreams Battery (32.1%) and CATL (19.5%) together secure over 51% of the market share. The top 5 players hold 70% and 75% shares in the E-compressor assembly and electrical compressor markets, respectively.

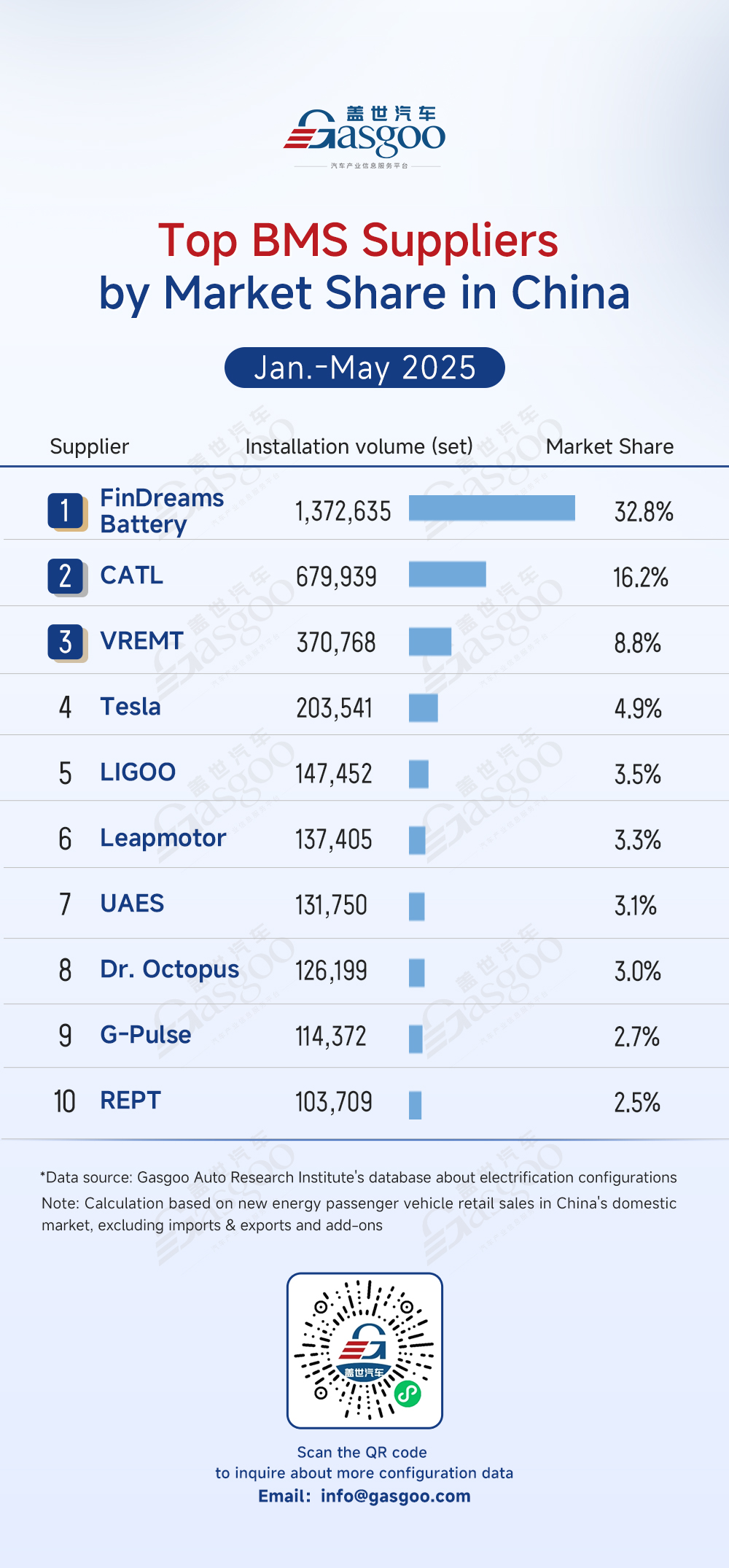

Notably, automakers' vertical integration is transforming supply chain dynamics, with in-house power battery pack production (e.g., Tesla, Leapmotor) now exceeding 50%. In the BMS market, FinDreams Battery leads with a 32.8% share supported by BYD's ecosystem, while automaker-developed solutions from VREMT and Tesla hold notable shares of 8.8% and 4.9%, respectively. This indicates that original equipment manufacturers (OEMs) are enhancing supply chain control through self-production or close collaboration with key suppliers. The electrification component market is becoming increasingly competitive, evolving into a dual-tier structure characterized by concentrated leadership and OEM integration.

Top power battery suppliers

CATL: 76,870 MWh installed, 41.6% market share

FinDreams Battery: 49,789 MWh installed, 26.9% market share

CALB: 12,953 MWh installed, 7.0% market share

Gotion High-Tech: 8,770 MWh installed, 4.7% market share

SVOLT: 7,517 MWh installed, 4.1% market share

EVE Energy: 4,969 MWh installed, 2.7% market share

Sunwoda: 4,330 MWh installed, 2.3% market share

Quzhou Jidian: 3,529 MWh installed, 1.9% market share

ZENERGY: 3,363 MWh installed, 1.8% market share

LG Energy Solution: 3,219 MWh installed, 1.7% market share

According to data compiled by the Gasgoo Automotive Research Institute, the power battery market for the Jan.-May 2025 period is highly concentrated, with the top 5 players capturing 84% of the share. CATL leads the market with 41.6%, followed by FinDreams Battery at 26.9%. While the market structure remains stable, competition persists.

Top power battery pack suppliers

FinDreams Battery: 1,346,658 sets installed, 32.1% market share

CATL: 818,170 sets installed, 19.5% market share

Tesla: 203,541 sets installed, 4.9% market share

Shanju Battery: 192,818 sets installed, 4.6% market share

REPT: 189,031 sets installed, 4.5% market share

SVOLT: 180,063 sets installed, 4.3% market share

Gotion High-Tech: 179,678 sets installed, 4.3% market share

CALB: 174,947 sets installed, 4.2% market share

Leapmotor: 137,405 sets installed, 3.3% market share

EVE Energy: 68,022 sets installed, 1.6% market share

Automakers' in-house production has exceeded 50%, underscoring a growing trend toward vertical integration and greater control over key components. FinDreams Battery leads the power battery pack market with a 32.1% share, driven by deep alignment with BYD's vehicle platform, while CATL ranks second at 19.5%, reflecting its dominance as an independent supplier. Combined, the top two players hold over 51% of the market, signaling a highly concentrated landscape. Looking ahead, ongoing technology upgrades and supply chain restructuring will play a key role in redefining market dynamics.

Top BMS suppliers

FinDreams Battery: 1,372,635 sets installed, 32.8% market share

CATL: 679,939 sets installed, 16.2% market share

VREMT: 370,768 sets installed, 8.8% market share

Tesla: 203,541 sets installed, 4.9% market share

LIGOO: 147,452 sets installed, 3.5% market share

Leapmotor: 137,405 sets installed, 3.3% market share

UAES: 131,750 sets installed, 3.1% market share

Dr. Octopus: 126,199 sets installed, 3.0% market share

G-Pulse: 114,372 sets installed, 2.7% market share

REPT: 103,709 sets installed, 2.5% market share

Automakers are increasingly taking control of the battery management system (BMS) market. Backed by BYD's vertically integrated ecosystem, FinDreams Battery commands over 30% of the BMS market, with CATL following at 16.2%—a testament to the strength of leading independents. Meanwhile, the rise of in-house systems from VREMT, Tesla, and others signals OEMs' increasing focus on building core capabilities. Looking ahead, the BMS landscape may undergo further reshaping as technology advances and OEMs continue to refine their supply chain strategies.

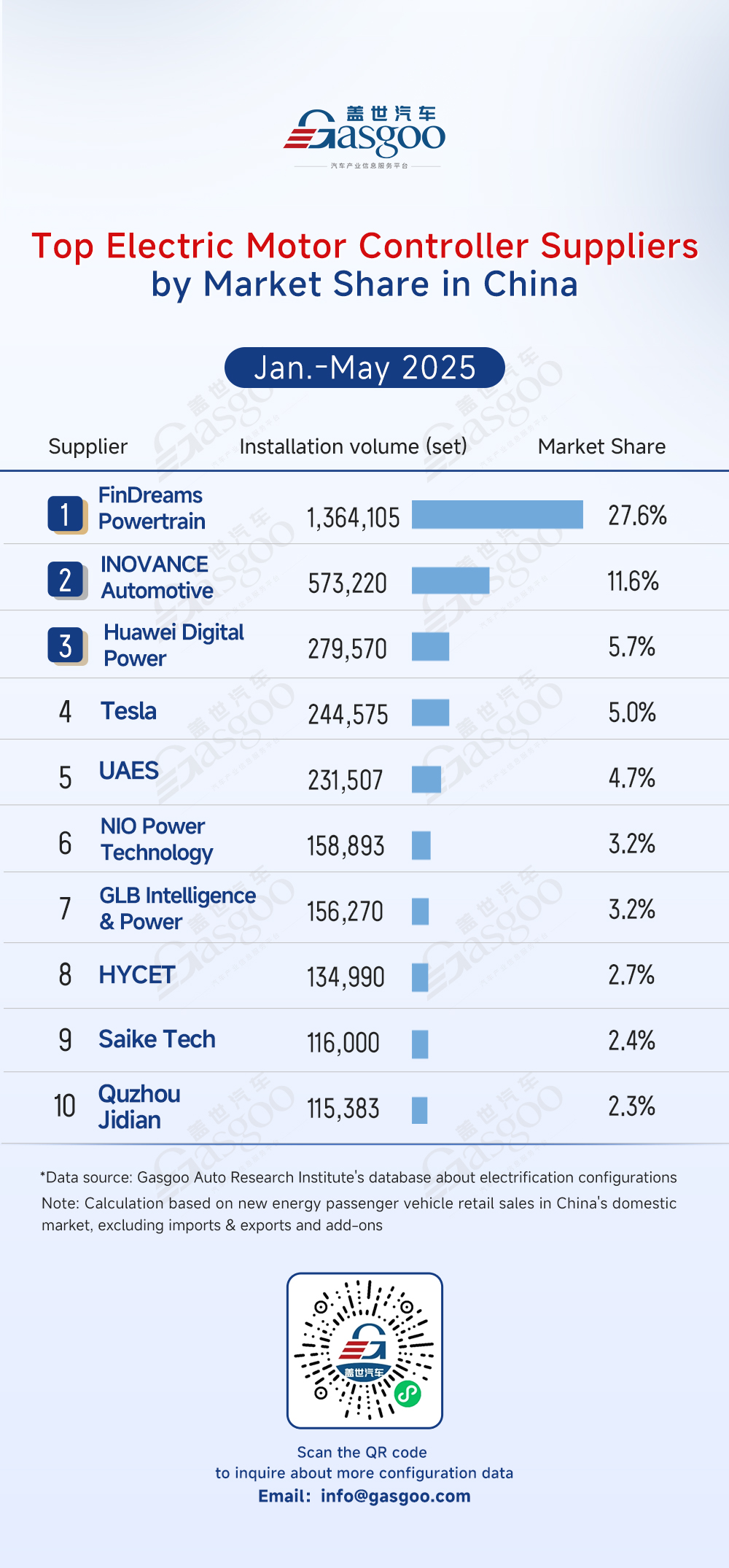

Top electric motor controller suppliers

FinDreams Powertrain: 1,364,105 sets installed, 27.6% market share

INOVANCE Automotive: 573,220 sets installed, 11.6% market share

Huawei Digital Power: 279,570 sets installed, 5.7% market share

Tesla: 244,575 sets installed, 5.0% market share

UAES: 231,507 sets installed, 4.7% market share

NIO Power Technology: 158,893 sets installed, 3.2% market share

GLB Intelligence & Power: 156,270 sets installed, 3.2% market share

HYCET: 134,990 sets installed, 2.7% market share

Saike Tech: 116,000 sets installed, 2.4% market share

Quzhou Jidian: 115,383 sets installed, 2.3% market share

With automakers increasingly producing key components in-house, over 50% of the electric motor controller market is now supplied internally. FinDreams Powertrain takes the lead with a 27.6% share, leveraging BYD's integrated ecosystem. Leading players maintain positions through technology and scale, while cross-sector entrants like Huawei Digital Power accelerate innovation and competition. With ongoing upgrades in vehicle intelligence and electrification, the market remains dynamic—technical development and supply chain collaboration will be key competitive factors.

Top suppliers of power semiconductor device (dedicated to e-drive)

BYD Semiconductor: 1,368,904 sets installed, 27.7% market share

CRRC Times Semiconductor: 714,897 sets installed, 14.5% market share

Silan Microelectronics: 400,962 sets installed, 8.1% market share

United Nova Technology: 348,858 sets installed, 7.1% market share

StarPower Semiconductor: 334,291 sets installed, 6.8% market share

Infineon: 318,519 sets installed, 6.5% market share

UAES: 259,629 sets installed, 5.3% market share

STMicroelectronics: 253,987 sets installed, 5.1% market share

MACMIC: 161,960 sets installed, 3.3% market share

AccoPower Semiconductor: 143,023 sets installed, 2.9% market share

The power semiconductor device (dedicated to e-drive) market is clearly dominated by China's local players, with the top 3—BYD Semiconductor, CRRC Times Semiconductor, and Silan Microelectronics—securing a combined 50% market share. BYD Semiconductor leads the market at 27.7%, followed closely by CRRC Times Semiconductor, and Silan Microelectronics. The market exhibits accelerating domestic substitution and growing concentration. With the broader adoption of 800V platforms and advances in automotive-grade power semiconductor device technology, Chinese suppliers are poised to strengthen their edge and consolidate market leadership.

Top electric drive motor suppliers

FinDreams Powertrain: 1,364,105 sets installed, 27.6% market share

Huawei Digital Power: 279,528 sets installed, 5.7% market share

INOVANCE Automotive: 269,844 sets installed, 5.5% market share

Tesla: 244,575 sets installed, 5.0% market share

UAES: 205,806 sets installed, 4.2% market share

GLB Intelligence & Power: 177,391 sets installed, 3.6% market share

Changzhou Huixiang: 168,407 sets installed, 3.4% market share

NIO Power Technology: 158,893 sets installed, 3.2% market share

HYCET: 148,962 sets installed, 3.0% market share

Shuanglin Auto Parts: 138,081 sets installed, 2.8% market share

FinDreams Powertrain once again leads the electric drive motor market with a 27.6% share, followed by Huawei Digital Power and Inovance Automotive, both leveraging strong R&D and product reliability. Overall market concentration remains relatively low, with narrowing gaps among suppliers pointing to intensifying competition. As the NEV industry advances, automakers are demanding higher standards in performance, cost, and efficiency—suppliers with strong innovation and cost control are poised to gain a larger share.

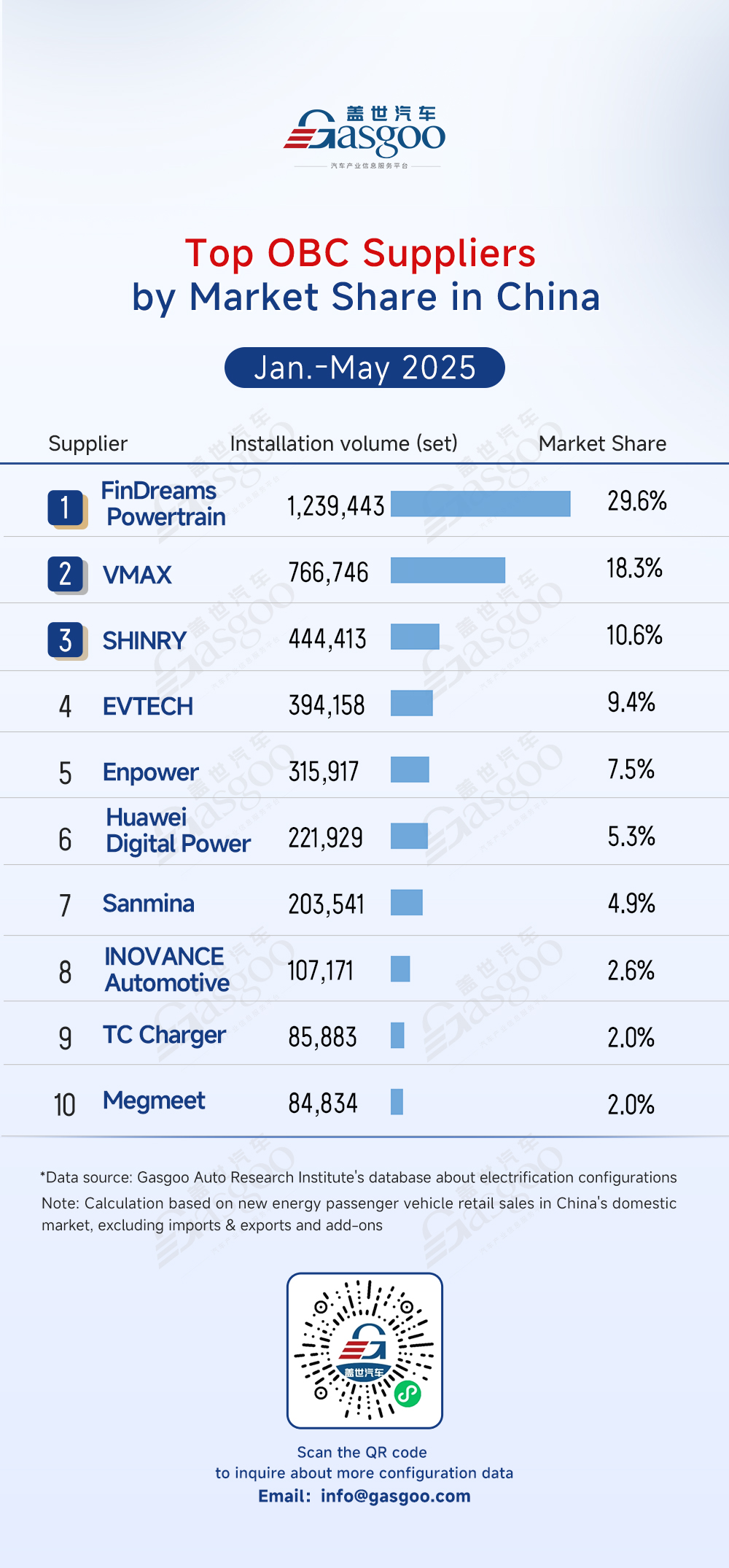

Top OBC suppliers

FinDreams Powertrain: 1,239,443 sets installed, 29.6% market share

VMAX: 766,746 sets installed, 18.3% market share

SHINRY: 444,413 sets installed, 10.6% market share

EVTECH: 394,158 sets installed, 9.4% market share

Enpower: 315,917 sets installed, 7.5% market share

Huawei Digital Power: 221,929 sets installed, 5.3% market share

Sanmina: 203,541 sets installed, 4.9% market share

INOVANCE Automotive: 107,171 sets installed, 2.6% market share

TC Charger: 85,883 sets installed, 2.0% market share

Megmeet: 84,834 sets installed, 2.0% market share

The on-board charger (OBC) market remains highly concentrated, with the top 10 suppliers accounting for 92% of total share. FinDreams Powertrain leads the market with a 29.6% share, followed by VMAX and SHINRY. Incumbents leverage strong technical expertise and system integration capabilities, while entrants such as Huawei Digital Power are gaining traction—underscoring both the rigidity of existing supply chains and the potential for disruption. While new technologies—like high-voltage fast charging—and shifting OEM sourcing strategies may reshape market dynamics, a high degree of concentration is likely to hold in the short term.

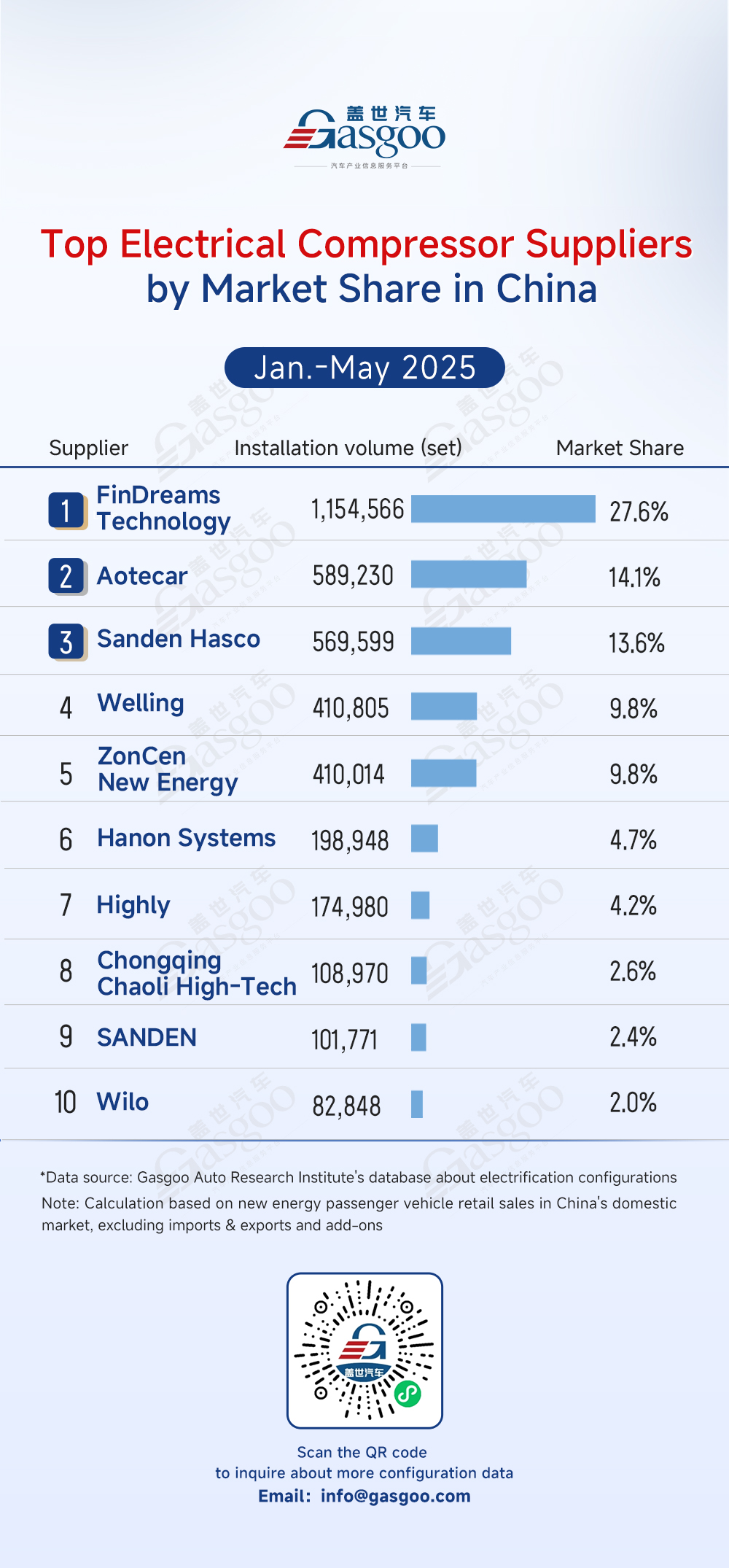

Top electrical compressor suppliers

FinDreams Technology: 1,154,566 sets installed, 27.6% market share

Aotecar: 589,230 sets installed, 14.1% market share

Sanden Hasco: 569,599 sets installed, 13.6% market share

Welling: 410,805 sets installed, 9.8% market share

ZonCen New Energy: 410,014 sets installed, 9.8% market share

Hanon Systems: 198,948 sets installed, 4.7% market share

Highly: 174,980 sets installed, 4.2% market share

Chongqing Chaoli High-Tech: 108,970 sets installed, 2.6% market share

SANDEN: 101,771 sets installed, 2.4% market share

Wilo: 82,848 sets installed, 2.0% market share

The top 5 suppliers account for 75% of the electrical compressor market, with FinDreams Technology leading at 27.6%. Major players like Aotecar and Sanden Hasco dominate the landscape. As NEVs advance, rising demand for high-voltage and integrated solutions may reshape the market, reinforcing the position of established players. Meanwhile, high entry barriers in scale and technology make it increasingly difficult for newcomers to break in.

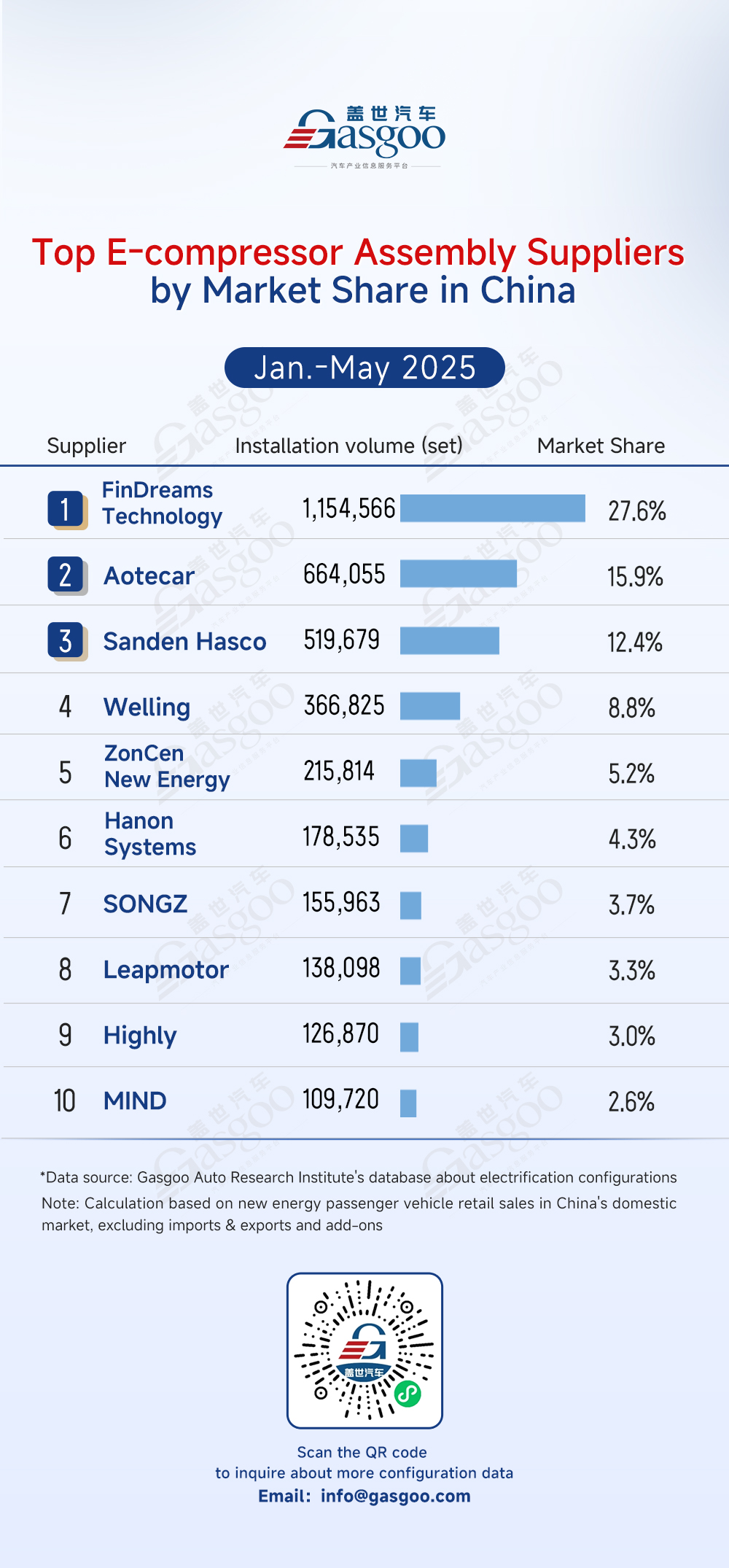

Top E-compressor assembly suppliers

FinDreams Technology: 1,154,566 sets installed, 27.6% market share

Aotecar: 664,055 sets installed, 15.9% market share

Sanden Hasco: 519,679 sets installed, 12.4% market share

Welling: 366,825 sets installed, 8.8% market share

ZonCen New Energy: 215,814 sets installed, 5.2% market share

Hanon Systems: 178,535 sets installed, 4.3% market share

SONGZ: 155,963 sets installed, 3.7% market share

Leapmotor: 138,098 sets installed, 3.3% market share

Highly: 126,870 sets installed, 3.0% market share

MIND: 109,720 sets installed, 2.6% market share

The top 5 players hold 70% of the E-compressor assembly market share, with FinDreams Technology leading at 27.6%. Aotecar, Sanden Hasco, and others follow closely, leveraging strong technical capabilities and integration advantages. While smaller players remain fragmented, deeper system integration and advancements like 800V compatibility are expected to drive the market toward suppliers with stronger technical and cost advantages.