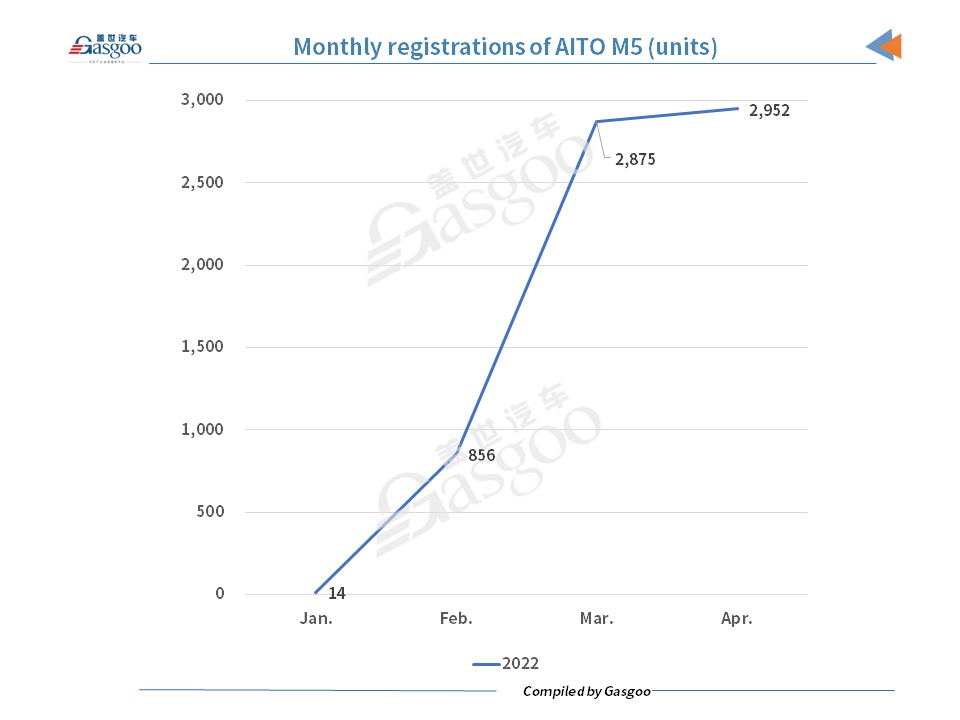

The AITO M5, the first model of the AITO brand which was jointly established by China’s technology company Huawei and automaker SERES, saw its monthly registrations close to 3,000 units for two consecutive months since its delivery started in March.

AITO M5; photo credit: AITO

The M5, built on Huawei’s DriveONE range-extended electric vehicle (REEV) platform, has a WLTC range of over 1,000 kilometers and can sprint from 0 to 100 kilometers per hour in 4.4 seconds.

It has one rear-wheel-drive version and three four-wheel-drive versions. After price rises in April and May, which were claimed to be results of increasing raw material cost, the model’s prices range from RMB259,800 (about $38,996) to RMB331,800 (about $49,803).

Monthly registrations continue to grow

According to the data compiled by Gasgoo Auto Research Institute (GARI), monthly registrations of the AITO M5 managed to maintain growth despite various industry challenges. In the first two whole months of deliveries, namely March and April, its monthly registrations stood at 2,875 and 2,952 units respectively.

The Covid-19 resurgence in Shanghai had a certain negative impact on the M5’s April registrations. In April, Shanghai consumers registered only one M5, far fewer than the 124 units registered in March.

By the end of April, the brand had registered 6,697 M5s, leaving a wide gap from its annual sales target. Richard Yu, CEO of Huawei's Intelligent Automotive Solution BU, said earlier that the brand expected to sell more than 30,000 vehicles per month and targeted annual sales of 300,000 units.

But in April, the executive admitted it is out of the question to achieve the goal when the whole industry has been challenged by chip supply shortage. It would be a miracle to sell more than 100,000 vehicles, he added in an interview in April.

According to the data AITO reported on the first day of June, by the end of May, the cumulative deliveries of the M5 had exceeded 10,000 units. Had it not been for the COVID-19 resurgence in some regions, the brand would have got a better delivery result, Richard Yu said at the 2022 Guangdong-HongKong-Macao Greater Bay Area International Auto Show.

Apart from the battery electric version of the M5, which will hit the market as early as in September, AITO also plans to launch its second model, the M7, at the end of June with the expected delivery following at the end of July this year. Claimed to outperform a one-million-yuan luxury vehicle in comfortable and intelligent experience, the M7 is obviously placed high hopes. With new models, the high-profile brand may have better delivery results in the rest of this year.

Retail registrations gain more share

By ownership, the AITO M5’s retail registrations in February, when scale delivery had not commenced, were only 10 units while the rest 846 M5s were registered by fleet buyers. The share of retail registrations surged to 63.6% in March and rose to 77% in April.

In terms of Jan.-Apr. period, the M5’s retail registrations accounted for 61.37% of its total year-to-date registrations. Only one M5 was registered for renting purpose in the first four months of this year.

With the support from Huawei, the sales network of the AITO has been built quickly. Currently, the model is mainly sold in Huawei’s offline stores. In January this year, Huawei announced that the model’s test ride and reservation would be available in 500 Huawei’s stores in 118 cities across the country.

The registration data showed that the M5 had been registered in 203 cities, but the average number was not so high. By the end of April, Chongqing, where the M5’s manufacturer SERES is headquartered, registered the most M5s this year, and Shenzhen, where Huawei is headquartered, followed.

In April, Shenzhen’s registrations of the M5 jumped 40.4% month over month to 264 units, outnumbering those of Chongqing, whose monthly registrations fell 48.25% from a month ago. Beijing was not on the top 10 cities list.

Second in REEV segment

In the Jan.-Apr. period, a total of five range-extended electric vehicle models are available in the market, namely the Li ONE, the AITO M5, the VOYAH Free, the SERES SF5 and the Enovate ME5.

The AITO M5 is actually a strong competitor in the segment with Jan.-Apr. registrations only second to the Li ONE among the said models. The Li ONE is the obvious leader in the segment with 36,109 registered in the first four months of this year, gaining a share of 73.78% out of the REEV segment. The AITO M5 came next with a share of 13.69% while the combined share of the rest three stood at 12.53%.

Comparatively, the SERES SF5 only registered 262 units in the span, with maximum monthly registrations not surpassing 100 units.

The AITO M7, to take on the Li ONE, is also a REEV model with more Huawei content and will continue to be sold in Huawei’s channels.