Rankings of electrification component suppliers in China (Jan.-Sept. 2025): FinDreams takes lead across multiple segments

According to data compiled by the Gasgoo Automotive Research Institute, China's electrified core component market became increasingly defined in January–September 2025, driven by both strong head-end consolidation and automakers' accelerated push for in-house technologies. In the power battery sector, CATL and FinDreams Battery established a clear "dual-leader" structure, together capturing more than 67% of the market. In both the power battery pack and BMS segments, FinDreams Battery led the field with a market share of over 30%, forming a two-player powerhouse alongside CATL.

Notably, the FinDreams group stands out, leading not only in batteries, battery packs, and BMS, but also in electric drive motor, motor controllers, OBCs, and electric compressors—showcasing the strength of its fully integrated supply chain. In power semiconductor device (dedicated to e-drive) market, China's local players dominate, with BYD Semiconductor at the forefront and the top 5 suppliers holding 64% of the market. multi-in-one main drive system (dedicated to BEVs) and eletric motor controllers also show a clear OEM self-supply trend, with Leapmotor and NIO Power Technology ranking among the major players.

Overall, China's core EV component market shows a high level of concentration. Leading players are building strong competitive moats through rapid technology iteration and large-scale delivery, while mid-tier suppliers pursue differentiated strategies in niche segments. Meanwhile, OEMs are accelerating in-house development, reshaping the supply chain and driving the industry toward high-quality growth through a mix of consolidation and diversification.

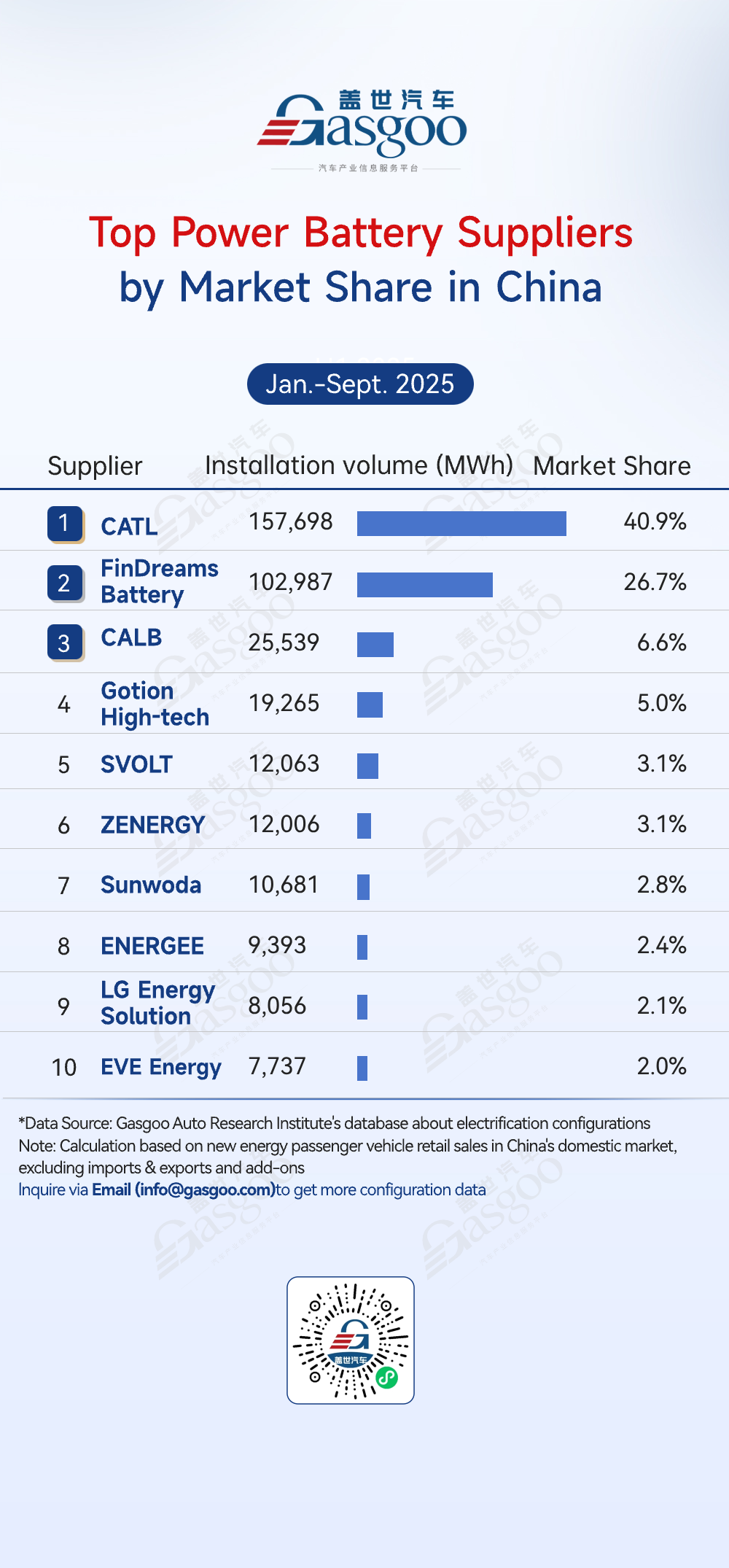

Top power battery suppliers

CATL: 157,698 MWh installed, 40.9% market share

FinDreams Battery: 102,987 MWh installed, 26.7% market share

CALB: 25,539 MWh installed, 6.6% market share

Gotion High-tech: 19,265 MWh installed, 5.0% market share

SVOLT: 12,063 MWh installed, 3.1% market share

ZENERGY: 12,006 MWh installed, 3.1% market share

Sunwoda: 10,681 MWh installed, 2.8% market share

ENERGEE: 9,393 MWh installed, 2.4% market share

LG Energy Solution: 8,056 MWh installed, 2.1% market share

EVE Energy: 7,737 MWh installed, 2.0% market share

Power battery installation data for the Jan.–Sept. 2025 period showed a highly concentrated market with clear tiering. CATL led with 157,698 MWh installed (40.9%), followed by FinDreams Battery at 102,987 MWh (26.7%); together they held over 67% of the market. CALB (6.6%), Gotion High-tech (5.0%), and SVOLT (3.1%) formed a distant second tier, while ZENERGY, Sunwoda, LG Energy Solution, and others remained in the 2%–3% range. Overall concentration was strong, with the top five suppliers accounting for 82% of total share. Technology iteration and large-scale delivery were the key competitive drivers, while smaller players had to rely on differentiated routes or niche applications to stay competitive.

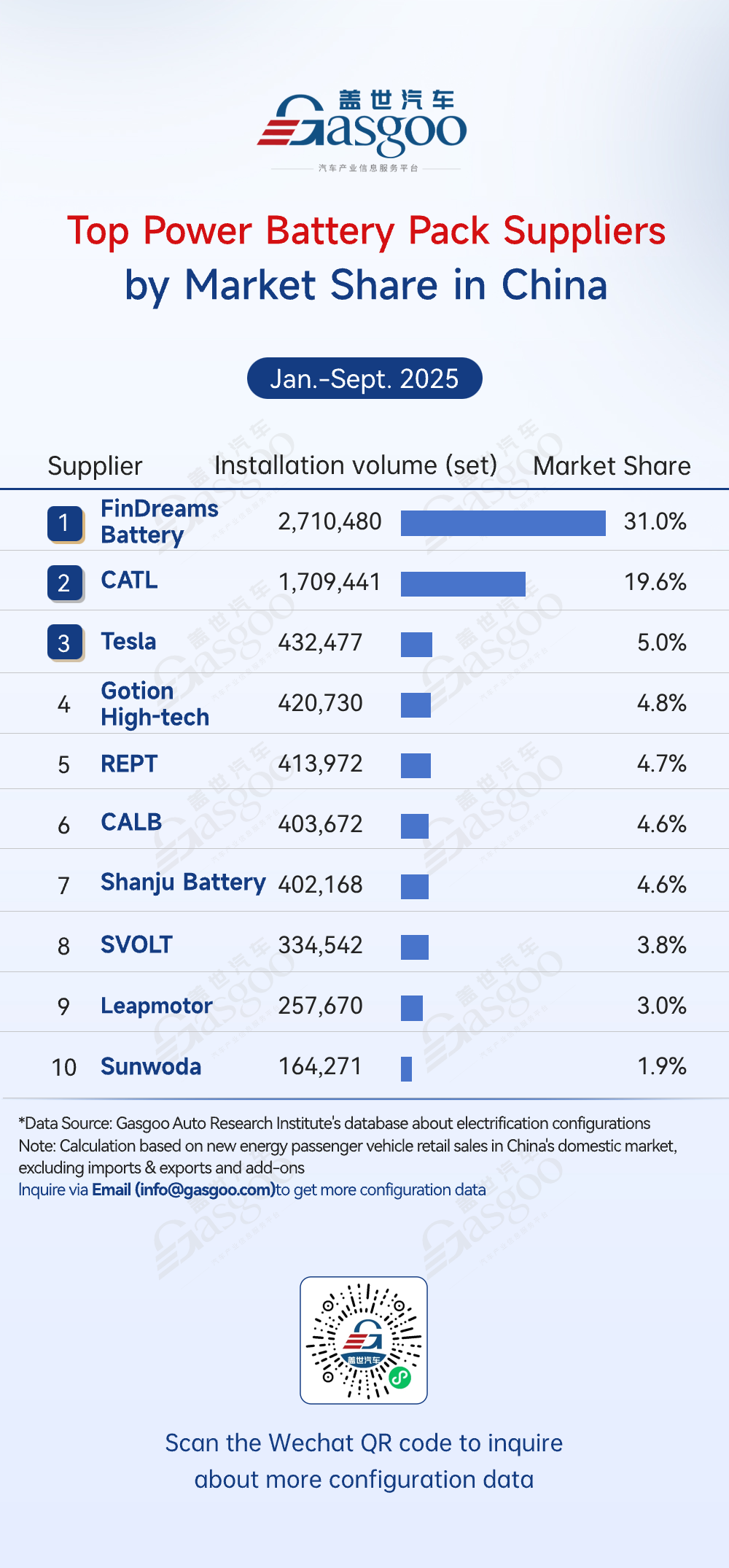

Top power battery pack suppliers

FinDreams Battery: 2,710,480 sets installed, 31.0% market share

CATL: 1,709,441 sets installed, 19.6% market share

Tesla: 432,477 sets installed, 5.0% market share

Gotion High-tech: 420,730 sets installed, 4.8% market share

REPT: 413,972 sets installed, 4.7% market share

CALB: 403,672 sets installed, 4.6% market share

Shanju Battery: 402,168 sets installed, 4.6% market share

SVOLT: 334,542 sets installed, 3.8% market share

Leapmotor: 257,670 sets installed, 3.0% market share

Sunwoda: 164,271 sets installed, 1.9% market share

Powe battery pack installations for the Jan.–Sept. 2025 period showed a clear "dual-leader + tight second tier" structure. FinDreams Battery led the pack with 2,710,480 sets installed (31.0%), followed by CATL with 1,709,441 sets (19.6%); together they commanded over 50.6% of the market. Tesla (5.0%), Gotion High-tech (4.8%), REPT (4.7%), CALB and Shanju Battery (both 4.6%) formed a tightly packed second tier with minimal gaps in share. Leapmotor's in-house PACK accounted for 3.0%, reflecting the growing trend of OEM self-manufacturing. Overall, as EV penetration rose, OEM in-house development reshaped the supply chain, pushing the market into a stage where top players consolidated through technology and scale, while second-tier suppliers competed through differentiation.

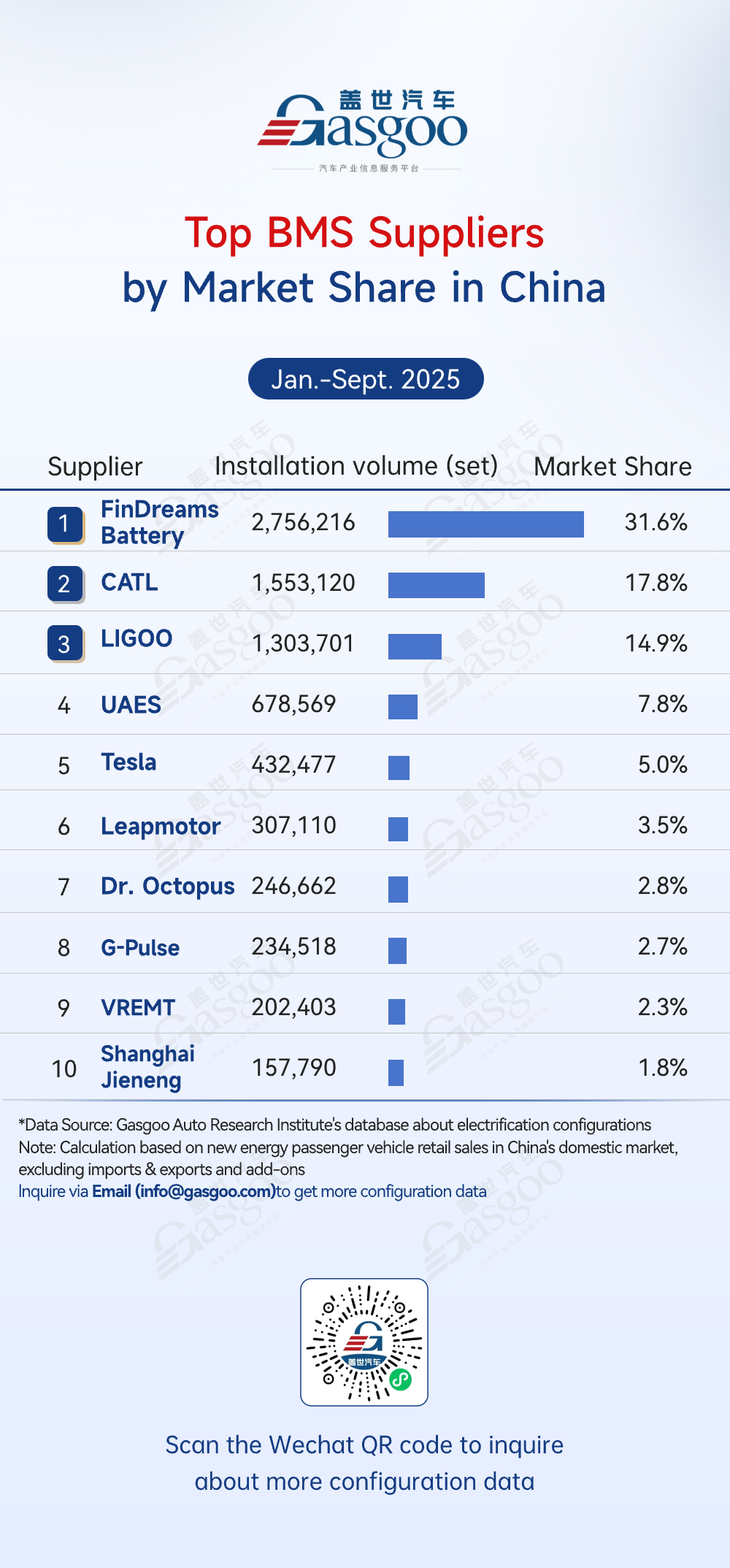

Top BMS suppliers

FinDreams Battery: 2,756,216 sets installed, 31.6% market share

CATL: 1,553,120 sets installed, 17.8% market share

LIGOO: 1,303,701 sets installed, 14.9% market share

UAES: 678,569 sets installed, 7.8% market share

Tesla: 432,477 sets installed, 5.0% market share

Leapmotor: 307,110 sets installed, 3.5% market share

Dr. Octopus: 246,662 sets installed, 2.8% market share

G-Pulse: 234,518 sets installed, 2.7% market share

VREMT: 202,403 sets installed, 2.3% market share

Shanghai Jieneng: 157,790 sets installed, 1.8% market share

The BMS market for the Jan.–Sept. 2025 Period remained highly concentrated. FinDreams Battery dominated with 31.6% market share, while CATL and LIGOO ranked closely behind, and the three together captured 64.3% of total installations. UAES and Tesla formed a clear second tier, and all other suppliers individually held less than 4%. The growing adoption of in-house BMS solutions by OEMs—led by BYD, Tesla, and Leapmotor—accelerated the shift toward greater supply-chain autonomy. This trend not only reinforced technical control over core battery systems but also drove a new phase of competition centered on integration, scale, and system-level optimization.

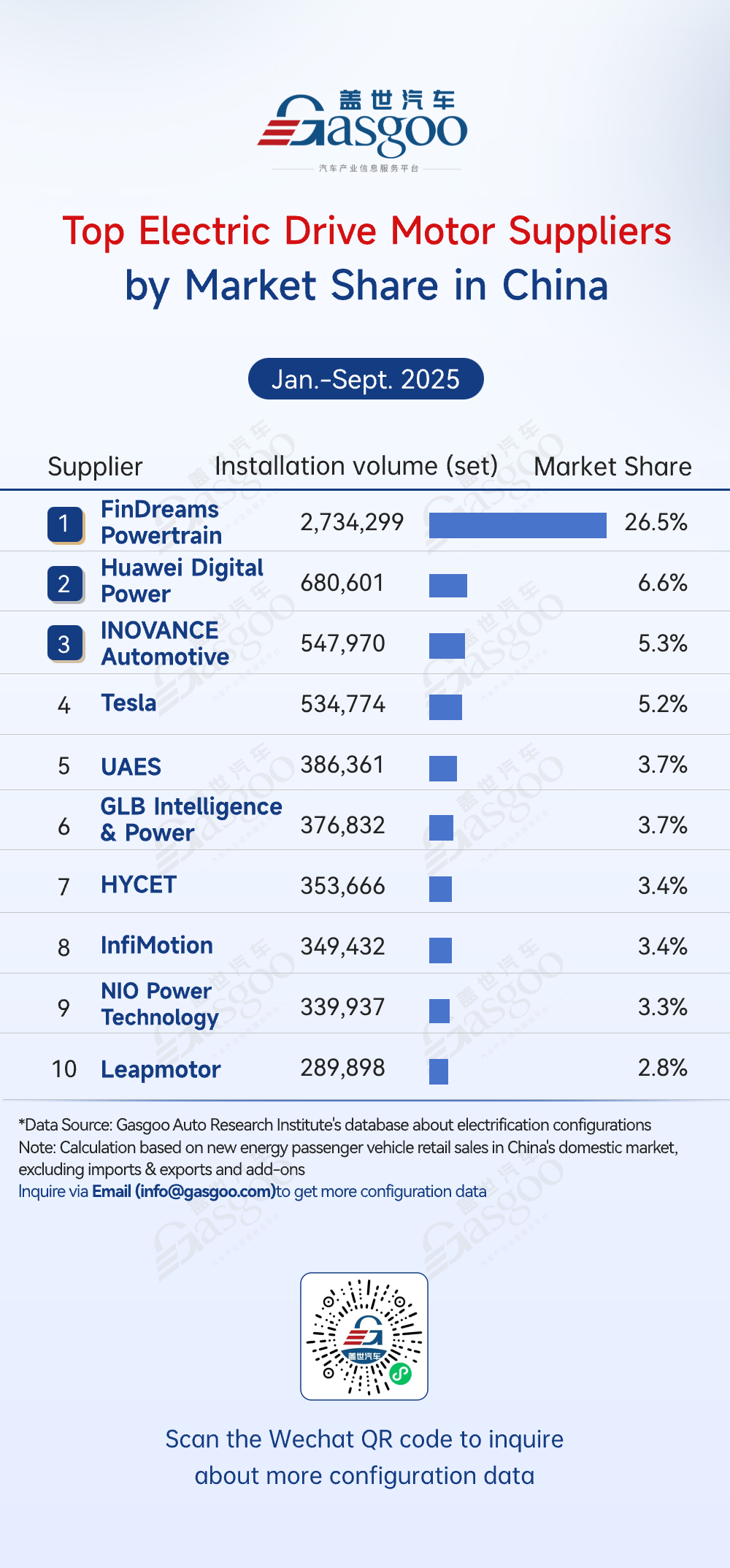

Top electric drive motor suppliers

FinDreams Powertrain: 2,734,299 sets installed, 26.5% market share

Huawei Digital Power: 680,601 sets installed, 6.6% market share

INOVANCE Automotive: 547,970 sets installed, 5.3% market share

Tesla: 534,774 sets installed, 5.2% market share

UAES: 386,361 sets installed, 3.7% market share

GLB Intelligence & Power: 376,832 sets installed, 3.7% market share

HYCET: 353,666 sets installed, 3.4% market share

InfiMotion: 349,432 sets installed, 3.4% market share

NIO Power Technology: 339,937 sets installed, 3.3% market share

Leapmotor: 289,898 sets installed, 2.8% market share

The electric drive motor market for the Jan.–Sept. 2025 period showed a "one strong leader, multiple contenders" pattern. FinDreams Powertrain dominated with 26.5% share, far ahead of the field. Huawei Digital Power, INOVANCE Automotive, and Tesla formed the second tier with 5%–7% shares, while UAES, GLB Intelligence & Power, HYCET, and others clustered around 3%. The market was top-heavy, with competition in the mid-tier still tight. Technology upgrades and scale delivery remained the key drivers shaping industry dynamics.

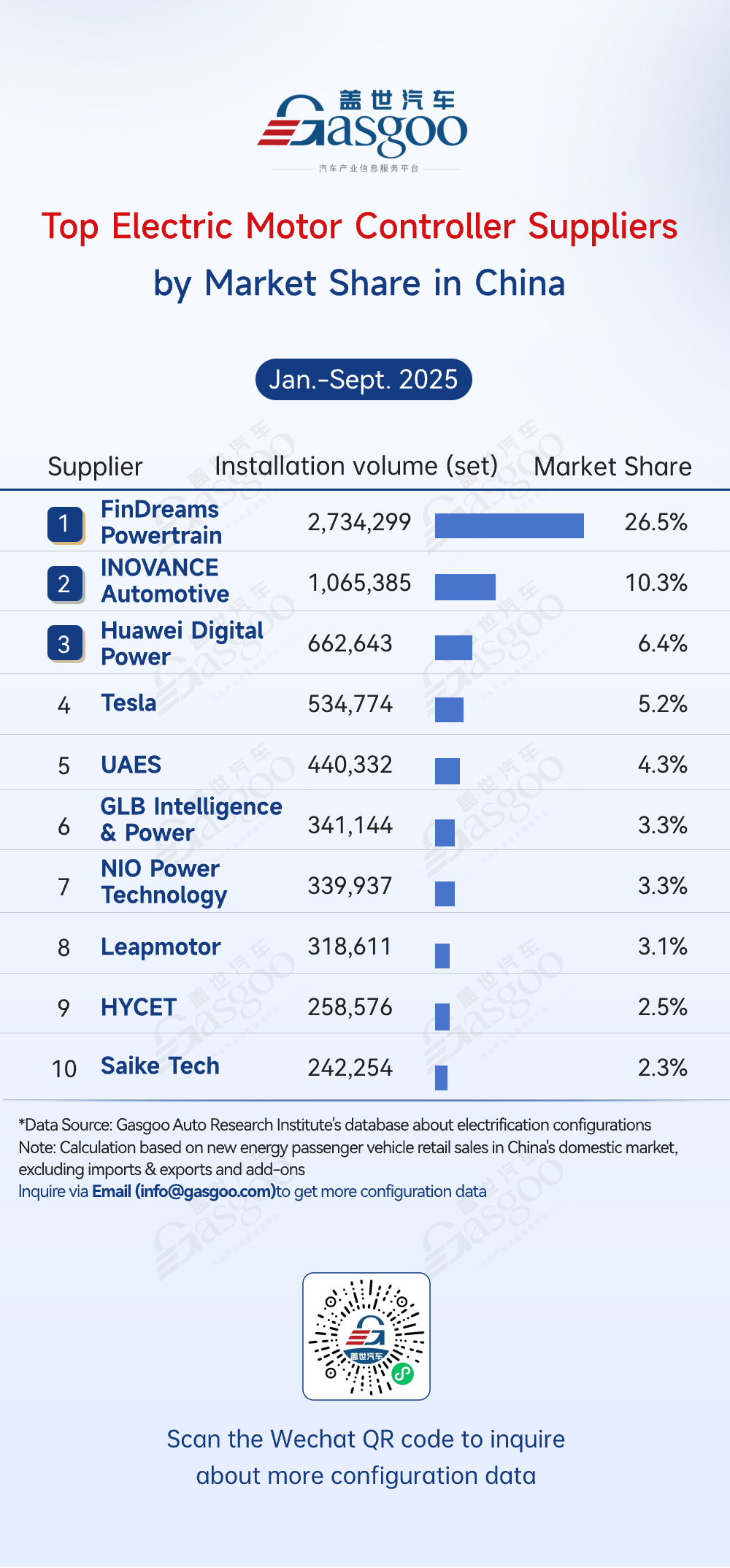

Top electric motor controller suppliers

FinDreams Powertrain: 2,734,299 sets installed, 26.5% market share

INOVANCE Automotive: 1,065,385 sets installed, 10.3% market share

Huawei Digital Power: 662,643 sets installed, 6.4% market share

Tesla: 534,774 sets installed, 5.2% market share

UAES: 440,332 sets installed, 4.3% market share

GLB Intelligence & Power: 341,144 sets installed, 3.3% market share

NIO Power Technology: 339,937 sets installed, 3.3% market share

Leapmotor: 318,611 sets installed, 3.1% market share

HYCET: 258,576 sets installed, 2.5% market share

Saike Tech: 242,254 sets installed, 2.3% market share

The electric motor controller market for the Jan.–Sept. 2025 period was increasingly dominated by in-house solutions, with OEM-made products accounting for over half of total installations. FinDreams Powertrain led the pack with a 26.5% share, followed by INOVANCE Automotive (10.3%) and Huawei Digital Power (6.4%). Tesla, UAES, GLB Intelligence & Power, NIO Power Technology, and Leapmotor held smaller but competitive shares, reflecting a crowded mid-field. The growing presence of OEM-affiliated suppliers highlighted the accelerating trend toward self-developed motor controller systems.

Top suppliers of power semiconductor device (dedicated to e-drive)

BYD Semiconductor: 2,731,887 sets installed, 26.5% market share

CRRC Times Semiconductor: 1,405,336 sets installed, 13.6% market share

United Nova Technology: 882,754 sets installed, 8.6% market share

Silan Microelectronics: 857,890 sets installed, 8.3% market share

Infineon: 706,885 sets installed, 6.9% market share

StarPower Semiconductor: 662,500 sets installed, 6.4% market share

STMicroelectronics: 547,552 sets installed, 5.3% market share

UAES: 508,287 sets installed, 4.9% market share

AccoPower Semiconductor: 253,538 sets installed, 2.5% market share

MACMIC: 158,926 sets installed, 1.5% market share

The power semiconductor device (dedicated to e-drive) market for the Jan.–Sept. 2025 period was characterized by a "local rise and concentrated leadership" pattern. BYD Semiconductor led the pack with 2,731,887 sets installed (26.5% share), followed by CRRC Times Semiconductor, United Nova Technology, Silan Microelectronics, and Infineon. The top five suppliers together accounted for 64% of the market, reflecting a highly concentrated landscape dominated by local players, while international vendors engaged in increasingly intense competition.

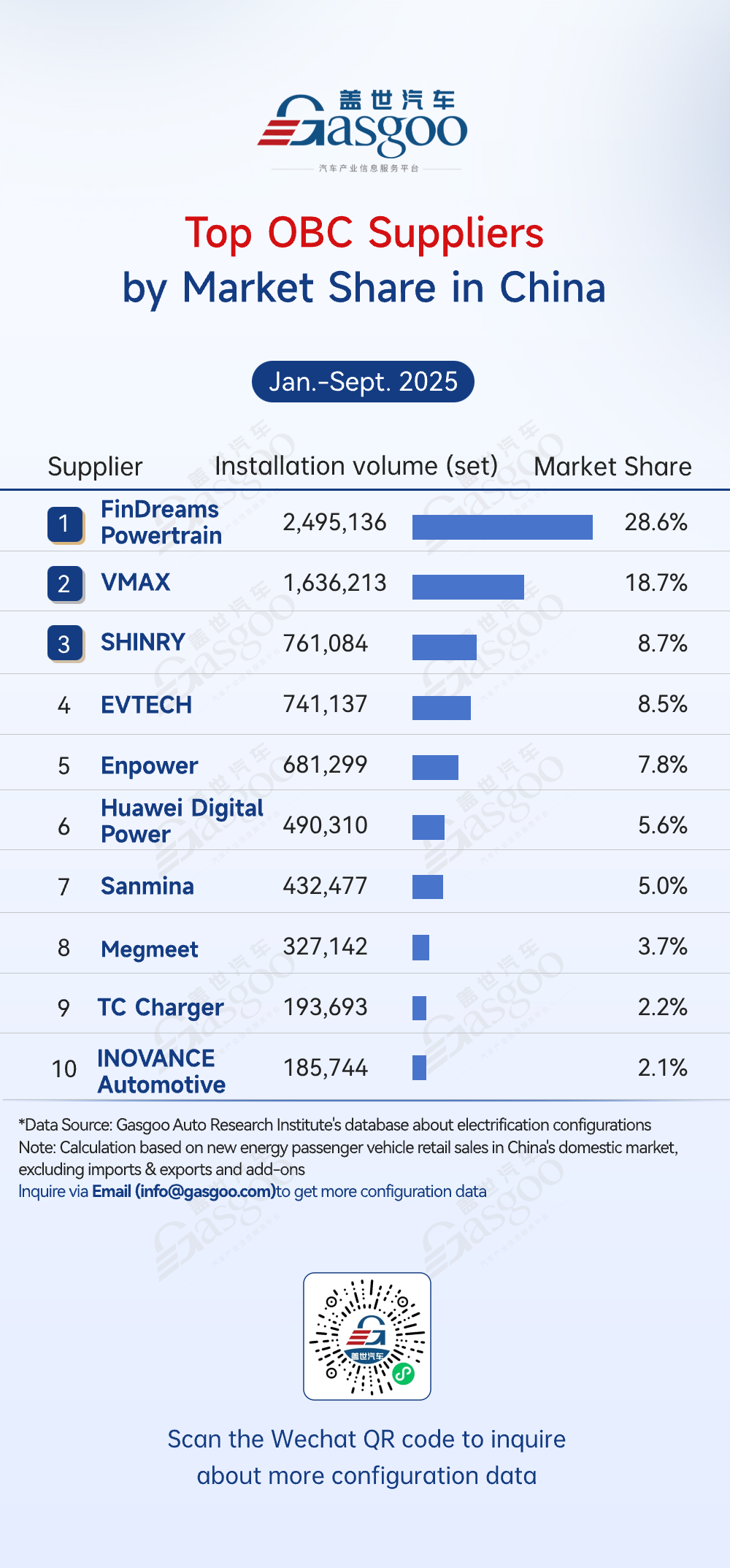

Top OBC suppliers

FinDreams Powertrain: 2,495,136 sets installed, 28.6% market share

VMAX: 1,636,213 sets installed, 18.7% market share

SHINRY: 761,084 sets installed, 8.7% market share

EVTECH: 741,137 sets installed, 8.5% market share

Enpower: 681,299 sets installed, 7.8% market share

Huawei Digital Power: 490,310 sets installed, 5.6% market share

Sanmina: 432,477 sets installed, 5.0% market share

Megmeet: 327,142 sets installed, 3.7% market share

TC Charger: 193,693 sets installed, 2.2% market share

INOVANCE Automotive: 185,744 sets installed, 2.1% market share

The OBC market for the Jan.–Sept. 2025 period was highly concentrated. FinDreams Powertrain took the lead with 2.495 million sets installed (28.6% share), followed by VMAX with 1.636 million units and 18.7%; together they accounted for 47.3%, forming the first tier. SHINRY, EVTECH, and Enpower made up the second tier with 7%–9% shares, bringing the top five to 63.6%. Huawei Digital Power, Sanmina, and others held below 6% each, totaling 36.4%. Overall, the market showed a clear “top-heavy, tiered” structure, with R&D strength and scaled delivery defining competitiveness.

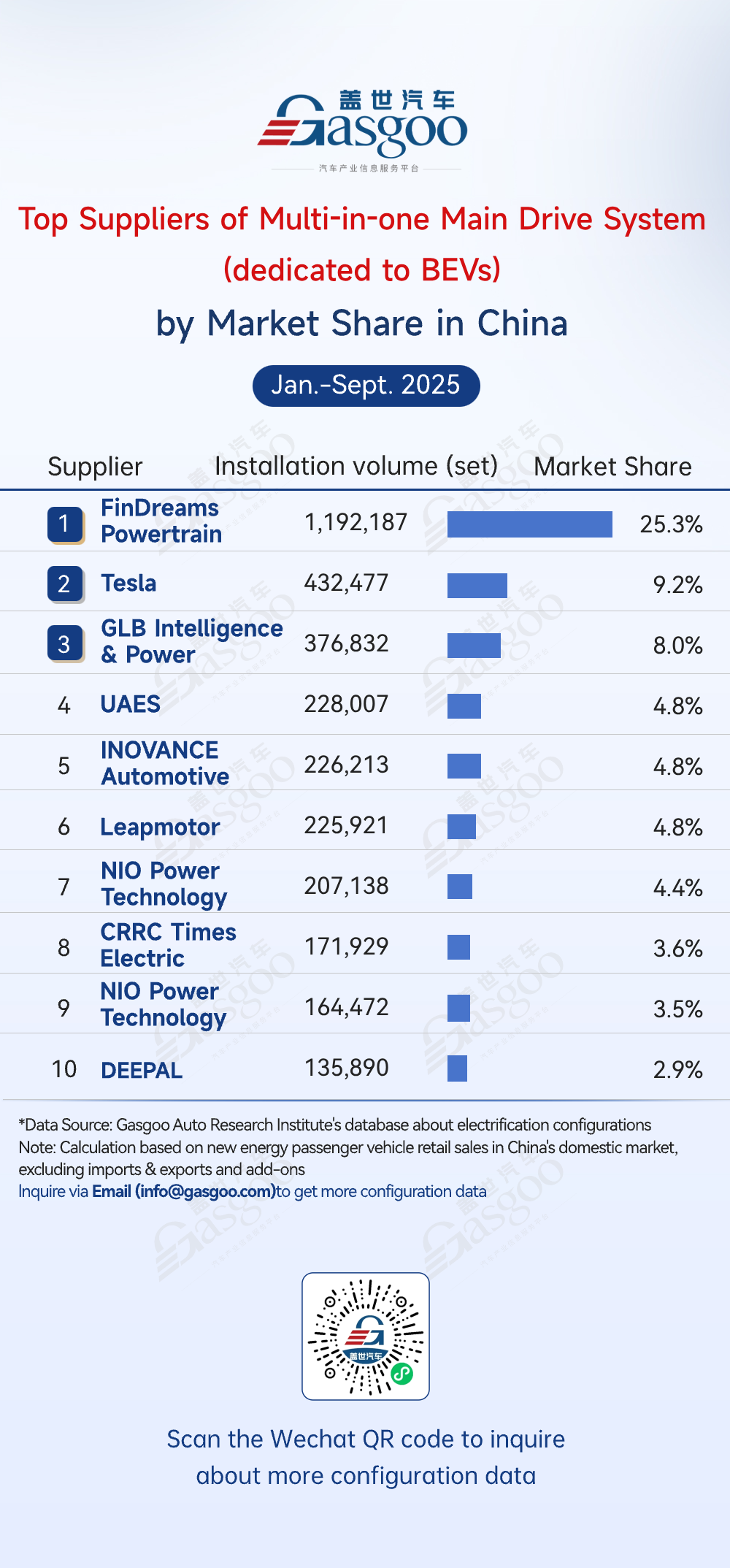

Top suppliers of multi-in-one main drive system (dedicated to BEVs)

FinDreams Powertrain: 1,192,187 sets installed, 25.3% market share

Tesla: 432,477 sets installed, 9.2% market share

GLB Intelligence & Power: 376,832 sets installed, 8.0% market share

UAES: 228,007 sets installed, 4.8% market share

INOVANCE Automotive: 226,213 sets installed, 4.8% market share

Leapmotor: 225,921 sets installed, 4.8% market share

NIO Power Technology: 207,138 sets installed, 4.4% market share

CRRC Times Electric: 171,929 sets installed, 3.6% market share

Quzhou Jidian: 164,472 sets installed, 3.5% market share

DEEPAL: 135,890 sets installed, 2.9% market share

The multi-in-one main drive system (dedicated to BEVs) market showed a clear shift toward OEM in-house supply during Jan.–Sept. 2025. FinDreams Powertrain led the pack with 1,192,187 sets installed (25.3% share), well ahead of the field. Tesla (9.2%) and GLB Intelligence & Power (8.0%) formed the second tier, while UAES, INOVANCE Automotive, and Leapmotor (each 4.8%) made up the third tier. The presence of Leapmotor, NIO Power Technology, and DEEPAL highlighted the deepening trend of OEM self-developed systems. Overall, the market was characterized by "top-tier leadership and OEM-driven supply."

Top electrical compressor suppliers

FinDreams Technology: 2,350,167 sets installed, 26.9% market share

Sanden Hasco: 1,437,210 sets installed, 16.5% market share

Aotecar: 1,165,534 sets installed, 13.3% market share

Welling: 789,689 sets installed, 9.0% market share

Highly: 608,675 sets installed, 7.0% market share

ZonCen New Energy: 544,763 sets installed, 6.2% market share

SANDEN: 216,239 sets installed, 2.5% market share

Chongqing Chaoli High-Tech: 207,178 sets installed, 2.4% market share

Hanon Systems: 185,179 sets installed, 2.1% market share

Wilo: 175,552 sets installed, 2.0% market share

The electric compressor market was highly concentrated at the top during Jan.–Sept. 2025. FinDreams Technology led the pack with 2,350,167 units installed and a 26.9% share, establishing a clear lead. Sanden Hasco (16.5%) and Aotecar (13.3%) followed, with the top three accounting for over 56% of the market. Welling (9.0%), Highly (7.0%), and ZonCen New Energy (6.2%) formed the second tier, while the remaining five suppliers, including SANDEN and Chongqing Chaoli High-Tech, held no more than 2.5% each, totaling 16.1%. Overall, the market remained highly concentrated, with traditional component makers and innovators competing side by side.

Gasgoo not only offers timely news and profound insight about China auto industry, but also help with business connection and expansion for suppliers and purchasers via multiple channels and methods. Buyer service:buyer-support@gasgoo.comSeller Service:seller-support@gasgoo.com