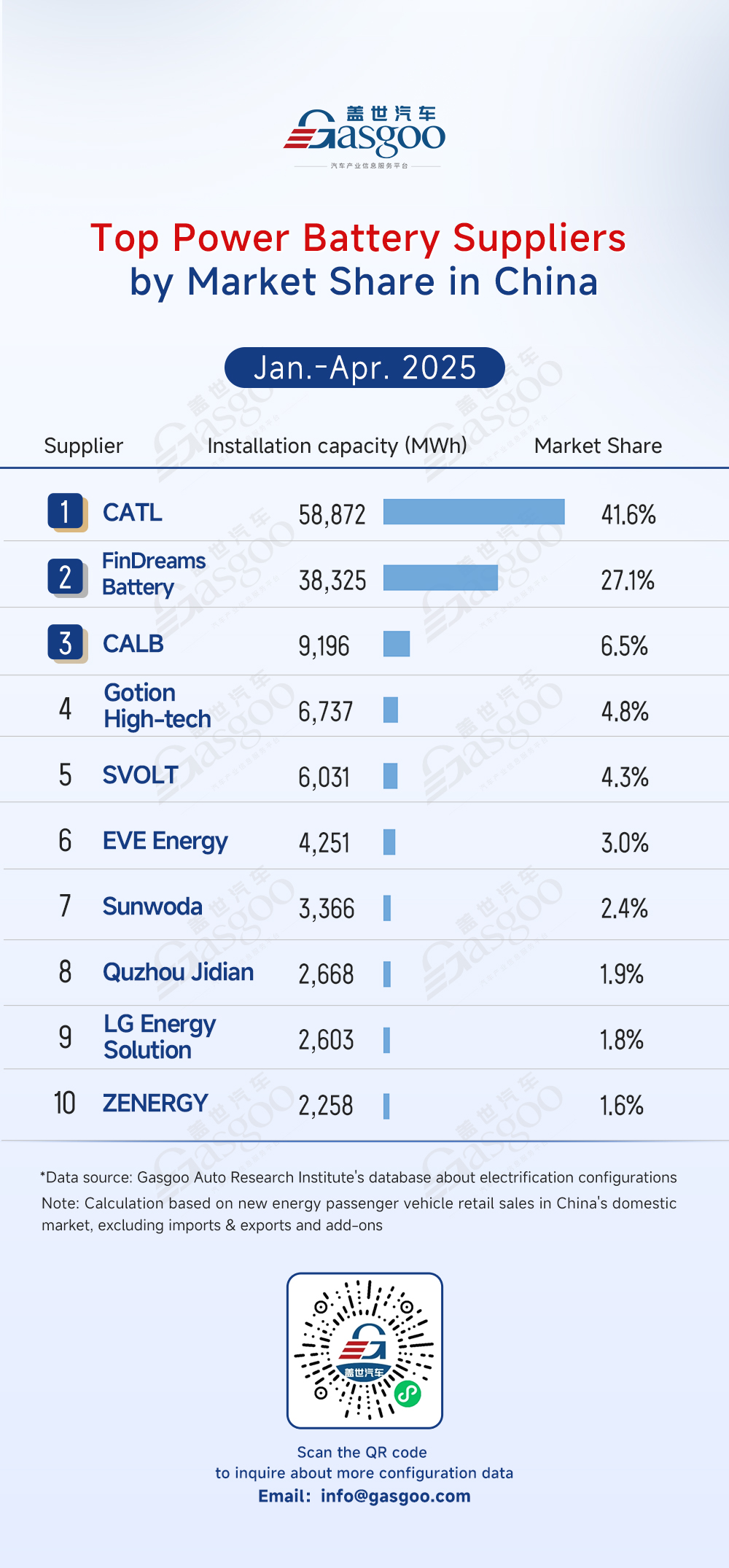

Top power battery suppliers

According to data compiled by the Gasgoo Automotive Research Institute, the power battery market for the Jan.-Apr. 2025 period shows a high level of concentration. The top 10 suppliers collectively account for nearly 95% of the China's local market share, highlighting the increasingly prominent dominance of leading players.

CATL secures the top position with a 41.6% market share (58,872 MWh installed). Leveraging its strong technological capabilities and large-scale production, CATL has built a comprehensive supply network that covers major carmakers, reinforcing its solid market leadership.

FinDreams Battery ranks second with a 27.1% market share (38,325 MWh installed). Backed by BYD's strong vertical integration, the company has established solid technological barriers in the lithium iron phosphate (LFP) segment and maintains stable growth through long-term partnerships with multiple leading Chinese carmakers.

CALB ranks third with a 6.5% market share (9,196 MWh installed). By pursuing a differentiated product strategy, the company has gained solid traction in both premium passenger vehicles and energy storage, steadily strengthening its position in the market.

Gotion High-tech captures 4.8% of the market (6,737 MWh installed), standing out in A00-segment electric vehicles (EVs) and energy storage through its focus on cost-efficient technologies.

The competitive landscape of the power battery market has settled into a "two giants followed by several strong players" structure: CATL and FinDreams Battery together secure nearly 70% of the market, reinforcing a duopoly. Meanwhile, other companies compete for the remaining share through technological innovation, client expansion, and cost optimization in niche segments. The high concentration among the top 10 suppliers highlights the industry's significant technological barriers and capital intensity, indicating that future competition will further consolidate around leading players, potentially accelerating market restructuring.

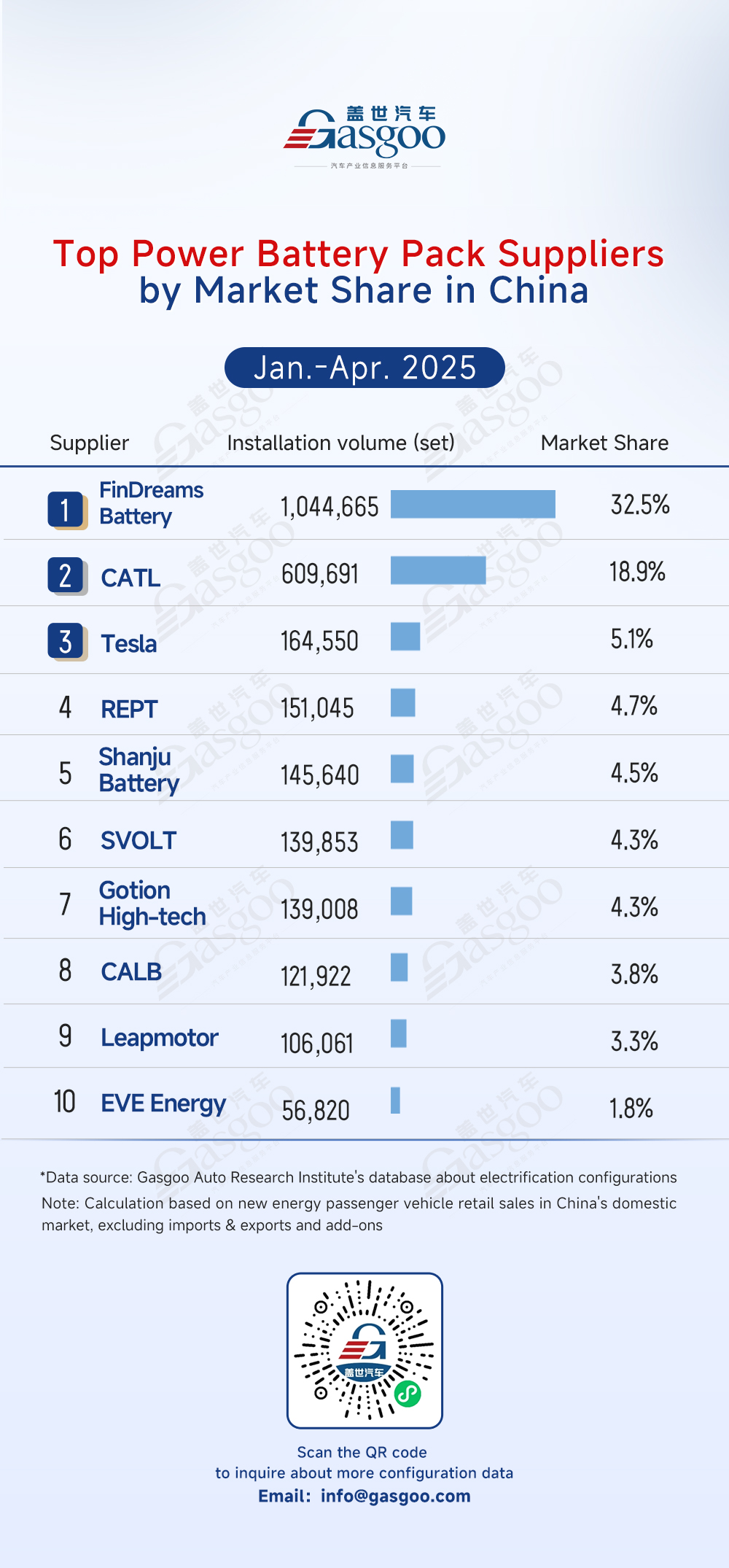

Top power battery pack suppliers

The latest data on power battery pack installations by the Gasgoo Automotive Research Institute shows a rapid acceleration in original equipment manufacturer (OEM) vertical integration, with carmakers' in-house battery pack production now exceeding 50% of total market volume—signaling a deep restructuring of the power battery supply chain.

FinDreams Battery takes the lead with a dominant 32.5% market share (1,044,665 sets installed). Its leadership is driven by close integration within BYD-affiliated entities and reflects the strategic determination of OEMs to control core battery system integration technologies. CATL ranks second with an 18.9% market share (609,691 sets installed), highlighting the growing trend of leading power battery manufacturers shifting towards system integration.

Notably, the automakers—Tesla (5.1%/164,550 sets) and Leapmotor (3.3%/106,061 sets) — have rapidly emerged as prominent power battery pack suppliers. Tesla's entry into the top three and Leapmotor's breakthrough into the top ten highlight the growing trend of carmakers building their own power battery pack capacity to achieve end-to-end technological control. These companies are not just reshaping the traditional supplier landscape — they are also shifting the balance of profit distribution and bargaining power across the power battery supply chain.

The current market dynamics reflect a deeper shift in the NEV industry, where carmakers are increasingly competing for control over key components. With OEM-produced battery packs now surpassing 50% of total installations, it is clear that carmakers are taking power battery system design and cost management into their own hands. As electrification technologies continue to advance, this trend of vertical integration is expected to accelerate, signaling a broader shift from standalone component supply to integrated system solutions across the supply chain.

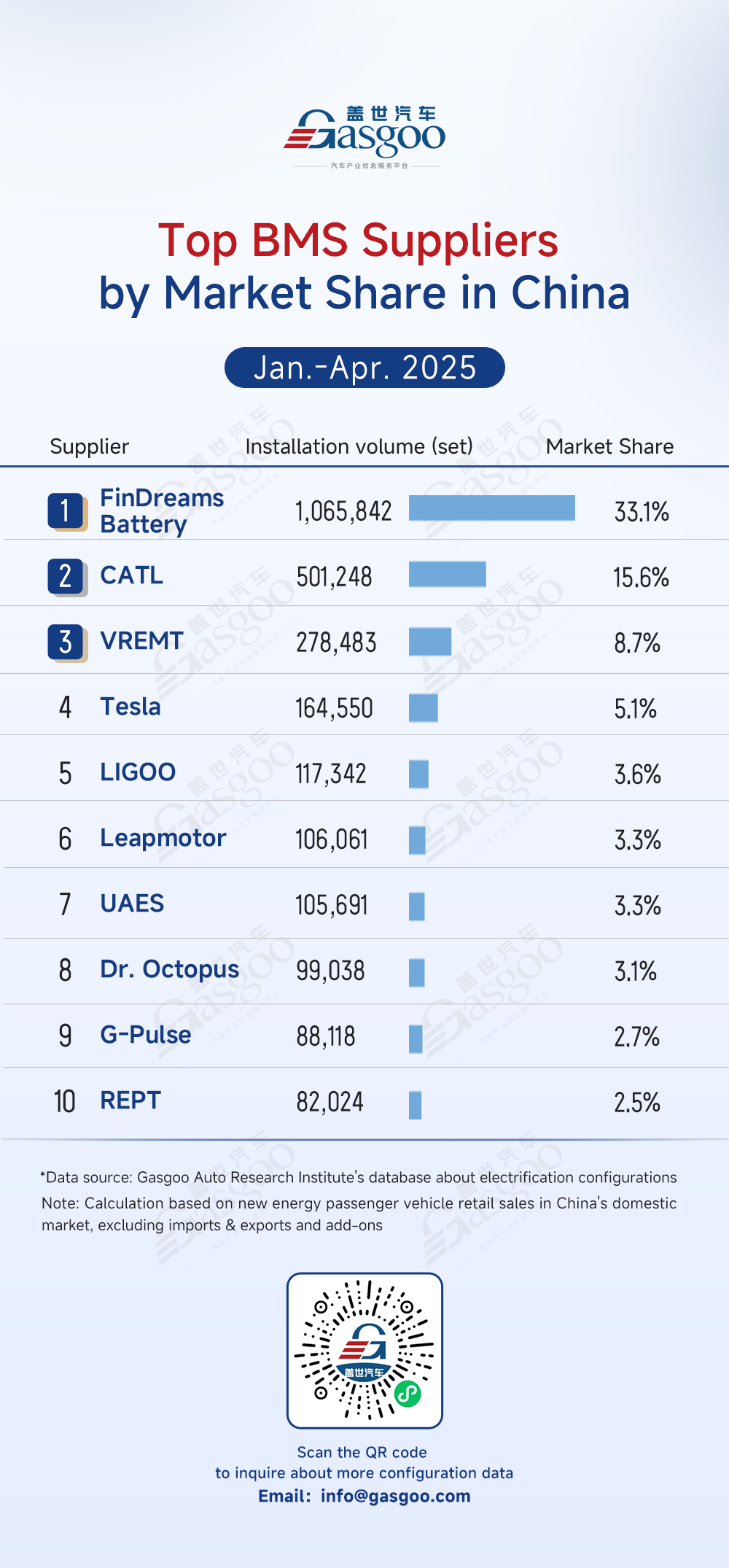

Top BMS suppliers

The battery management system (BMS) supplier rankings show a clear trend: carmakers are increasingly focusing on having direct control over BMS technology. This is strongly reflected in the market structure. FinDreams Battery ranks first with a 33.1% market share (1,065,842 sets installed). Its leading position comes not only from its technical strength but also from the growing strategy of carmakers to take control of key components.

As a global leader in the power battery sector, CATL has also demonstrated strong performance in the BMS market, securing the second place with a 15.6% market share (501,248 sets installed), highlighting not only the growing trend of top power battery suppliers expanding into system integration, but also carmakers' push to gain greater control over BMS technologies.

Notably, VREMT (8.7% / 278,483 sets) and Leapmotor (3.3% / 106,061 sets), either carmakers themselves or their affiliated companies, both secure leading positions on the list. Their strong performance highlights the growing push among OEMs to bring BMS R&D and production in-house, underscoring the urgent need for direct control over battery management technologies. Meanwhile, UAES captures a 3.3% market share with 105,691 sets, signaling that some carmakers are also choosing deep collaborations with traditional suppliers to retain influence over BMS technology.

The current market landscape highlights a key shift in the NEV supply chain. As competition in electrification deepens, BMS has become a critical battleground, with OEMs aiming to take control of this core technology to strengthen their competitive edge. The strong positions of FinDreams Battery, CATL, and VREMT epitomize this clear industry trend. Looking ahead, OEMs' demand for BMS autonomy is set to grow, pushing suppliers to open up their technologies and driving OEMs to increase their own R&D efforts—reshaping how the BMS market will compete in the future.

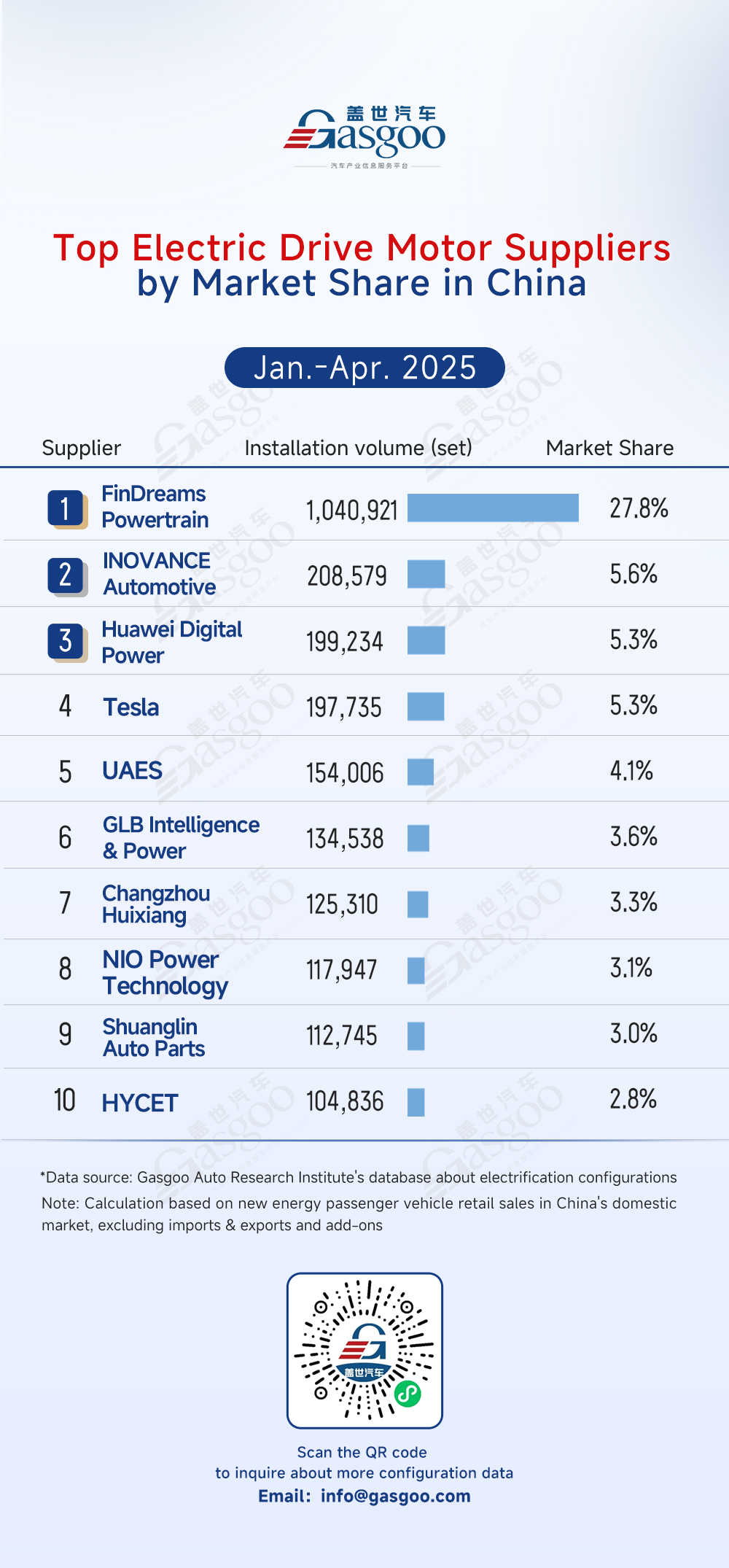

Top electric drive motor suppliers

The installation rankings of electric drive motor suppliers highlight a highly concentrated market dominated by leading players. FinDreams Powertrain, INOVANCE Automotive, and Huawei Digital Power firmly hold the top three positions, collectively steering the direction of the industry.

FinDreams Powertrain leads the pack with a dominant 27.8% share (1,040,921 sets). INOVANCE Automotive ranks second with a 5.6% share (208,579 sets), while Huawei Digital Power closely follows with a 5.3% share (199,234 sets), forming a highly competitive second-tier group.

The three leading companies stand out in technology, product performance, and market presence. FinDreams Powertrain benefits from vertical integration, INOVANCE Automotive brings strengths from industrial automation, and Huawei Digital Power leverages power electronics expertise. Together, they provide high-reliability, high-efficiency electric drive motor solutions for NEVs.

Beyond the top players, companies like Tesla, UAES, GLB Intelligence & Power, Changzhou Huixiang, NIO Power Technology, Shuanglin Auto Parts, and HYCET also hold steady shares in niche markets. This layered market structure reflects how leading companies strengthen their positions through technological and scale advantages, while specialized players carve out space with differentiated offerings. Competition across all tiers—focused on system integration, cost efficiency, and customer responsiveness—continues to drive the technological progress and ecosystem development of the electric drive motor industry.

Leading suppliers now closely integrate their capabilities in technology, manufacturing, and sales. As NEVs demand better electric drive motor performance, FinDreams Powertrain, INOVANCE Automotive, and Huawei Digital Power will build on their strengths in materials, processes, and modular design to deliver improved powertrain solutions.

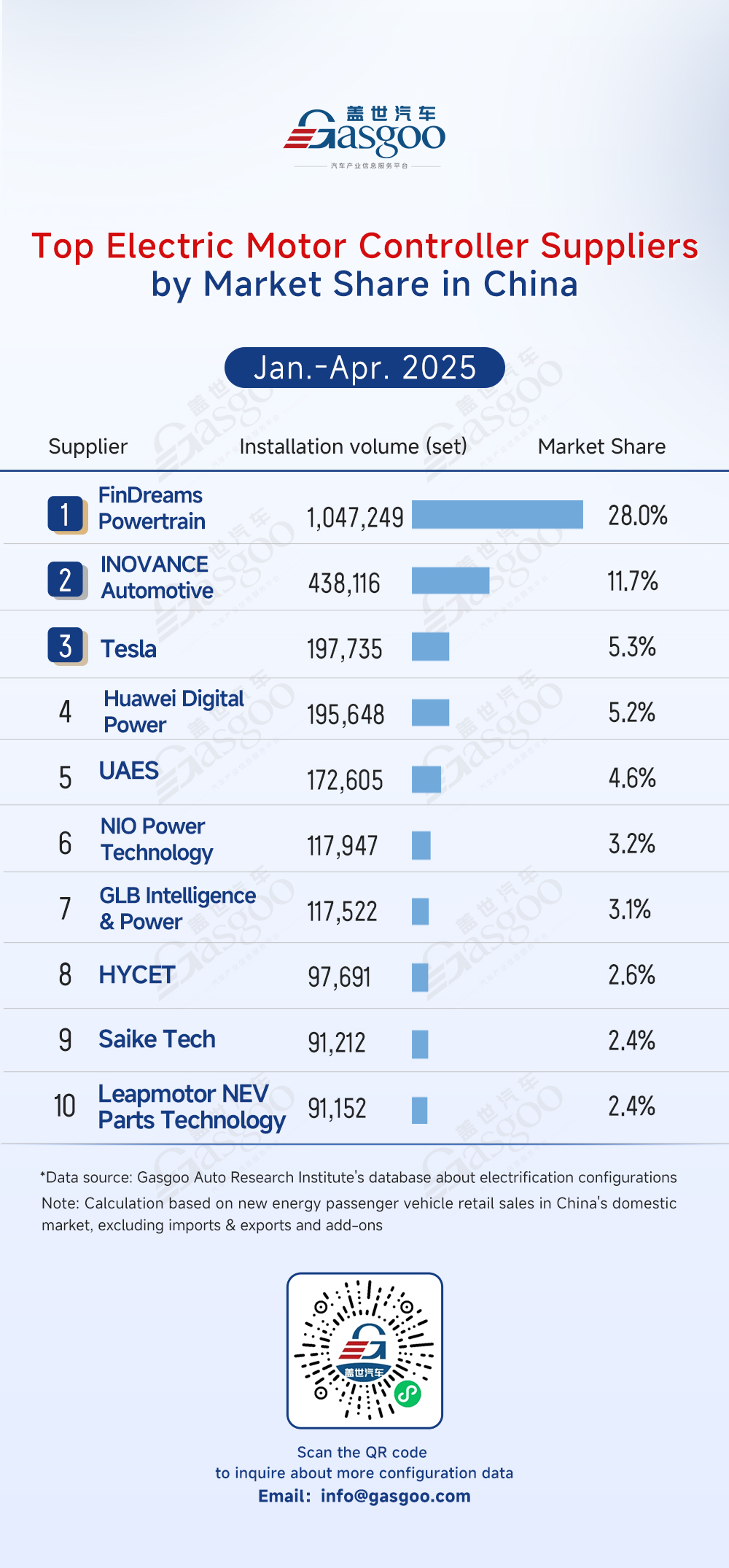

Top electric motor controller suppliers

The electric motor controller supplier rankings clearly outline the market landscape, with industry resources increasingly concentrating among top players. FinDreams Powertrain and INOVANCE Automotive, together accounting for 40% of the market share, dominate as the dual oligopoly. FinDreams Powertrain takes the lead with a 28.0% market share (1,047,249 sets), significantly outpacing competitors. INOVANCE Automotive follows closely with an 11.7% share (438,116 sets).

Beyond the top players, Huawei Digital Power, UAES, NIO Power Technology, GLB Intelligence & Power, HYCET, Saike Tech, and Leapmotor NEV Parts Technology also hold steady shares in niche markets. Similar to the electric drive motor market, the electric motor controller market shows a clear tiered structure, with companies competing across multiple dimensions.

Under the current competitive landscape, leading suppliers have built strong synergies in technology, manufacturing, and market channels. As performance demands for motor controllers rise, companies like FinDreams Powertrain and INOVANCE Automotive will continue to leverage their strengths in power semiconductors, control algorithms, and modular design to deliver high-quality solutions for NEVs.

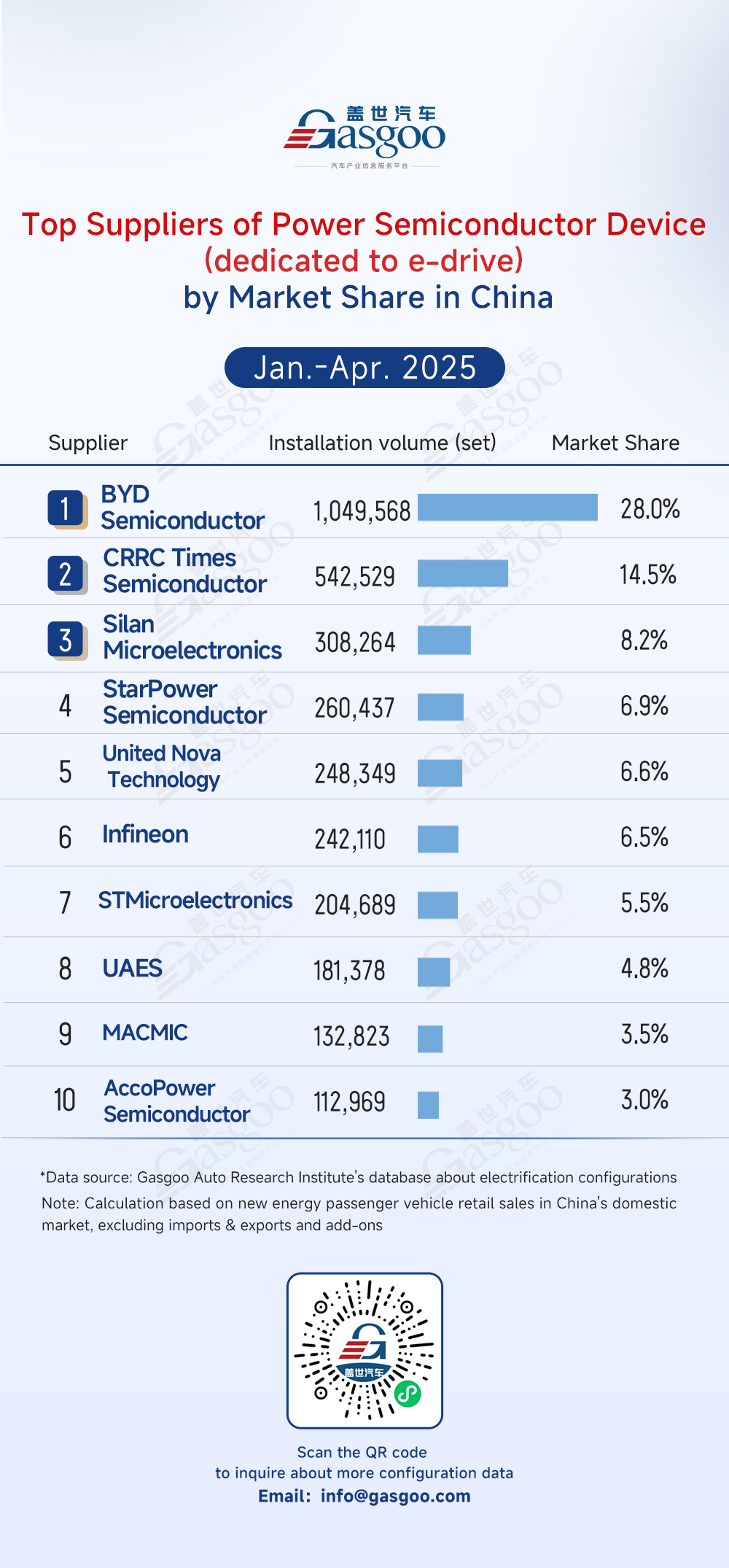

Top suppliers of power semiconductor device (dedicated to e-drive)

According to the rankings below, the resources of the power semiconductor device (dedicated to e-drive) market are highly concentrated among leading players. BYD Semiconductor, CRRC Times Semiconductor, and Silan Microelectronics dominate the market with a combined share of 50.7%. Among them, BYD Semiconductor takes the lead with a 28.0% market share (1,049,568 sets), significantly outperforming other competitors. CRRC Times Semiconductor ranks second with a 14.5% share (542,529 sets), while Silan Microelectronics follows with an 8.2% share (308,264 sets), shaping the second-tier competition.

The three leading companies stand out in technology, product performance, and market presence. BYD Semiconductor leverages its integrated supply chain, CRRC Times Semiconductor draws on rail technology, and Silan Microelectronics focuses on self-developed IGBT chips. Together, they deliver reliable, high-efficiency power semiconductor device (dedicated to e-drive) solutions for NEVs.

Besides the leading tier, companies such as StarPower Semiconductor, United Nova Technology, Infineon, STMicroelectronics, UAES, MACMIC, and AccoPower Semiconductor also hold stable shares in niche markets.

Leading suppliers have built strong collaboration in technology, manufacturing, and markets. As demands rise, BYD Semiconductor, CRRC Times Semiconductor, and Silan Microelectronics will keep using material innovation, process improvement, and modular design to support industry upgrades.

Top OBC suppliers

The On-Board Charger (OBC) supplier rankings clearly outline the competitive landscape, with industry resources mainly controlled by the top players. The top 10 suppliers together hold over 90% of the market share, shaping an oligopolistic market. FinDreams Powertrain takes the lead with a 29.7% share (954,768 sets), demonstrating clear dominance in the OBC sector. VMAX follows with an 18.2% share (586,499 sets), while SHINRY holds 10.6% with 342,519 sets, forming a solid second-tier competitive group.

Besides the leading players, companies such as EVTECH, Enpower, Sanmina, Huawei Digital Power, INOVANCE Automotive, TC Charger, and Megmeet also hold stable shares in niche markets.

Leading suppliers deeply integrate technology, manufacturing, and market channels. FinDreams Powertrain leverages its full-industry chain, VMAX and SHINRY drive innovation through R&D, while others focus on niche strengths. This diverse competition supports charging system upgrades for NEVs.

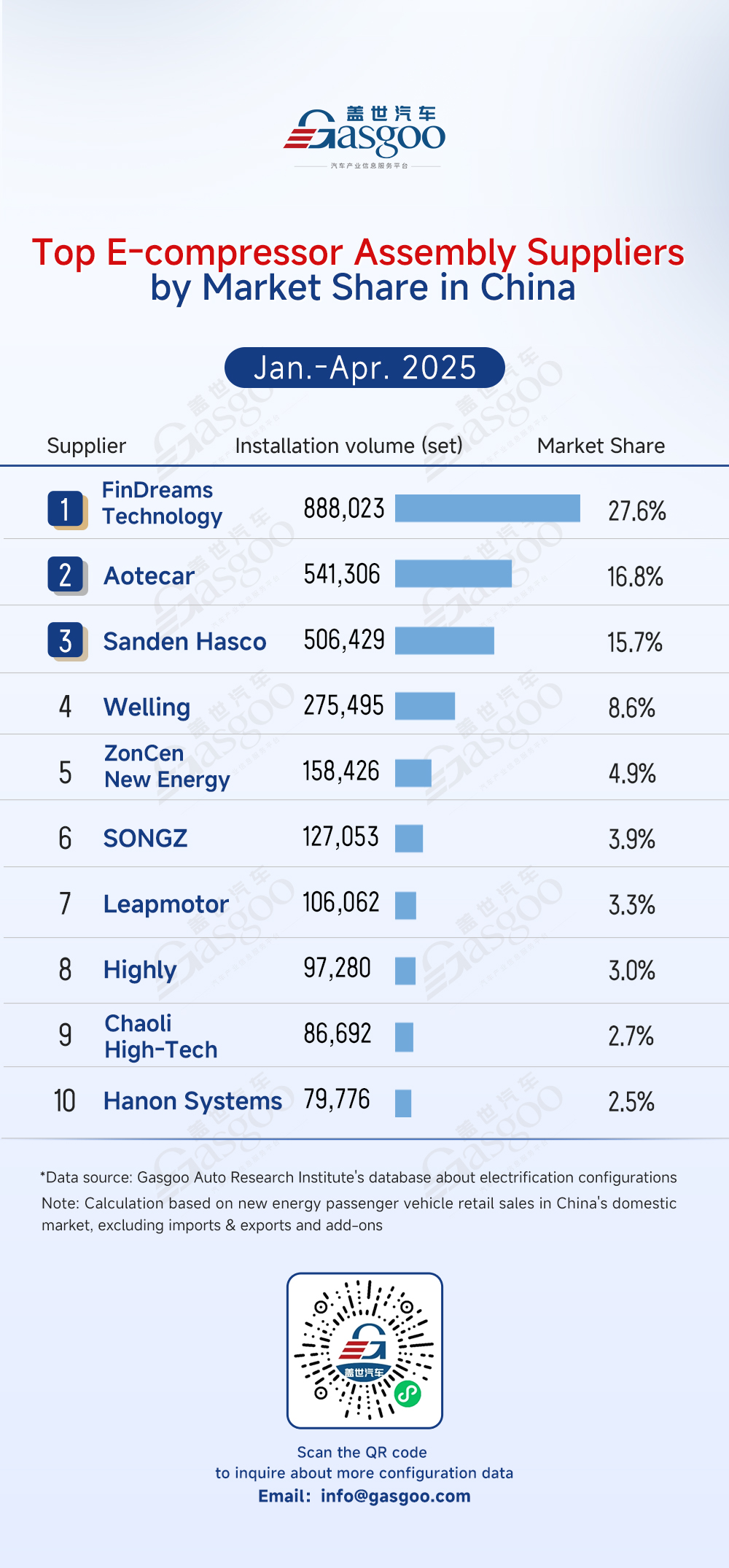

Top E-compressor assembly suppliers

According to the E-compressor assembly supplier rankings below, top players in the market rapidly consolidating nearly 90% of the market share. FinDreams Technology leads the way with a 27.6% share (888,023 sets), demonstrating a significant advantage. Aotecar ranks second with a 16.8% share (541,306 sets), followed closely by Sanden Hasco with 15.7% (506,429 sets), forming a solid second-tier competitive group.

Welling, ZonCen New Energy, SONGZ, Leapmotor, Highly, Chaoli High-Tech, and Hanon Systems maintain steady positions in niche segments. Companies at all levels compete on system integration, cost efficiency, and customer responsiveness, collectively advancing technology and strengthening the ecosystem.

Leading suppliers integrate technology, manufacturing, and market channels. FinDreams Technology uses its full-industry chain for efficient resource integration, while Aotecar and Sanden Hasco drive innovation through R&D. Other companies focus on niche areas to build competitive advantages, offering diverse solutions for E-compressor assembly system upgrades.

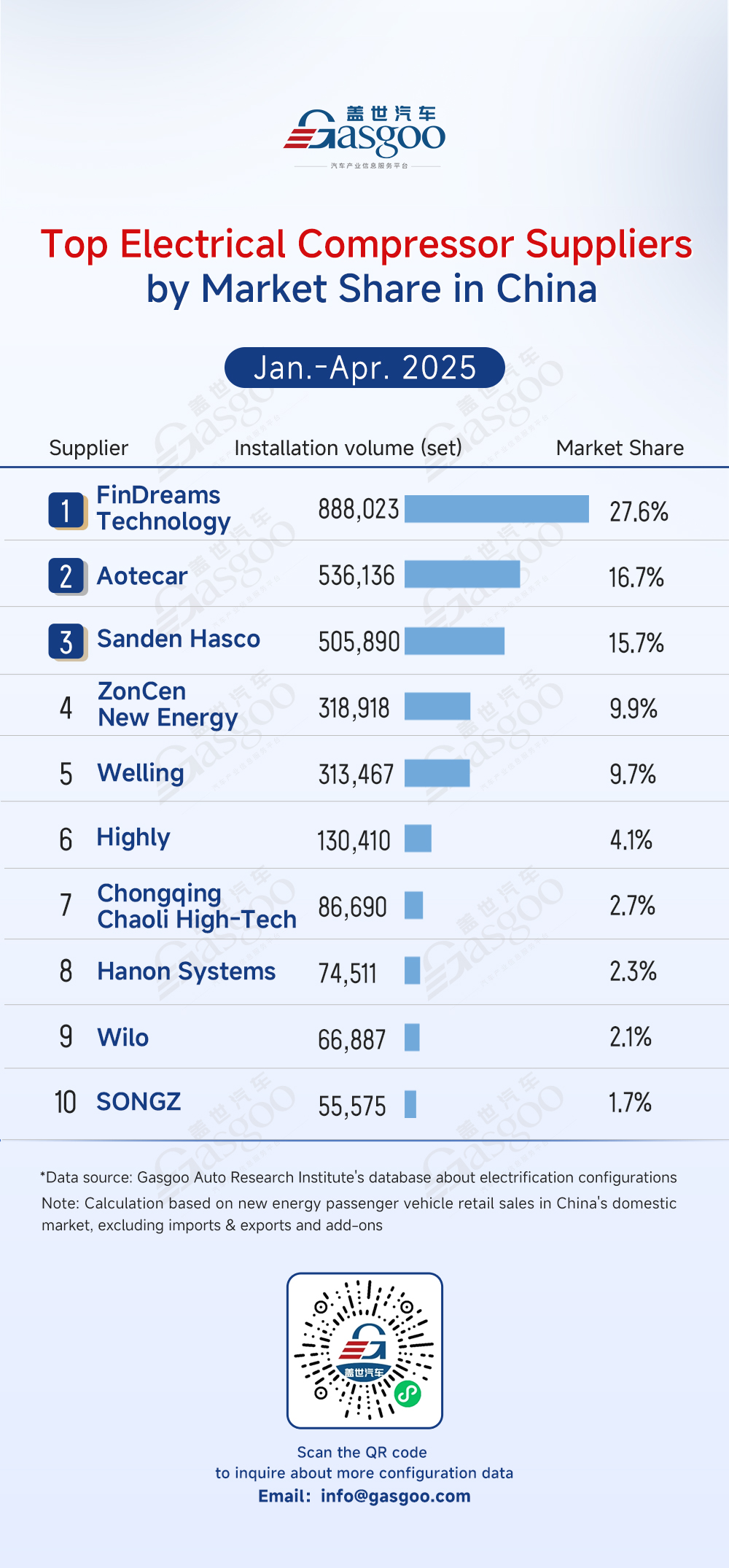

Top electrical compressor suppliers

The electrical compressor supplier rankings reveal that market share is concentrated among top players. FinDreams Technology holds a strong lead with a 27.6% share (888,023 sets installed). Aotecar and Sanden Hasco follow with 16.7% and 15.7%, respectively. ZonCen New Energy (9.9%) and Welling (9.7%) complete the top five, together forming a competitive yet diverse landscape.

Besides the top players, Highly, Chongqing Chaoli High-Tech, Hanon Systems, Wilo, and SONGZ hold steady market shares. This clear tiered market shows leaders' advantages in technology and scale, while niche specialists survive through differentiation. Competition on performance, cost, and service drives innovation and ecosystem growth in electric compressors.

In the current competitive landscape, leading suppliers leverage synergies in R&D, manufacturing, and market channels. FinDreams Technology integrates its supply chain, Aotecar and Sanden Hasco stay competitive through R&D, while Zhongcheng New Energy and Weiling focus on niche markets.